Hawaii Tax Forms and Templates

Documents:

251

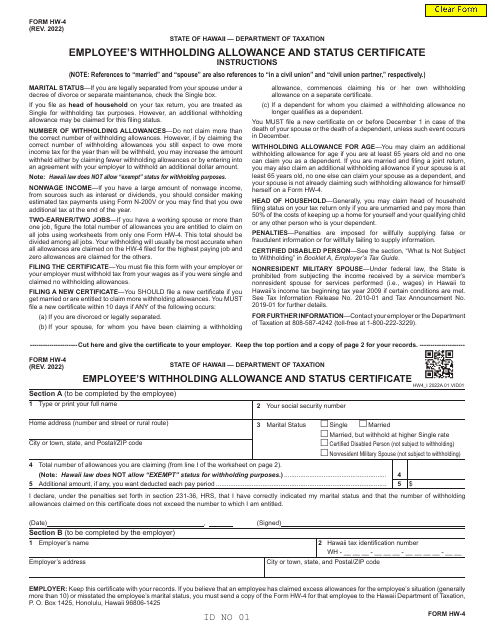

This is a state of Hawaii legal document completed by an employee for their employer's records to provide information about withholding allowances.

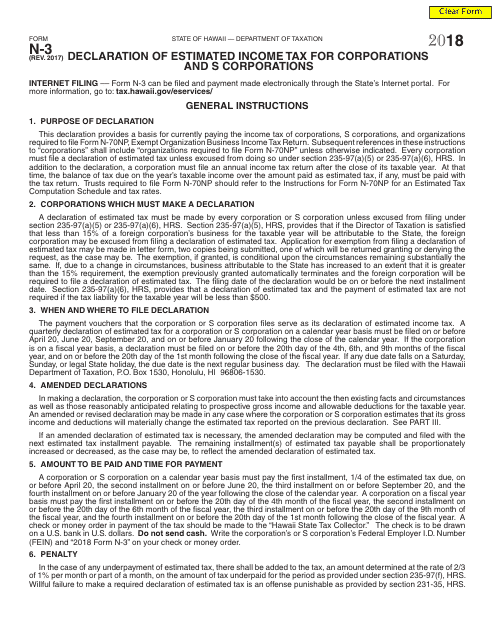

This Form is used for corporations and S corporations in Hawaii to declare their estimated income tax.

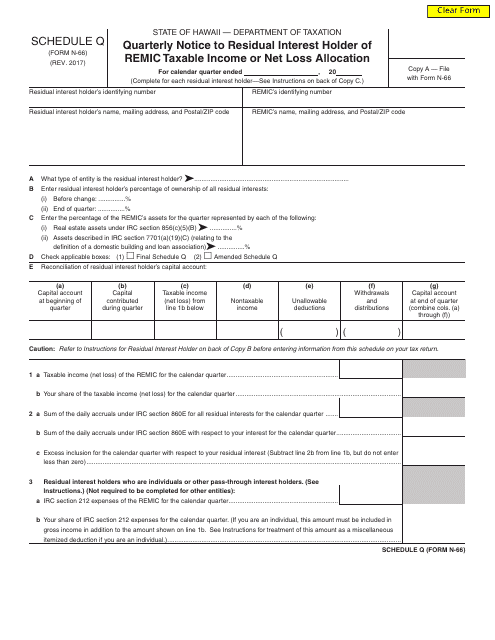

This form is used for providing quarterly notice to residual interest holders of REMIC taxable income or net loss allocation in Hawaii.

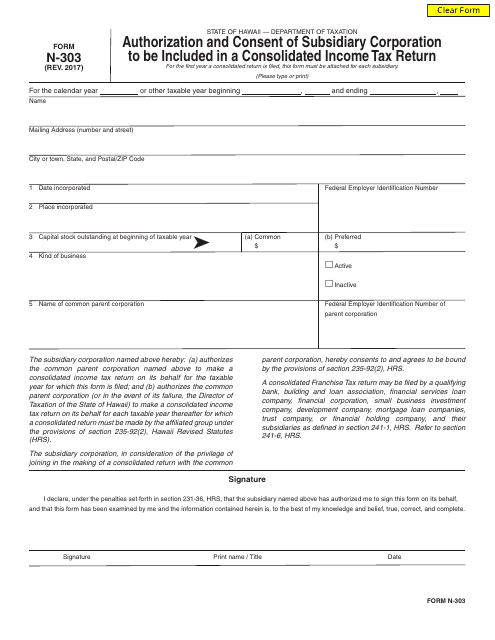

This form is used for a subsidiary corporation in Hawaii to authorize and consent to be included in a consolidated income tax return.

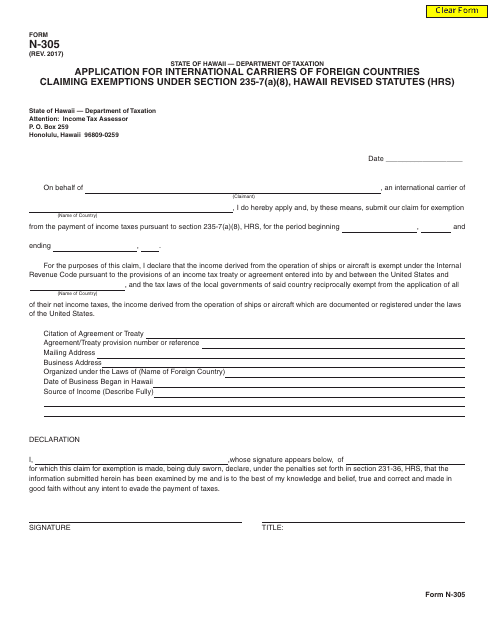

This document is used by international carriers of foreign countries to apply for exemptions under Section 235-7(A)(8) of the Hawaii Revised Statutes.

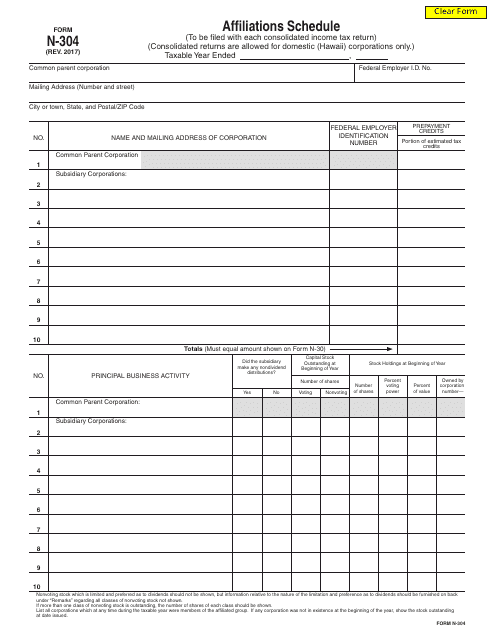

This Form is used for reporting any affiliations or connections that a taxpayer has with entities in Hawaii. It is used as part of the Hawaii state income tax return.

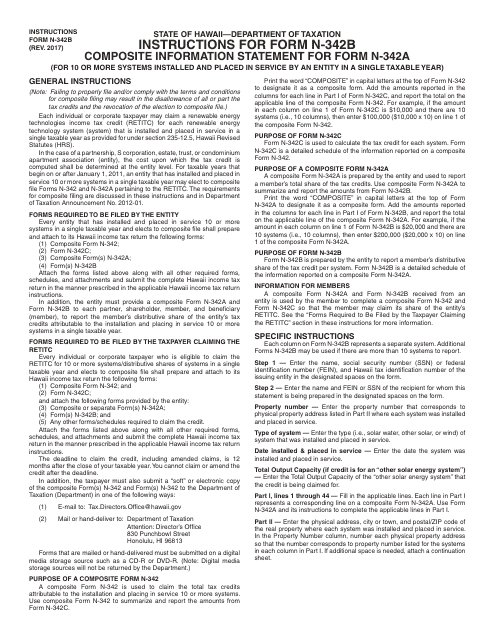

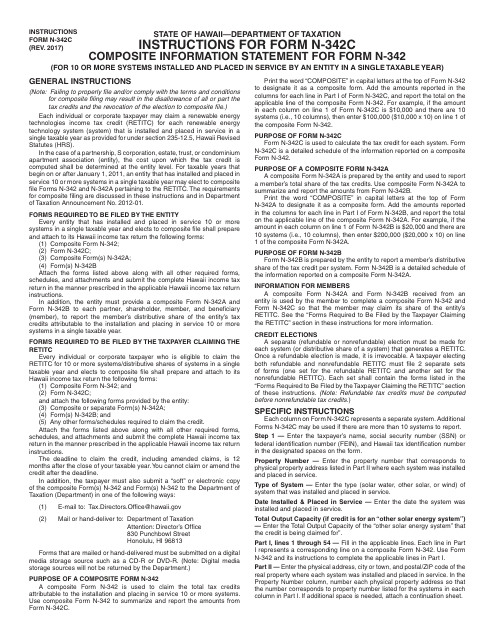

This Form is used for providing composite information for Form N-342a in Hawaii.

This document provides instructions for completing Form N-342C Composite Information Statement, which is used in Hawaii for tax reporting purposes.

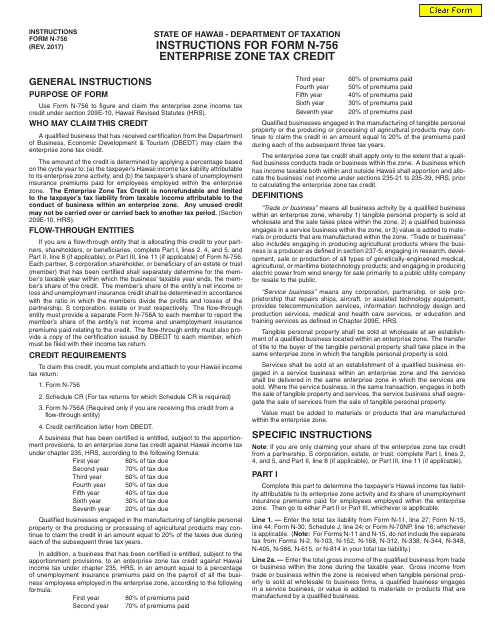

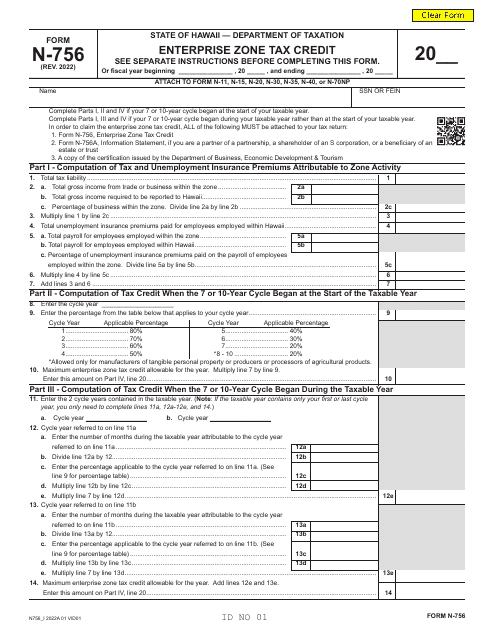

This form is used for claiming the Enterprise Zone Tax Credit in Hawaii. It provides instructions on how to accurately fill out the form and submit it to the appropriate authorities.

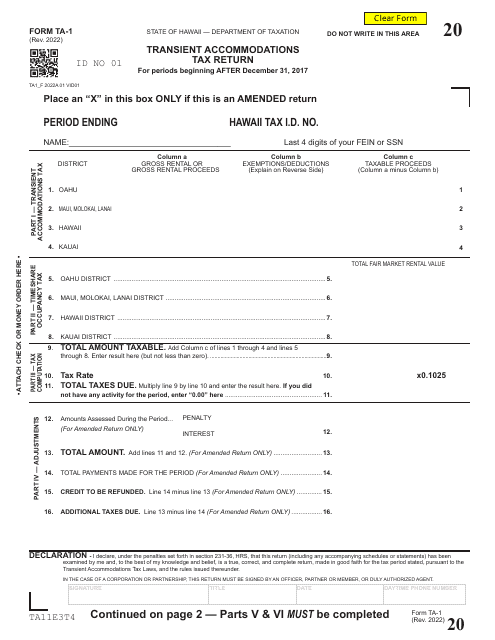

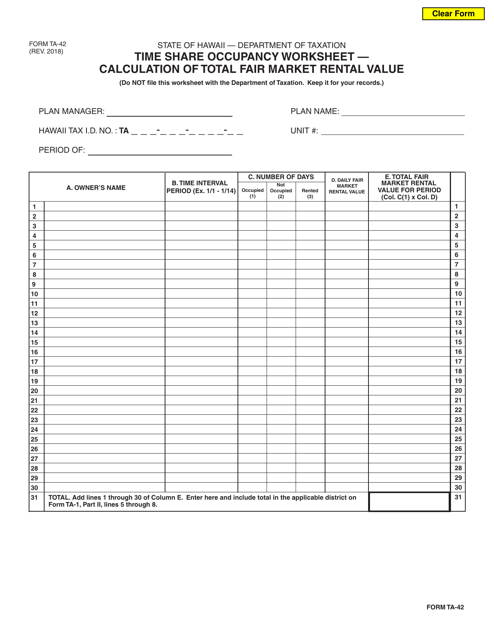

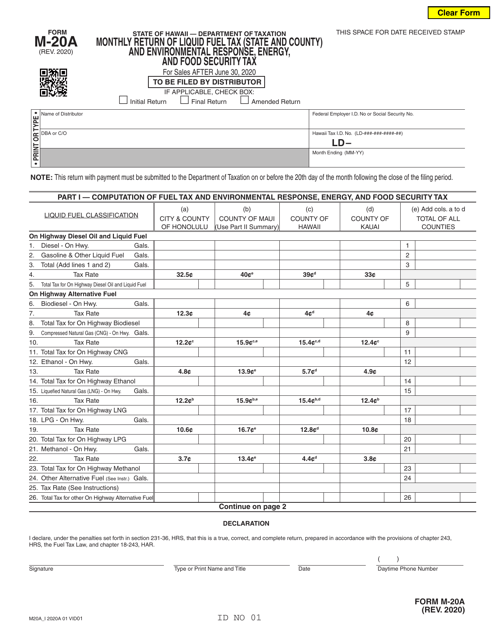

Form TA-1 Transient Accommodations Tax Return for Periods Beginning After December 31, 2017 - Hawaii

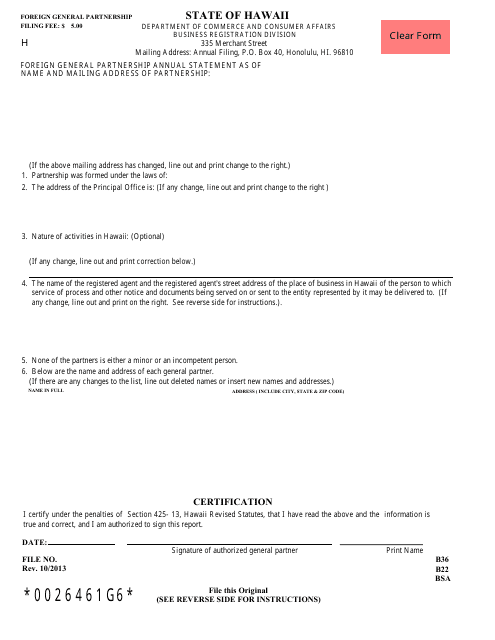

This document is used for submitting the annual statement of a foreign general partnership in the state of Hawaii. It provides information about the partnership's activities and financial status.

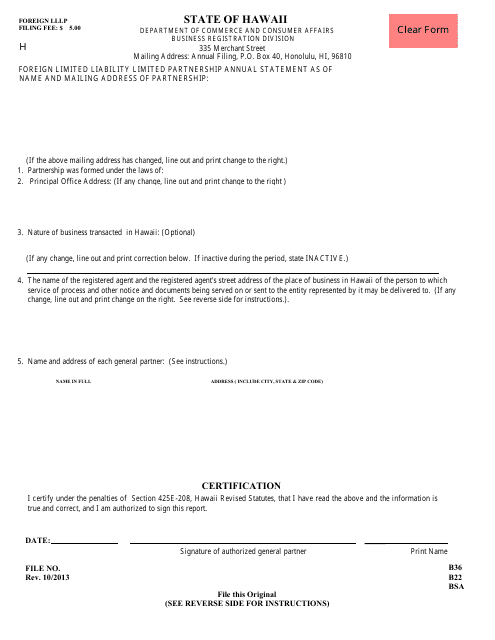

This annual statement is used for reporting the financial and operational details of a foreign limited liability limited partnership operating in Hawaii. It is a requirement for compliance with state regulations.

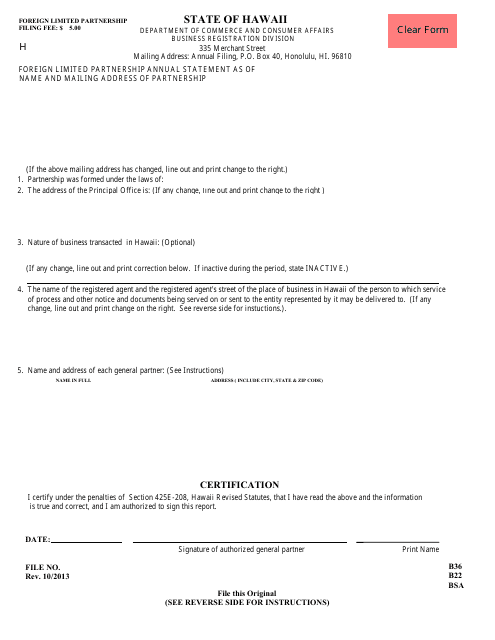

This form is used for foreign limited partnerships to submit their annual statement in Hawaii.

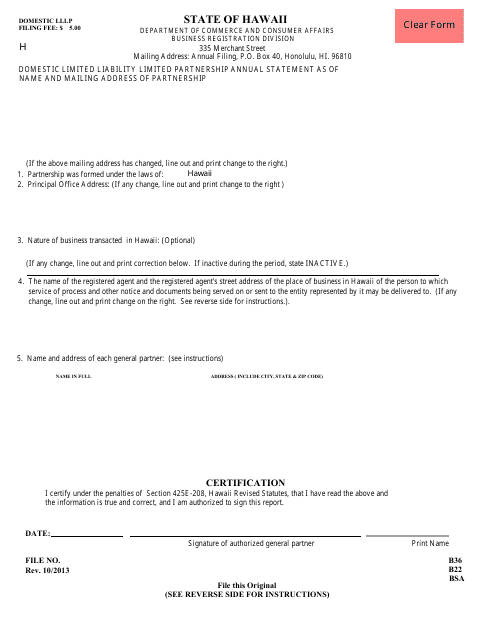

This form is used for filing the annual statement for a domestic limited liability limited partnership in Hawaii. It provides information about the partnership's finances and operations.

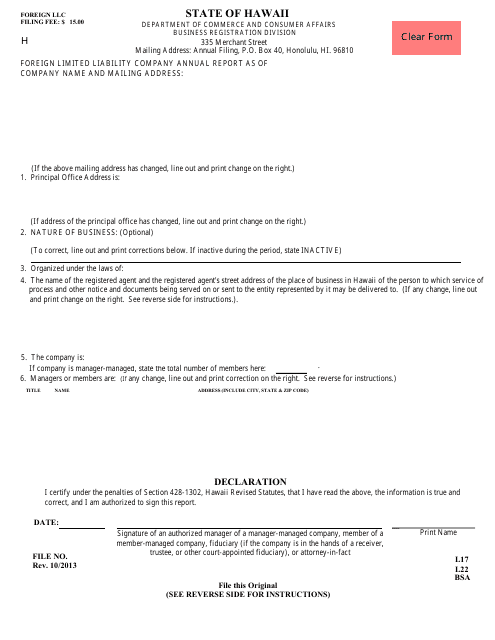

This form is used for filing the annual report of a foreign limited liability company in Hawaii.