Fill and Sign New Jersey Legal Forms

Documents:

3923

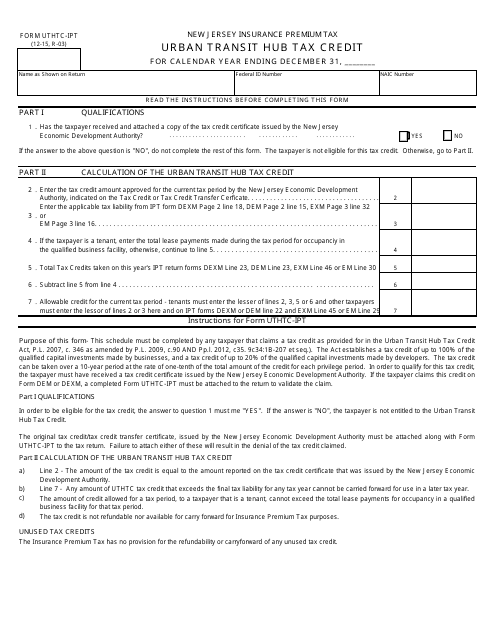

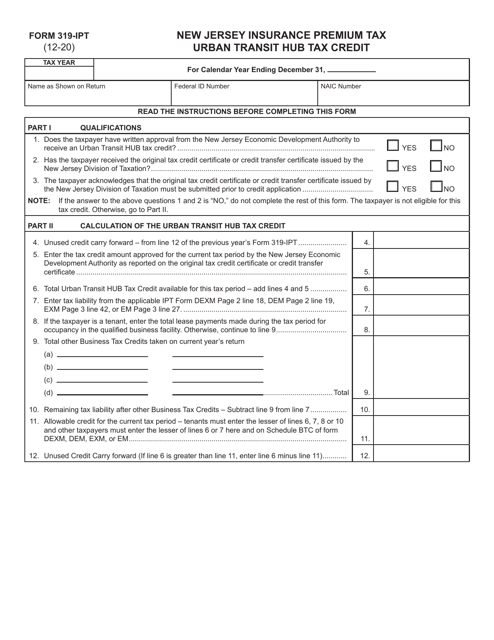

This Form is used for claiming the Urban Transit Hub Tax Credit in New Jersey.

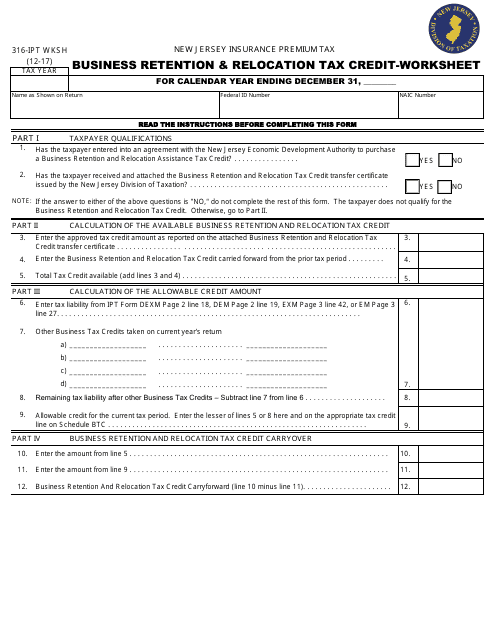

This form is used for calculating the Business Retention & Relocation Tax Credit in New Jersey.

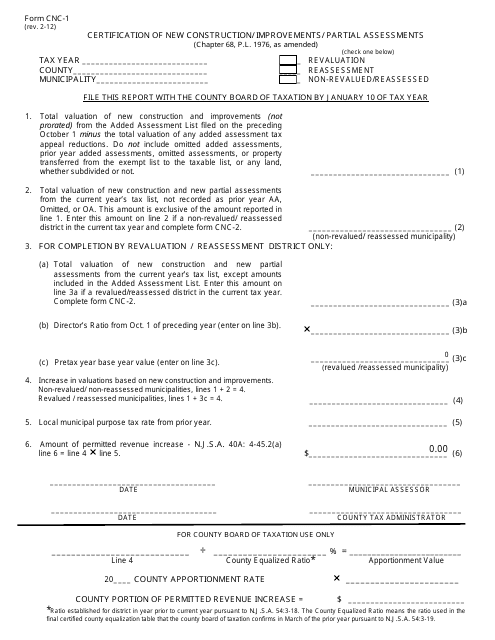

This Form is used for certifying new construction, improvements, or partial assessments in New Jersey.

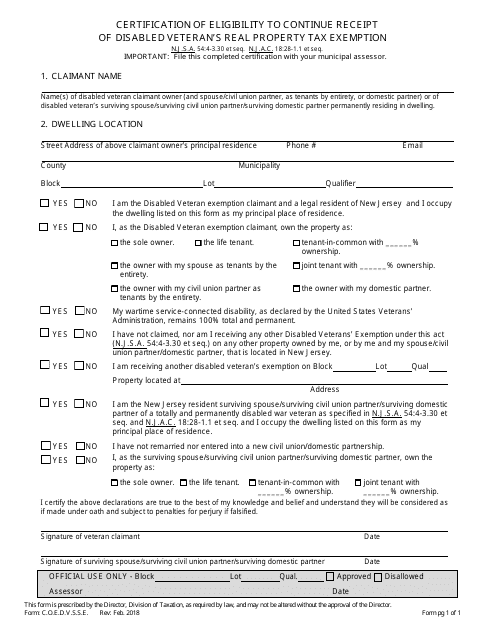

This Form is used for applying for a Certification of Eligibility to Continue Receipt of Disabled Veteran's Real Property Tax Exemption in New Jersey.

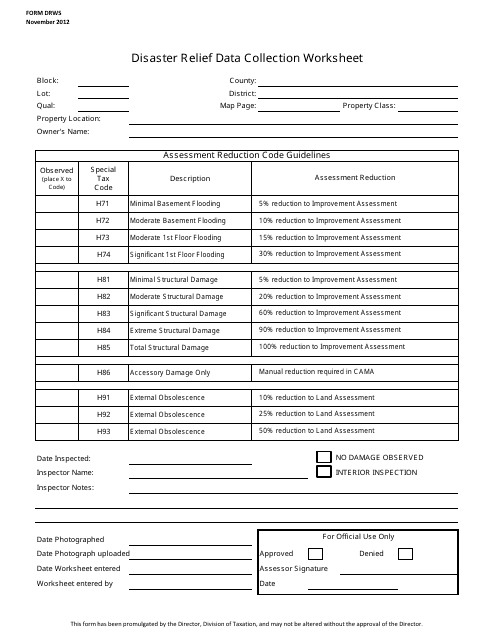

This form is used for collecting data related to disaster relief efforts in New Jersey. It is designed to gather important information that will assist with planning and implementing relief programs in the state.

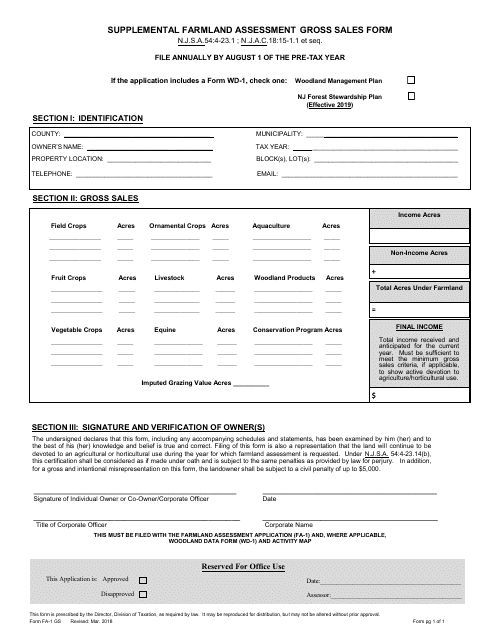

This form is used for reporting gross sales for supplemental farmland assessment in New Jersey.

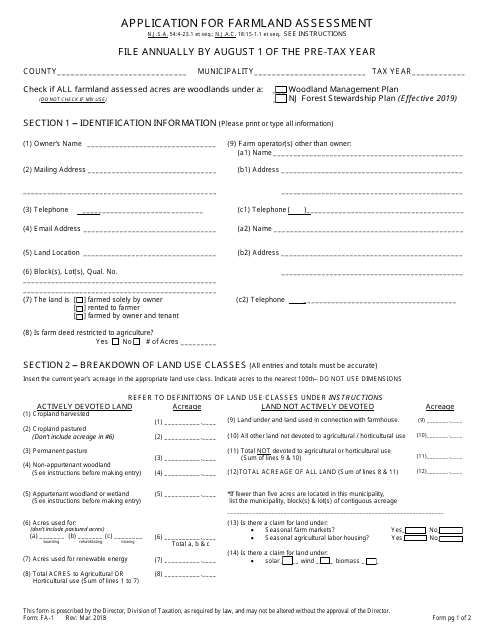

This form is used to apply for farmland assessment in New Jersey. It is for individuals or businesses who own farmland and wish to qualify for reduced property taxes.

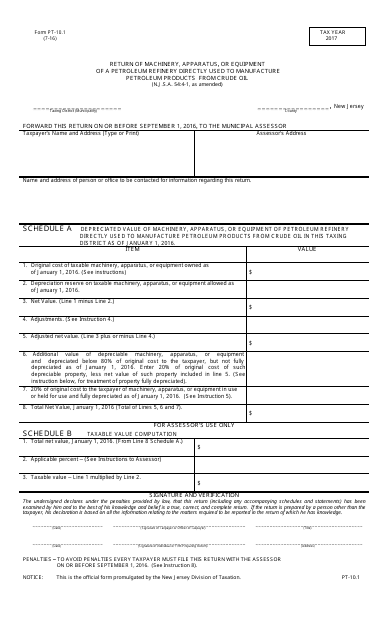

This form is used for reporting machinery, apparatus, or equipment used in petroleum refineries in New Jersey for manufacturing petroleum products from crude oil.

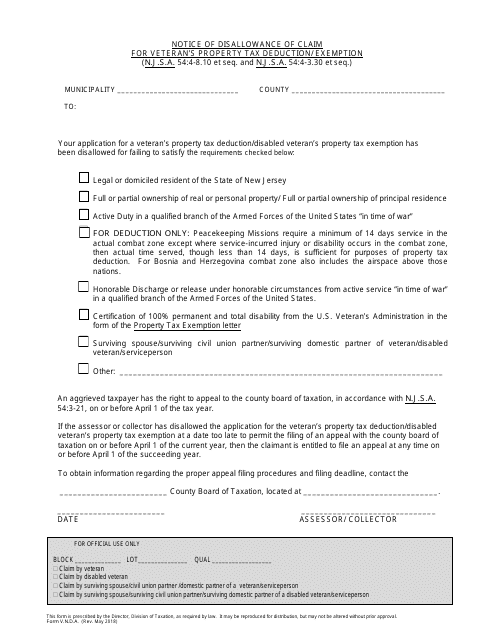

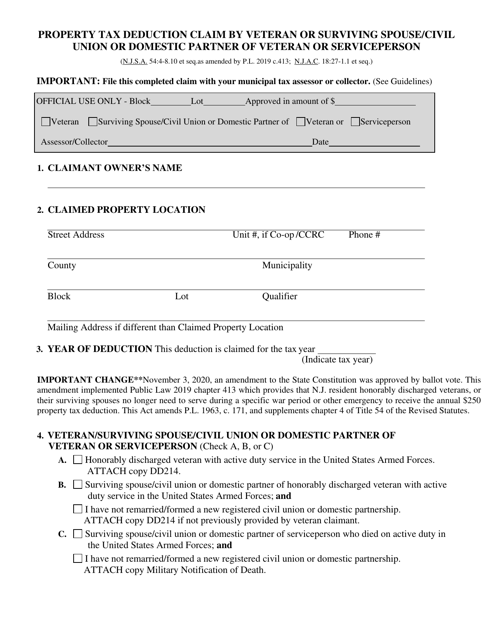

This form is used for submitting a notice of disallowance of a claim for veteran's property tax deduction or exemption in New Jersey.

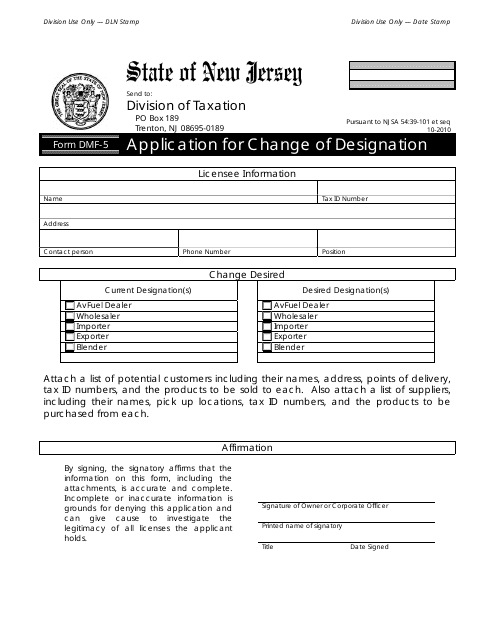

This form is used for applying for a change of designation in the state of New Jersey.

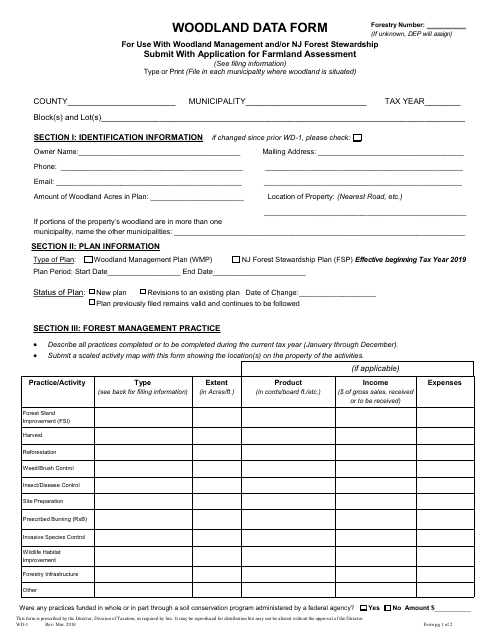

This form is used for collecting data related to woodlands in New Jersey.

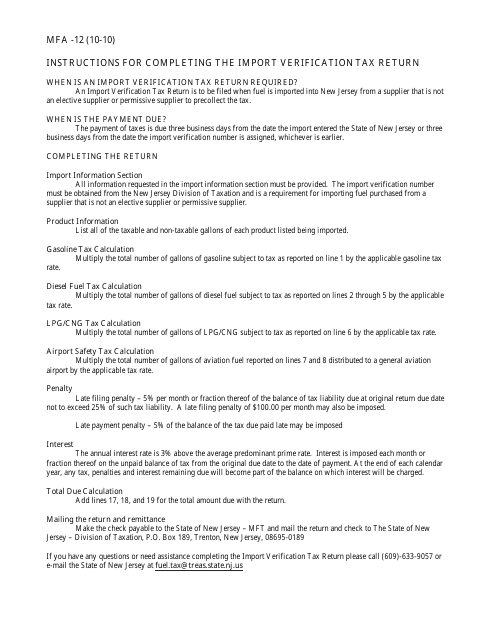

This Form is used for reporting and verifying import taxes paid by businesses in New Jersey.

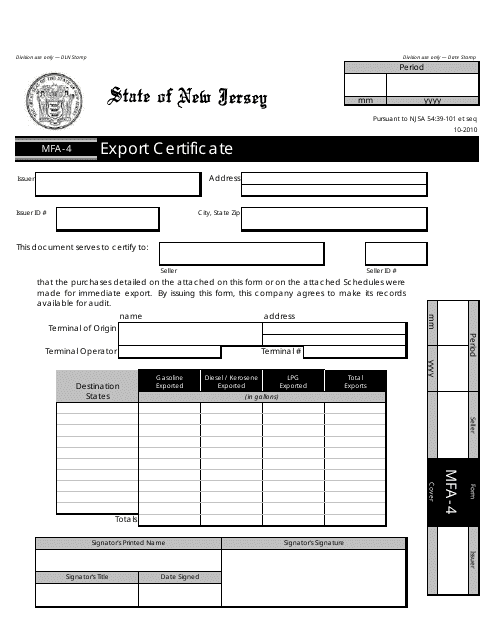

This form is used for obtaining an export certificate in the state of New Jersey. It is necessary for exporting goods out of the state and ensuring compliance with regulatory requirements.

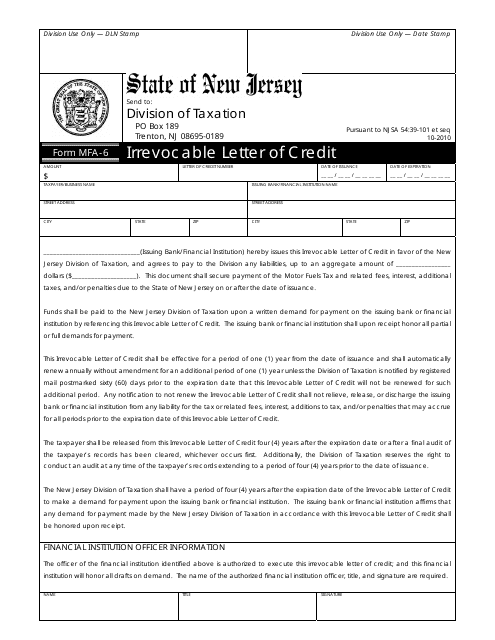

This form is used for creating an irrevocable letter of credit in the state of New Jersey.

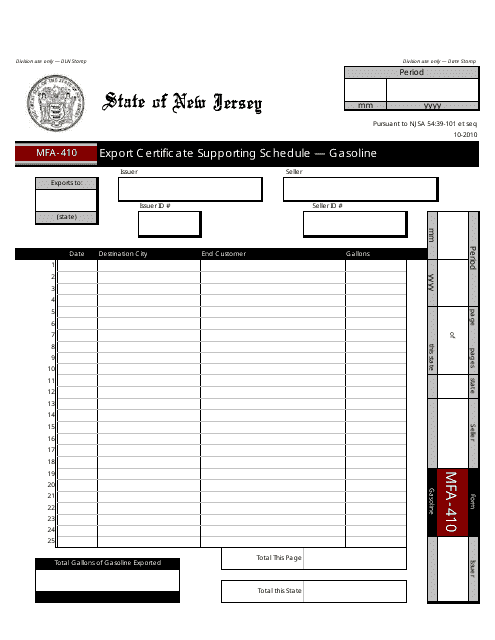

This form is used for declaring the supporting schedule for gasoline export certificates in New Jersey.

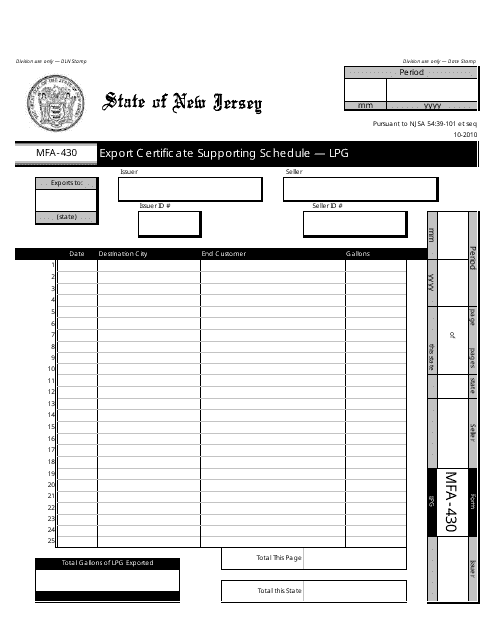

This form is used for supporting the export certificate for LPG (liquefied petroleum gas) in New Jersey.

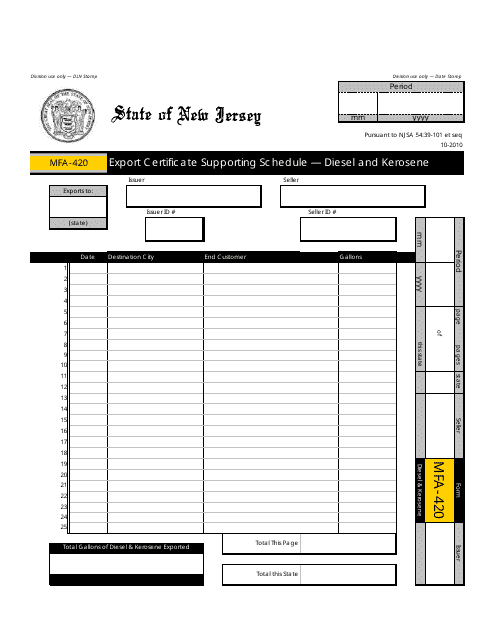

This form is used for providing supporting information for Export Certificate for Diesel and Kerosene in the state of New Jersey.

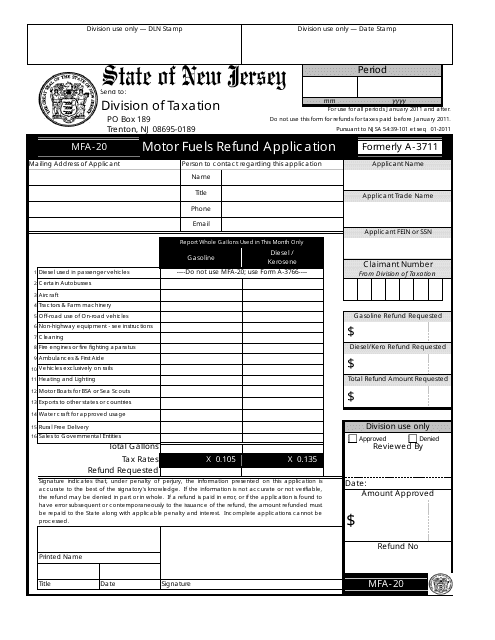

This form is used for applying for a motor fuels refund in the state of New Jersey.

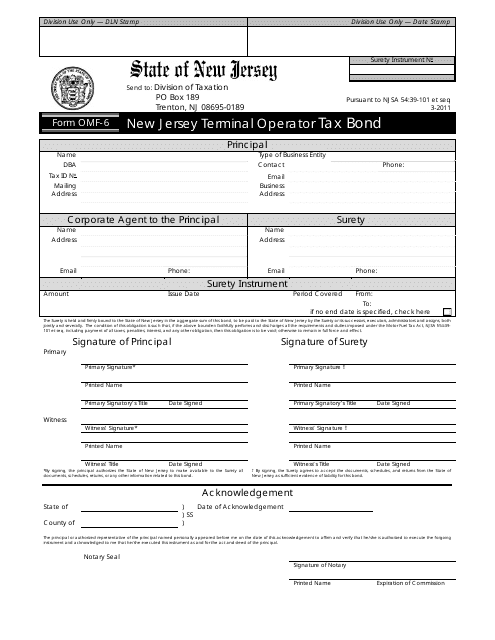

This form is used for obtaining a Terminal Operator Tax Bond in the state of New Jersey.

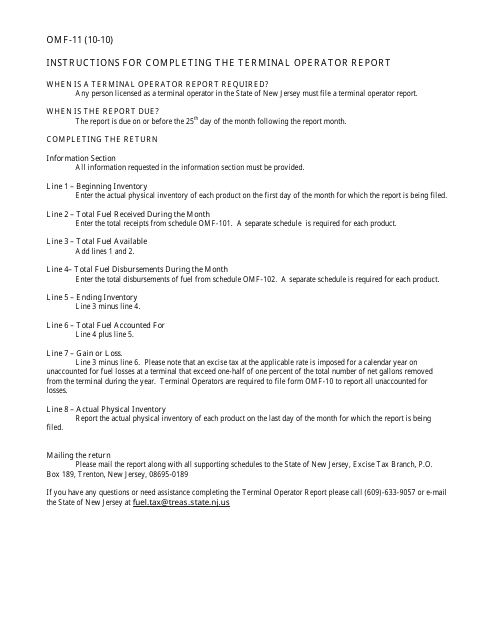

This Form is used for submitting a Terminal Operator Report in the state of New Jersey. It provides instructions on how to complete and file the form.

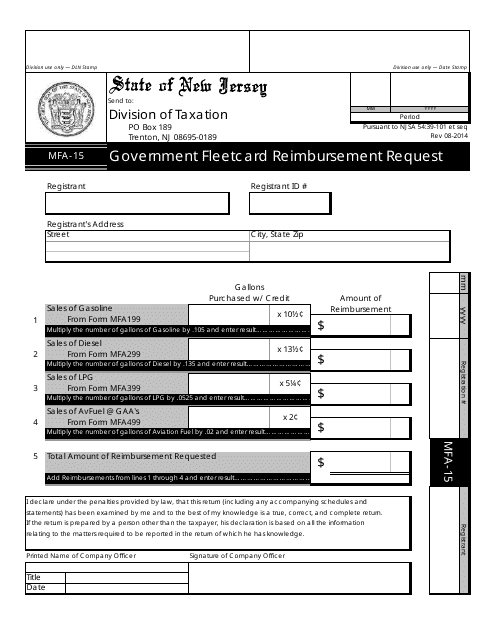

This Form is used for requesting reimbursement for government fleetcard expenses in New Jersey.

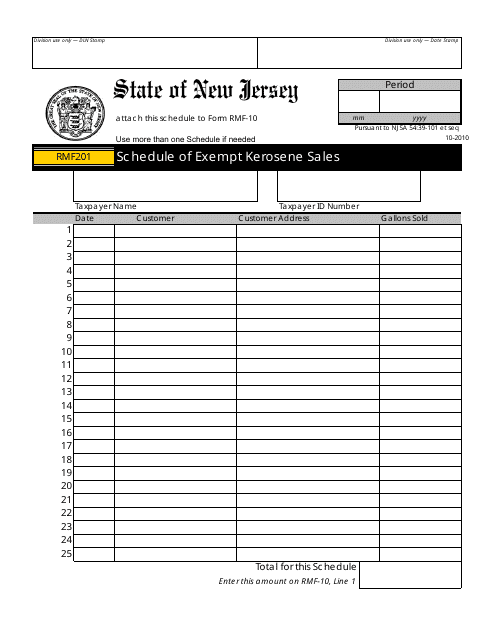

This form is used for reporting schedule of exempt kerosene sales in New Jersey.

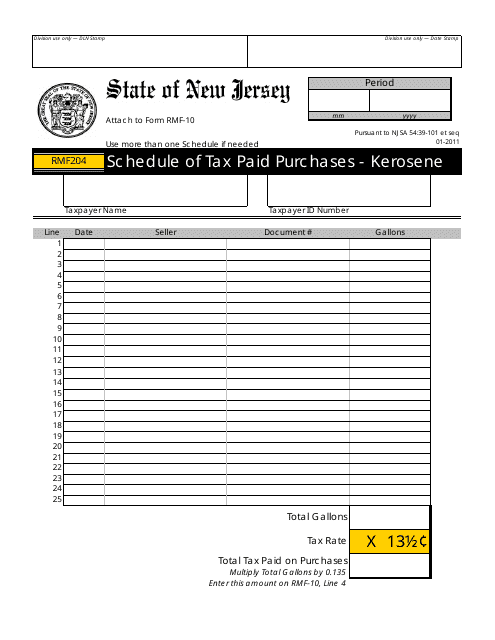

This form is used for reporting tax-paid purchases of kerosene in the state of New Jersey. It helps businesses keep track of their tax payments on kerosene purchases.

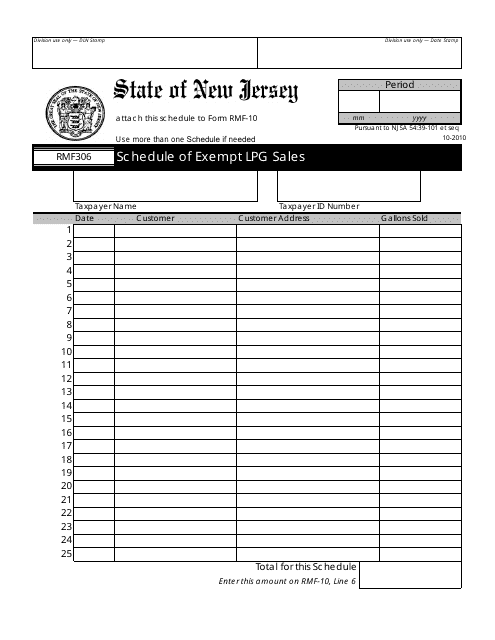

This form is used for reporting exempt LPG (liquefied petroleum gas) sales in the state of New Jersey.

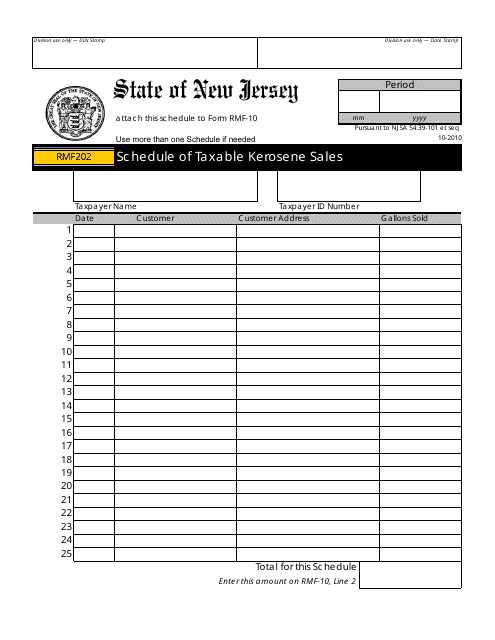

This Form is used for reporting and documenting the sales of taxable kerosene in the state of New Jersey. It is used by businesses to comply with tax regulations and provide accurate information to the government.

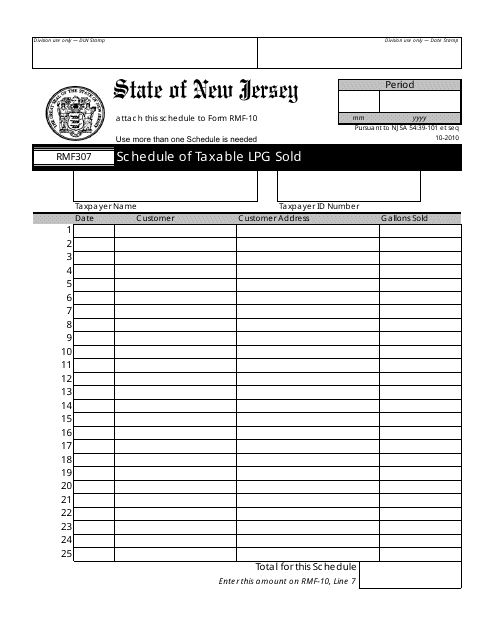

This Form is used for reporting the schedule of taxable LPG (liquefied petroleum gas) sold in the state of New Jersey.

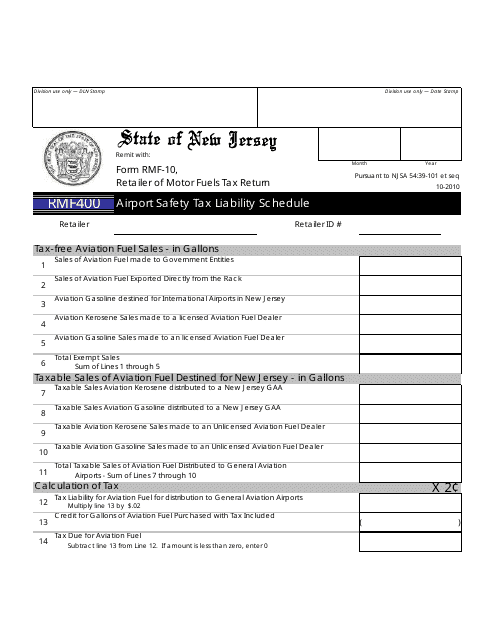

This form is used for reporting and calculating airport safety tax liability in the state of New Jersey.

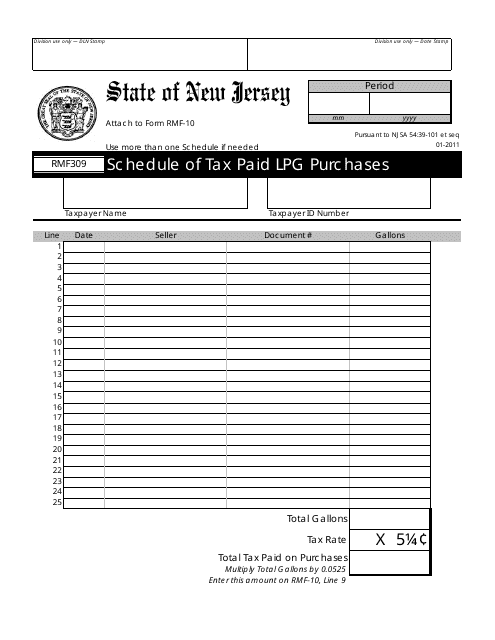

This form is used for reporting and recording the tax paid on purchases of LPG (liquefied petroleum gas) in the state of New Jersey.

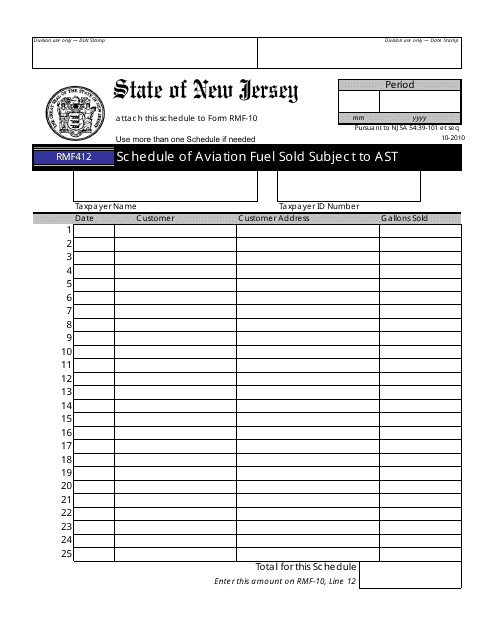

This form is used for reporting the schedule of aviation fuel sold subject to the AST (Aboveground Storage Tank) regulations in New Jersey.

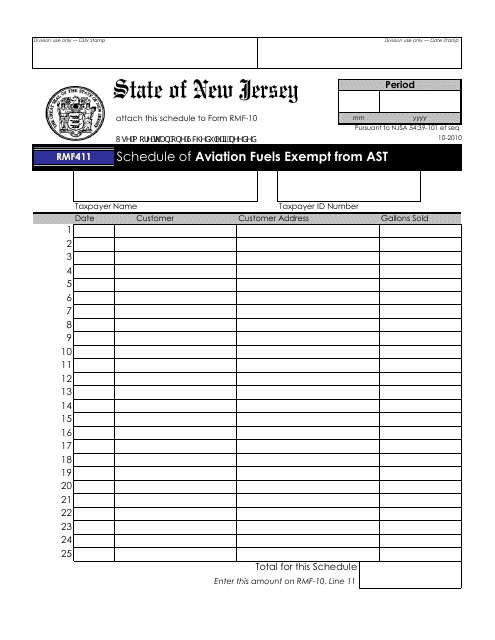

This form is used for listing aviation fuels that are exempt from the petroleum products gross receipts tax in New Jersey.

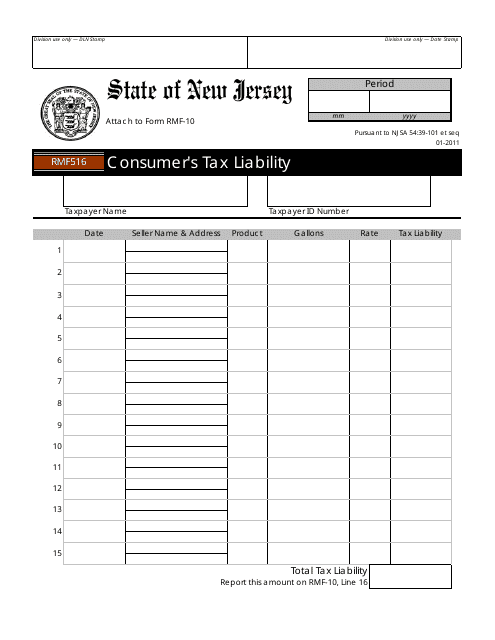

This form is used for reporting a consumer's tax liability in the state of New Jersey.

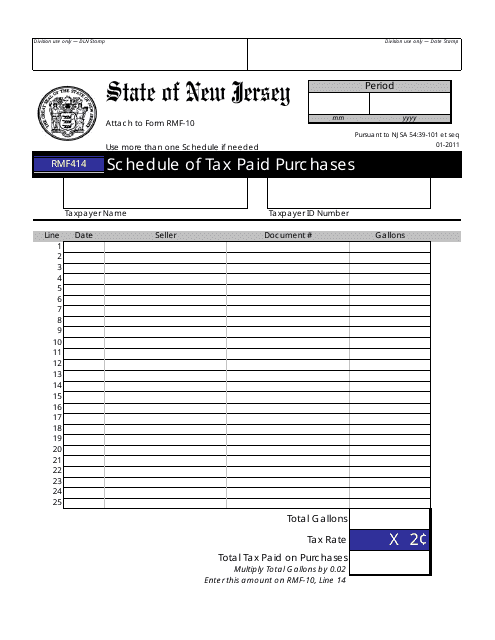

This Form is used for reporting and tracking tax paid purchases in the state of New Jersey. It helps businesses keep a record of their tax payments and is required for tax filing purposes.

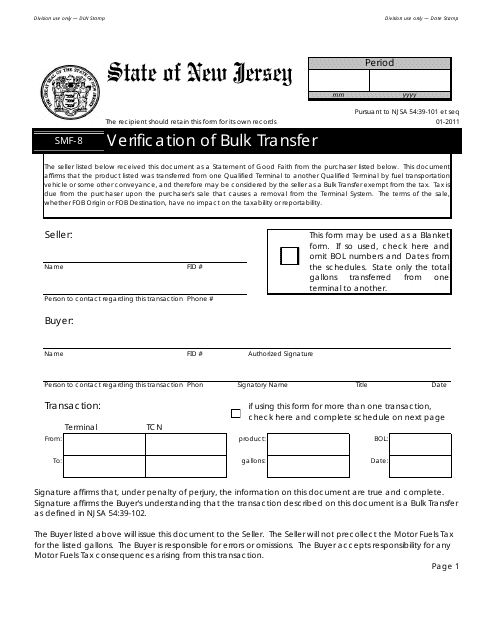

This Form is used for verifying a bulk transfer in the state of New Jersey.