Fill and Sign Vermont Legal Forms

Documents:

3409

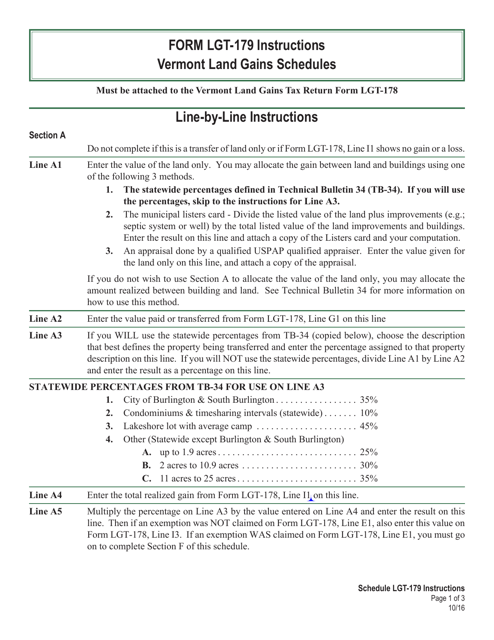

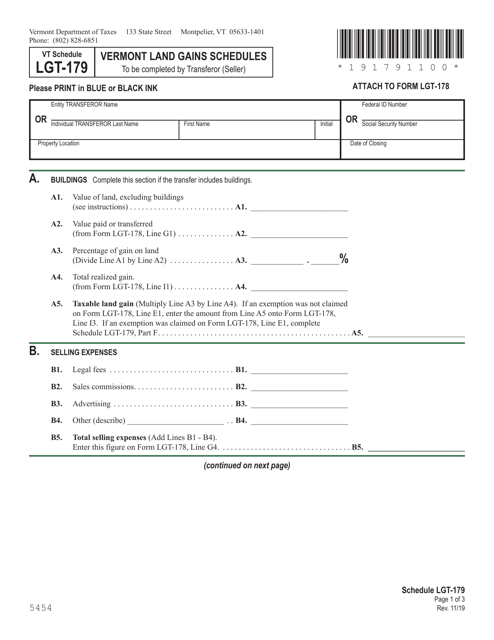

This document is a schedule form used in Vermont for reporting land gains. It is specifically designated as LGT-179.

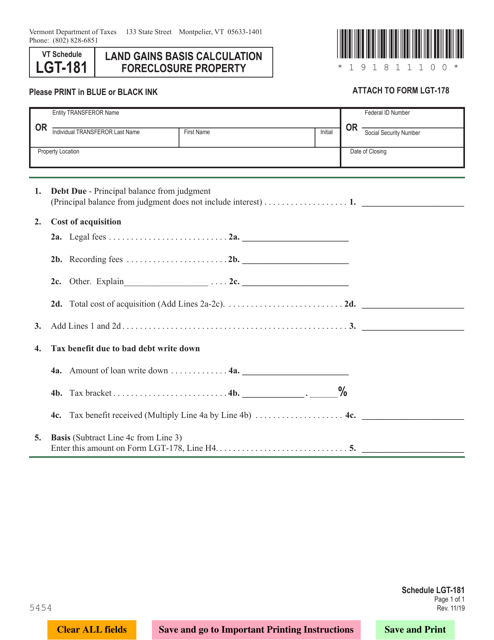

This form is used for reporting and paying the Vermont Land Gains Tax, which is a tax on the sale of certain Vermont real estate. This document must be filed by individuals or businesses who have realized a gain from the sale of qualifying property in Vermont.

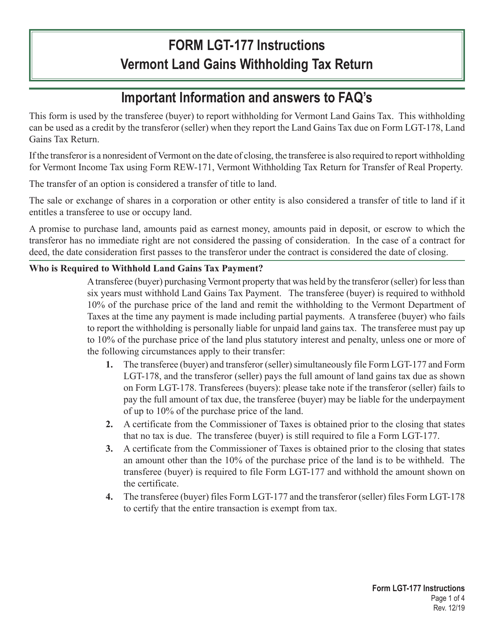

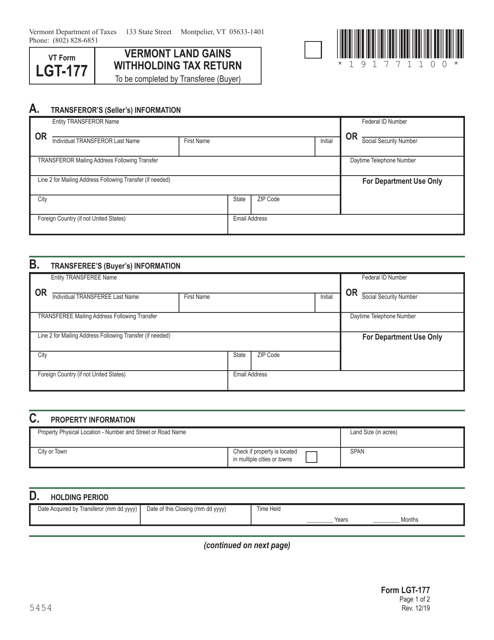

This form is used for filing the Vermont Land Gains Withholding Tax Return in Vermont.

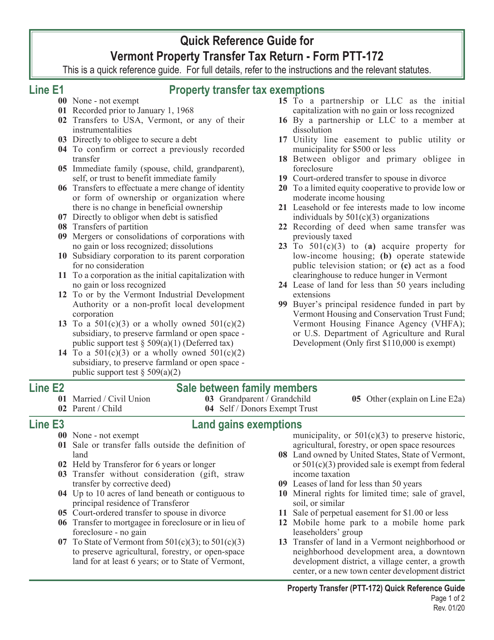

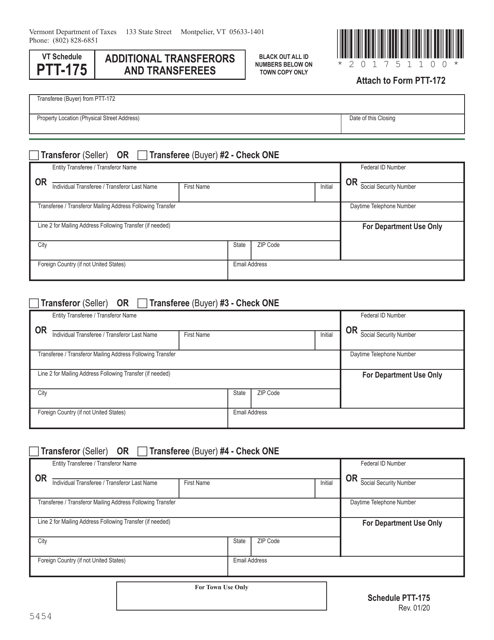

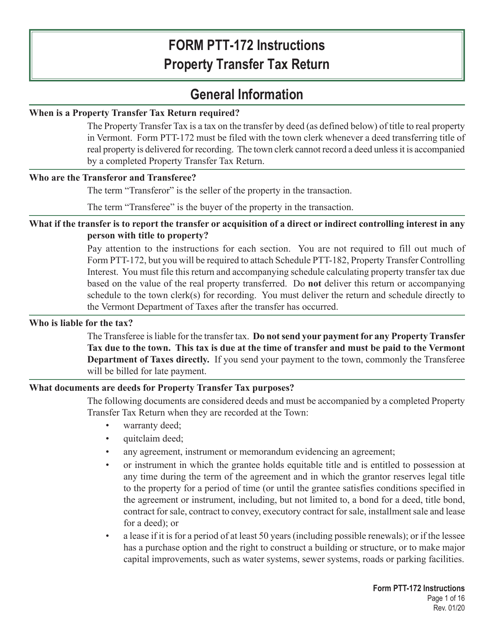

This document is used for reporting and paying the Vermont Property Transfer Tax when a property is being transferred in Vermont. It provides instructions on how to complete the Vermont Property Transfer Tax Return (Form PTT-172) and fulfill the associated tax obligations.

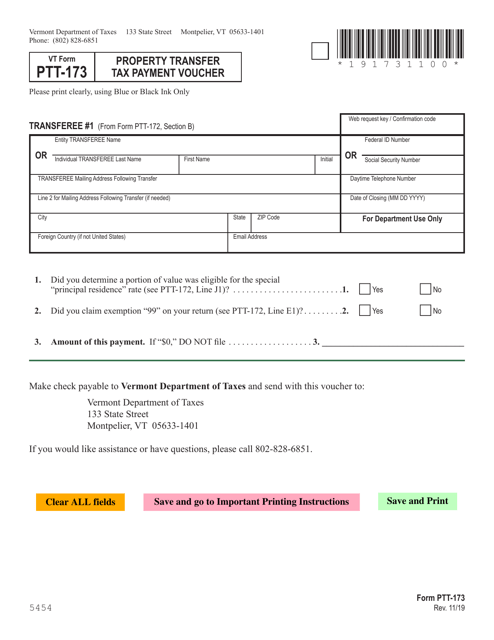

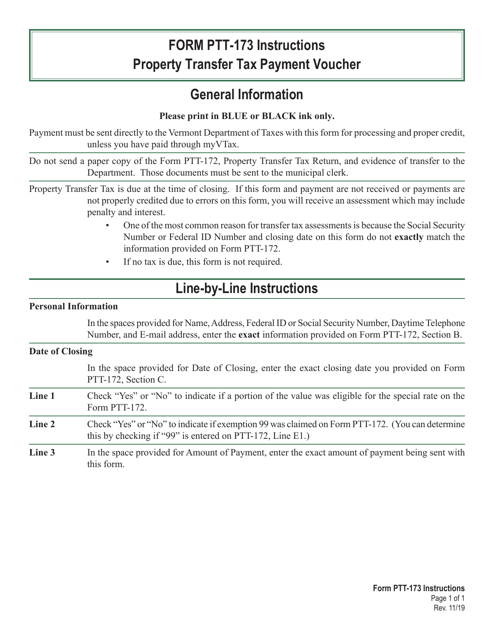

This form is used for making payments for property transfer taxes in Vermont.

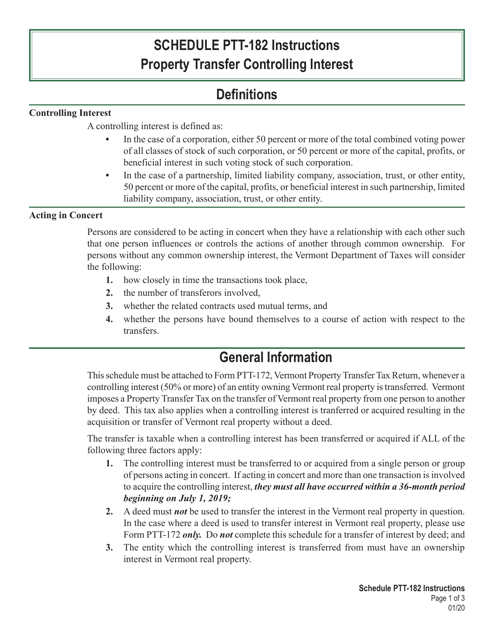

This document provides instructions for completing Schedule PTT-182, which is used to report the transfer of controlling interest in property in the state of Vermont.

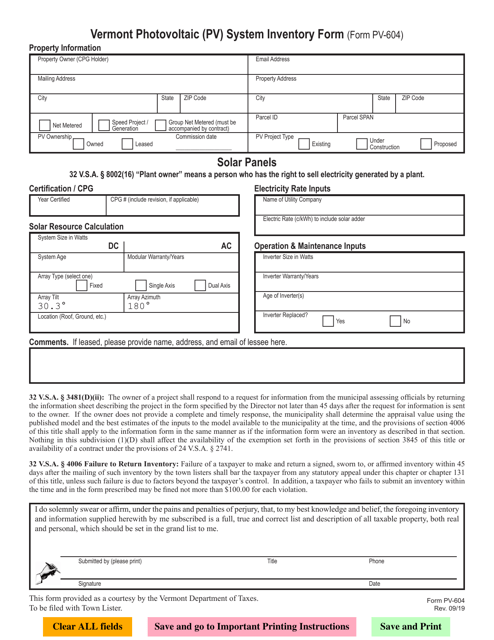

This form is used for inventorying photovoltaic (PV) systems in Vermont.

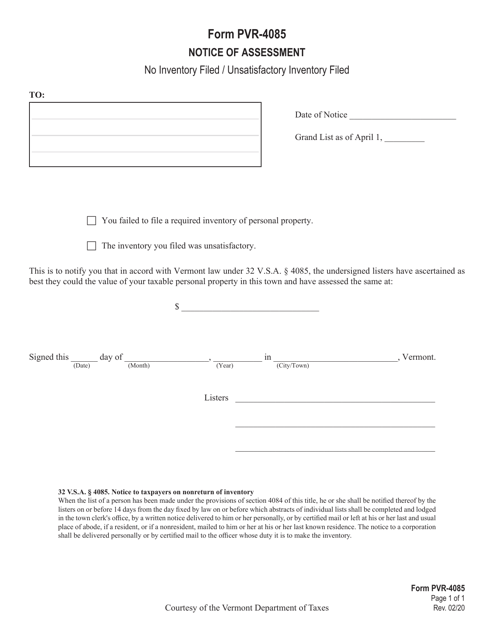

This Form is used for submitting a Notice of Assessment for a Vermont business that has either not filed an inventory or has filed an unsatisfactory inventory.

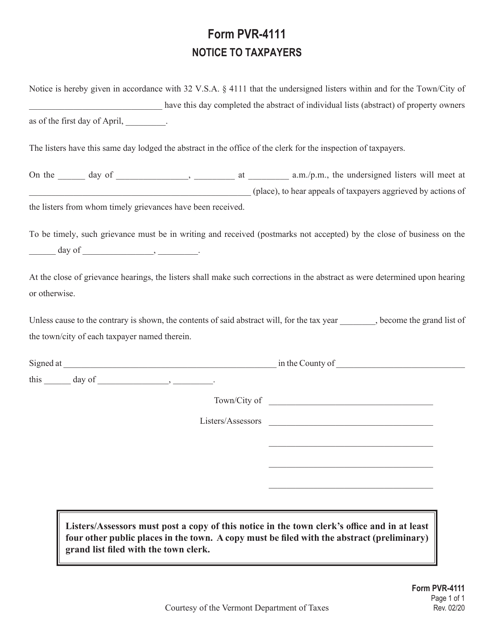

This form is used for providing notice to taxpayers in Vermont regarding their taxes. It may contain important information about filing deadlines, payment due dates, or any changes in tax laws specific to Vermont.

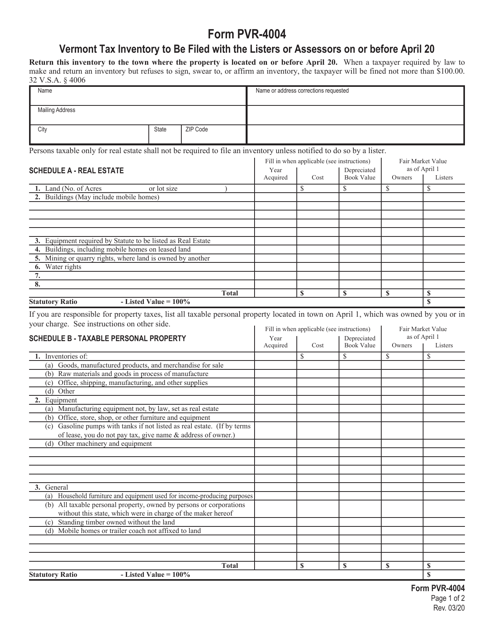

This form is used for submitting the Vermont Tax Inventory to the Listers or Assessors by April 20. It is required for tax purposes in the state of Vermont.

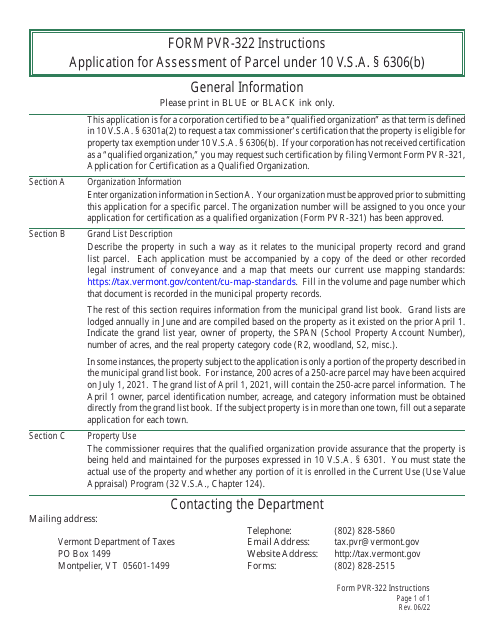

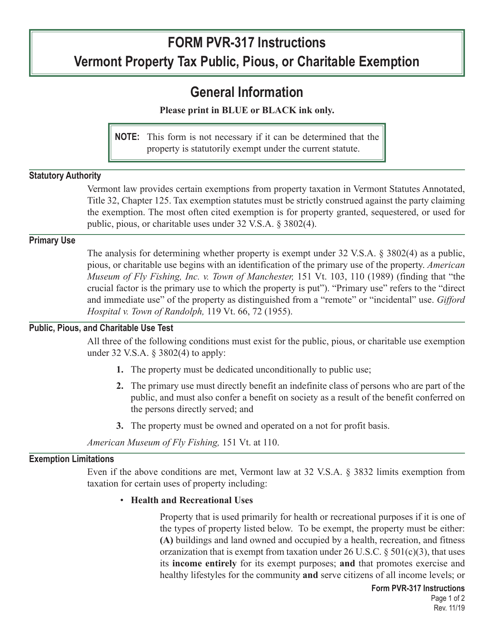

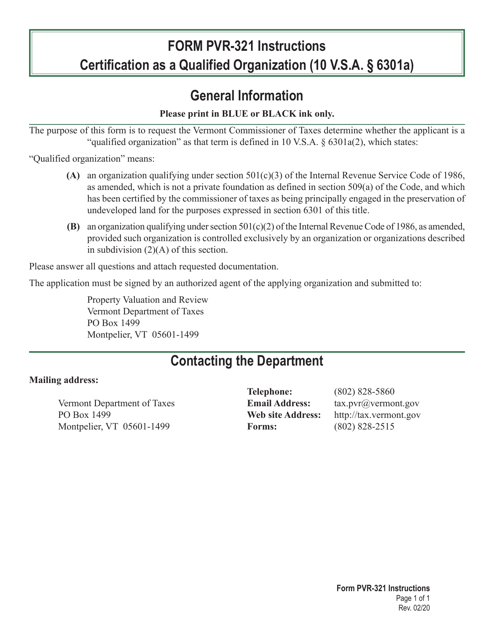

This form is used for applying for certification as a qualified organization in Vermont.

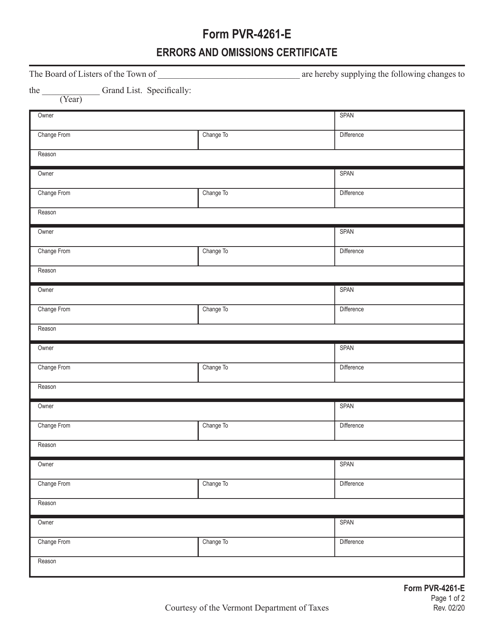

This form is used for obtaining an Errors and Omissions Certificate in the state of Vermont.

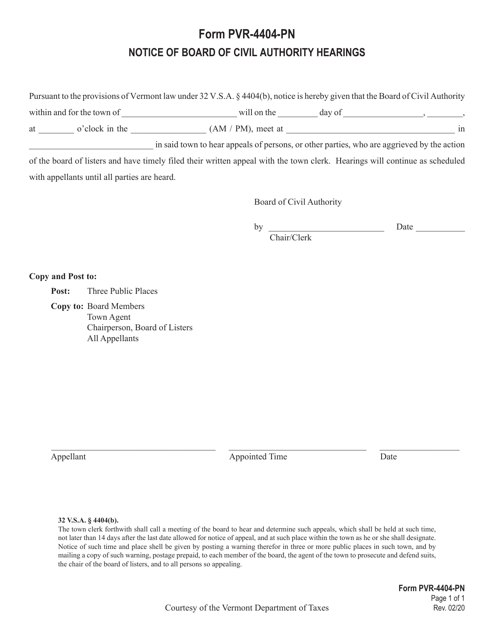

This form is used for providing notice of Board of Civil Authority hearings in the state of Vermont. It is a document that informs individuals about upcoming hearings and their rights to participate in the proceedings.

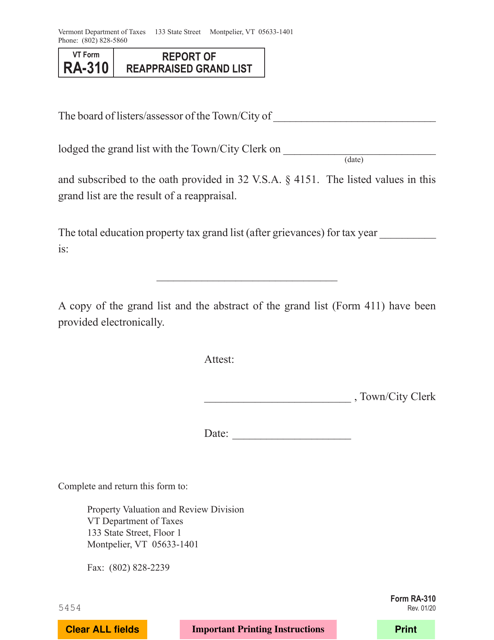

This form is used for reporting the reappraised grand list in the state of Vermont. It is used to assess property values and ensure accurate tax assessments.

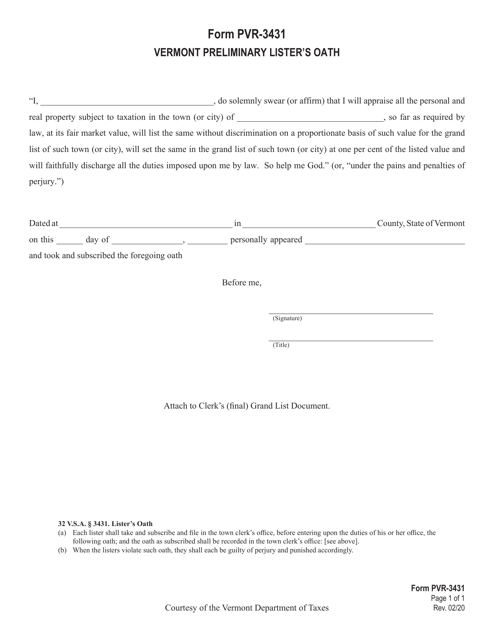

This form is used for the Vermont Preliminary Lister's Oath.

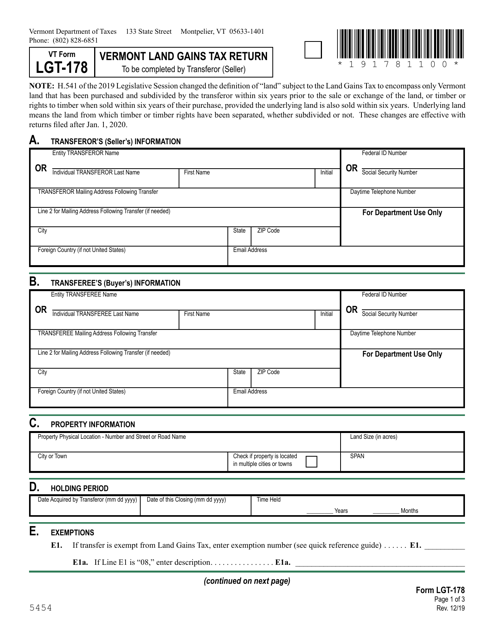

This Form is used for filing the Vermont Land Gains Tax Return in the state of Vermont. It provides instructions on how to report and pay the land gains tax on any gains from the sale of Vermont real estate.

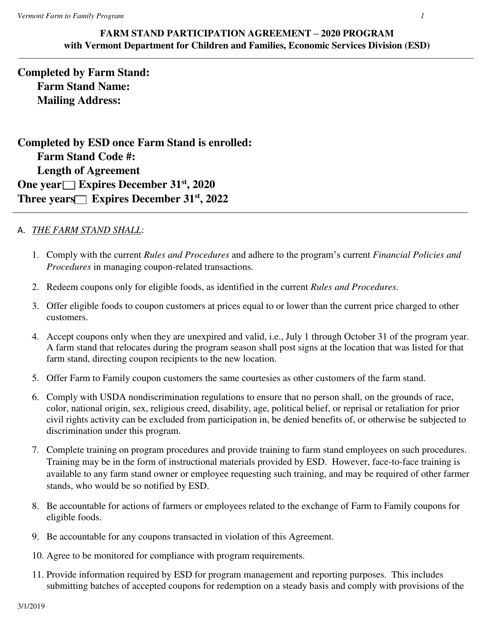

This Form is used to collect and provide information about farm stands in Vermont.

This Form is used for confirming the registration of participants in the Vermont Farm to Family Market Manager Training program.

This document is for farmers who want to participate in a farmers market in Vermont. It outlines the terms and conditions of their participation, including fees, regulations, and responsibilities.

This document is used for participating in a farm stand in Vermont.

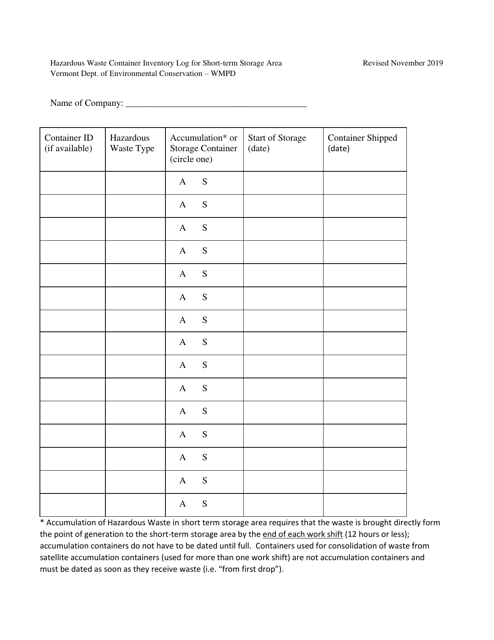

This document is used for keeping track of hazardous waste containers in the short-term storage area in Vermont. It helps ensure proper management and disposal of hazardous waste.