Georgia Withholding Form Templates

The Georgia Withholding Form is used for reporting and remitting withholding taxes on various types of income and transactions in the state of Georgia. This includes withholding on sales or transfer of real property and associated tangible personal property by nonresidents, as well as other types of payments subject to withholding such as wages, lottery winnings, and gambling winnings. The form ensures that the appropriate amount of taxes is withheld and paid to the state of Georgia.

Documents:

1

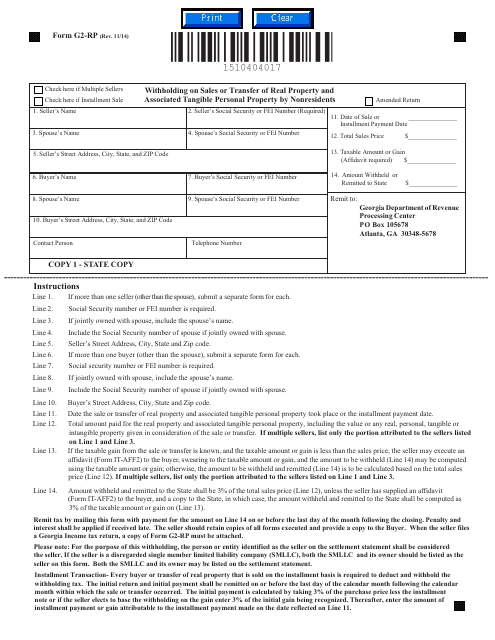

This form is used for reporting and withholding taxes on the sale or transfer of real property and associated tangible personal property by nonresidents in the state of Georgia, United States.