Fill and Sign Customs and Border Protection (CBP) Forms

Documents:

372

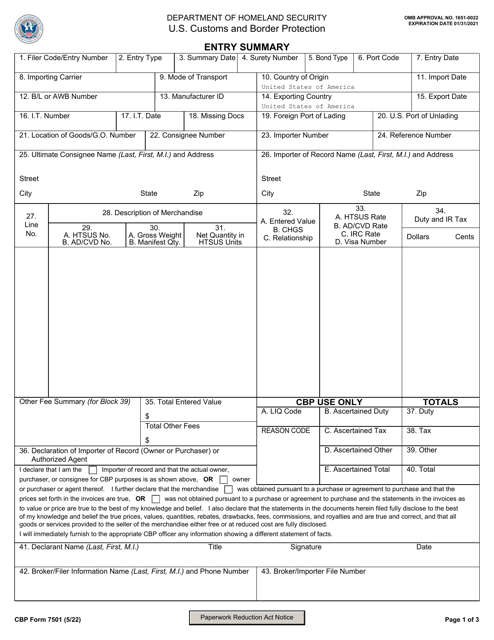

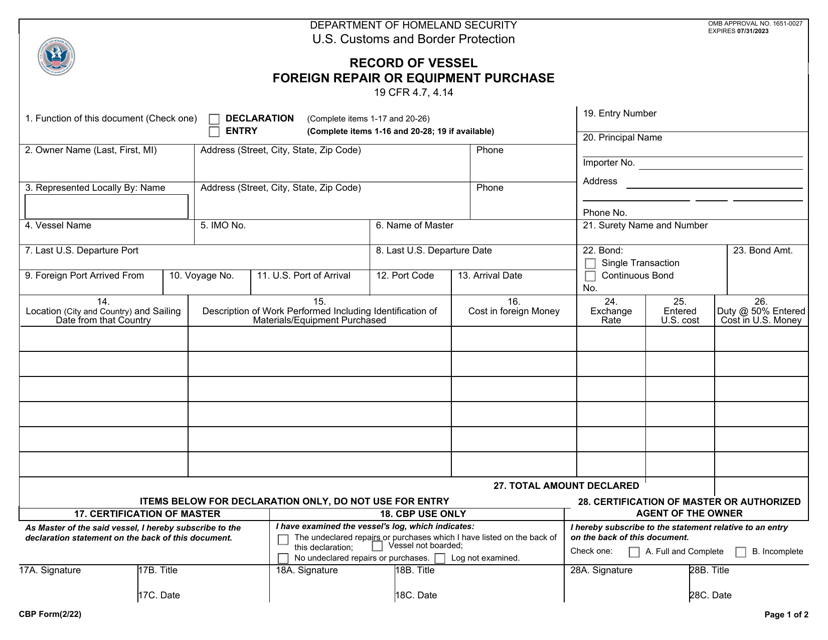

This form serves to describe relevant information about the imported commodity, such as its origin, classification, and appraisement. The information is used to record the amount of tax and duty paid.

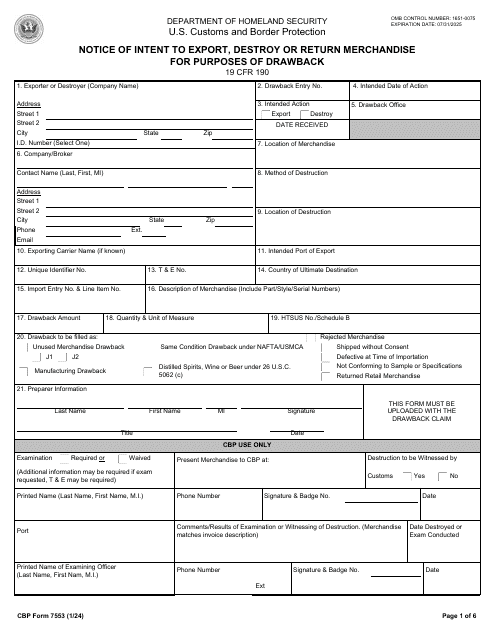

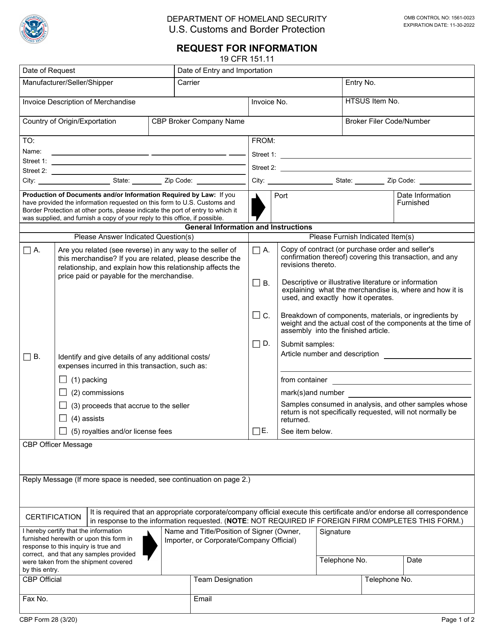

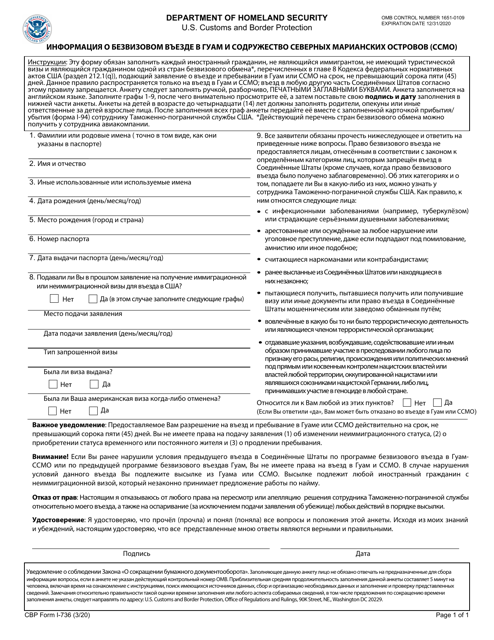

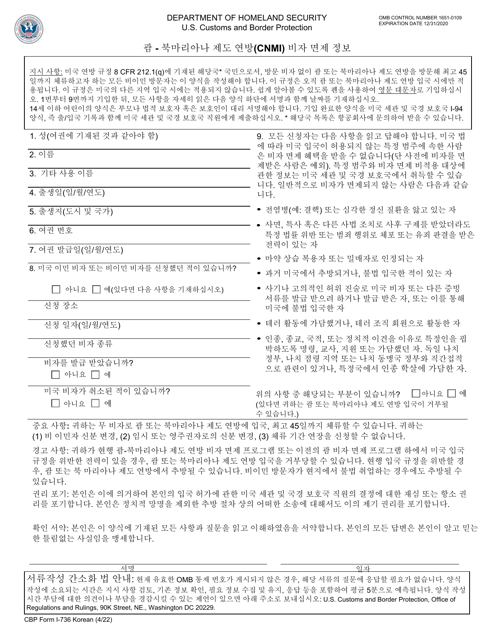

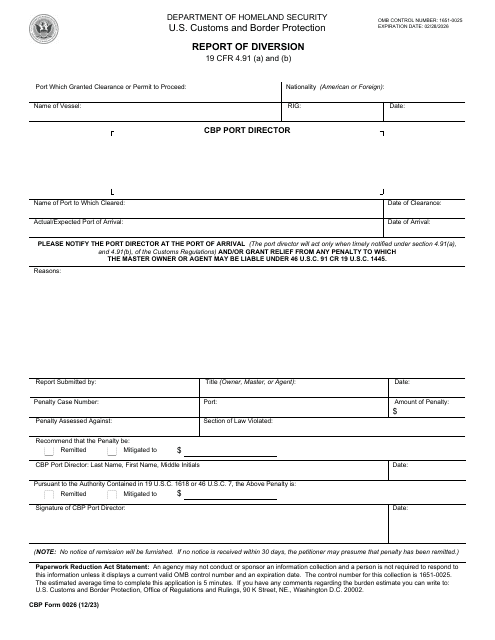

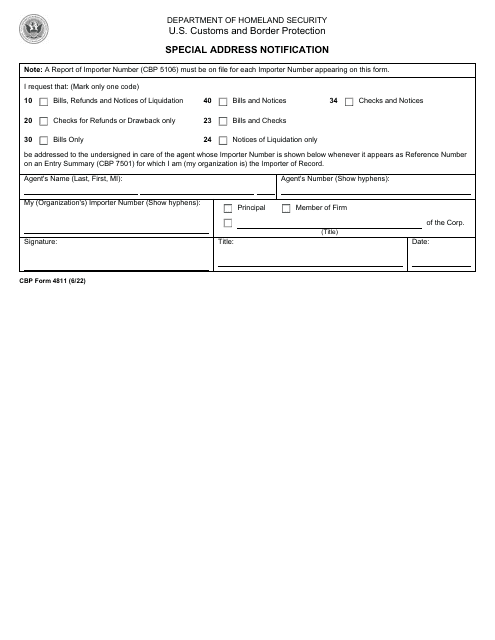

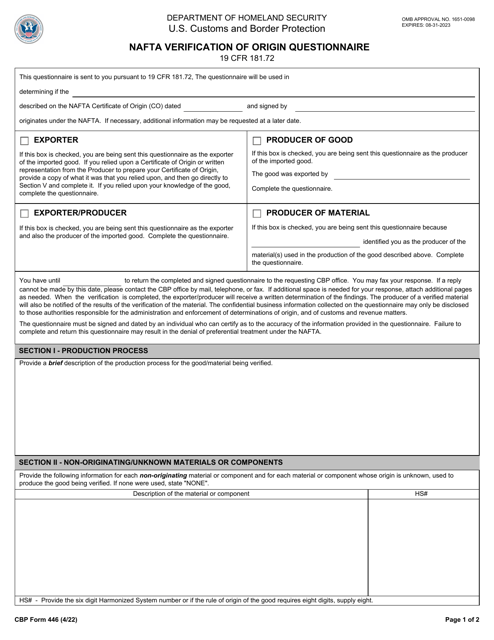

This document is used to request information from the U.S. Customs and Border Protection (CBP).

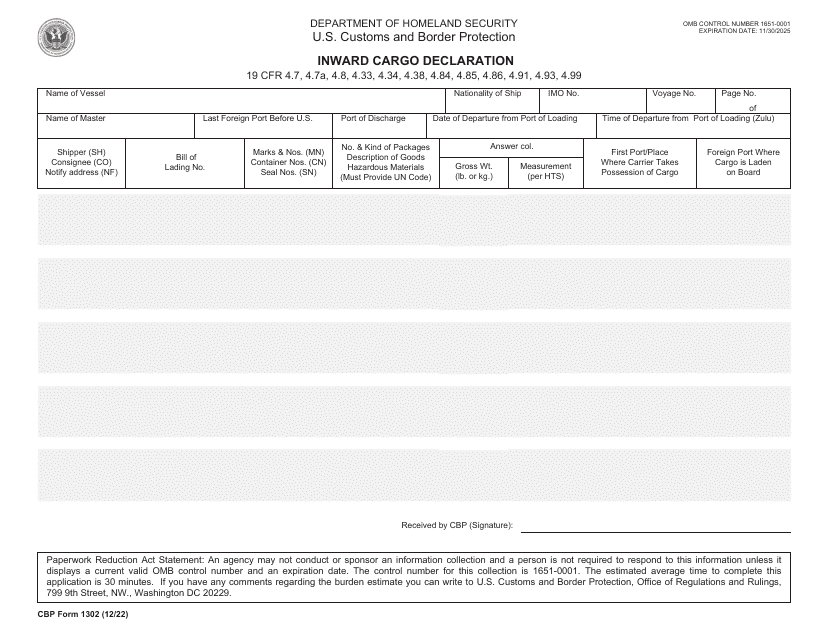

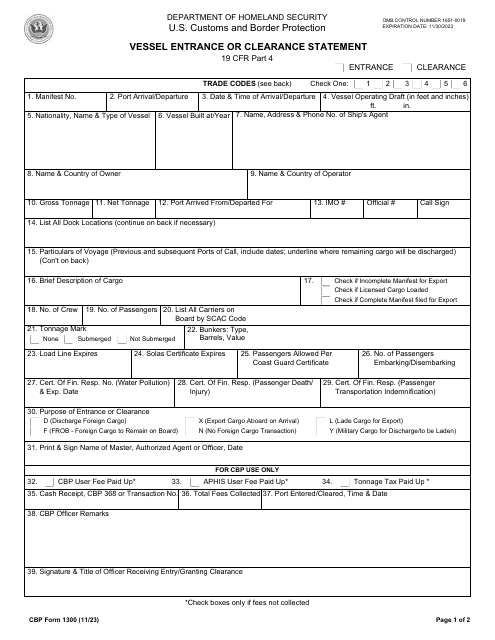

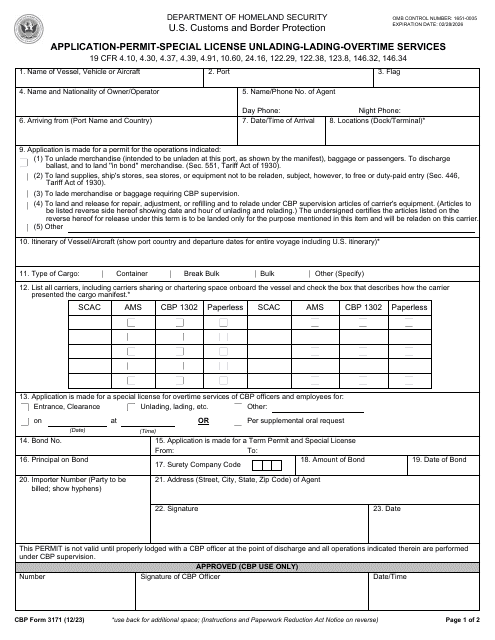

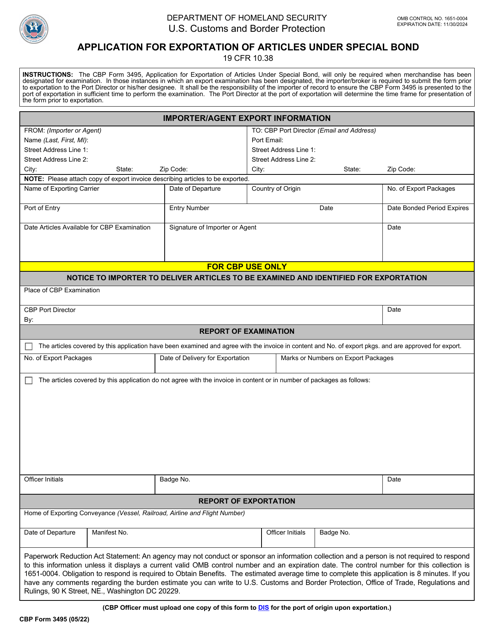

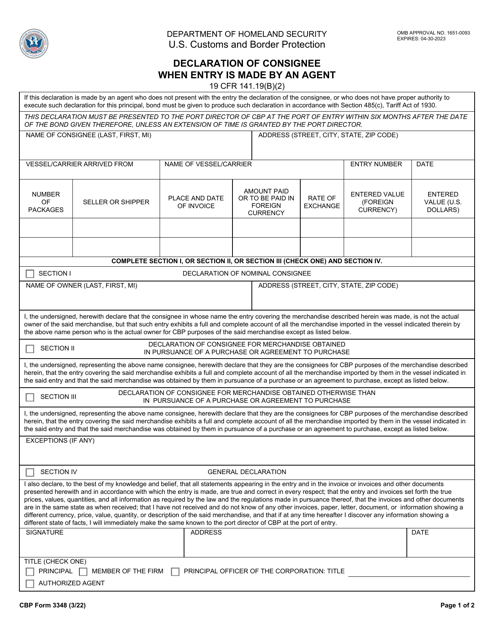

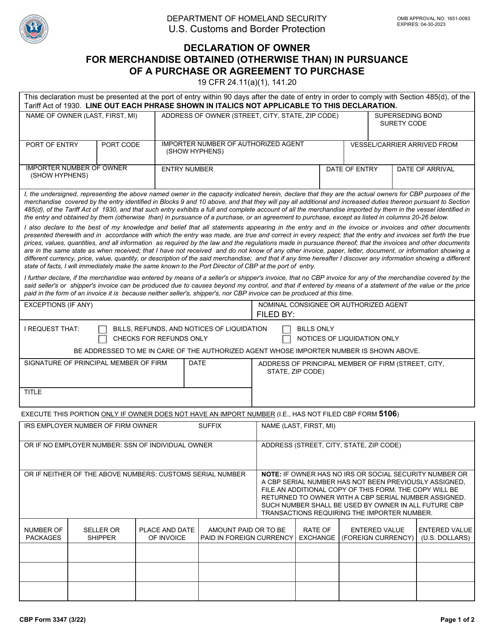

Fill out this form when you import items into the United States. The Customs and Border Protection (CBP) uses this information to verify that the consignee and shipment details are correct, and a bond is in the CBP records.

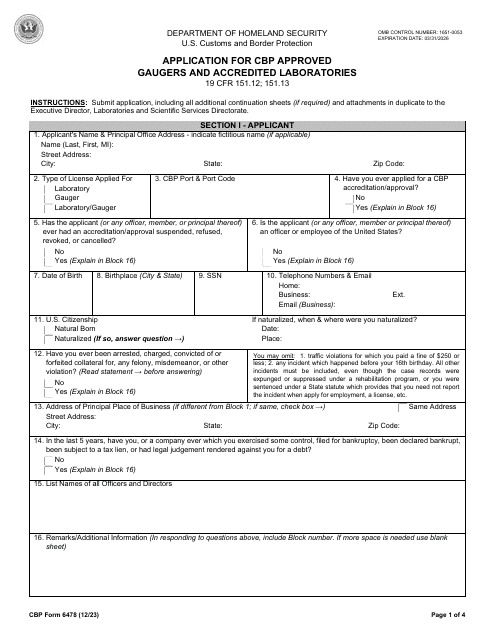

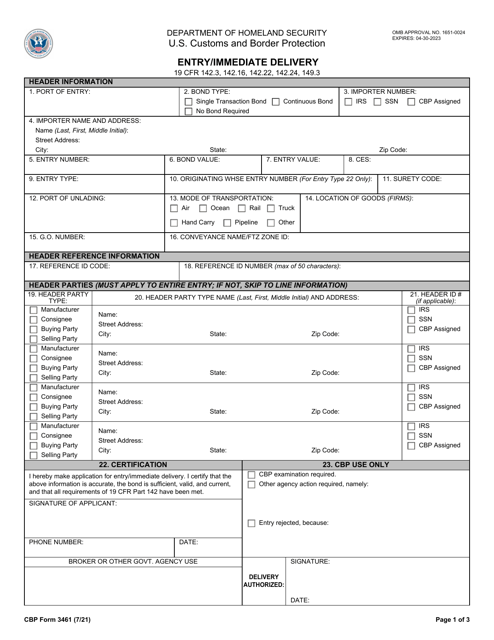

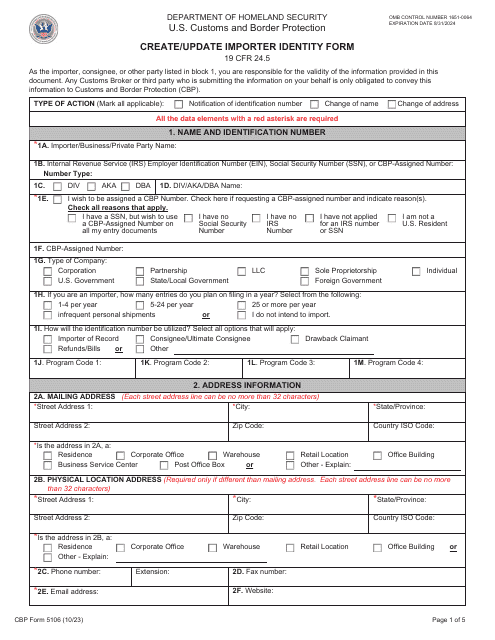

Download this form to create or update an Importer Account with Customs and Border Protection (CBP). Anyone who submits their first entry has to file an import entry. This information is entered into the CBP's database or is used to correct the file of a registered importer.

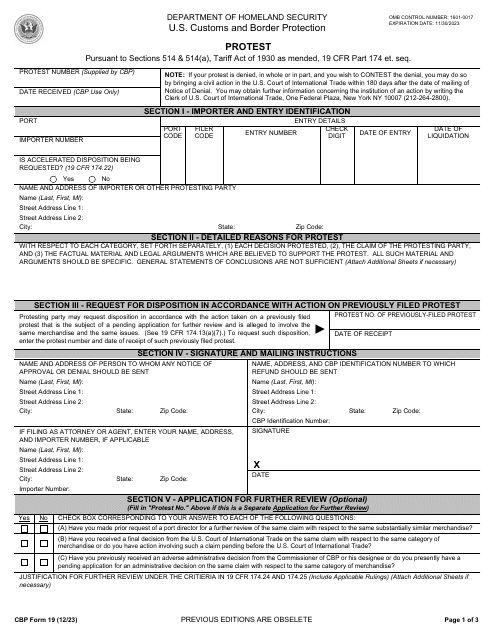

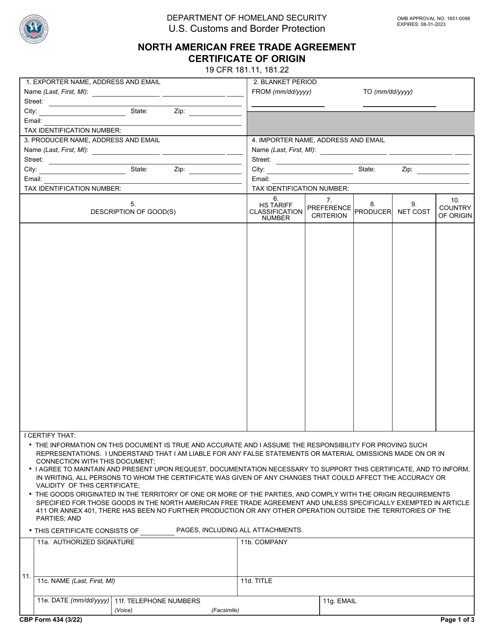

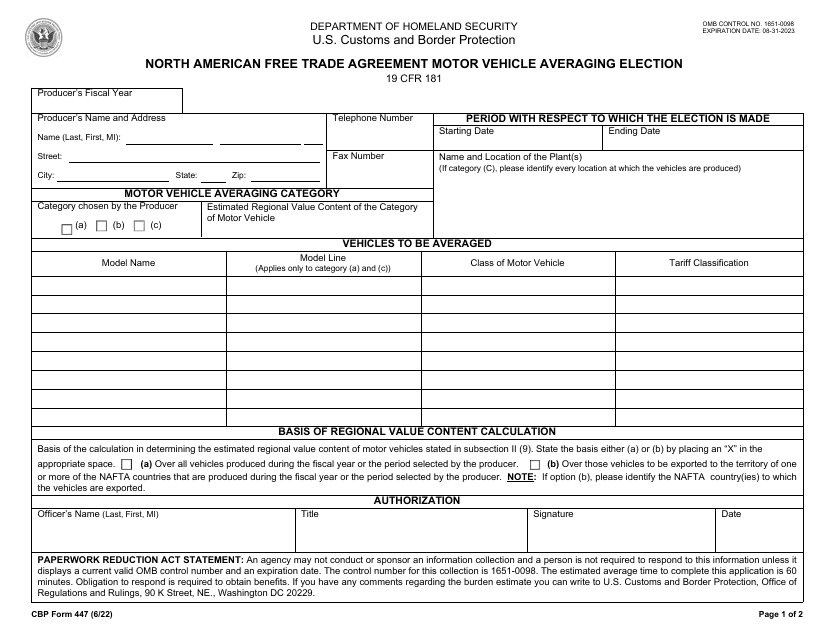

This form is used by the United States, Canada, and Mexico and is a trilaterally agreed up form. It is used to certify that the goods qualify for the preferential tariff treatment determined by the North American Free Trade Agreement (NAFTA).