Fill and Sign Montana Legal Forms

Documents:

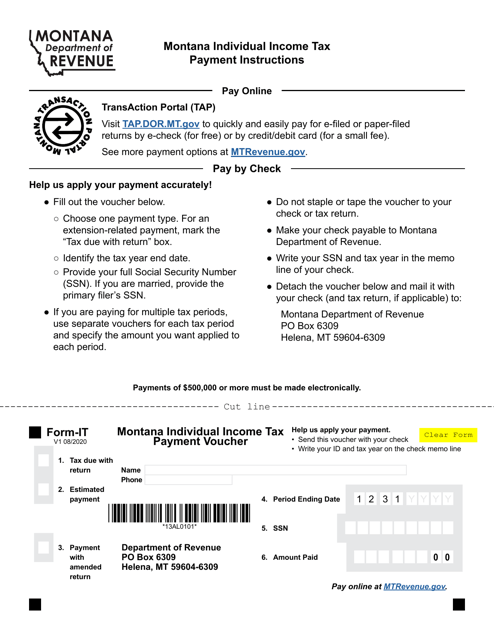

2288

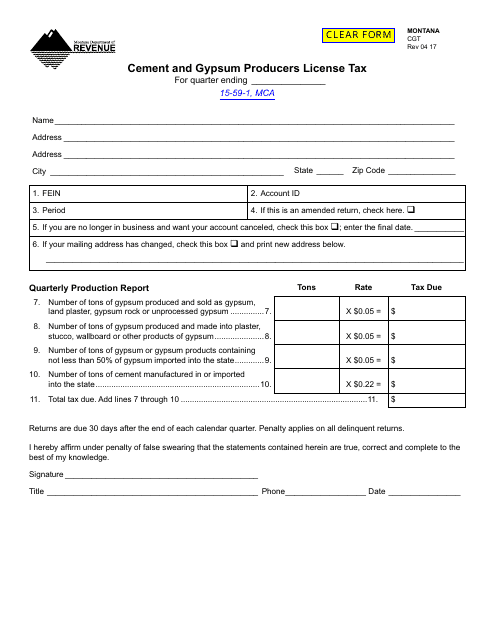

This form is used for obtaining a license tax for cement and gypsum producers in the state of Montana.

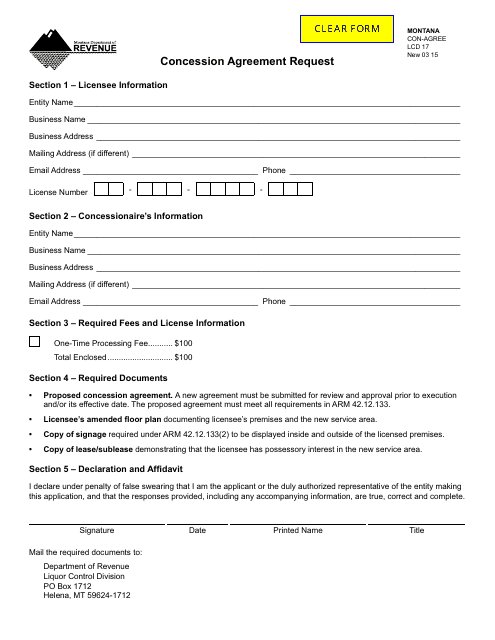

This Form is used for requesting a Concession Agreement in the state of Montana.

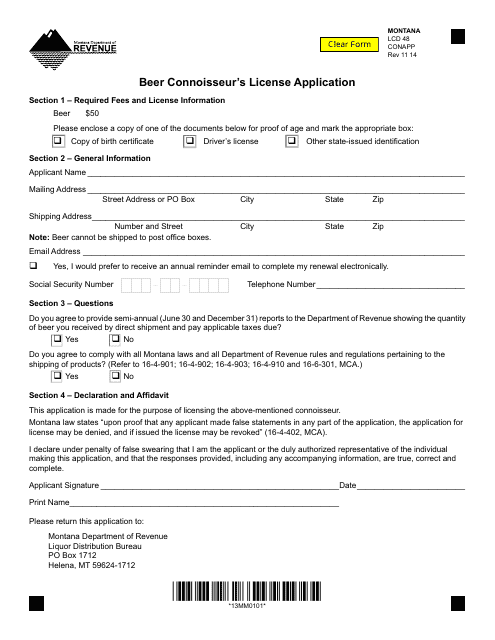

This Form is used for applying for a Beer Connoisseur's License in Montana.

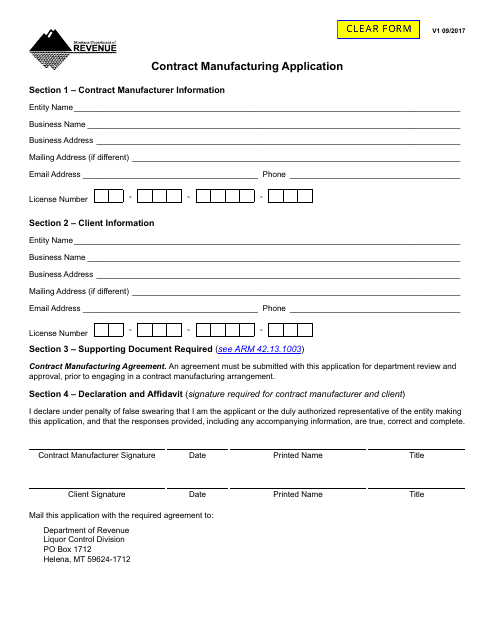

This document is used for applying for contract manufacturing services in Montana.

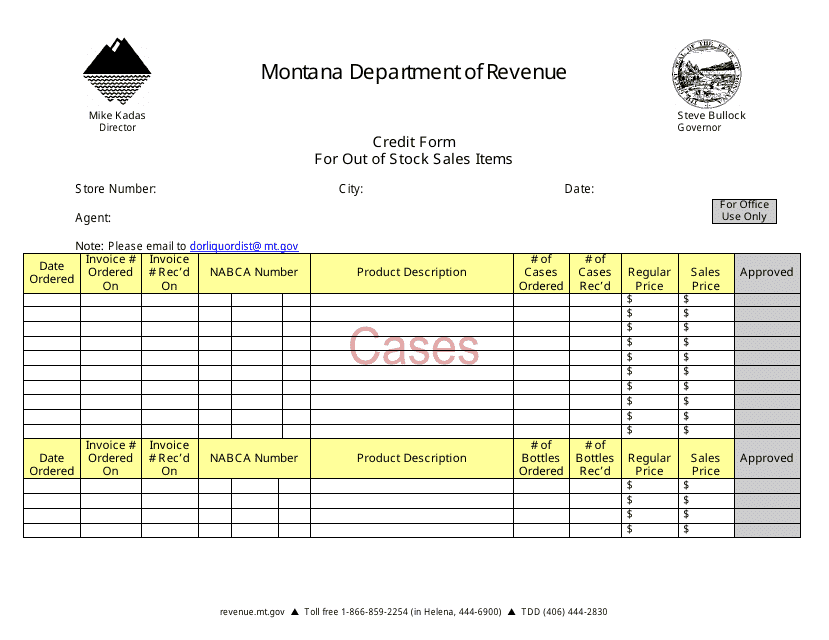

This form is used for processing credit refunds for out-of-stock sales items in Montana.

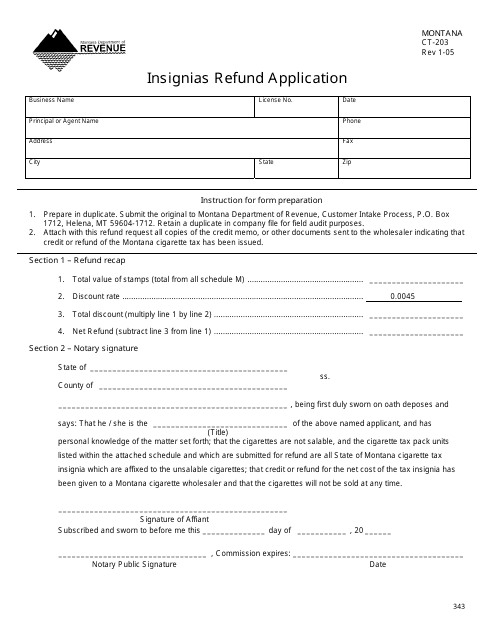

This form is used for requesting a refund for insignias in Montana.

This form is used for applying for a tax certificate in the state of Montana.

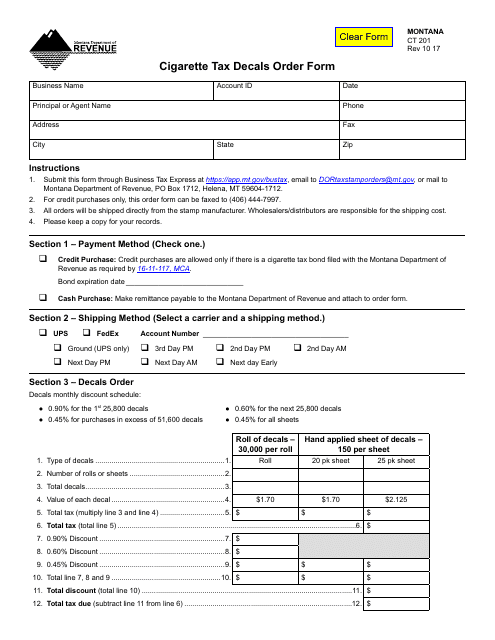

This Form is used for ordering cigarette tax decals in Montana. It facilitates the process of ensuring that appropriate taxes are paid on cigarette sales and helps monitor compliance with tax regulations.

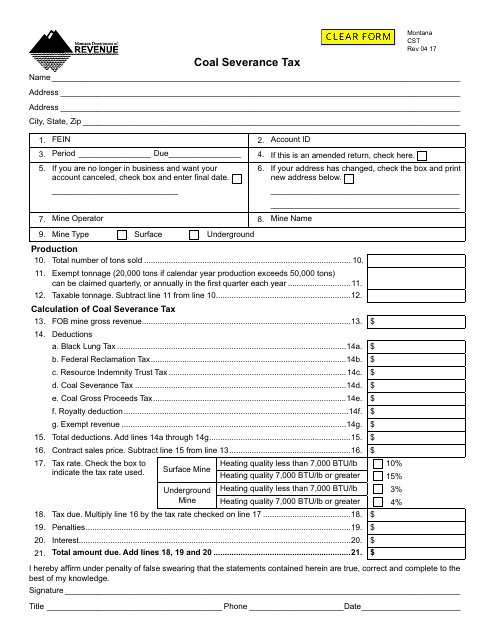

This Form is used for filing the coal severance tax in Montana. It is a tax form specifically for businesses involved in coal mining and extraction in the state.

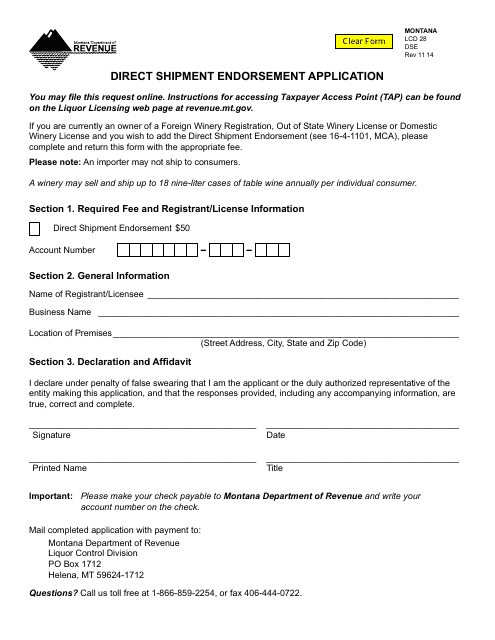

This form is used for applying for a Direct Shipment Endorsement in Montana. It allows individuals or businesses to ship certain types of alcohol directly to consumers in the state.

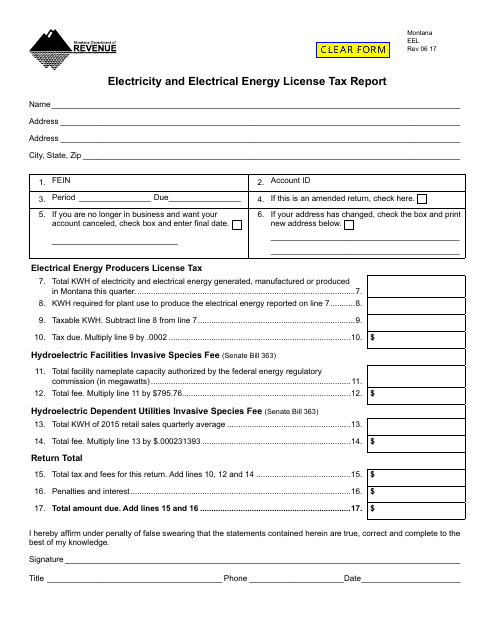

This Form is used for reporting electricity and electrical energy license tax in the state of Montana.

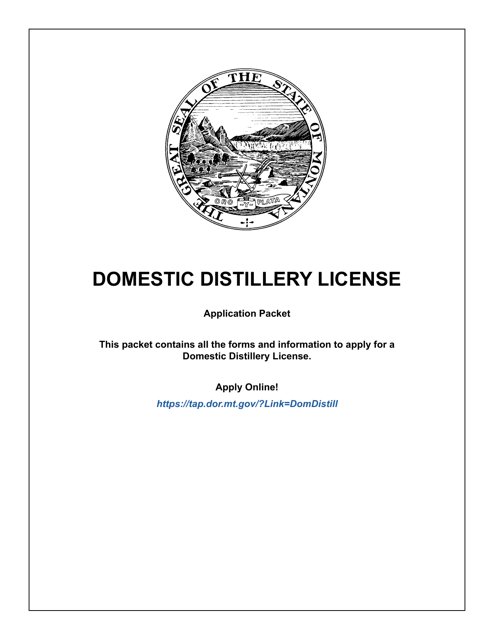

This Form is used for applying for a Domestic Winery License in Montana.

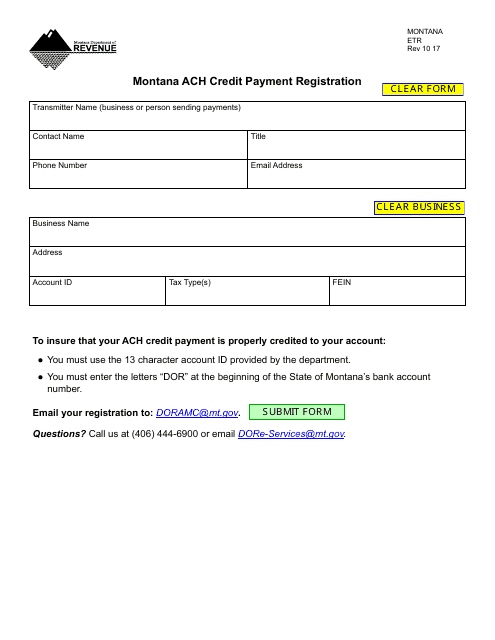

This Form is used for registering for ACH credit payment in Montana.

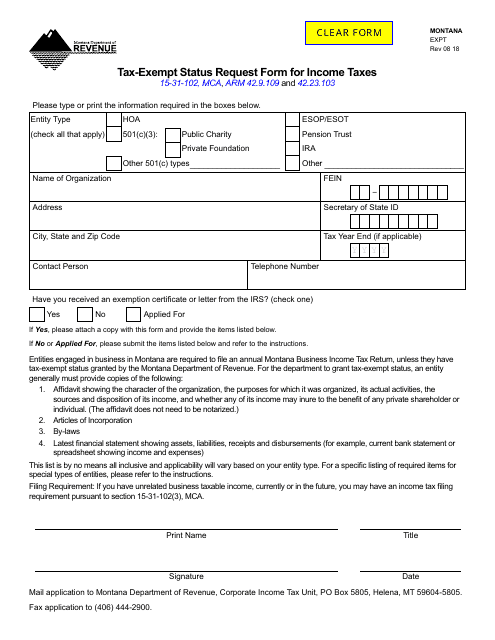

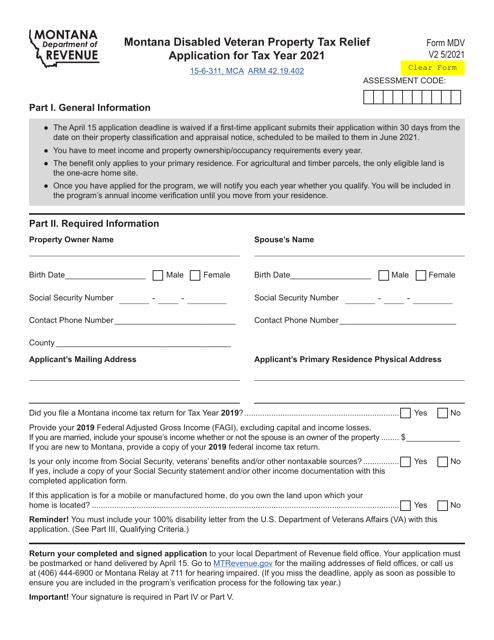

This form is used to request tax-exempt status for income taxes in Montana.

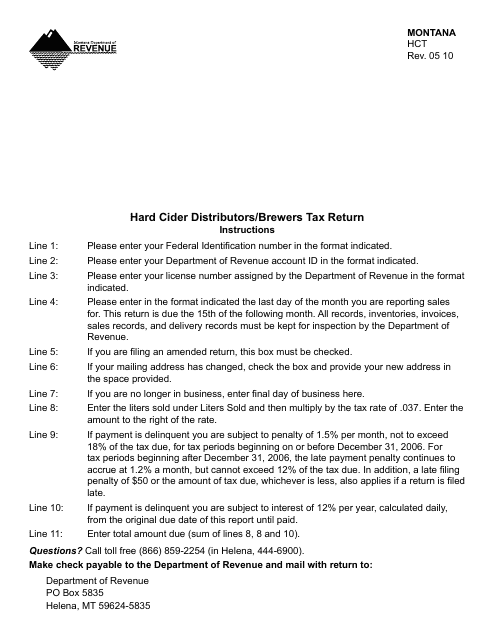

This form is used for filing the tax return for hard cider distributors and brewers in Montana.

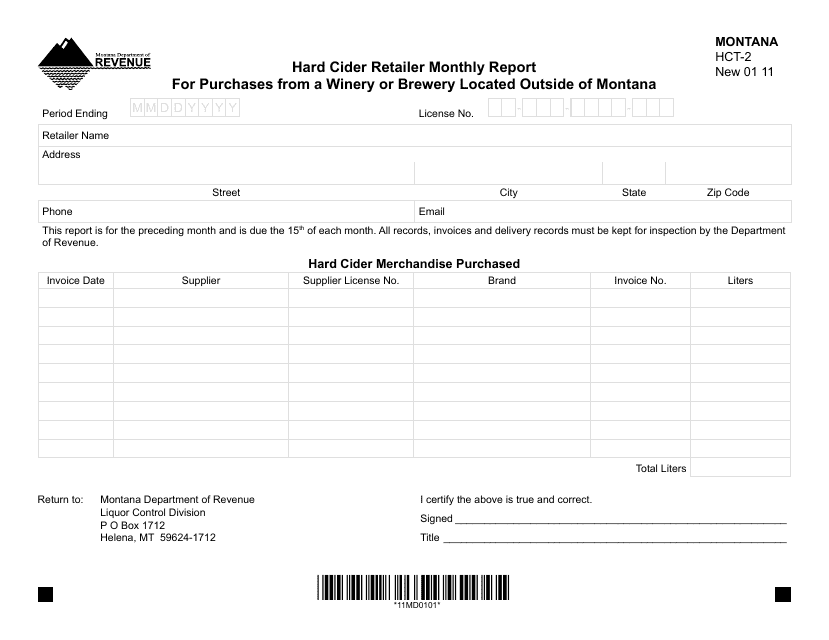

This form is used for retailers in Montana to report their monthly purchases of hard cider from wineries or breweries located outside of Montana. It is required by the Montana Department of Revenue for tax purposes.

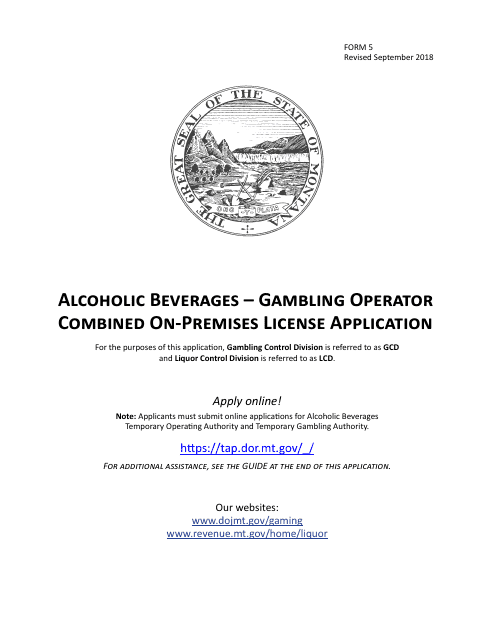

This form is used for applying for a combined on-premises license to sell alcoholic beverages and offer gambling services in Montana.

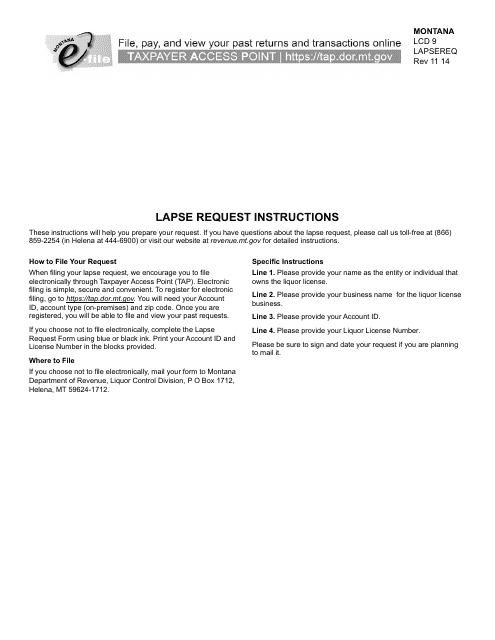

This form is used for submitting a lapse request in the state of Montana.

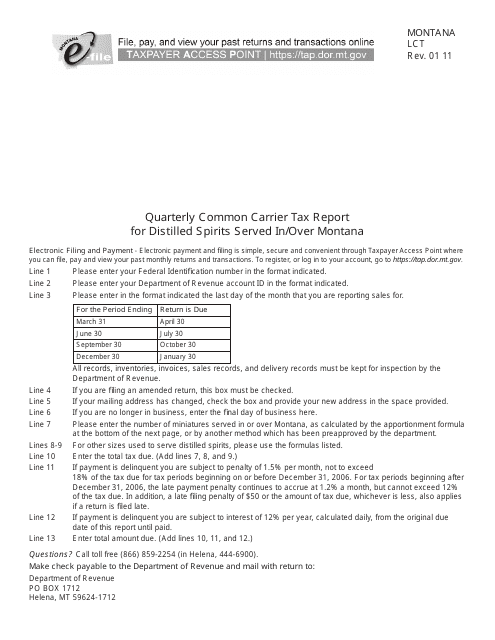

This form is used for reporting and paying the quarterly common carrier tax on distilled spirits served in or over Montana. It is specific to Montana and is required for businesses involved in the transportation or delivery of distilled spirits within the state.

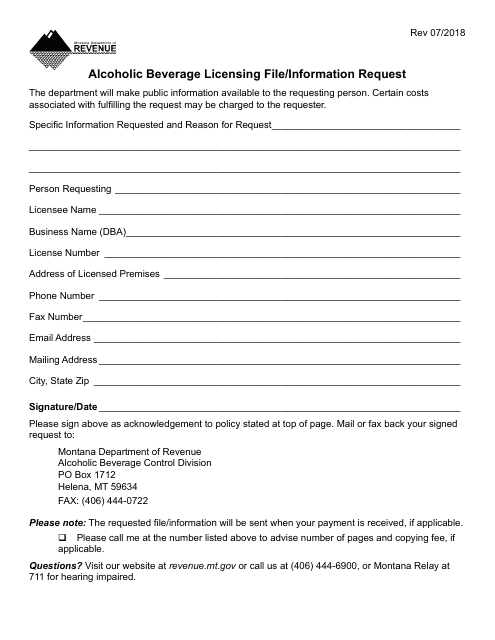

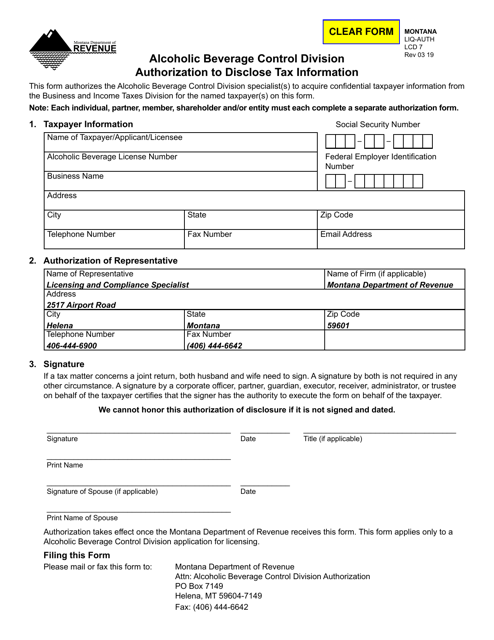

This form is used for requesting information about the alcoholic beverage licensing file in Montana.

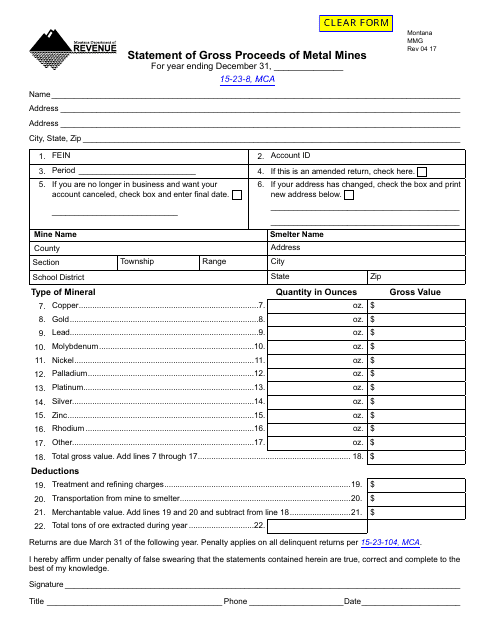

This Form is used for reporting the total revenue generated from metal mines in Montana. It provides a detailed breakdown of the gross proceeds obtained from mining activities.

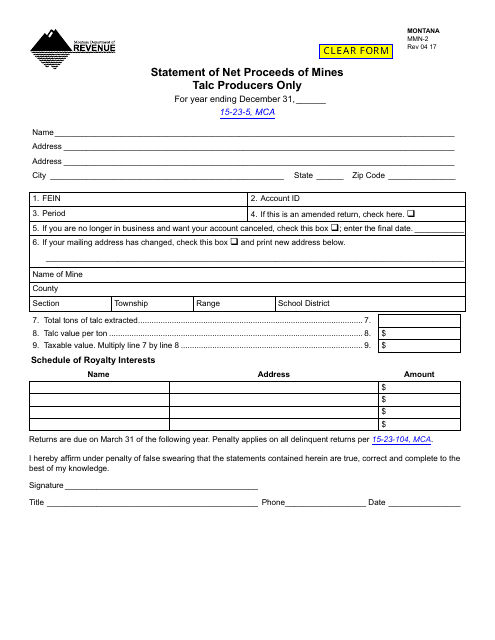

This form is used for talc producers in Montana to provide a statement of net proceeds from mines.

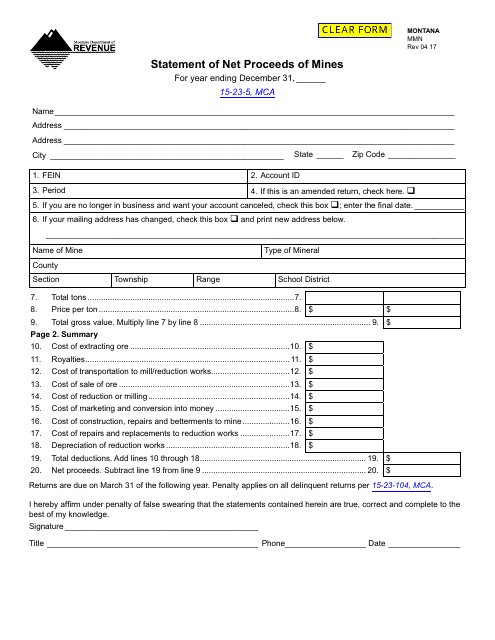

This Form is used for reporting the net proceeds of mines in the state of Montana. It helps to calculate and document the income generated from mining activities.

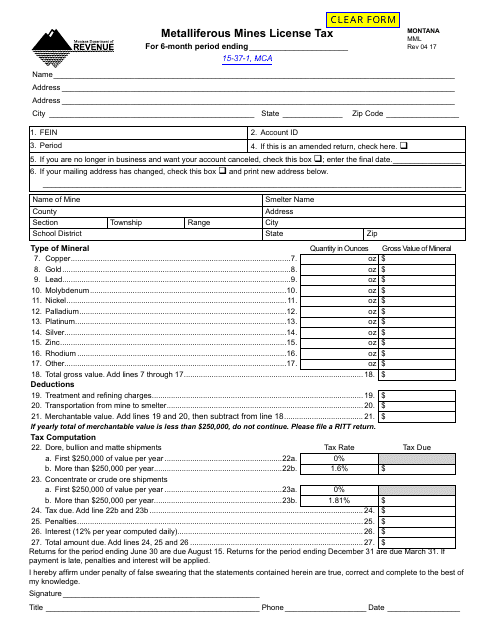

This form is used for submitting a tax payment for a Metalliferous Mines License in the state of Montana.

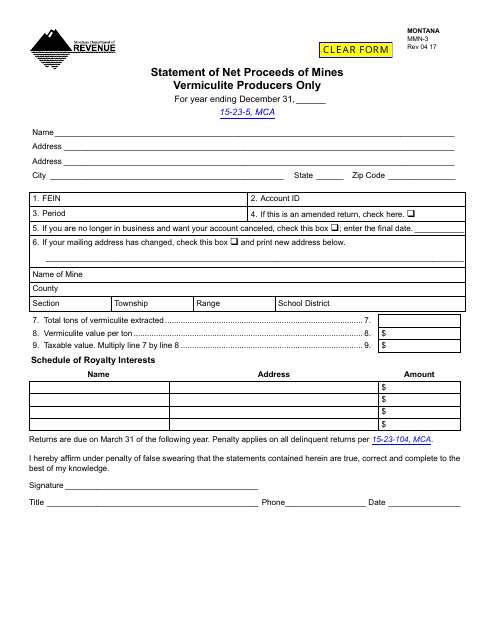

This form is used for vermiculite producers in Montana to report their statement of net proceeds of mines.

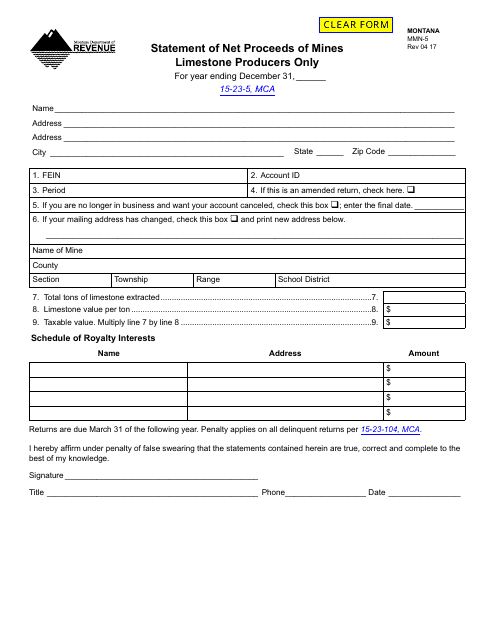

This form is used for limestone producers in Montana to report their statement of net proceeds from mining activities.

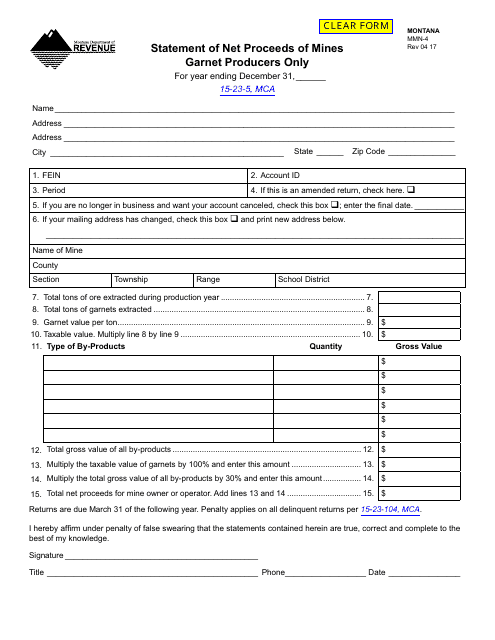

This form is used for garnet producers in Montana to report their statement of net proceeds from mining activities.

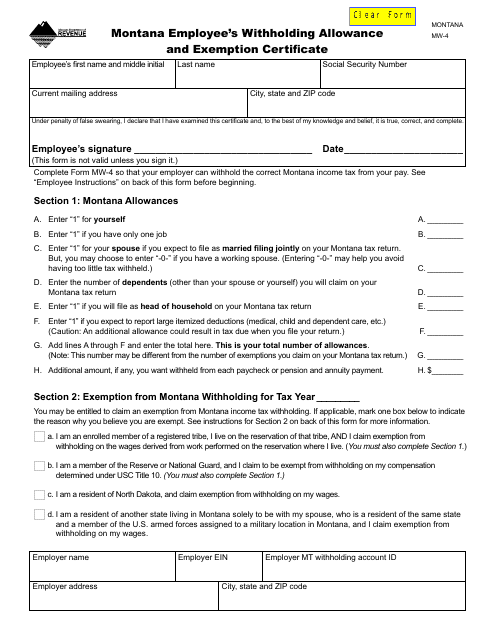

This form is used for reporting employee allowances and exemptions for state income tax withholding in Montana.