Fill and Sign New Jersey Legal Forms

Documents:

3923

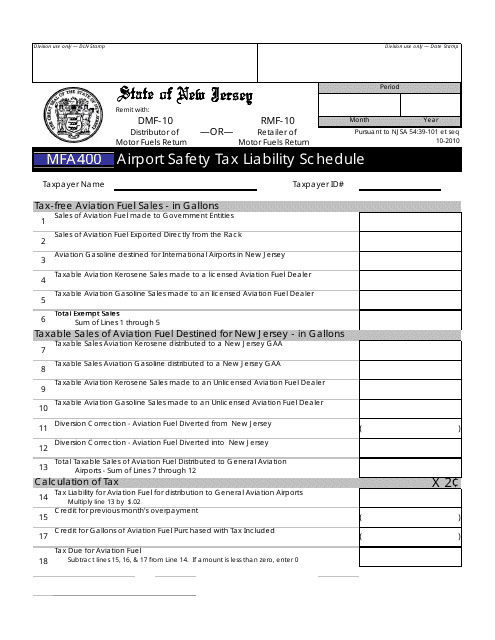

This form is used for reporting and calculating the airport safety tax liability in the state of New Jersey.

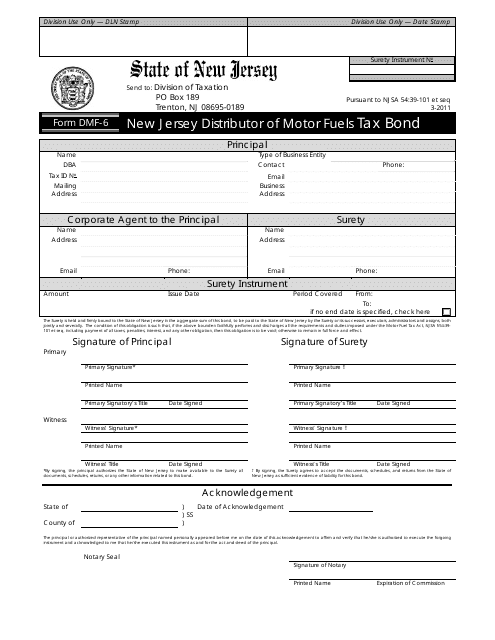

This form is used for obtaining a Distributor of Motor Fuels Tax Bond in the state of New Jersey. It is required for businesses that distribute motor fuels to ensure compliance with tax obligations.

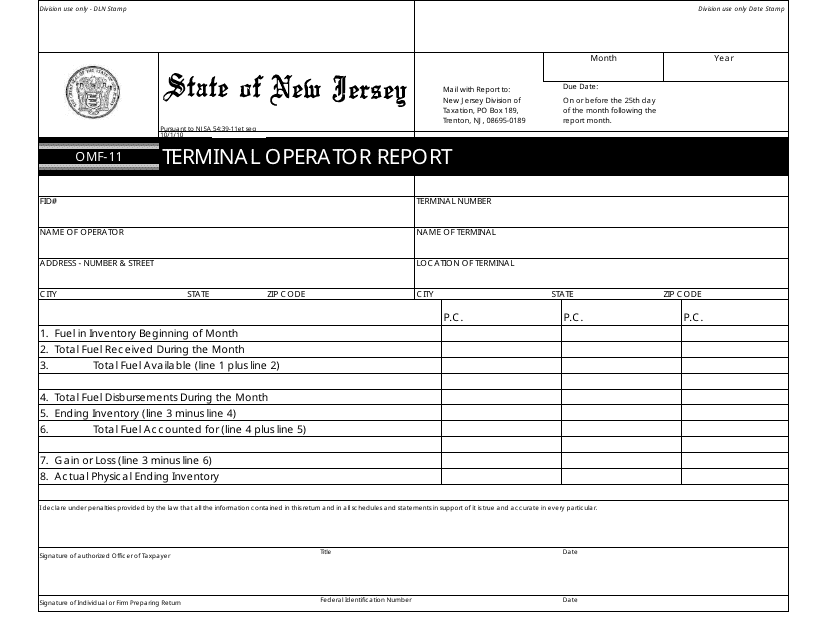

This Form is used for submitting the Terminal Operator Report in the state of New Jersey. It is required for operators of terminal facilities to report information related to their operations, including product receipts and dispositions.

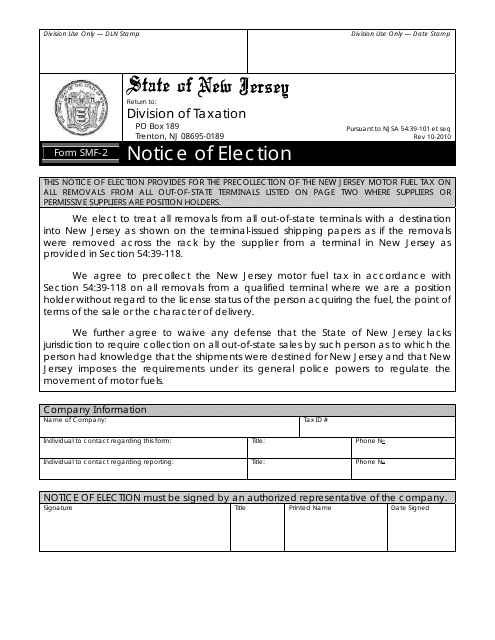

This form is used for officially notifying the state of New Jersey of an election.

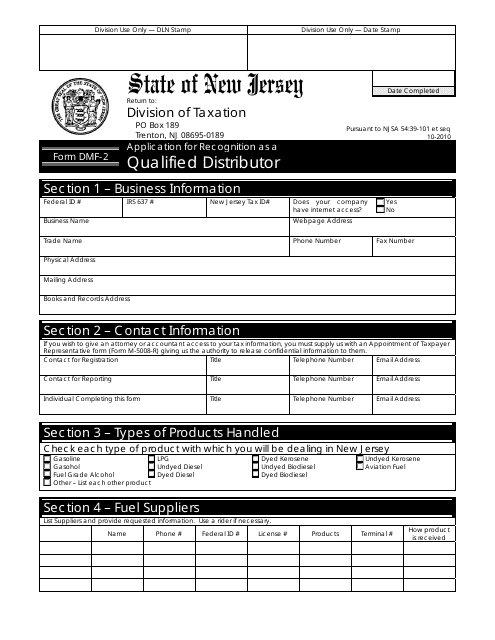

This form is used for applying to be recognized as a qualified distributor in the state of New Jersey.

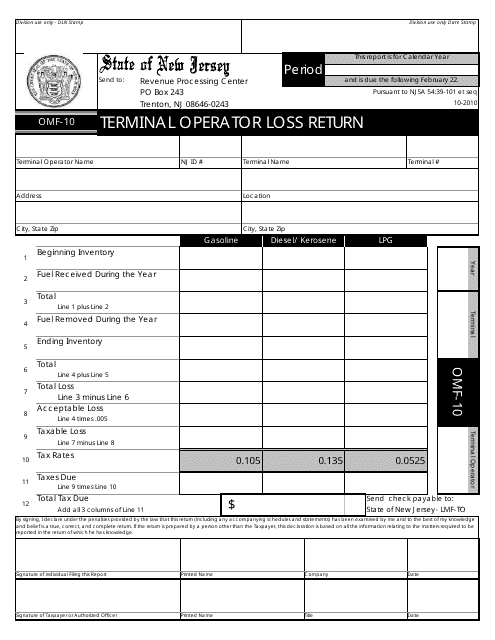

This Form is used for reporting terminal operator losses in New Jersey.

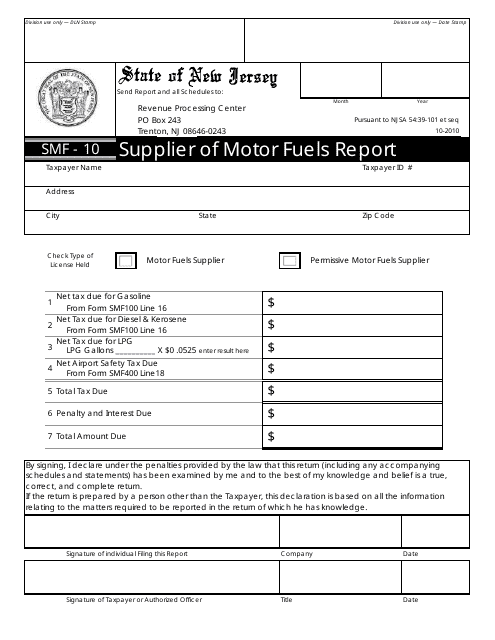

This form is used for suppliers of motor fuels in New Jersey to report their sales and related information.

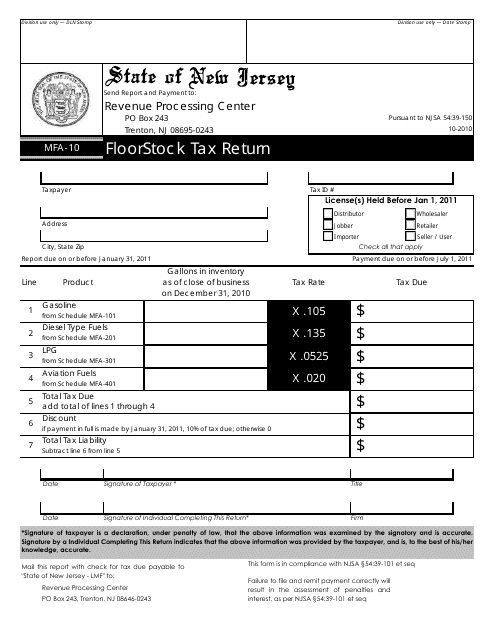

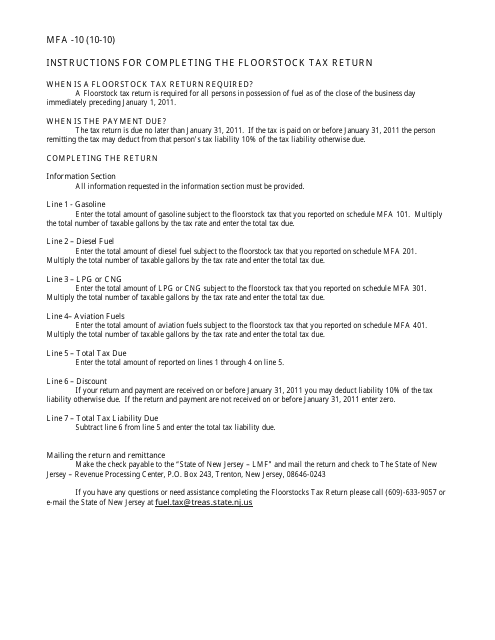

This document is used for filing the Floorstock Tax Return in the state of New Jersey.

This form is used for filing the Floorstock Tax Return in the state of New Jersey. It provides instructions on how to report and pay the tax on inventory held on the floor for sale.

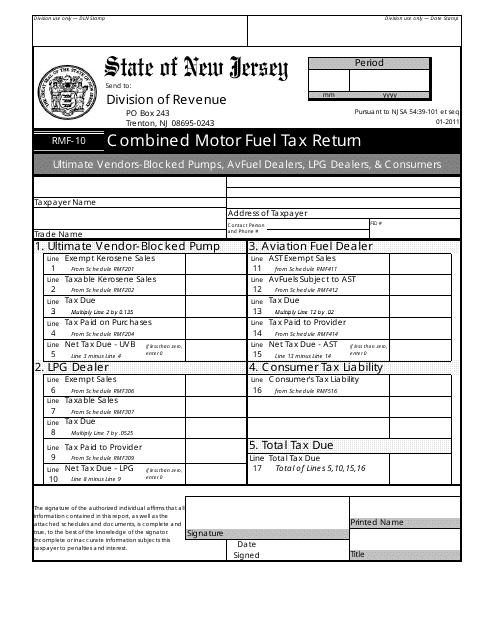

This form is used for filing motor fuel tax returns in the state of New Jersey.

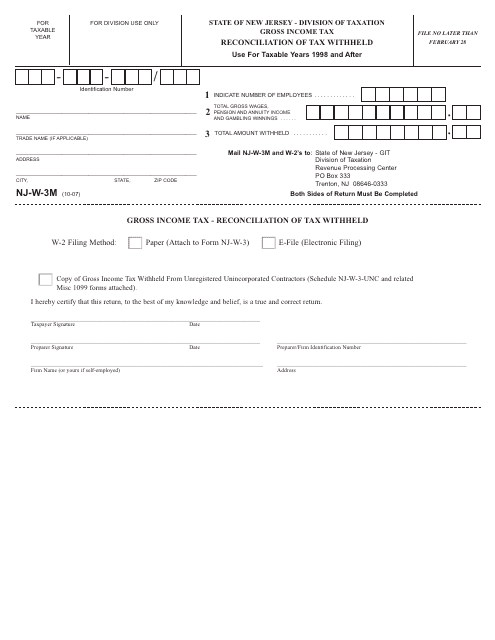

This form is used for reconciling tax withheld by employers in the state of New Jersey. It helps ensure accurate reporting and payment of payroll taxes.

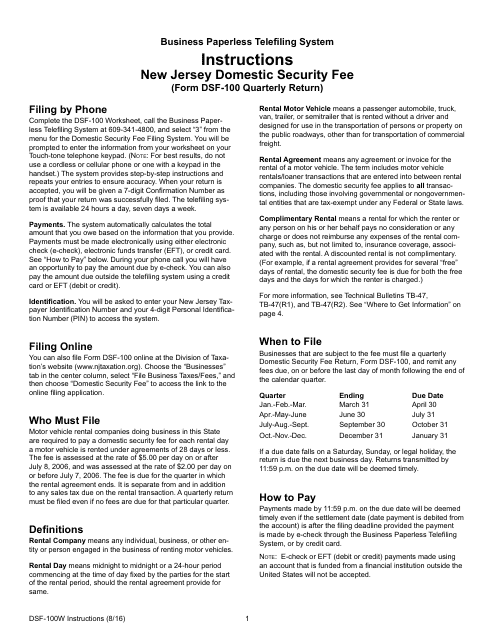

This document is used for submitting the quarterly return for businesses in New Jersey. It provides instructions on how to fill out and submit Form DSF-100.

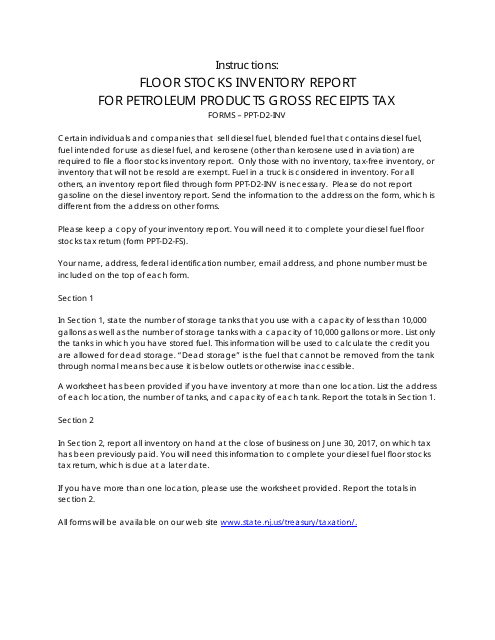

This document provides instructions for completing Form PPT-D2-INV, which is used to report floor stocks inventory for petroleum products gross receipts tax in New Jersey.

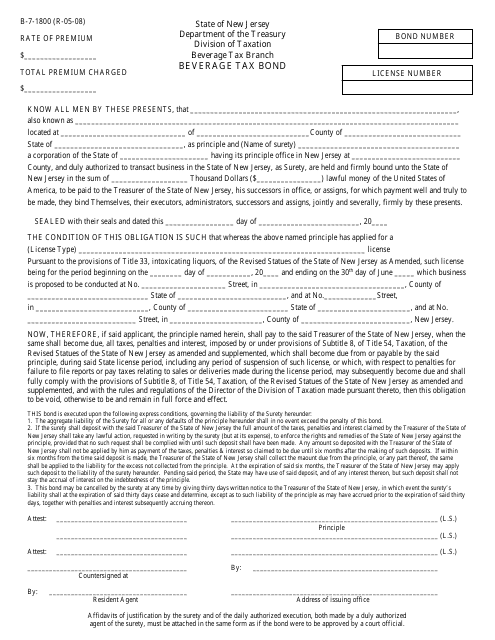

This form is used for obtaining a beverage tax bond in the state of New Jersey. The bond is required for businesses that sell or distribute beverages and ensures compliance with tax obligations.

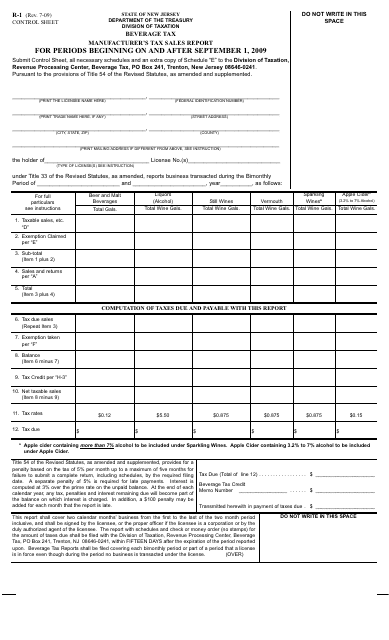

This form is used for reporting the sales of beverages and calculating the manufacturer's tax in New Jersey for periods beginning on or after September 2009.

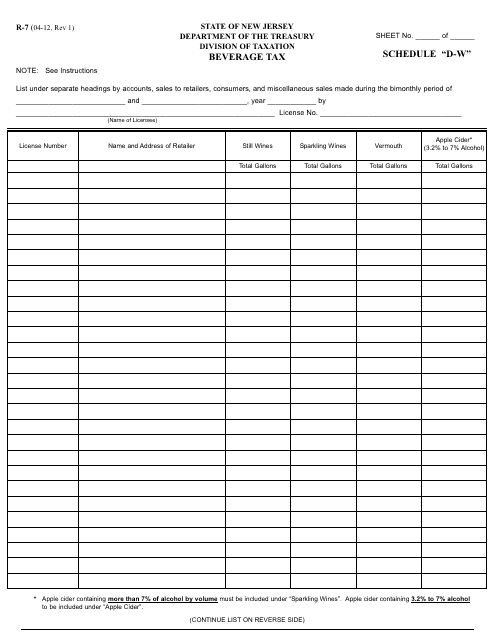

This form is used for reporting and paying beverage tax in New Jersey. It is specifically for Schedule D-W, which applies to wholesalers.

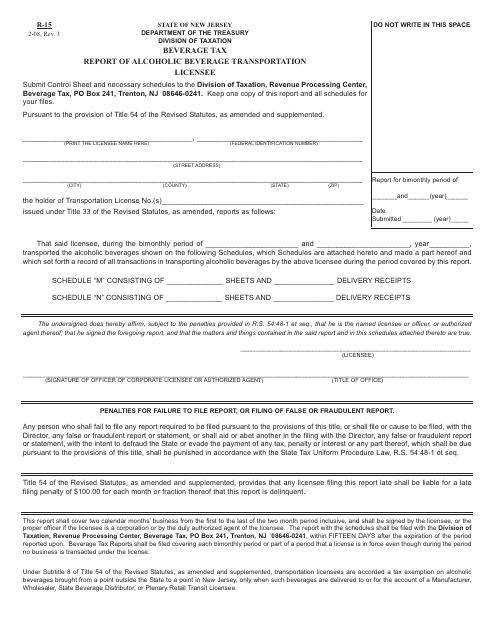

This form is used for reporting the transportation of alcoholic beverages by licensees in New Jersey, and the payment of applicable beverage taxes.

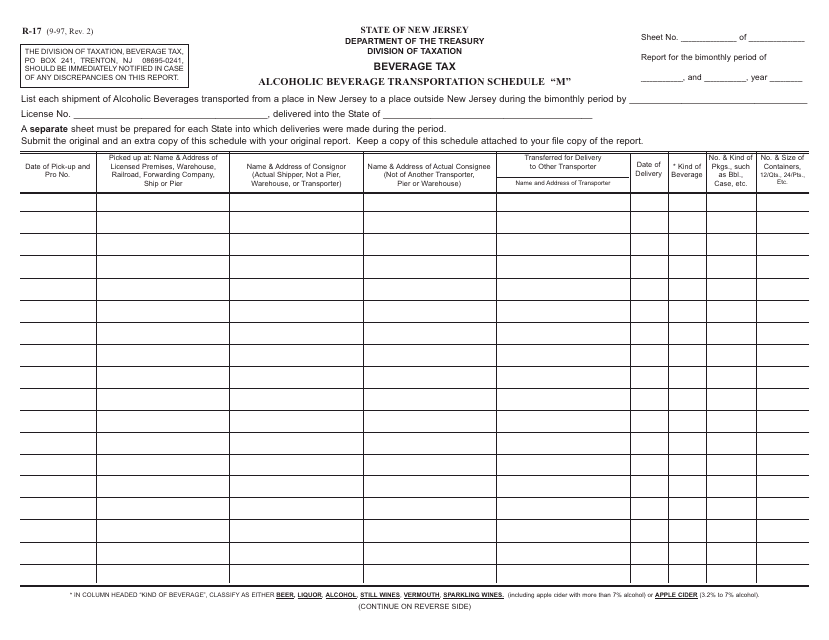

This form is used for reporting the transportation of alcoholic beverages in the state of New Jersey.

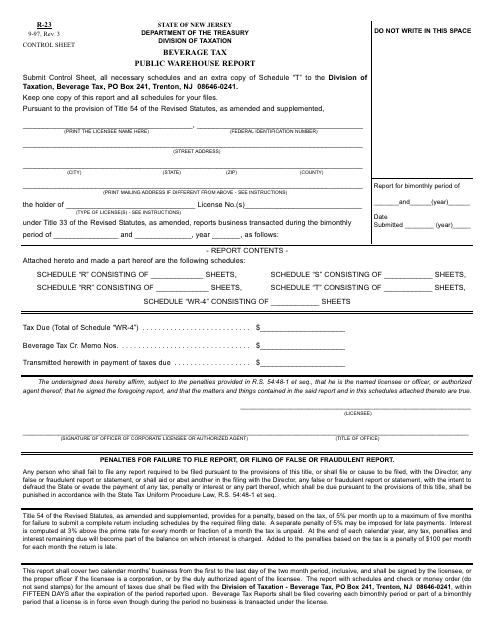

This form is used for filing a public warehouse report for beverage tax in New Jersey.

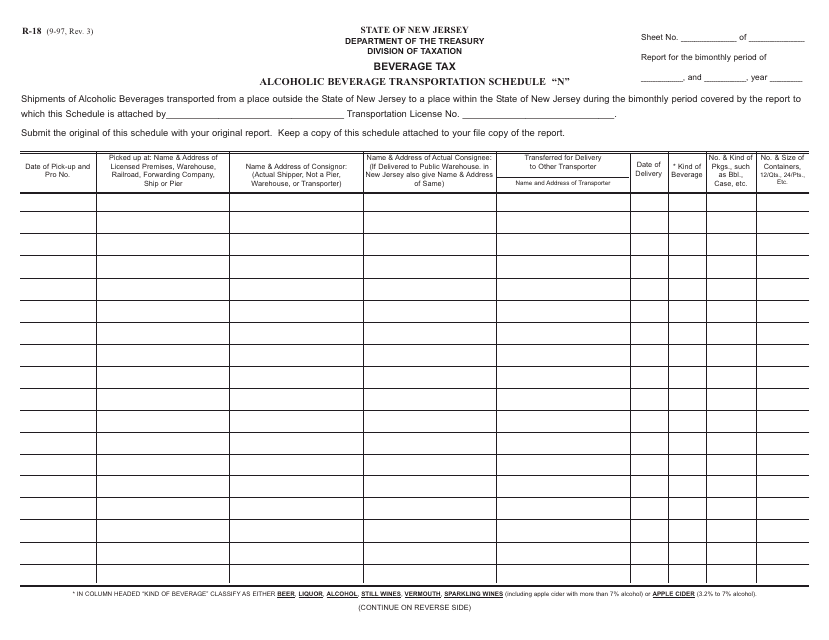

This form is used for reporting the transportation of alcoholic beverages in New Jersey. It is specifically for schedule N of form R-18.

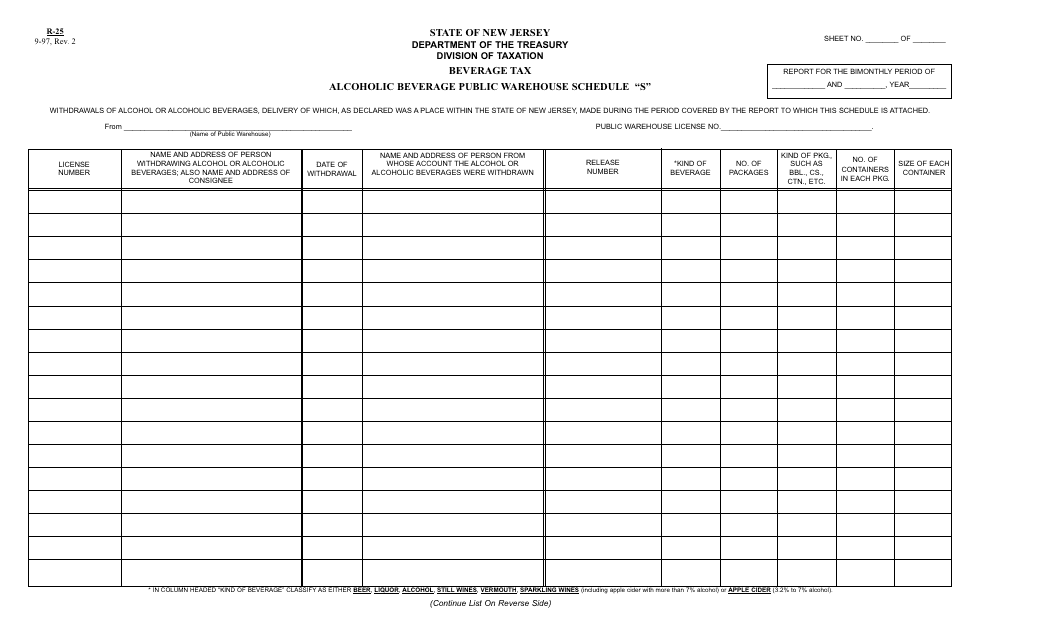

This form is used for reporting the inventory of alcoholic beverages stored in public warehouses in New Jersey. It is required by the state's Alcoholic Beverage Control Division.

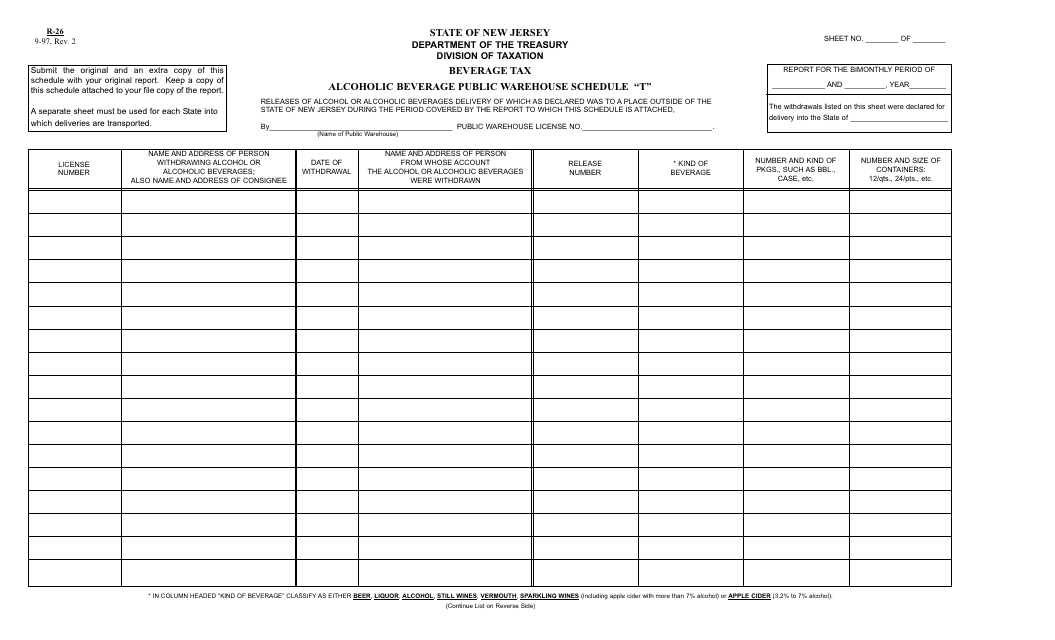

This form is used for reporting the schedule of alcoholic beverages stored in public warehouses in New Jersey.

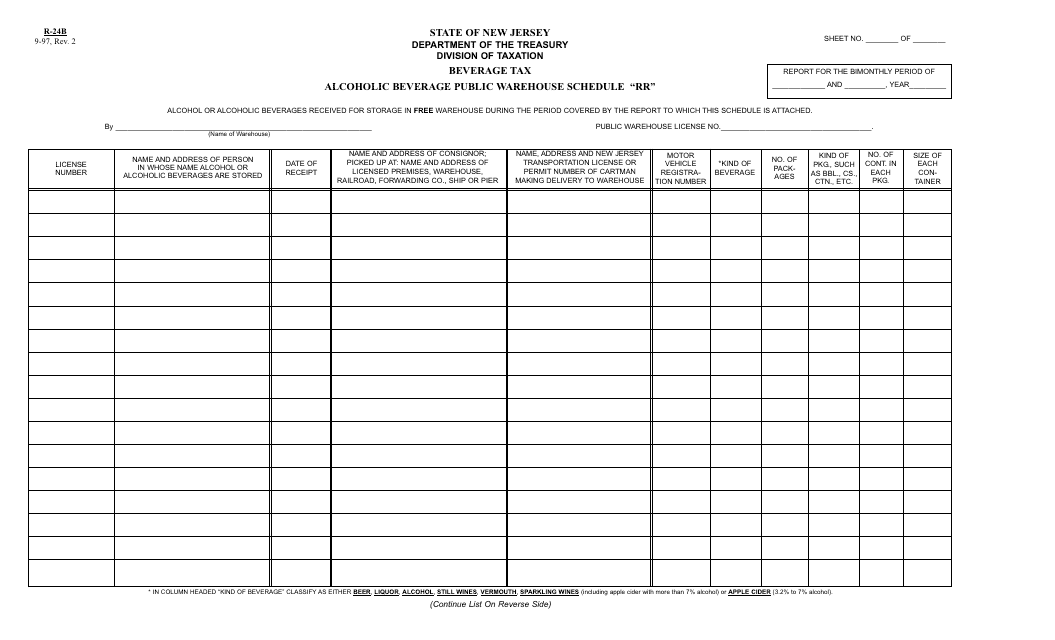

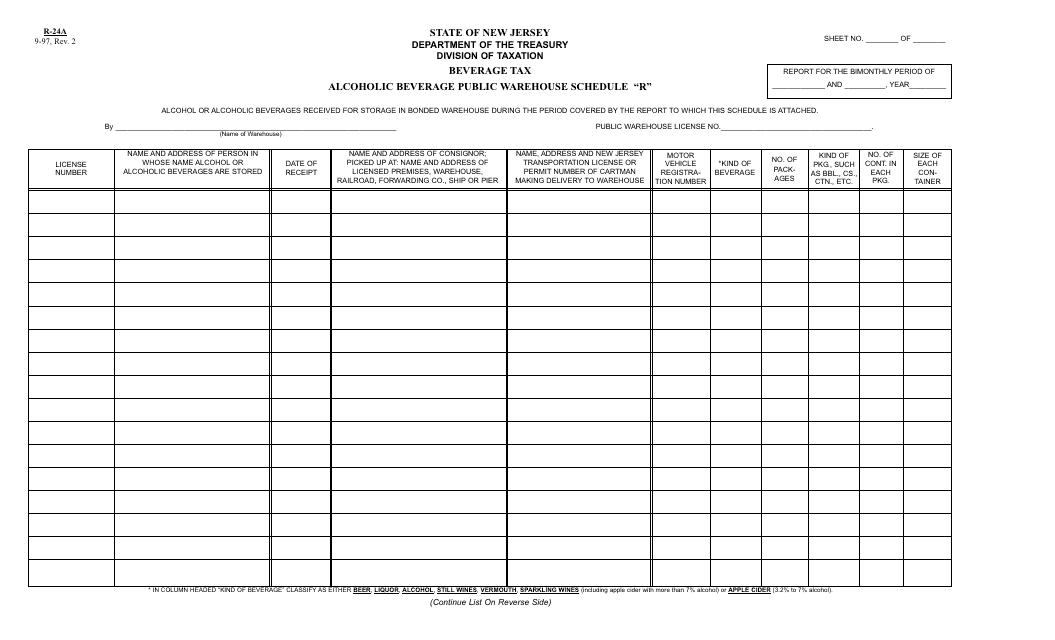

This form is used for filing the Alcoholic Beverage Public Warehouse Schedule "r" in New Jersey. It is used by alcoholic beverage warehouse operators to report their inventory and transactions.

This Form is used for reporting information about an alcoholic beverage public warehouse in New Jersey. It is required by the state government to ensure compliance with regulations related to the storage and distribution of alcoholic beverages.

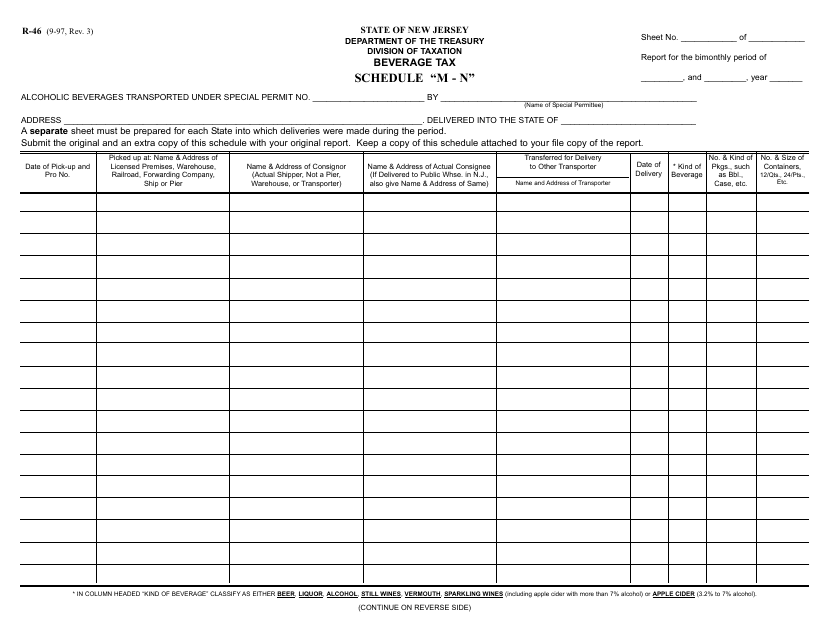

This form is used for reporting and paying alcohol beverage taxes in the state of New Jersey. It is specifically for Schedule M-N.

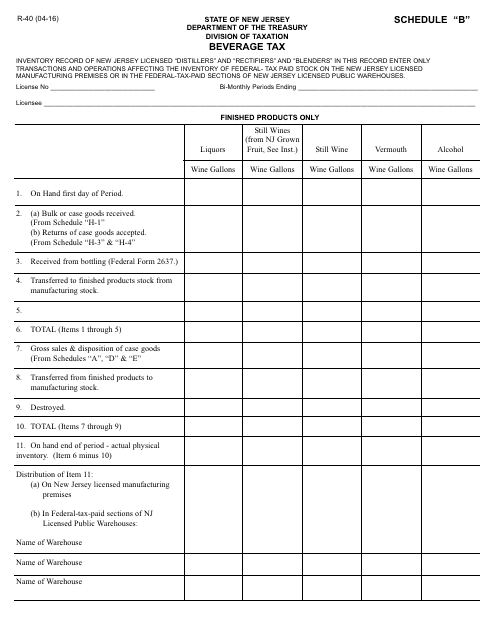

This Form is used for keeping records of inventory for licensed distillers, rectifiers, and blenders in New Jersey.

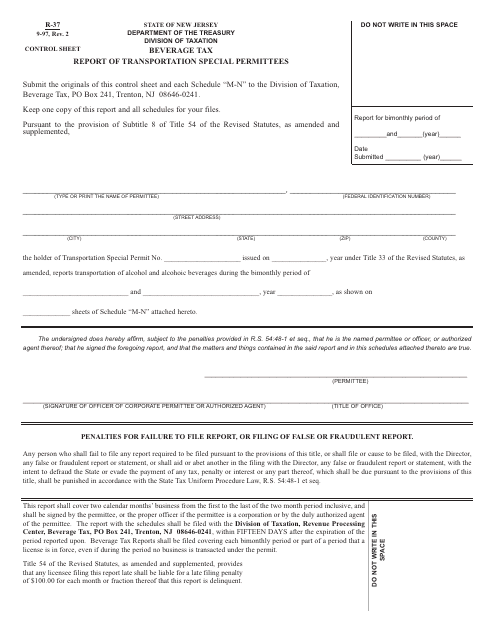

This form is used for reporting transportation special permittees in the state of New Jersey. It is used to gather information about companies or individuals that hold special permits for transportation services.

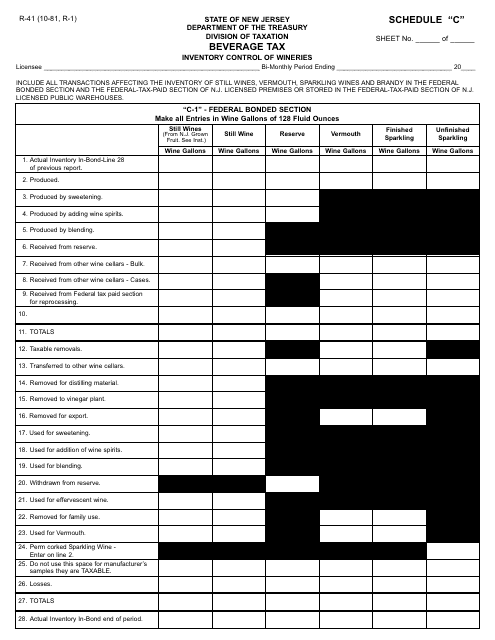

This form is used for inventory control of wineries in New Jersey for the purpose of beverage tax.

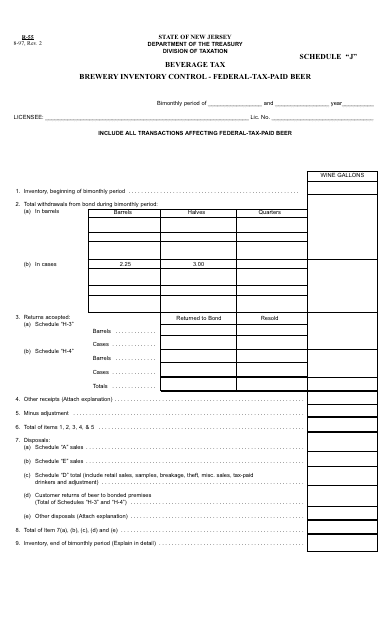

This type of document is used by breweries in New Jersey to maintain control over their inventory of federally taxed beer.

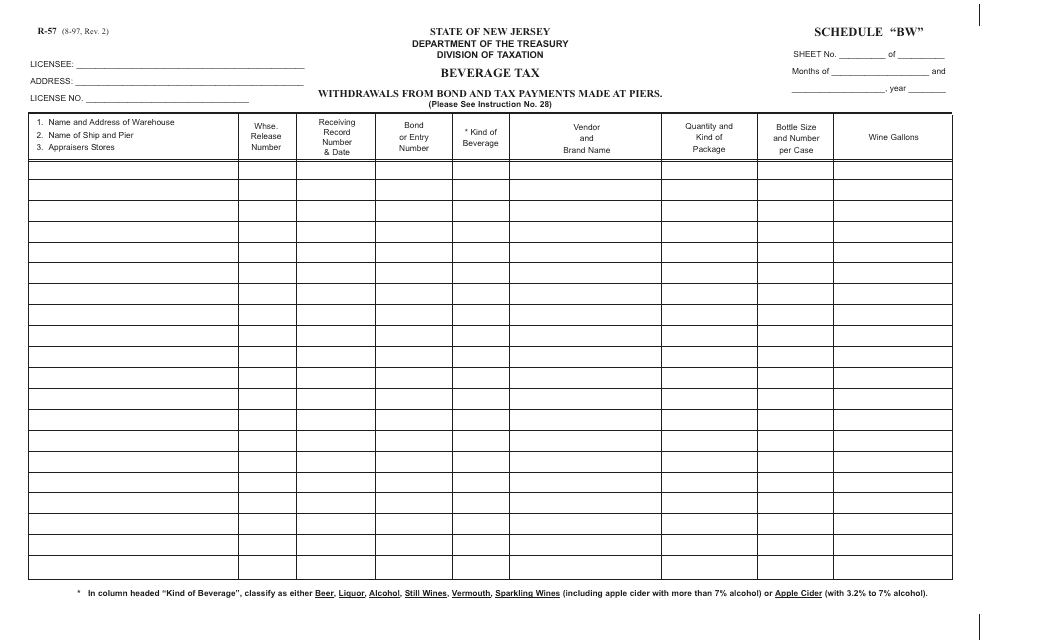

This Form is used for reporting withdrawals from bonds and tax payments made at piers in New Jersey.

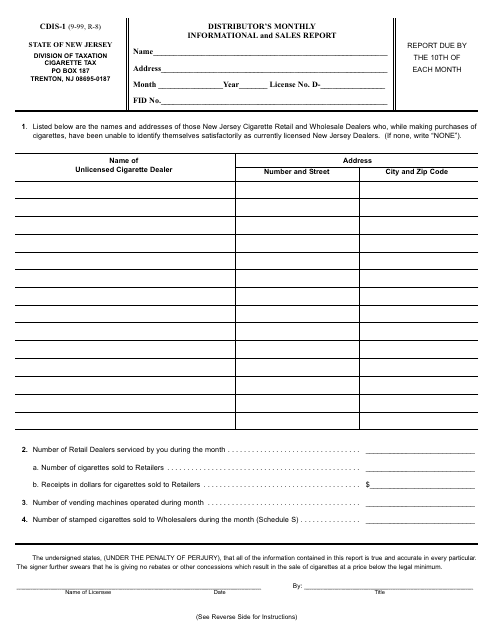

This form is used for distributors in New Jersey to submit their monthly informational and sales report.

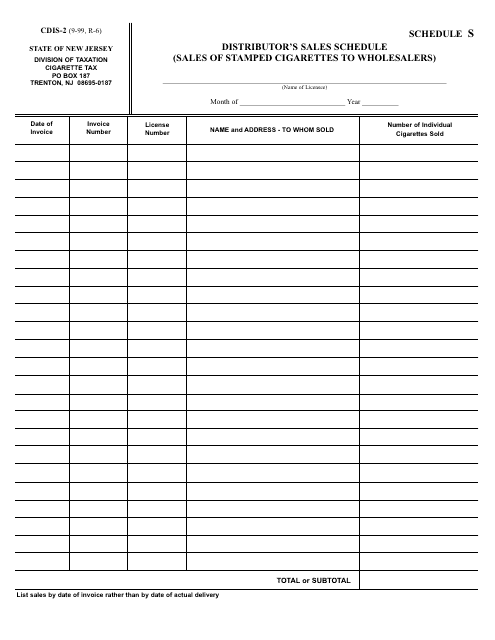

This form is used for reporting the sales of stamped cigarettes to wholesalers in New Jersey.

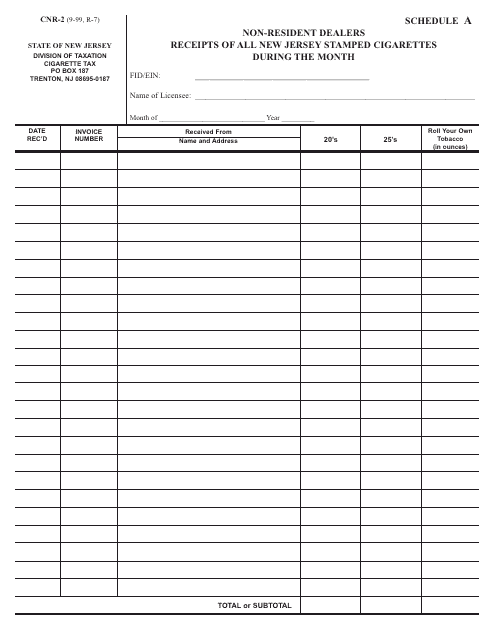

This form is used for reporting the receipts of all New Jersey stamped cigarettes by non-resident dealers during a specific month in New Jersey.