Nevada Tax Forms and Templates

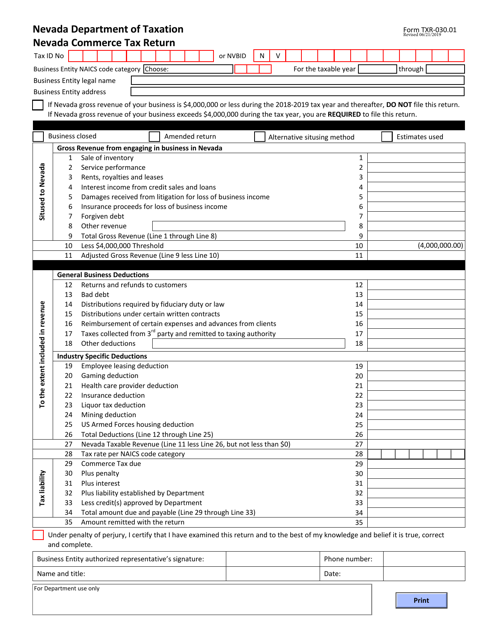

Nevada Tax Forms are used for the purpose of filing taxes and reporting various tax obligations to the Nevada Department of Taxation. These forms are specific to the state of Nevada and are required for individuals and businesses to accurately report and pay their taxes in accordance with Nevada tax laws.

Documents:

4

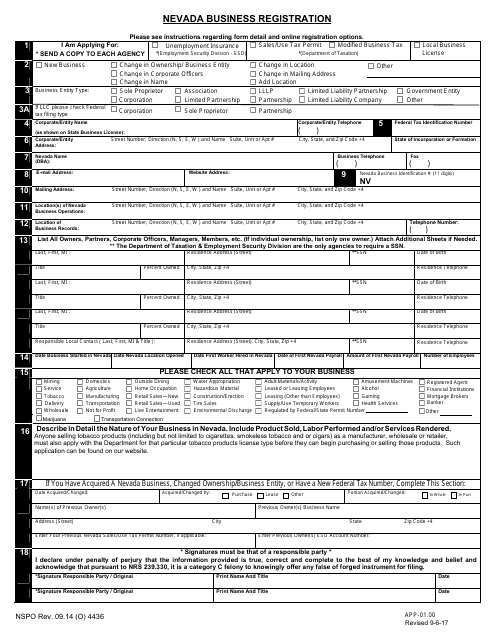

This Form is used for registering a business in Nevada.

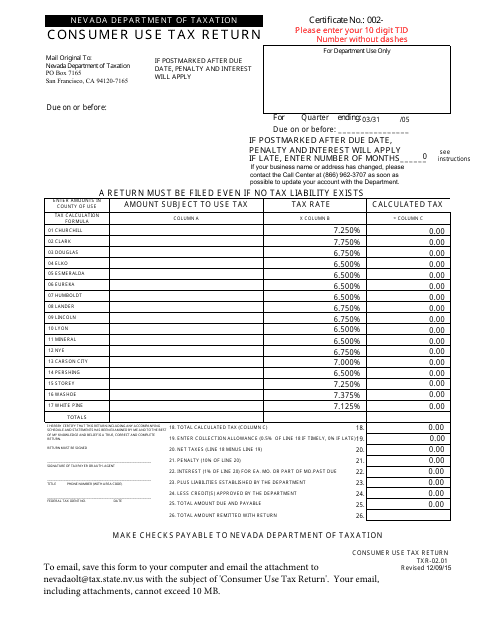

This Form is used for reporting and paying consumer use tax in the state of Nevada.

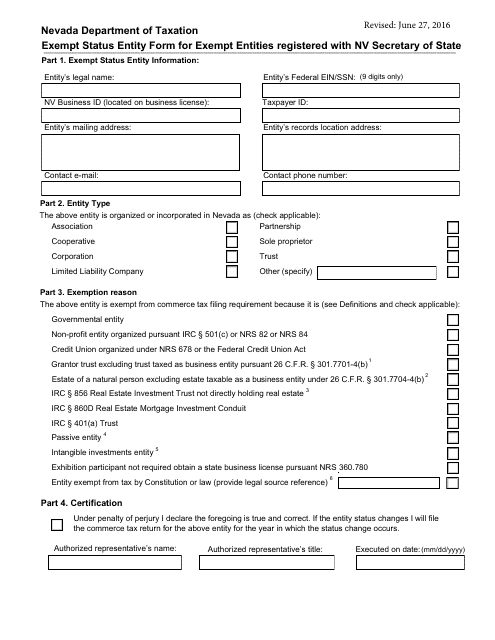

This form is used for exempt entities that are registered with the Secretary of State in Nevada to apply for exempt status. It allows these entities to claim exemptions from certain taxes or fees.