Fill and Sign Kansas Legal Forms

Documents:

3066

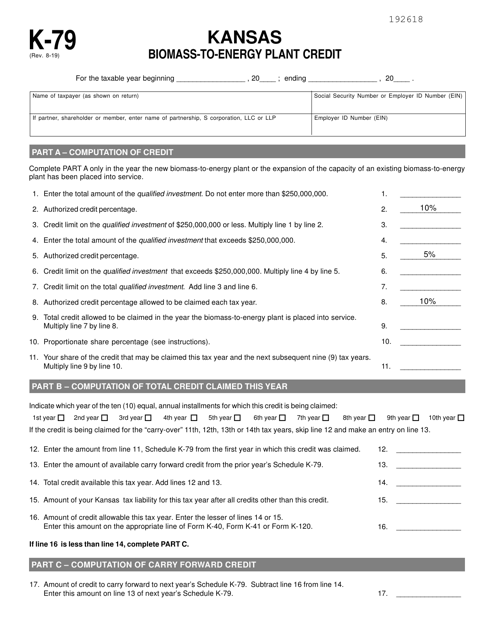

This document is used for claiming the Kansas Biomass-To-Energy Plant Credit in Kansas.

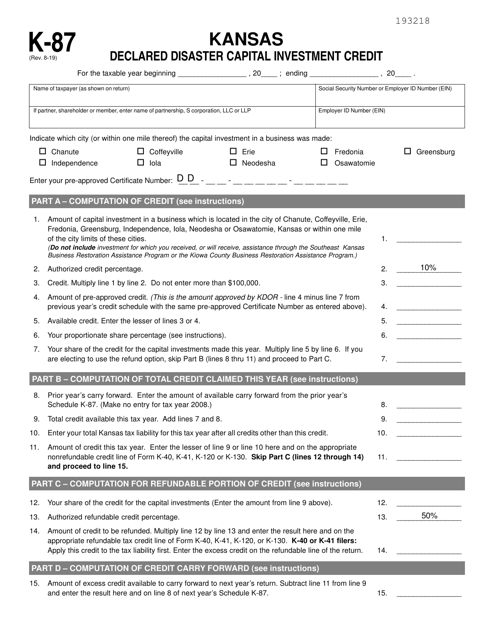

This form is used for claiming the Kansas Declared Disaster Capital Investment Credit in the state of Kansas. It allows businesses to receive a tax credit for capital investments made in areas that have been declared as disaster areas by the state.

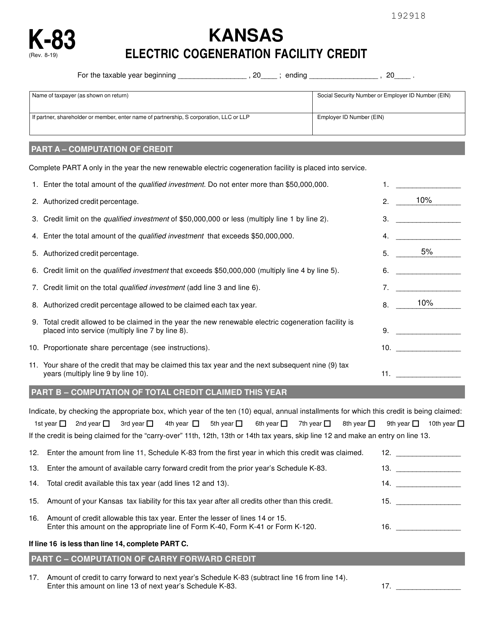

This type of document is used for claiming the Kansas Electric Cogeneration Facility Credit in the state of Kansas. It is a tax form specifically for businesses that generate electricity through cogeneration facilities in Kansas.

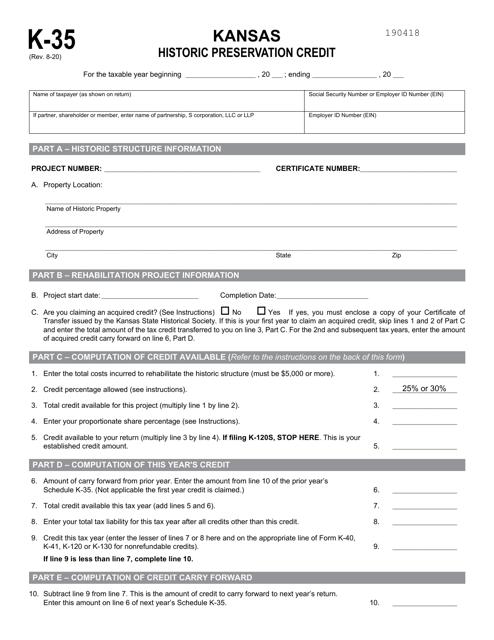

This form is used for claiming the Kansas Historic Preservation Credit in the state of Kansas. It is a tax credit available for eligible taxpayers who have made qualified expenditures for the rehabilitation and preservation of historic properties in the state.

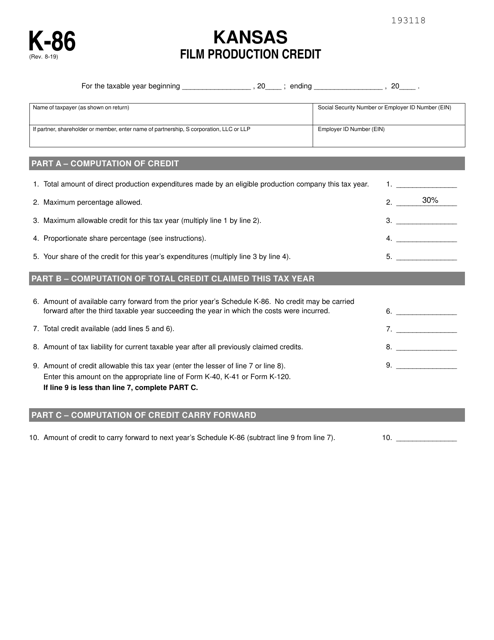

This document is used for claiming the Kansas film production credit in the state of Kansas.

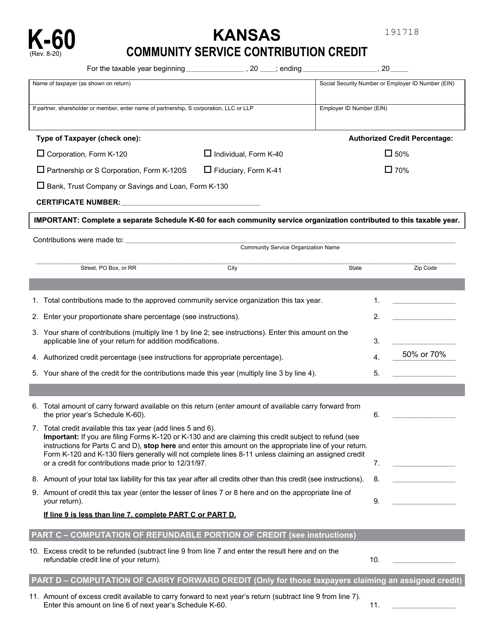

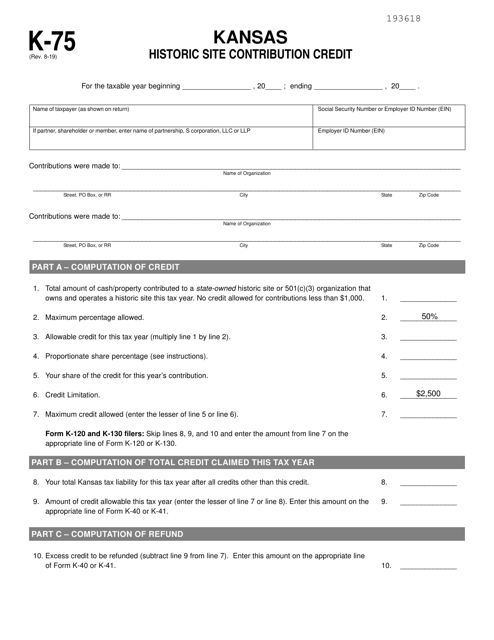

This document is used for claiming the Kansas Historic Site Contribution Credit in the state of Kansas. This credit is available for taxpayers who make contributions to qualified historic sites in Kansas.

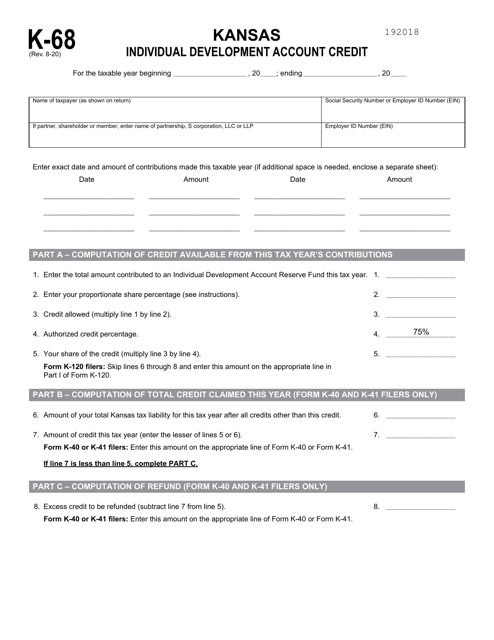

This document provides information about the Schedule K-68 Kansas Individual Development Account Credit in the state of Kansas. It outlines the details and requirements for claiming this credit, which is aimed at encouraging saving and asset building for low-income individuals.

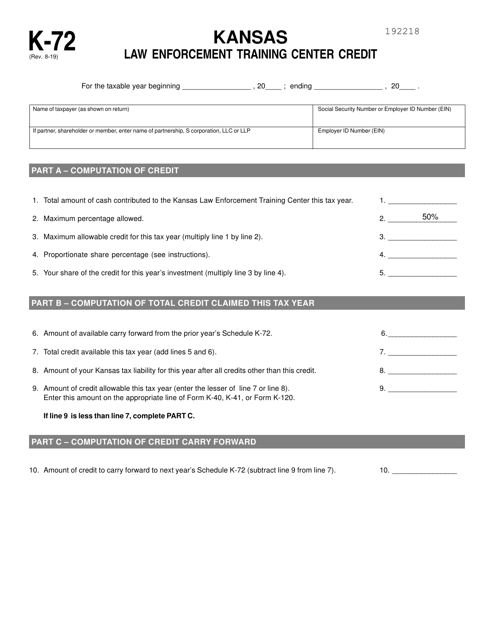

This form is used for claiming the Kansas Law Enforcement Training Center Credit in Kansas. This credit is available to individuals who have completed law enforcement training at the Kansas Law Enforcement Training Center.

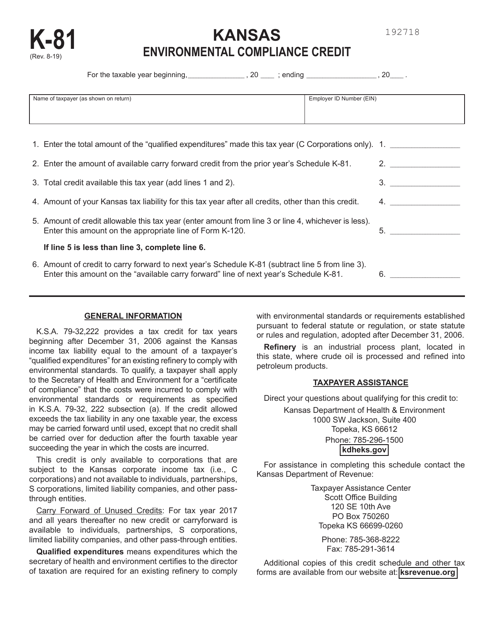

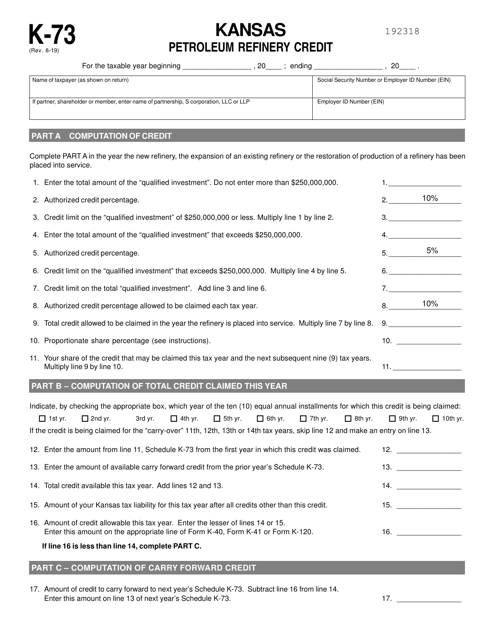

This document is used for claiming the Kansas Petroleum Refinery Credit in the state of Kansas. It allows petroleum refineries to apply for a credit against their tax liability for certain qualified activities.

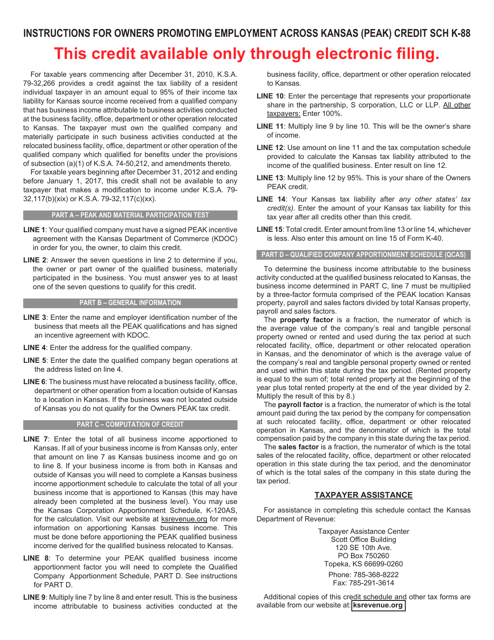

This document provides instructions for claiming the Schedule K-88 Owners Promoting Employment Across Kansas (PEAK) Credit in Kansas. The PEAK Credit is aimed at encouraging job creation and economic growth in the state.

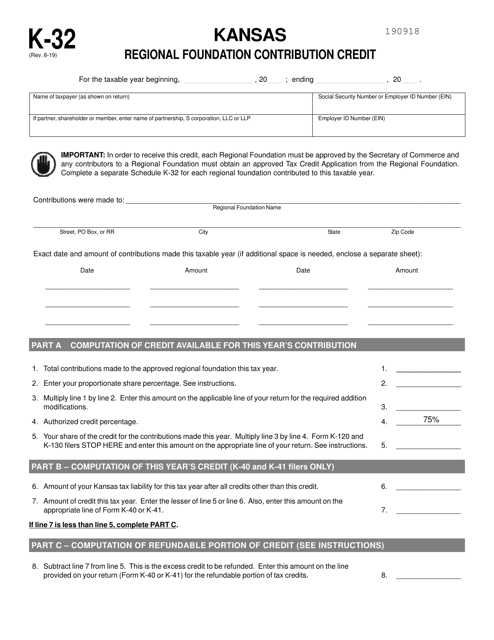

This document is used for claiming the Kansas Regional Foundation Contribution Credit on your state tax return.

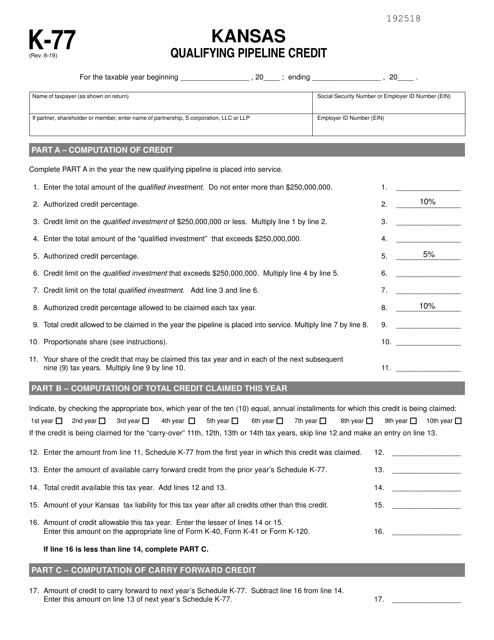

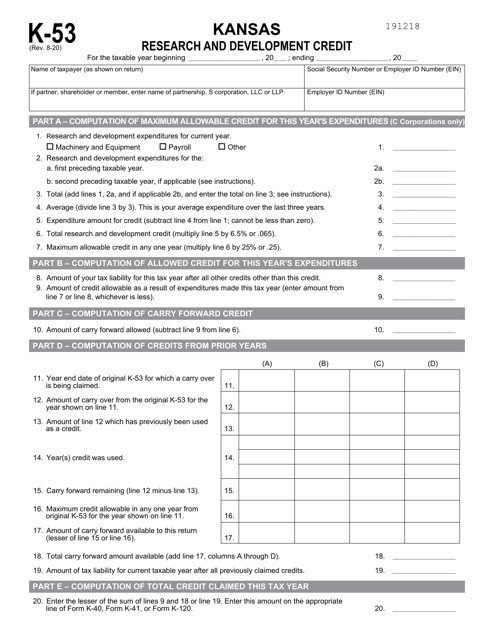

This form is used for claiming the Kansas Research and Development Credit in the state of Kansas.

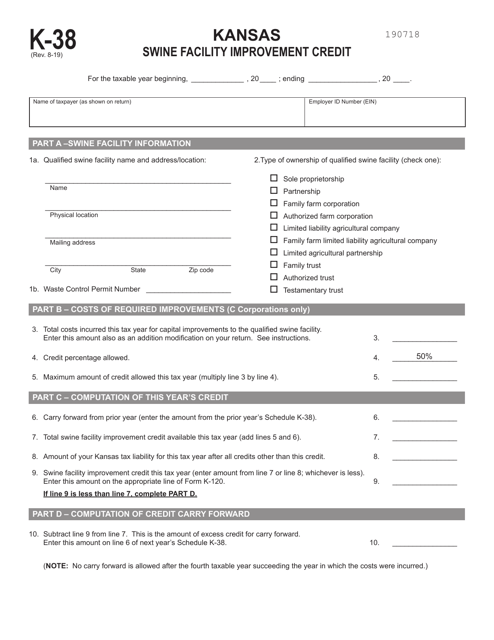

This form is used for claiming the Kansas Swine Facility Improvement Credit on your state tax return if you have made improvements to a swine facility in Kansas.

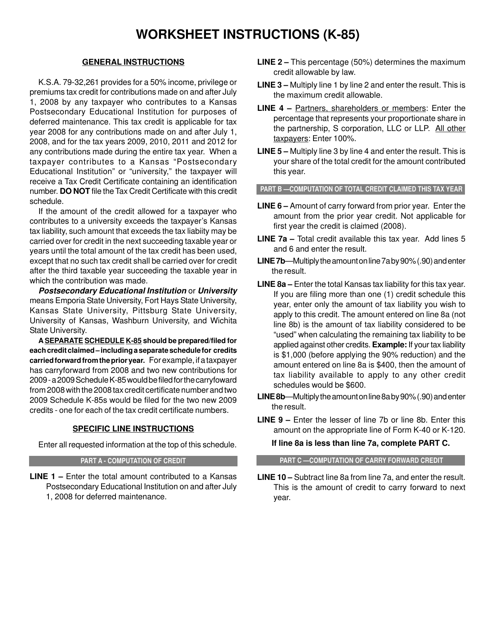

This document provides instructions for Schedule K-85, which is used in Kansas to claim the University Deferred Maintenance Credit. It provides the necessary guidance on how to properly complete this schedule for tax purposes in Kansas.

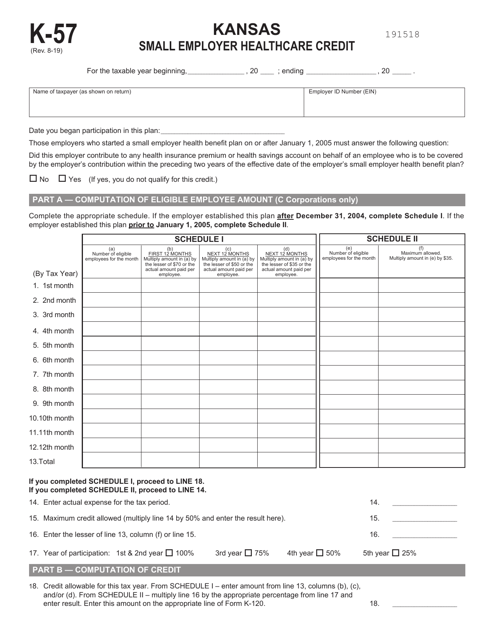

This document is used for claiming the Kansas Small Employer Healthcare Credit in Kansas. It is a tax credit available to small employers who provide health insurance to their employees.

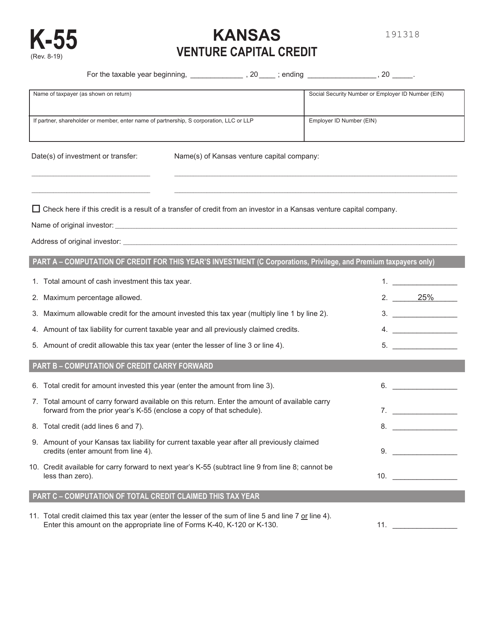

This form is used for claiming the Kansas Venture Capital Credit in the state of Kansas. It is available for individuals or businesses who have invested in qualified Kansas venture capital funds.

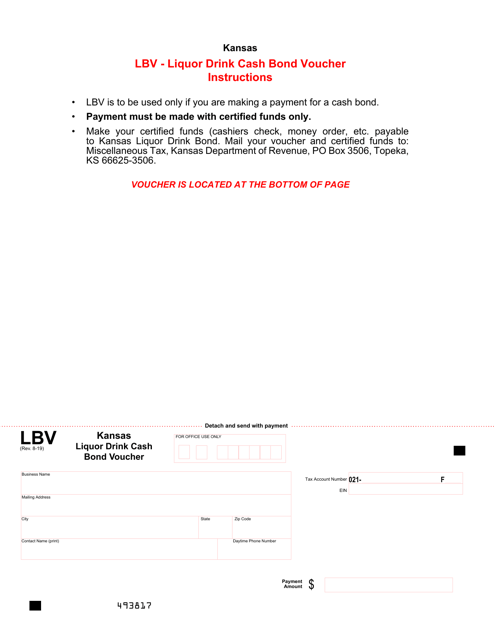

This form is used for submitting a cash bond voucher for Kansas liquor drink licenses.

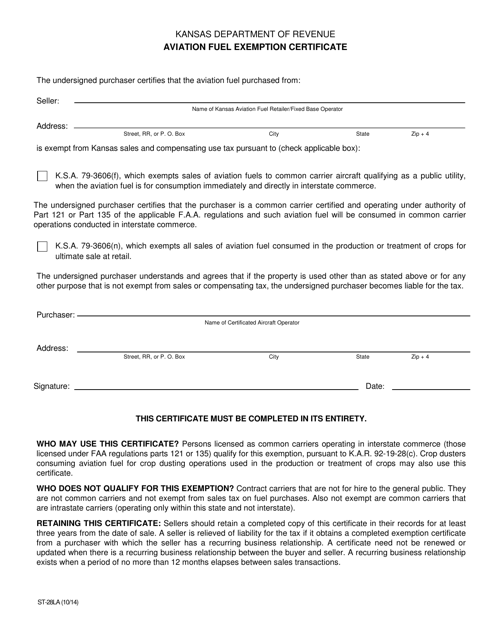

This Form is used for claiming a fuel exemption on aviation fuel in the state of Kansas.

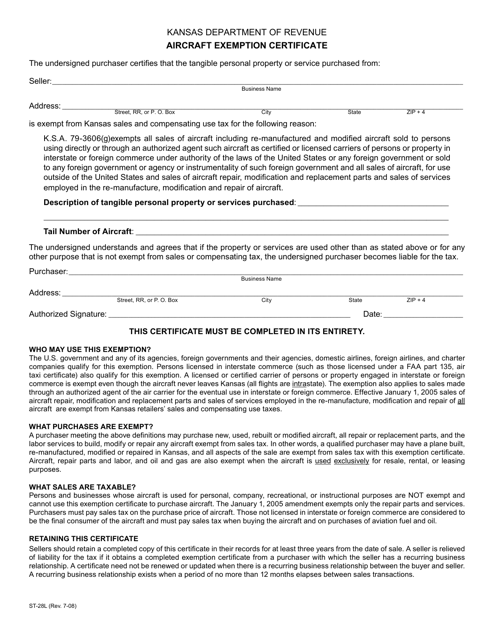

This Form is used for requesting an exemption from aircraft sales tax in the state of Kansas.

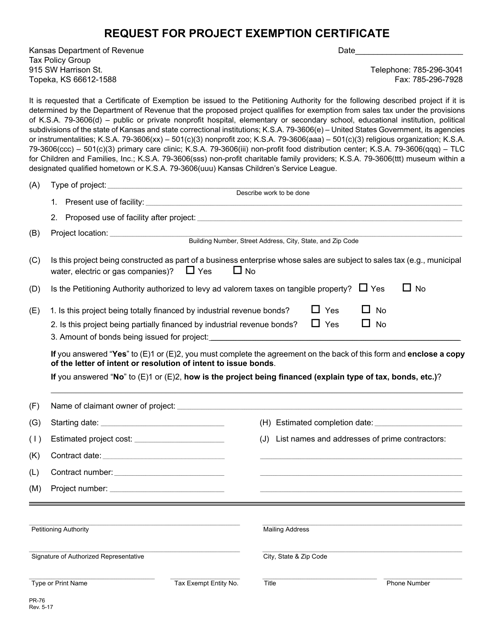

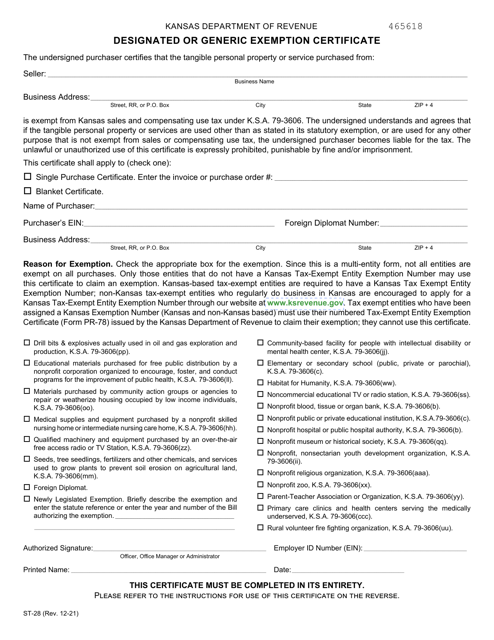

This form is used for requesting a Project Exemption Certificate in the state of Kansas. It is necessary for obtaining tax exemption status for specific projects.

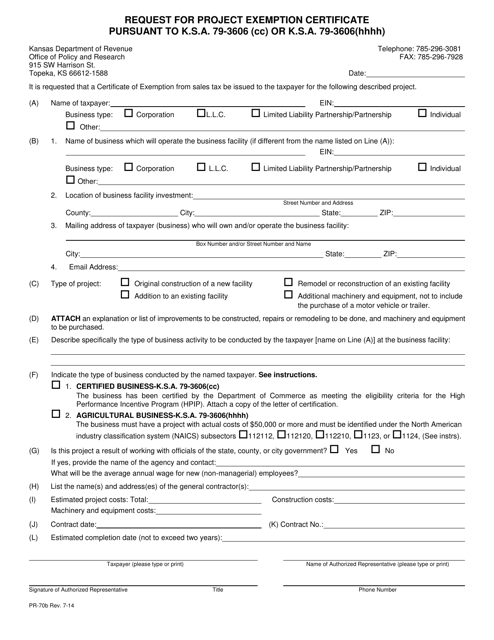

This form is used for requesting an exemption from certain taxes or fees for projects located in designated Enterprise Zones in Kansas.

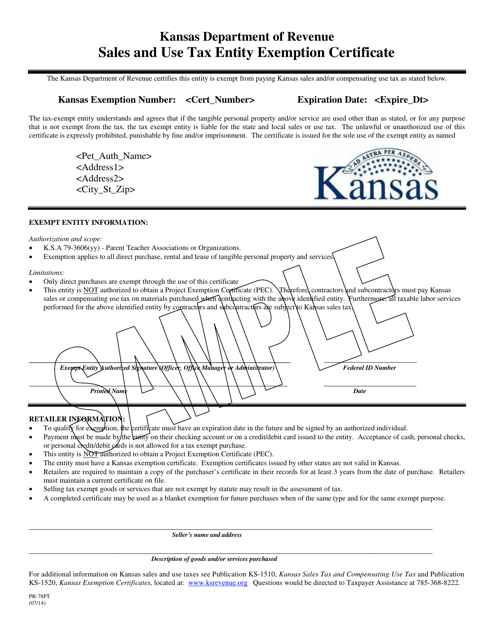

This Form is used for requesting sales and use tax exemption as a Parent Teacher Association in Kansas.

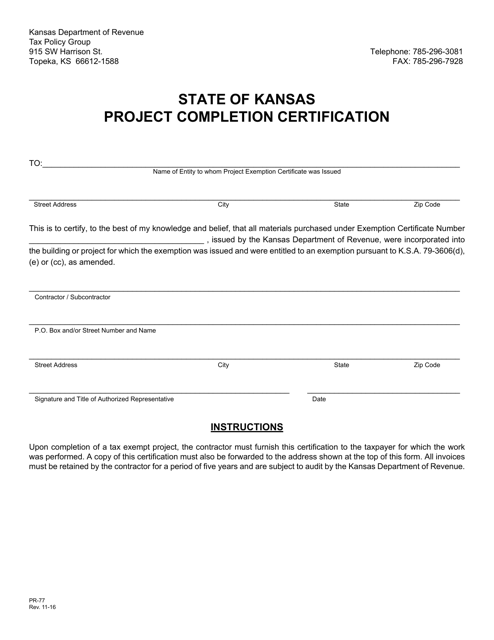

This Form is used for certifying the completion of a project in the state of Kansas.

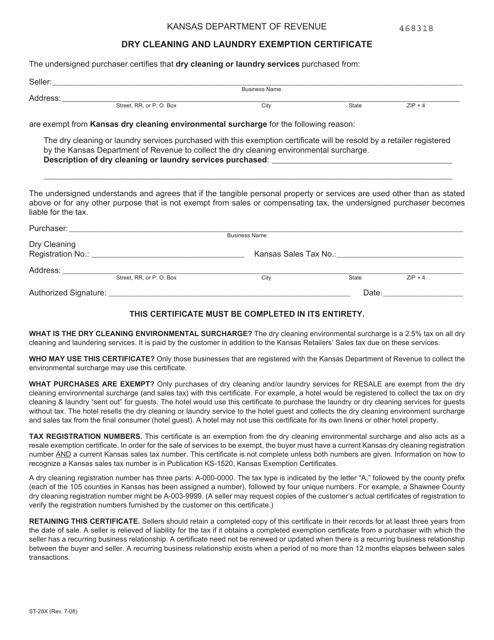

This Form is used for requesting a tax exemption on dry cleaning and laundry services in the state of Kansas.

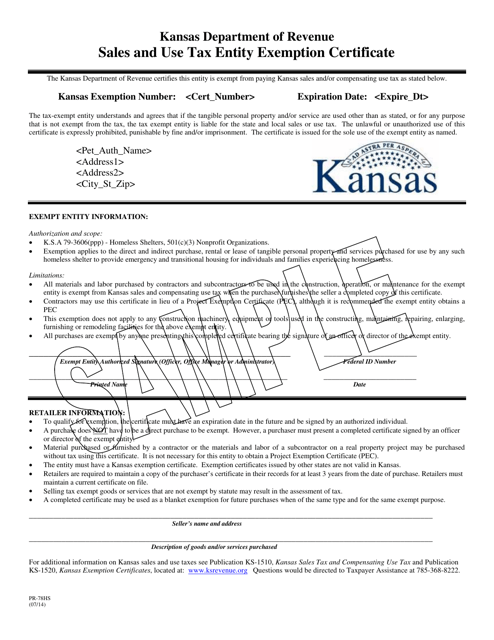

This form is used for requesting sales and use tax exemption for homeless shelters in Kansas. A sample of the form is provided.

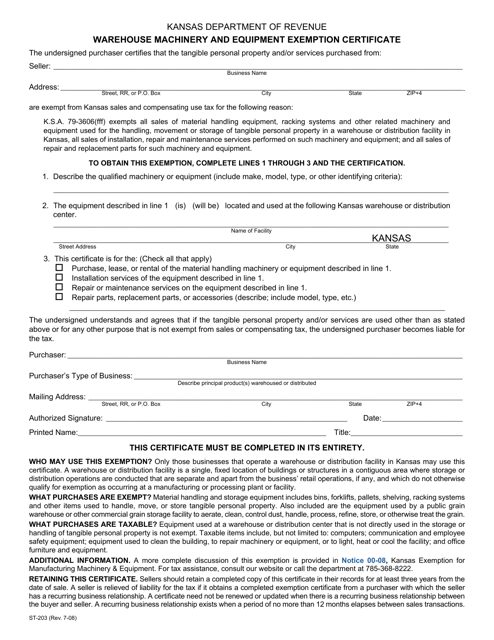

This form is used for requesting an exemption from sales tax on warehouse machinery and equipment in the state of Kansas.

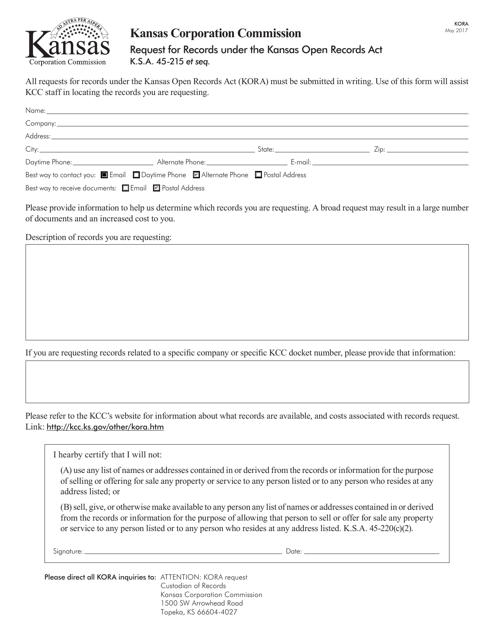

This Form is used for requesting records under the Kansas Open Records Act in Kansas.

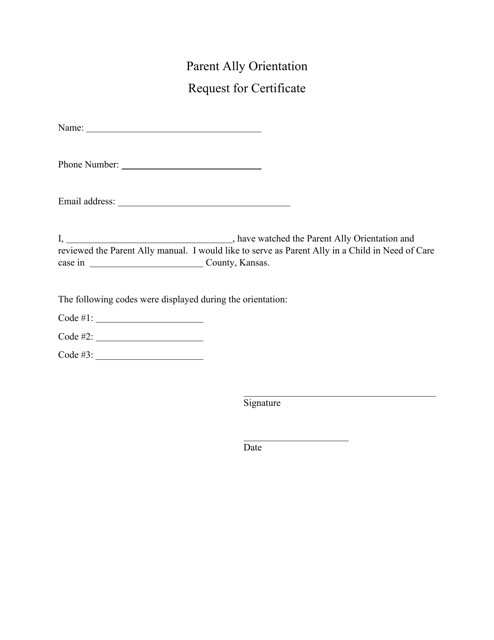

This document is a request for a certificate to participate in a Parent Ally Orientation program in the state of Kansas.