Fill and Sign Kentucky Legal Forms

Documents:

2845

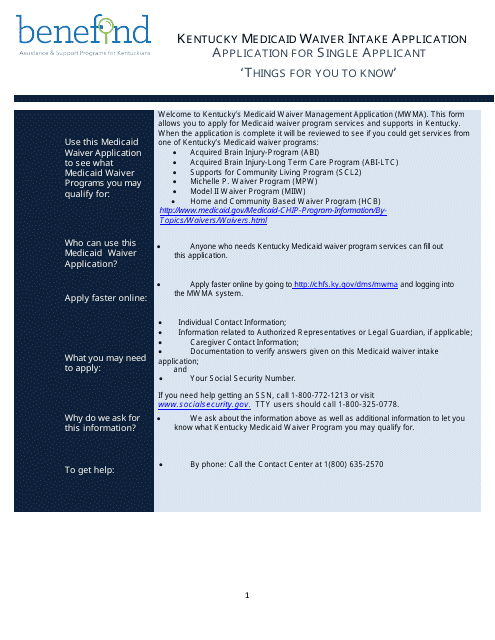

This form is used for applying for the Medicaid Waiver program in Kentucky. It is the initial application to determine eligibility for the program.

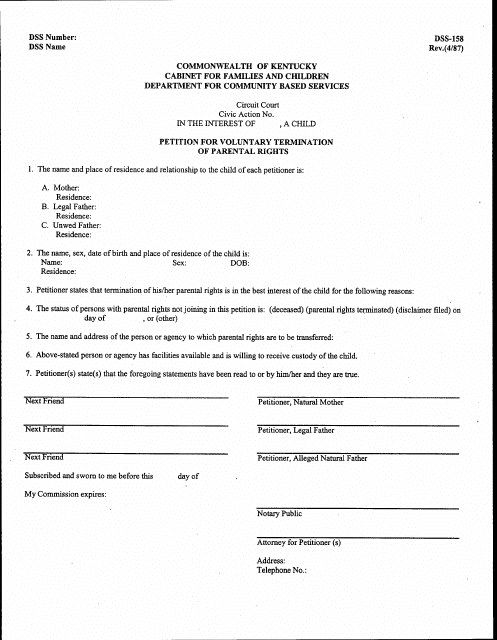

This form is used for filing a petition to voluntarily terminate parental rights in the state of Kentucky. It is used when a parent wishes to permanently relinquish their rights and responsibilities towards their child.

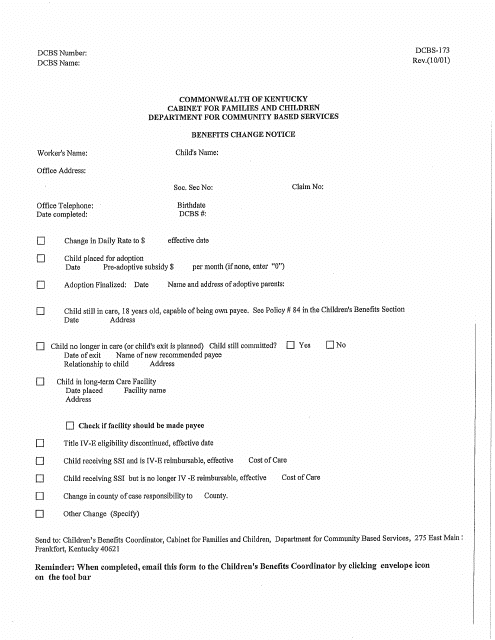

This form is used for notifying the Kentucky Department of Community Based Services about changes to your benefits.

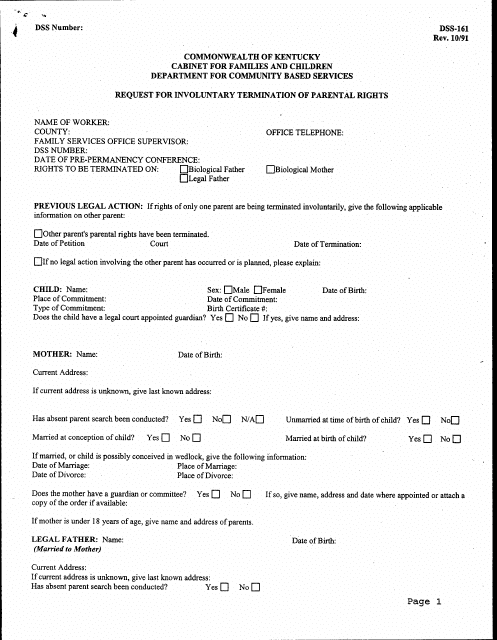

This form is used for requesting the involuntary termination of parental rights in the state of Kentucky.

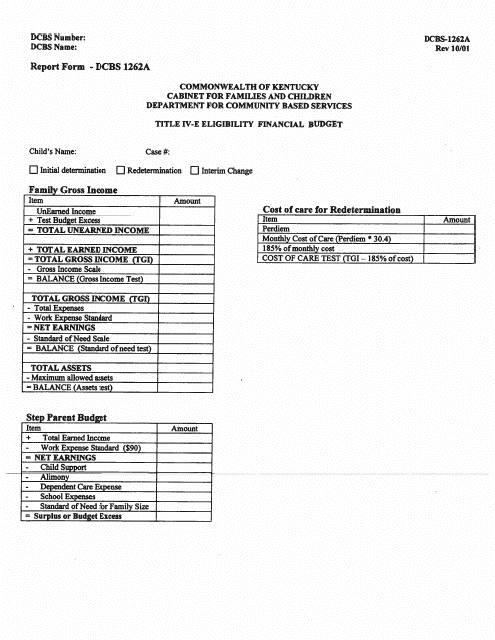

This Form is used for determining the Title IV-E eligibility financial budget in the state of Kentucky.

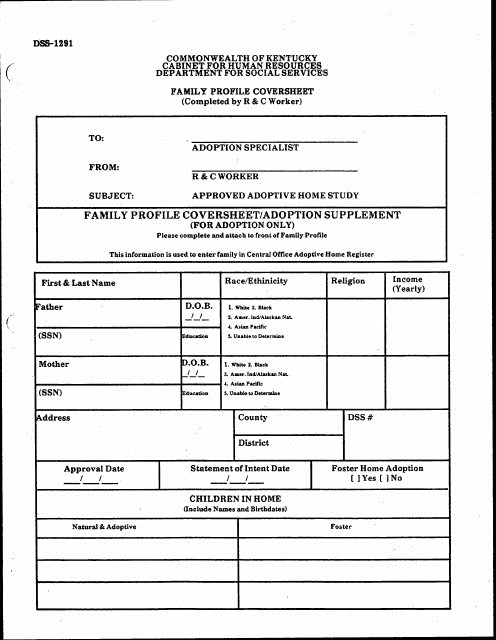

This document is used as a coversheet for the Family Profile form in Kentucky. It is used to provide an overview of the family's profile information.

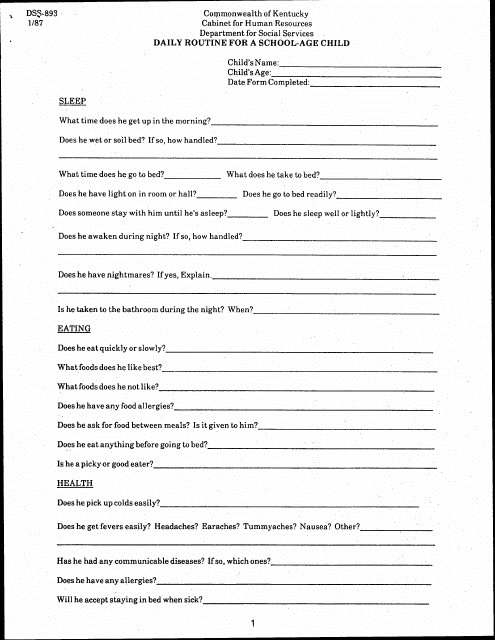

This form is used to document the daily routine of a school-age child in Kentucky. It helps parents and caregivers keep track of their child's activities and schedule.

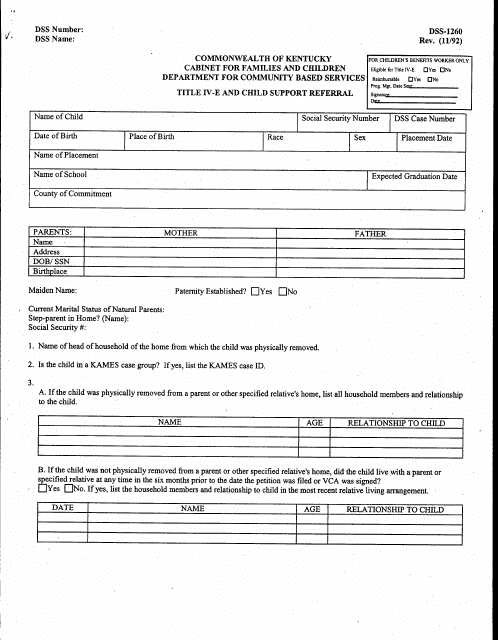

This form is used for referring child support cases to the Title IV-E program in Kentucky.

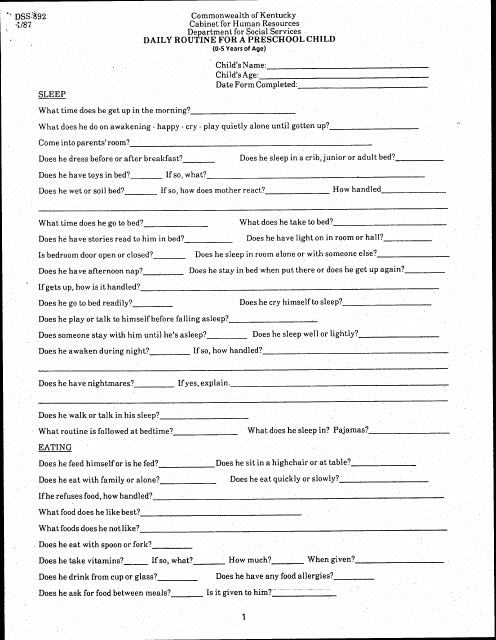

This document outlines the daily routine for preschool children in the state of Kentucky, aged between 0 and 5 years. It provides guidance on the activities, schedule, and structure of a typical day in a preschool setting in Kentucky.

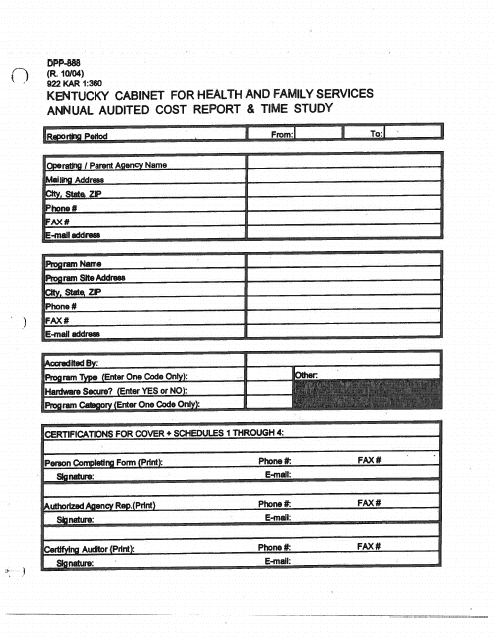

This form is used for submitting the Annual Audited Cost Report and Time Study in the state of Kentucky.

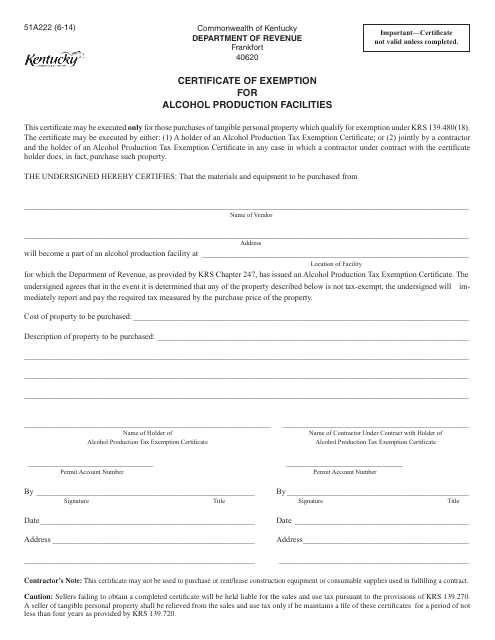

This Form is used for obtaining a certificate of exemption for alcohol production facilities in the state of Kentucky.

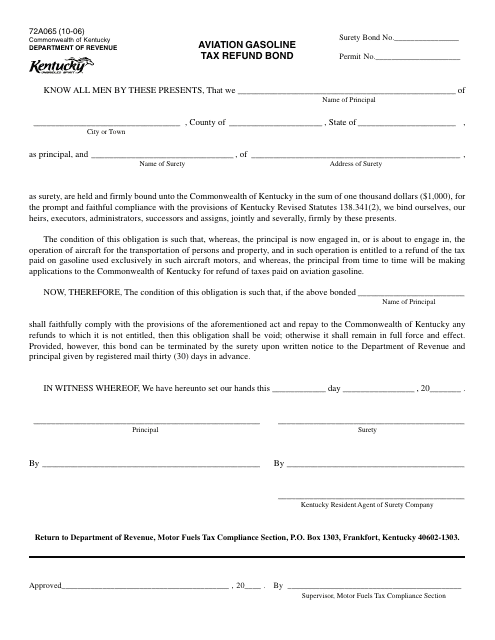

This form is used for obtaining a refund of aviation gasoline taxes paid in the state of Kentucky.

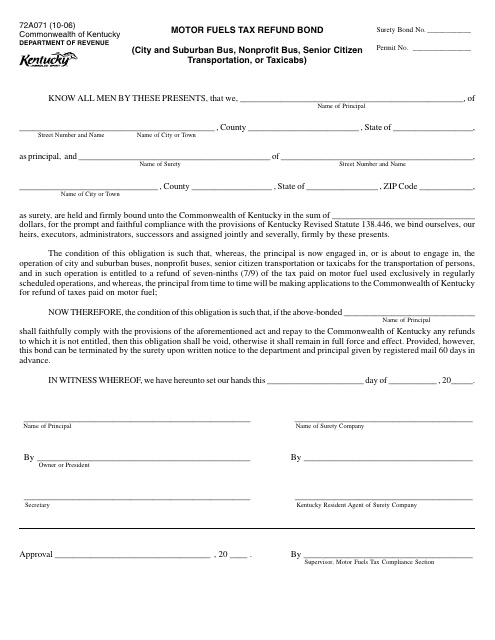

This form is used for obtaining a motor fuels tax refund bond for city and suburban buses, nonprofit buses, senior citizen transportation, or taxicabs in Kentucky.

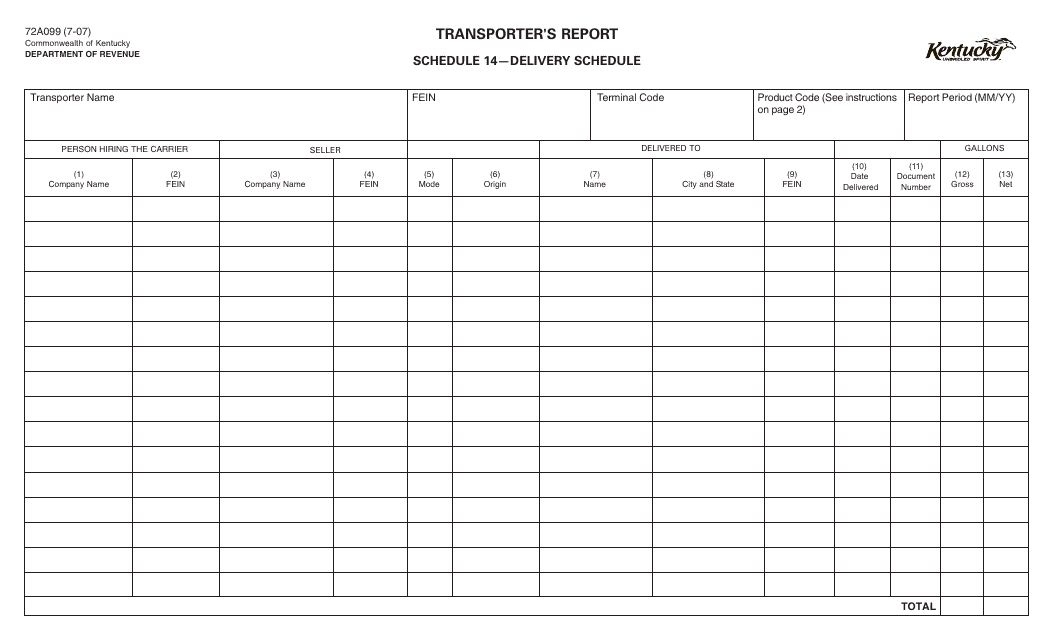

This Form is used for providing a delivery schedule in the state of Kentucky.

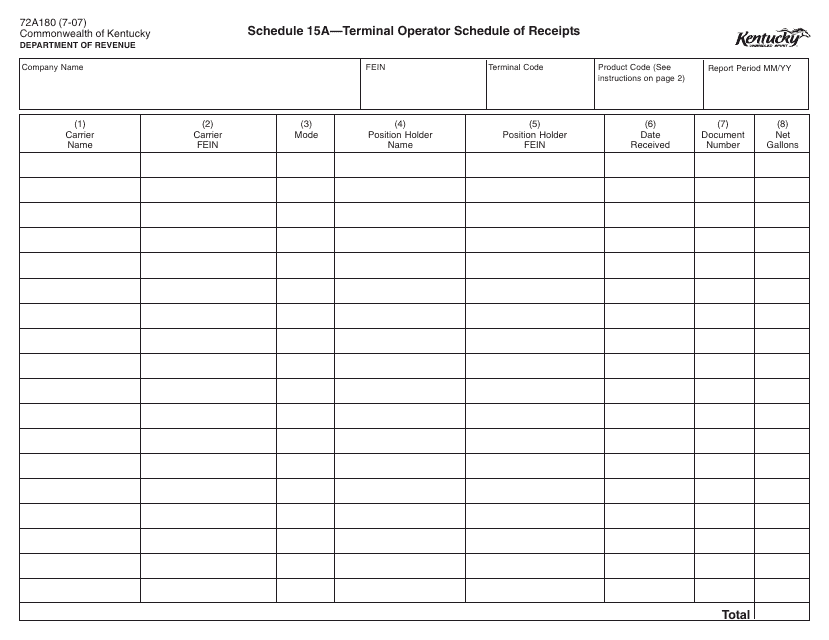

This form is used for reporting the receipts of terminal operators in Kentucky.

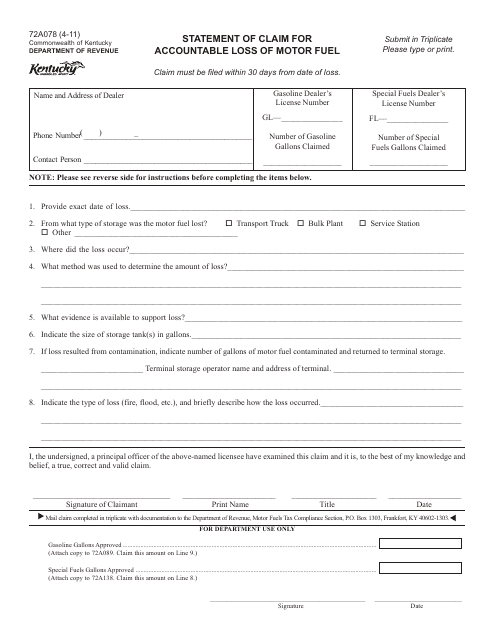

This Form is used for filing a statement of claim for accountable loss of motor fuel in the state of Kentucky.

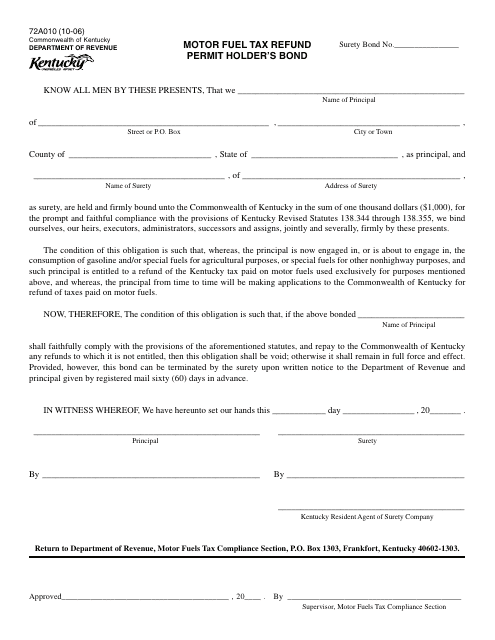

This Form is used for obtaining a refund of motor fuel taxes in Kentucky. It requires the holder of a Motor Fuel Tax Refund Permit to provide a bond.

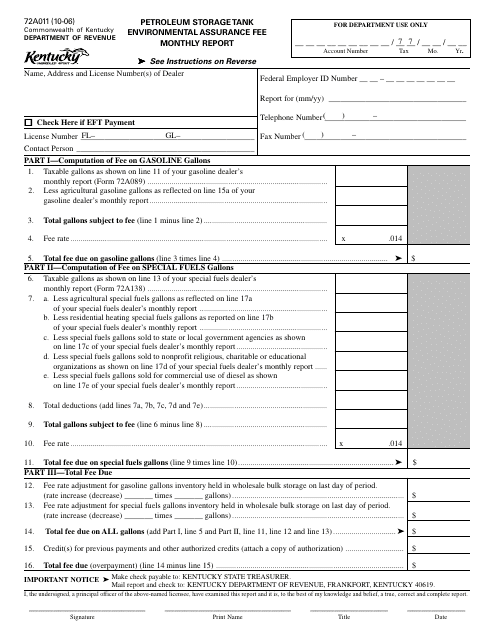

This Form is used for reporting the monthly fees related to petroleum storage tanks in Kentucky.

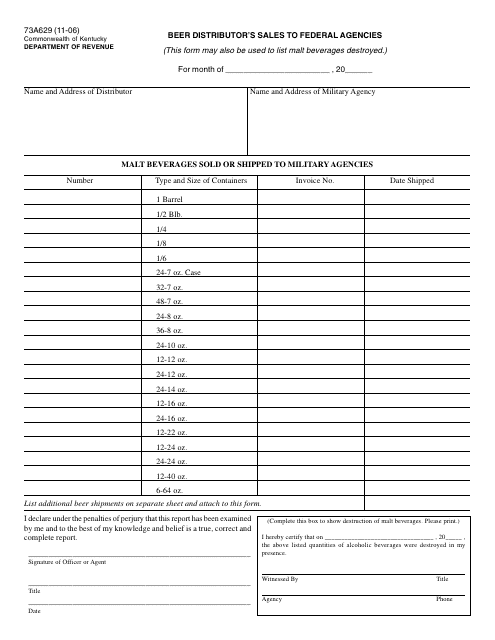

This form is used for beer distributors in Kentucky to report their sales to federal agencies.

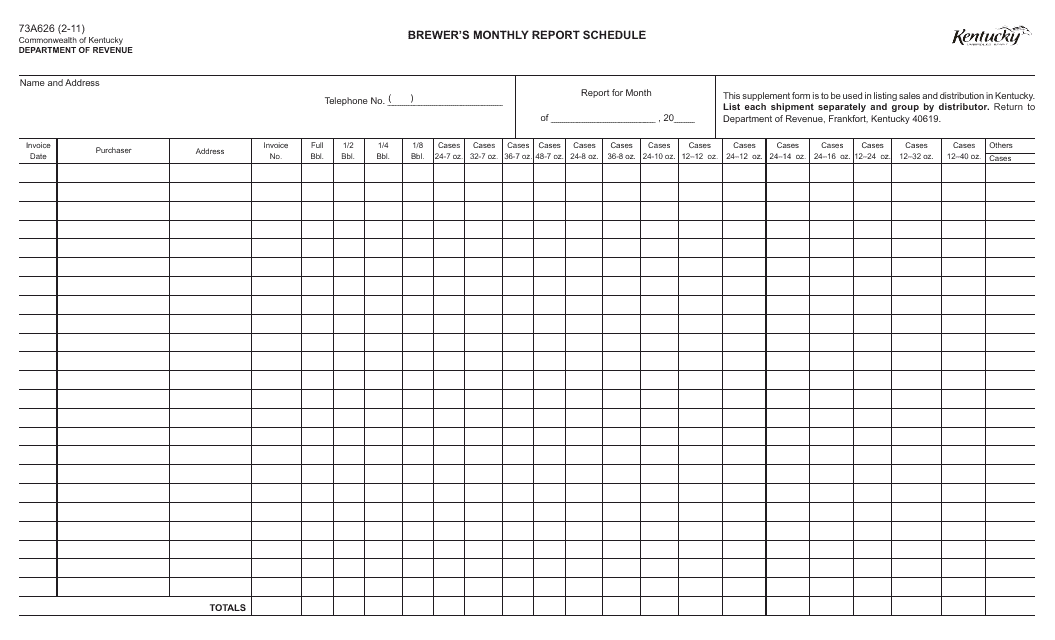

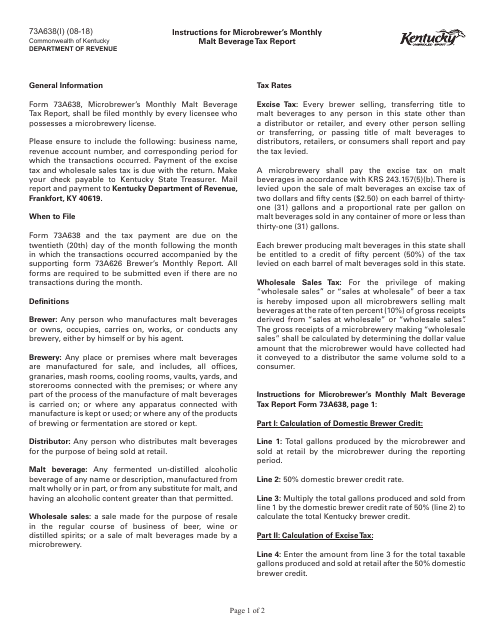

This form is used for reporting monthly sales and production data by brewers in Kentucky.

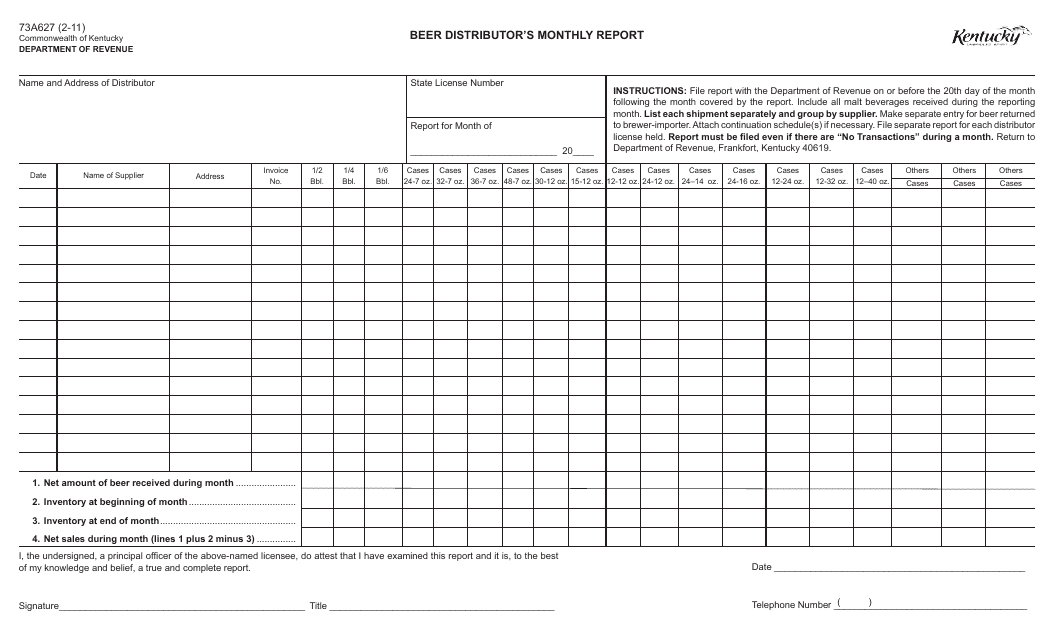

This Form is used for beer distributors in Kentucky to submit their monthly report.

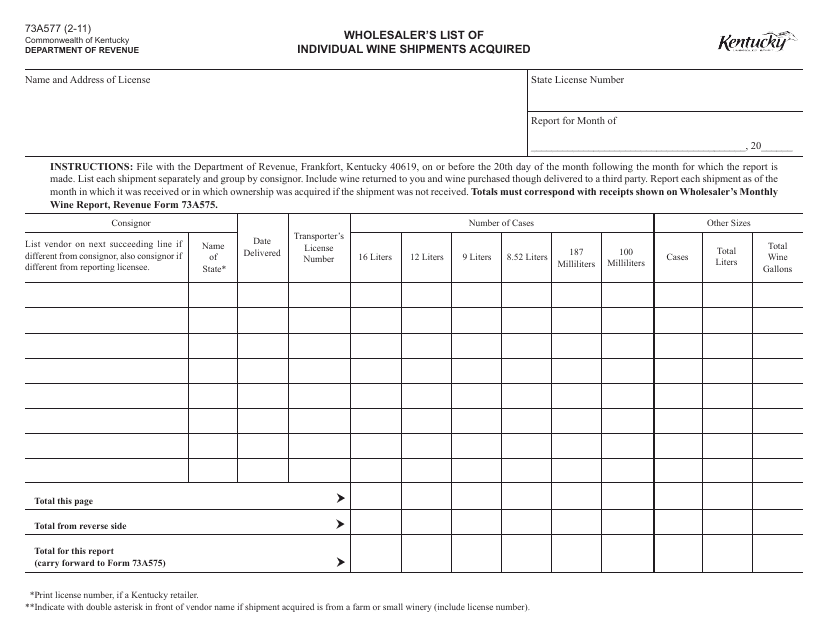

This document is used by wholesalers in Kentucky to report the individual wine shipments they have acquired.

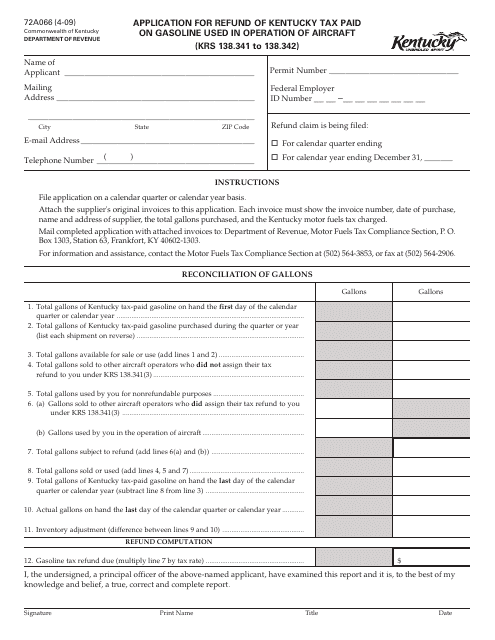

This form is used for applying for a refund of Kentucky tax paid on gasoline used in the operation of aircraft in Kentucky.

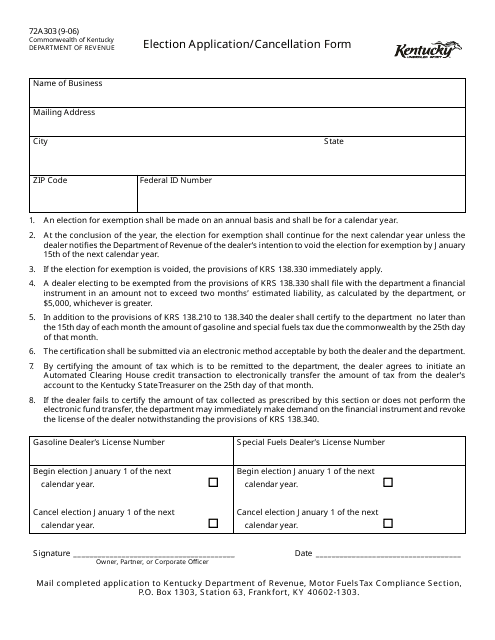

This form is used for applying or canceling an election application in the state of Kentucky.

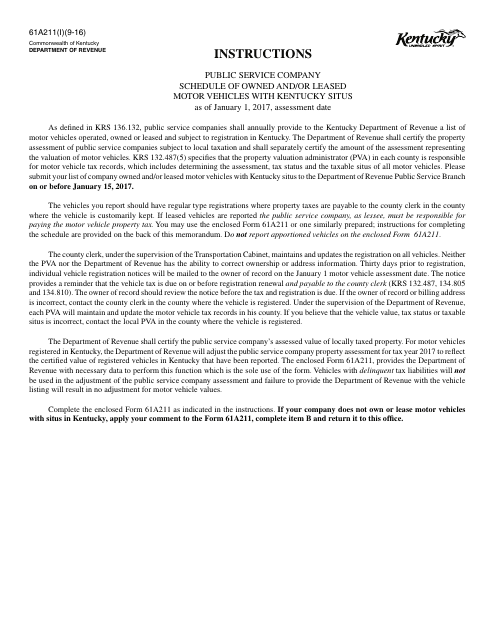

This document is used for reporting owned and/or leased motor vehicles by public service companies with Kentucky situs. It provides instructions on how to complete Form 61A211.

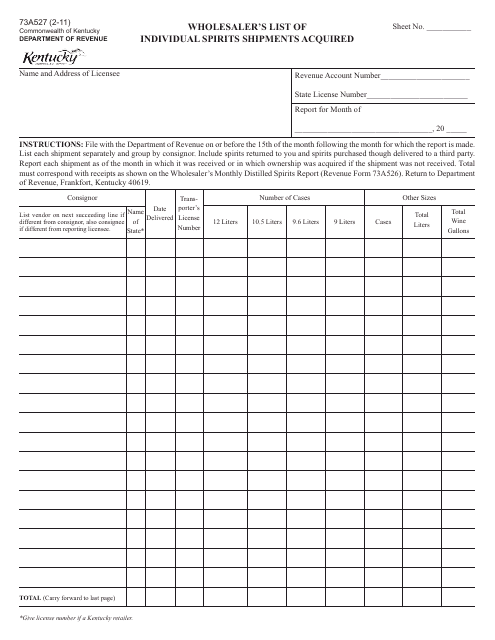

This form is used for wholesalers in Kentucky to report the individual spirits shipments they have acquired.

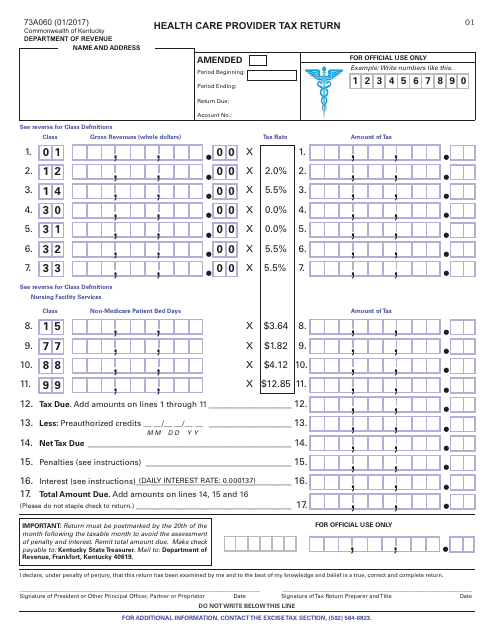

This form is used for filing the Health Care Provider Tax Return in the state of Kentucky.

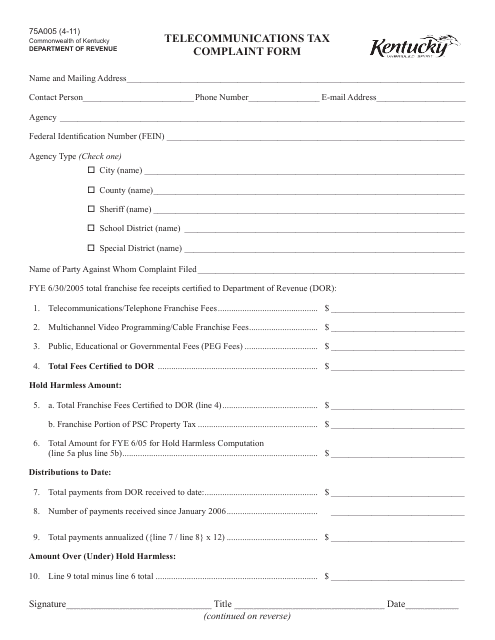

This Form is used for filing a complaint regarding telecommunications tax in the state of Kentucky.

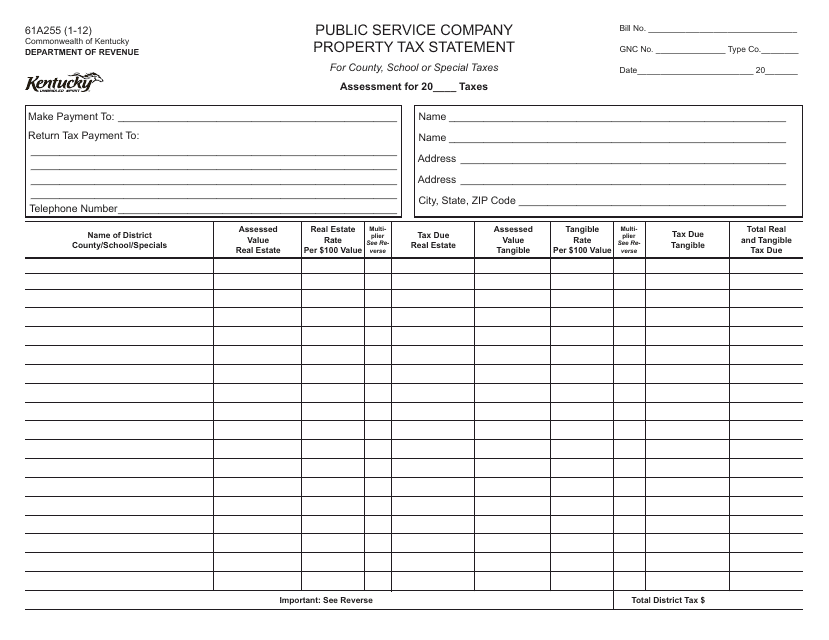

This form is used for filing the Public Service Company Property Tax Statement in Kentucky. It provides information related to the property owned by public service companies for tax purposes.

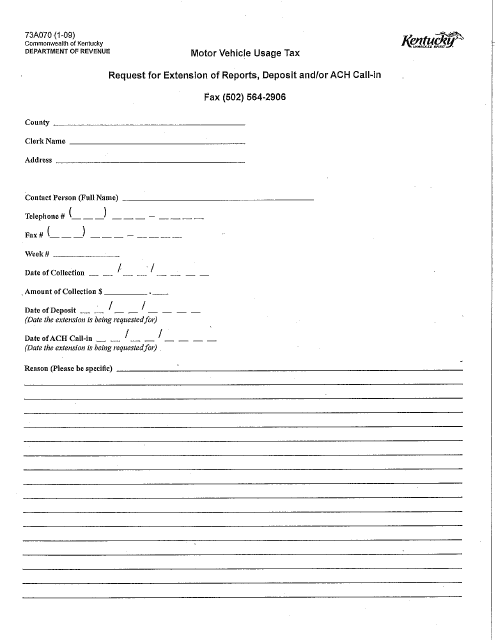

This form is used for requesting an extension for reports, deposits, and ACH call-ins in the state of Kentucky.

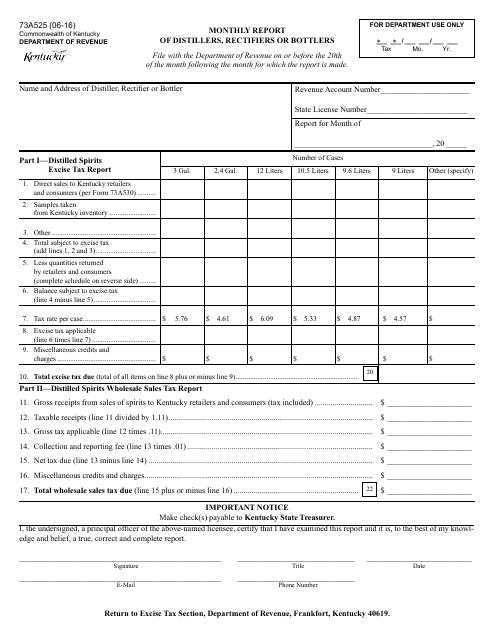

This Form is used for submitting monthly reports by distillers, rectifiers, or bottlers in Kentucky. It helps track and monitor their operations and compliance with regulations.

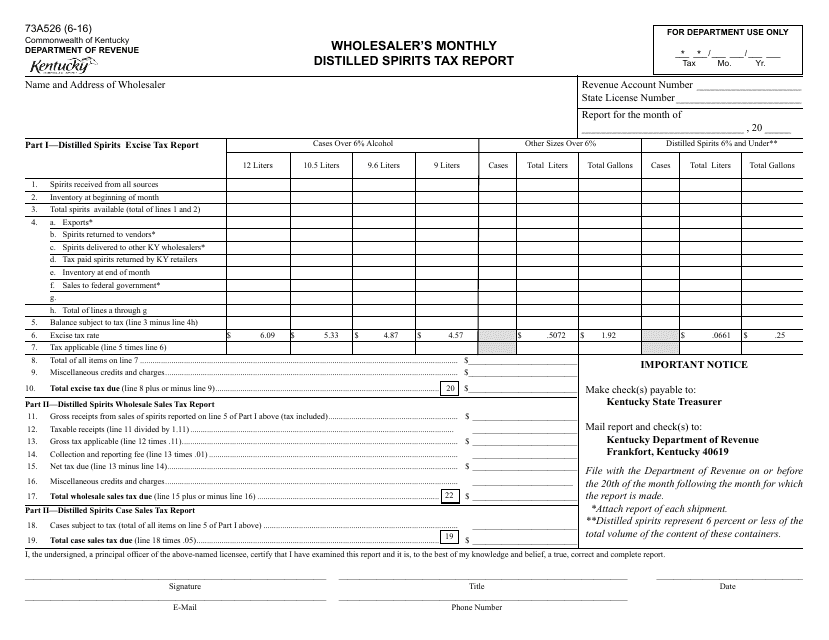

This Form is used for wholesalers in Kentucky to report their monthly distilled spirits tax.

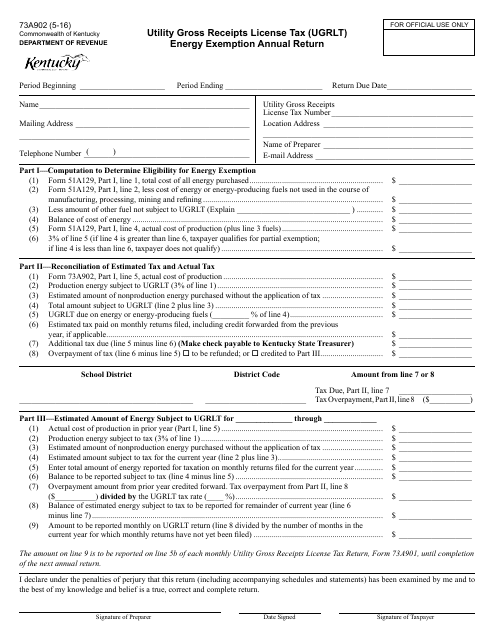

This document is used for filing an annual return to claim exemption from the Utility Gross Receipts License Tax (UGRLT) Energy Exemption in Kentucky.

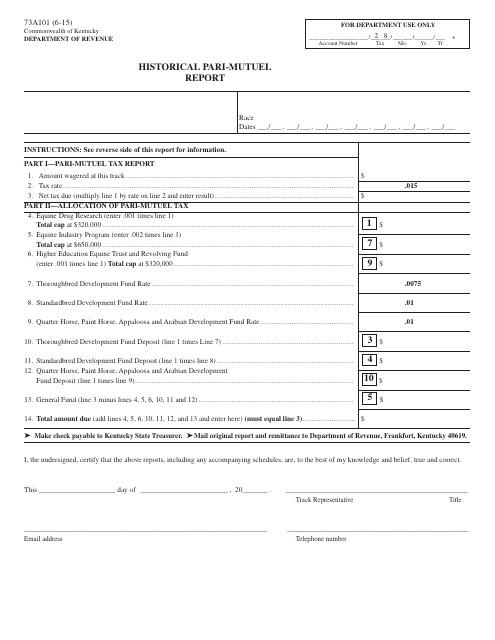

This form is used for reporting historical pari-mutuel data in the state of Kentucky.

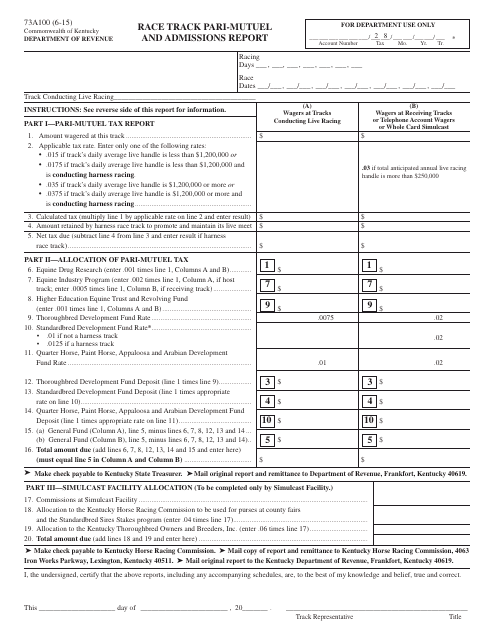

This Form is used for reporting race track pari-mutuel and admissions data in Kentucky.

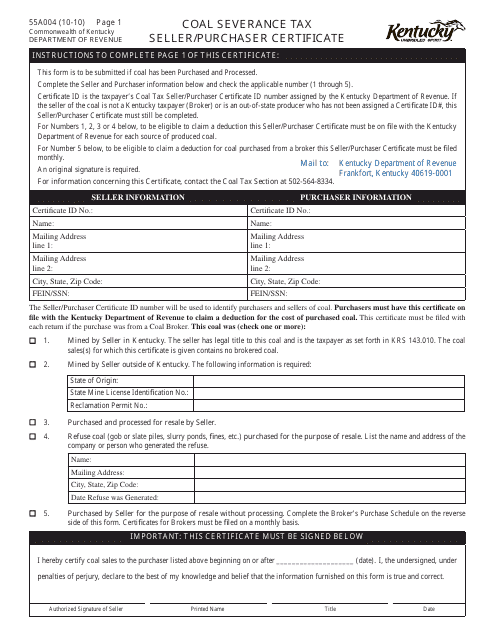

This Form is used for reporting and certifying coal severance tax transactions between sellers and purchasers in Kentucky.

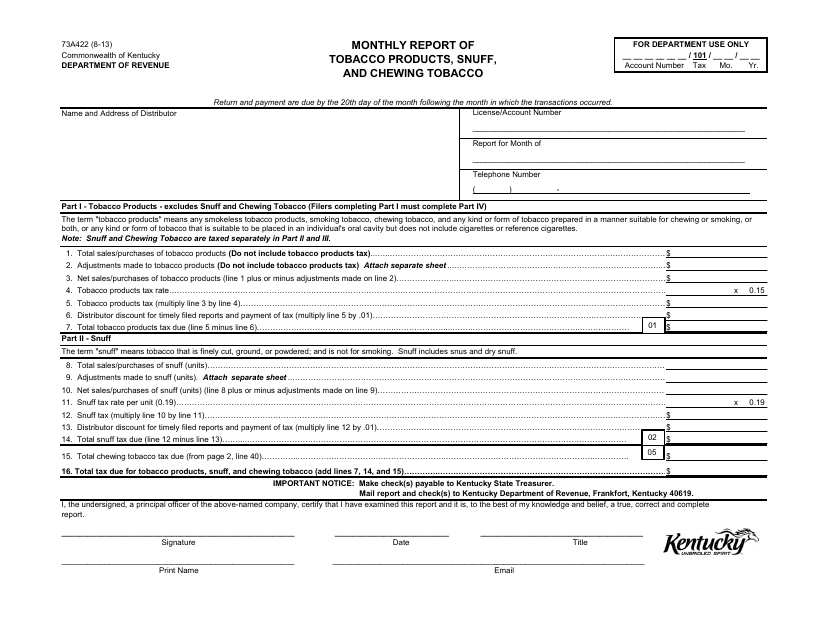

This form is used for monthly reporting of tobacco products, snuff, and chewing tobacco in the state of Kentucky.