Goodwill Letter Templates and Samples

What Is a Goodwill Letter?

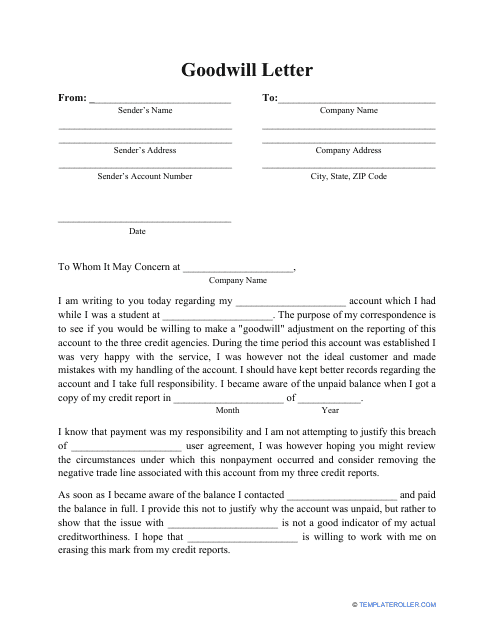

A Goodwill Letter is a formal document sent by the borrower to the creditor with the request to delete delinquencies from the borrower's credit score. It can work as an effective tool that removes negative marks from your credit history. Any individual or company that has worked with a bank or some other lender has a chance to clean their credit score if they complete a Goodwill Letter that explains what led to the delay in payment or another slip-up in their credit history.

Alternate Name:

- Goodwill Adjustment Letter.

Goodwill Letter Types

If your relationship with the creditor has been rocky and you have constantly missed deadlines, failed to make payments on time, and ignored calls and letters from the financial institution that asked you to provide explanations for the noncompliance with your original arrangement, this document might not be enough to repair your credit. However, if made more than one payment over several years of working with the bank, there is a high probability they will accommodate your request.

If you are looking for a template to use, check out our library of documents below, including:

- A generic Goodwill Letter.

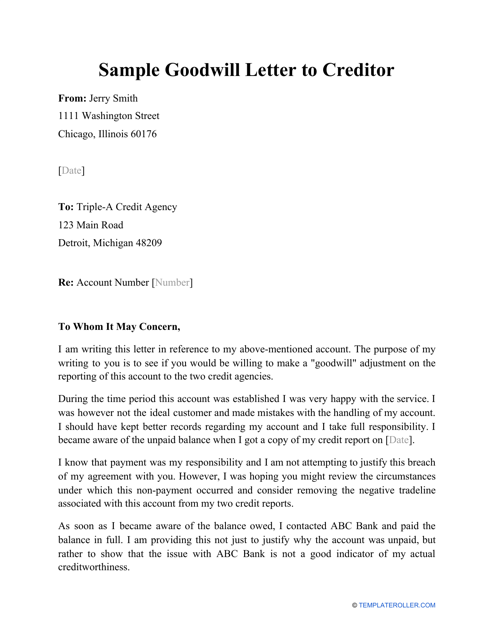

- A sample Goodwill Letter to send to your creditor.

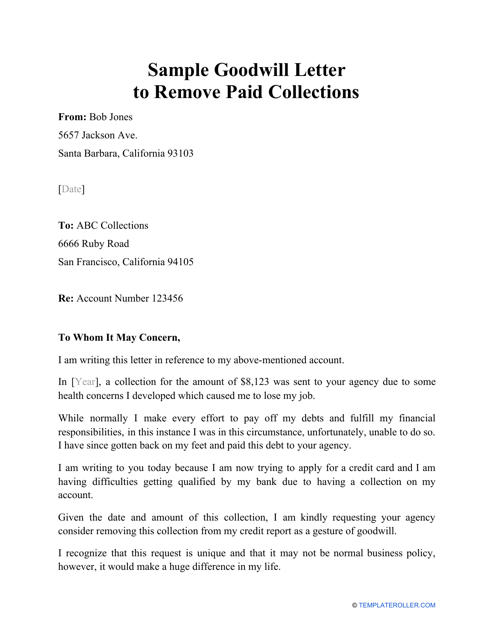

- A sample Goodwill Letter to remove paid collections.

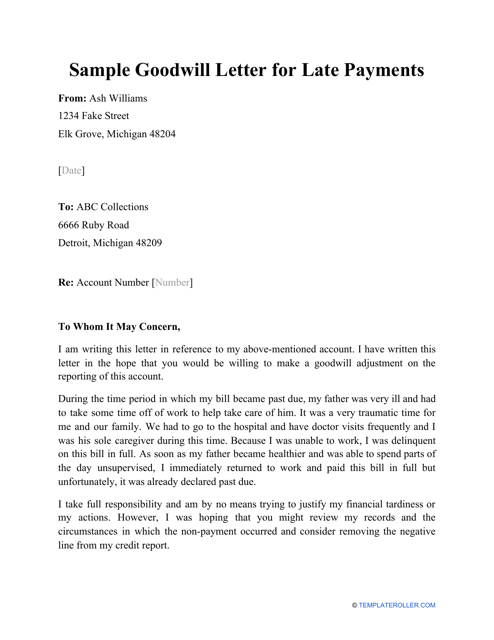

- An example of a Goodwill Letter for late payments.

How to Write a Goodwill Letter?

Here is how you compose a Goodwill Adjustment Letter:

- Greet the creditor and introduce yourself. State the number of your loan, account, or agreement so that you are easily identified.

- Indicate the reason for writing a letter. For instance, you need to take a loan but the prospective lender refuses because there has been a missed loan payment in your credit history which you dealt with several months after the deadline. In this case, prepare a Goodwill Letter for Late Payments and explain the situation to your original lender - perhaps this was a one-time incident, you failed to pay because of overwhelming bills that accumulated after you were fired, and you already compensated the creditor in full.

- Strengthen your point of view with supporting evidence - you cannot just claim you have lost your job or had to take care of a sick family member, you need to confirm this information by the termination of employment letter from your former place of work or medical bills that impacted your finances. Additionally, you can prove your creditworthiness by submitting bank statements, wage statements, tax returns, and other proof that shows you have always been a responsible borrower especially when it comes to one missed payment years ago that still blemishes your credit history.

- Do not forget you are drafting a formal statement - while it is possible to refer to emotional damage you have suffered, the main purpose of a Goodwill Letter to creditor is to convince the latter you have a strong credit history and prove it with sufficient evidence, not just words and declarations.

- Thank the creditor for their time and attention, express hope that the negative information will be deleted, add your contact details to stay in touch with the recipient, and sign the letter. Send it via certified mail to obtain proof of delivery and receipt.

Related Letter Templates and Tags:

Documents:

4

A credit borrower may prepare this type of letter and send it to a creditor if the former needs to remove negative entries from their credit history.

This type of letter may be used when an individual has missed a payment for a loan or credit card and are requesting to have the negative mark removed from their credit report.

Individuals may use this type of letter when they want to try to remove late payments from their credit history.

Individuals may use this letter when they would like to remove collection accounts on their credit report.