Fill and Sign Kentucky Legal Forms

Documents:

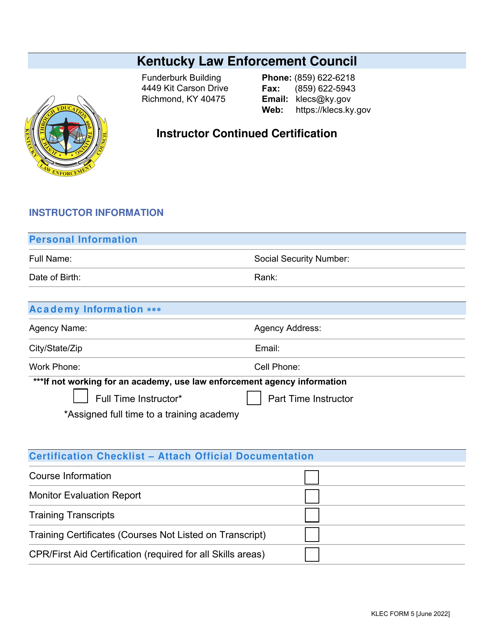

2845

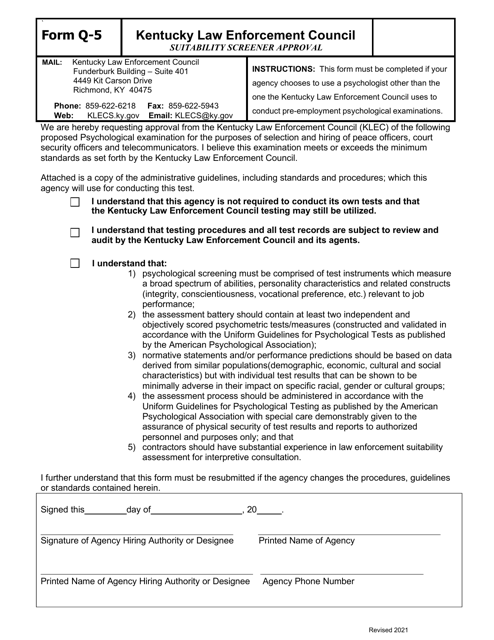

This form is used for obtaining approval for the suitability screener in the state of Kentucky.

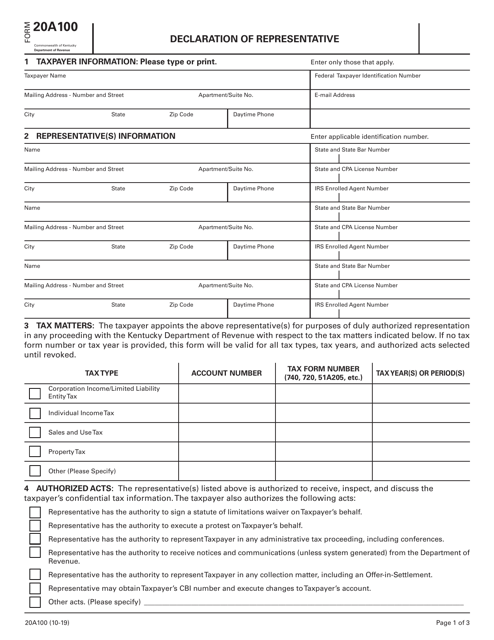

This form is used for declaring a representative for legal purposes in the state of Kentucky.

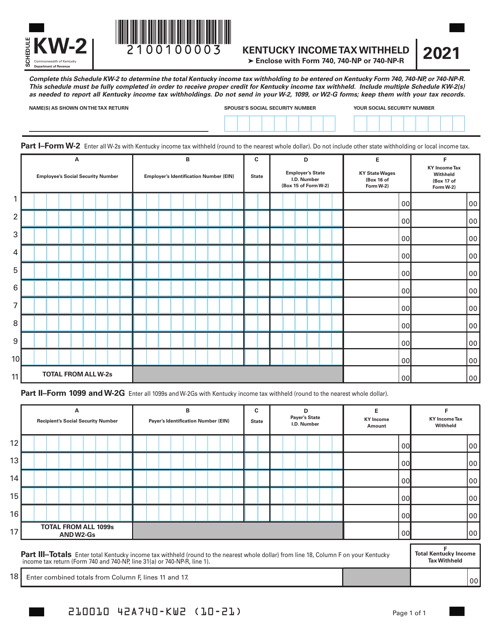

This Form is used for reporting Kentucky income tax withheld from employee's paychecks in Kentucky.

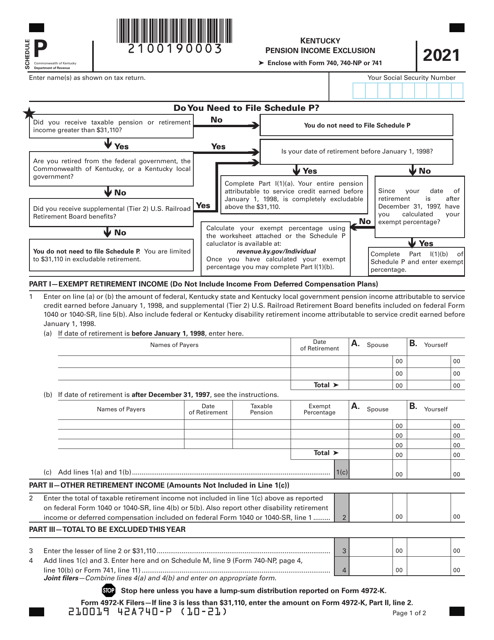

This document is a Schedule P used for the Kentucky Pension Income Exclusion. It is used to exclude pension income from Kentucky state taxes.

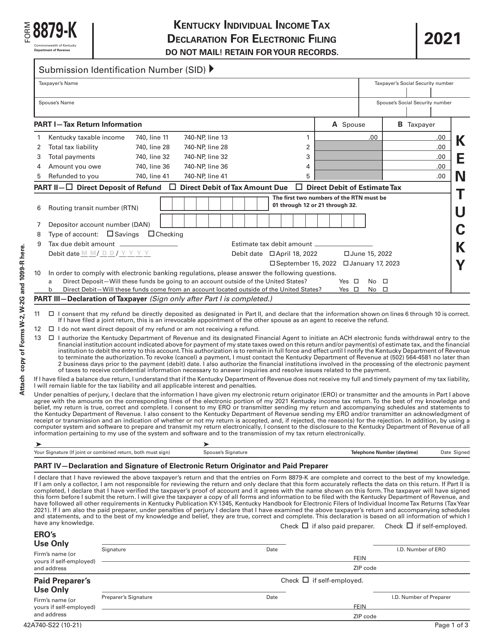

This form is used for Kentucky residents to declare their individual income tax for electronic filing.

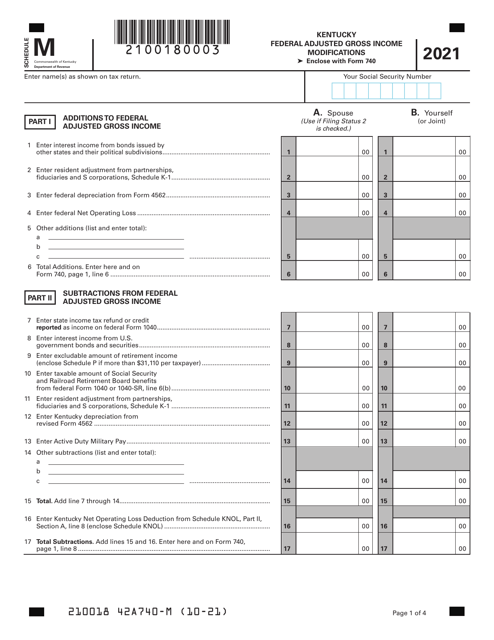

This Form is used for reporting adjustments to your federal adjusted gross income for residents of Kentucky.

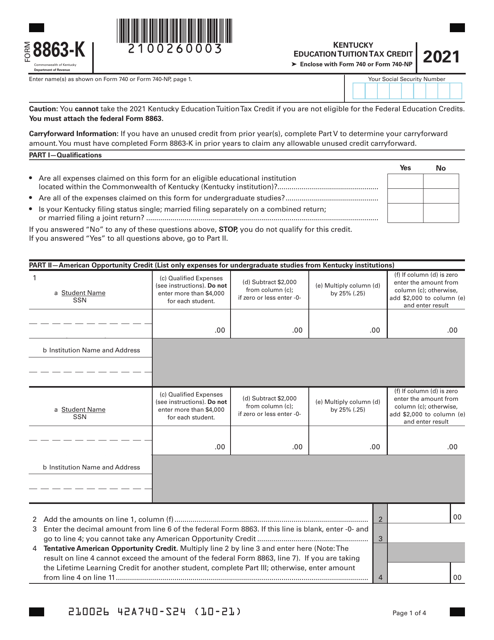

This Form is used for claiming the Kentucky Education Tuition Tax Credit in the state of Kentucky.

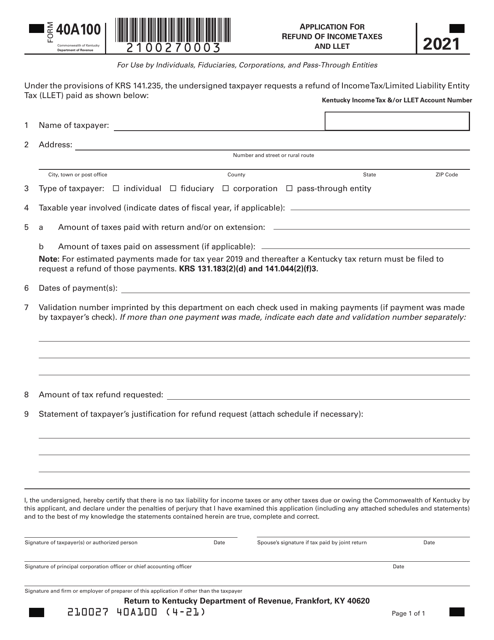

This form is used for applying for a refund of income taxes and let in Kentucky.

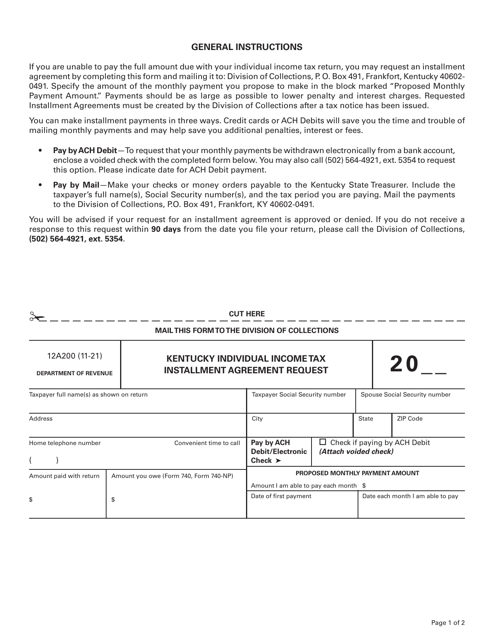

This Form is used for requesting an installment agreement for paying your individual income tax in Kentucky.

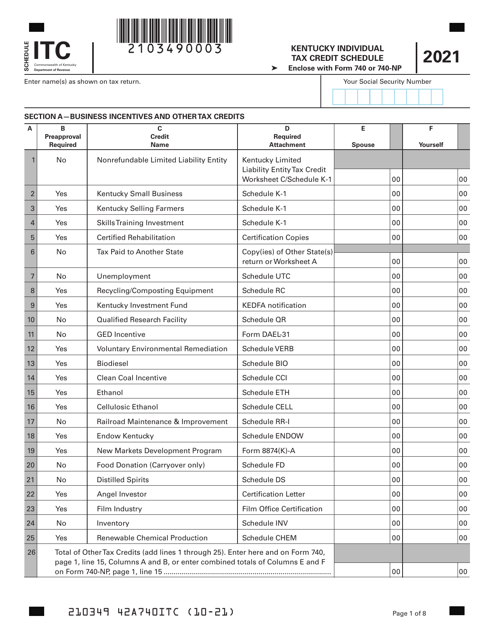

This document is the Schedule ITC Kentucky Individual Tax Credit Schedule for residents of Kentucky. It is used to report any tax credits that individuals may be eligible for in the state of Kentucky.

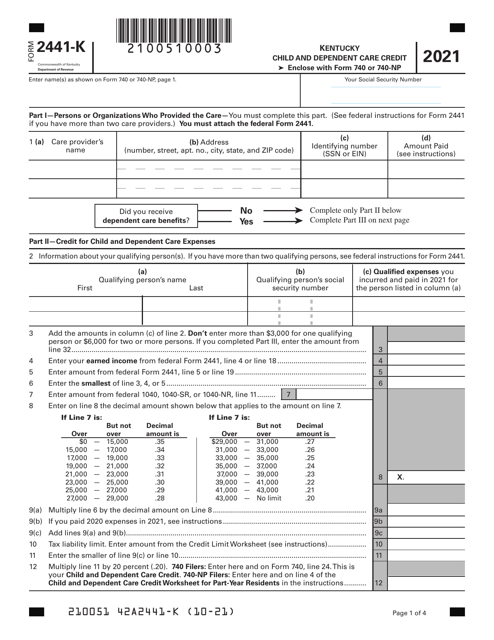

This form is used for claiming the Kentucky Child and Dependent Care Credit in Kentucky. It helps taxpayers to report their qualifying expenses for child and dependent care and determine the amount of credit they are eligible for.

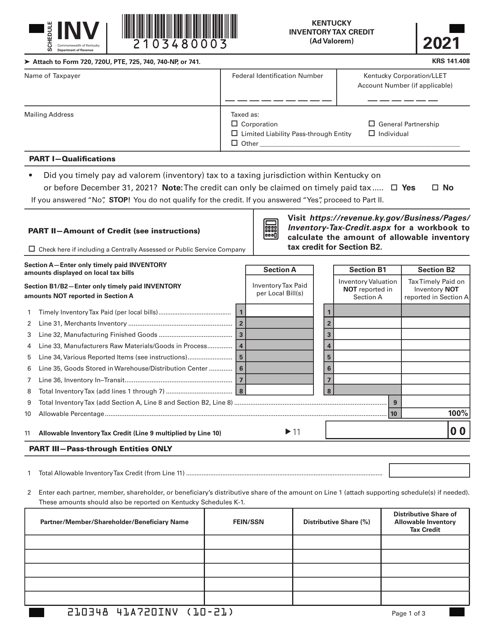

This document is used to schedule the Kentucky Inventory Tax Credit (Ad Valorem) for businesses in Kentucky.

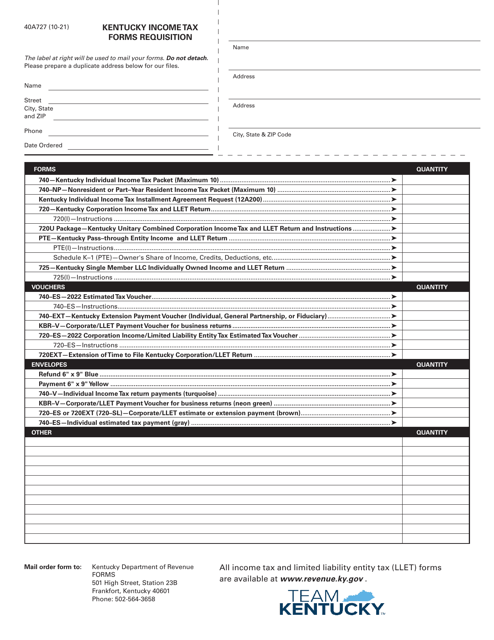

This Form is used for ordering Kentucky income tax forms.