Fill and Sign Rhode Island Legal Forms

Documents:

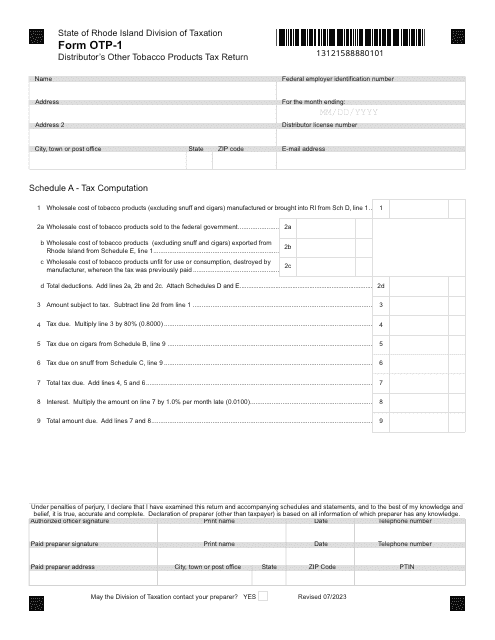

3581

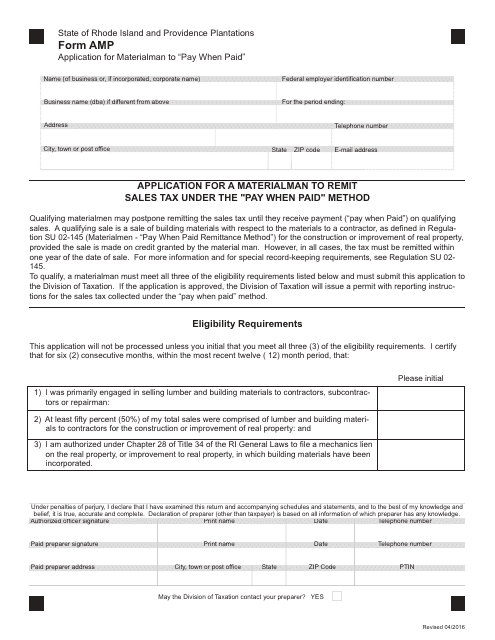

This form is used for materialmen in Rhode Island to remit sales tax under the "pay when paid" method. It allows them to report and pay the appropriate sales tax on their transactions.

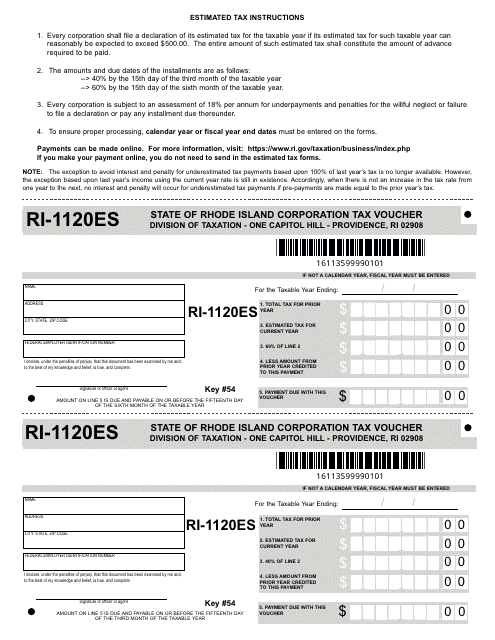

This form is used for submitting corporation tax payments to the State of Rhode Island.

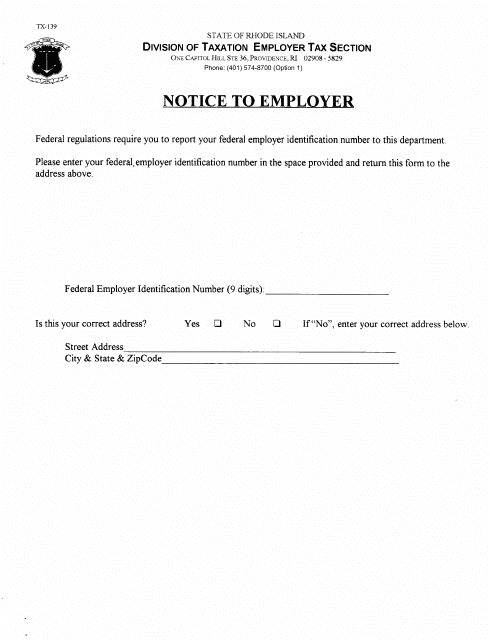

This document notifies an employer in Rhode Island of certain information or actions that they need to know or take.

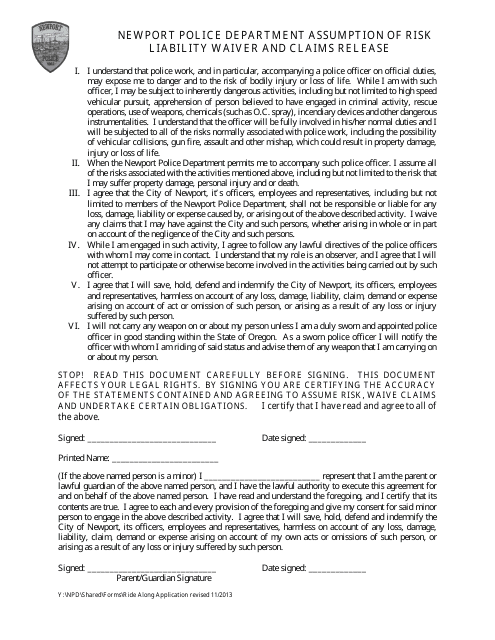

This document is used for participants in activities organized by the City of Newport, Rhode Island to acknowledge and accept the risks involved and release the city from any liability for injuries or damages that may occur.

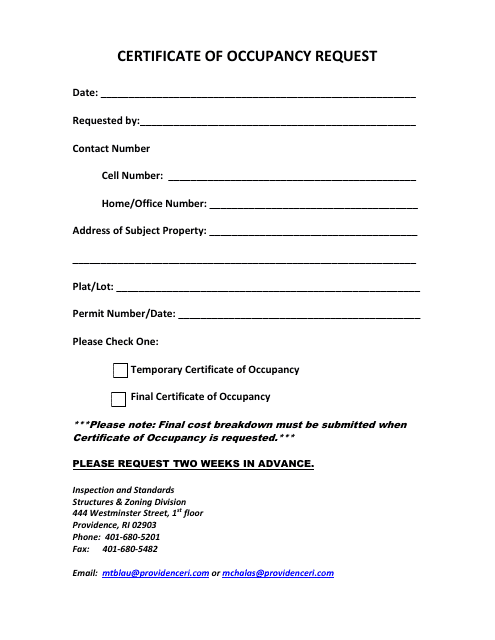

This Form is used for requesting a Certificate of Occupancy in the City of Providence, Rhode Island. It is required for proving that a building or property complies with all local codes and regulations, and is safe for occupancy.

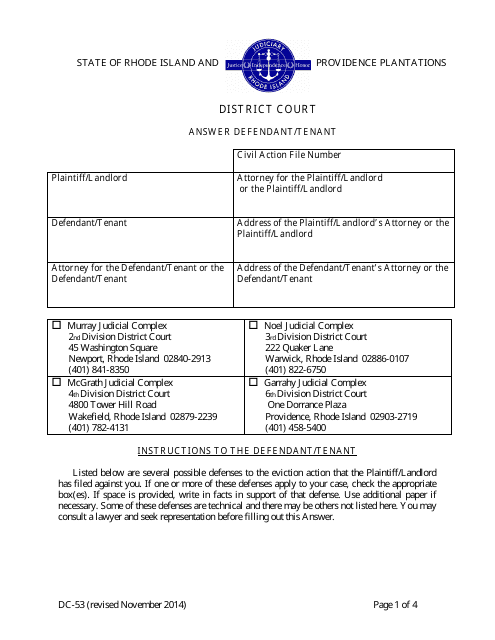

This document is used for a defendant/tenant to file their answer in a District Court case in Rhode Island.

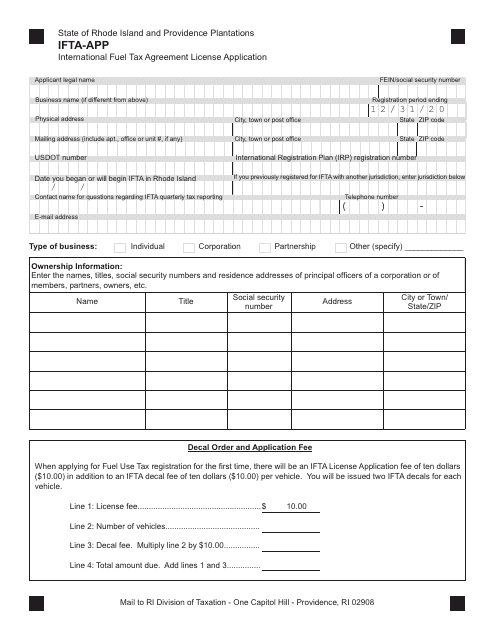

This document is an application form for obtaining an International Fuel Tax Agreement (IFTA) license in Rhode Island. It is used by individuals or businesses engaged in interstate commercial transportation to report and pay fuel taxes.

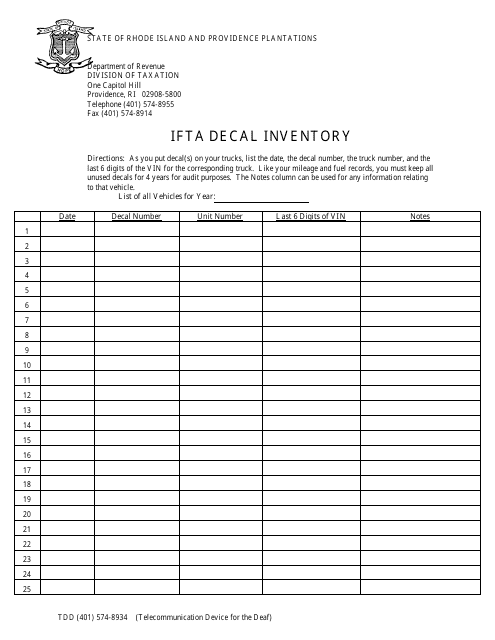

This form is used to track the inventory of IFTA decals in Rhode Island. It helps to ensure that the correct number of decals are available for distribution to qualifying vehicles.

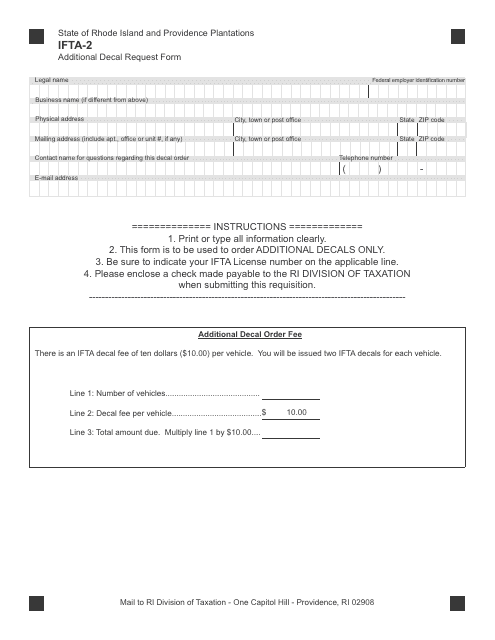

This Form is used for requesting additional decals under the International Fuel Tax Agreement (IFTA) in Rhode Island.

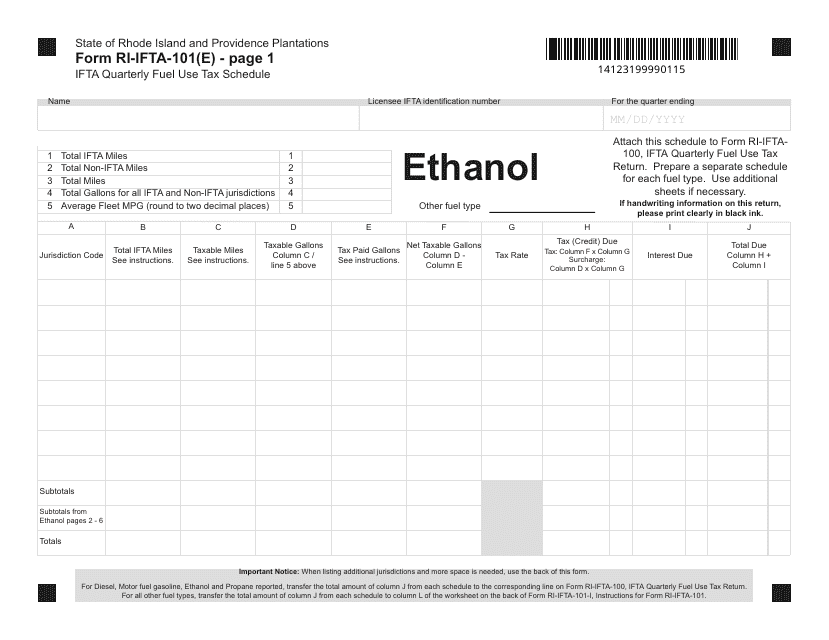

This Form is used for reporting quarterly fuel use tax for ethanol in Rhode Island.

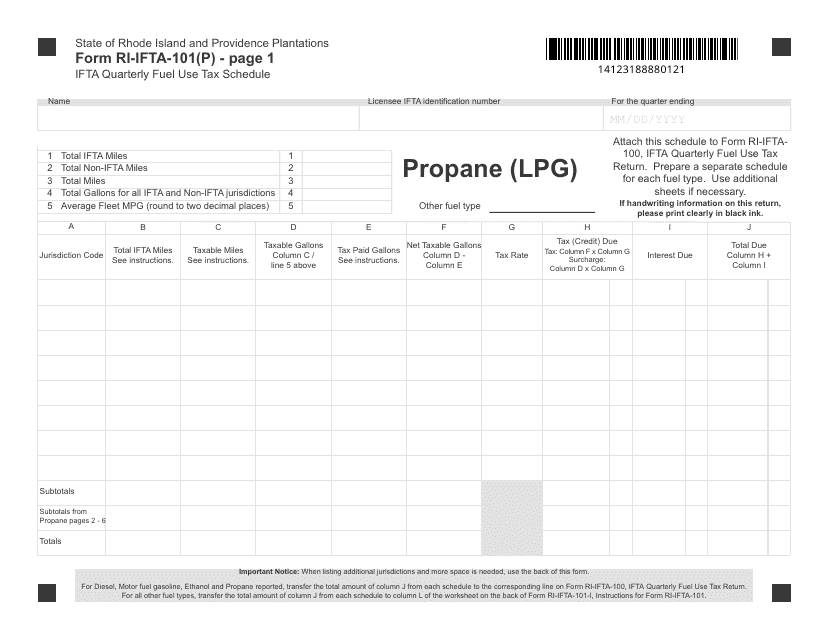

This form is used for reporting the quarterly fuel use tax for propane (LPG) in Rhode Island.

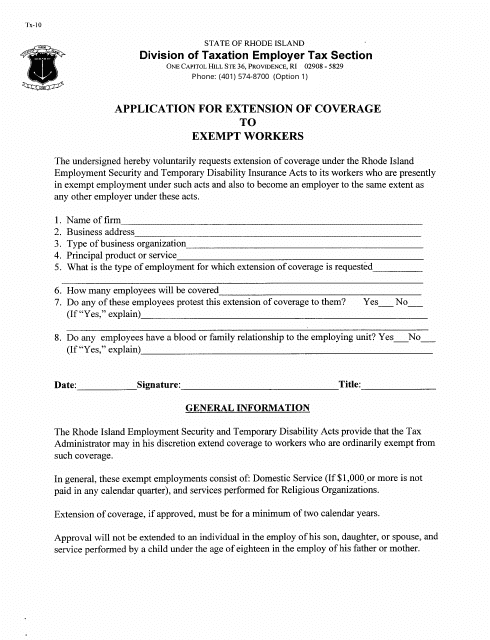

This Form is used for religious organizations in Rhode Island to apply for an extension of coverage to exempt workers.

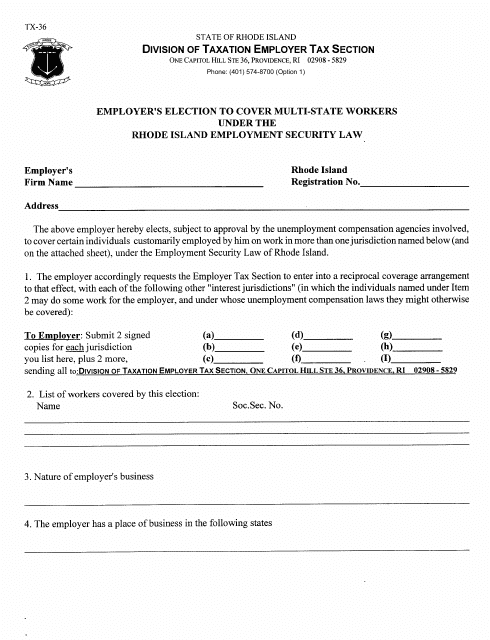

This document is for employers who have workers in multiple states and want to elect coverage for their workers in Rhode Island.

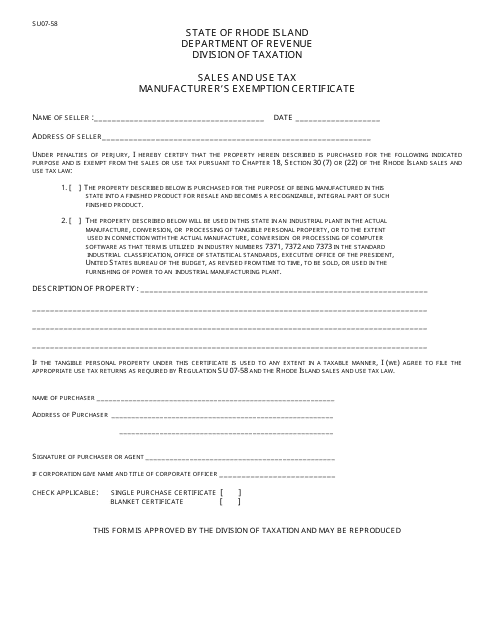

This form is used for obtaining a sales and use tax exemption for manufacturers in Rhode Island.

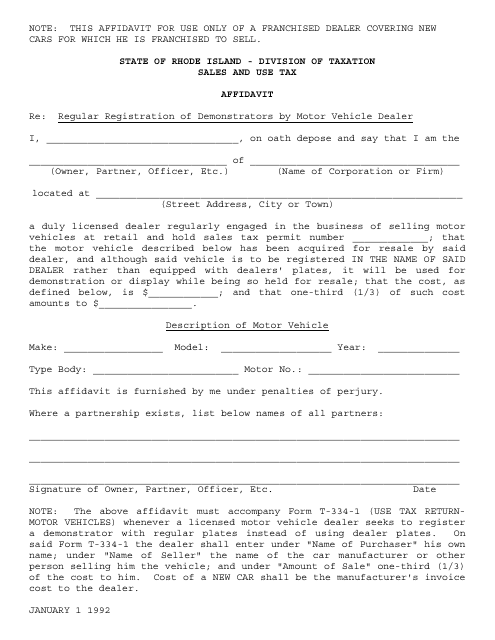

This document is for motor vehicle dealers in Rhode Island to register demonstrators for regular use.

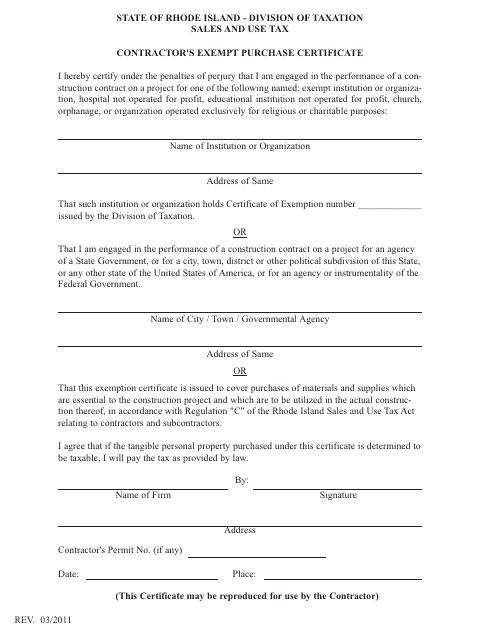

This Form is used for contractors in Rhode Island to claim exemptions on certain purchases. It allows them to avoid paying sales tax on qualifying items.

This Form is used for obtaining an Exemption Certificate in Rhode Island for the purpose of recycling, reusing or treating hazardous waste.

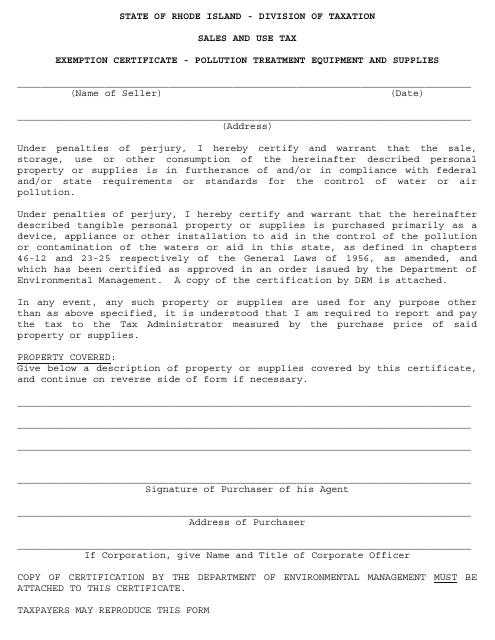

This form is used for applying for an exemption certificate for pollution treatment equipment and supplies in the state of Rhode Island.

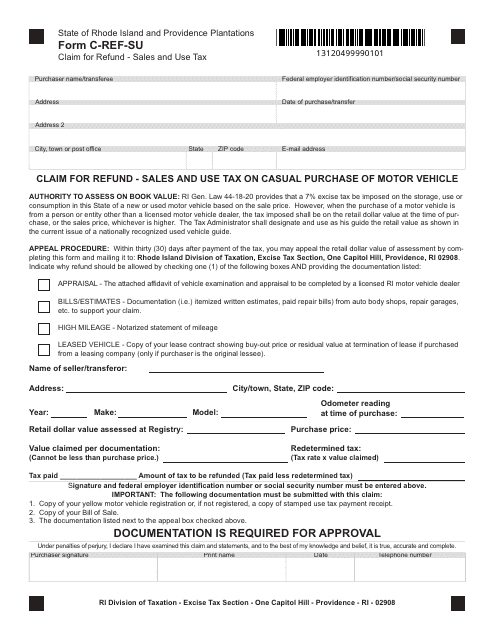

This Form is used for claiming a refund on sales and use tax paid for a casual purchase of a motor vehicle in Rhode Island.

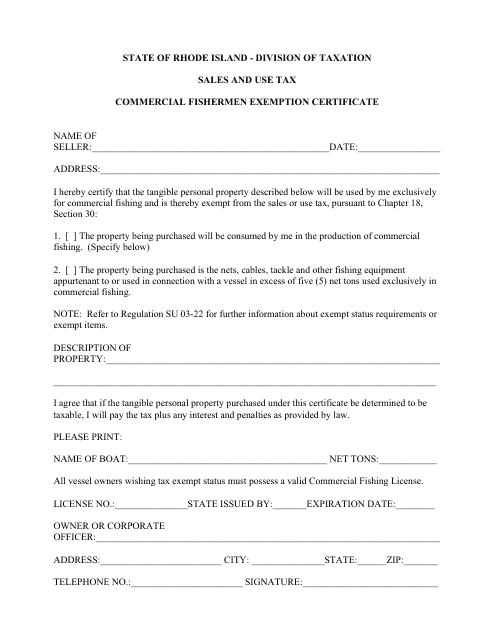

This document is for commercial fishermen in Rhode Island who are exempt from specific regulations.

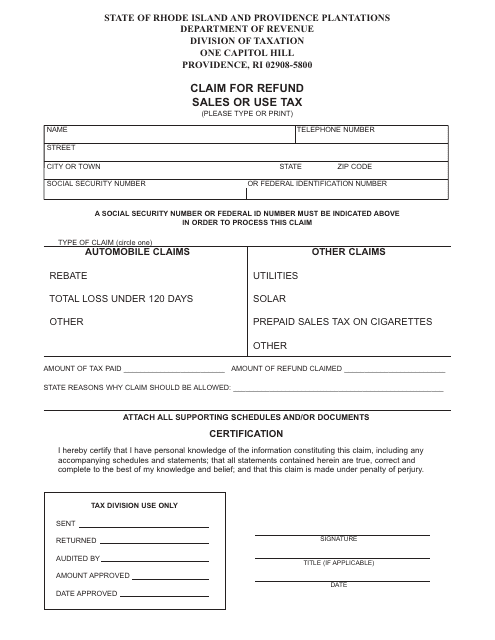

This document is for claiming a refund of sales or use tax paid in Rhode Island. You can use this form to request a refund if you believe you have overpaid or are eligible for a tax exemption.

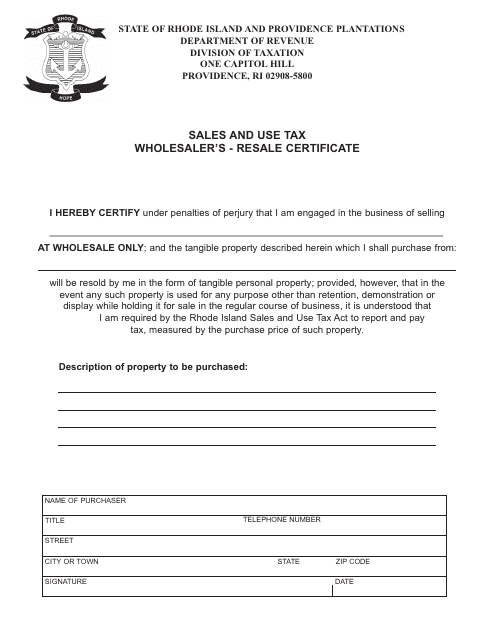

This document is used by wholesalers in Rhode Island to obtain a resale certificate, which allows them to purchase goods for resale without paying sales tax.

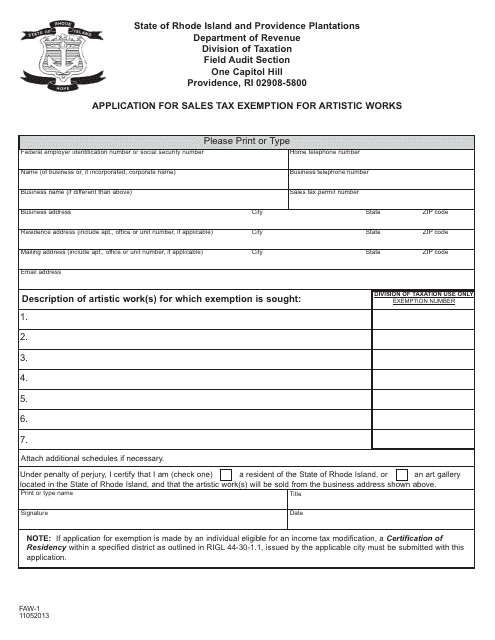

This form is used for applying for sales tax exemption on artistic works in Rhode Island. It is used by artists and sellers of artistic works to claim exemption from paying sales tax on their sales.

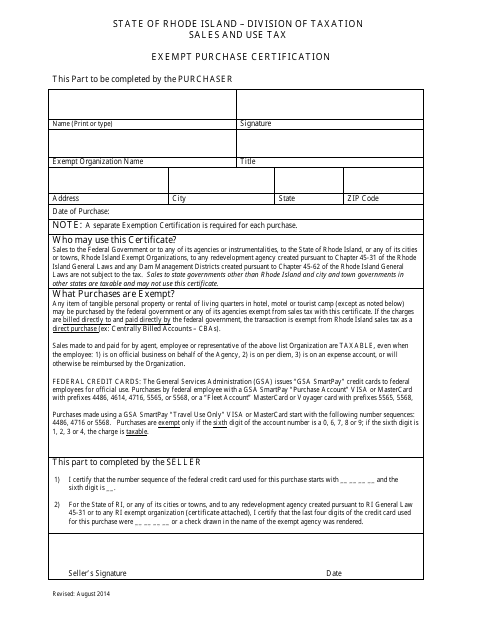

This form is used for certifying that a purchase is exempt from certain taxes in the state of Rhode Island.

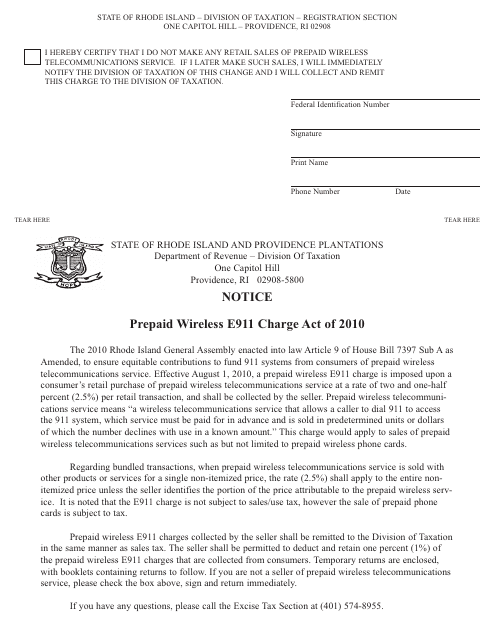

This Form is used for opting out of the Prepaid Wireless Telecommunications Charge in Rhode Island.

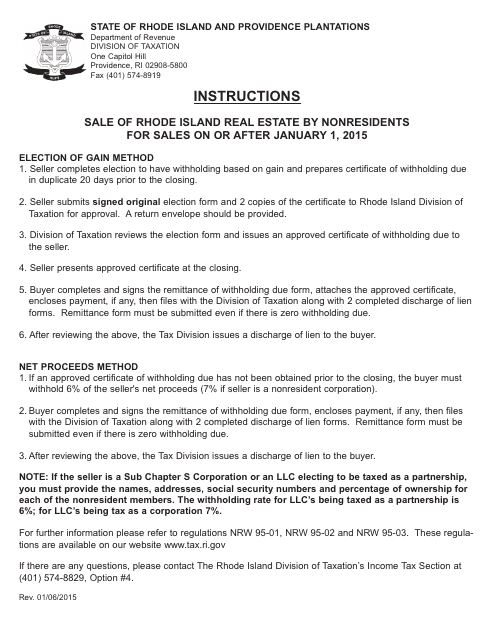

This document provides instructions for nonresidents on how to sell real estate in Rhode Island for sales that occurred on or after January 1, 2015. It outlines the specific requirements and steps that need to be followed during the sales process.

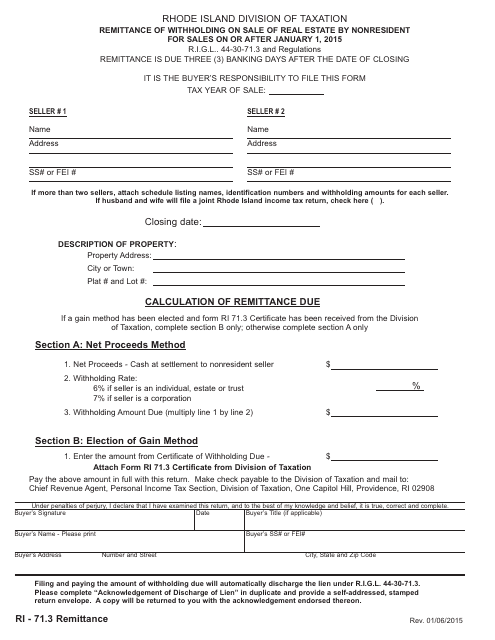

This type of document is used for remitting withholding taxes on the sale of real estate by nonresidents in Rhode Island.

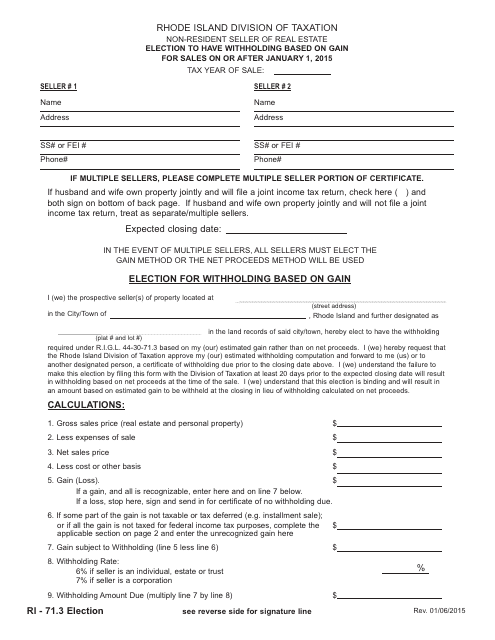

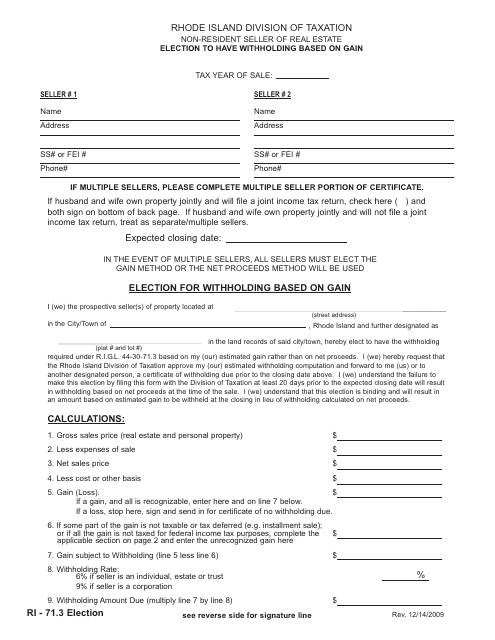

This form is used for non-resident sellers of real estate in Rhode Island who want to elect to have withholding based on their gain from the sale. This is applicable for sales that occurred on or after January 1, 2015.

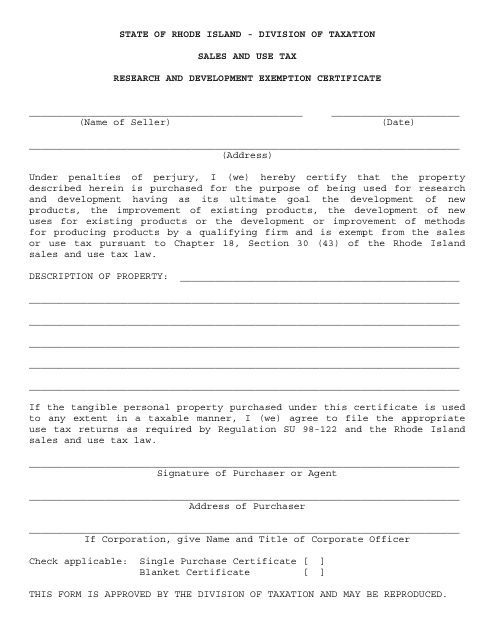

This Form is used for applying for a Research and Development Exemption Certificate in Rhode Island. The certificate exempts businesses from certain taxes for qualified research and development activities.

This form is used for non-resident sellers of real estate in Rhode Island to elect withholding based on gain.