Free Notice of Determination Forms and Templates

What Is a Notice of Determination?

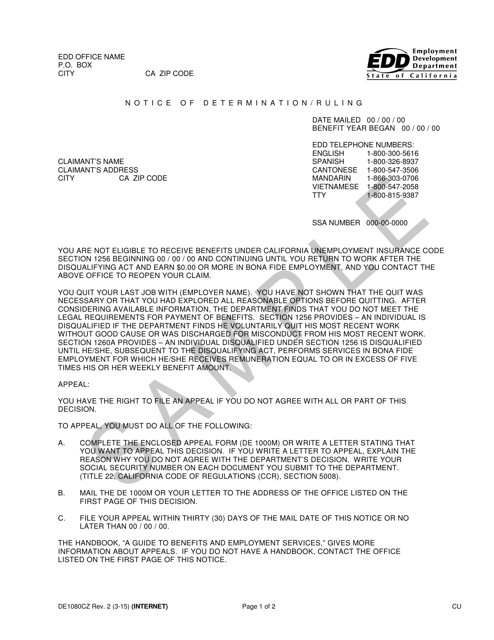

A Notice of Determination is a document that is used to notify an individual who applied for unemployment compensation benefits about the decision on whether they were found eligible for the benefits or not. The notice is sent out by the state’s unemployment agency.

Alternate Name:

- Unemployment Determination Letter.

Each state runs its own unemployment program, so the process of applying for compensation benefits and receiving a notice of determination differs depending on the state where a filer is applying. To find their state’s unemployment agency, an applicant should visit the official website of the U.S. government.

How Long Does It Take to Get a Determination Letter From Unemployment?

It might take a while until an applicant will receive their Unemployment Determination Letter. After they lose their job due to reasons that were not their fault, a filer should file a claim for unemployment benefits as soon as they can. The application for benefits must be submitted to the state’s unemployment agency and after they have received it, the claim will be thoroughly reviewed and, if needed, additional information will be gathered. Depending on the waiting period established by state authorities (if it was established in a state where the claim was filed), how many claims are being processed, and the amount of additional information that the agency may require, it can take up to three or four weeks.

How Will I Know If My Unemployment Is Approved?

Most states use online unemployment benefit services, where an applicant can check the status of their application online. To find the service a filer should visit the official website of the Department of Labor and Workforce Development of the state where they applied for the unemployment benefits.

The filer will receive an Unemployment Notice of Determination by mail or by email, depending on how they wanted to be notified in their claim for benefits. The notice follows a certain structure and can include sections like:

- In the first part an applicant will find information on whether they were qualified or disqualified for benefits;

- In the second part a filer will be provided with a motivated explanation on the reasons why they were disqualified (if they were disqualified);

- The next part contains references particular laws that support the decision that has been made;

- The last part of the notice will inform a filer on how to appeal the decision if they disagree with it, and the time period when they can file an appeal. It will also provide a filer with the full address of where an appeal must be submitted.

Not the form you were looking for? Check out these related topics:

- Apply for unemployment benefits;

- Learn more about SNAP and TANF programs in your state;

- Get SSA benefits for you and your family.

Related Articles

Documents:

3

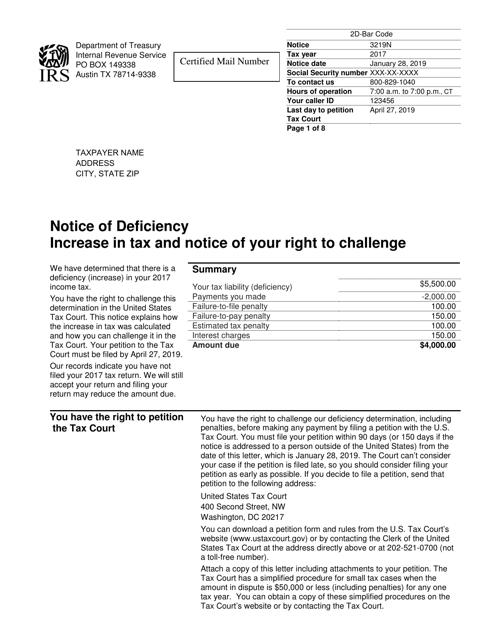

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

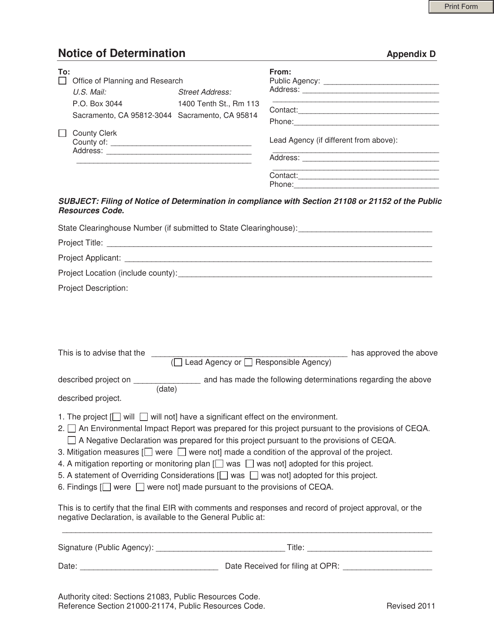

This form is used for submitting a Notice of Determination or Ruling in the state of California.

This document is a notice of determination used in the state of California. It provides information regarding a decision or outcome related to a specific matter.