Kansas Tax Forms and Templates

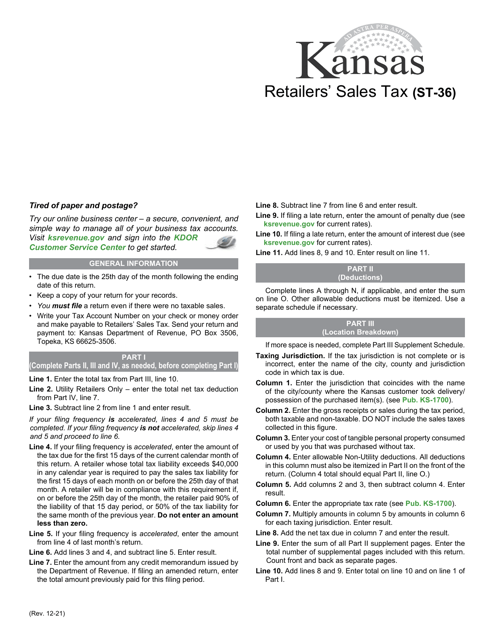

Kansas Tax Forms are used by individuals and businesses in the state of Kansas to report their income, calculate their taxes owed, and claim any applicable deductions, credits, or exemptions. These forms cover various types of taxes, including income tax, sales tax, property tax, and tobacco products tax, among others. By filing these forms accurately and on time, taxpayers fulfill their obligations and ensure compliance with Kansas tax laws.

Documents:

67

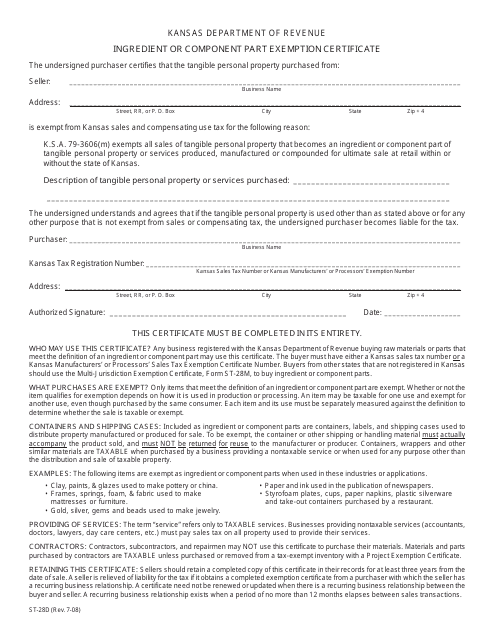

This document is used for claiming an exemption on certain ingredients or component parts in Kansas.

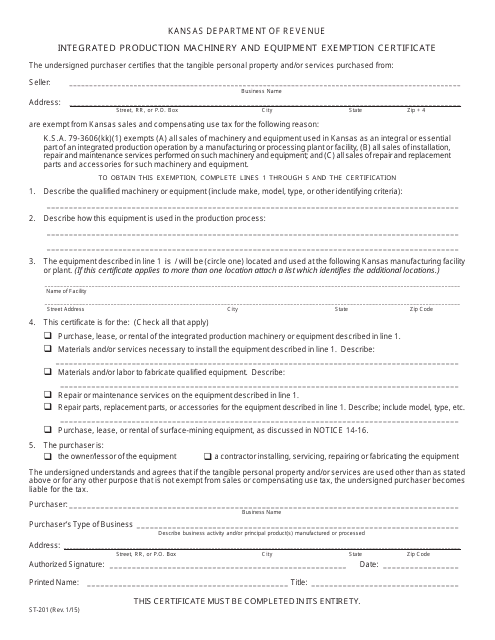

This form is used for claiming exemption from sales tax on machinery and equipment used in the production process in Kansas. It is specifically for businesses that are engaged in manufacturing, processing, or fabricating products.

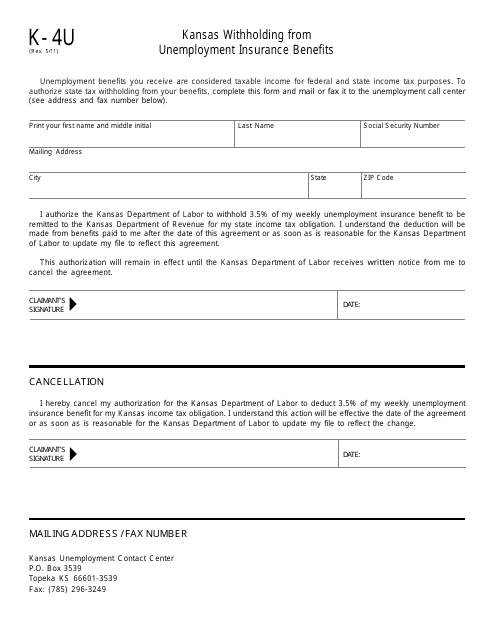

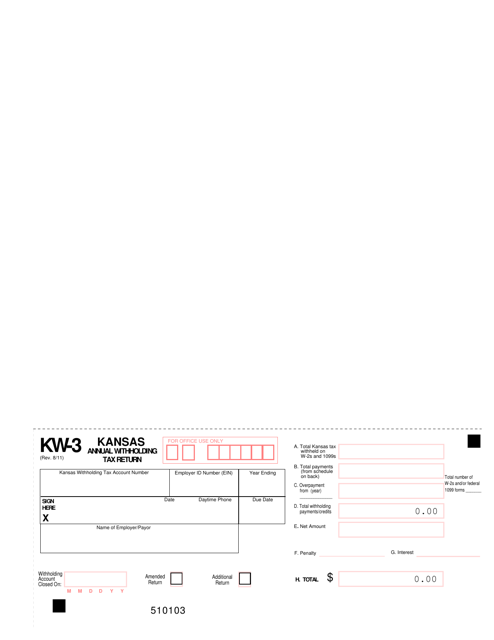

This form is used for reporting Kansas withholding allowance from unemployment benefits.

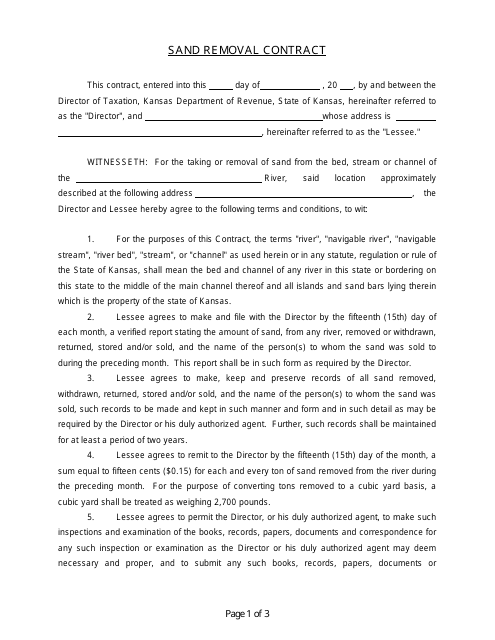

This Form is used for creating a contract for the removal of sand in Kansas.

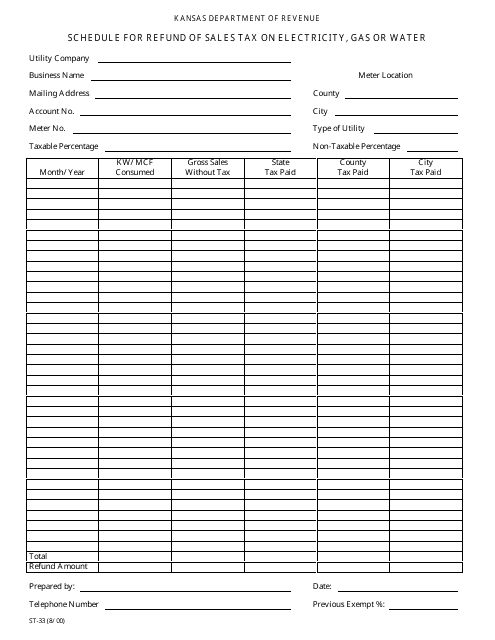

This Form is used for applying for a refund of sales tax paid on electricity, gas, or water in the state of Kansas.

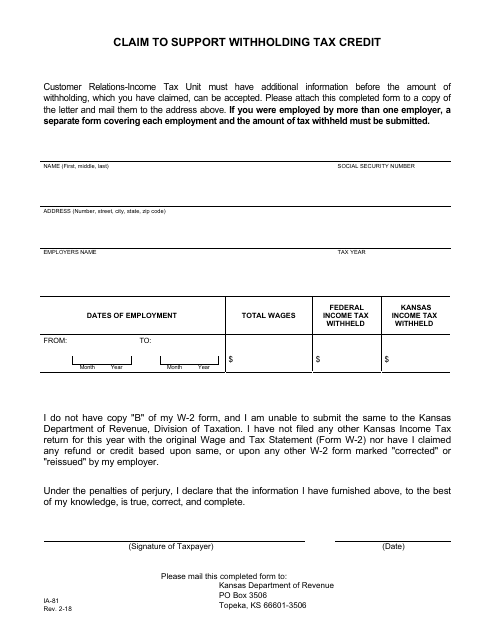

This Form is used for residents of Kansas to claim a withholding tax credit.

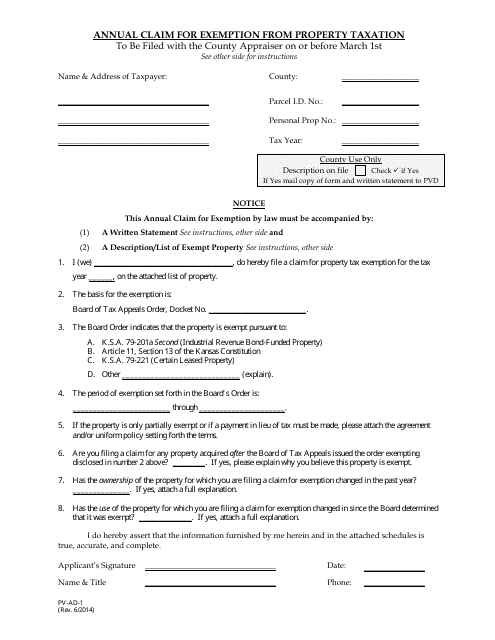

This Form is used for filing an annual claim for exemption from property taxation in the state of Kansas. It allows qualifying individuals or organizations to request an exemption from property taxes on their eligible property.

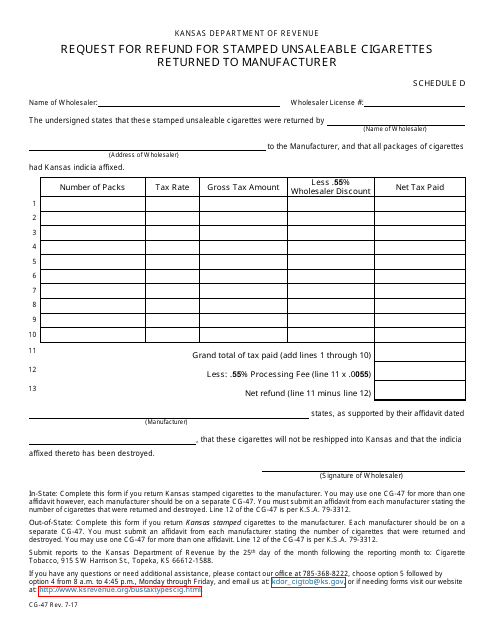

This form is used for requesting a refund for unsaleable stamped cigarettes in Kansas that have been returned to the manufacturer.

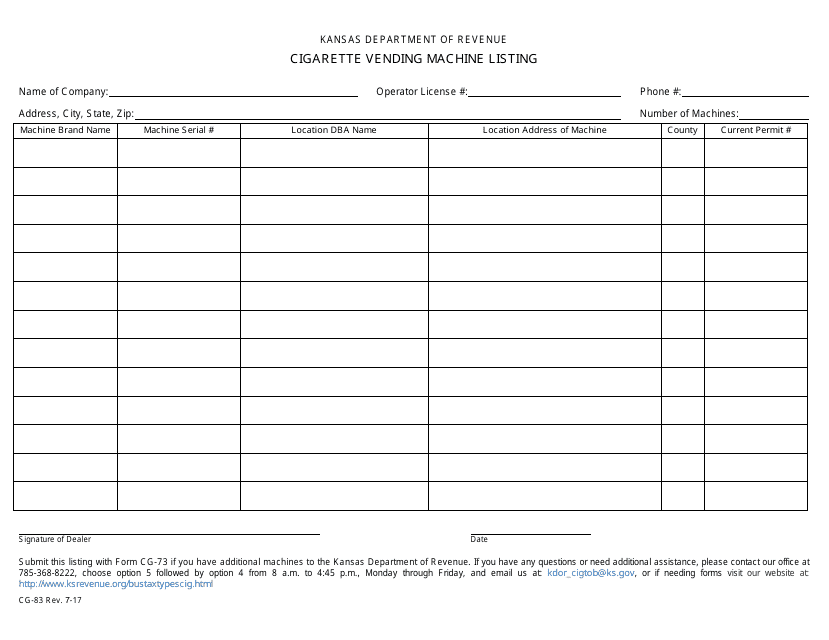

This form is used for listing cigarette vending machines in Kansas.

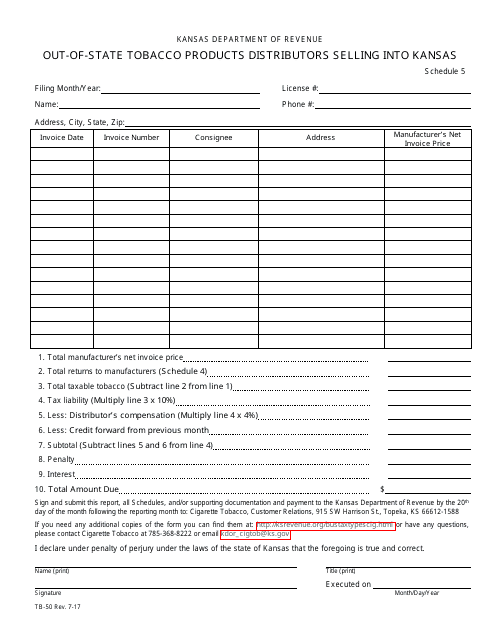

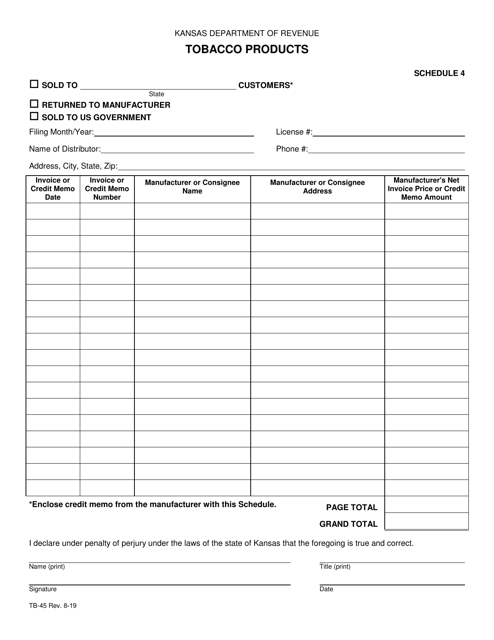

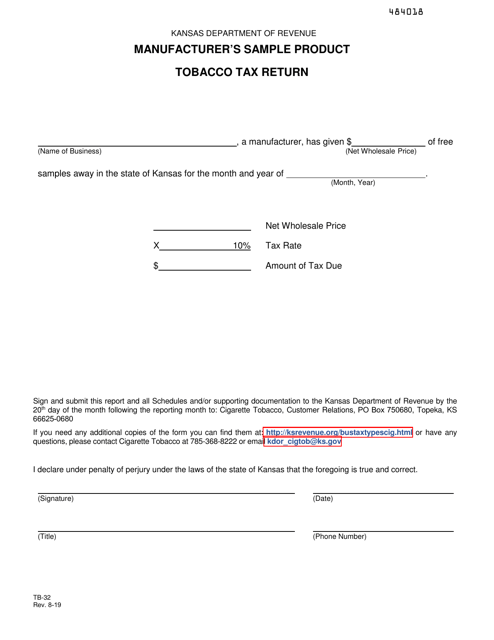

This Form is used for out-of-state tobacco product distributors who sell into Kansas to comply with Kansas regulations.

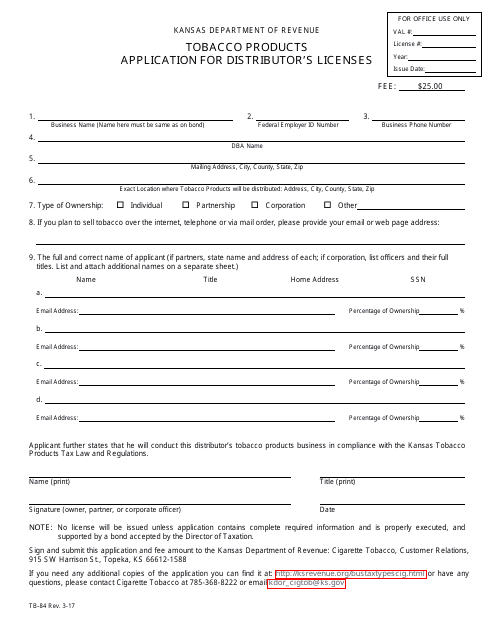

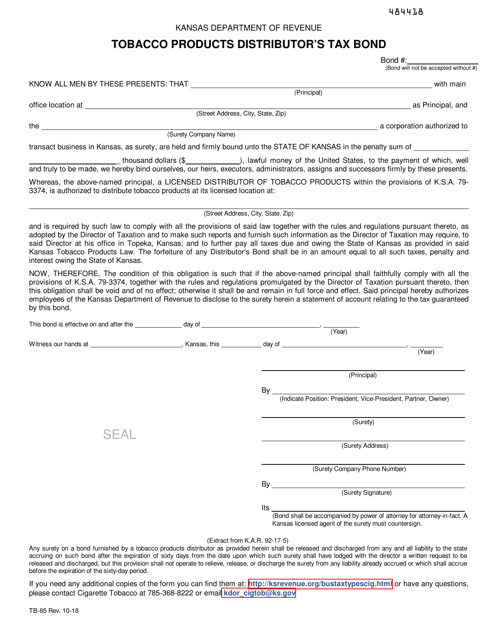

This document is used for applying for a distributor's license for tobacco products in the state of Kansas.

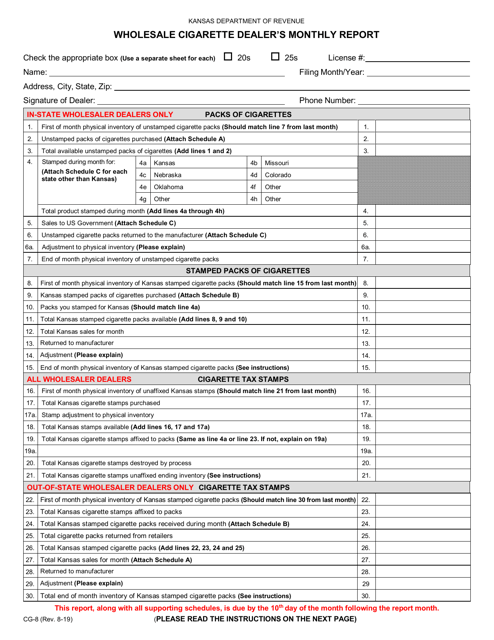

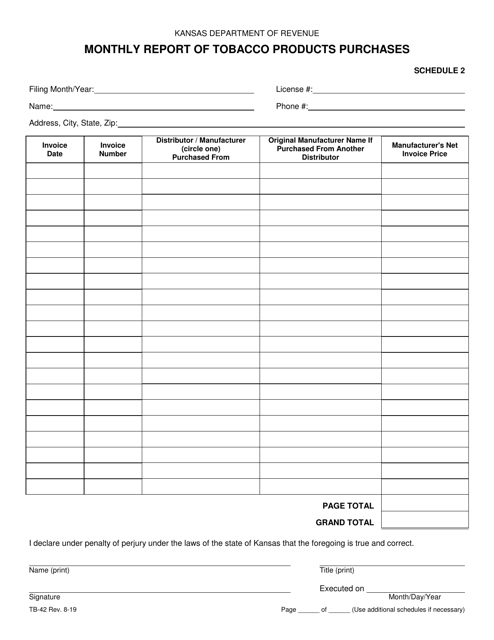

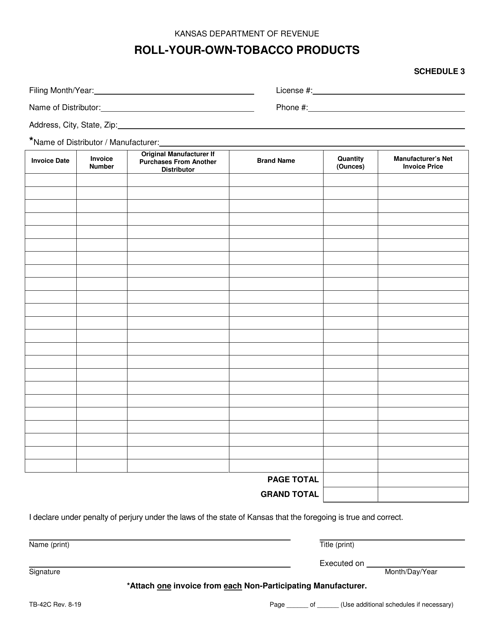

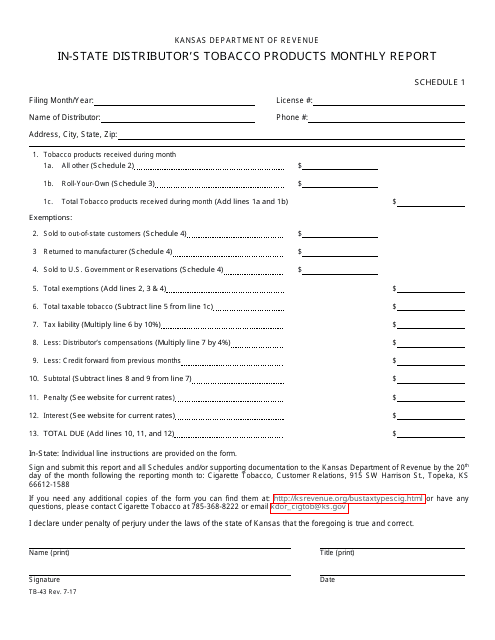

This form is used for in-state distributors of tobacco products in Kansas to report their monthly sales.

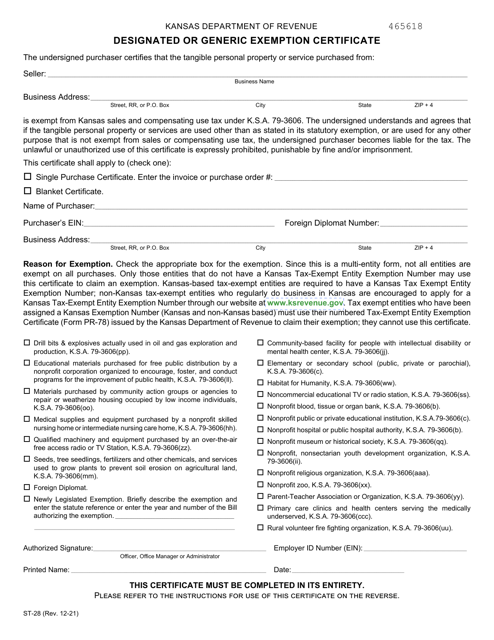

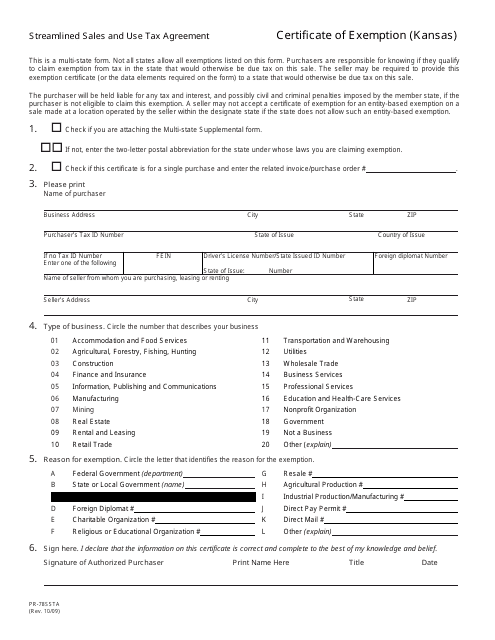

This form is used for obtaining a certificate of exemption from sales and use taxes in Kansas under the Streamlined Sales and Use Tax Agreement.

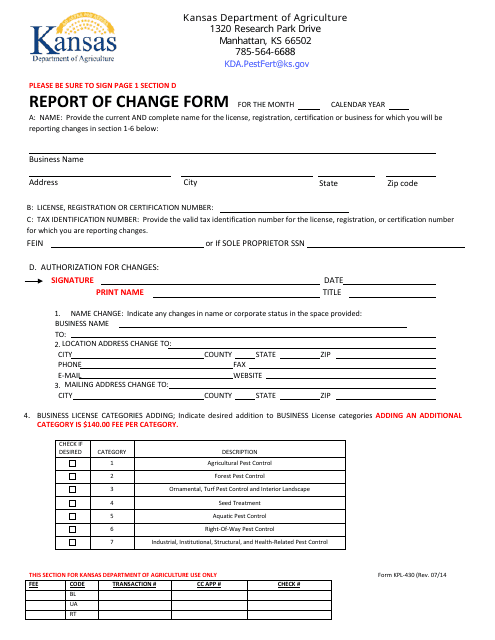

This form is used for reporting changes in Kansas.

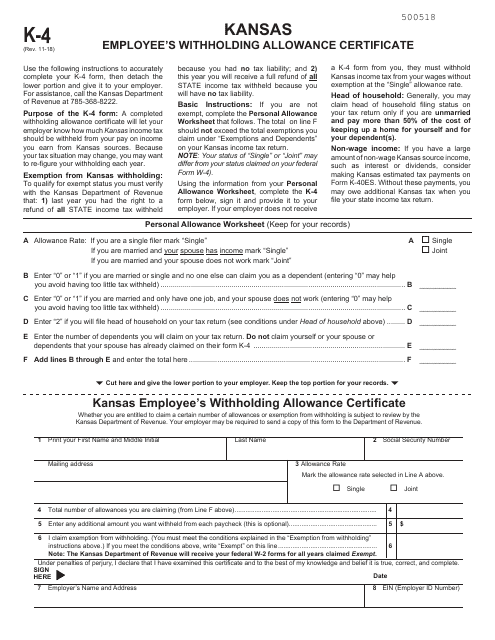

This form is used for employees in Kansas to declare their withholding allowances for state income tax purposes.

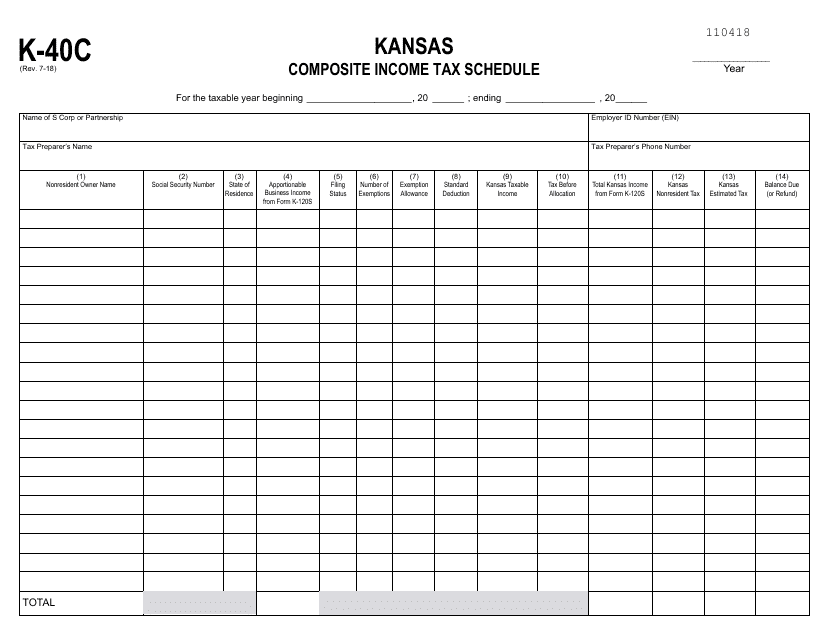

This form is used for reporting composite income tax for individuals in the state of Kansas.

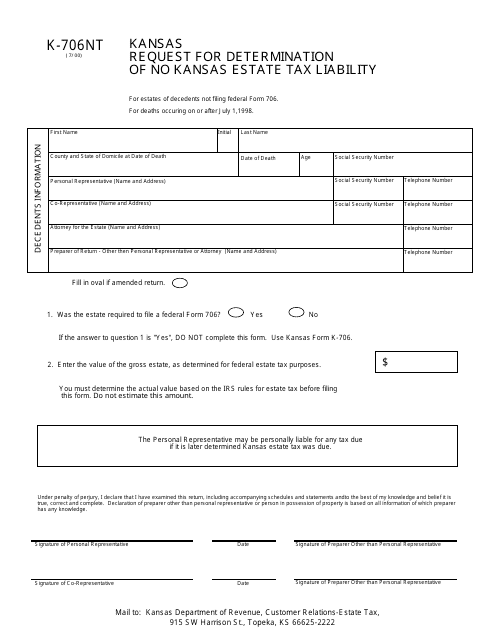

This form is used for requesting a determination of no Kansas estate tax liability in the state of Kansas.

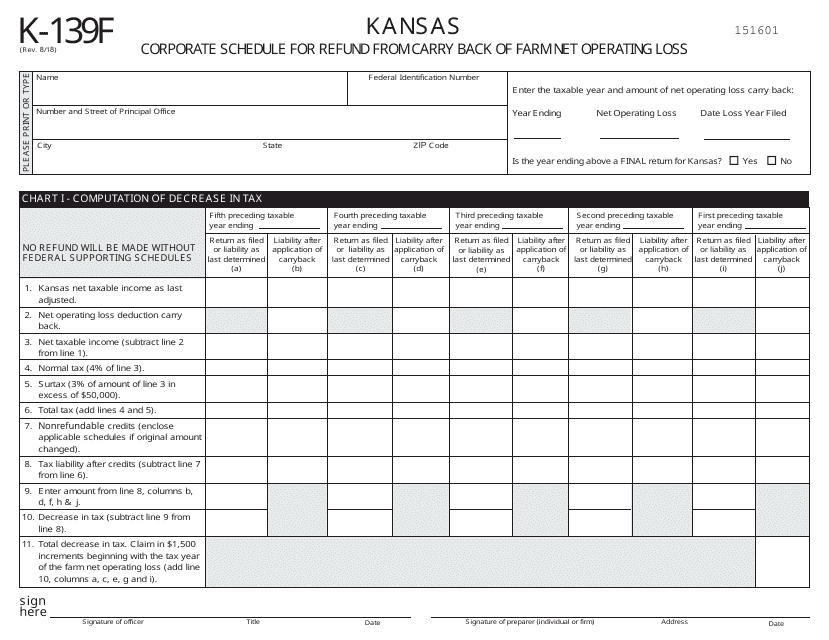

This form is used for Kansas corporations to claim a refund from carrying back farm net operating losses.

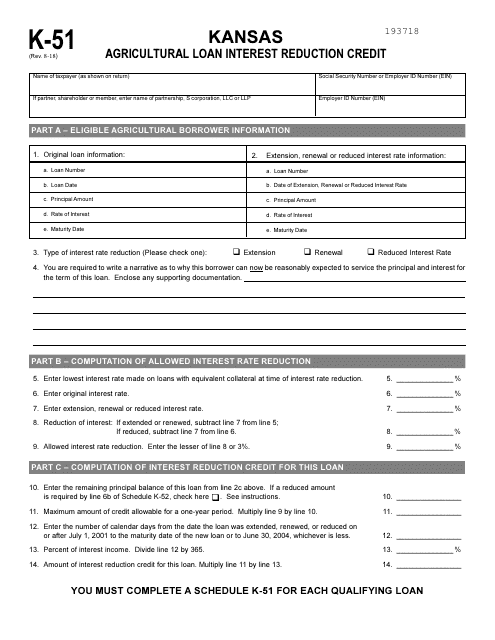

This document is used for claiming the Agricultural Loan Interest Reduction Credit in the state of Kansas for qualifying farmers and ranchers who have received an agricultural loan.

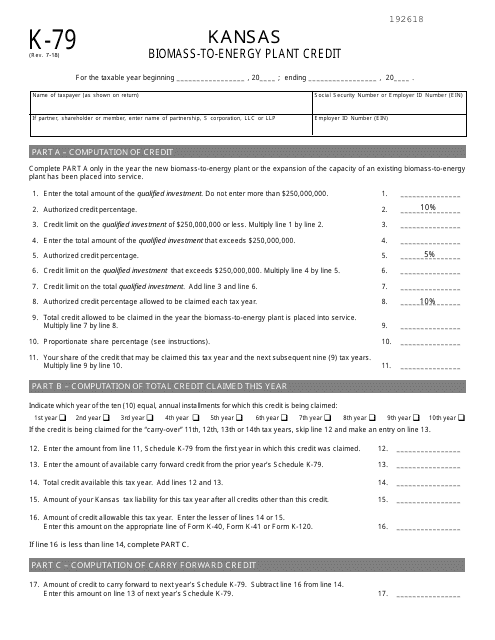

This form is used for claiming the Biomass-To-Energy Plant Credit in the state of Kansas. It allows businesses that operate biomass-to-energy plants to receive a tax credit for the energy generated from biomass sources.

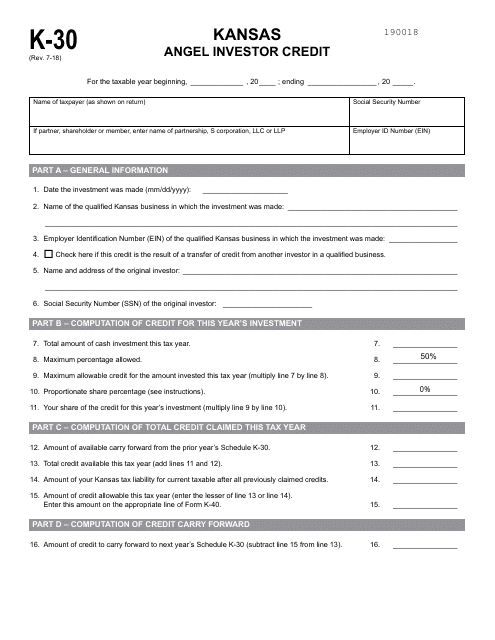

This form is used for claiming the Angel Investor Credit in Kansas. It helps individuals and businesses who invest in qualified Kansas businesses to claim a tax credit.