Fill and Sign Connecticut Legal Forms

Documents:

3177

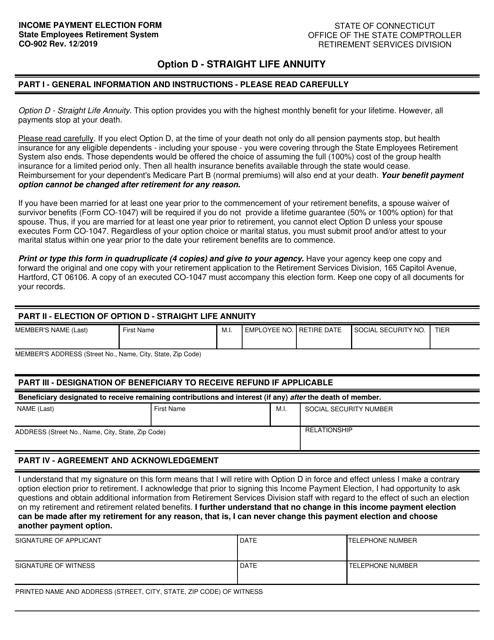

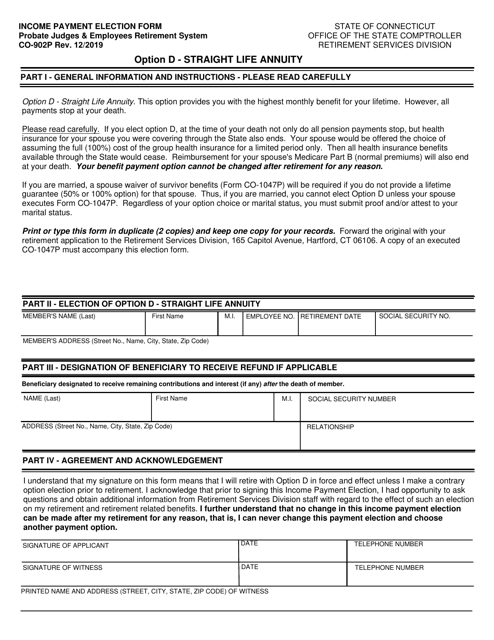

This form is used in Connecticut for making an income payment election, specifically selecting Option D - Straight Life Annuity.

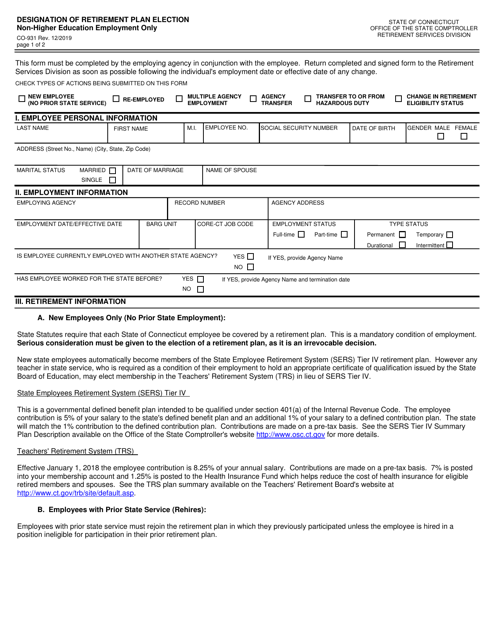

This form is used for designating retirement plan elections for non-higher education employment in Connecticut.

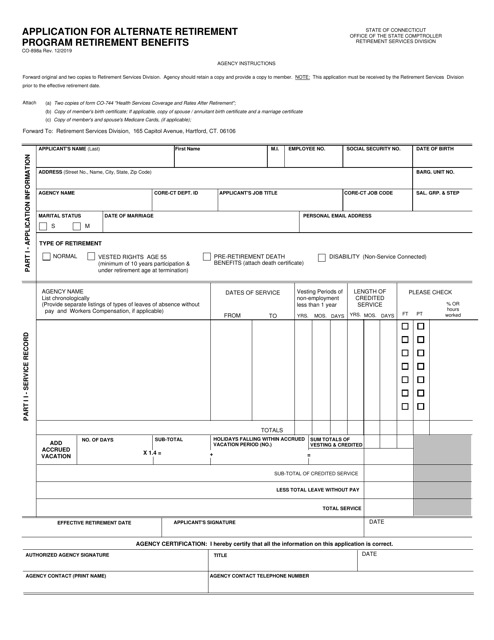

This form is used for applying for retirement benefits under the Alternate Retirement Program in Connecticut.

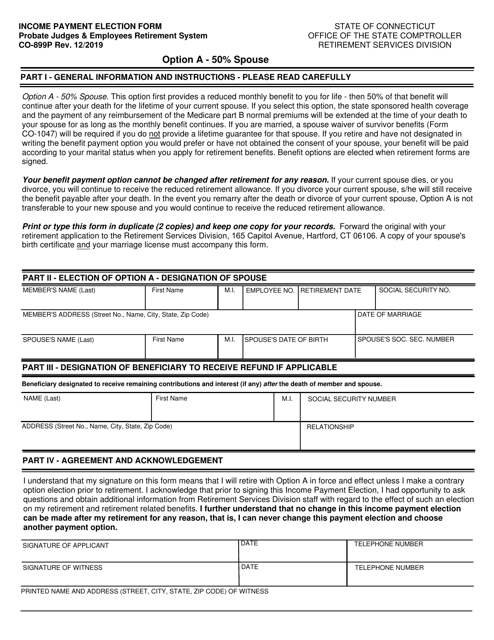

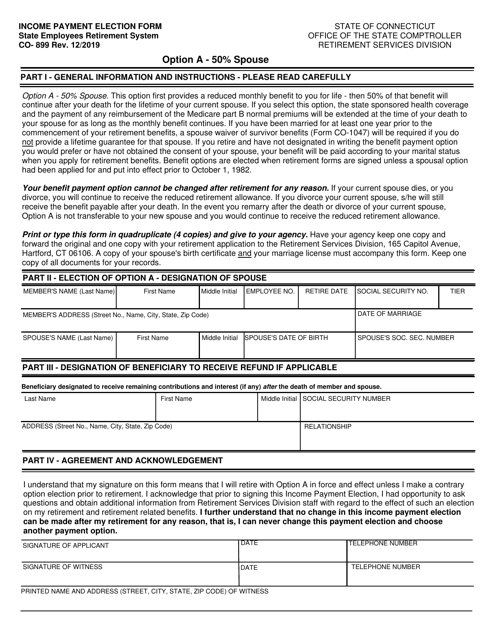

This form is used for making income payment elections in the state of Connecticut, specifically for the option of allocating 50% of the payment to a spouse.

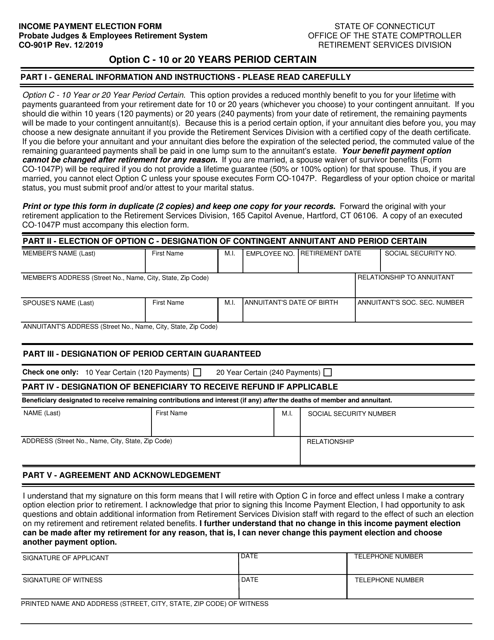

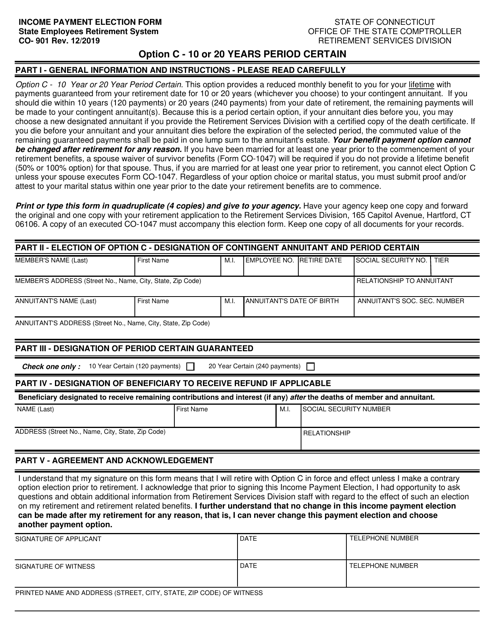

This Form is used for making an income payment election with Option C for a 10 to 20 years period certain in Connecticut.

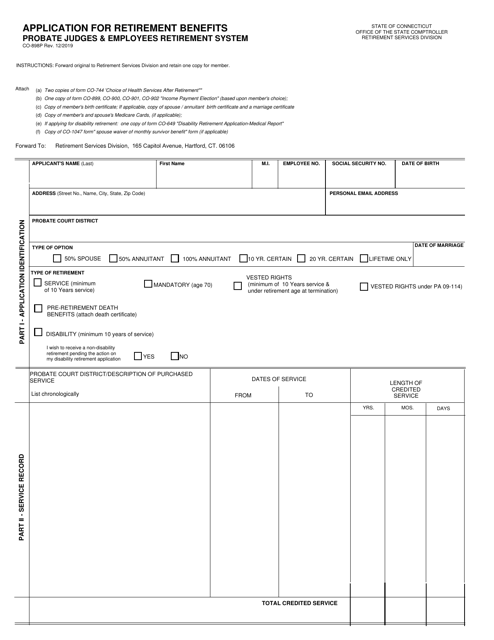

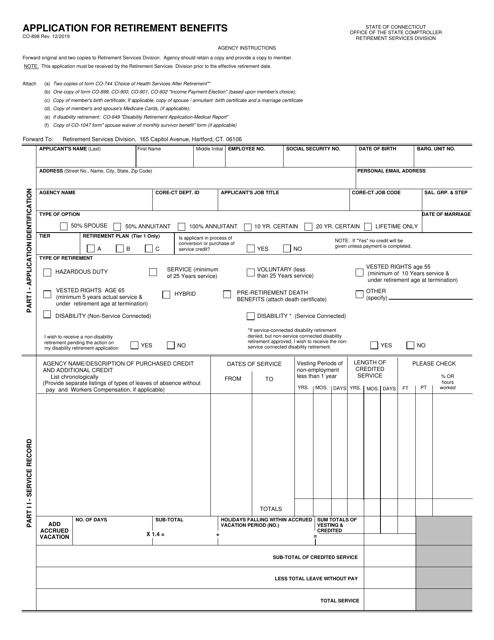

This Form is used for applying for retirement benefits in the state of Connecticut.

This form is used for making an income payment election and selecting Option D - Straight Life Annuity in the state of Connecticut.

This form is used for making an income payment election in Connecticut, allowing you to designate 50% of your income to your spouse.

This form is used to apply for retirement benefits in the state of Connecticut.

This form is used for making an income payment election in Connecticut. Option C allows you to choose a 10 to 20-year period certain for receiving payments.

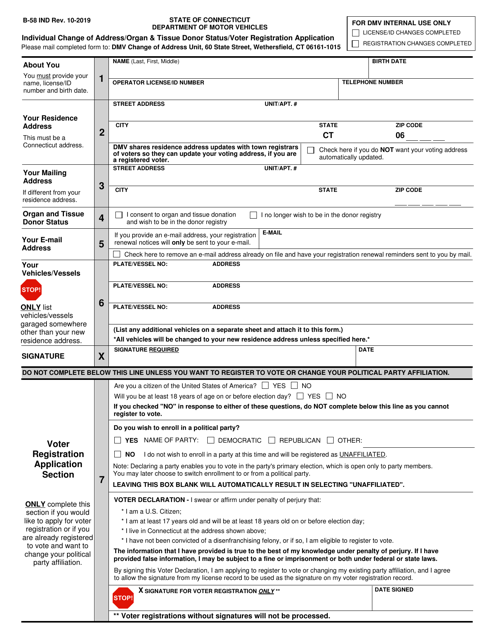

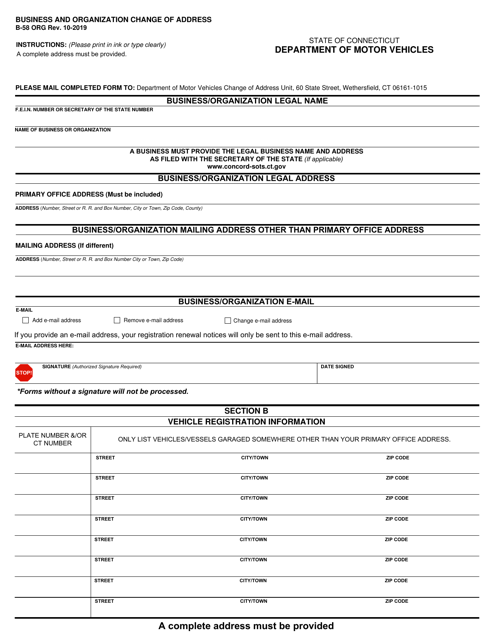

This form is used for business and organizations in Connecticut to notify the state of a change in their address.

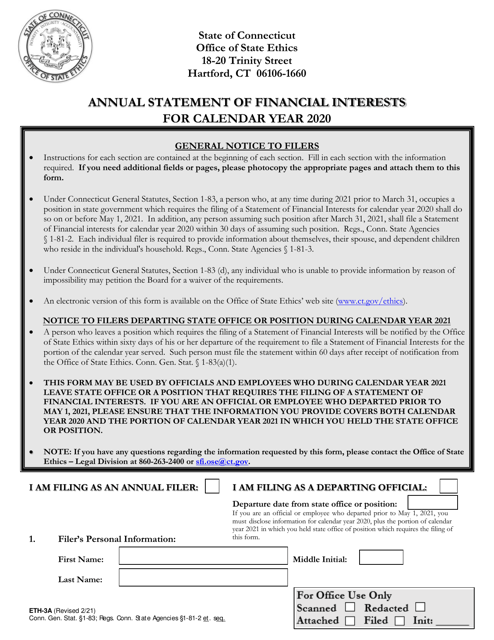

This form is used for filing the annual statement of financial interests in the state of Connecticut.

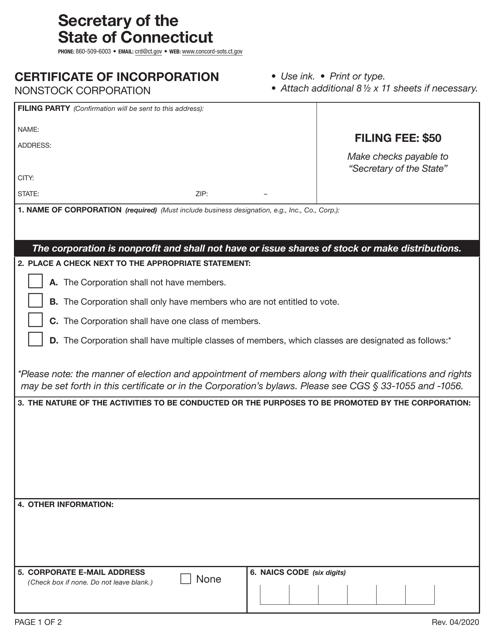

This document is used for incorporating a nonstock corporation in the state of Connecticut. It certifies the formation of the corporation and includes key information such as the corporation's name, purpose, and registered agent.

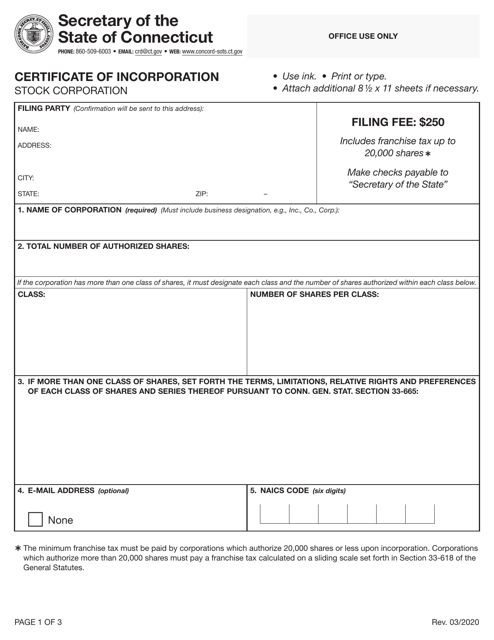

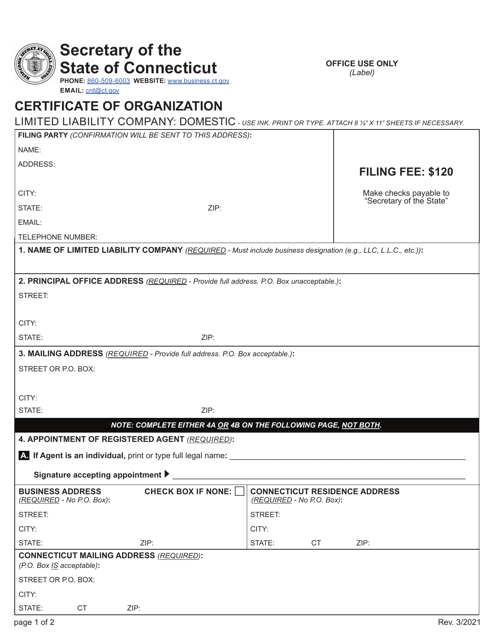

This document certifies the formation of a stock corporation in the state of Connecticut. It outlines the legal structure, ownership, and other important information about the corporation.

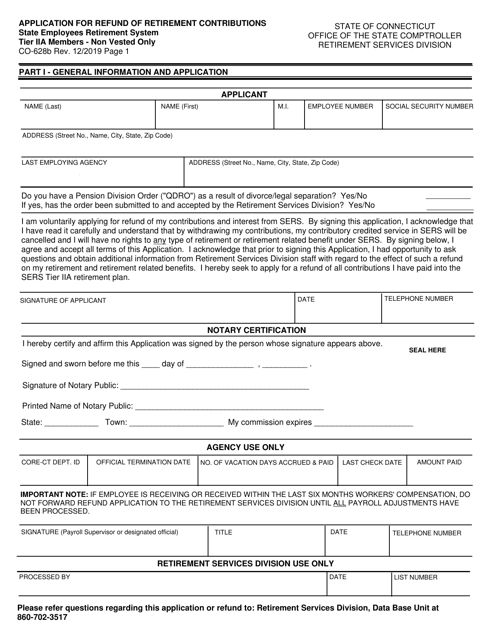

This form is used for Connecticut Tier IIA members who are non-vested and wish to apply for a refund of their retirement contributions.

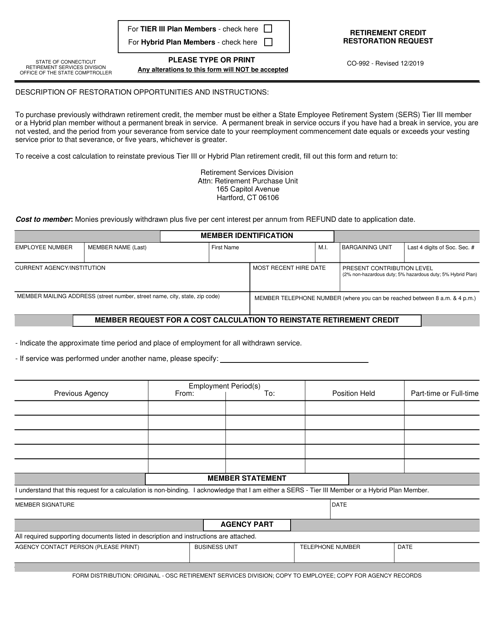

This form is used for requesting the restoration of retirement credits for Tier III and Hybrid members in Connecticut.

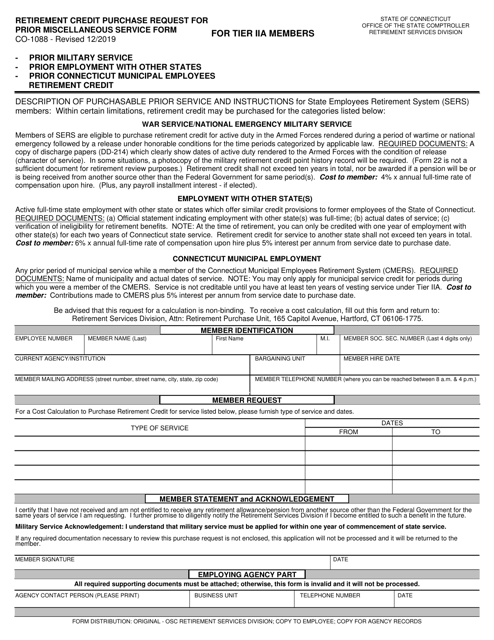

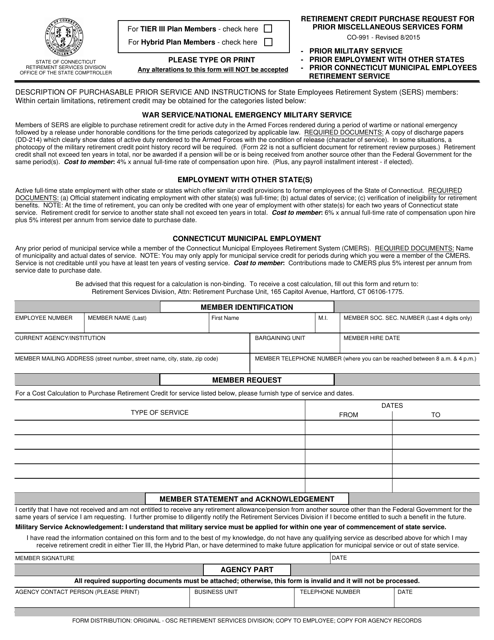

This form is used for requesting the retirement credit purchase for prior miscellaneous service in Connecticut.

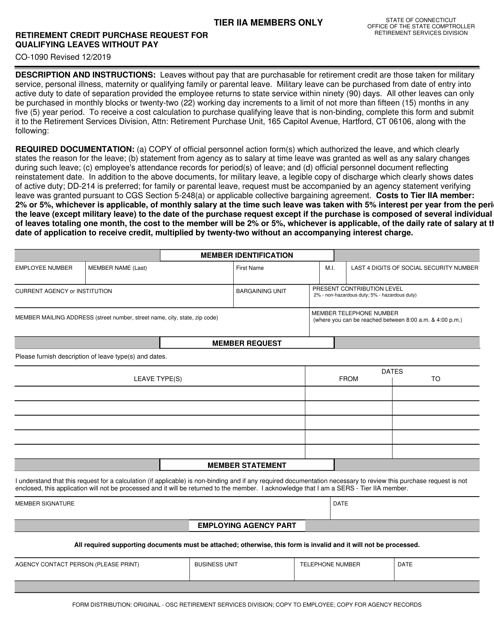

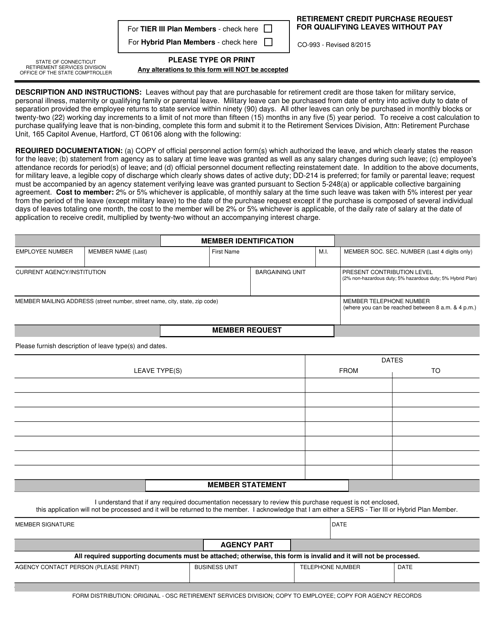

This form is used for requesting retirement credit purchase for qualifying leaves without pay in Connecticut.

This form is used for requesting the purchase of prior miscellaneous services for retirement credit in Connecticut.

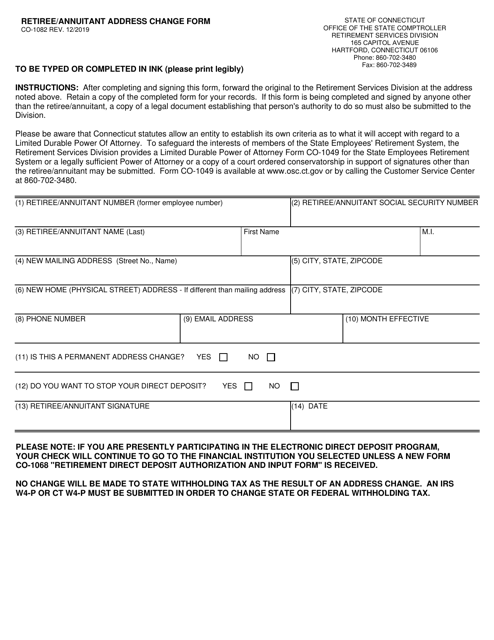

This Form is used for retired individuals or annuitants to change their address in the state of Connecticut.

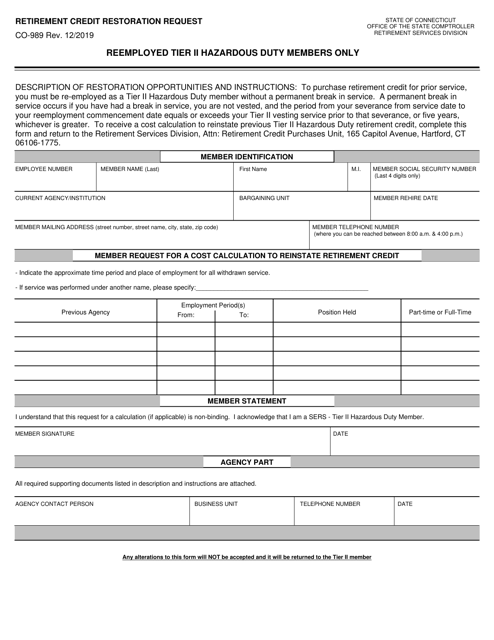

This form is used for requesting the restoration of retirement credit for reemployed Tier II hazardous duty members in Connecticut.

This form is used for requesting a retirement credit purchase for qualifying leaves without pay in the state of Connecticut.

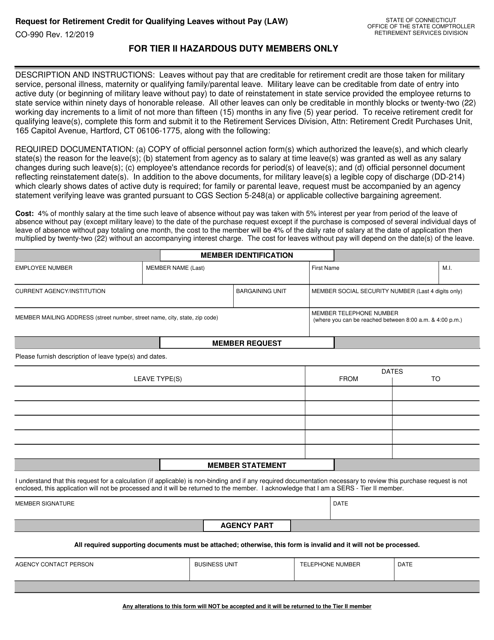

This form is used for requesting retirement credit for qualifying leaves without pay for Tier II hazardous duty members in Connecticut.

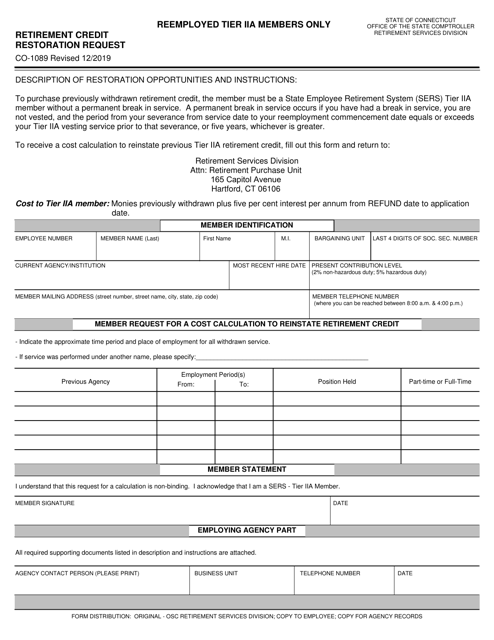

This form is used for requesting the restoration of retirement credits in the state of Connecticut.

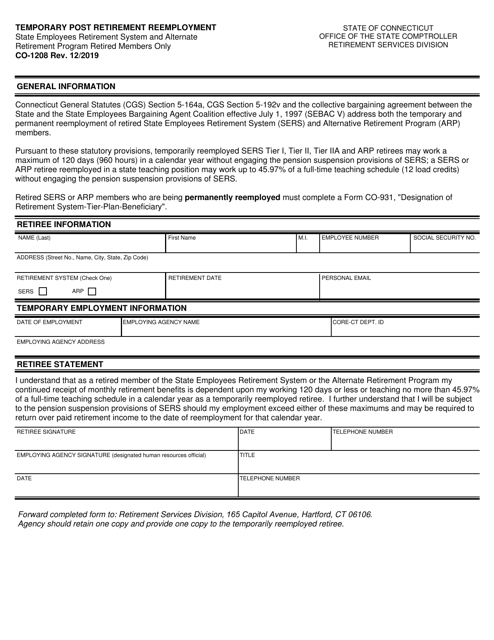

This form is used for reporting temporary post-retirement reemployment in Connecticut.

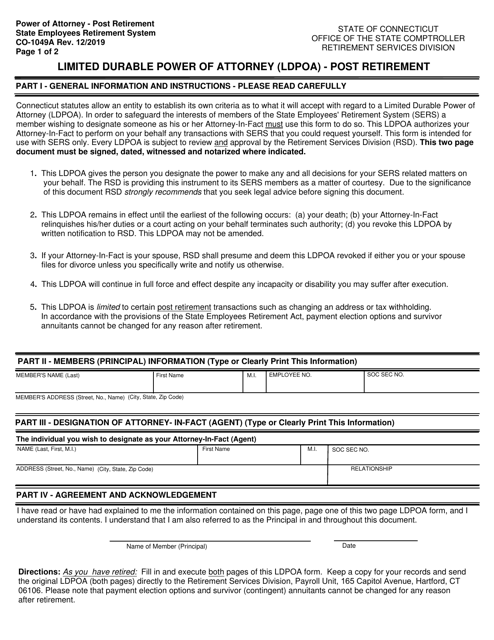

This Form is used for creating a Limited Durable Power of Attorney specifically designed for post-retirement in the state of Connecticut.

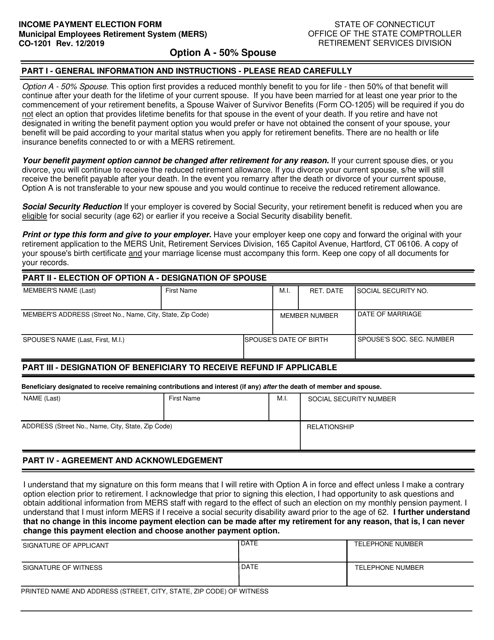

This form is used for making an income payment election for MERS (Municipal Employees' Retirement System) in Connecticut. Option A is for choosing to allocate 50% of the income payment to the spouse.

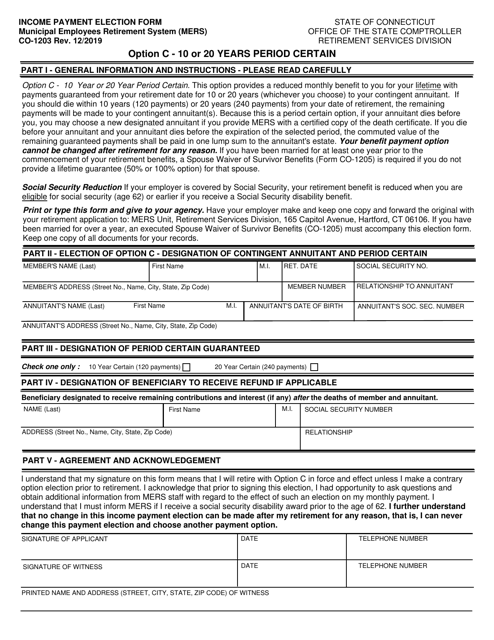

This form is used for making an income payment election under the MERS retirement plan in Connecticut. Option C allows you to choose a 10 or 20-year period certain for receiving payments.

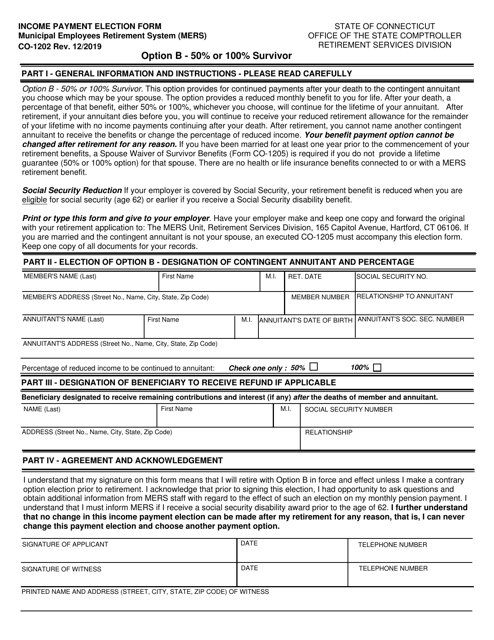

This form is used for making income payment election for MERS retirement plans in Connecticut. Option B allows the participant to choose between 50% or 100% survivor benefit.