Nj Tax Forms and Templates

Documents:

322

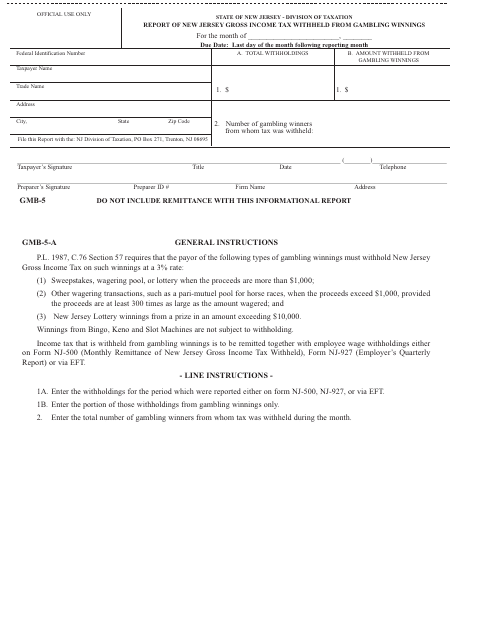

This form is used for reporting the amount of New Jersey Gross Income Tax withheld from gambling winnings in New Jersey.

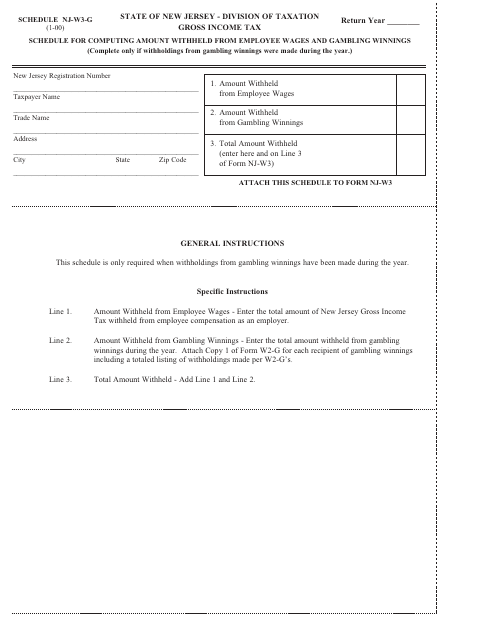

This document is used for computing the amount withheld from employee wages and gambling winnings in New Jersey.

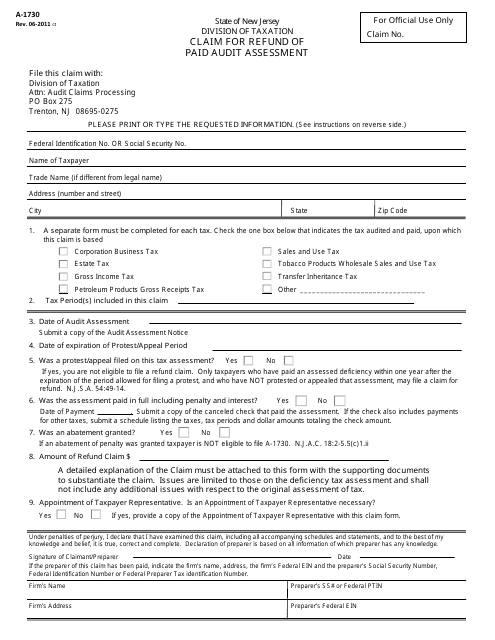

This Form is used for residents of New Jersey to claim a refund for a paid audit assessment.

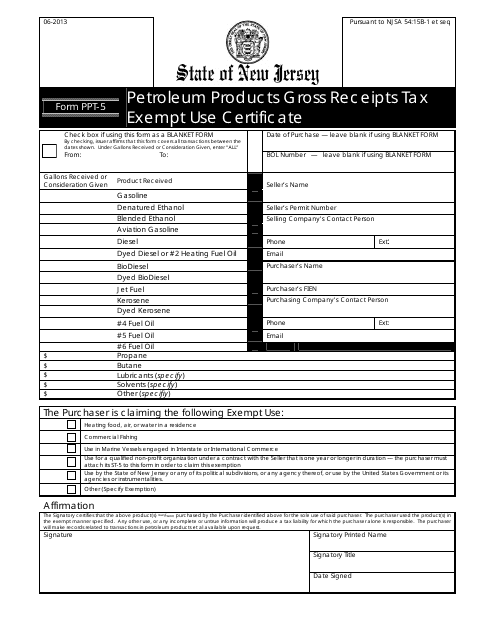

This Form is used for applying for an exemption from the gross receipts tax on the use of petroleum products in New Jersey.

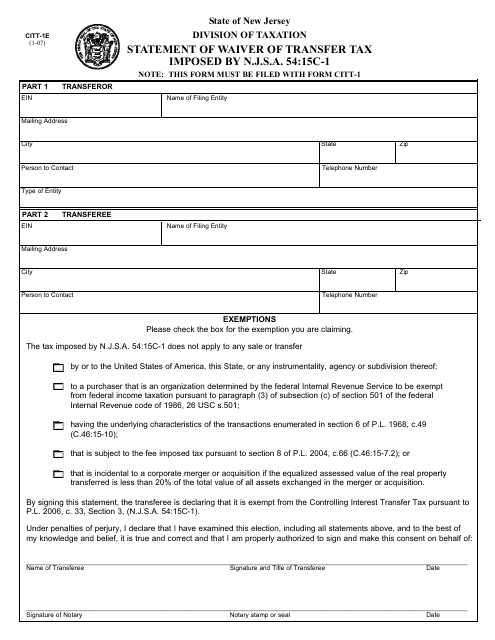

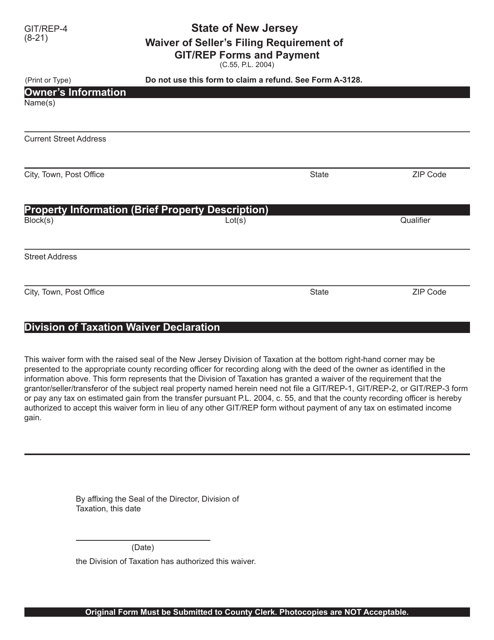

This form is used for declaring the waiver of transfer tax in the state of New Jersey.

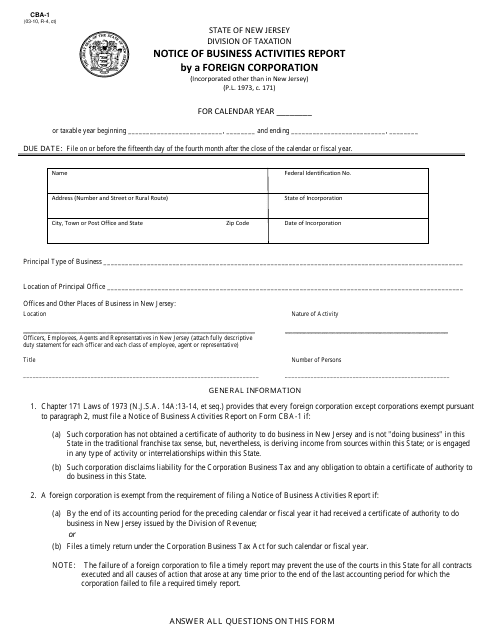

This form is used for a foreign corporation to report its business activities in the state of New Jersey. It is required by the New Jersey Division of Revenue and Enterprise Services to ensure compliance with state regulations.

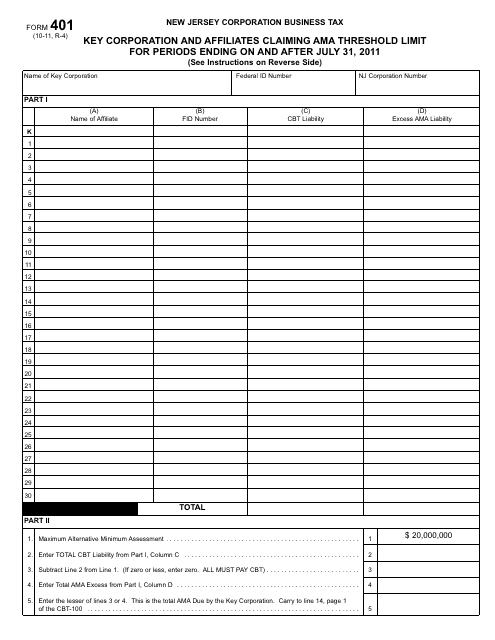

This Form is used for Key Corporation and its affiliates to claim the Ama Threshold Limit for periods ending on or after July 31, 2011 in New Jersey.

This type of document is used for nonoperational activities in New Jersey for taxable years ending on or after July 31, 2007.

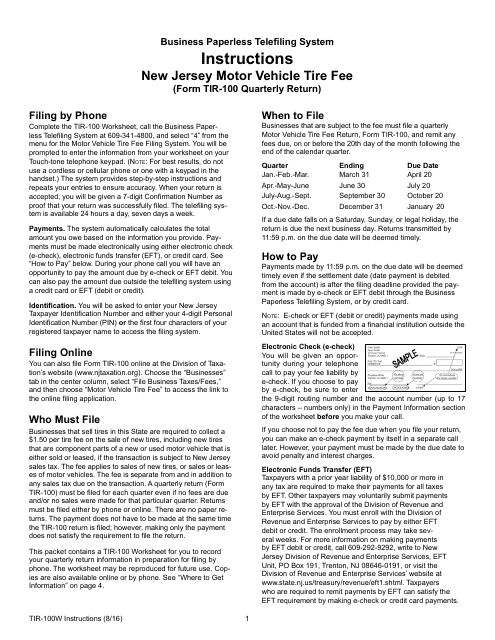

This Form is used for reporting and paying the New Jersey Motor Vehicle Tire Fee, which is required for anyone selling new tires in the state of New Jersey.

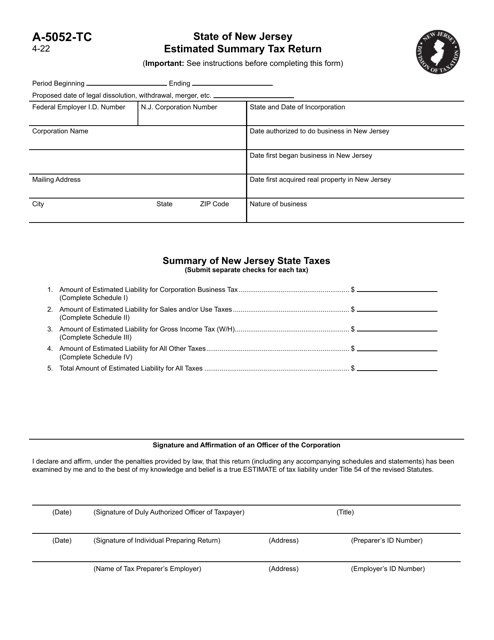

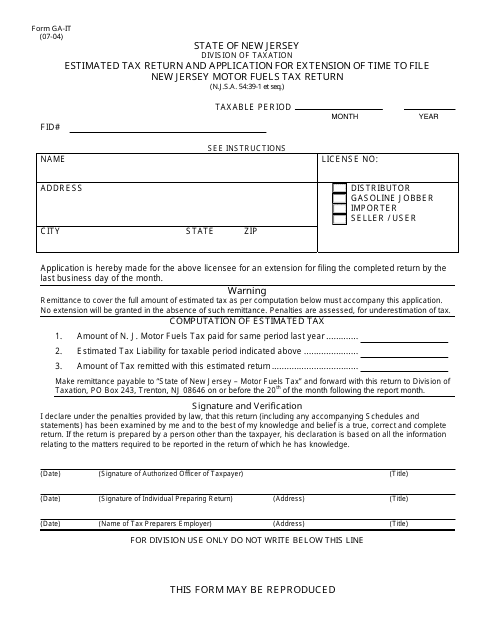

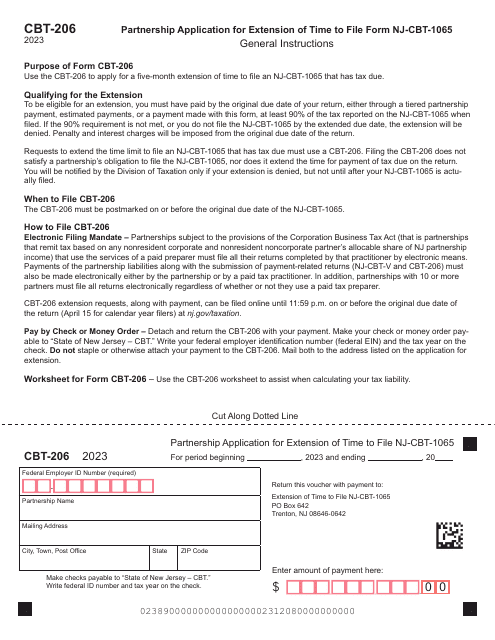

This Form is used for filing a Georgia state estimated tax return and applying for an extension of time to file a New Jersey Motor Fuels Tax Return.

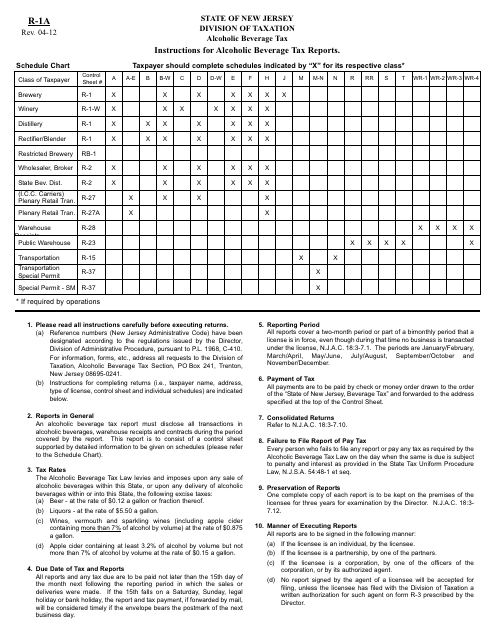

This document provides instructions for completing and filing the Alcoholic Beverage Tax Reports (Form R-1A) in the state of New Jersey. It is a necessary form for businesses involved in the sale of alcoholic beverages in order to report and pay the required taxes.

This form is used for reporting and paying inheritance tax for residents of New Jersey.

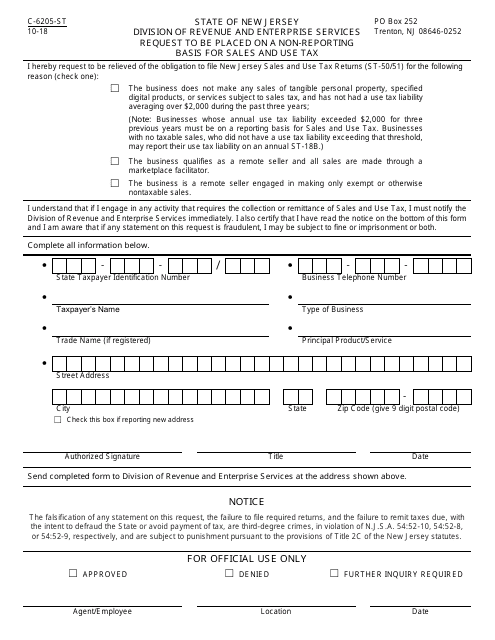

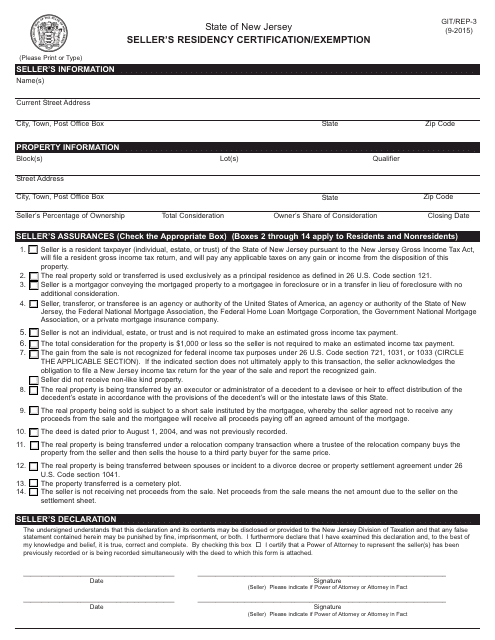

This document is used for declaring the residency status or claiming exemption as a seller in the state of New Jersey.

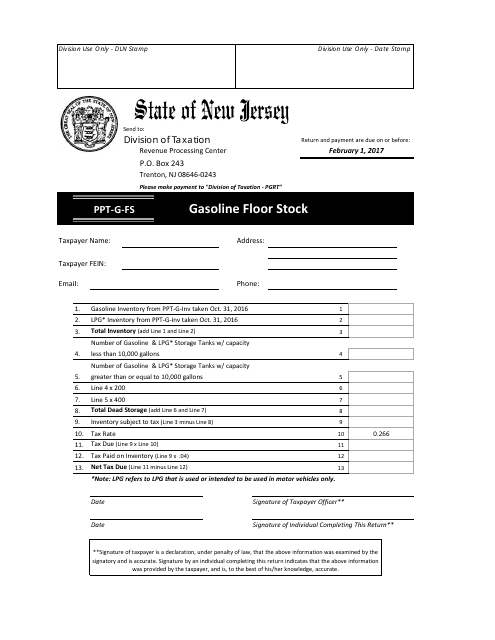

This Form is used for reporting and tracking gasoline floor stock inventory in the state of New Jersey.

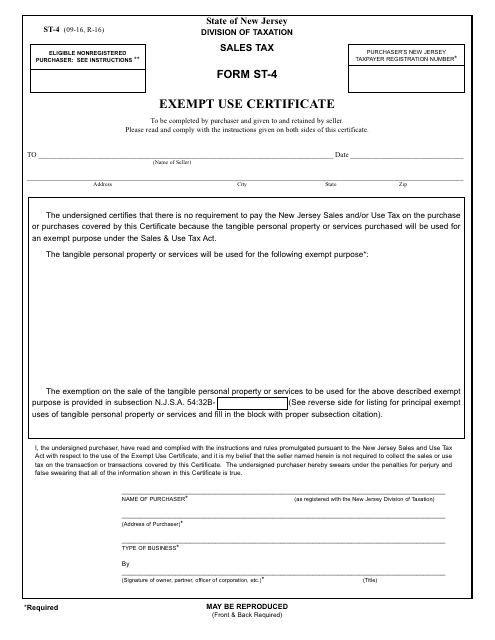

This form is used for claiming exemption from sales tax for specific items or services in the state of New Jersey.

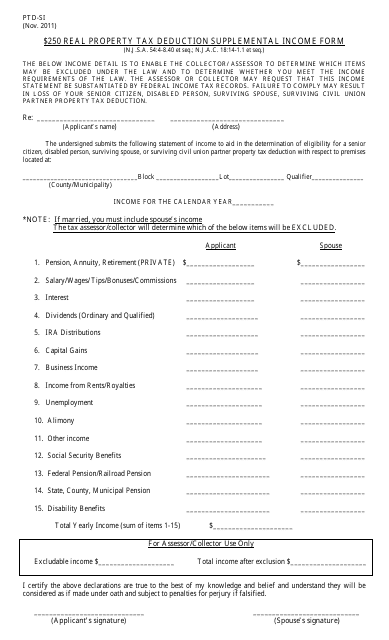

This form is used for reporting supplemental income for the Real Property Tax Deduction in New Jersey.

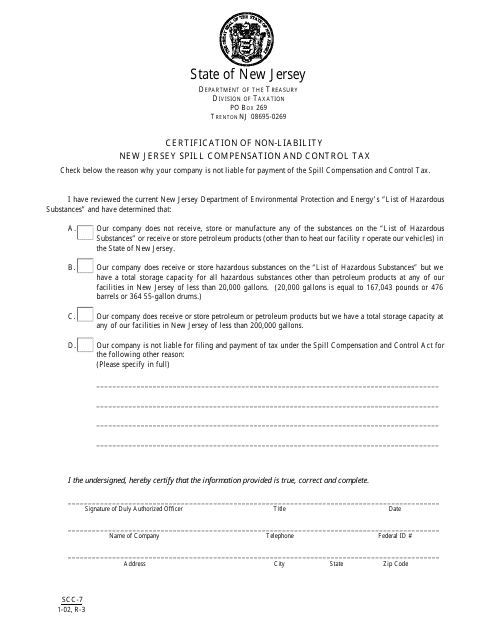

Form SCC-7 Certification of Non-liability New Jersey Spill Compensation and Control Tax - New Jersey

This form is used for certifying non-liability for the New Jersey Spill Compensation and Control Tax in the state of New Jersey.

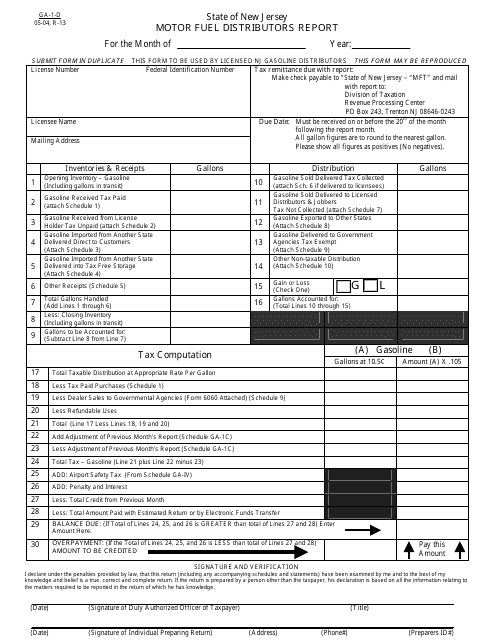

This Form is used for motor fuel distributors in New Jersey to report their activities.

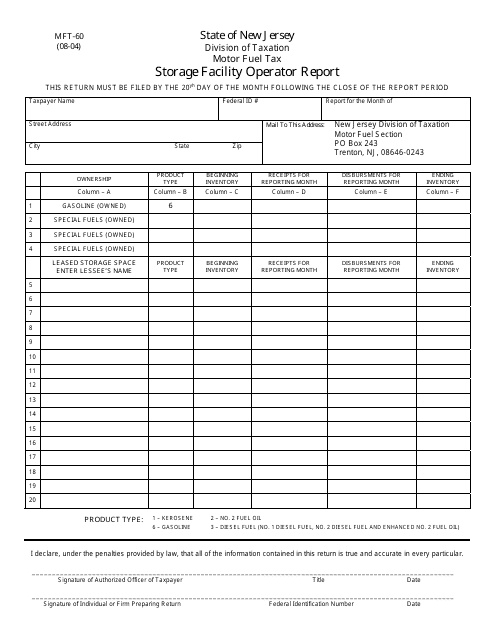

This Form is used for storage facility operators in New Jersey to report their operations and activities.

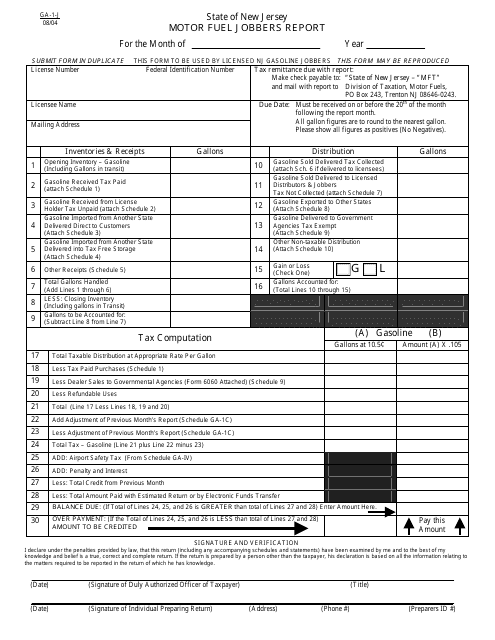

This form is used for motor fuel jobbers in New Jersey to report their activity related to fuel sales and distribution.

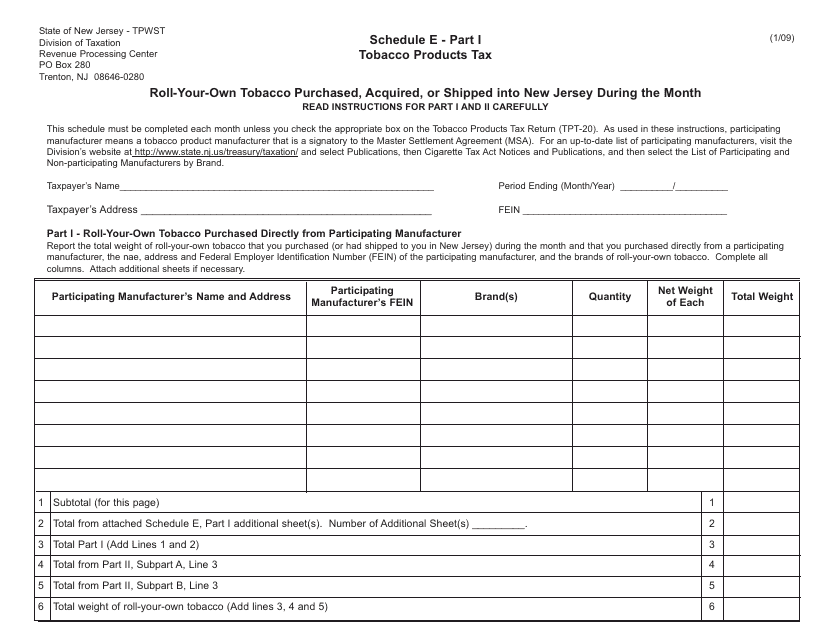

This form is used for reporting the purchase, acquisition, or shipment of roll-your-own tobacco into New Jersey during a specific month.

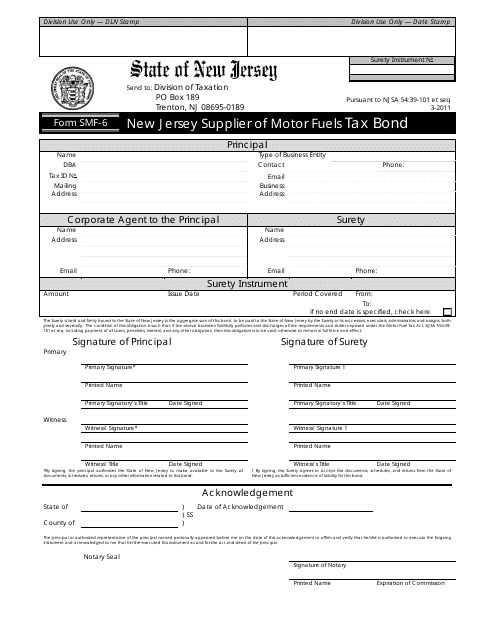

This form is used for applying for a tax bond in the state of New Jersey.

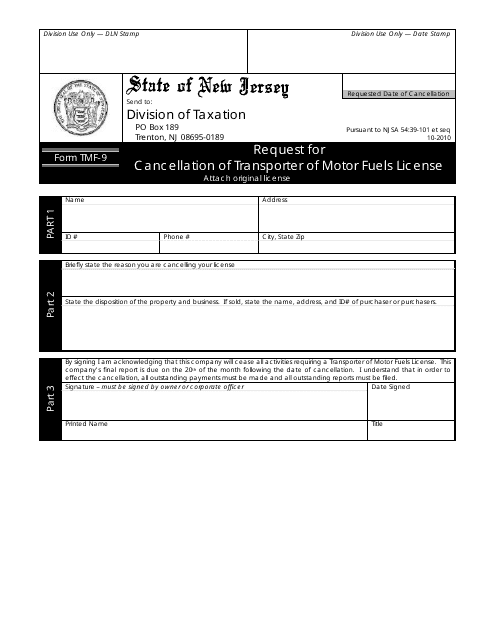

This Form is used for requesting the cancellation of a Transporter of Motor Fuels License in the state of New Jersey.

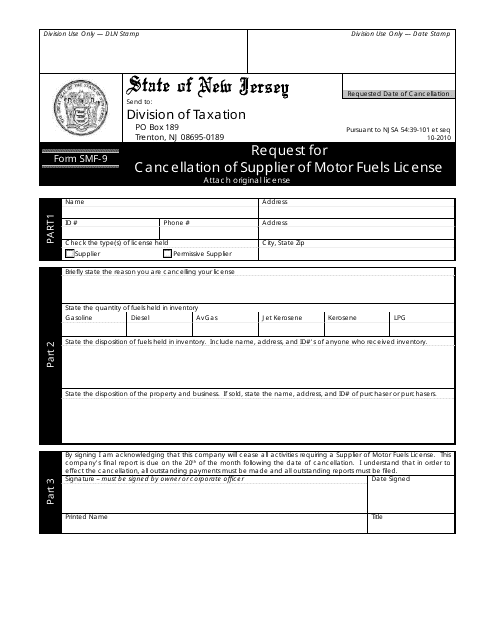

This form is used for requesting the cancellation of a Supplier of Motor Fuels License in the state of New Jersey.

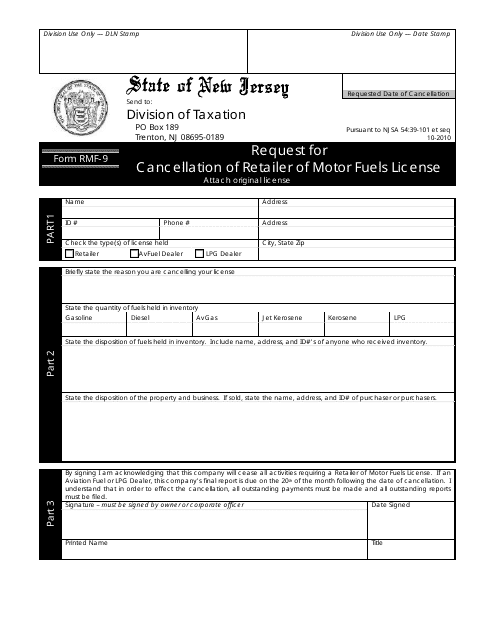

This form is used for canceling a retailer of motor fuels license in New Jersey.

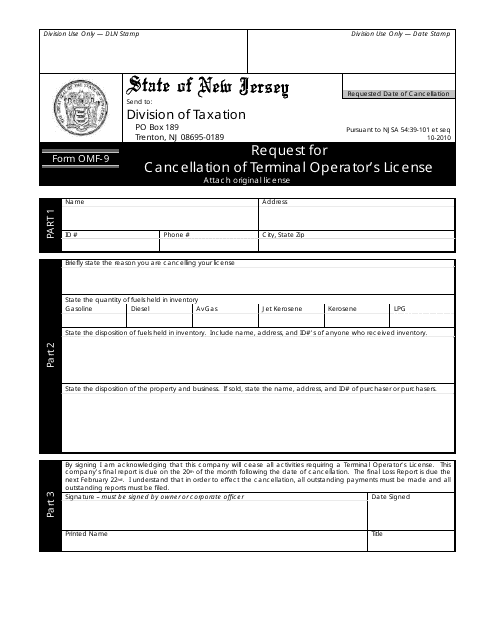

This Form is used for requesting the cancellation of a terminal operator's license in New Jersey.

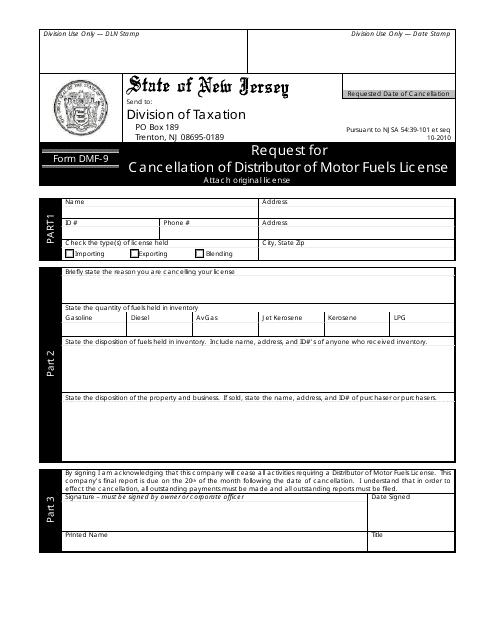

This form is used for requesting the cancellation of a distributor of motor fuels license in New Jersey.

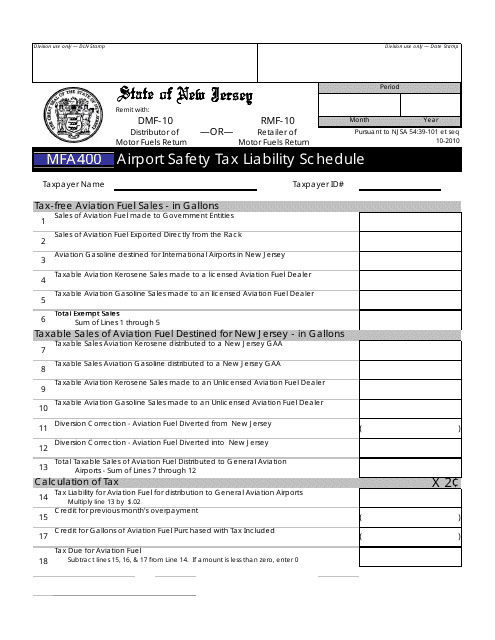

This form is used for reporting and calculating the airport safety tax liability in the state of New Jersey.

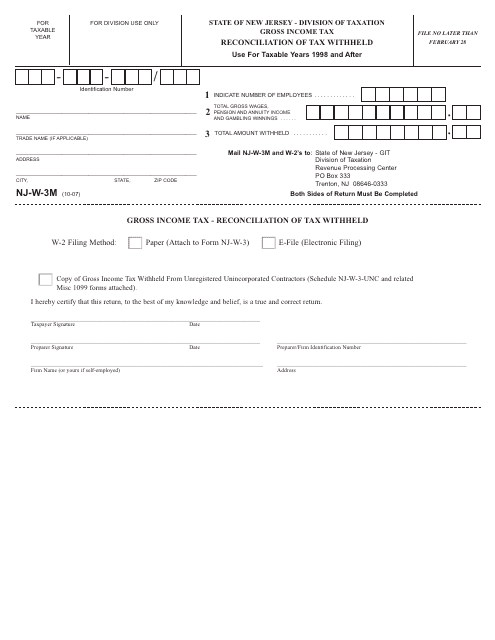

This form is used for reconciling tax withheld by employers in the state of New Jersey. It helps ensure accurate reporting and payment of payroll taxes.

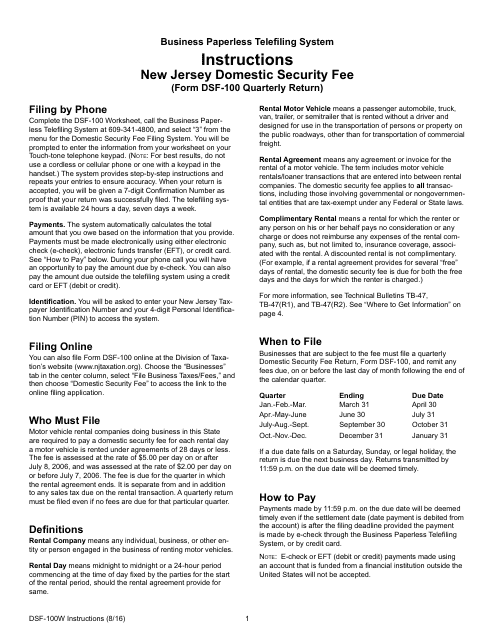

This document is used for submitting the quarterly return for businesses in New Jersey. It provides instructions on how to fill out and submit Form DSF-100.

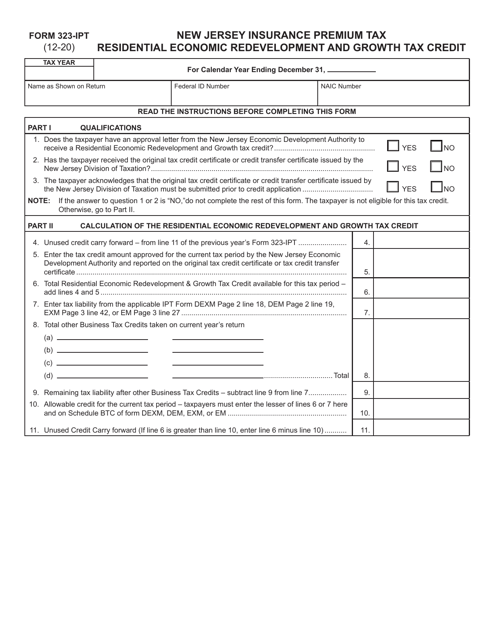

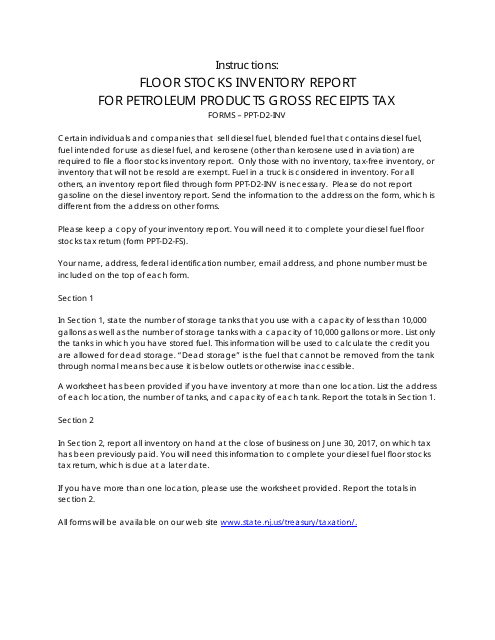

This document provides instructions for completing Form PPT-D2-INV, which is used to report floor stocks inventory for petroleum products gross receipts tax in New Jersey.

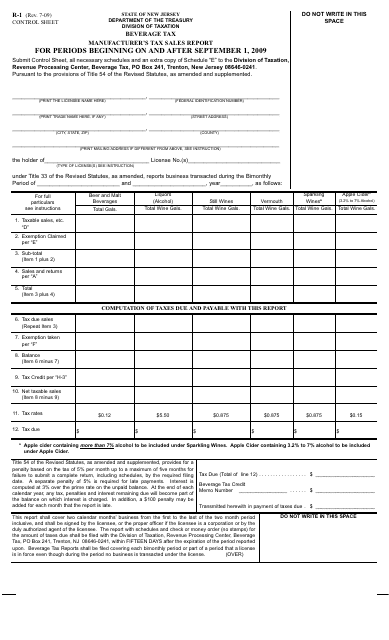

This form is used for reporting the sales of beverages and calculating the manufacturer's tax in New Jersey for periods beginning on or after September 2009.

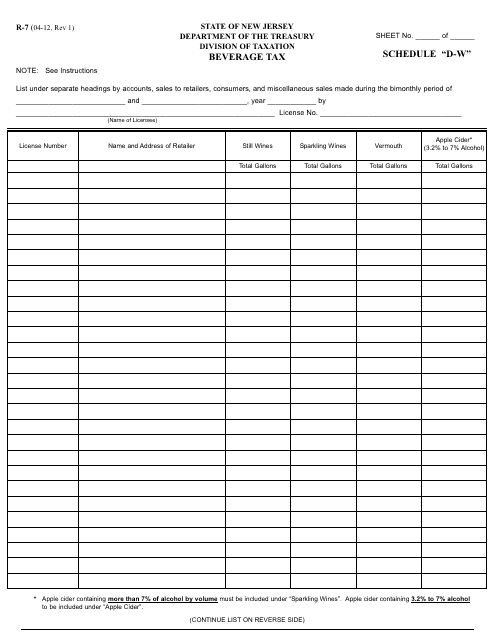

This form is used for reporting and paying beverage tax in New Jersey. It is specifically for Schedule D-W, which applies to wholesalers.