Ct Tax Forms and Templates

Documents:

80

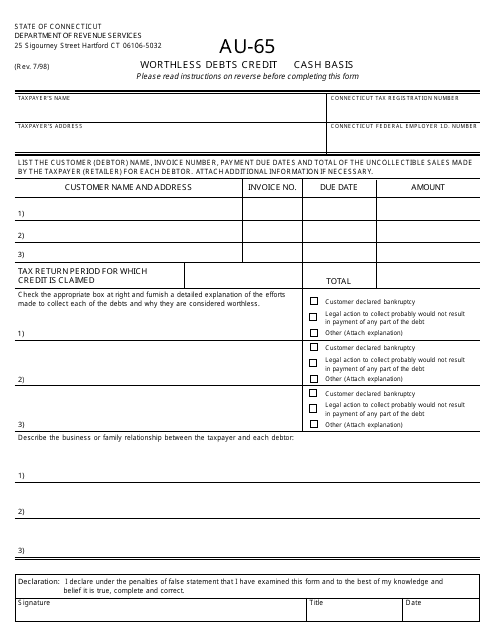

This Form is used for claiming a credit for worthless debts on a cash basis in the state of Connecticut.

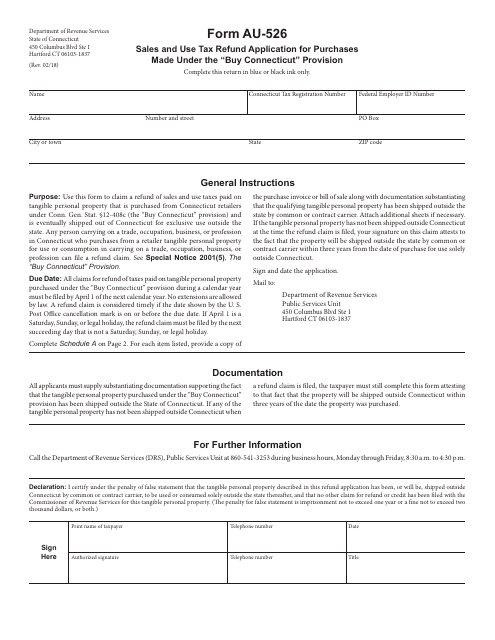

This Form is used for requesting a refund of sales and use tax on purchases made under the "buy Connecticut" provision in Connecticut.

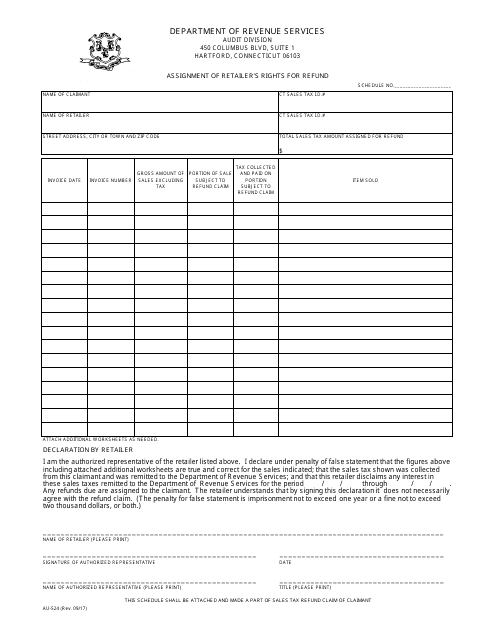

This form is used for assigning a retailer's rights for refund in Connecticut. It allows retailers to transfer their right to claim a refund to another party.

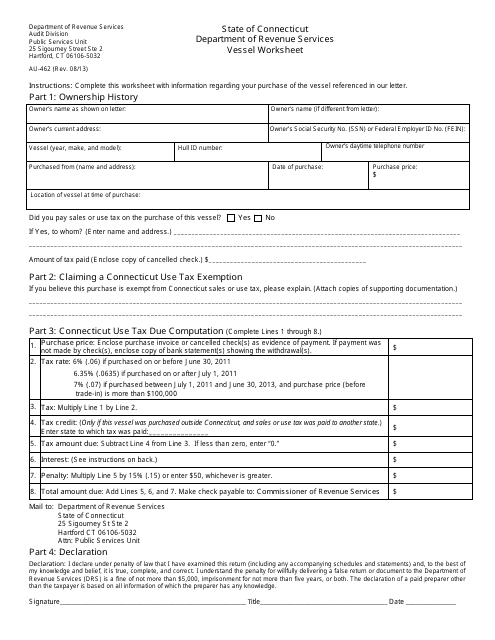

This form is used for completing a vessel worksheet in the state of Connecticut. The worksheet provides information about the vessel, such as the make, model, and registration details.

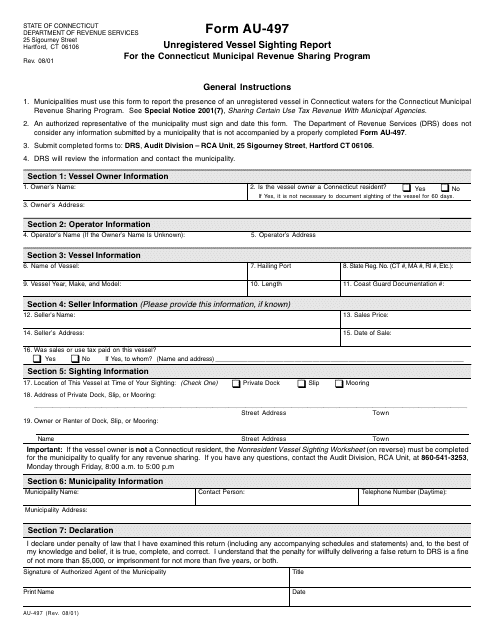

This Form is used for reporting unregistered vessel sightings in Connecticut for the Municipal Revenue Sharing Program.

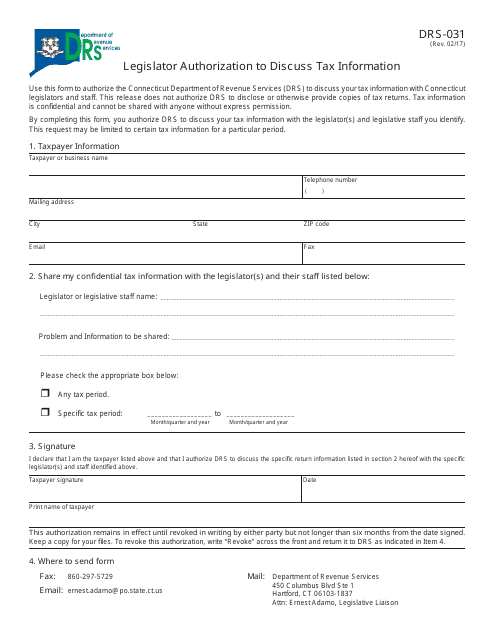

This form is used for Connecticut legislators to authorize discussion of tax information.

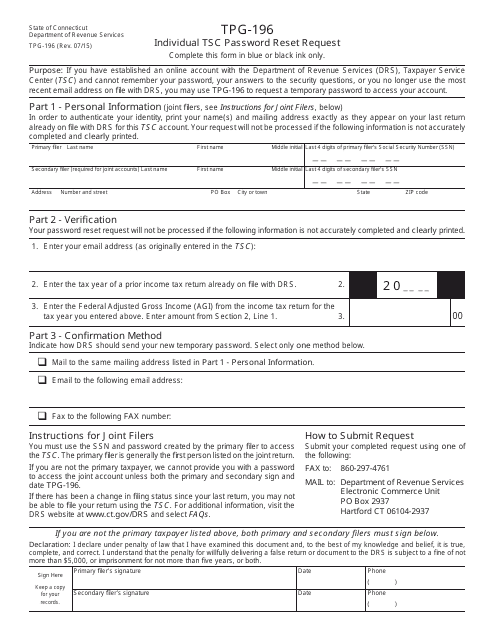

This document is used for requesting a password reset for an individual's TSC (Taxpayer Service Center) account in Connecticut.

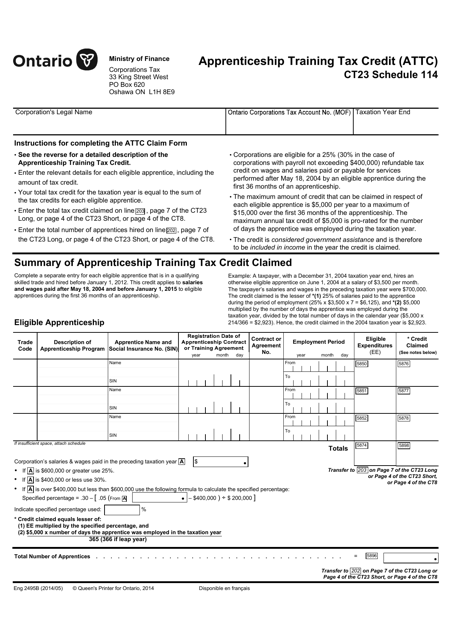

This form is used for claiming the Apprenticeship Training Tax Credit in Ontario, Canada. It is a schedule that needs to be filed along with Form CT23 (2495B).

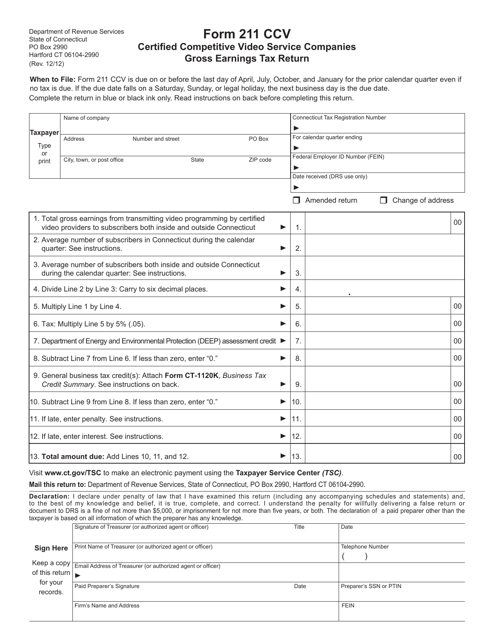

This form is used for certified competitive video service companies to report their gross earnings for tax purposes in the state of Connecticut.

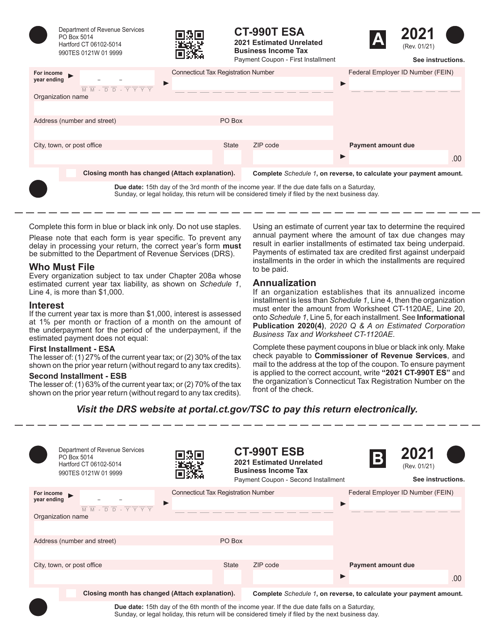

This form is used for submitting estimated unrelated business income tax in the state of Connecticut.

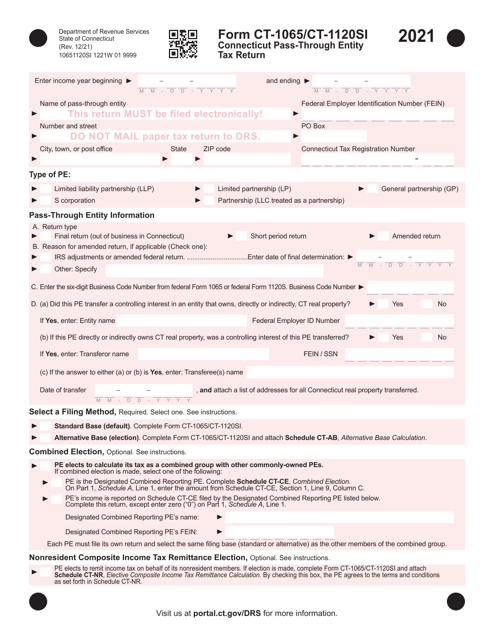

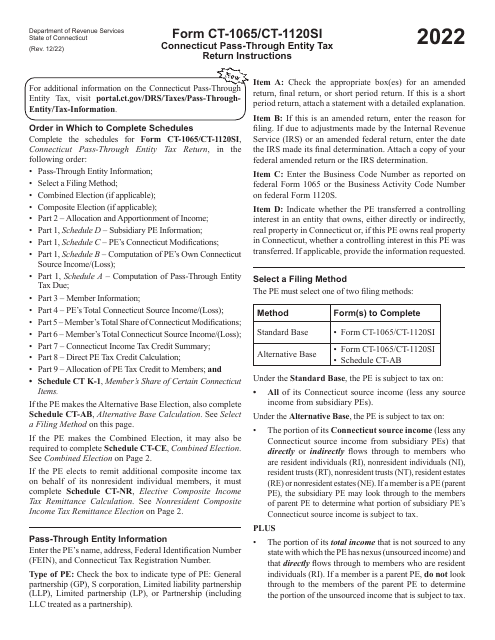

This Form is used for filing the Connecticut Pass-Through Entity Tax Return for Connecticut residents.

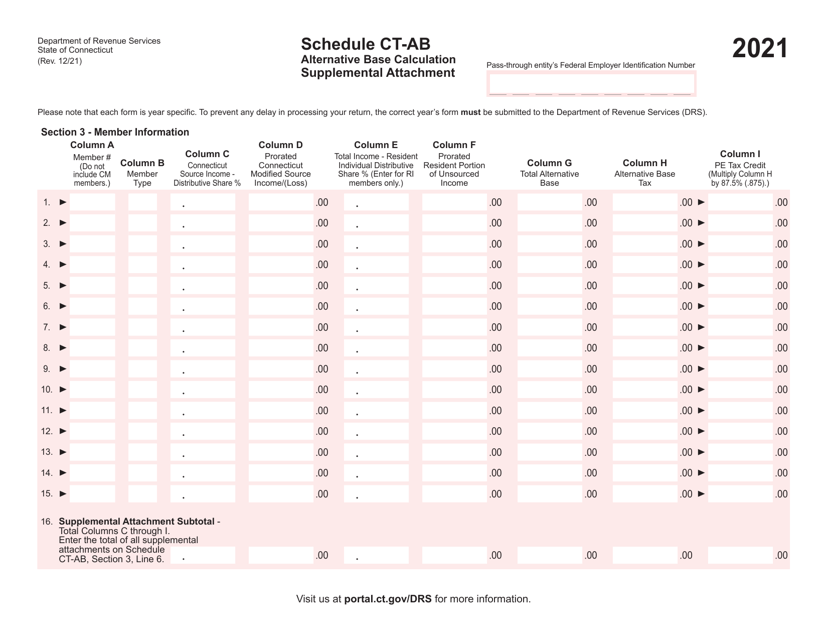

This form is used for providing a supplemental attachment for the alternative base calculation on Schedule CT-AB in Connecticut.

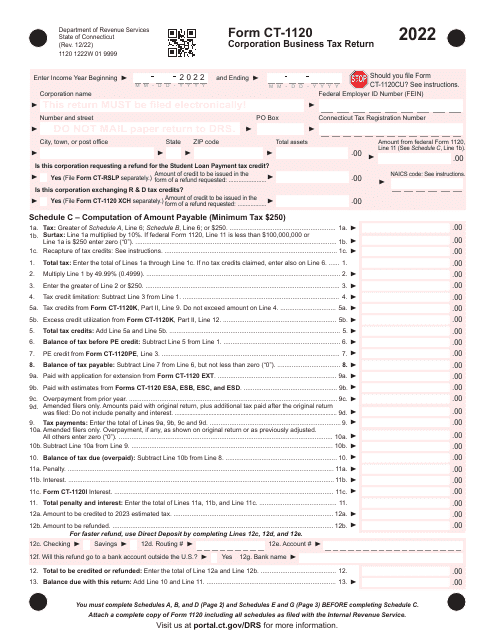

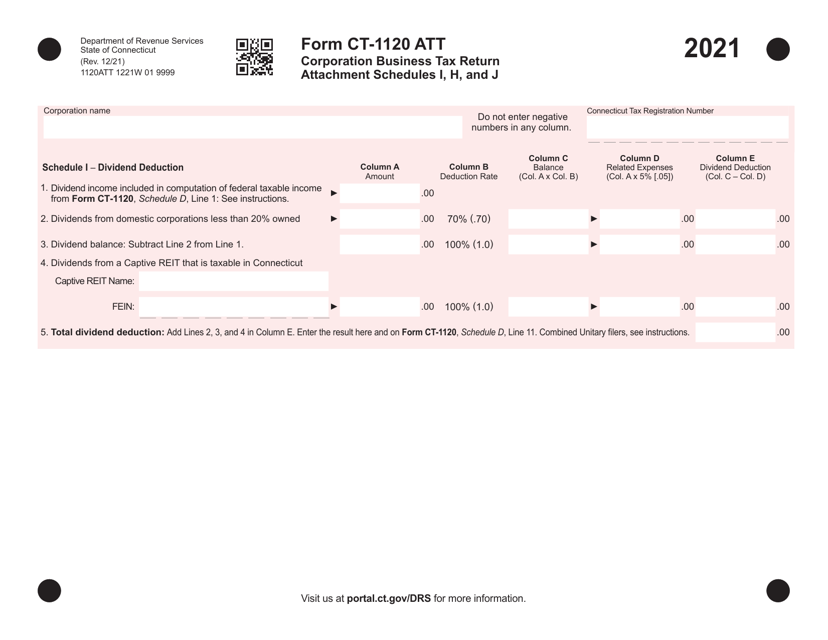

This form is used for filing the Corporation Business Tax Return in Connecticut. It includes schedules H, I, and J for reporting specific details related to the corporation's business activities.

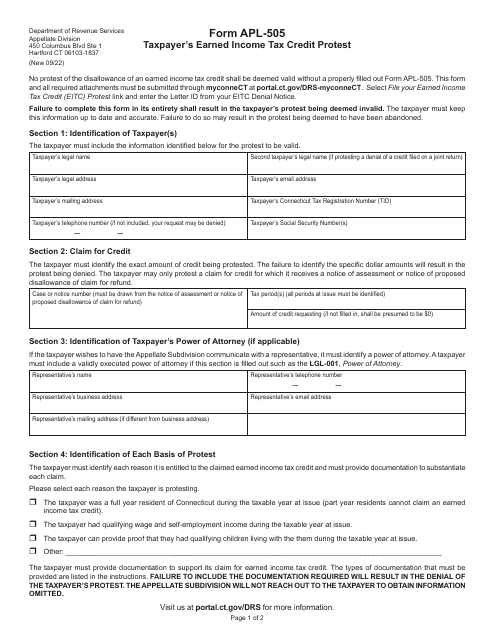

This form is used for taxpayers in Connecticut to protest their eligibility for the Earned Income Tax Credit.