Fill and Sign New Hampshire Legal Forms

Documents:

3292

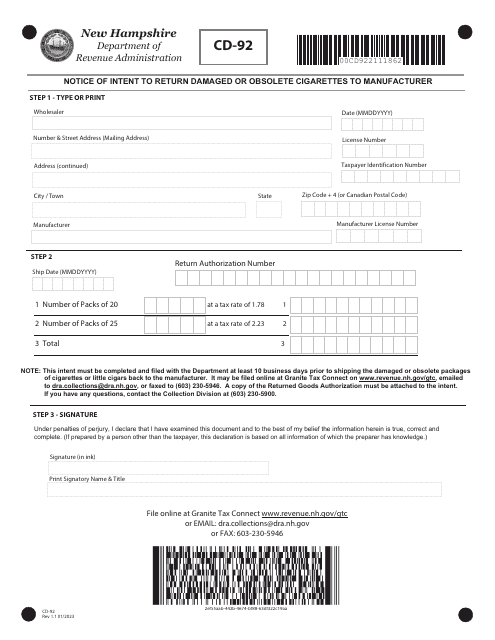

Form CD-92 Notice of Intent to Return Damaged or Obsolete Cigarettes to Manufacturer - New Hampshire

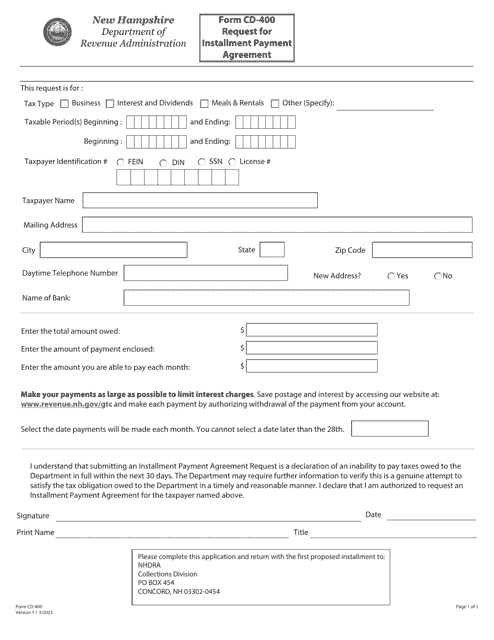

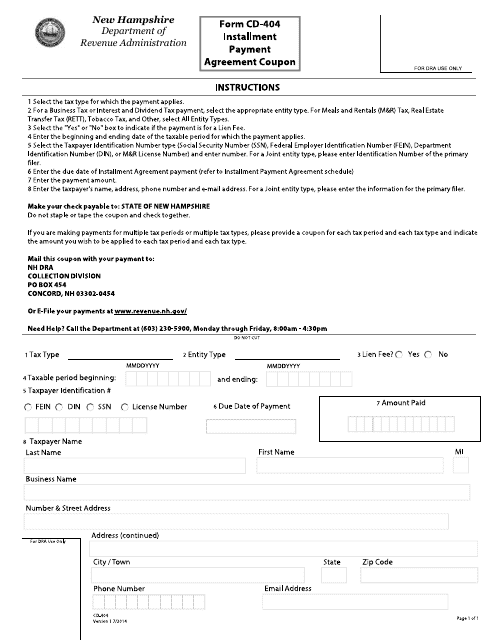

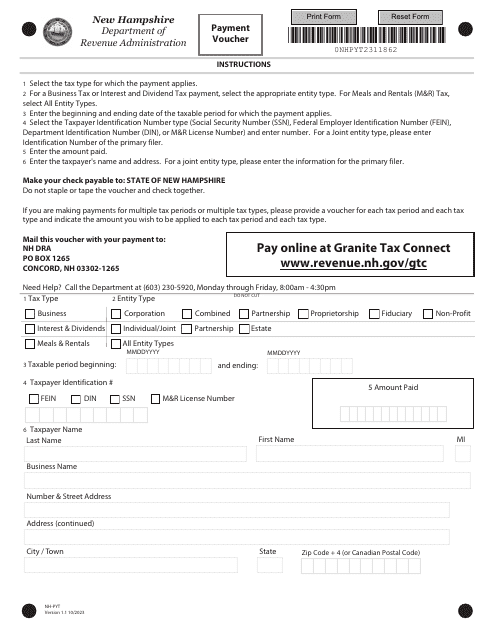

This form is used for submitting an installment payment agreement coupon in the state of New Hampshire.

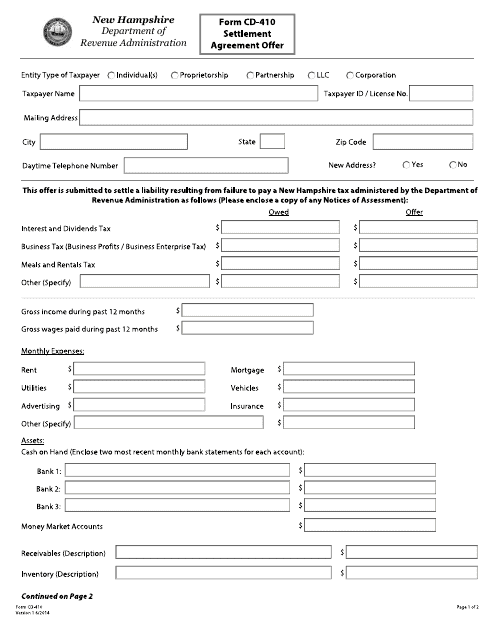

This form is used for making a settlement agreement offer in the state of New Hampshire.

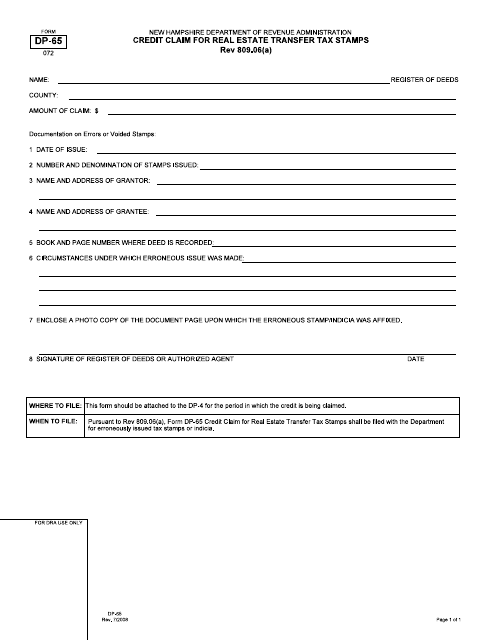

This form is used for claiming credit for real estate transfer tax stamps in New Hampshire.

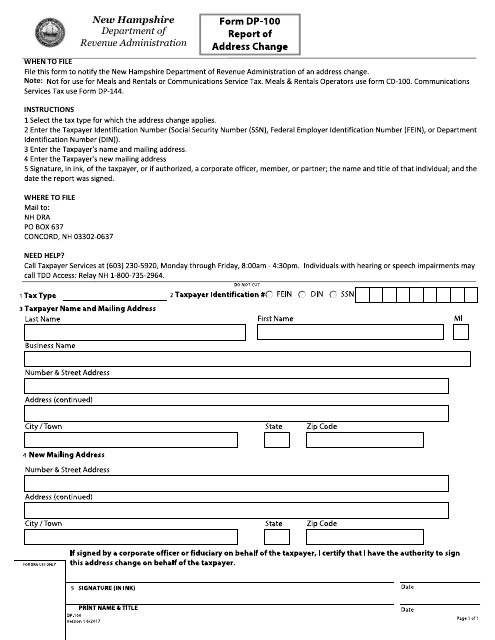

This Form is used for reporting a change of address in New Hampshire.

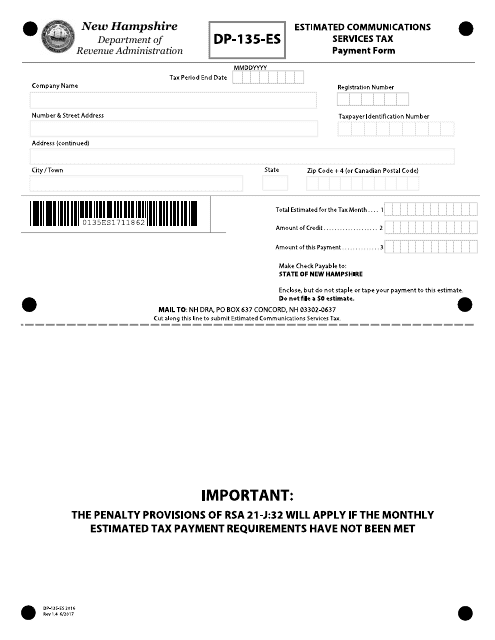

This Form is used for making estimated communications services tax payments in the state of New Hampshire.

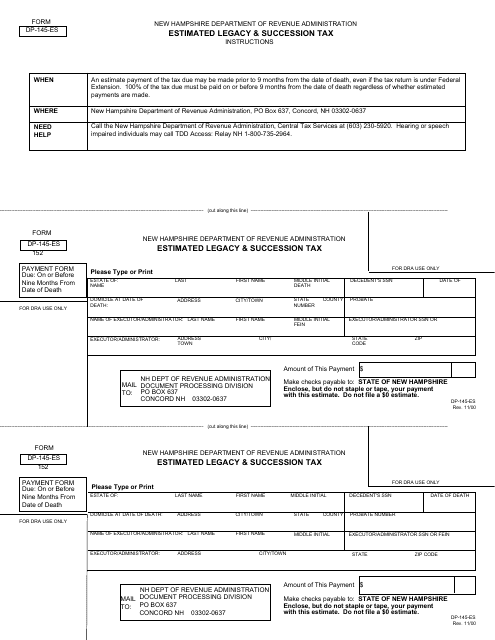

This Form is used for estimating and paying legacy and succession taxes in the state of New Hampshire. It is relevant for individuals who are handling the estate planning and transfer of wealth.

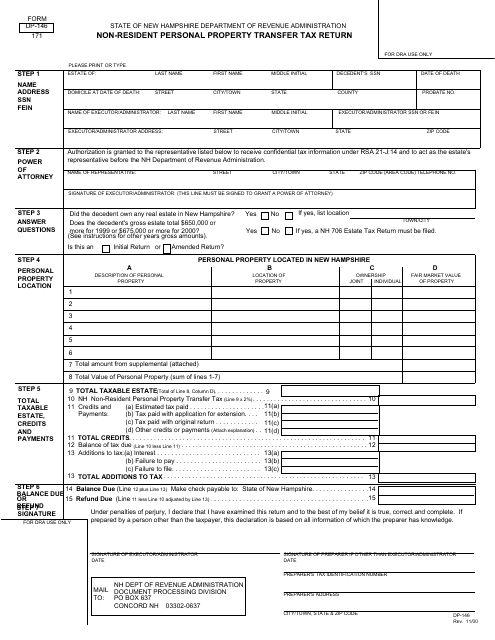

This Form is used for reporting and paying transfer tax on personal property for non-residents in New Hampshire.

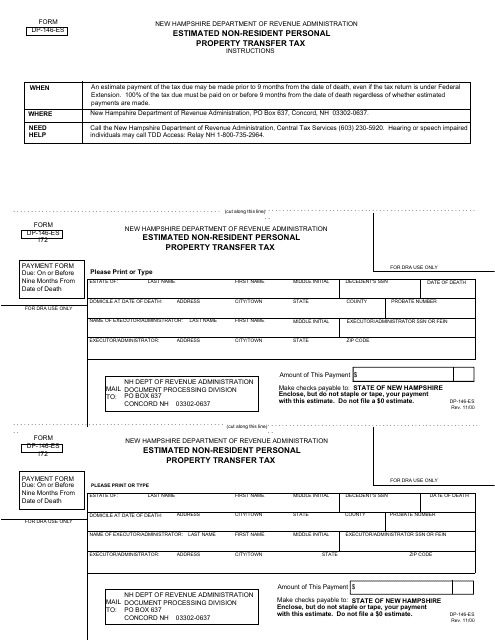

This document is used for estimating the non-resident personal property transfer tax in New Hampshire.

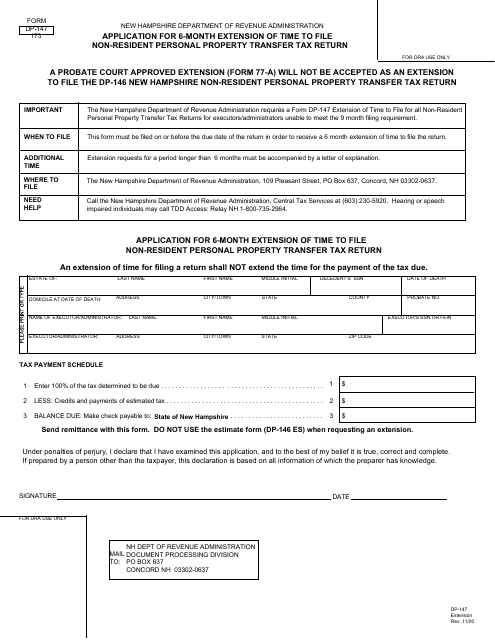

This form is used for applying for a 6-month extension of time to file your non-resident personal property transfer tax return in the state of New Hampshire.

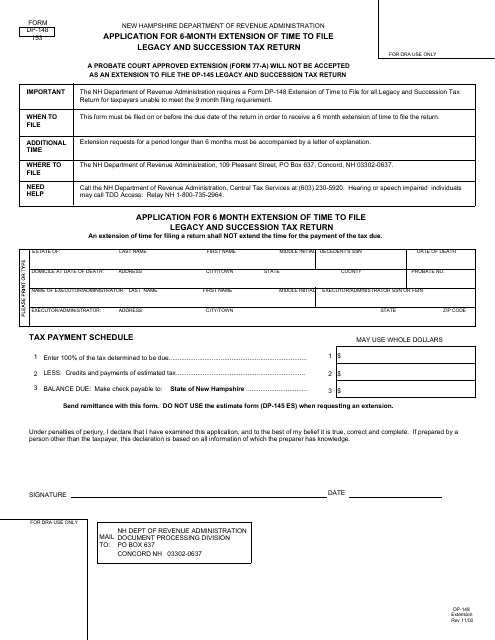

This Form is used for requesting a 6-month extension to file the Legacy and Succession Tax Return in the state of New Hampshire.

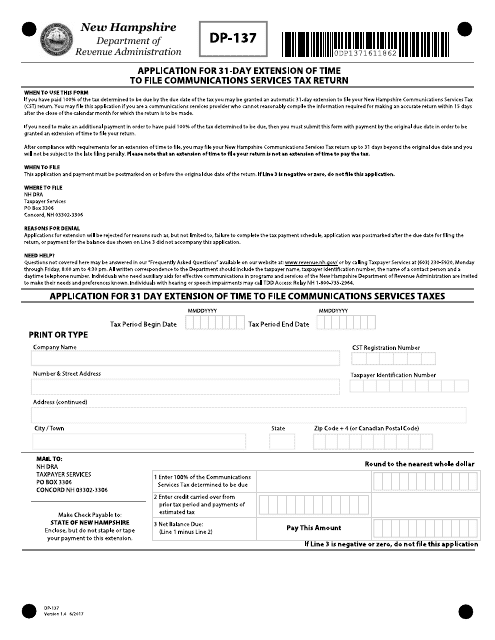

This Form is used for applying for a 31-day extension of time to file the Communications Services Tax Return in the state of New Hampshire.

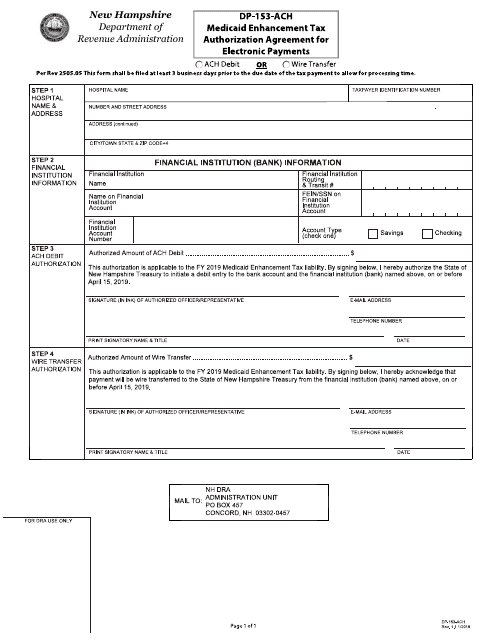

This Form is used for authorizing electronic payments for Medicaid Enhancement Tax in New Hampshire.

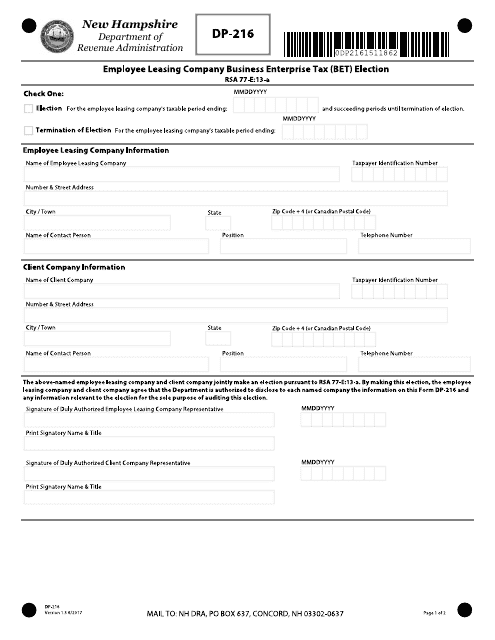

This Form is used for making a Business Enterprise Tax (Bet) election for Employee Leasing Companies in New Hampshire.

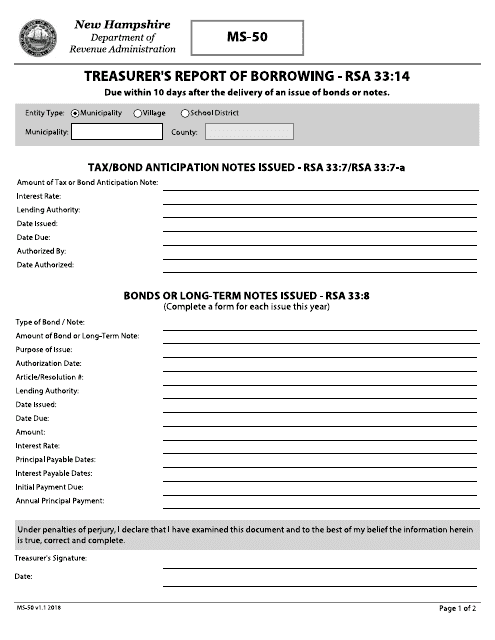

This form is used for reporting borrowing activities of a treasurer in the state of New Hampshire.

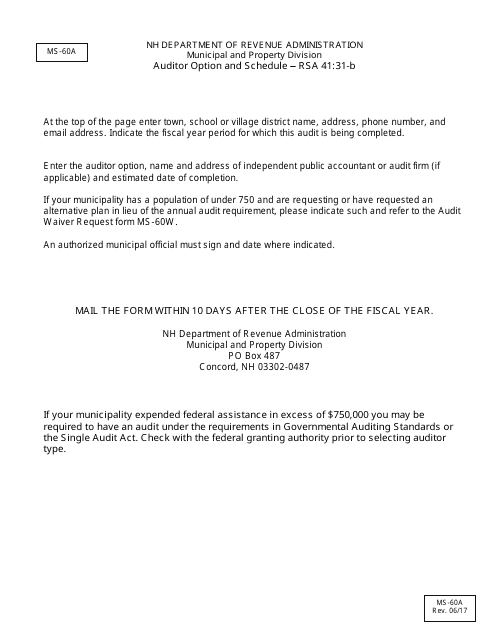

This form is used for the Auditor Option and Schedule in the state of New Hampshire.

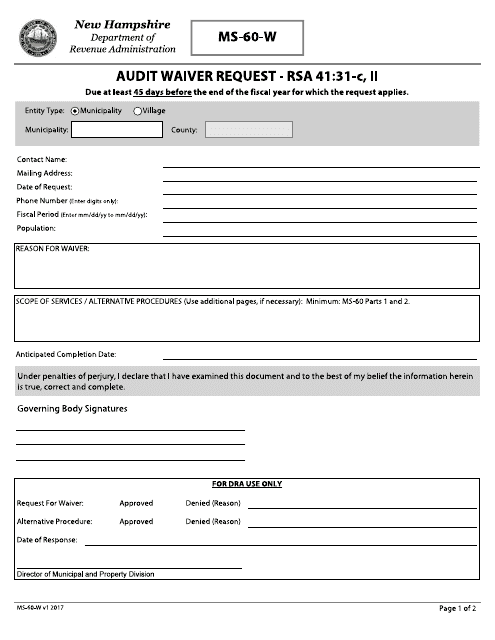

This form is used for requesting an audit waiver in the state of New Hampshire.

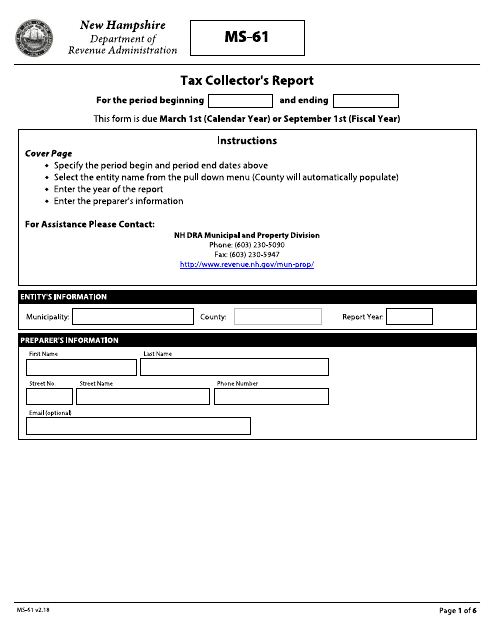

This Form is used for reporting taxes collected by the tax collector in the state of New Hampshire.

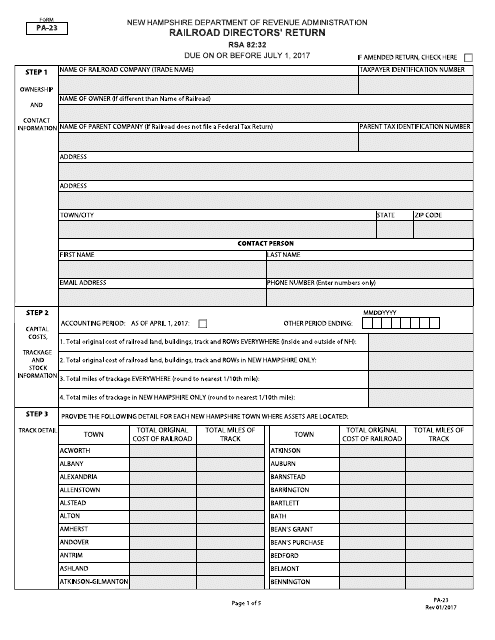

This form is used for filing the Railroad Directors' Return in the state of New Hampshire.

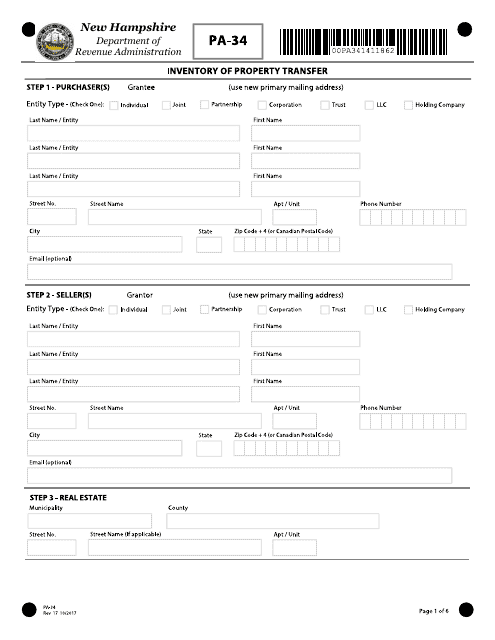

This form is used for documenting and reporting the transfer of property in the state of New Hampshire. It helps to maintain an inventory of property transfers and ensures compliance with state regulations.

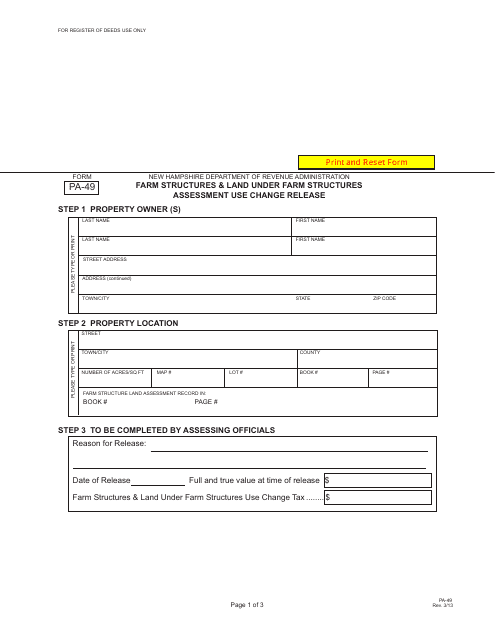

This form is used for releasing the use change of farm structures and land under farm structures assessment in the state of New Hampshire.

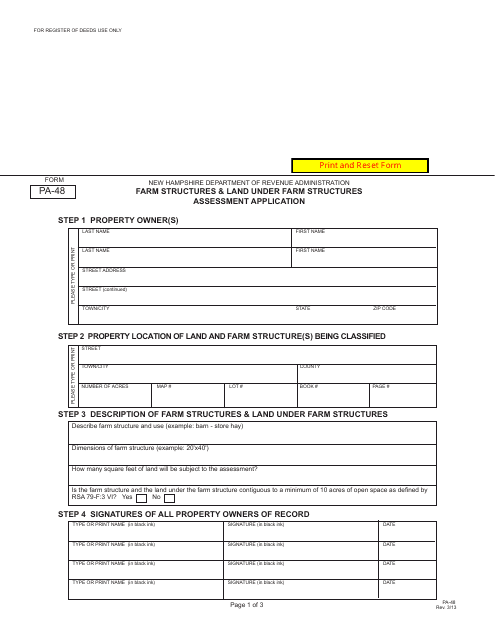

This form is used for applying for the assessment of farm structures and land under farm structures in New Hampshire. It allows farmers to receive tax benefits for their agricultural property.