Fill and Sign Kansas Legal Forms

Documents:

3066

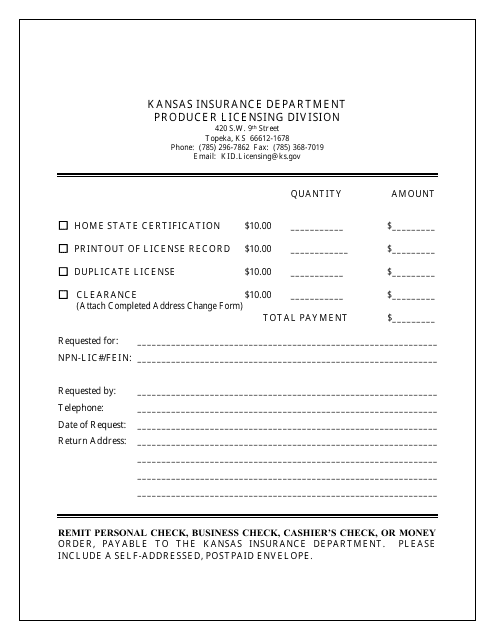

This document certifies that an individual's home state is Kansas. It may be required for various purposes such as applying for a job or obtaining certain licenses or permits.

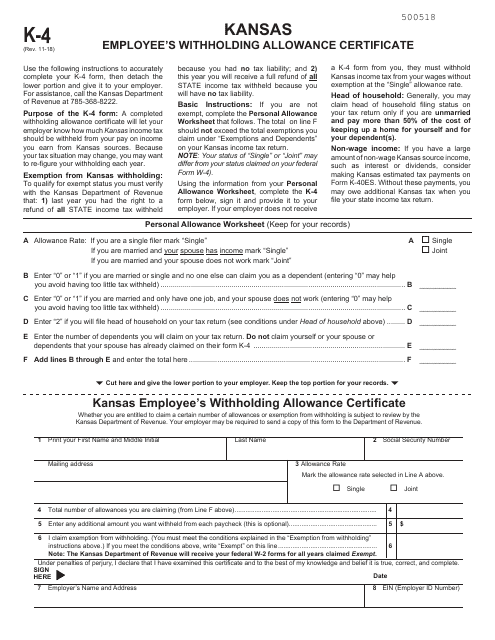

This form is used for employees in Kansas to declare their withholding allowances for state income tax purposes.

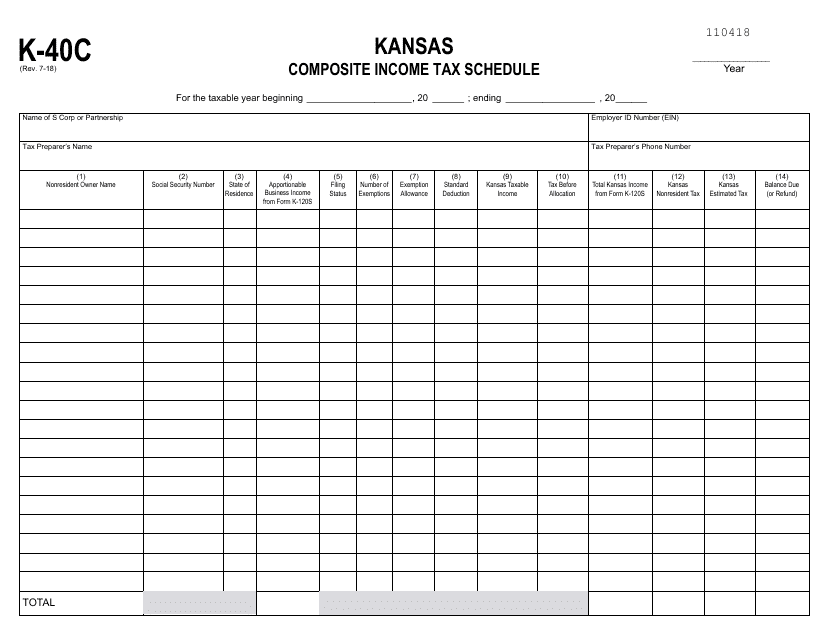

This form is used for reporting composite income tax for individuals in the state of Kansas.

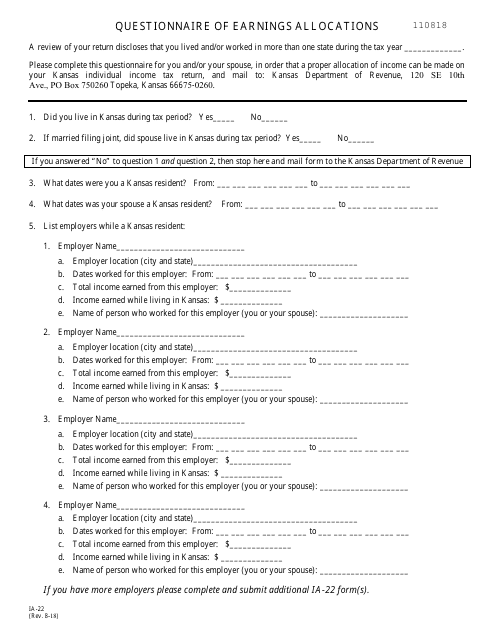

This form is used for allocating earnings in the state of Kansas. It is a questionnaire that helps identify how income should be allocated for tax purposes.

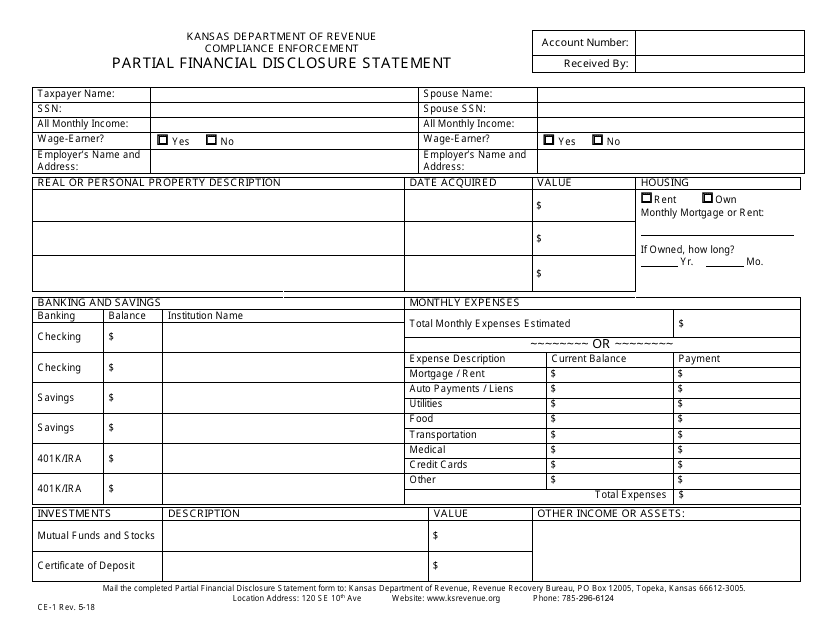

This form is used for filing a partial financial disclosure statement in the state of Kansas.

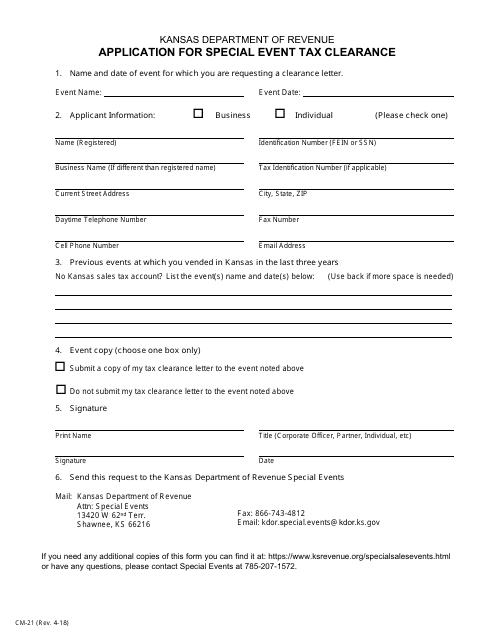

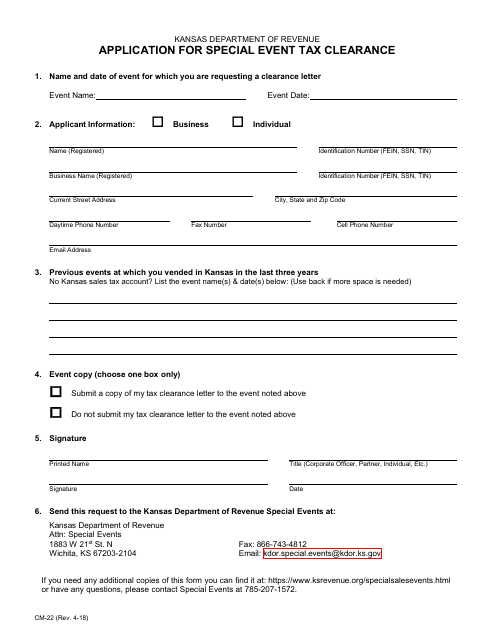

This form is used for applying for a special event tax clearance in the state of Kansas. It is required for organizers planning to hold a special event that may be subject to taxes.

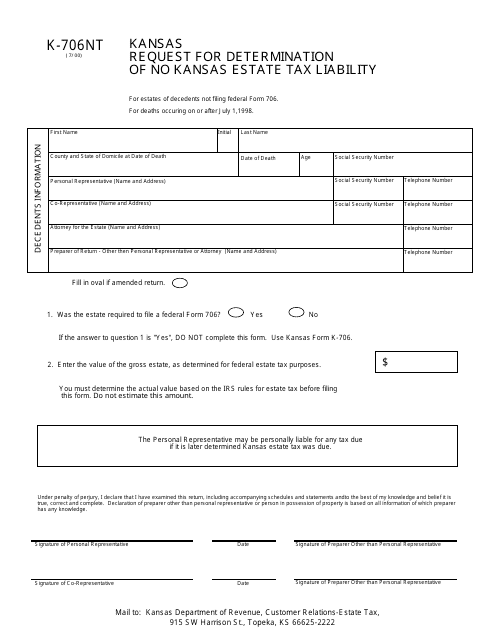

This form is used for requesting a determination of no Kansas estate tax liability in the state of Kansas.

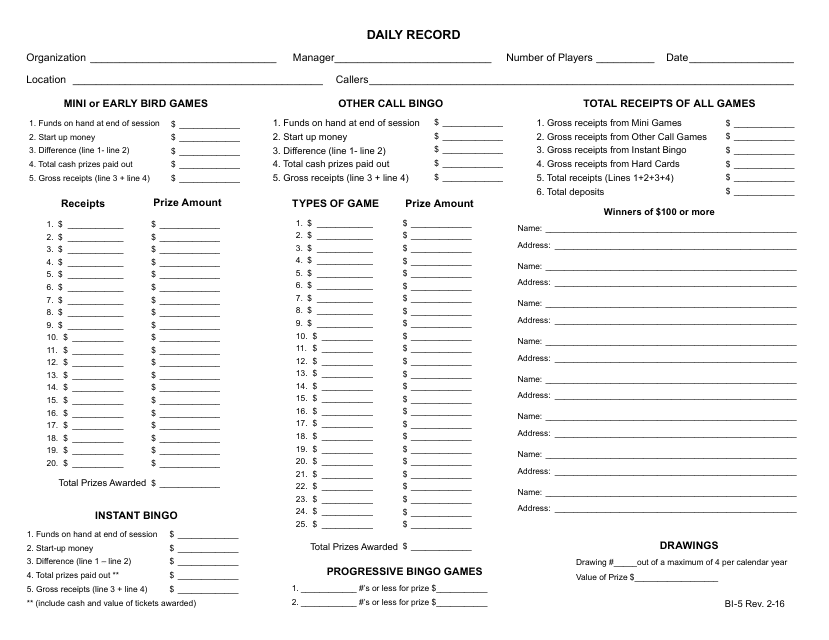

This form is used for maintaining a daily record in the state of Kansas. It is used to document and keep track of activities, events, and important information on a daily basis.

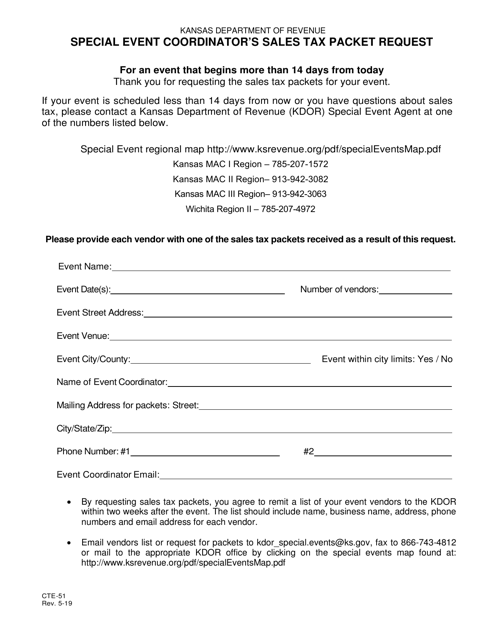

This form is used to apply for a special event tax clearance in Kansas. It is required for organizing special events that involve the sale of goods or services. The form helps ensure that all necessary taxes are paid and event organizers comply with state regulations.

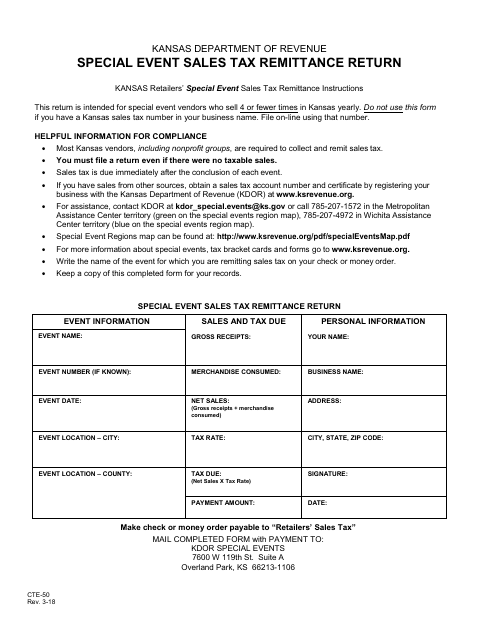

This Form is used for remitting sales tax for special events in Kansas.

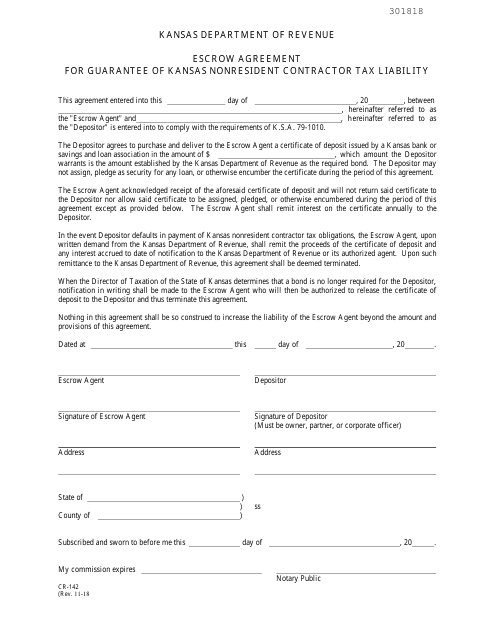

This form is used for establishing an escrow agreement to guarantee the tax liability of a nonresident contractor in Kansas.

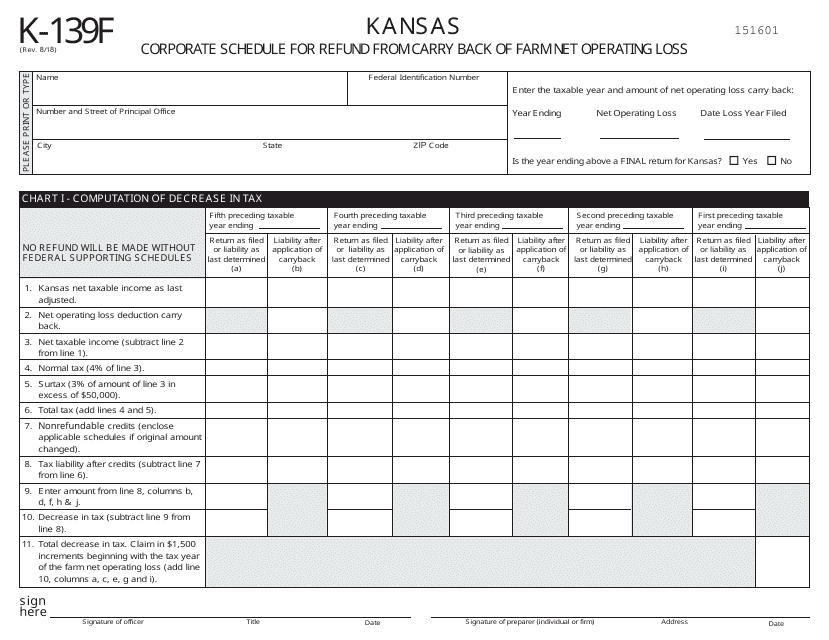

This form is used for Kansas corporations to claim a refund from carrying back farm net operating losses.

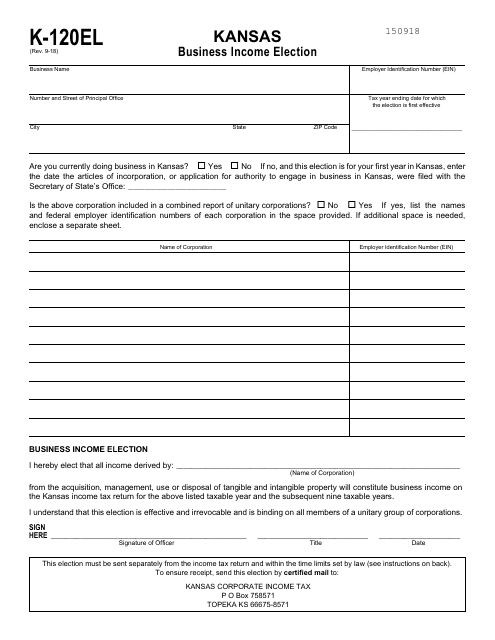

This form is used for electing Kansas business income tax treatment.

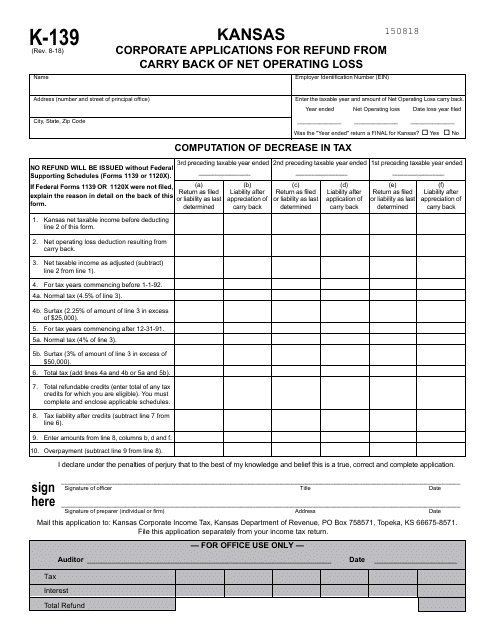

This form is used by corporations in Kansas to apply for a refund resulting from carrying back a net operating loss.

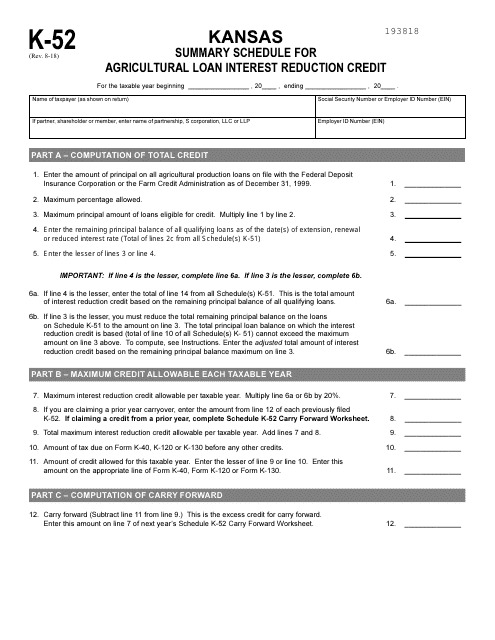

This type of document is used for providing a summary of the agricultural loan interest reduction credit in the state of Kansas. It is used by individuals or businesses who are claiming this credit on their tax return.

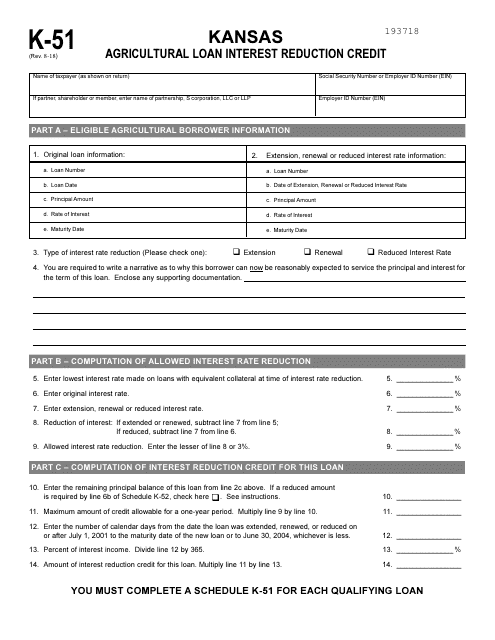

This document is used for claiming the Agricultural Loan Interest Reduction Credit in the state of Kansas for qualifying farmers and ranchers who have received an agricultural loan.

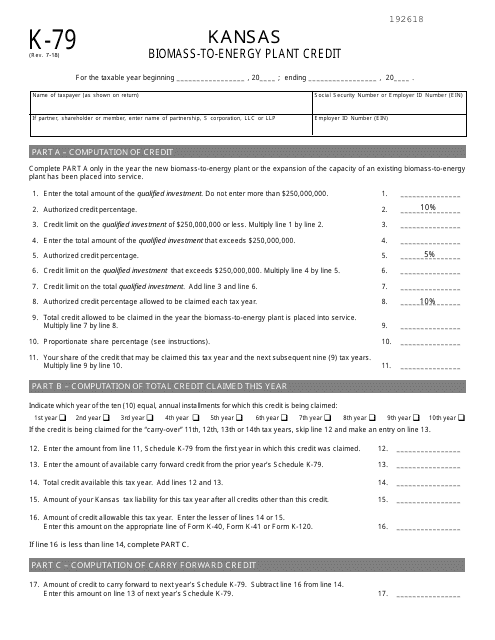

This form is used for claiming the Biomass-To-Energy Plant Credit in the state of Kansas. It allows businesses that operate biomass-to-energy plants to receive a tax credit for the energy generated from biomass sources.

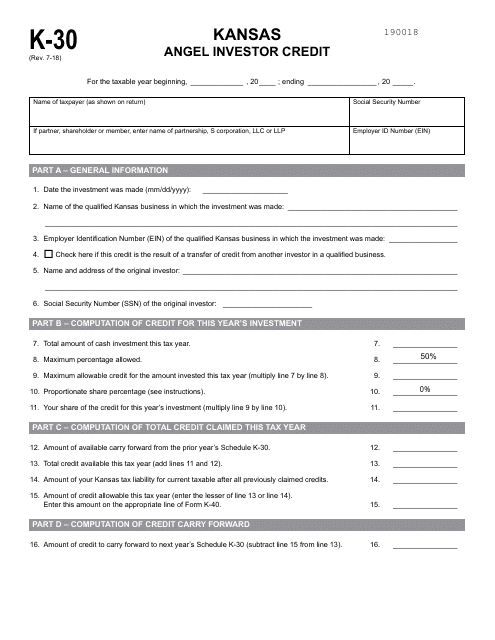

This form is used for claiming the Angel Investor Credit in Kansas. It helps individuals and businesses who invest in qualified Kansas businesses to claim a tax credit.

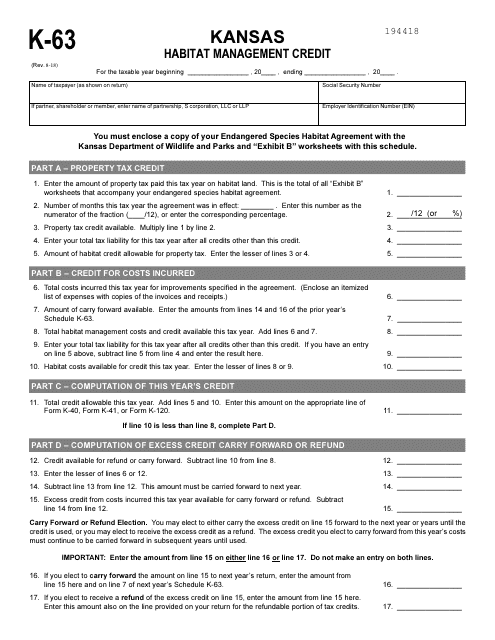

This document is for claiming the Kansas Habitat Management Credit on your tax return in Kansas. It provides a schedule and instructions for calculating and reporting this credit, which is designed to incentivize landowners to conserve and enhance habitat for wildlife in the state of Kansas.

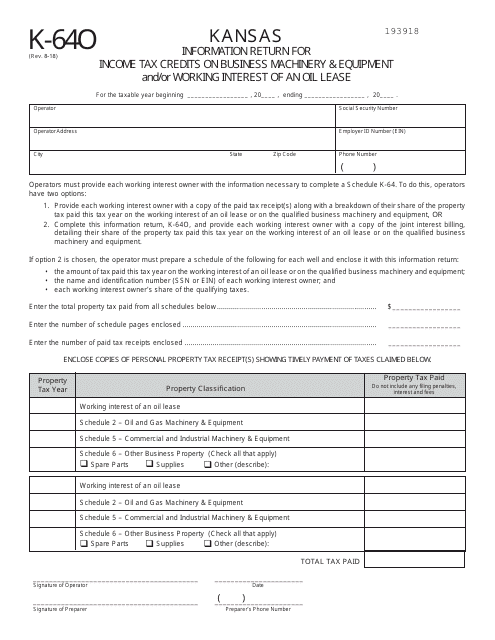

This form is used for reporting income tax credits on business machinery and equipment, as well as working interest of an oil lease in the state of Kansas.

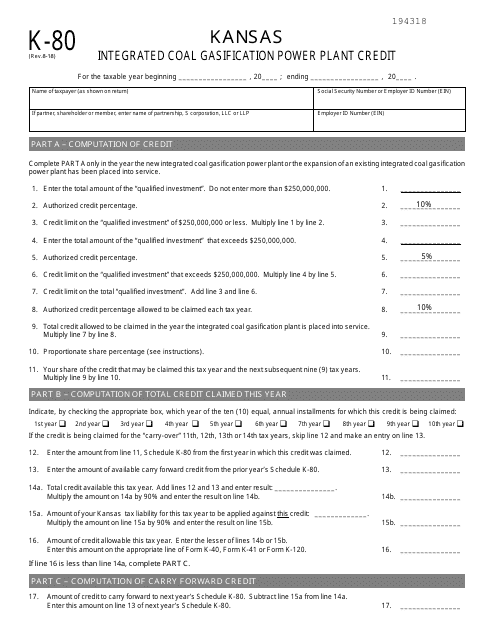

This form is used for claiming the Integrated Coal Gasification Power Plant Credit in the state of Kansas.

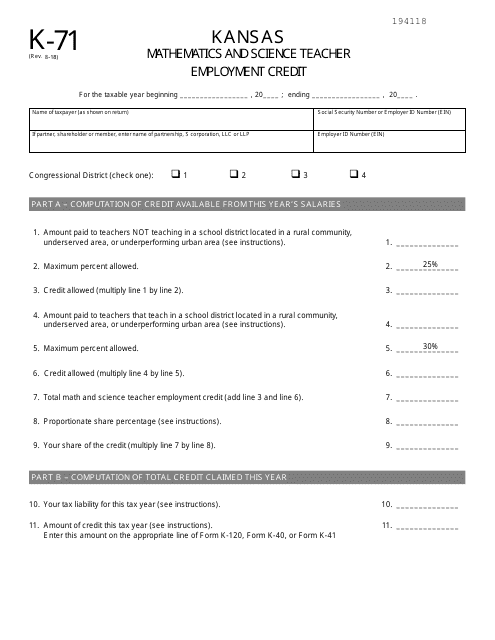

This form is used for claiming the Mathematics and Science Teacher Employment Credit in Kansas. It is specifically for teachers who specialize in these subjects and are employed in the state of Kansas.

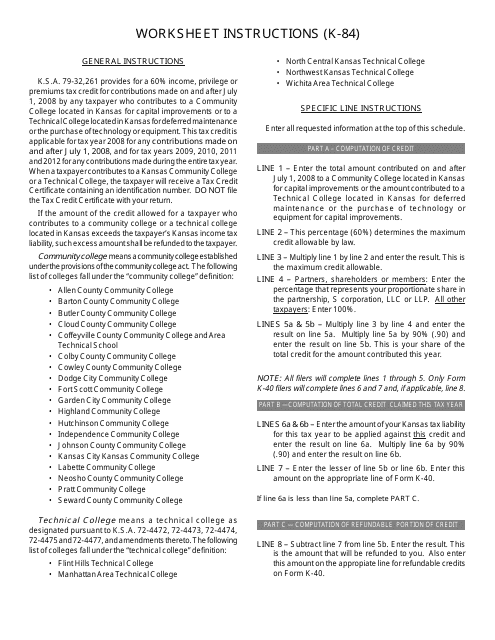

Instructions for Worksheet K-84 Technical and Community College Deferred Maintenance Credit - Kansas

This document provides instructions for completing Worksheet K-84, which is used to claim the Technical and Community College Deferred Maintenance Credit in the state of Kansas. It includes information on the eligibility criteria and how to calculate the credit amount.

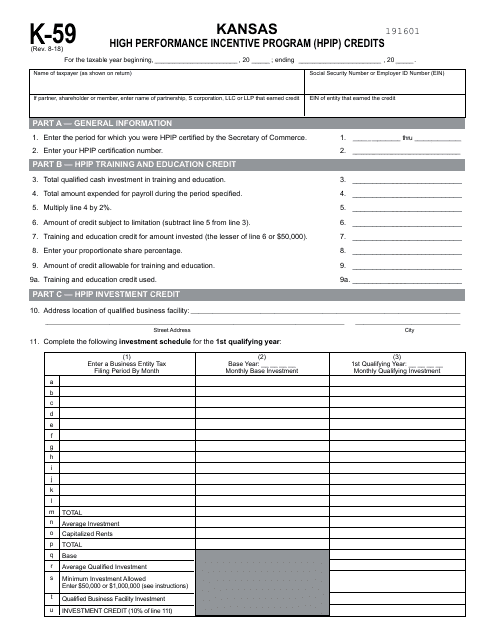

This form is used for claiming Kansas High Performance Incentive Program (HPIP) credits in the state of Kansas.