Sc Tax Forms and Templates

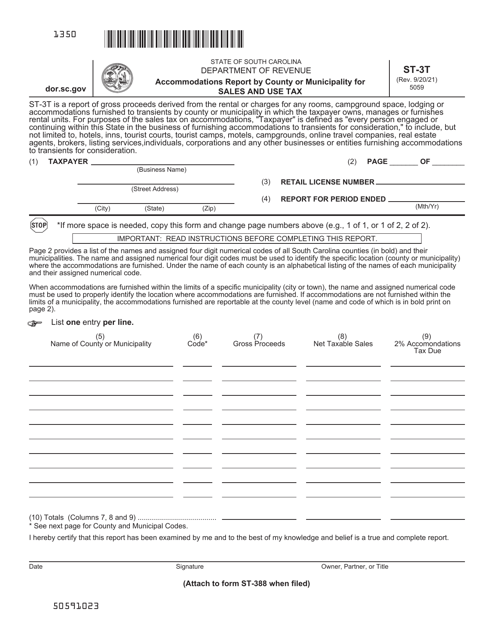

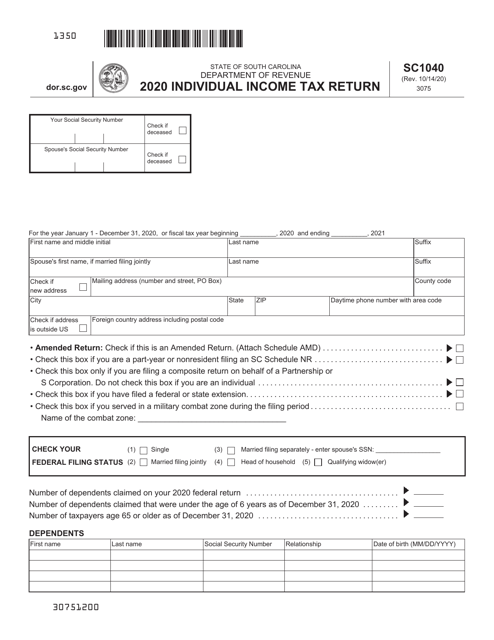

SC Tax Forms are official documents used for reporting and filing income taxes in the state of South Carolina. These forms are used to calculate and report state income tax liabilities, claim tax credits and deductions, and determine any potential tax refunds or amounts owed to the state. Individuals, businesses, and organizations in South Carolina must use these forms to comply with state tax laws and fulfill their tax obligations.

Documents:

14

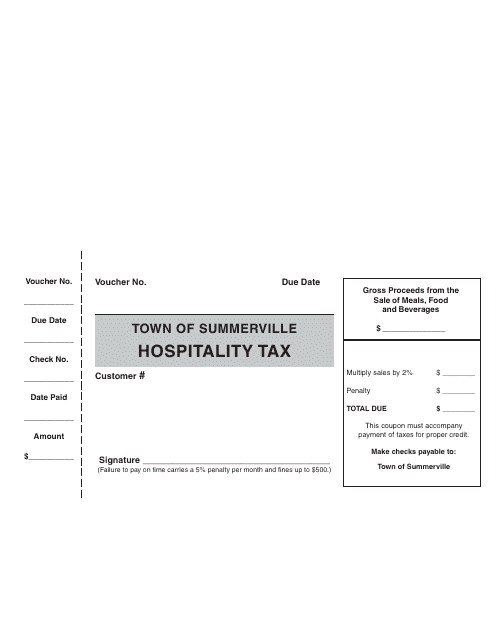

This form is used for reporting and remitting hospitality taxes to the Town of Summerville, South Carolina.

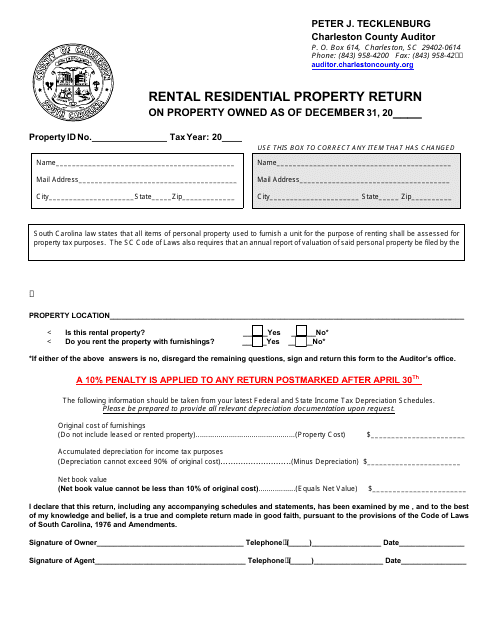

This Form is used for reporting rental residential property in Charleston, South Carolina.

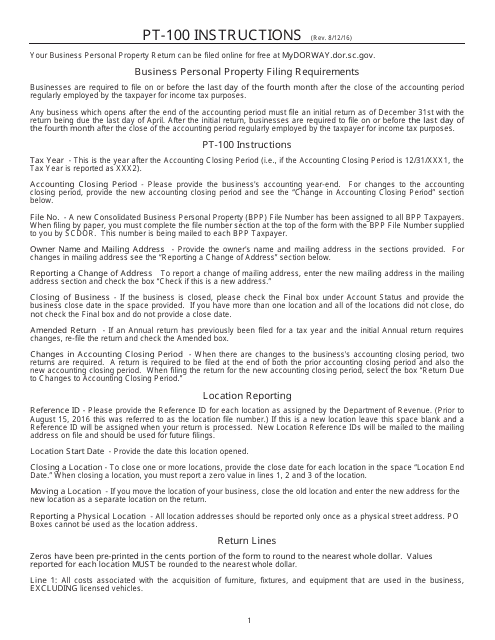

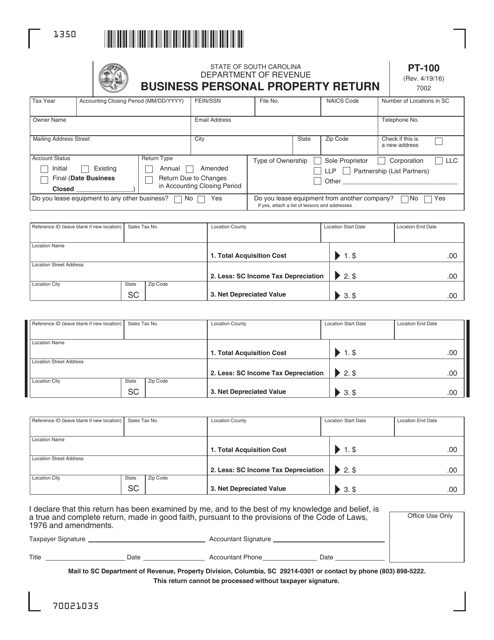

This Form is used for filing the Business Personal Property Return in South Carolina. It provides instructions on how to properly fill out and submit the form for reporting business personal property for taxation purposes.

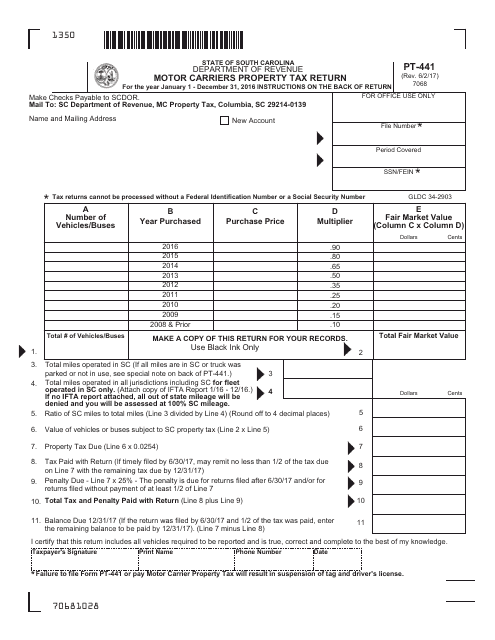

This form is used for South Carolina motor carriers to report and pay property taxes related to their operations.

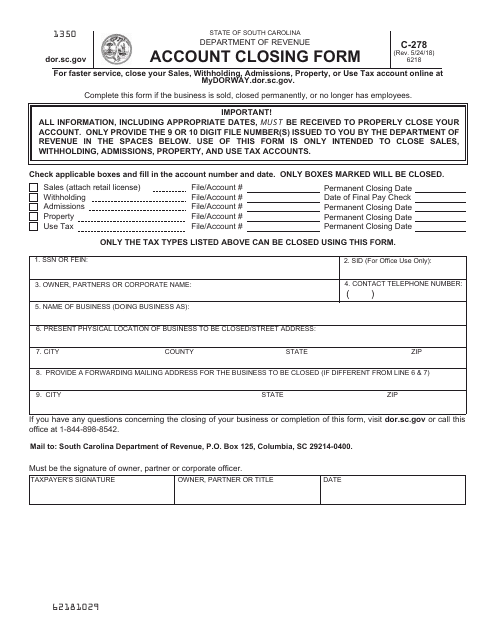

This Form is used for closing a financial account in South Carolina.

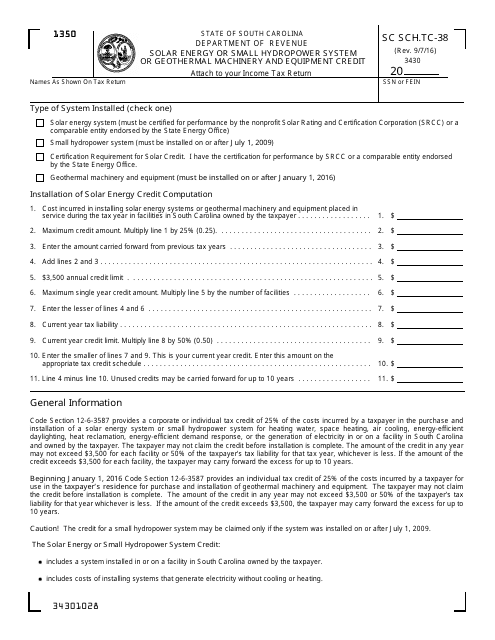

This Form is used for claiming the Solar Energy or Small Hydropower System or Geothermal Machinery and Equipment Credit in South Carolina.

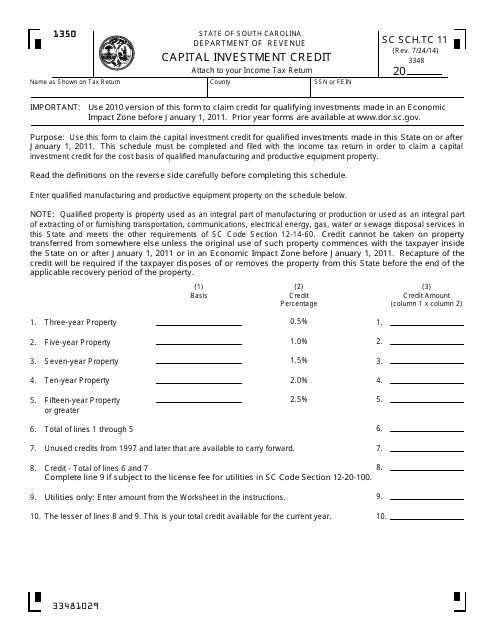

This Form is used for claiming the Capital Investment Credit in South Carolina.

This form is used for reporting business personal property in South Carolina. It is required for businesses to assess and declare the value of all tangible personal property they own, lease, or possess in order to calculate property taxes.