Tennessee Department of Revenue Forms and Templates

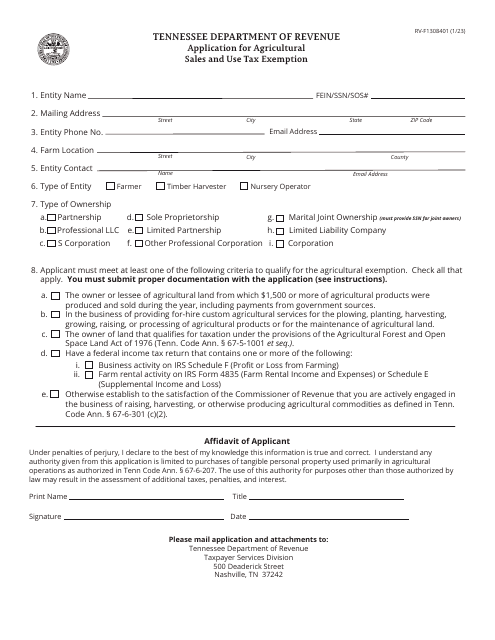

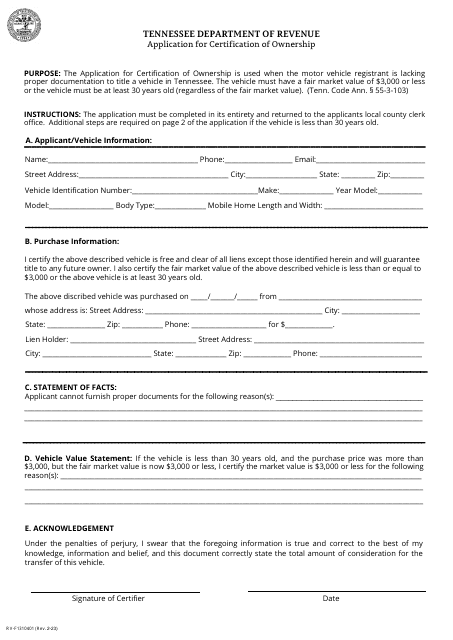

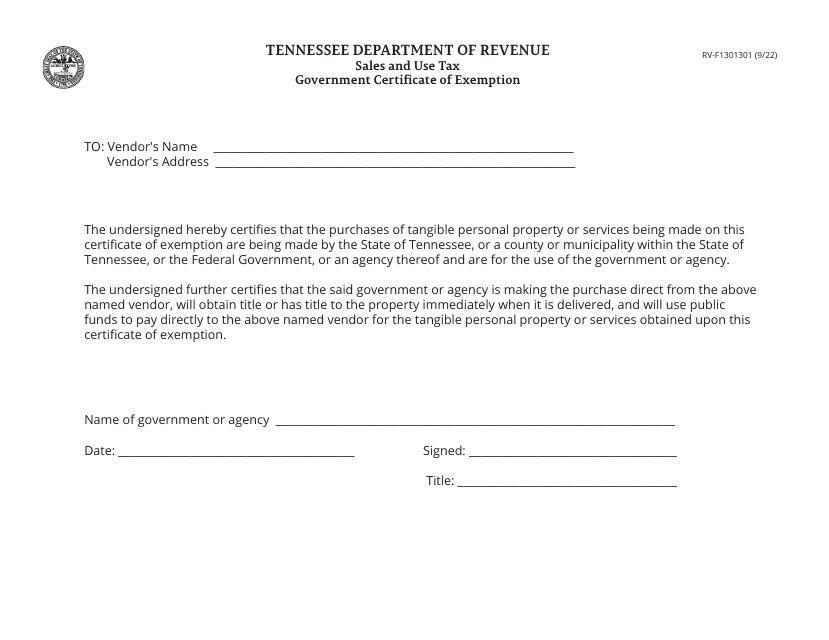

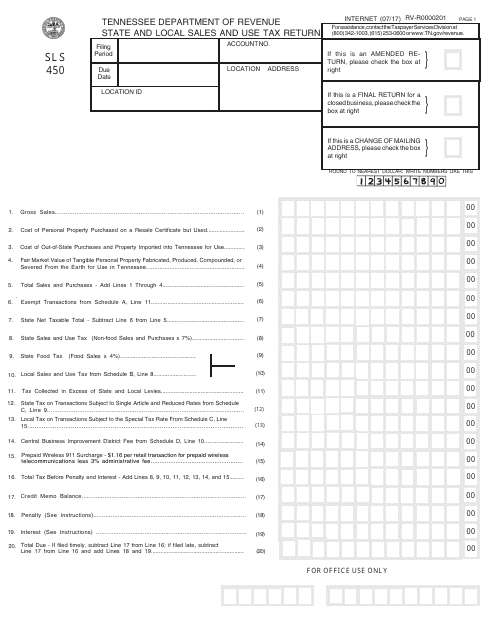

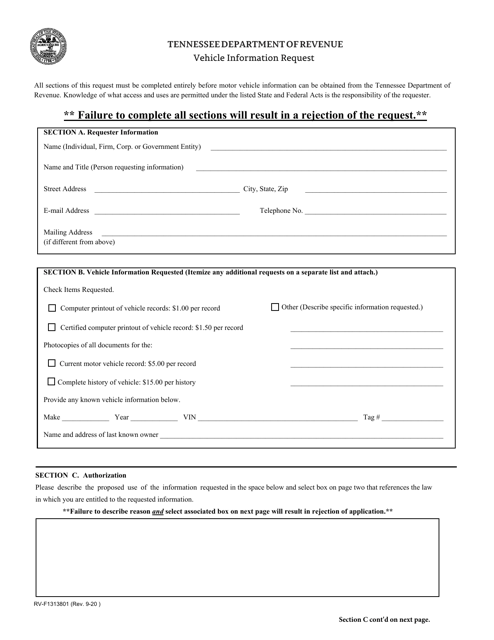

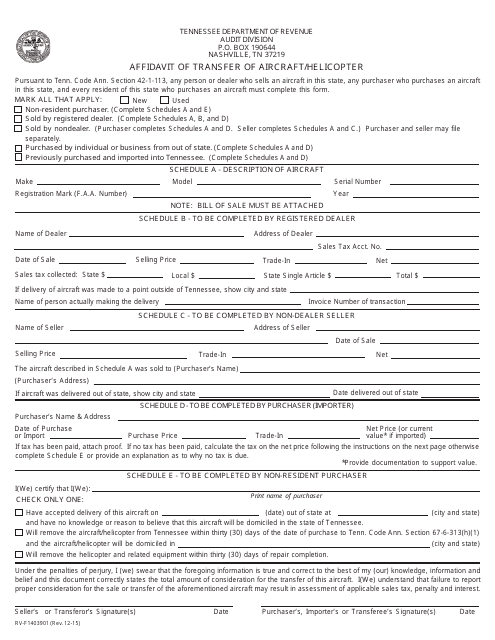

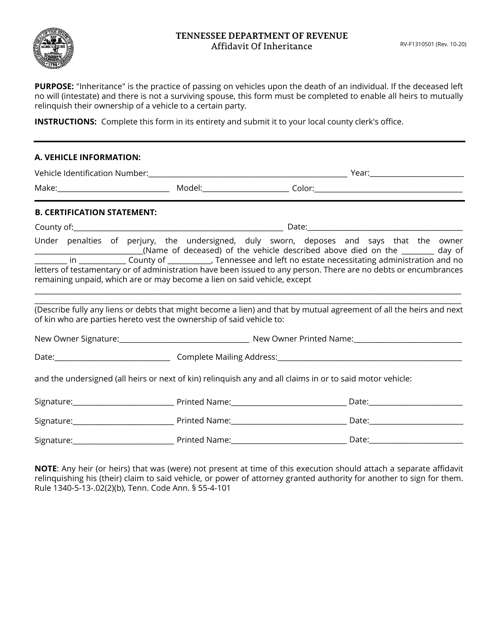

Tennessee Department of Revenue Forms are used for various tax-related purposes in the state of Tennessee. These forms are designed to help individuals, businesses, and organizations fulfill their tax obligations and comply with Tennessee tax laws. They cover a wide range of tax matters, including income taxes, sales and use taxes, property taxes, and vehicle taxes. The forms provide a standardized way to report income, calculate taxes owed, claim deductions and credits, and request refunds or adjustments. They are essential tools for taxpayers to accurately report and pay their taxes in accordance with state regulations.

Documents:

9

This form is used for reporting and declaring quarterly franchise and excise taxes in the state of Tennessee.

This Form is used for transferring ownership of an aircraft or helicopter in the state of Tennessee. It is an affidavit that confirms the details of the transfer.