Fill and Sign Kentucky Legal Forms

Documents:

2845

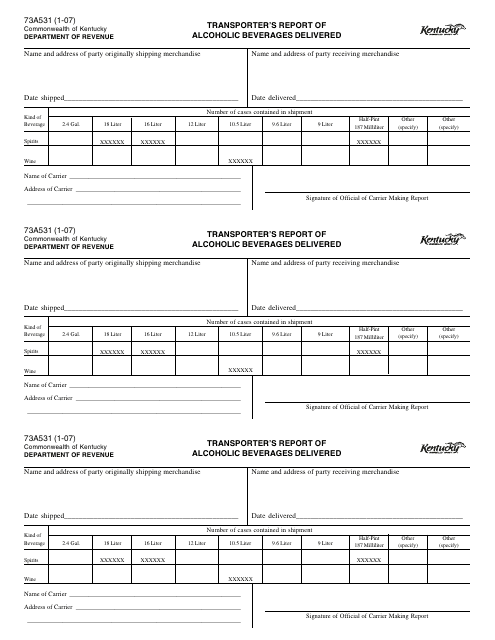

This Form is used for reporting the delivery of alcoholic beverages by transporters in the state of Kentucky.

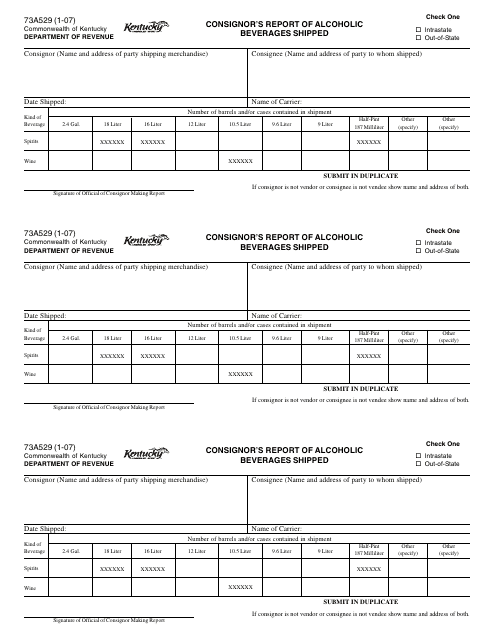

This form is used for reporting the shipment of alcoholic beverages in the state of Kentucky. It is specifically for consignors to report their shipments.

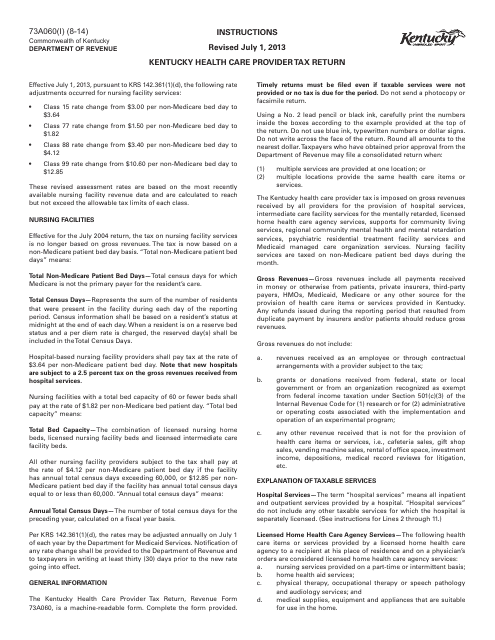

This Form is used for filing the Kentucky Health Care Provider Tax Return in Kentucky.

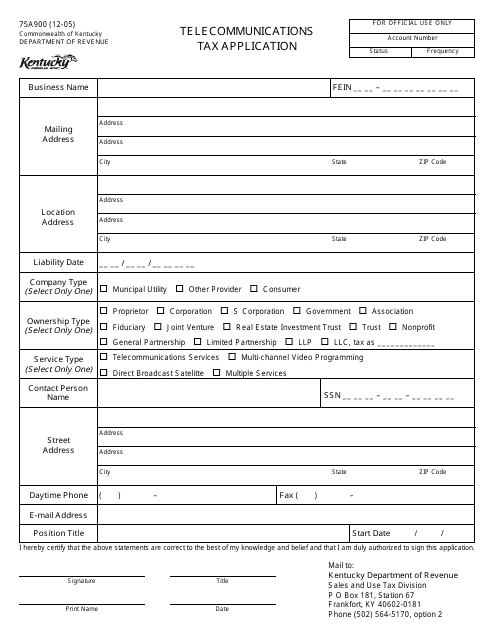

This form is used for applying for telecommunications tax in the state of Kentucky.

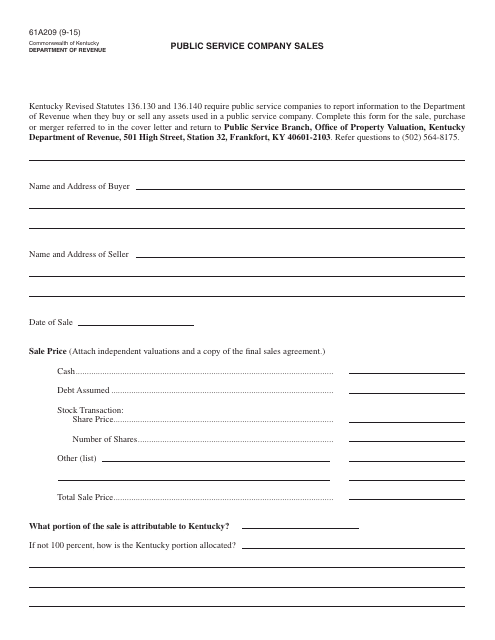

This Form is used for reporting the sales by public service companies in Kentucky.

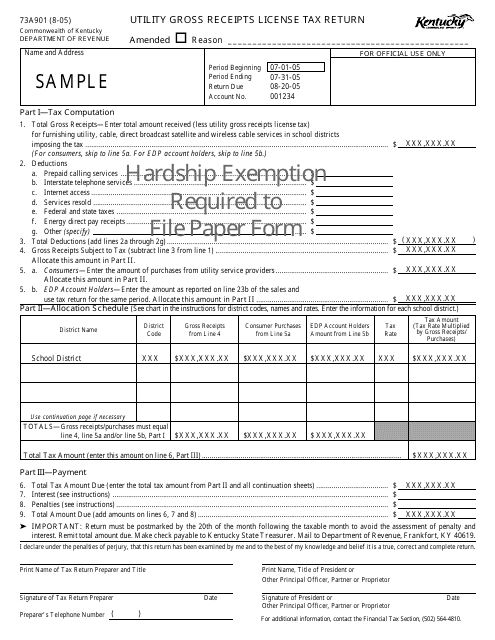

This form is used for filing the Utility Gross Receipts License Tax Return in Kentucky.

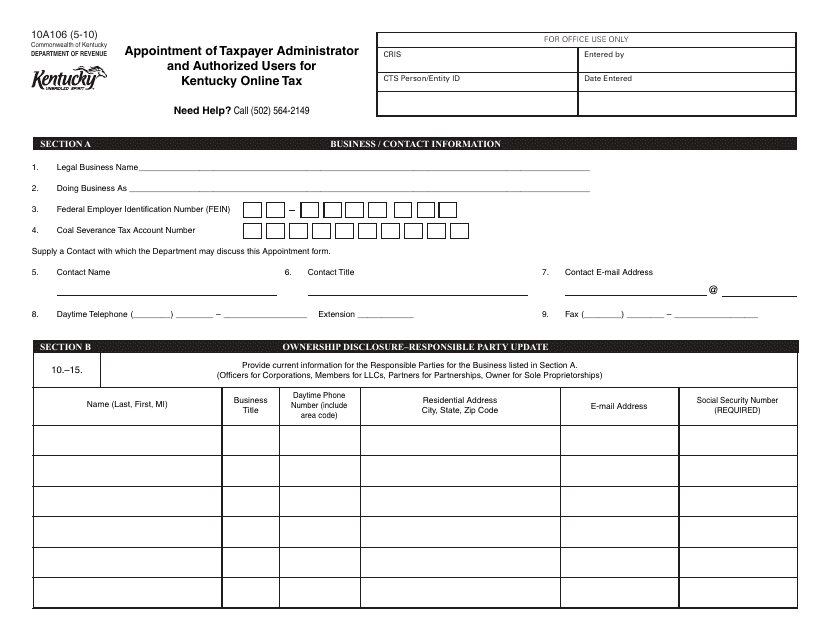

This form is used for appointing a taxpayer administrator and authorized users for Kentucky Online Tax in Kentucky.

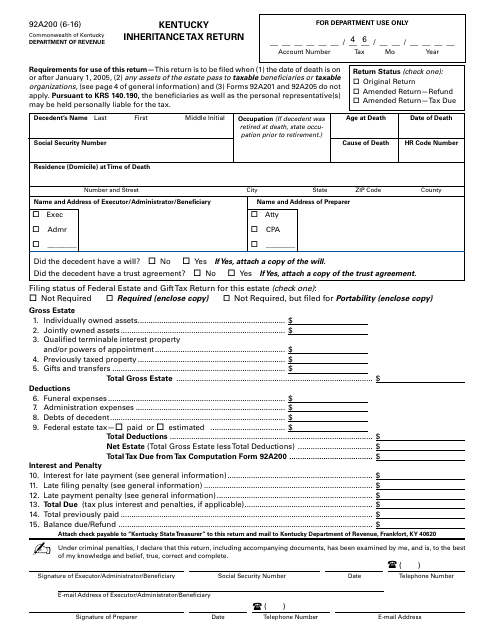

This Form is used for reporting and paying inheritance taxes in Kentucky. It helps determine the amount of tax owed by the estate of a deceased person.

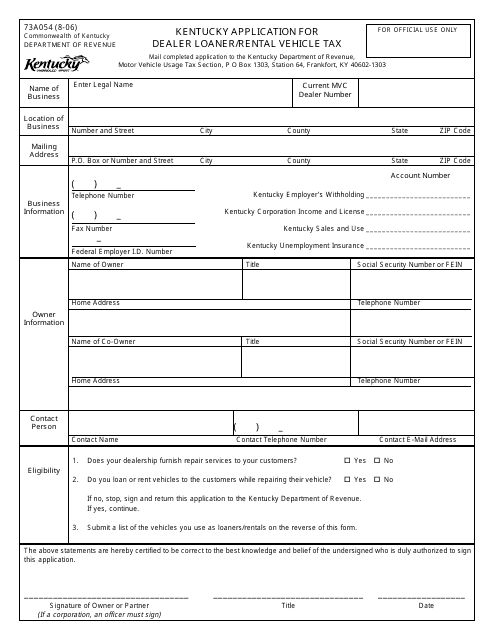

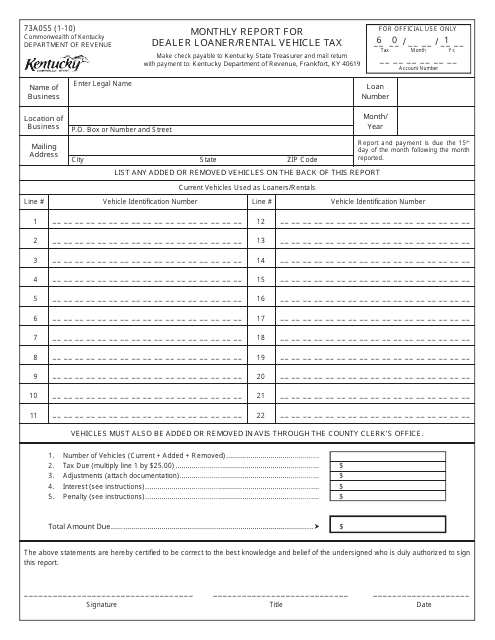

This document is used for applying for a dealer loaner/rental vehicle tax in Kentucky.

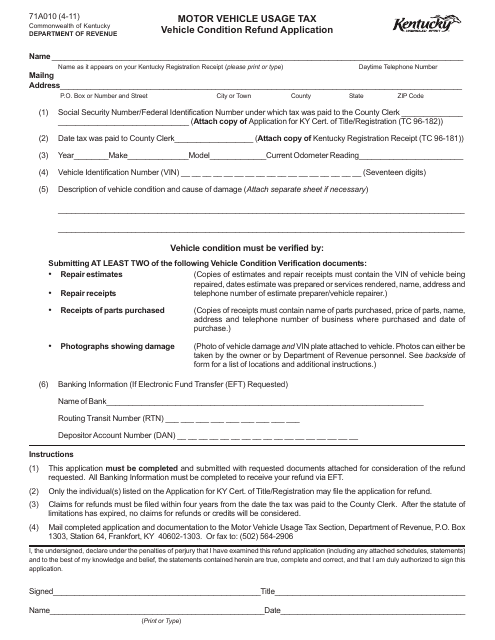

This form is used for applying for a refund on the motor vehicle usage tax in Kentucky if the vehicle is in a condition that makes it eligible for a refund.

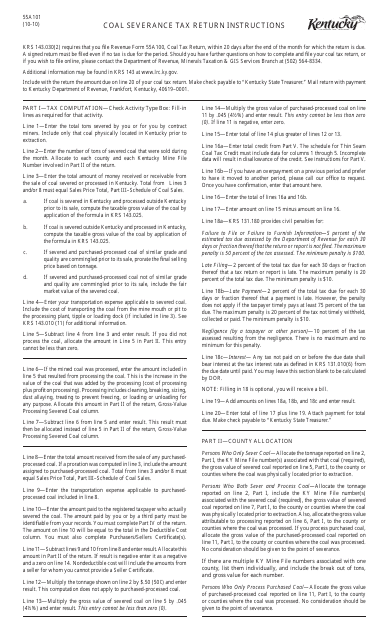

This Form is used for reporting and paying the coal severance tax in the state of Kentucky. It provides instructions on how to properly fill out and submit the form.

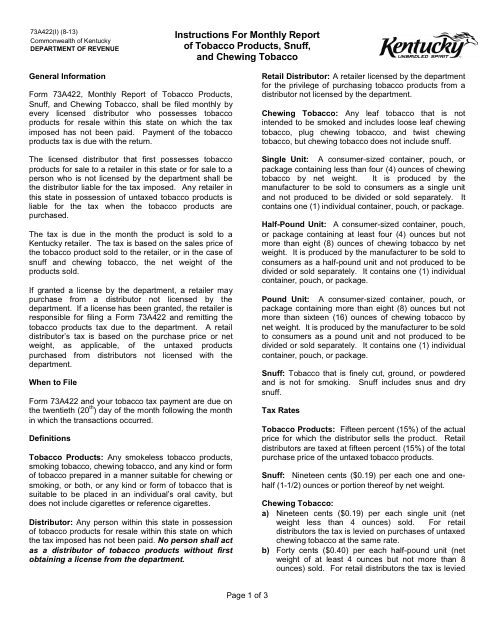

This document is used for the Monthly Report of Tobacco Products, Snuff, and Chewing Tobacco in the state of Kentucky. It provides instructions on how to fill out the necessary information for reporting purposes.

This Form is used for reporting monthly taxes on dealer loaner and rental vehicles in the state of Kentucky.

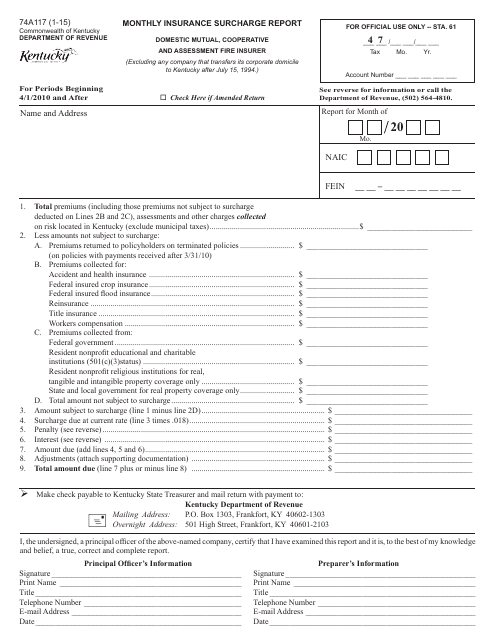

This form is used for reporting monthly insurance surcharges for domestic mutual, cooperative, and assessment fire insurers in Kentucky.

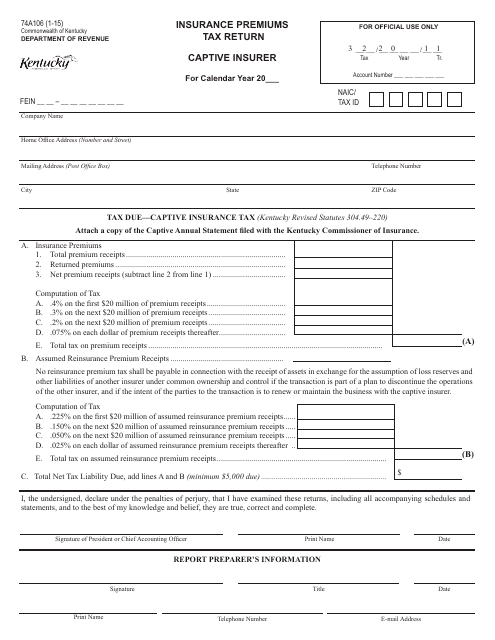

This form is used for reporting insurance premiums tax return for captive insurers in the state of Kentucky.

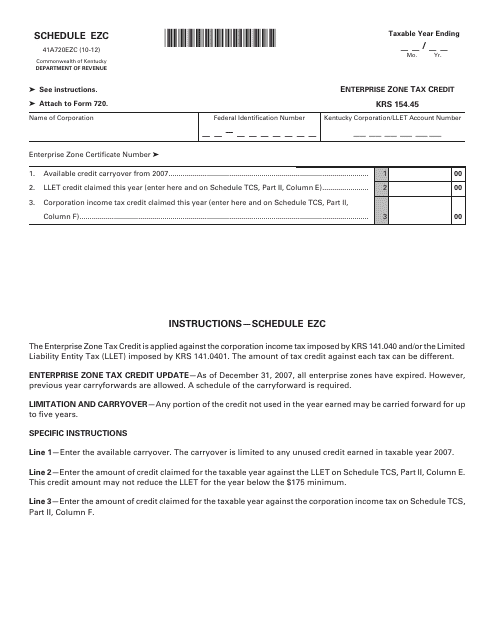

This form is used for claiming the Enterprise Zone tax credit in Kentucky.

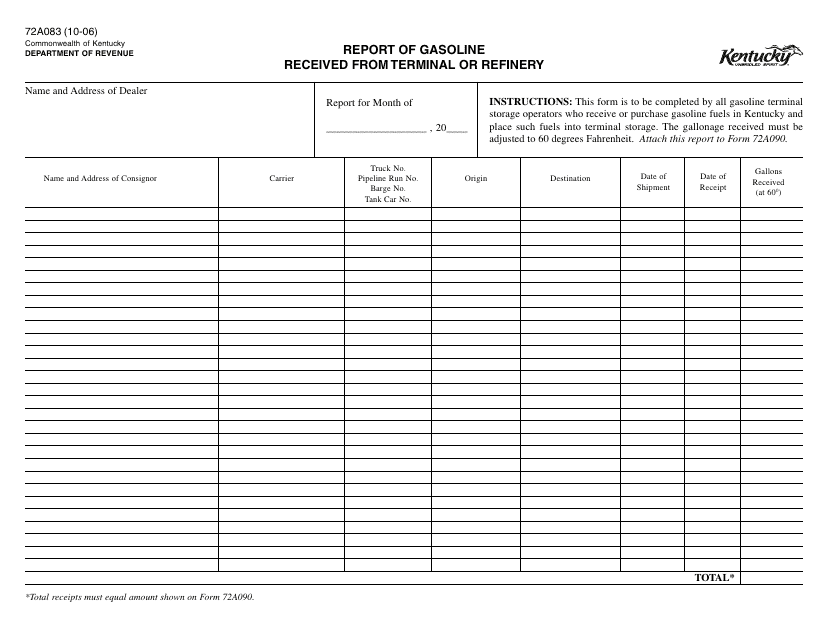

This form is used for reporting gasoline received from a terminal or refinery in Kentucky.

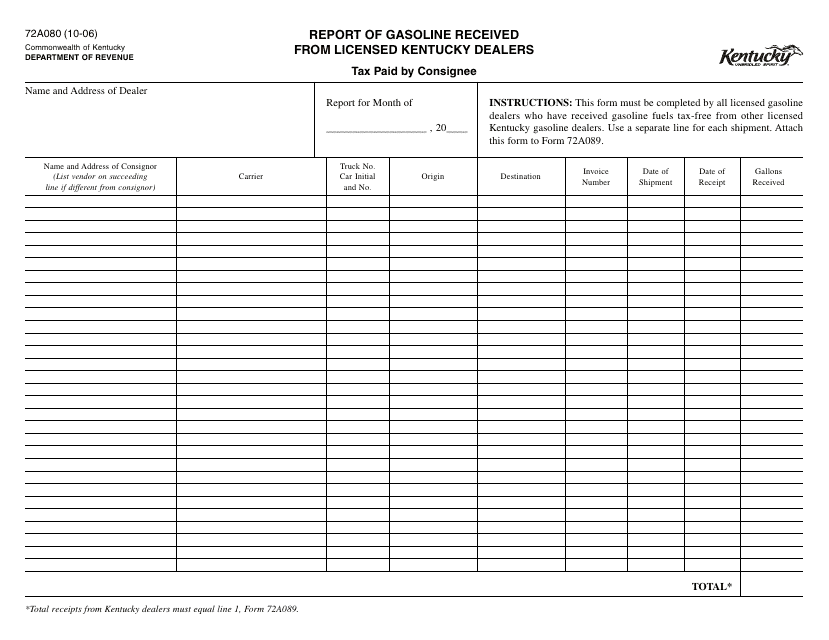

This type of document is used in Kentucky to report the amount of gasoline received from licensed dealers, and to document the tax paid by the consignee.

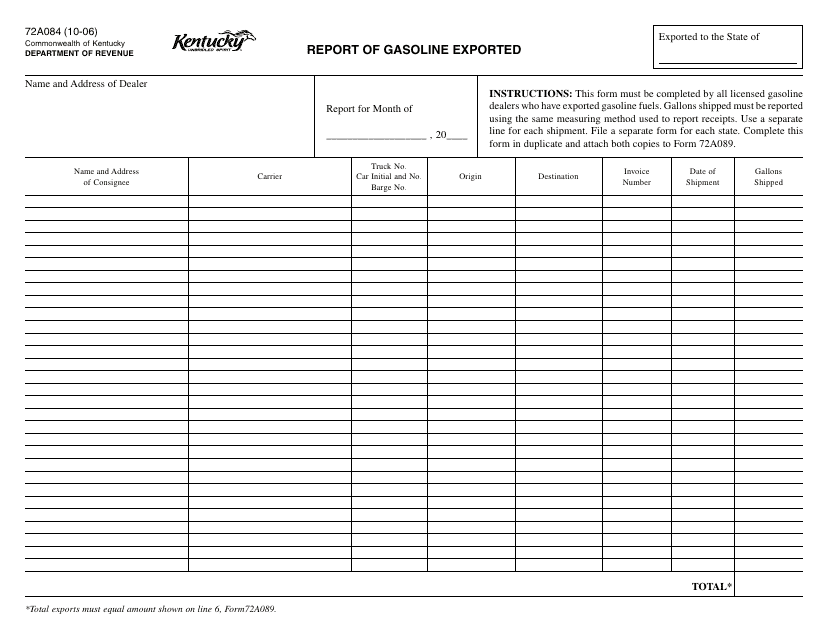

This form is used for reporting the export of gasoline in the state of Kentucky.

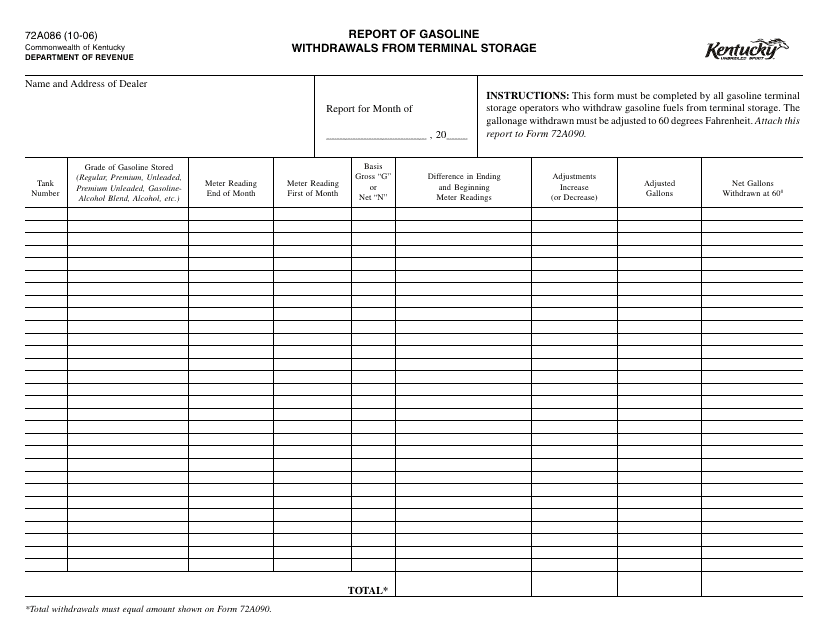

This form is used for reporting the withdrawal of gasoline from terminal storage in Kentucky.

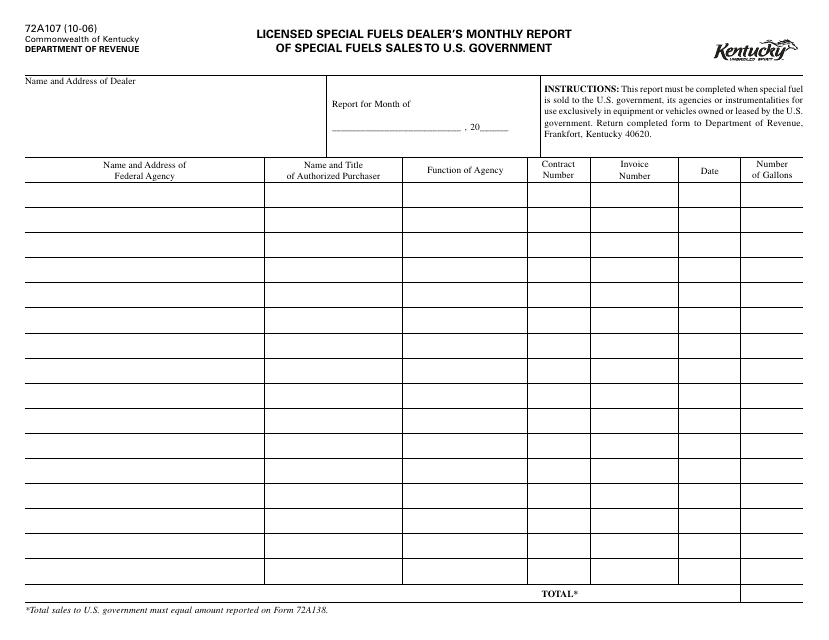

This form is used for licensed special fuel dealers in Kentucky to report their monthly sales of special fuels to the U.S. Government. It helps track and regulate the sales of special fuels to the government in Kentucky.

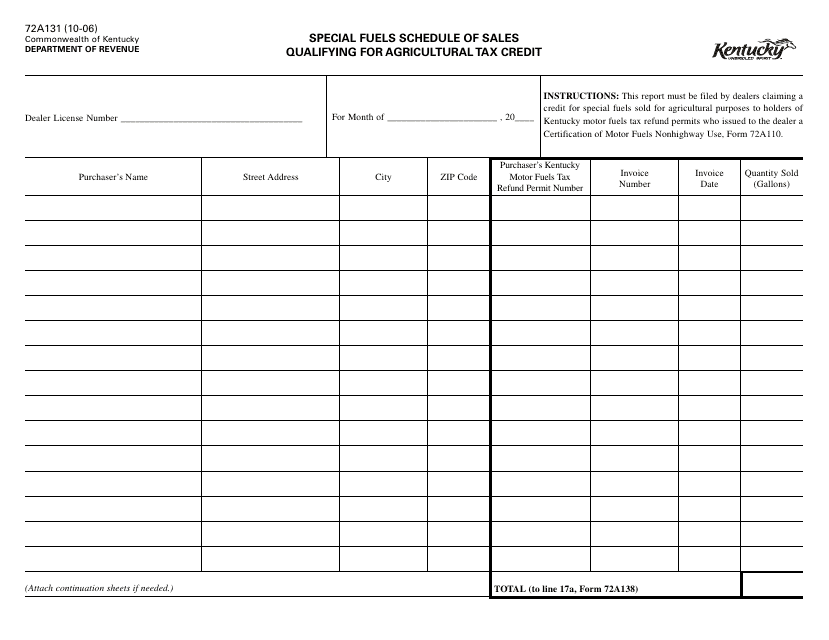

This form is used for reporting sales of special fuels that qualify for the agricultural tax credit in Kentucky. It is specifically for agricultural businesses to claim tax credits on fuel purchased for qualifying agricultural activities.

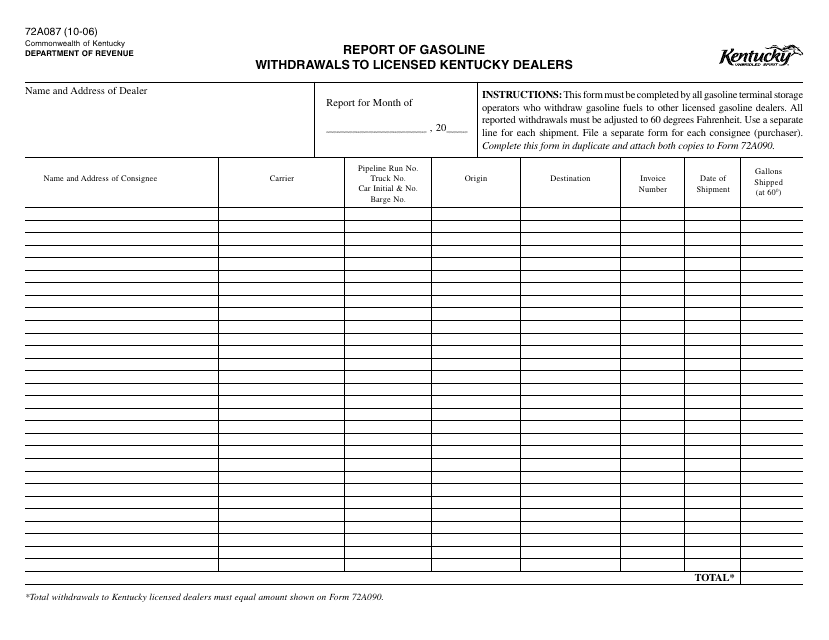

This Form is used for reporting gasoline withdrawals by licensed Kentucky dealers in Kentucky.

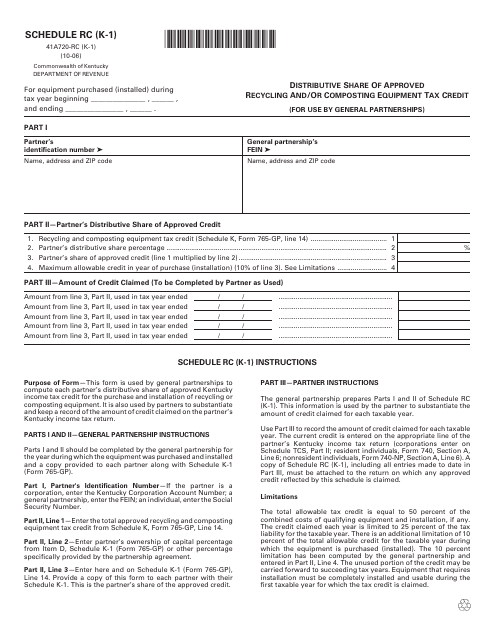

This Form is used for claiming the distributive share of approved recycling and/or composting equipment tax credit by general partnerships in Kentucky.

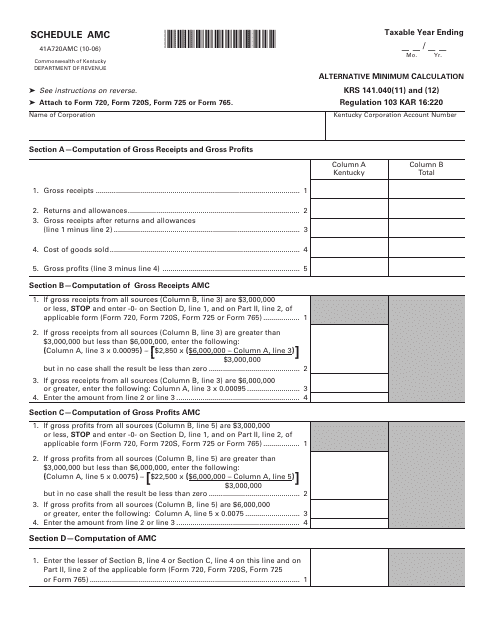

This form is used for calculating the alternative minimum tax in Kentucky.

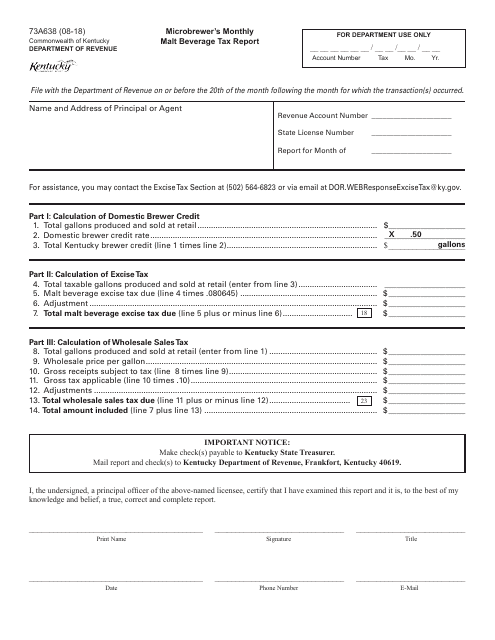

This document is used for reporting monthly malt beverage tax for microbrewers in Kentucky.

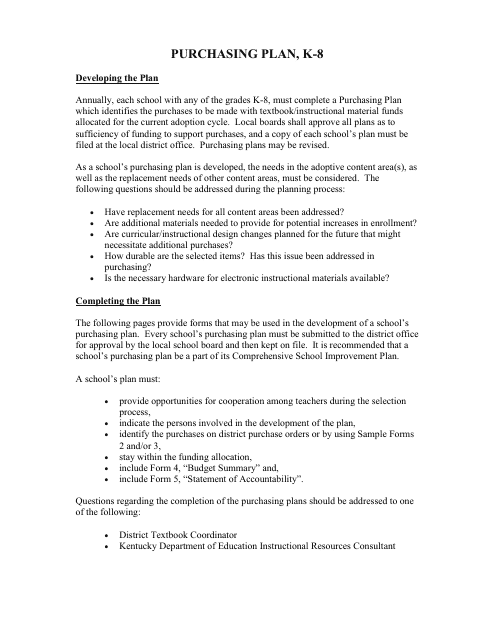

This document provides a purchasing plan for grades K-8 in the state of Kentucky. It outlines the procurement process for schools and establishes guidelines for purchasing supplies and resources for students.

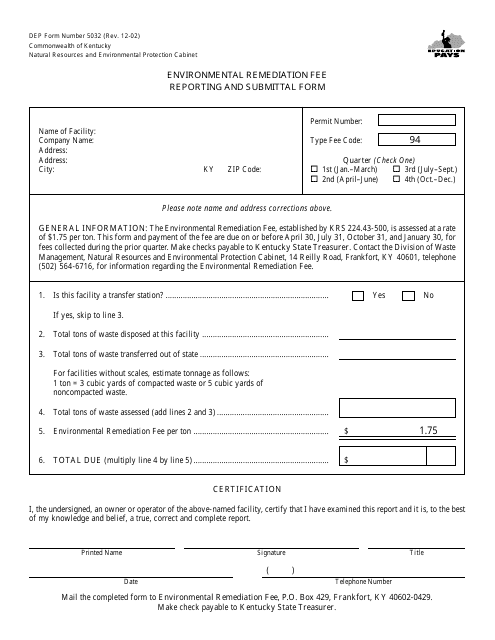

This form is used for reporting and submitting environmental remediation fees in the state of Kentucky. It is required for individuals or businesses engaged in remediation activities to calculate and pay the appropriate fees based on their activities.

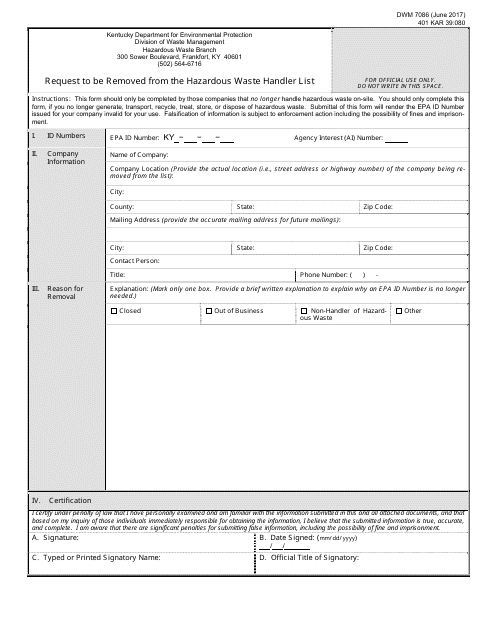

This Form is used for requesting to be removed from the hazardous waste handler list in Kentucky.

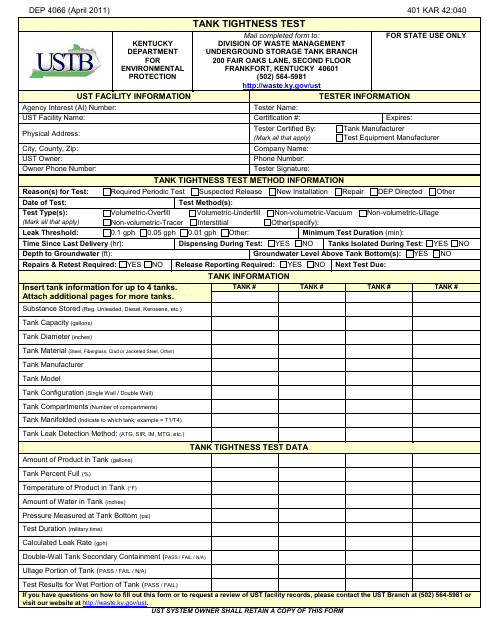

This form is used for conducting a tank tightness test in the state of Kentucky. It is used to ensure that underground storage tanks are free from leaks and are in compliance with regulations.

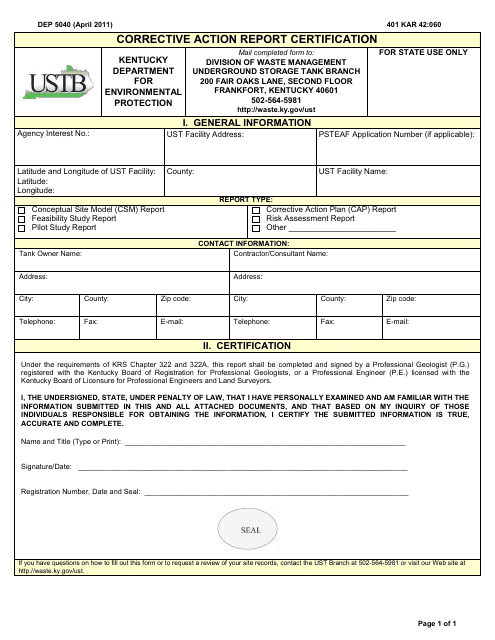

This form is used for certifying a Corrective Action Report in the state of Kentucky.

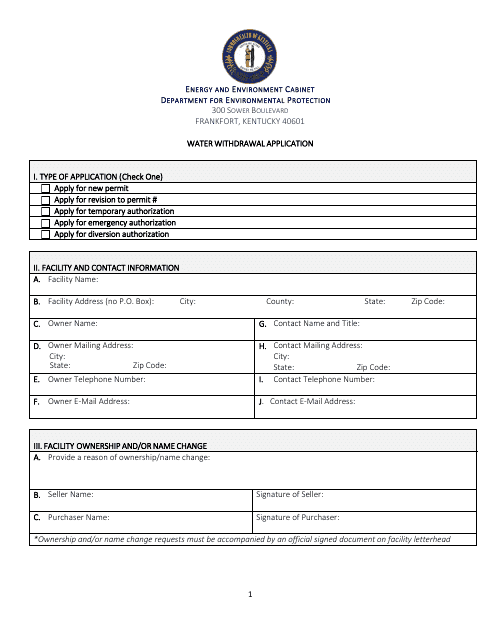

This form is used for applying to withdraw water in the state of Kentucky.

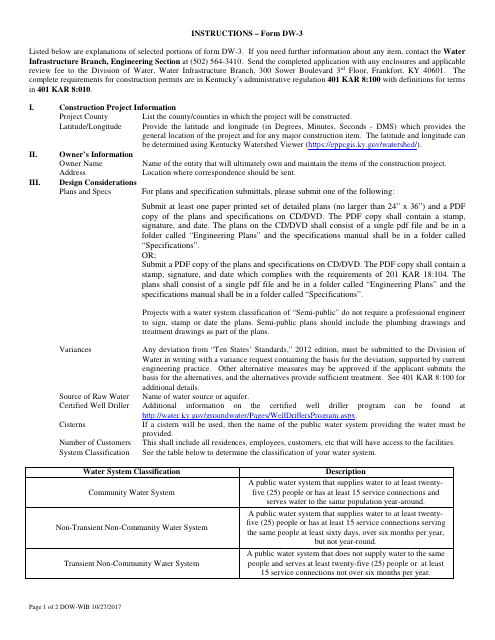

This form is used for applying for construction of small groundwater and semi-public systems in Kentucky. It provides instructions on how to fill out the Form DW-3 application.

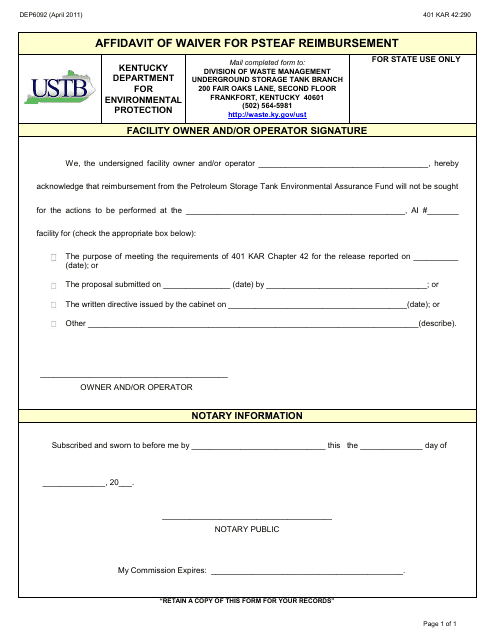

This form is used for requesting a waiver for reimbursement of Psteaf (Public Safety Training Assistance for Educational Financial) expenses in Kentucky.

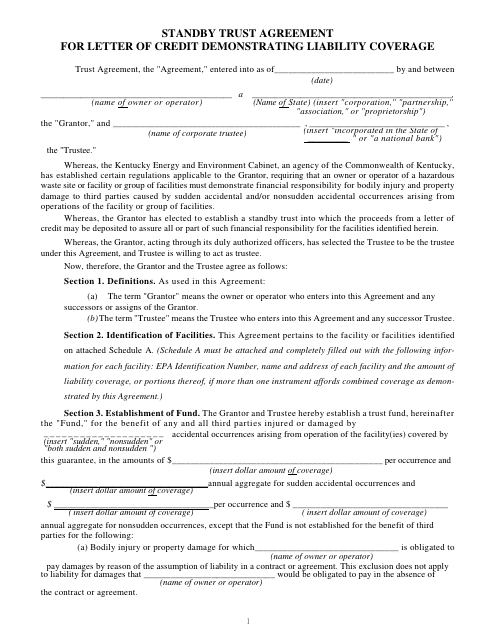

This form is used for establishing a standby trust agreement to demonstrate liability coverage for a letter of credit in the state of Kentucky.

This form is used for a Trust Agreement in the state of Kentucky. It outlines the terms and conditions of a trust arrangement, including the responsibilities of the trustee and the beneficiaries.

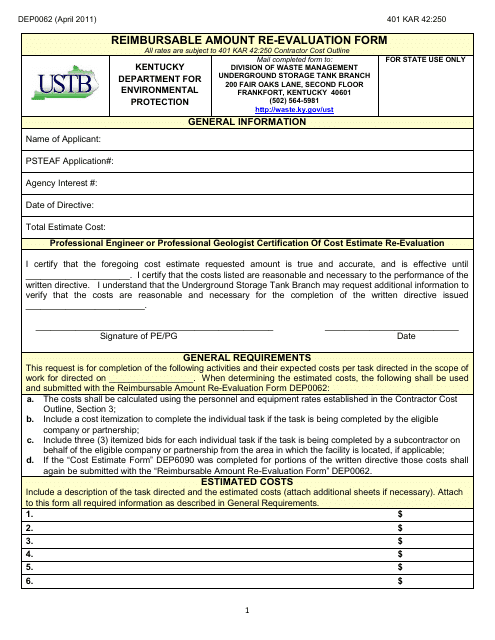

This form is used for re-evaluating the reimbursable amount in Kentucky.

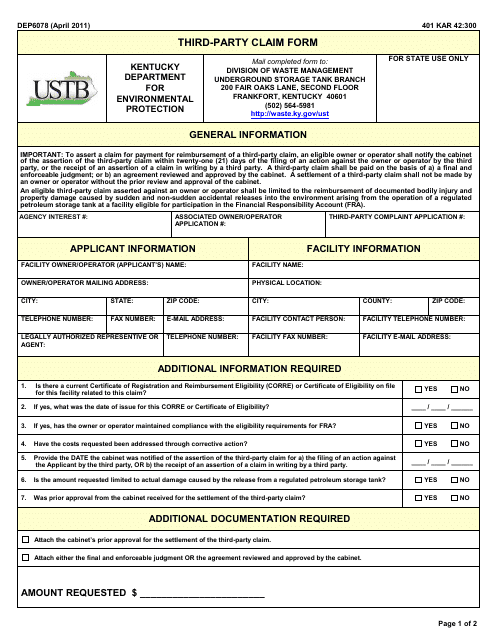

This Form is used for filing a third-party claim in the state of Kentucky.