Fill and Sign Arkansas Legal Forms

Documents:

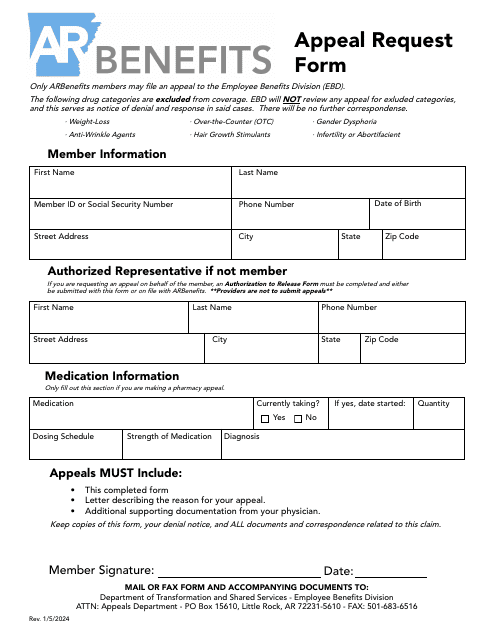

2390

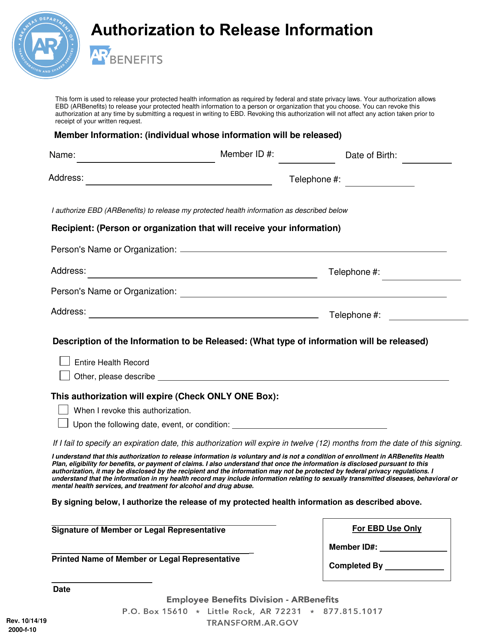

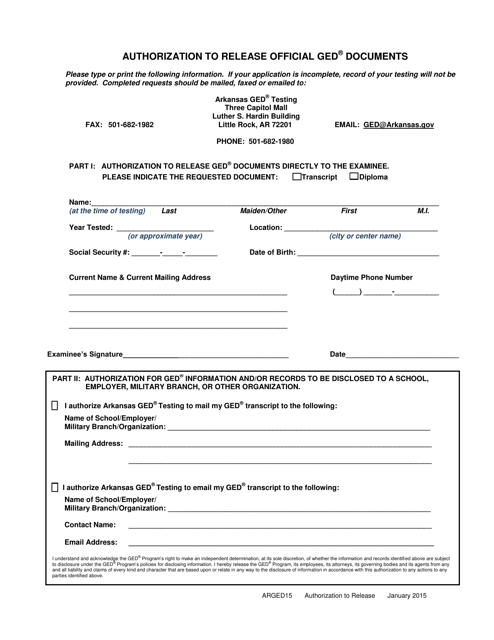

This form is used for obtaining authorization to release information in the state of Arkansas.

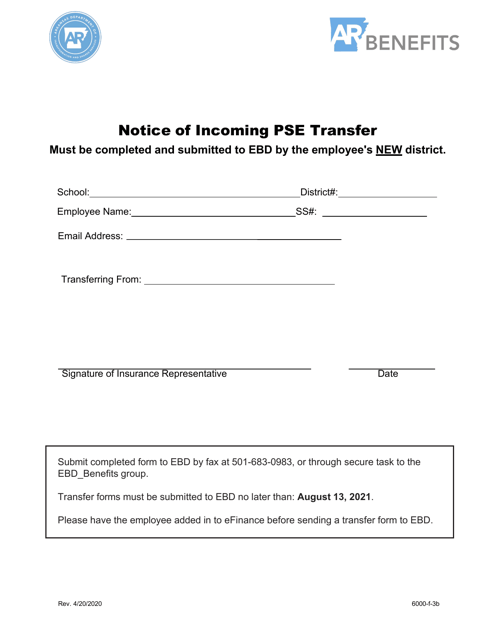

This Form is used for providing notice of an incoming PSE transfer in the state of Arkansas.

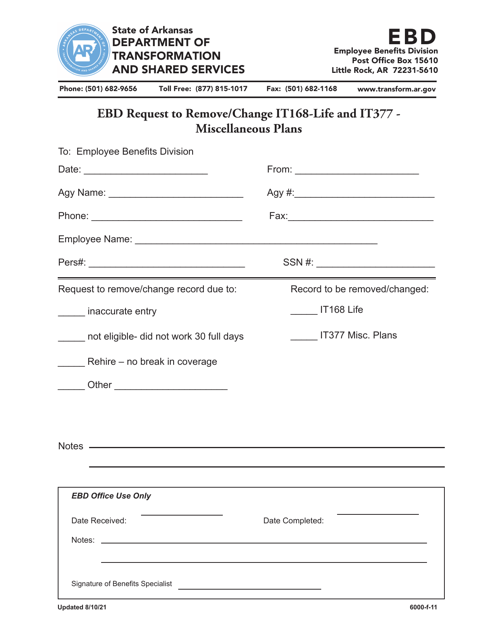

This Form is used for requesting the removal or change of It168-life and It377 - Miscellaneous Plans in the state of Arkansas.

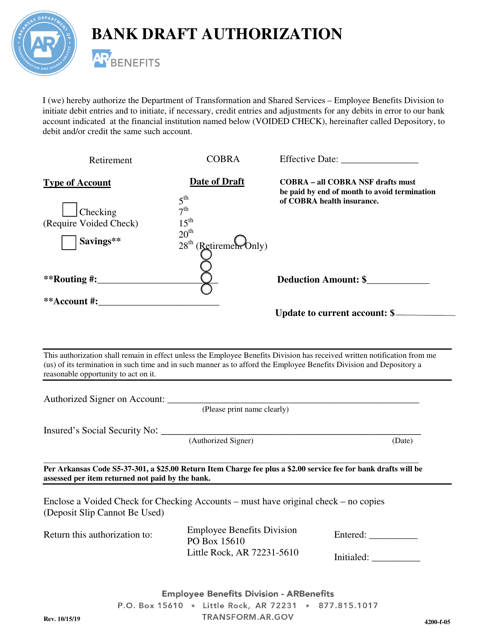

This form is used for authorizing a bank draft in Arkansas.

This Form is used for applying to become a Family Support Partner, Peer Support Specialist, or Youth Support Specialist in Arkansas.

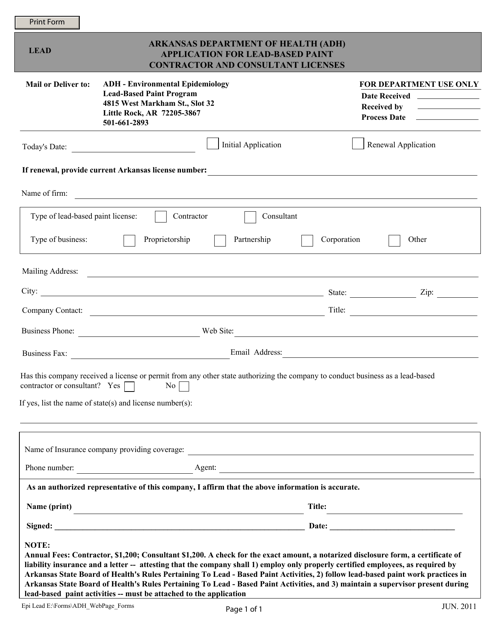

This form is used for applying for Lead-Based Paint Contractor and Consultant Licenses in Arkansas. It is necessary for individuals and companies involved in activities related to lead-based paint to obtain the appropriate licenses.

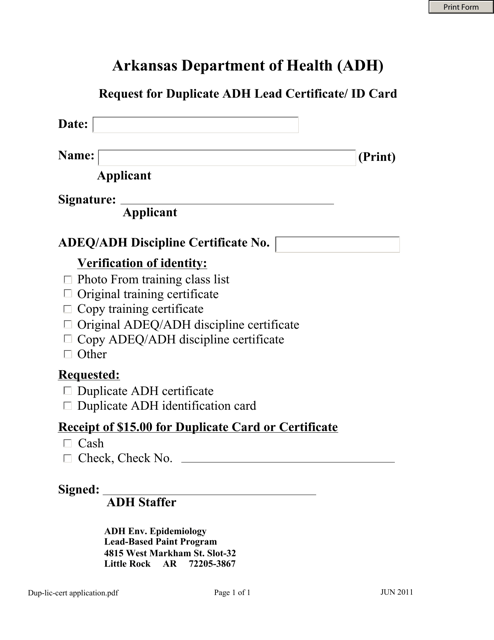

This Form is used for requesting a duplicate ADH lead certificate/ID card in Arkansas.

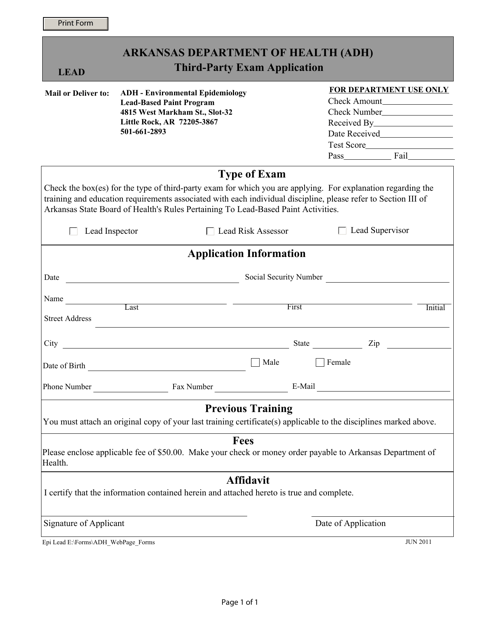

This document is for individuals applying to take a third-party exam in the state of Arkansas.

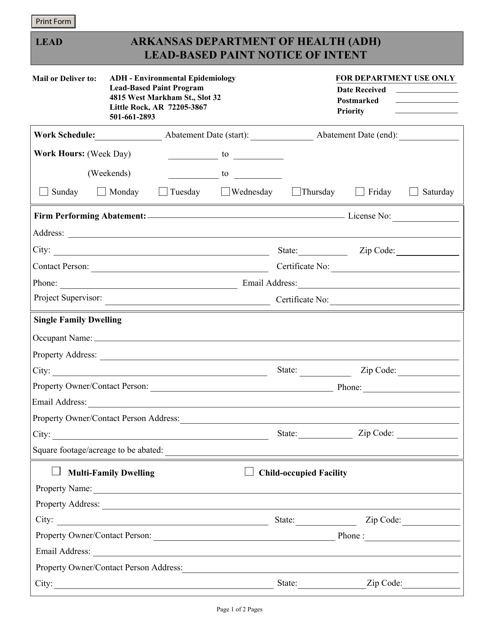

This form is used for notifying the intent to perform activities involving lead-based paint in Arkansas.

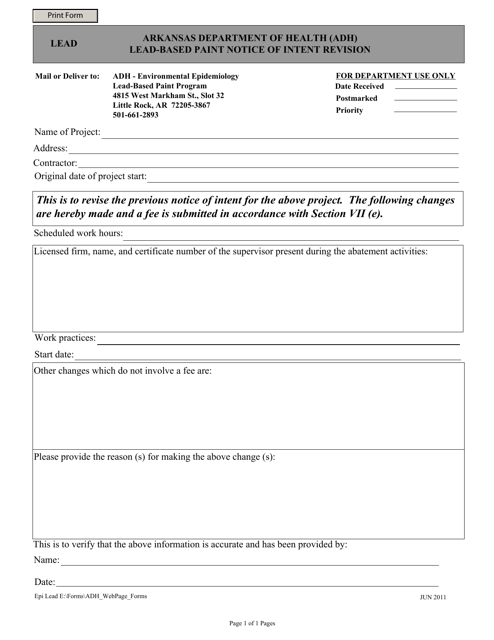

This form is used for revising the Lead-Based Paint Notice of Intent in Arkansas.

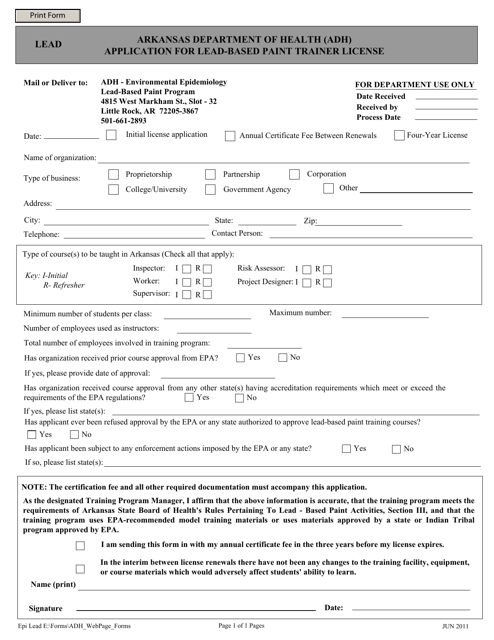

This form is used for applying for a Lead-Based Paint Trainer License in the state of Arkansas. The license allows individuals to provide training on lead-based paint safety and regulations.

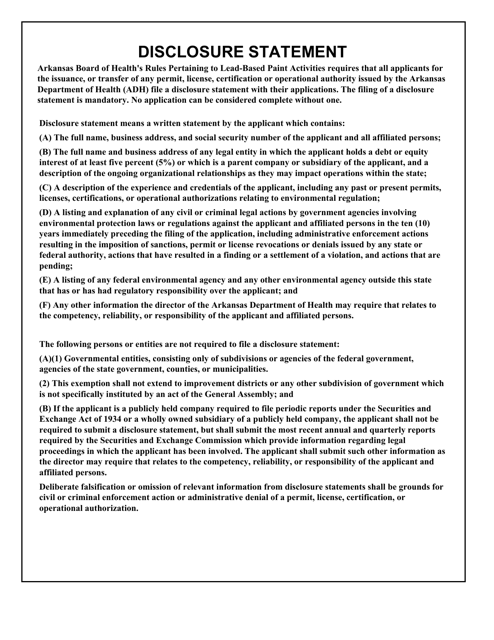

This document is a disclosure statement specific to the state of Arkansas. It provides information on certain financial and legal matters that may be relevant to a particular transaction or agreement.

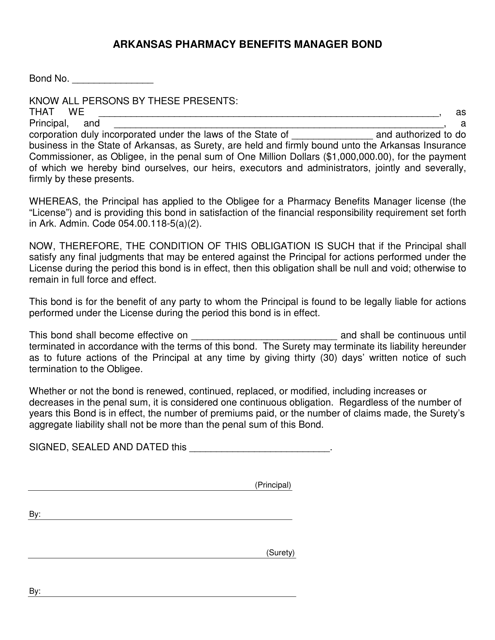

This type of document is a bond required for Pharmacy Benefits Managers operating in the state of Arkansas. It ensures that the manager complies with state regulations and protects consumers.

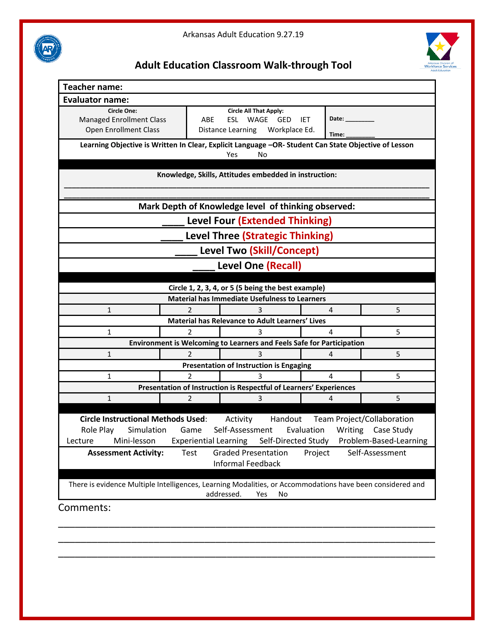

This document provides a tool for conducting classroom walk-throughs in adult education settings in Arkansas to assess teaching practices and student engagement.

This form is used for authorizing the release of official GED documents in Arkansas.

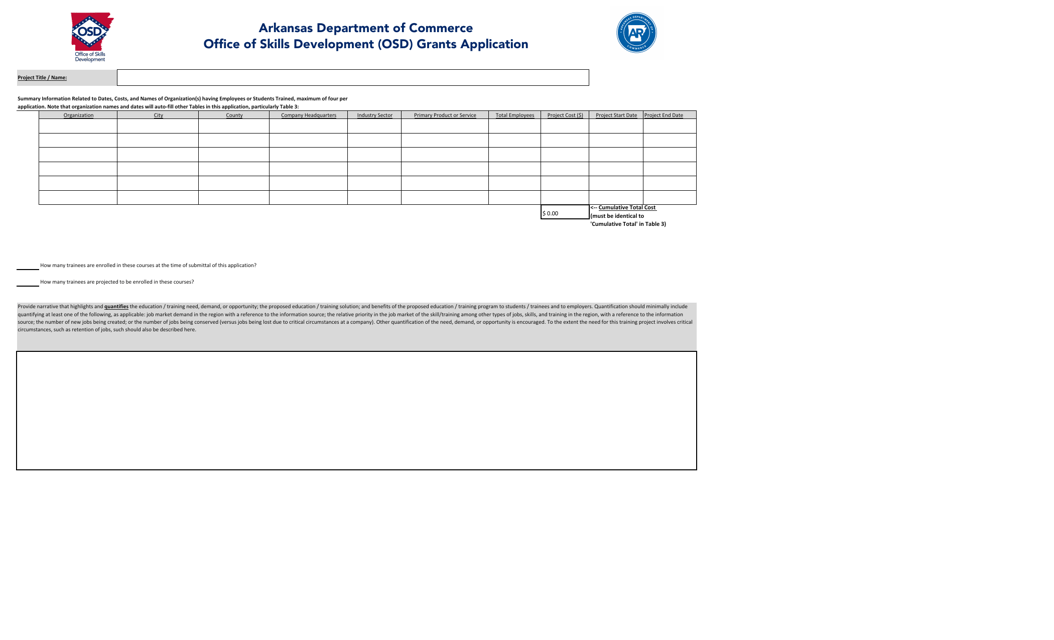

This document is for applying for grants from the Office of Skills Development (OSD) in Arkansas.

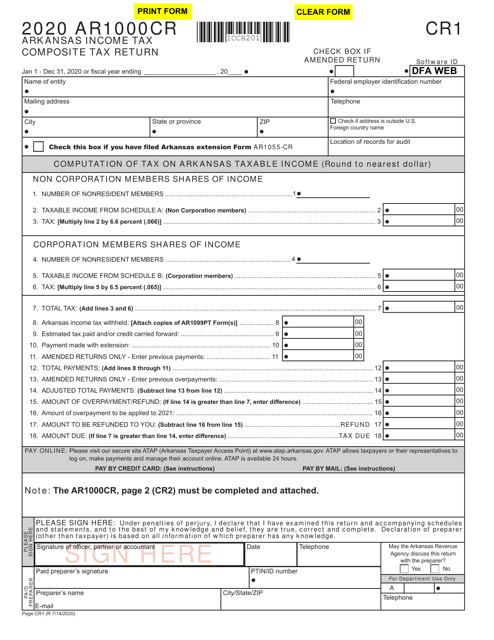

This document is used for filing a composite tax return for Arkansas income tax.

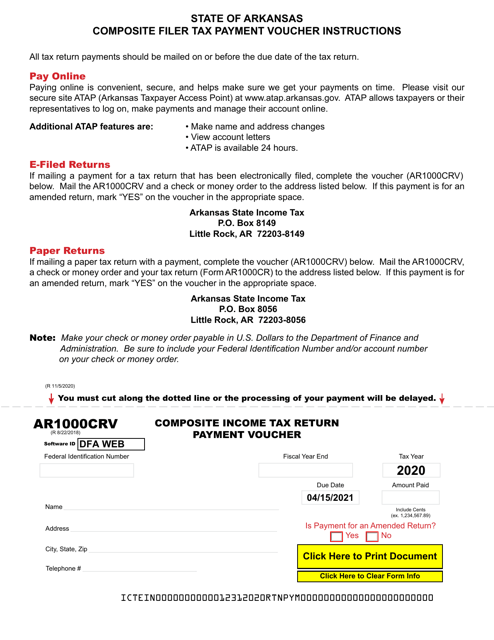

This Form is used for making payment for the Arkansas Composite Income Tax Return.

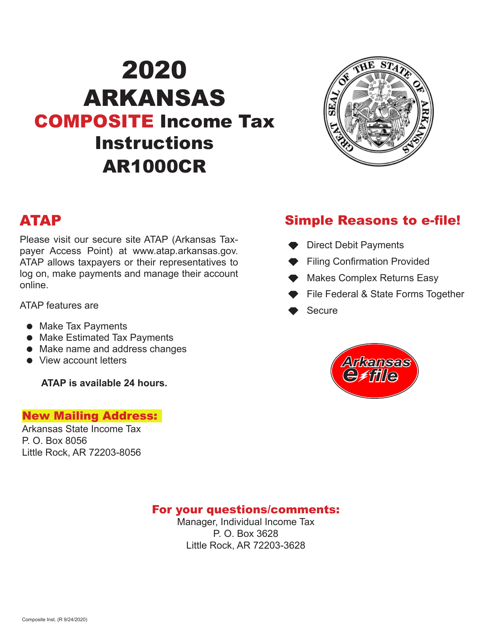

This Form is used for filing the Arkansas Income Tax Composite Tax Return for individuals or entities participating in a composite filing. This form is specific to Arkansas state income taxes.

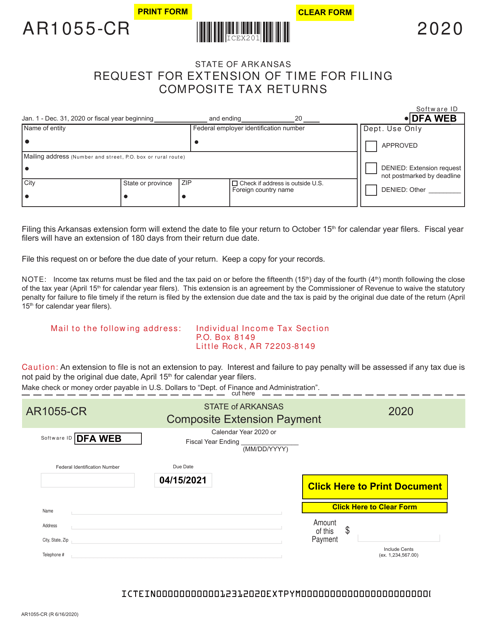

This form is used for requesting an extension of time to file composite tax returns in Arkansas.

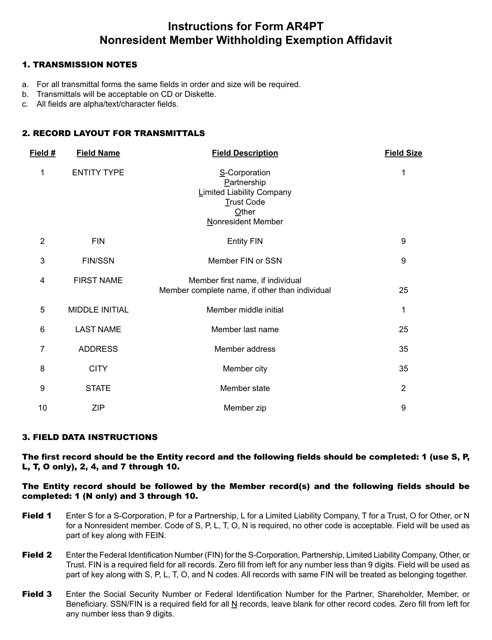

This Form is used for nonresident members to claim withholding exemption in Arkansas. It provides instructions on how to fill out and submit Form AR4PT.

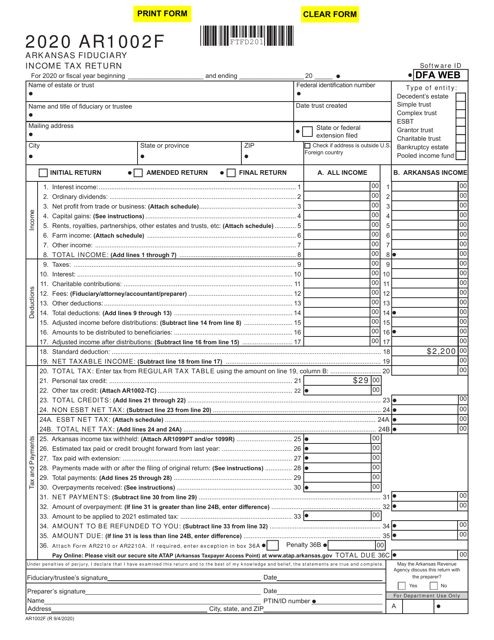

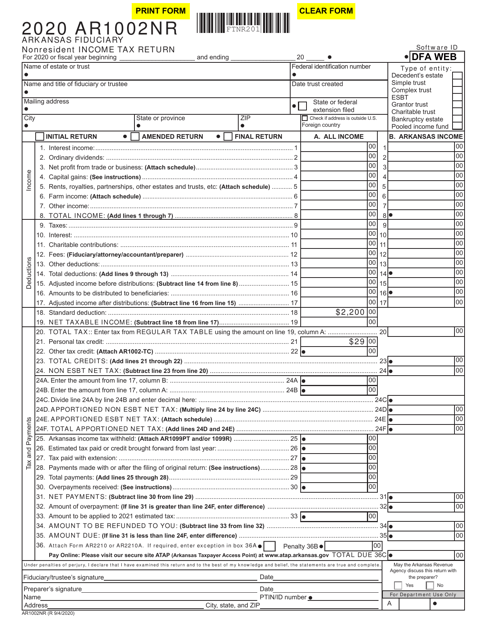

This Form is used for filing Arkansas state income tax returns for foreign individuals and non-resident taxpayers. It provides instructions on how to accurately complete the AR1002F and AR1002NR forms.

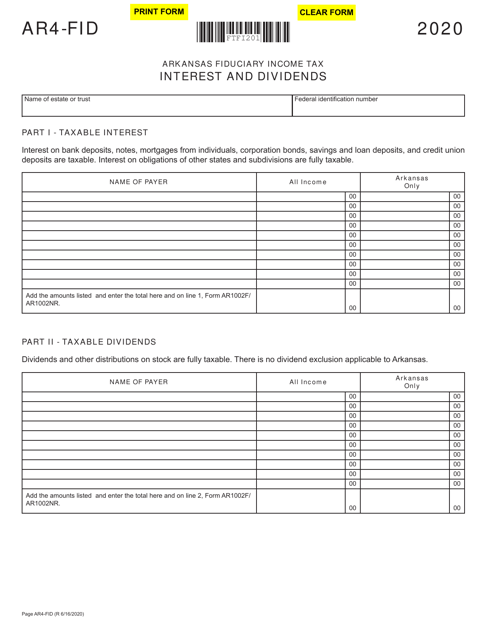

This form is used for reporting income from interest and dividends in Arkansas for fiduciary entities.

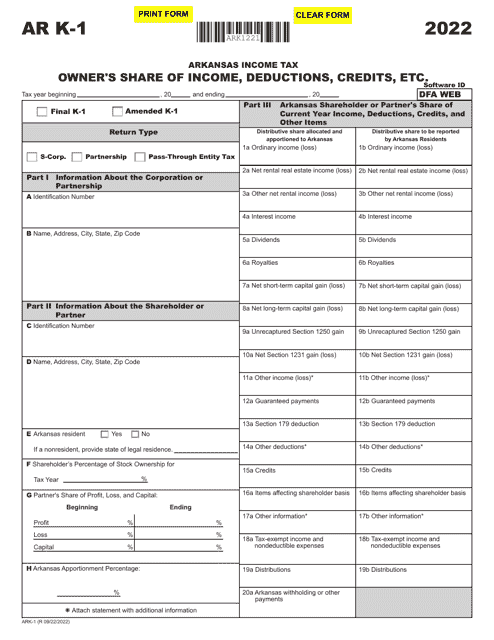

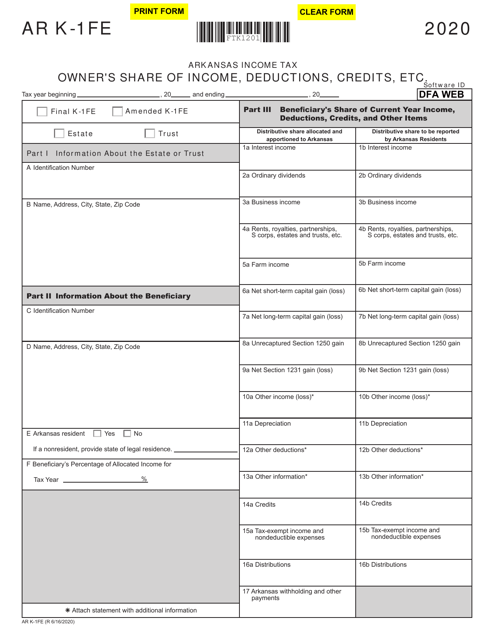

This form is used for reporting an owner's share of income, deductions, credits, and other financial details for Arkansas income tax purposes.

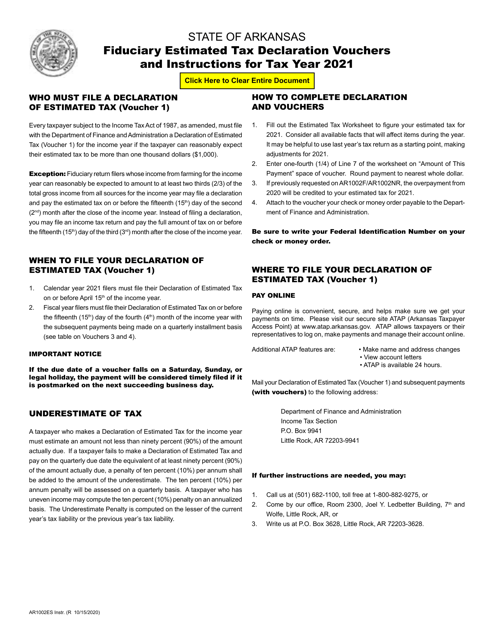

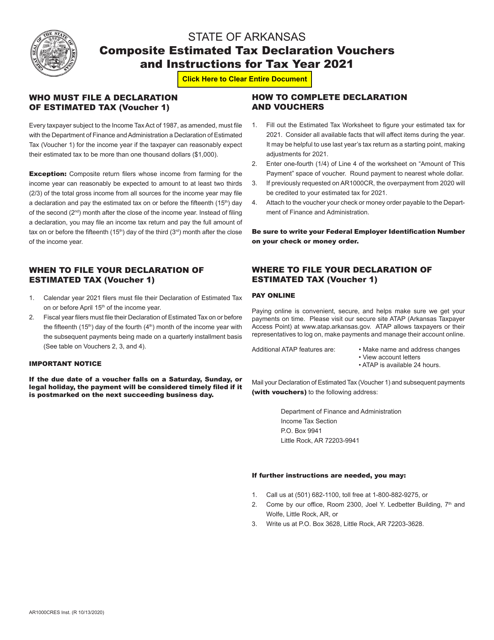

This form is used for filing estimated tax declarations by fiduciaries in Arkansas.

This Form is used for filing the Arkansas Fiduciary Income Tax Return for residents of Arkansas who have income from a trust or estate.

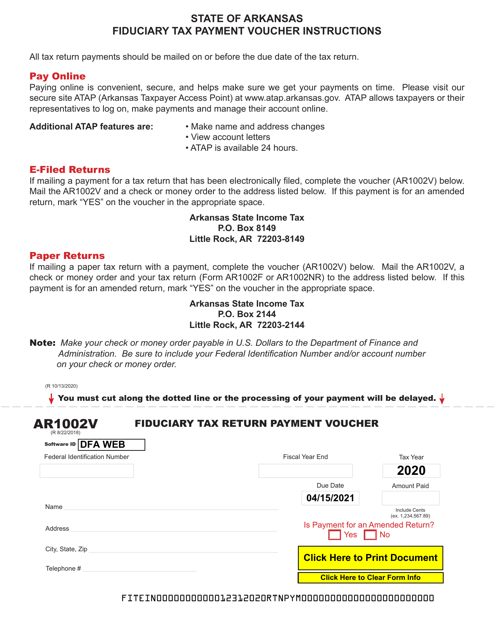

This form is used for making tax payments for a Fiduciary Tax Return in the state of Arkansas.

This form is used for submitting estimated tax payments for individuals or businesses in Arkansas. It is specifically for composite returns, which are filed on behalf of nonresident shareholders of pass-through entities.

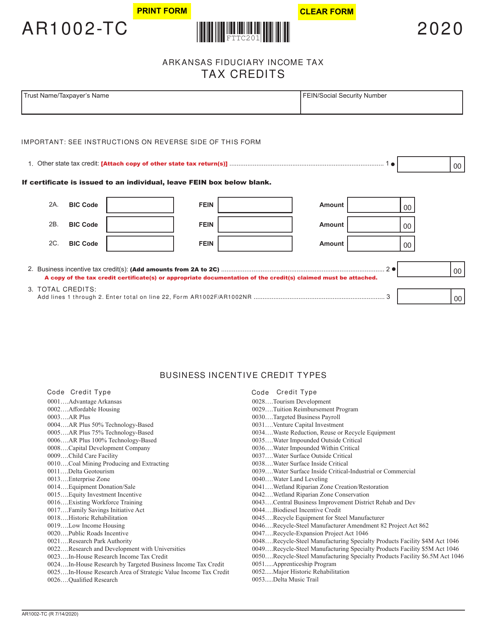

This Form is used for reporting the Fiduciary Schedule of Tax Credits and Business Incentive Credits in the state of Arkansas. It is used by fiduciaries to disclose any tax credits and business incentive credits received or claimed on behalf of a trust or estate.

This form is used for filing Arkansas Fiduciary Nonresident Income Tax Return in Arkansas by individuals who are not residents.

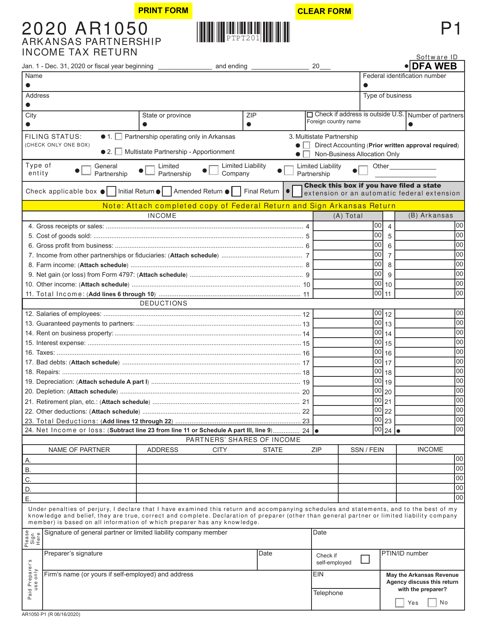

This document is used for filing the Arkansas Partnership Income Tax Return in the state of Arkansas. It provides instructions on how to report partnership income and deductions for tax purposes.

This document is used for filing the Arkansas Partnership Income Tax Return in the state of Arkansas for businesses that are registered as partnerships.