Tax Worksheet Templates

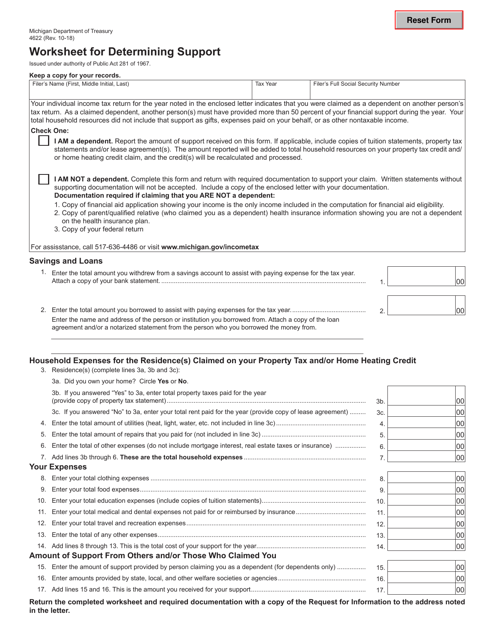

Tax Worksheet Templates are tools that provide a format for individuals to organize and calculate their tax-related information. These templates are designed to assist taxpayers in accurately reporting their income, deductions, credits, and other relevant information for the purpose of preparing their tax returns. They serve as a guide for taxpayers to track expenses, calculate deductions, and determine tax liability. Overall, Tax Worksheet Templates help individuals maintain organized records and ensure accurate reporting during the tax filing process.

Documents:

143

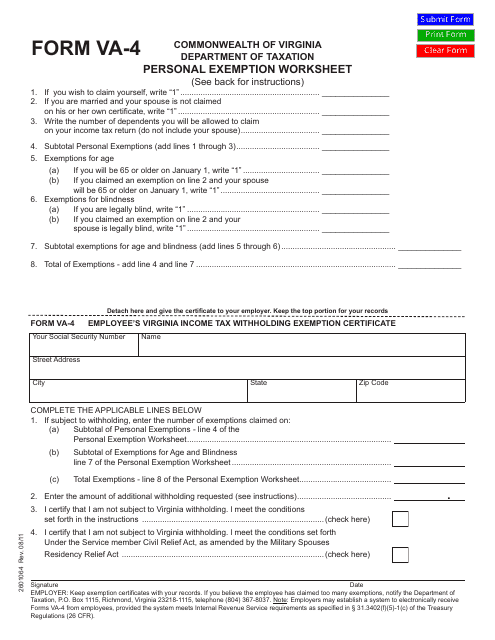

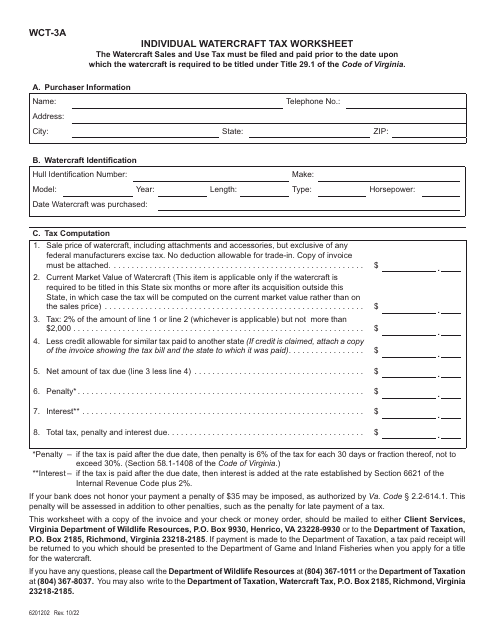

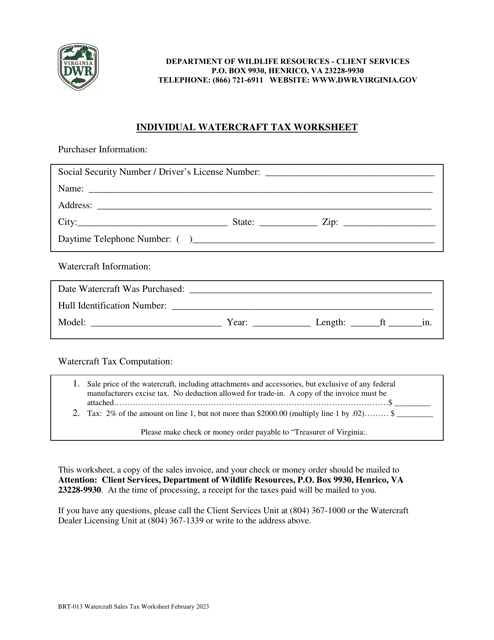

This form is used for calculating personal exemptions for tax purposes in the state of Virginia.

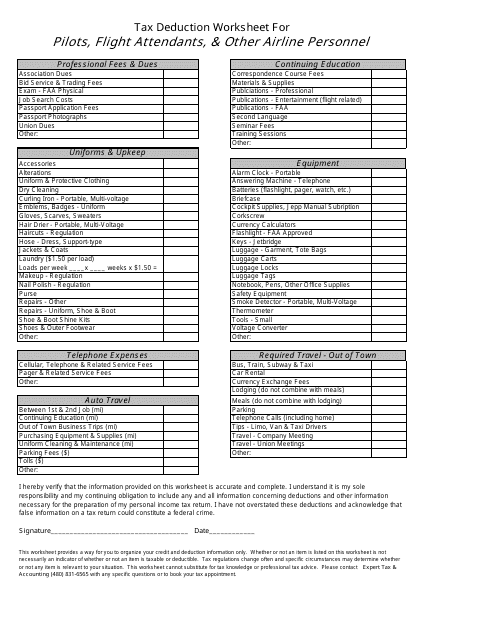

This form is used for calculating tax deductions specific to pilots, flight attendants, and other airline personnel. It helps ensure that eligible expenses related to work in the aviation industry are properly accounted for.

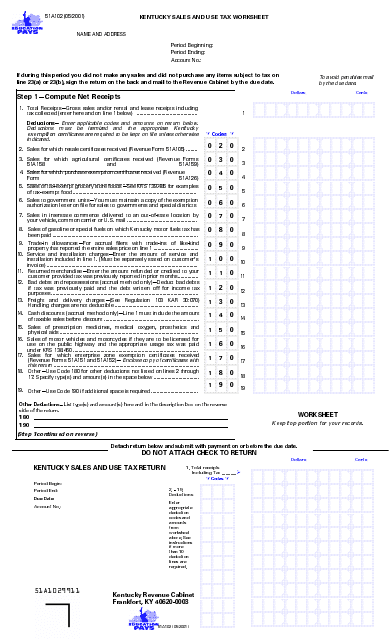

This Form is used for calculating sales and use tax in the state of Kentucky. It helps individuals and businesses determine the amount of tax owed based on their sales and use of taxable items.

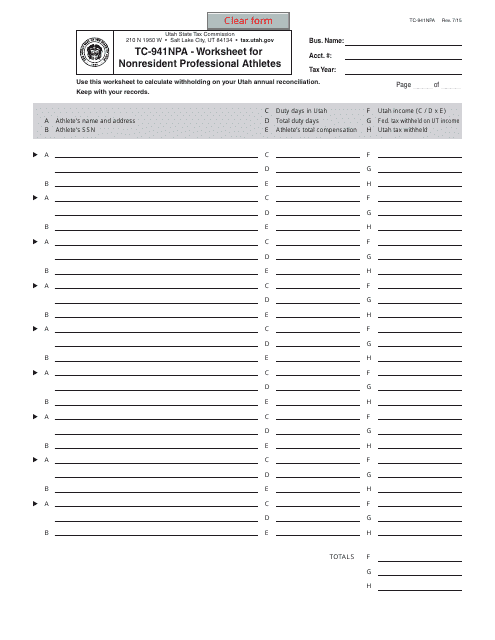

This form is used for nonresident professional athletes in Utah to calculate taxes owed.

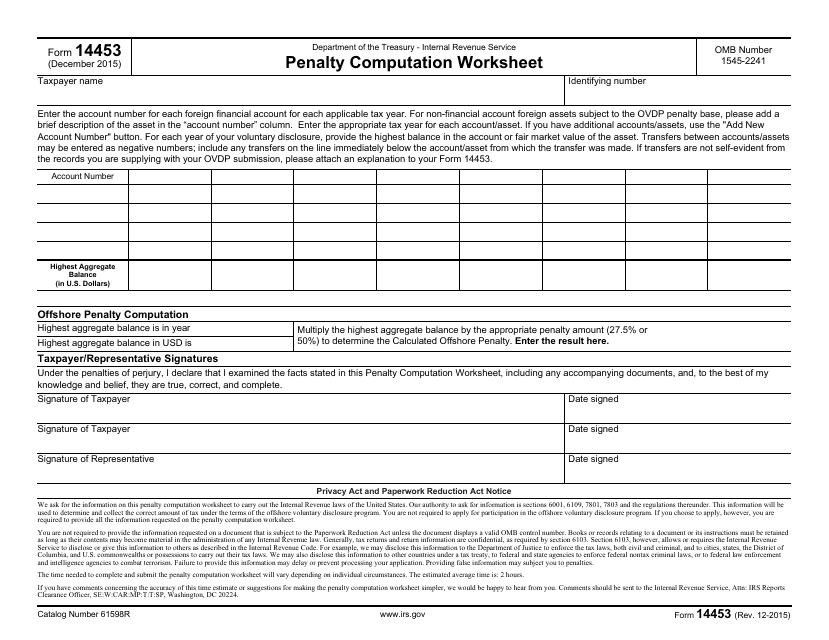

This document is used to calculate penalties owed to the IRS. It provides a worksheet for determining the amount of the penalty.

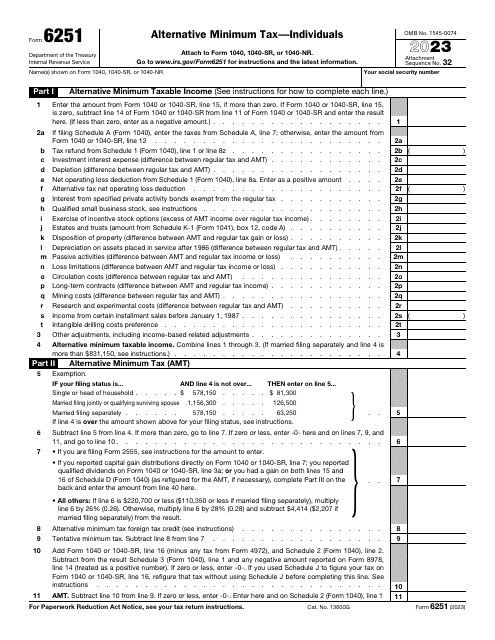

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

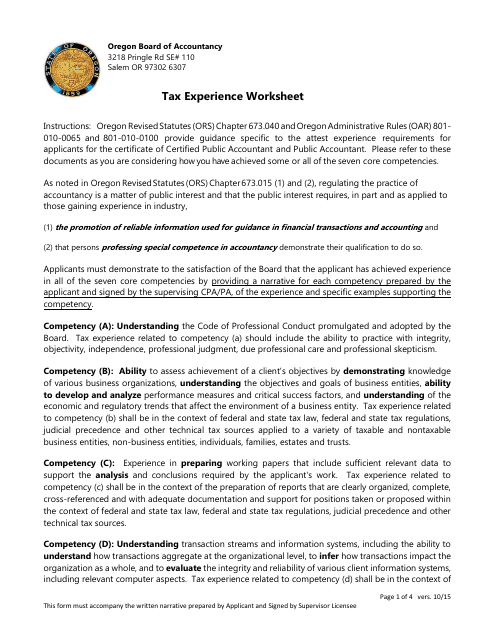

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

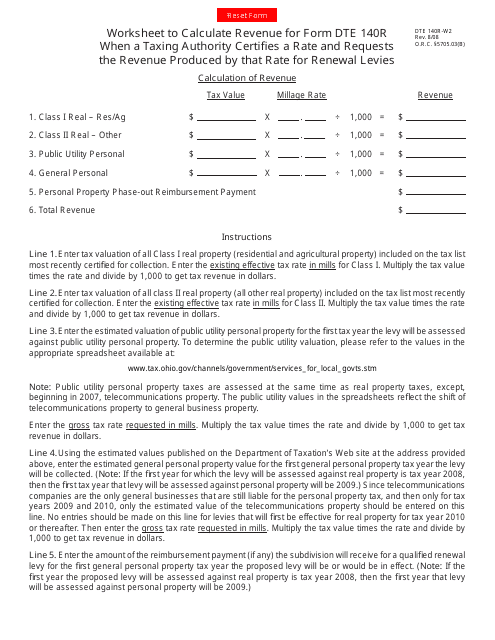

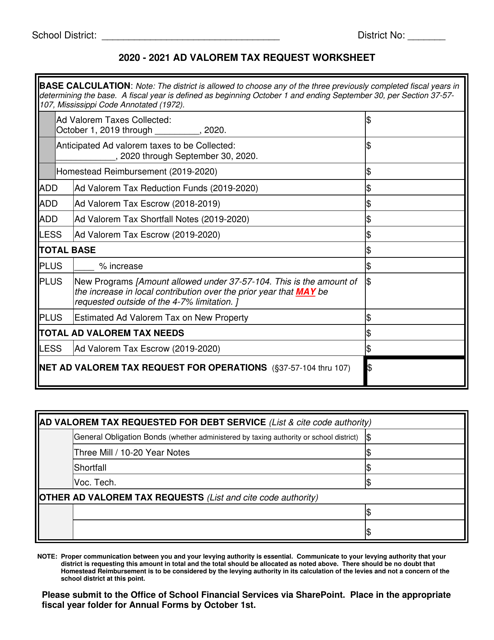

This form is used for completing the worksheet required for renewing levies in Ohio.

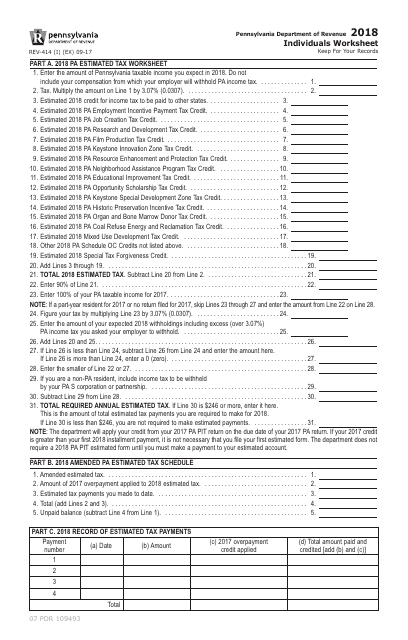

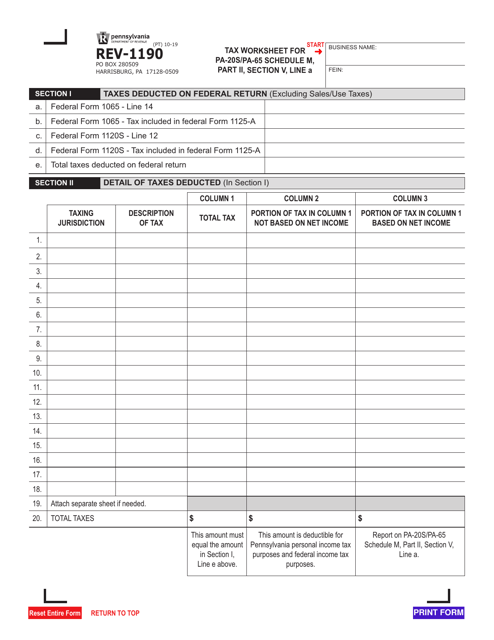

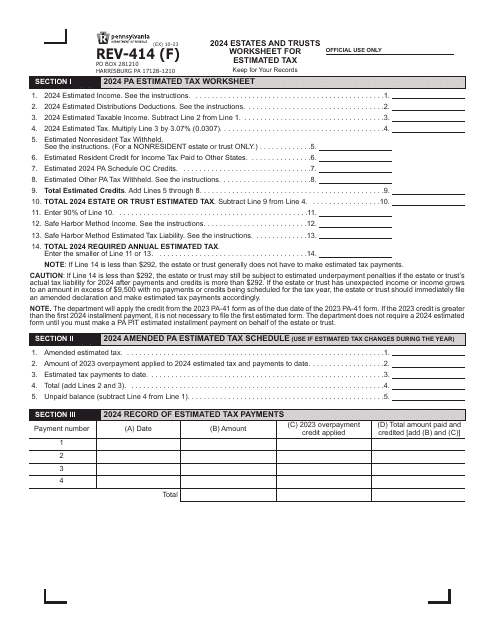

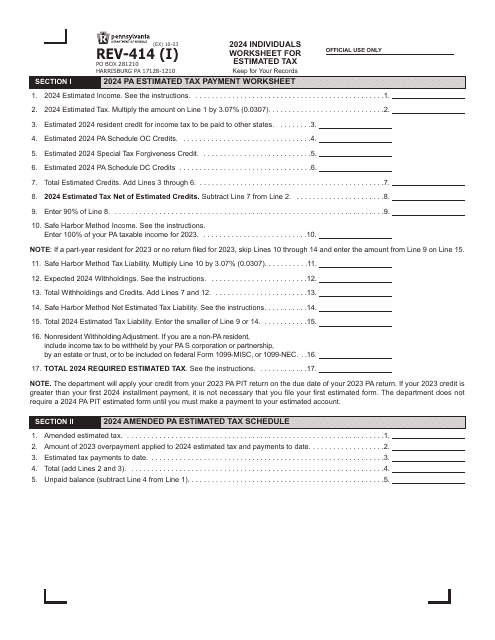

This form is used for individuals in Pennsylvania to complete a worksheet related to their taxes.

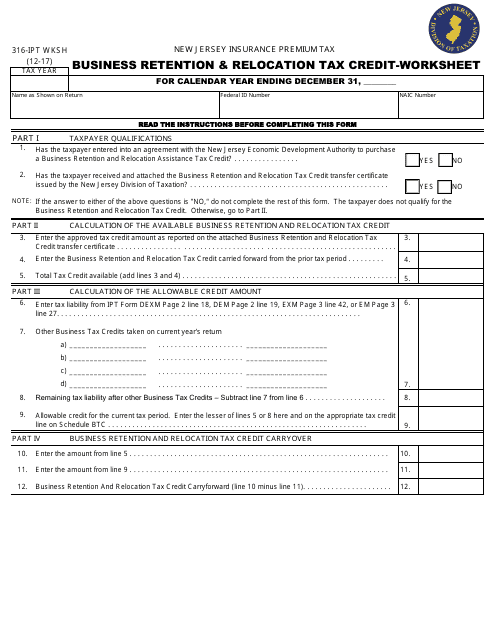

This form is used for calculating the Business Retention & Relocation Tax Credit in New Jersey.

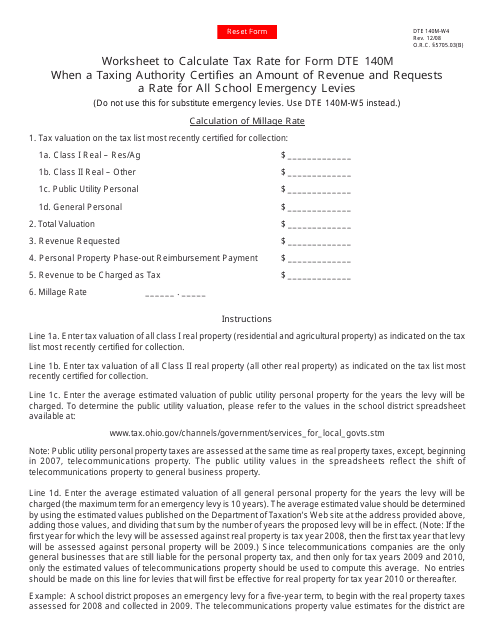

This form is used for calculating the tax rate for Form DTE 140M when a taxing authority requests a rate for all school emergency levies in Ohio.

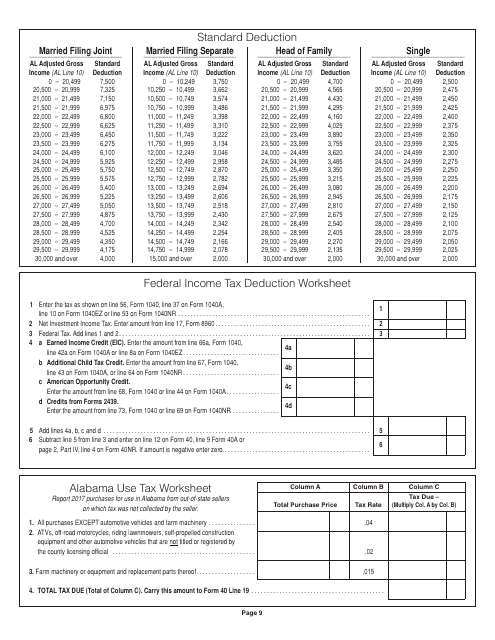

This document provides a worksheet for Alabama residents to calculate their federal income tax deductions.

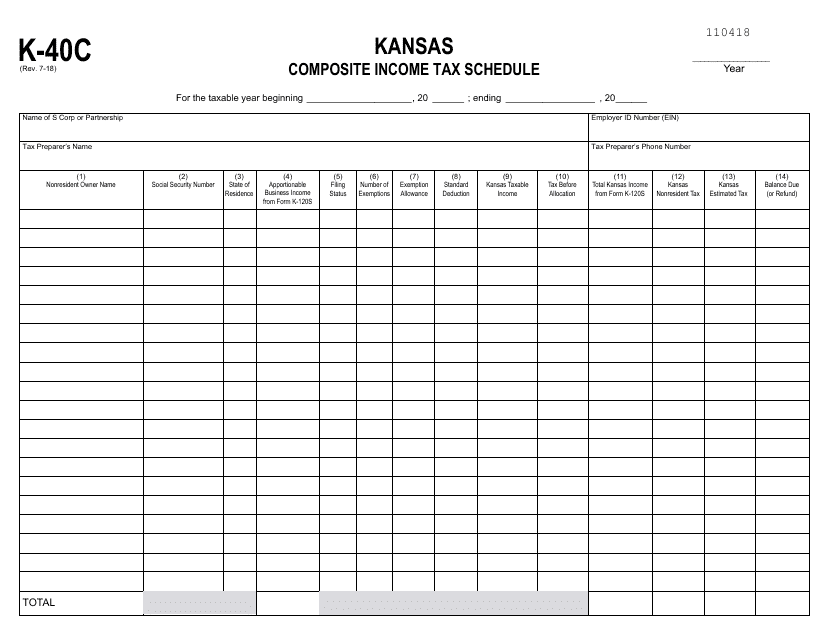

This form is used for reporting composite income tax for individuals in the state of Kansas.

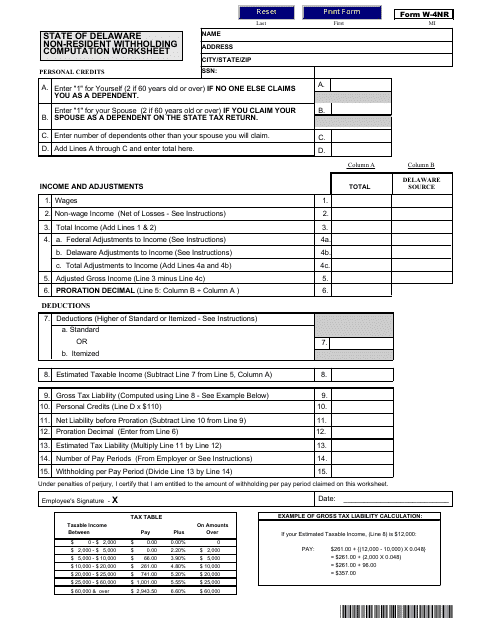

This form is used for calculating withholding taxes for non-resident taxpayers in Delaware.

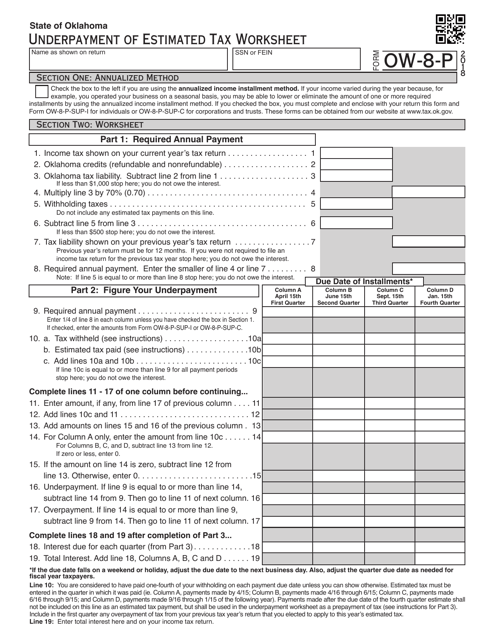

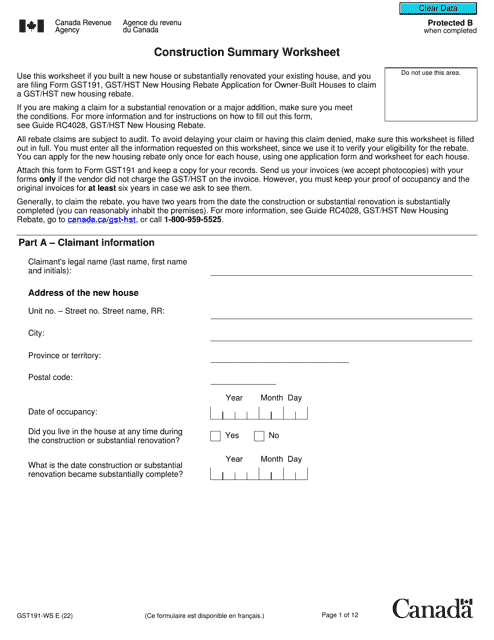

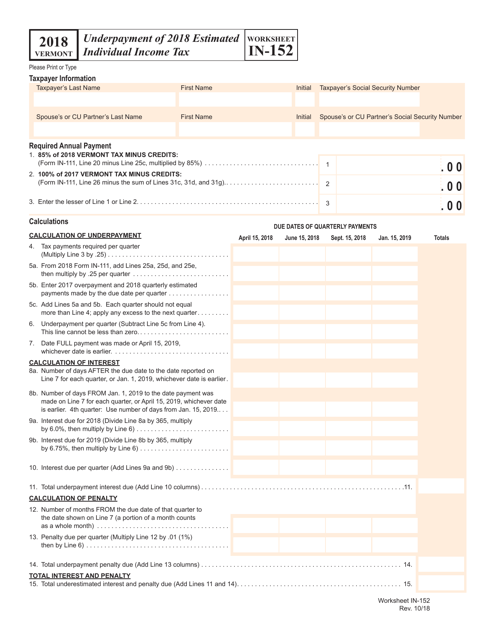

This form is used for calculating and reporting any underpayment of estimated individual income tax in Vermont for the year 2018.

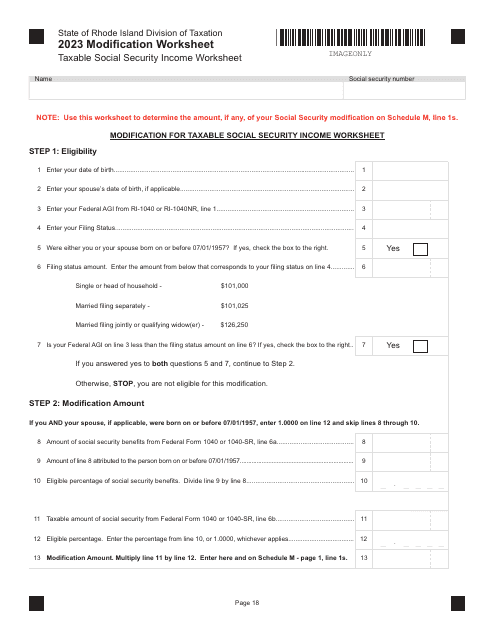

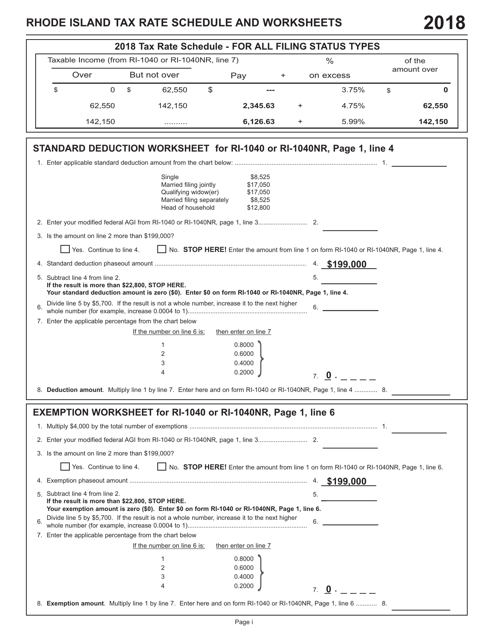

This document provides information about the tax rate schedule and worksheets for residents of Rhode Island. It includes details on how to calculate and pay taxes based on income brackets.

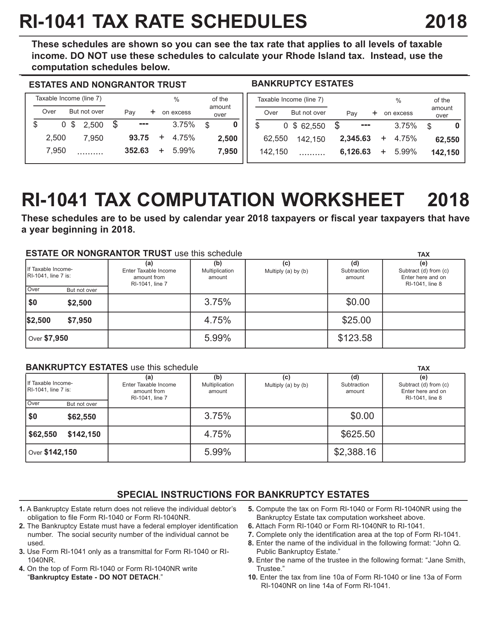

This form is used for calculating the tax rates and liabilities for fiduciaries in Rhode Island.

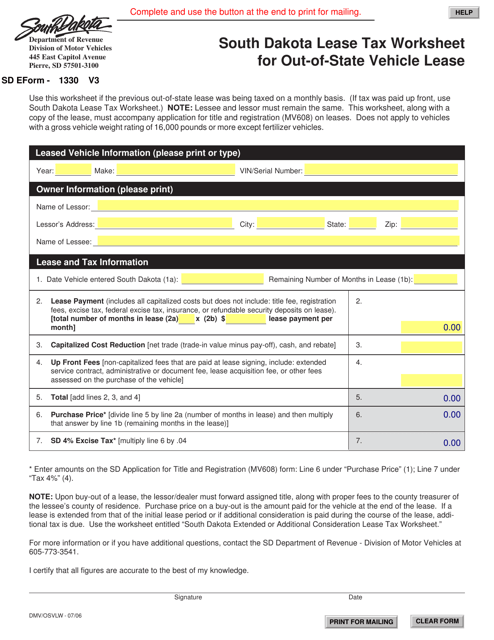

This Form is used for calculating lease tax on out-of-state vehicle leases in South Dakota.

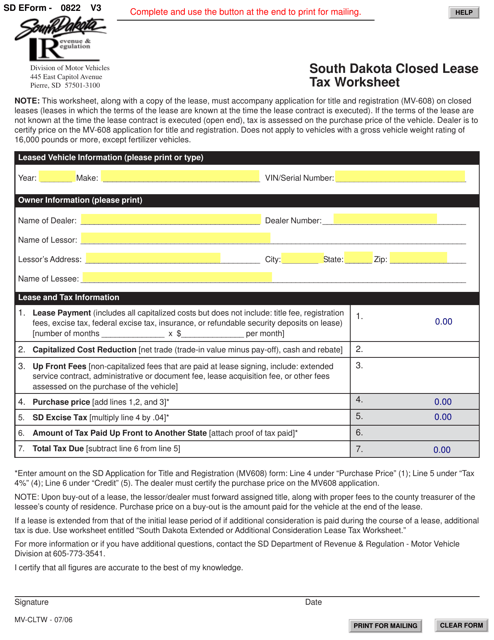

This document is a tax worksheet specific to South Dakota for closed lease transactions. It is used to calculate and report taxes related to the lease of a vehicle in South Dakota.

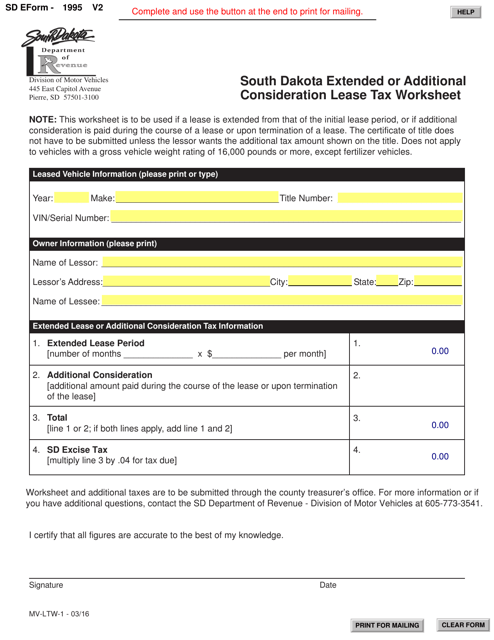

This document is used for calculating the extended or additional consideration lease tax in South Dakota.

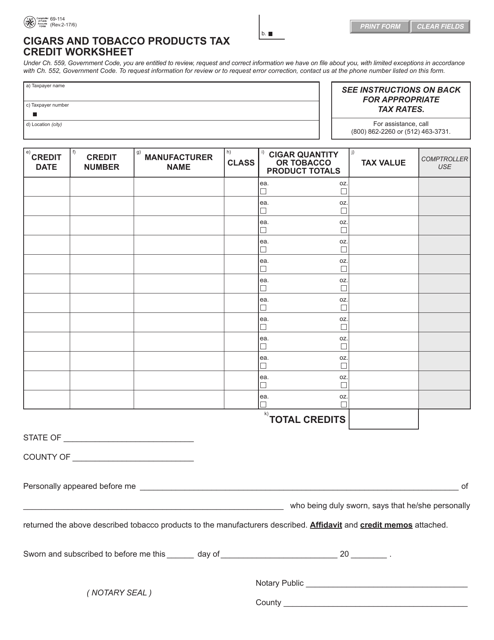

This form is used for calculating the tax credit for cigars and tobacco products in Texas.

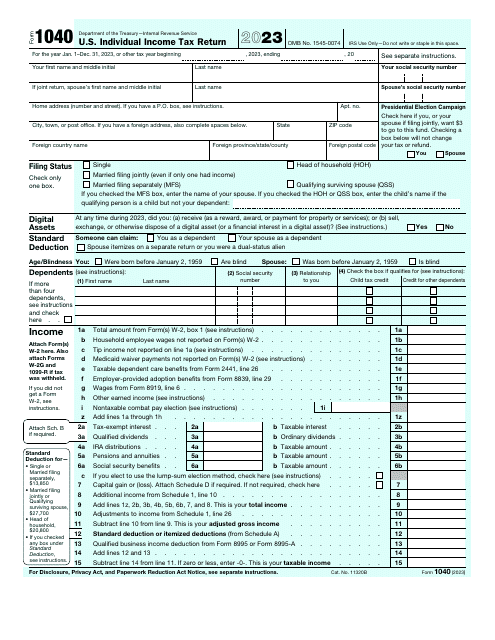

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.