Ct Tax Exempt Form Templates

Connecticut Tax Exempt Forms are used to claim exemptions from certain taxes in the state of Connecticut. These forms are typically used by individuals or organizations that qualify for specific tax-exempt statuses, such as non-profit organizations, government entities, or individuals who meet certain criteria. By completing and submitting the appropriate tax exempt form, the eligible individuals or entities can avoid paying certain taxes in Connecticut. Some common types of tax exemptions that may be claimed through these forms include sales tax exemptions, property tax exemptions, and income tax exemptions.

Documents:

1

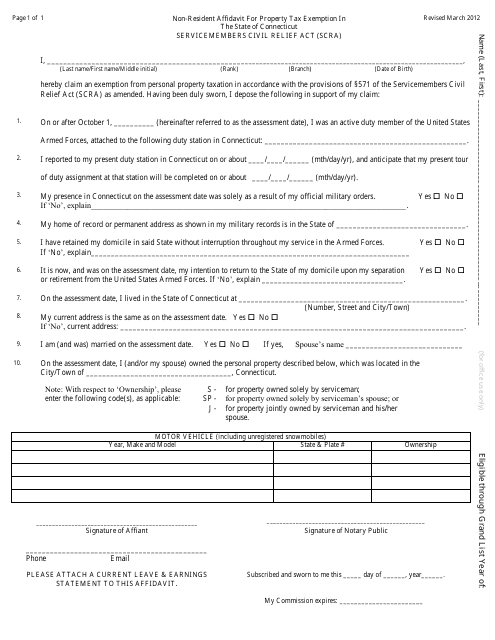

This document is a template for a non-resident affidavit that can be used to apply for property tax exemption in the state of Connecticut under the Service Members Civil Relief Act (SCRA).