Ttb Forms and Templates

TTB Forms are forms used by the Alcohol and Tobacco Tax and Trade Bureau (TTB), which is a part of the U.S. Department of the Treasury. These forms are used for various purposes related to regulating and collecting taxes on alcohol, tobacco, and firearms in the United States. They are used to track and document activities such as the production, sale, import, export, and taxation of these products.

Documents:

39

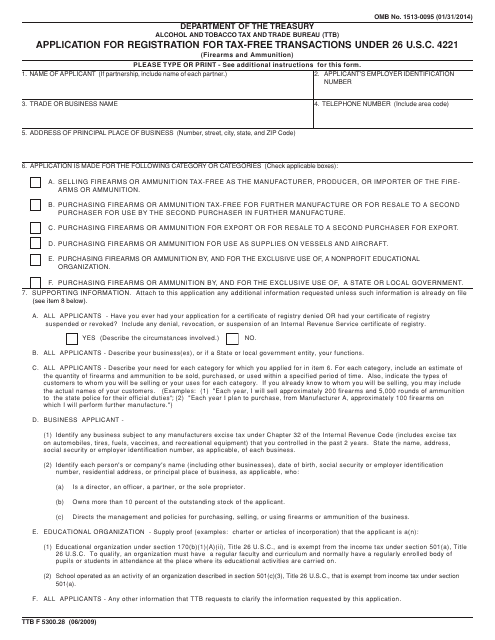

This form is used for registering tax-free transactions for firearms and ammunition under 26 U.S.C. 4221. It is necessary for businesses involved in the sale or manufacturing of firearms and ammunition to apply for this registration.

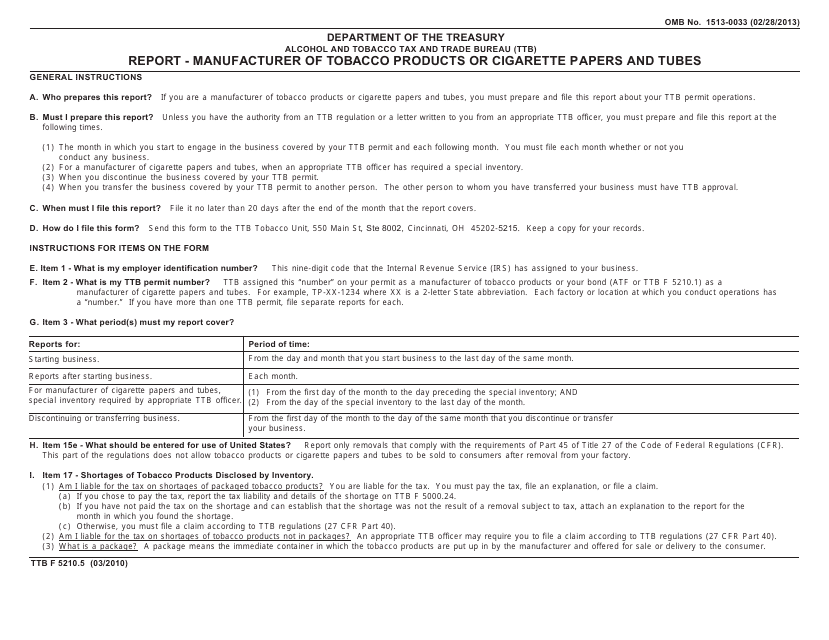

This document is used for reporting the information of manufacturers of tobacco products, cigarette papers, and tubes.

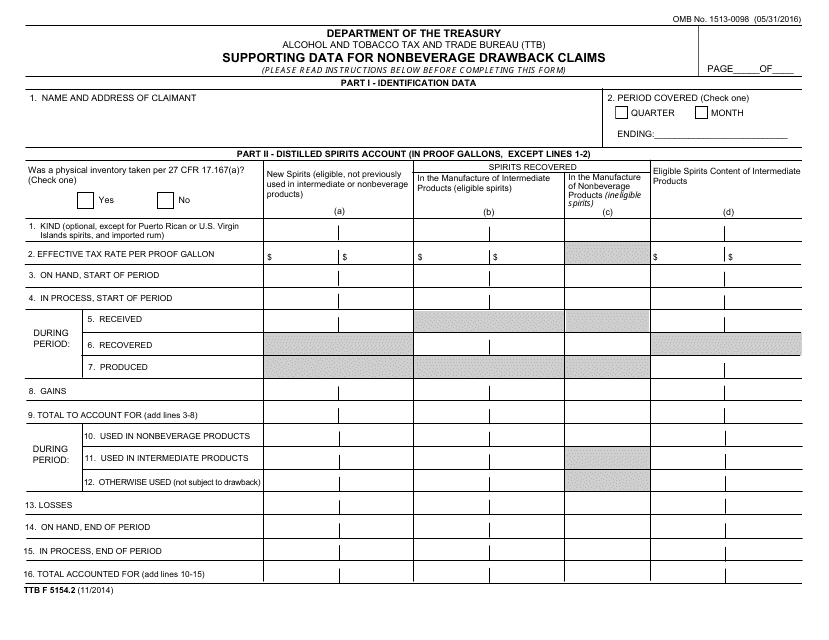

This Form is used for submitting supporting data for nonbeverage drawback claims to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

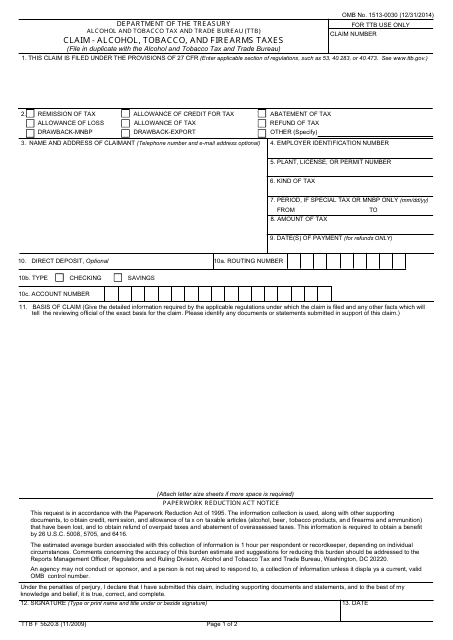

This form is used for claiming refunds for alcohol, tobacco, and firearms taxes in the United States.

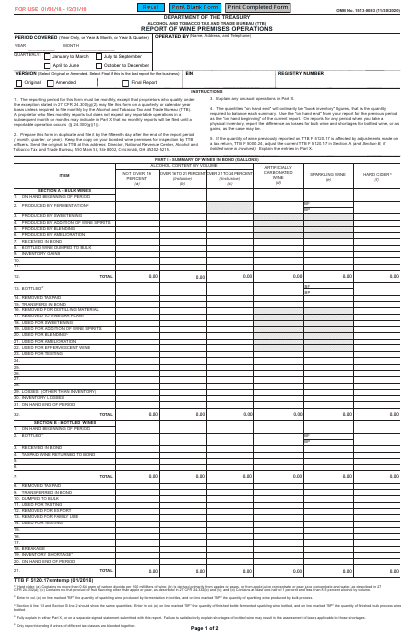

This form is used for reporting wine premises operations.

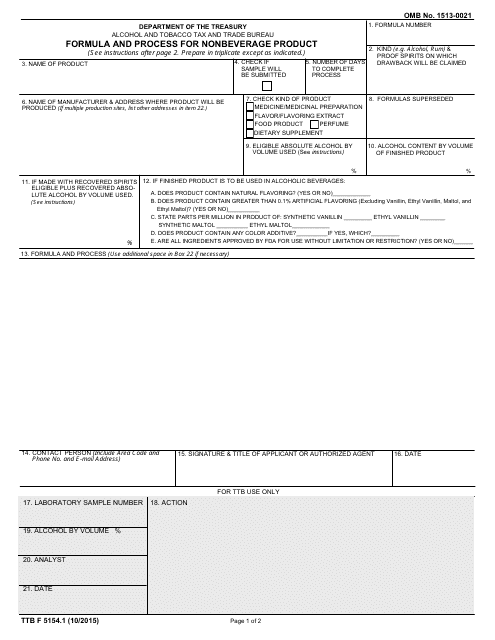

This Form is used for documenting the formula and process for nonbeverage products.

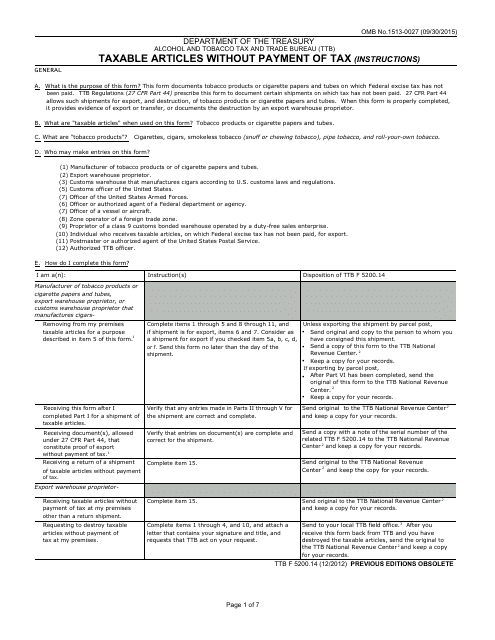

This document is used for reporting the taxable articles that are not paid for with tax.

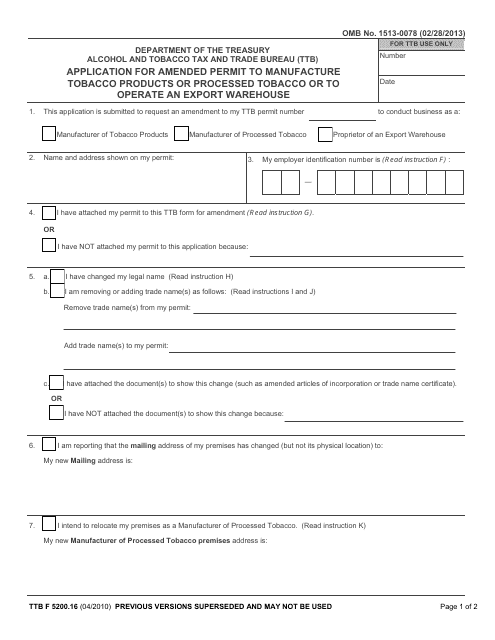

This document is used for applying for an amended permit to manufacture tobacco products or processed tobacco or to operate an export warehouse.

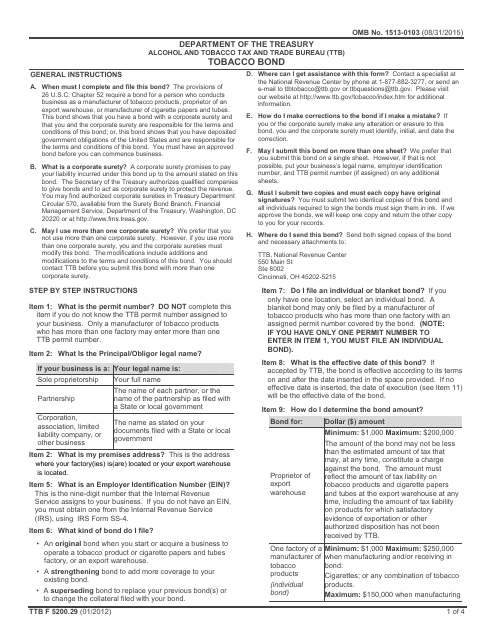

This document is a Tobacco Bond form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) to ensure compliance with regulations related to the production and distribution of tobacco products.

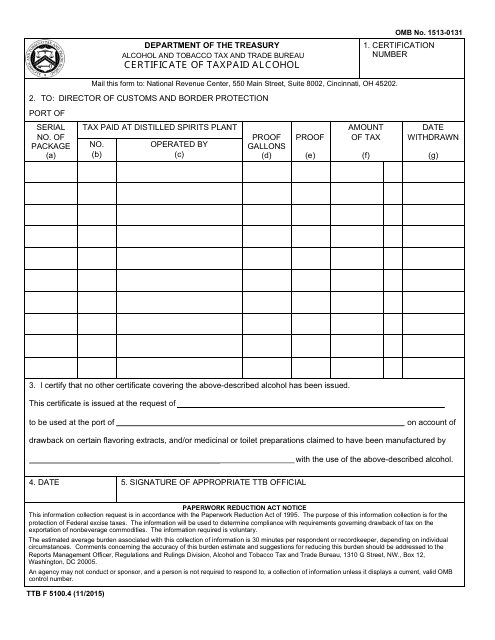

This form is used for obtaining a certificate for alcohol on which taxes have been paid.

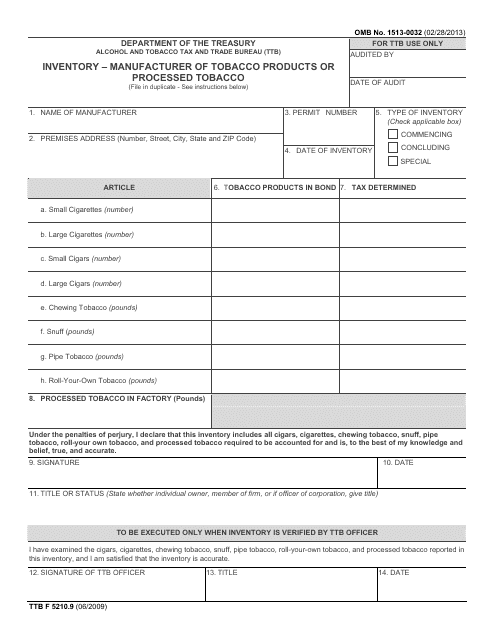

This form is used for inventory reporting by manufacturers of tobacco products or processed tobacco.

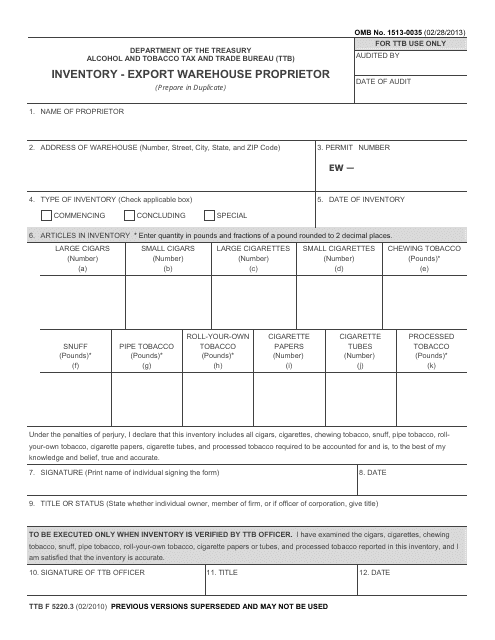

This Form is used for inventory management by export warehouse proprietors.

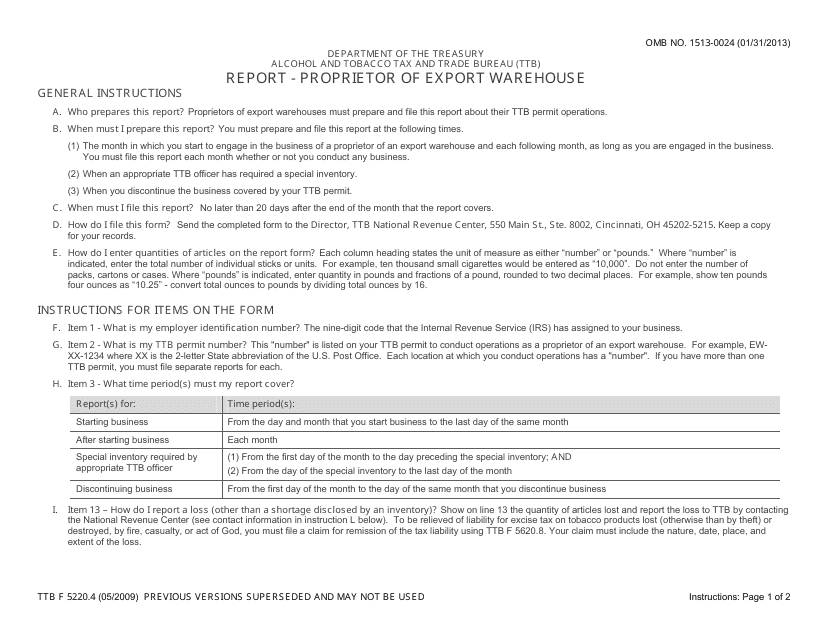

This document is used for reporting the proprietor of an export warehouse to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

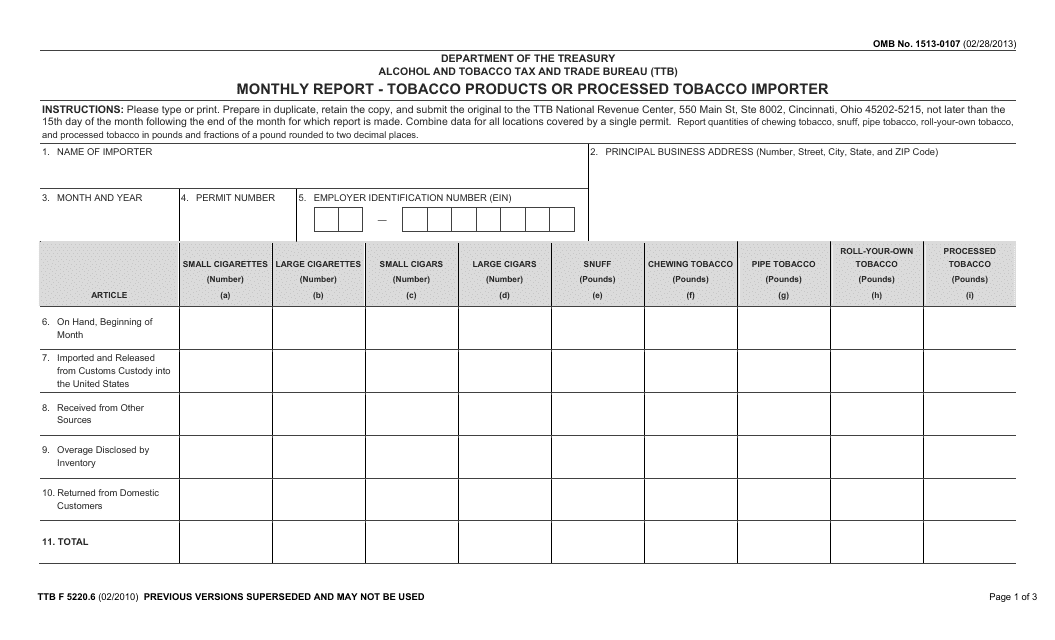

This Form is used for monthly reporting by importers of tobacco products or processed tobacco. It helps track import activities and compliance with regulations.

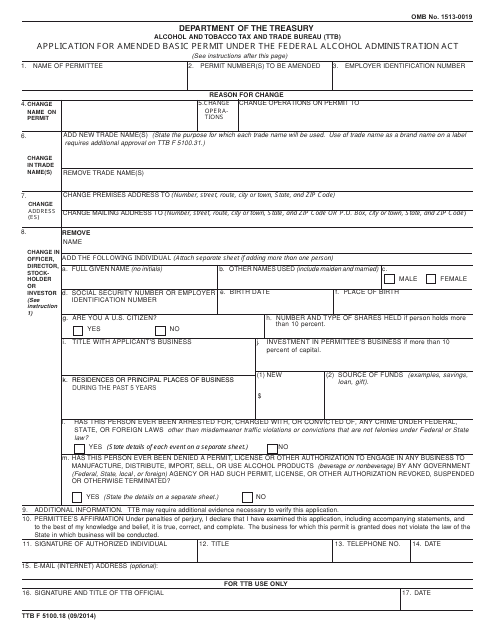

This document is used for applying for an amended basic permit under the Federal Alcohol Administration Act, which is required for individuals or businesses involved in the alcohol industry.

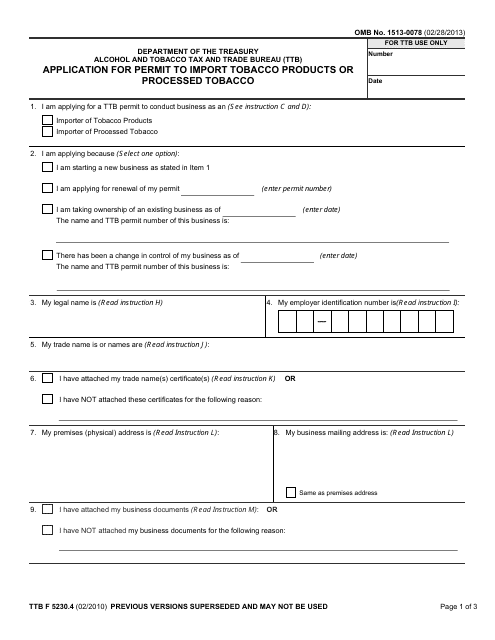

This Form is used for applying for a permit to import tobacco products or processed tobacco into the US.

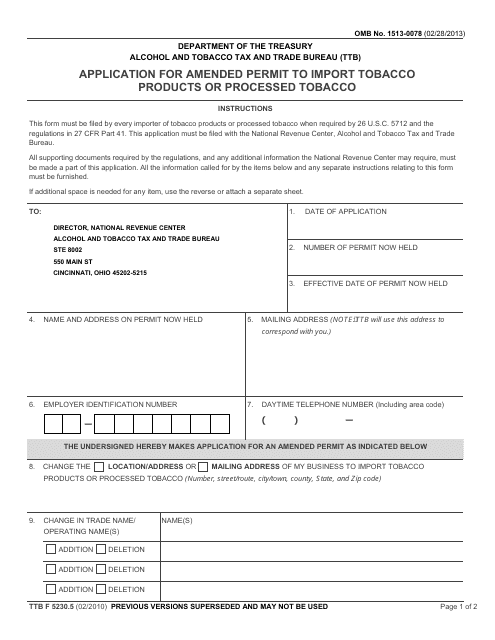

This Form is used for applying for an amended permit to import tobacco products or processed tobacco.

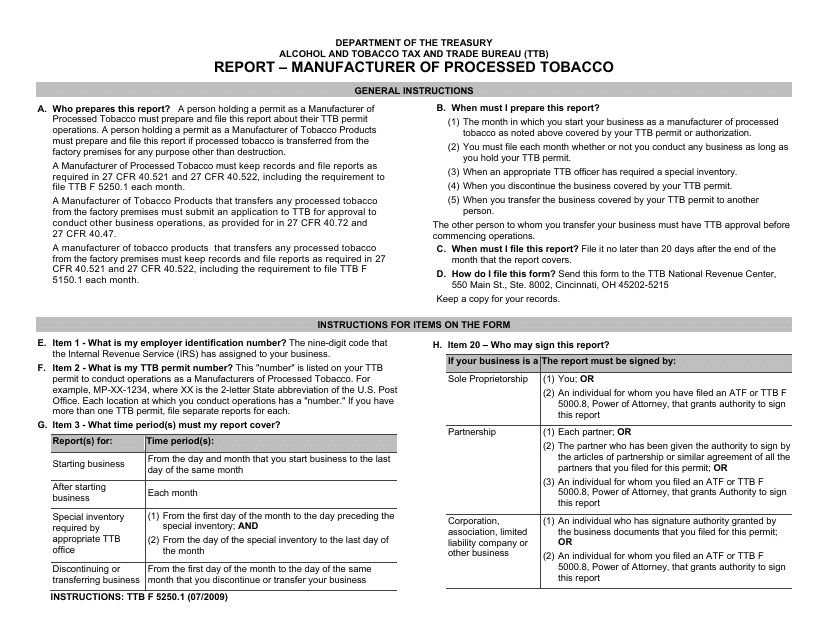

This type of document is used for reporting information about manufacturers of processed tobacco.

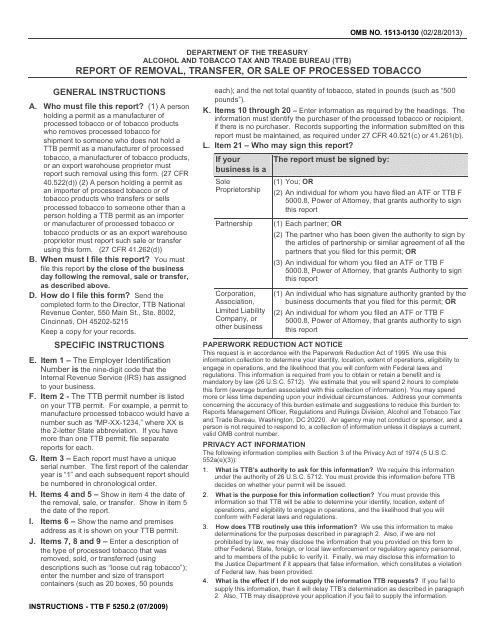

This Form is used for reporting the removal, transfer, or sale of processed tobacco.

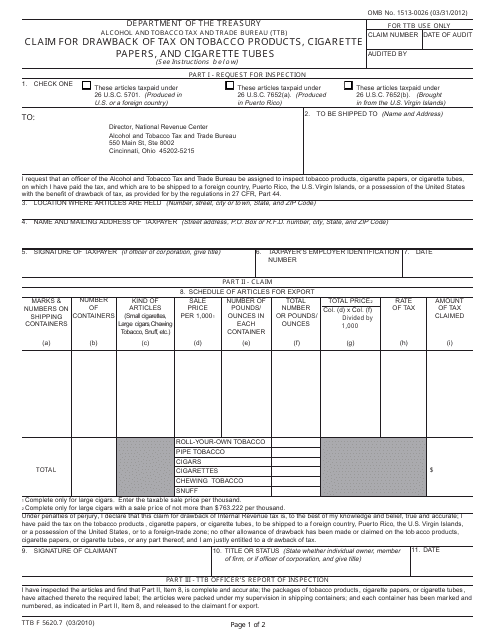

TTB Form 5620.7 Claim for Drawback of Tax on Tobacco Products, Cigarette Papers, and Cigarette Tubes

This form is used for claiming a refund of taxes paid on tobacco products such as cigarettes, cigarette papers, and cigarette tubes.

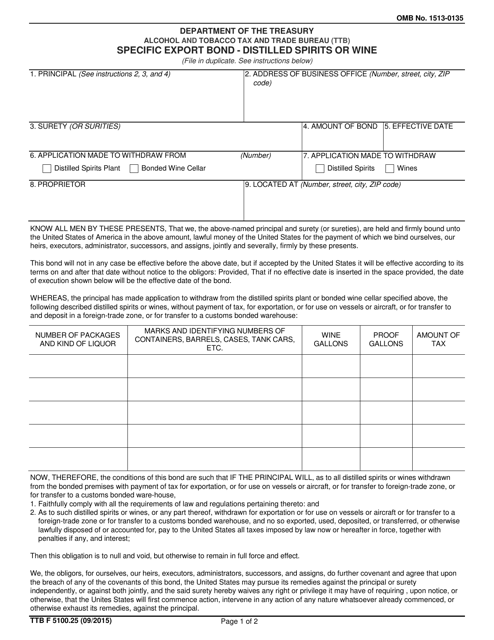

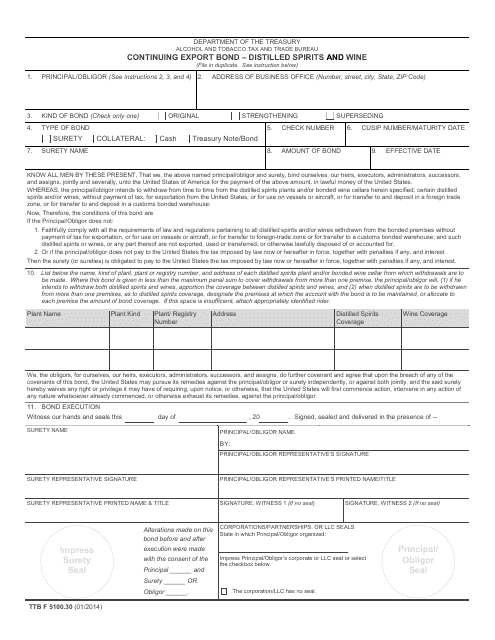

This form is used for implementing a continuing export bond for distilled spirits and wine.

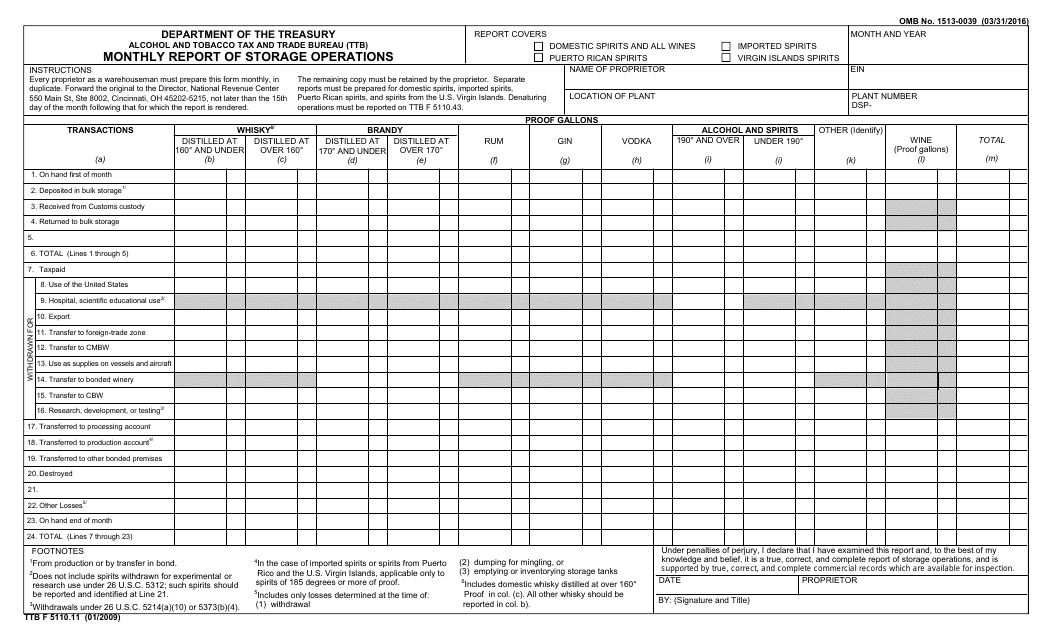

This Form is used for reporting monthly storage operations.

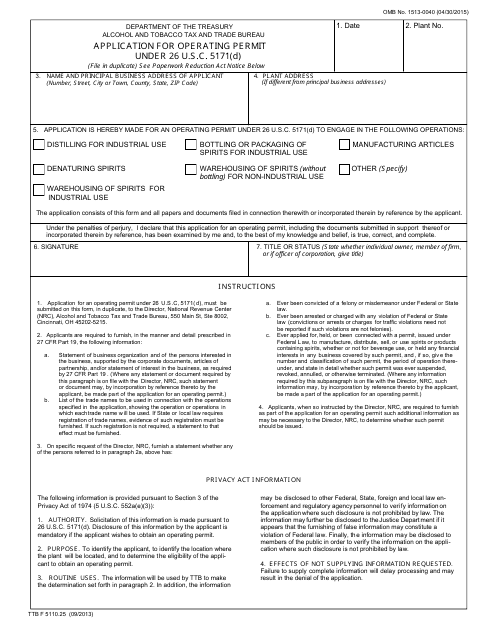

This document is used for applying for an operating permit under a specific section of the United States Internal Revenue Code.

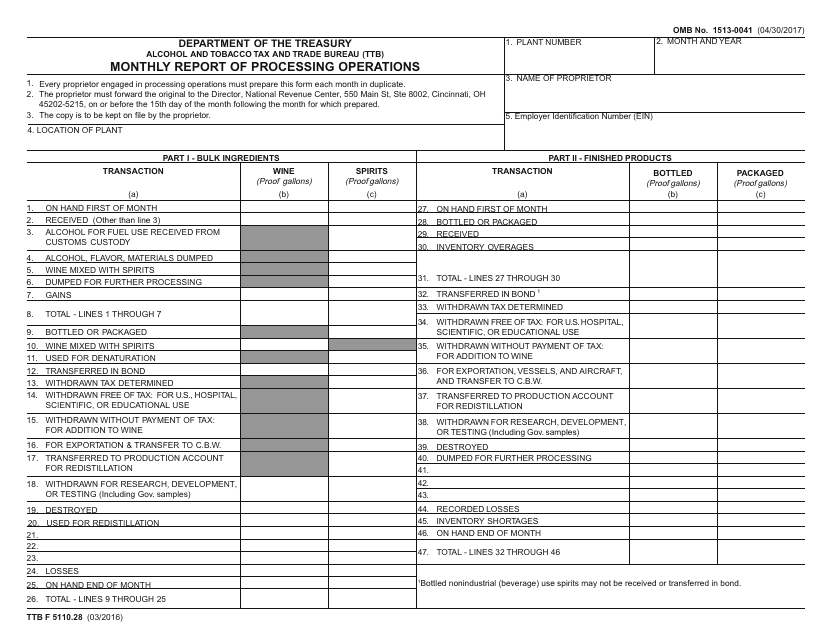

This Form is used for reporting monthly processing operations. It is typically used by businesses involved in distilling, brewing, or blending of alcohol beverages. The form gathers information about production, inventory, and transfers of alcohol products.

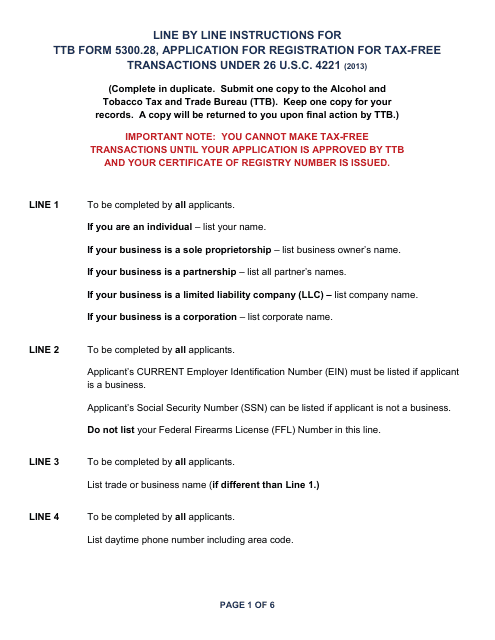

This document is an application form used to register for tax-free transactions under a specific section of the U.S. tax code (26 U.S.C. 4221). It provides instructions on how to fill out the form and apply for this special tax status.

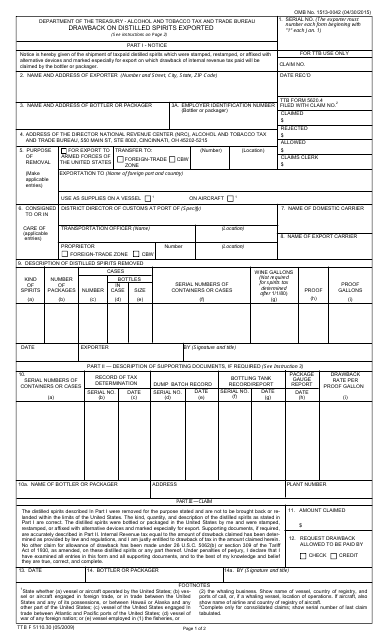

This Form is used for claiming a refund or credit for the excise tax paid on distilled spirits that are exported from the United States.

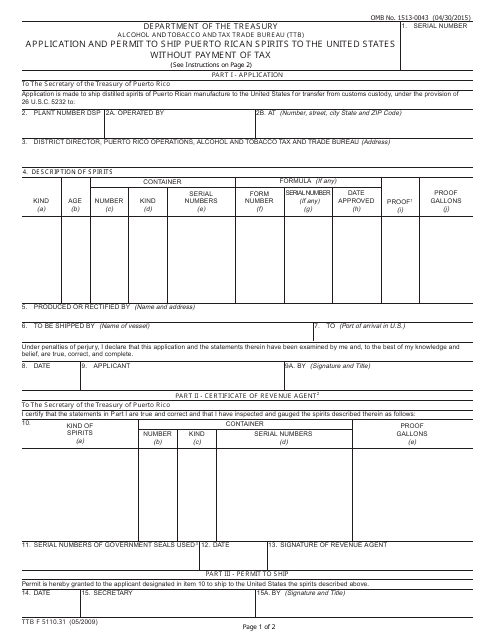

This Form is used for applying and obtaining a permit to ship Puerto Rican spirits to the United States without payment of tax.

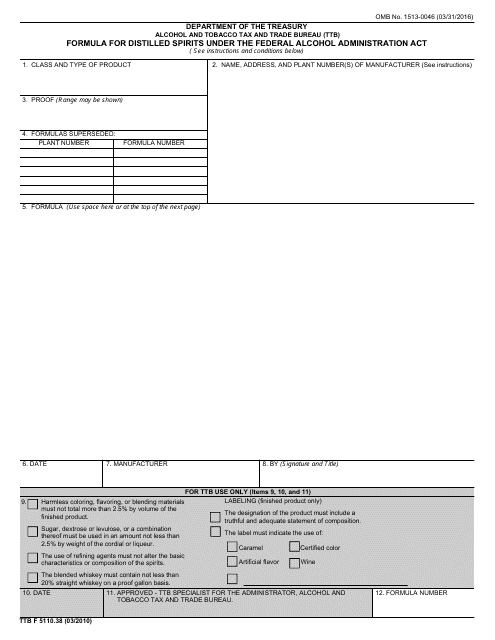

This Form is used for submitting the formula for distilled spirits under the Federal Alcohol Administration Act.

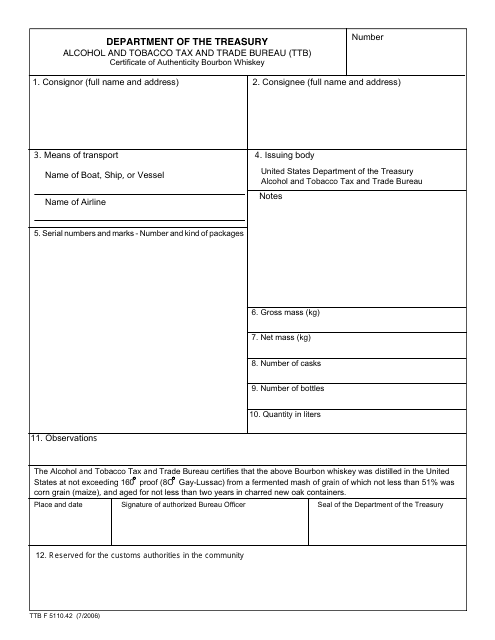

This form is used for obtaining a certificate of authenticity for Bourbon Whiskey. It is required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for ensuring the quality and authenticity of the product.

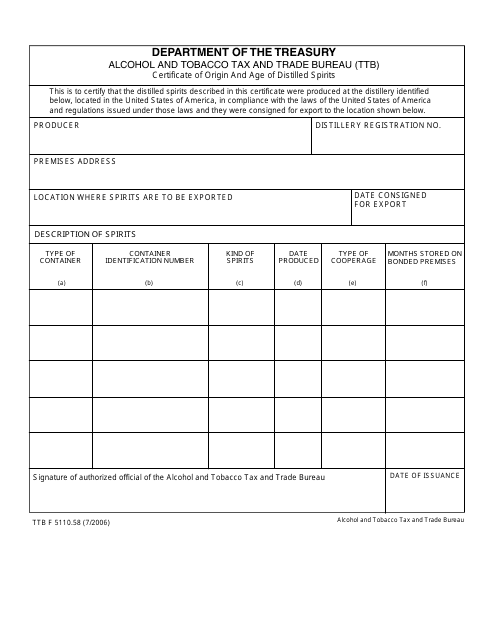

This document is used to certify the origin and age of distilled spirits.

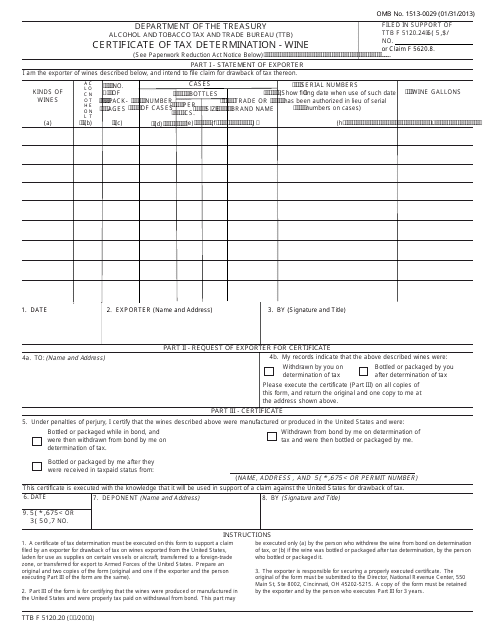

This TTB Form is used for obtaining a Certificate of Tax Determination for wine. It helps to determine the tax liability for wine producers and importers.

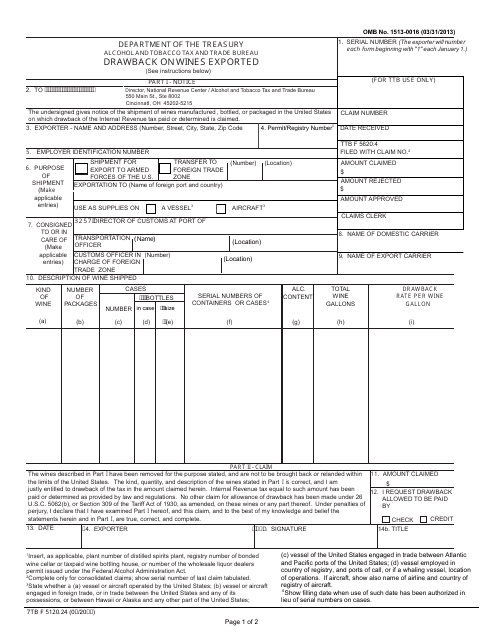

This form is used for claiming a drawback on wines that have been exported.

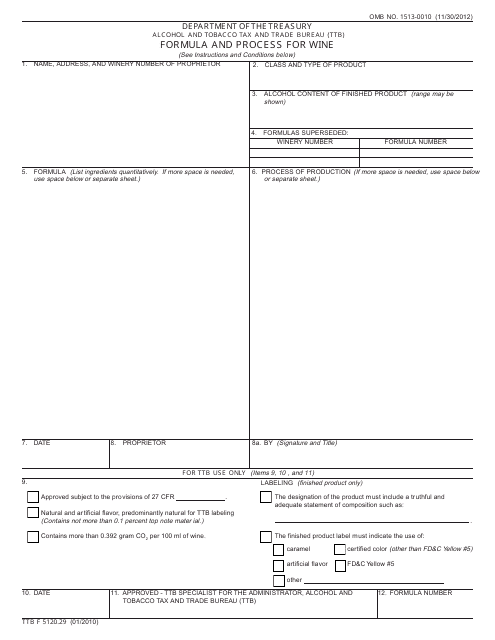

This document outlines the formula and process for producing wine, as required by the Alcohol and Tobacco Tax and Trade Bureau (TTB). It provides guidelines for winemakers to ensure compliance with regulations.

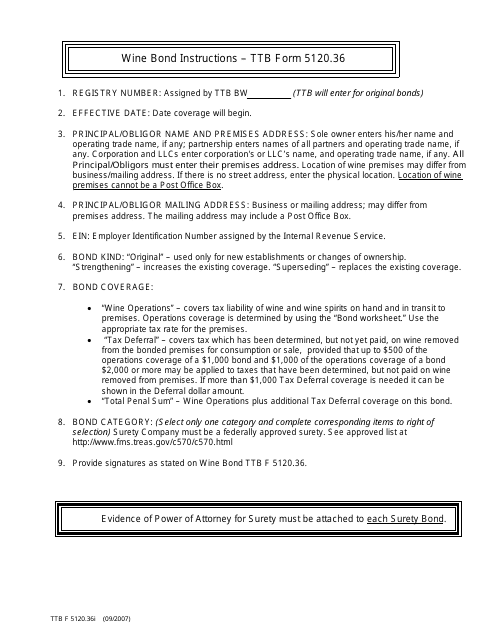

This document provides instructions for completing the TTB Form 5120.36I Wine Bond. This form is used for wine manufacturers or importers to post a bond with the Alcohol and Tobacco Tax and Trade Bureau (TTB) to ensure compliance with applicable laws and regulations. The bond serves as a financial guarantee that any taxes owed on the wine will be paid in a timely manner.

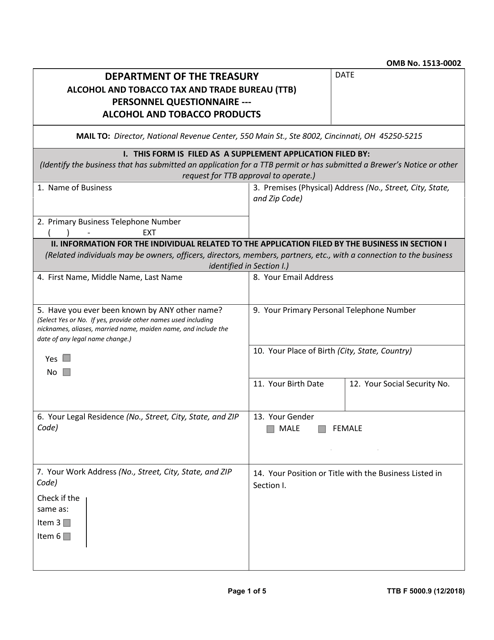

This Form is used for conducting personnel questionnaires related to alcohol and tobacco products by the Alcohol and Tobacco Tax and Trade Bureau (TTB).

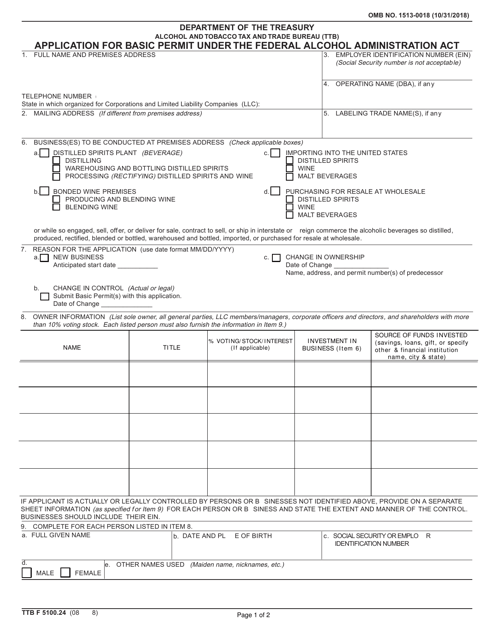

This form is used for applying for a basic permit under the Federal Alcohol Administration Act. It is necessary for businesses involved in the production or importation of alcohol to obtain this permit.

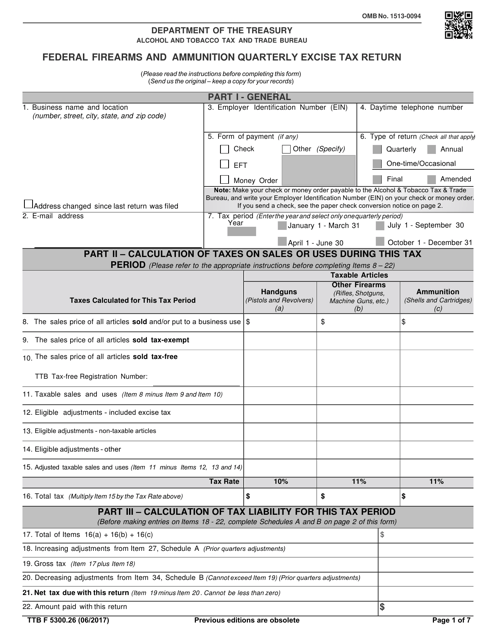

This form is used for reporting and paying the federal excise tax on firearms and ammunition on a quarterly basis.

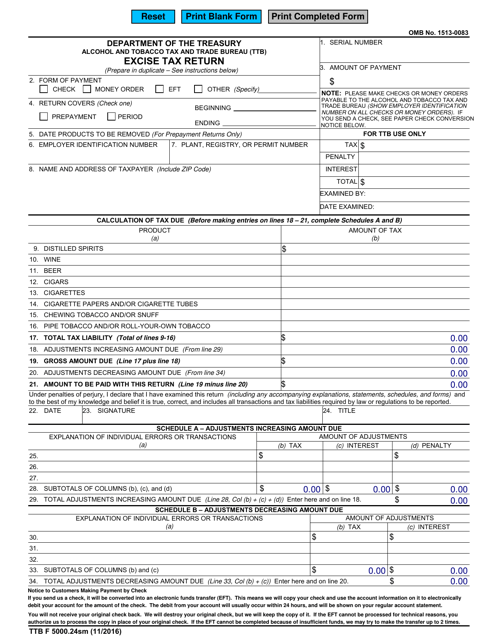

This form is used for filing an excise tax return with the Alcohol and Tobacco Tax and Trade Bureau (TTB).