Fill and Sign Connecticut Legal Forms

Documents:

3177

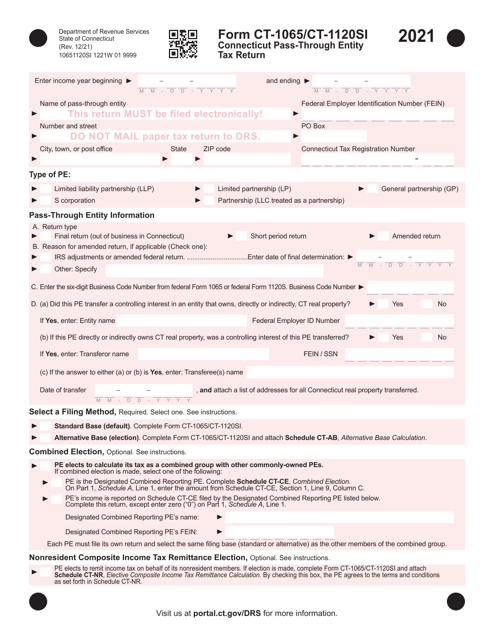

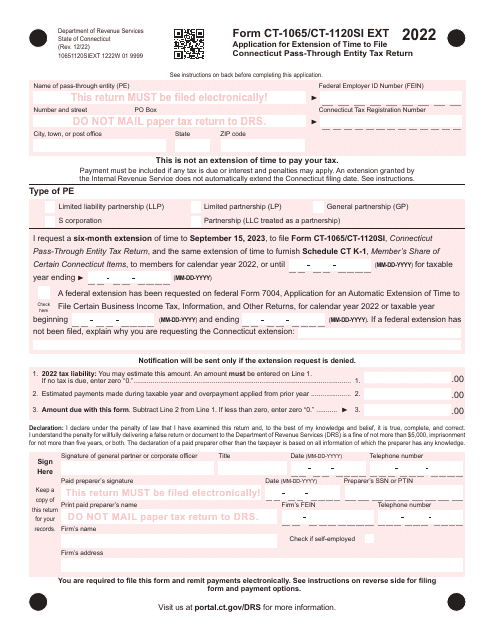

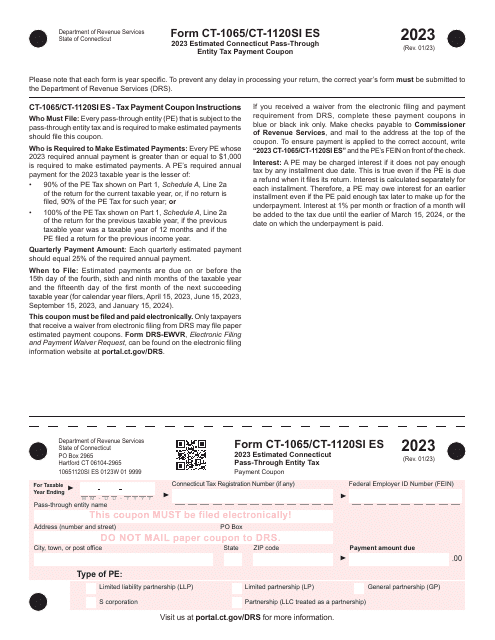

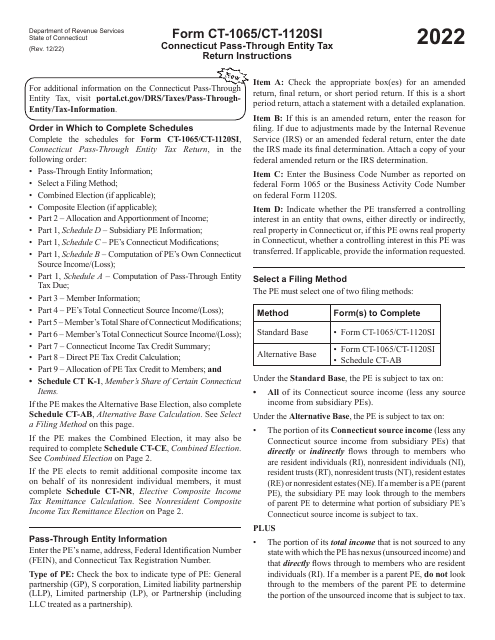

This Form is used for filing the Connecticut Pass-Through Entity Tax Return for Connecticut residents.

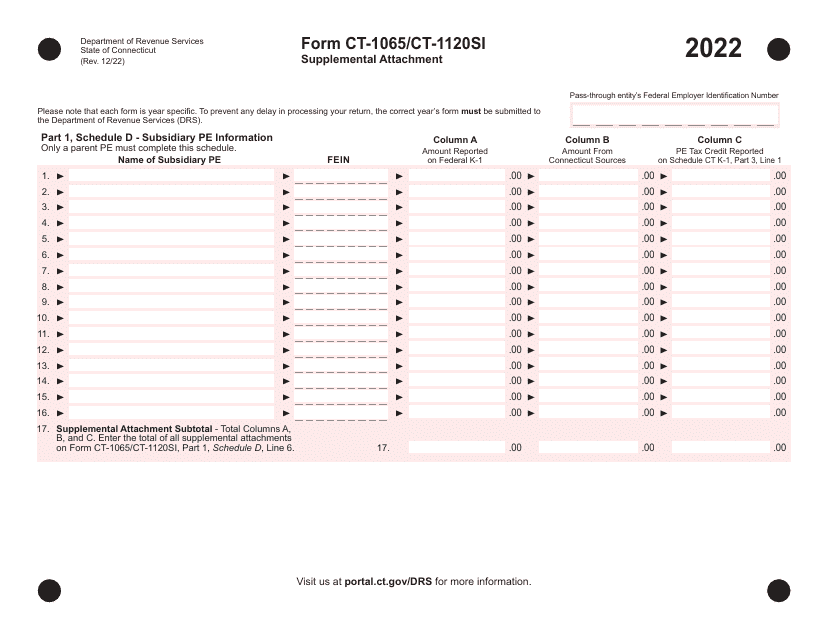

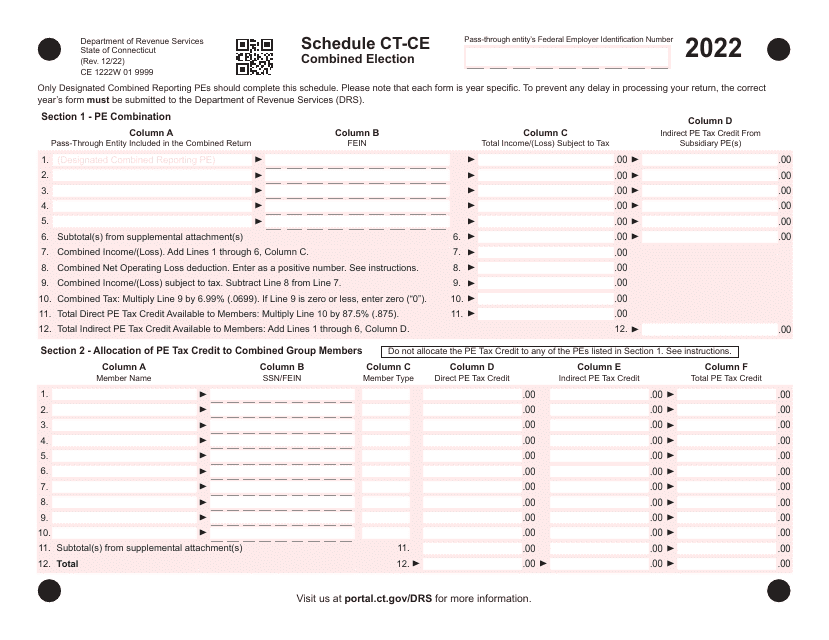

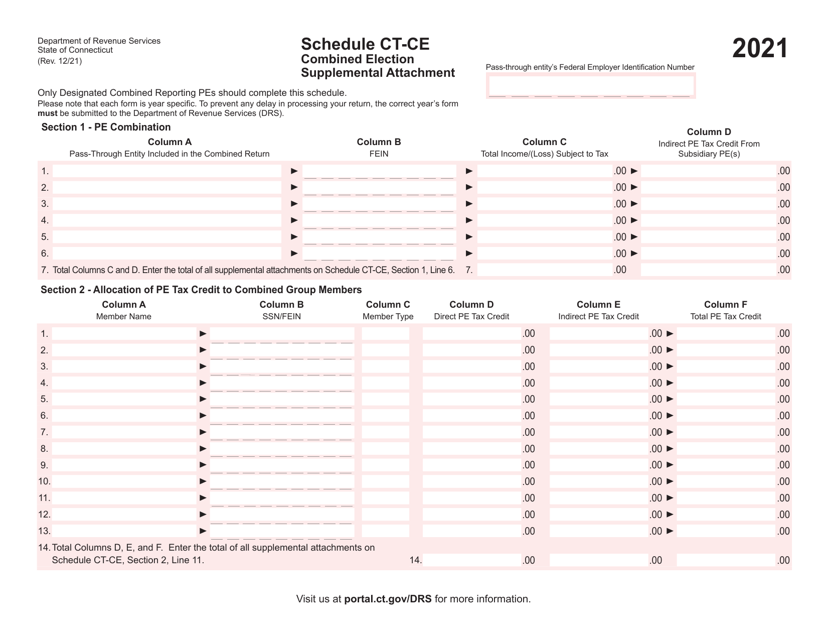

This document is a supplemental attachment to the Schedule CT-CE Combined Election form in Connecticut. It provides additional information or requirements for the election process.

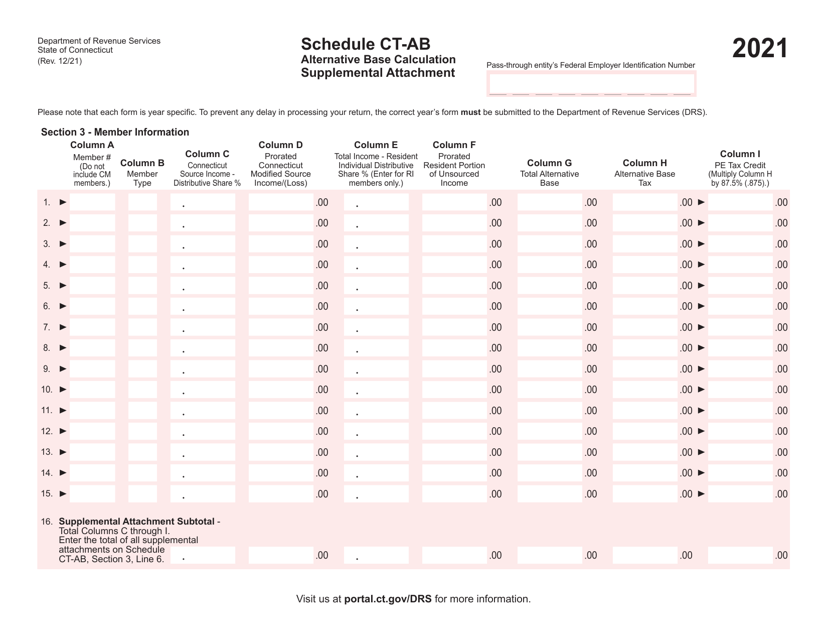

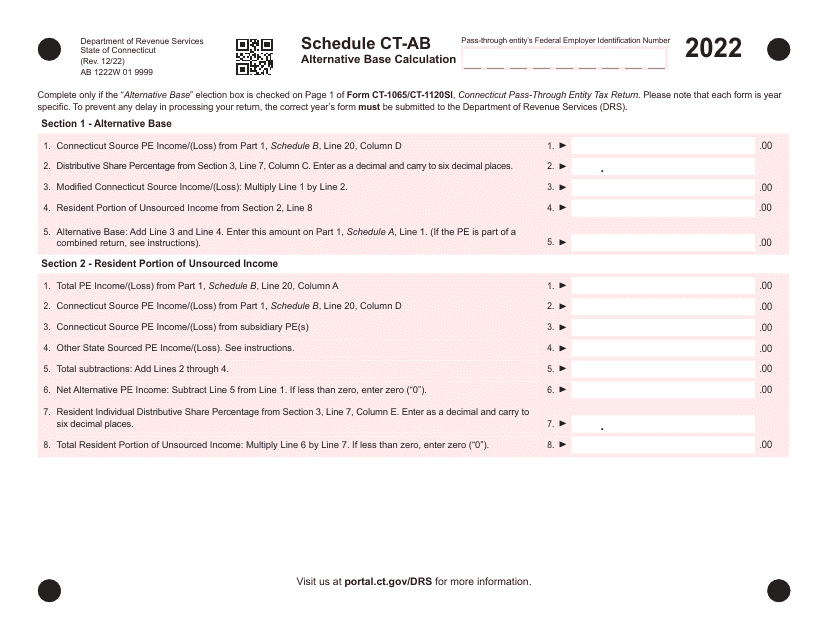

This form is used for providing a supplemental attachment for the alternative base calculation on Schedule CT-AB in Connecticut.

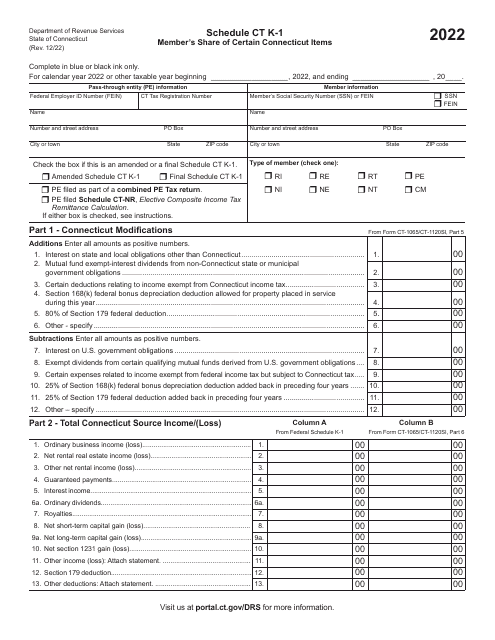

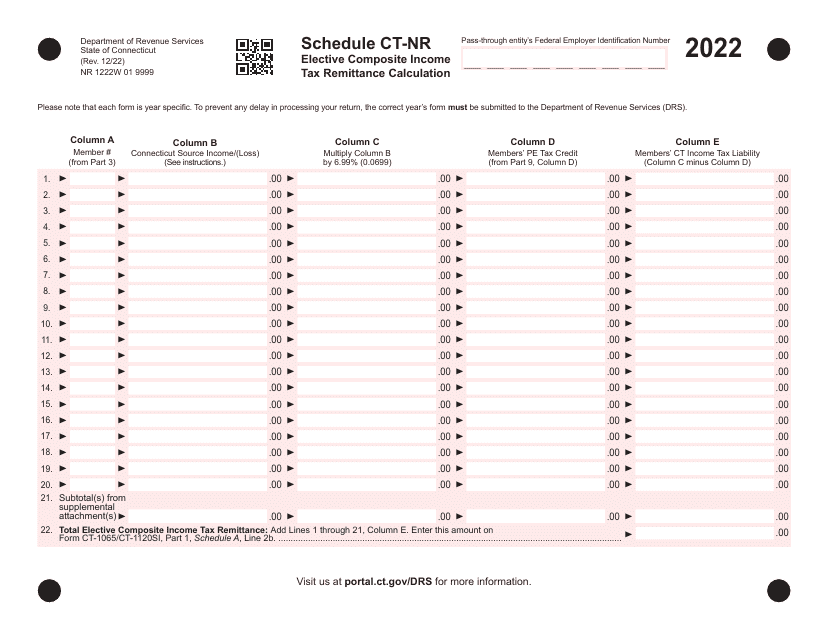

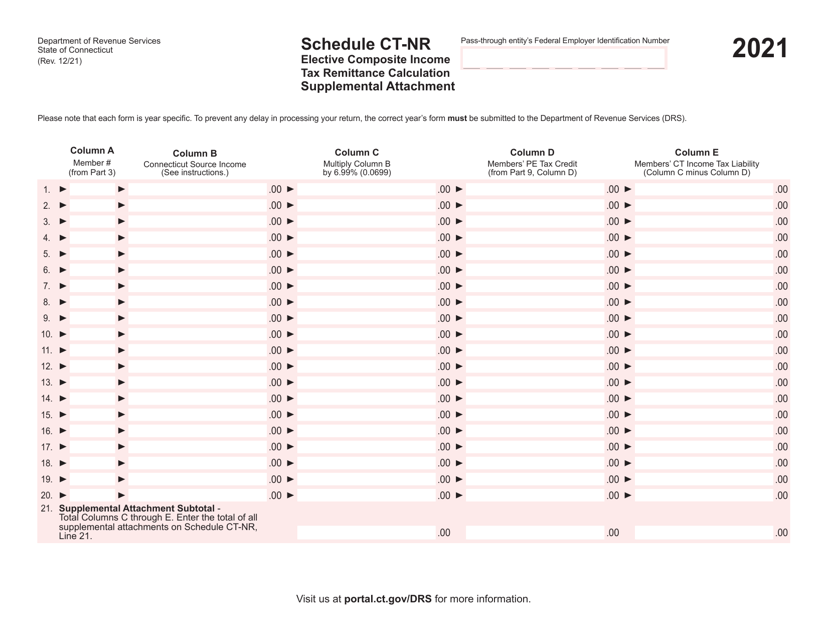

This document is a supplemental attachment for calculating the composite income tax remittance for nonresident electing Connecticut taxpayers. It is used to schedule and calculate the remittance amount.

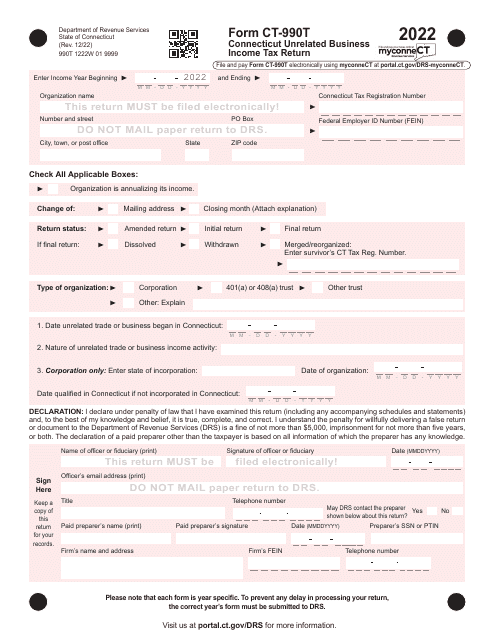

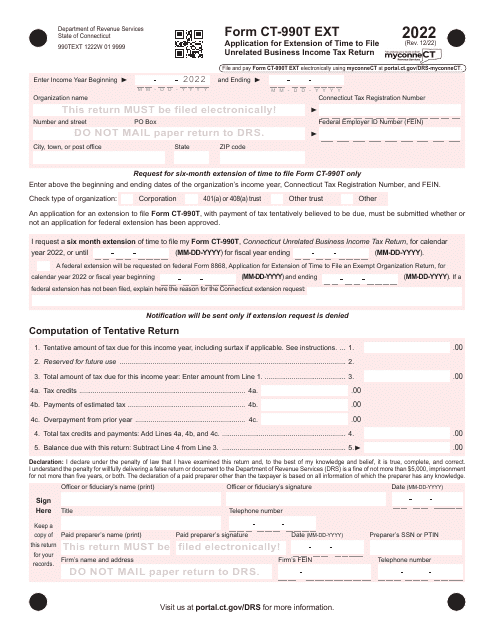

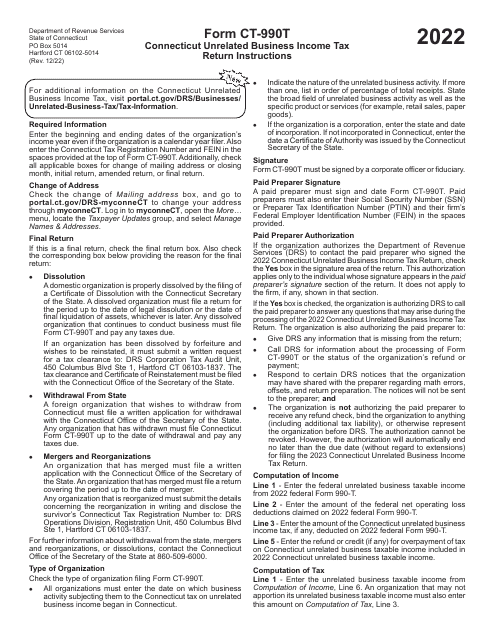

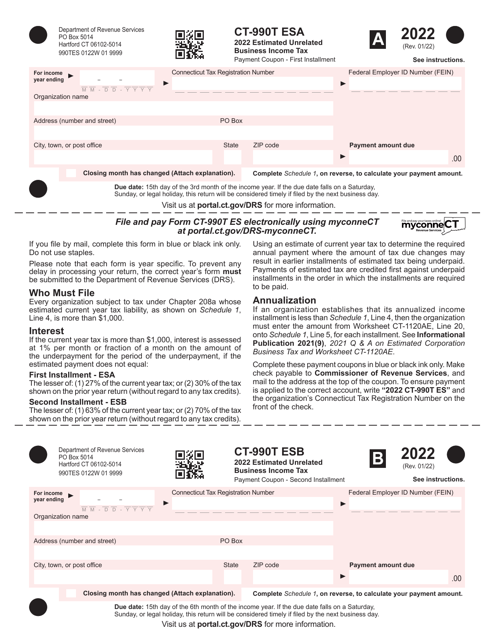

This form is used for estimating the unrelated business income tax for entities operating in Connecticut.

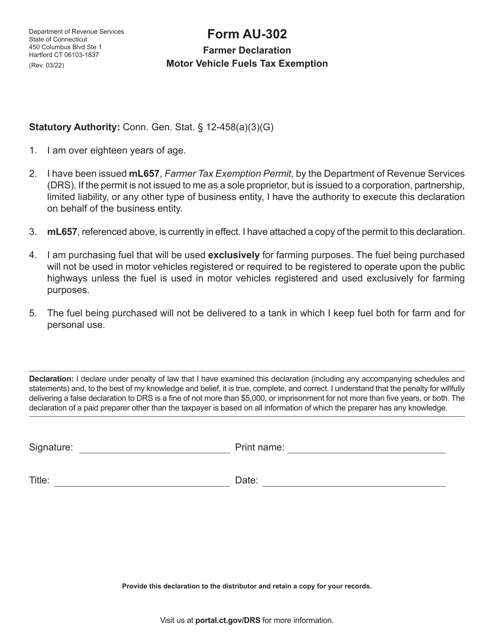

This form is used for farmers in Connecticut to declare their eligibility for a motor vehicle fuels tax exemption. Farmers can use this form to claim a tax exemption on fuels used for agricultural purposes.

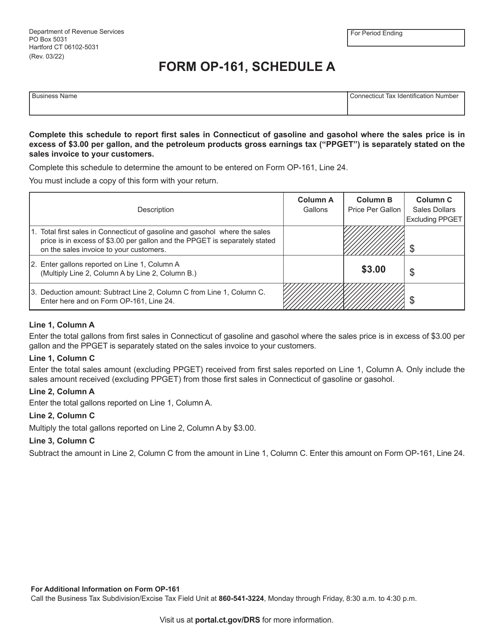

This form is used for filing the Petroleum Products Gross Earnings Tax Return in Connecticut when the sales price exceeds $3.00 per gallon.