Iowa Tax Forms and Templates

Iowa Tax Forms are used for various purposes related to taxation in the state of Iowa. These forms are used by individuals, businesses, and organizations to report their income, expenses, and other relevant information for the purpose of calculating and paying taxes. The forms cover a range of tax obligations including income tax, sales tax, property tax, and more. They are used to help individuals and businesses fulfill their tax obligations to the state of Iowa.

Documents:

14

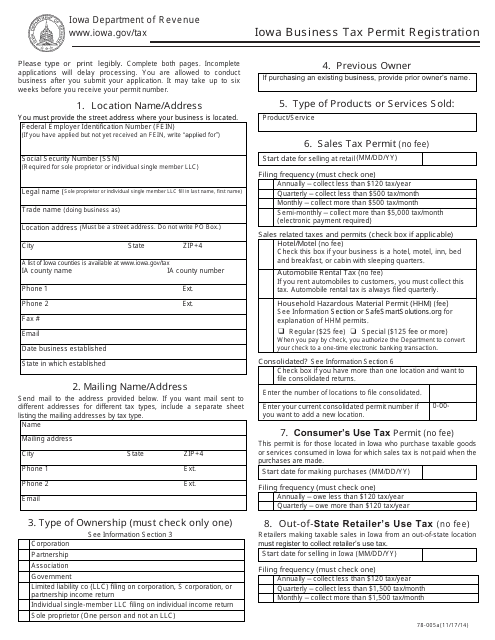

This form is used for business owners in Iowa to register for a tax permit.

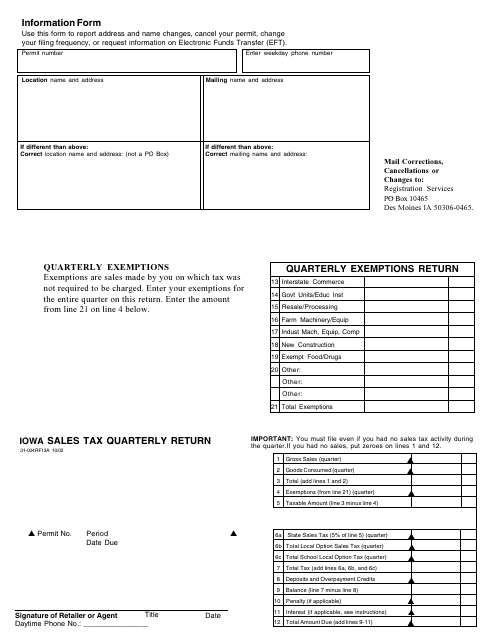

This Form is used for submitting Iowa sales tax quarterly return.

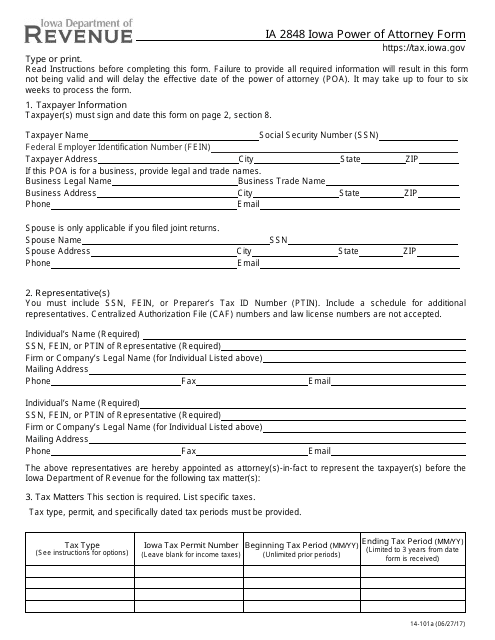

This Form is used for Iowa residents to appoint a power of attorney in Iowa. It allows the designated person to act on the individual's behalf in legal and financial matters.

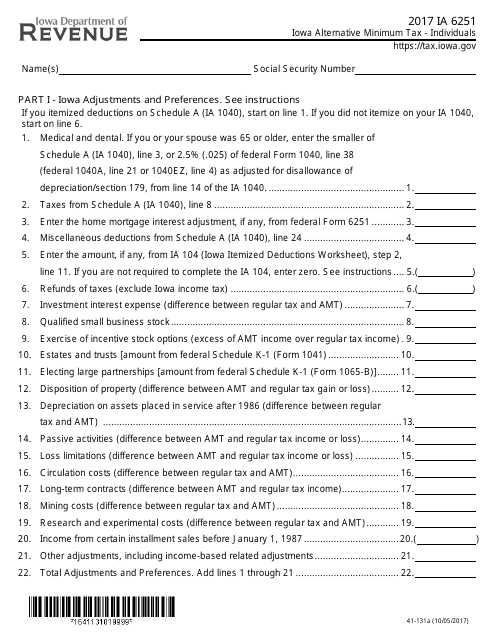

This Form is used for calculating the alternative minimum tax for individuals in the state of Iowa.

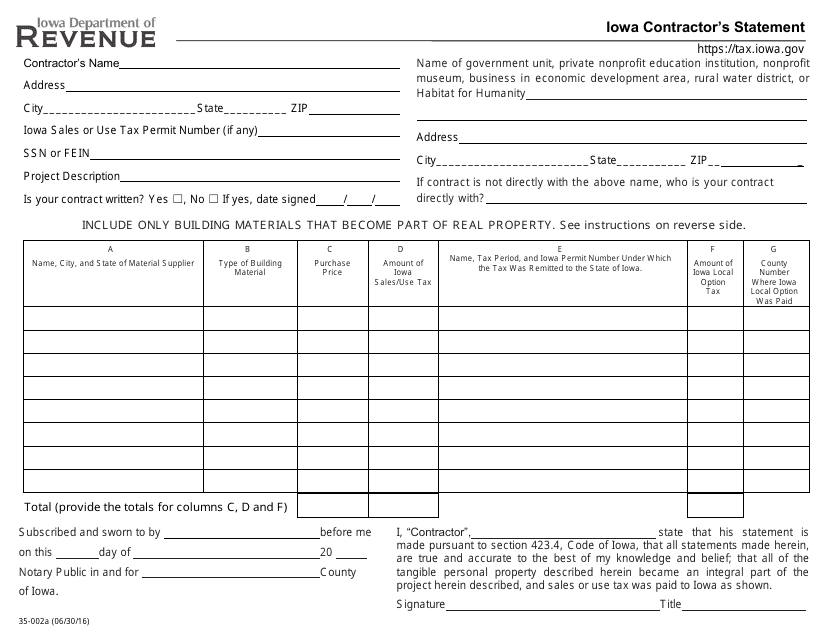

This form is used for Iowa contractors to provide a statement regarding their work.

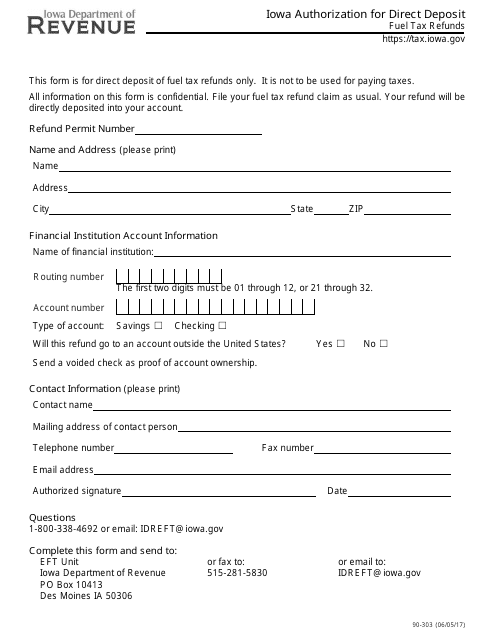

This form is used for applying to have fuel tax refunds directly deposited into your account in Iowa.

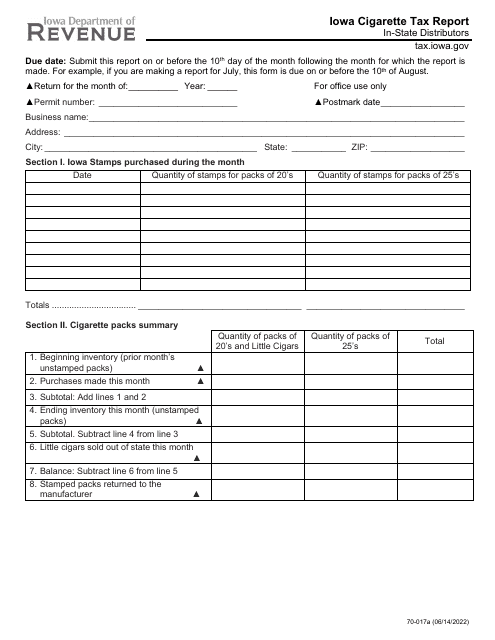

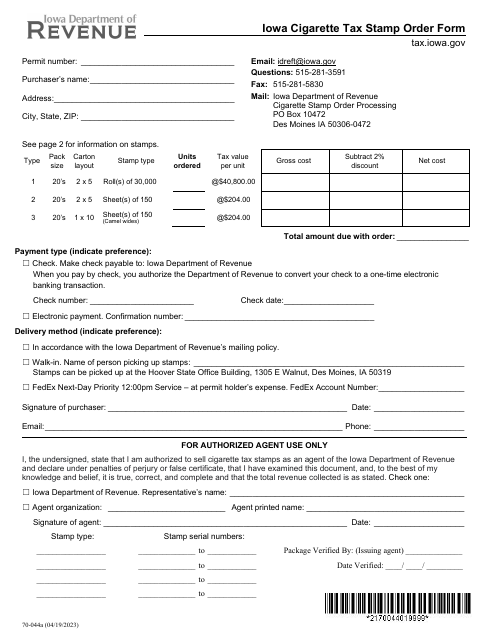

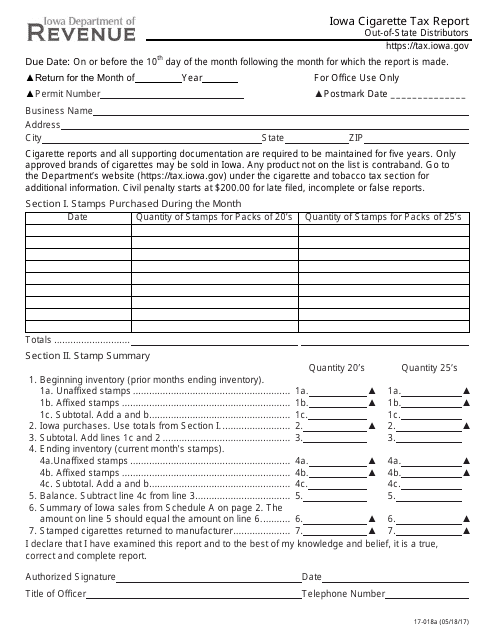

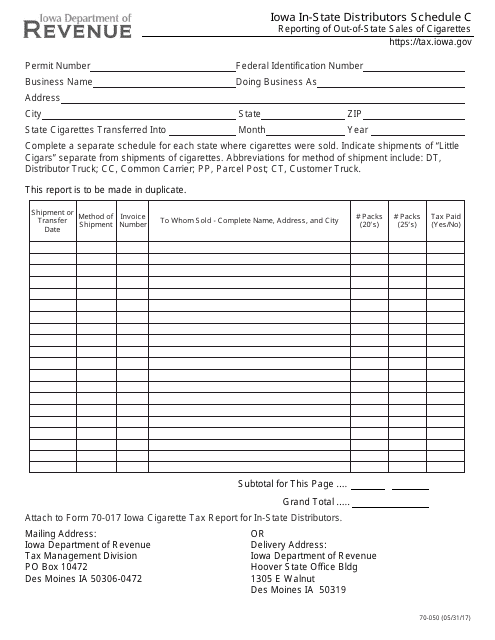

This form is used for Iowa cigarette tax report specifically for out-of-state distributors in Iowa. It helps in reporting and paying the required taxes for distributing cigarettes in the state of Iowa.

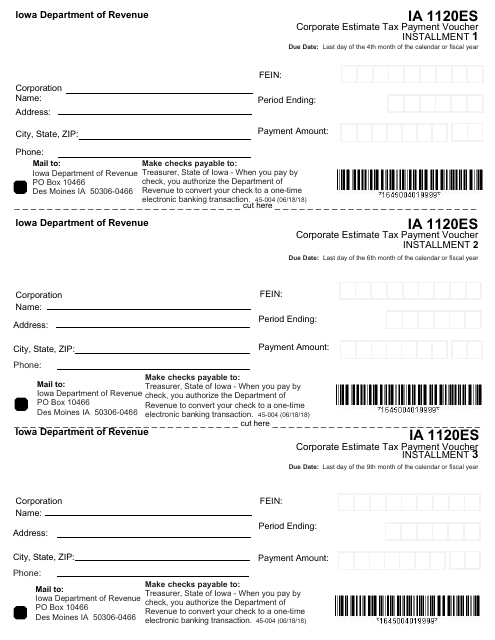

This form is used for making estimated tax payments by corporations in Iowa.

This Form is used for reporting out-of-state sales of cigarettes by in-state distributors in Iowa.

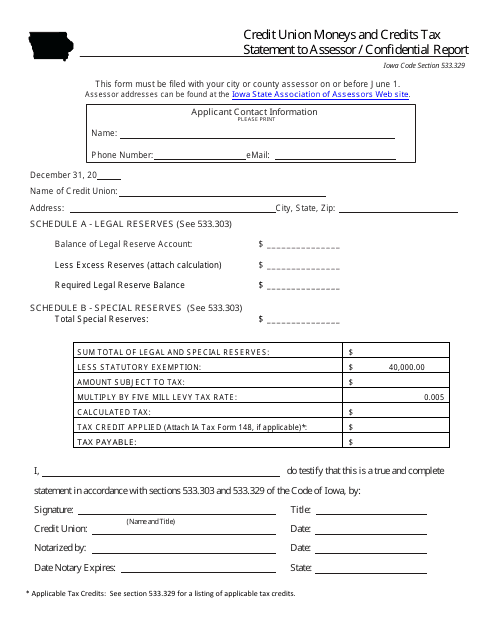

This document is used for reporting the moneys and credits of a credit union to the assessor in Iowa. It is a confidential report form.