New Hire Reporting Form Templates

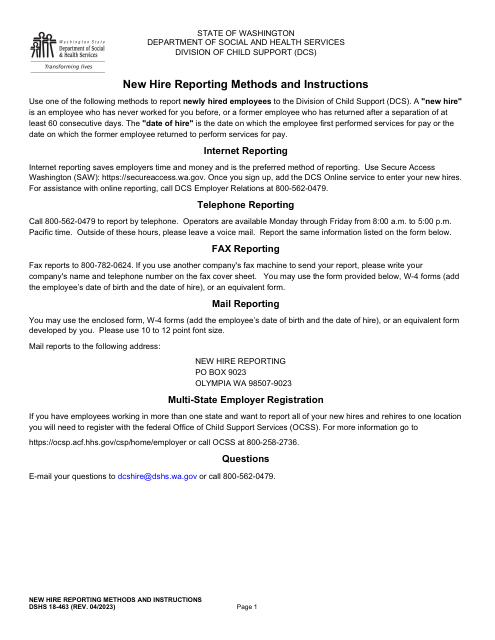

New Hire Reporting Forms are used to gather information about newly hired employees and report it to the appropriate government agency. The purpose of these forms is to assist in the enforcement of various government programs such as child support enforcement, unemployment insurance, and income tax withholding. By submitting the form, employers provide details about their new employees, including their personal information and employment details, to ensure compliance with applicable laws and regulations.

Documents:

39

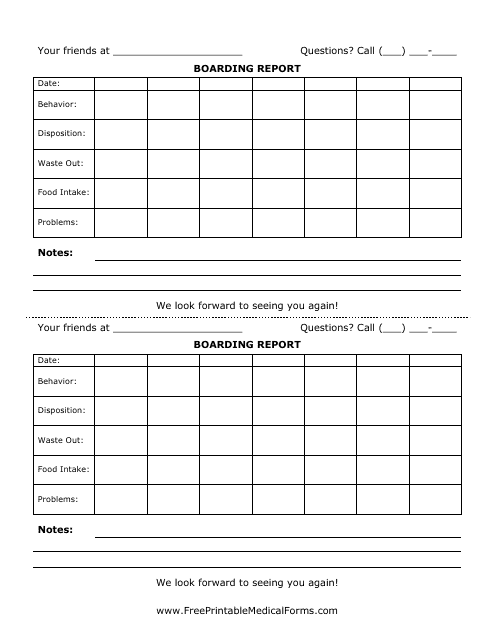

This document is a template for creating a boarding report. It is used to provide a detailed overview of the boarding process for a specific event or activity. The template typically includes information such as boarding locations, times, procedures, and any special instructions or considerations.

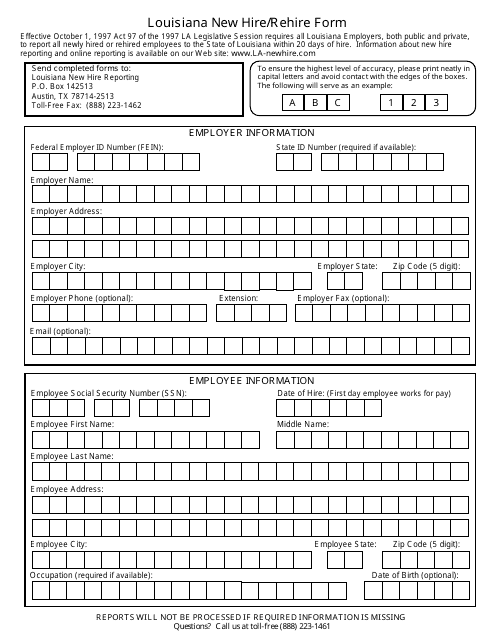

This form is used for reporting new hires or rehires in the state of Louisiana. It helps employers comply with state regulations and provide necessary information about their employees to the appropriate agencies.

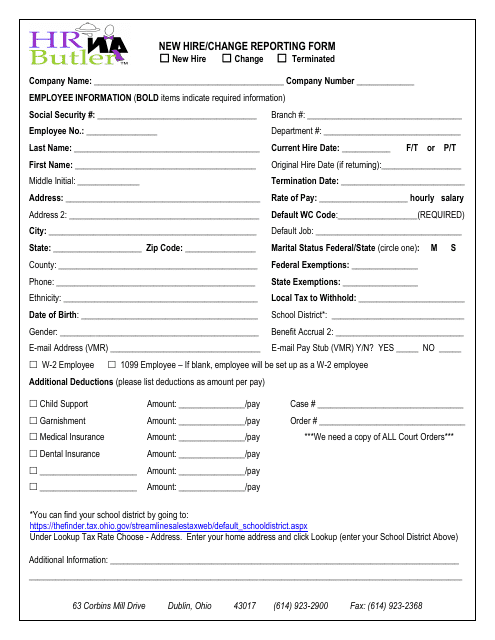

This form is used for reporting new hires or changes in employee information to HR Butler in Ohio.

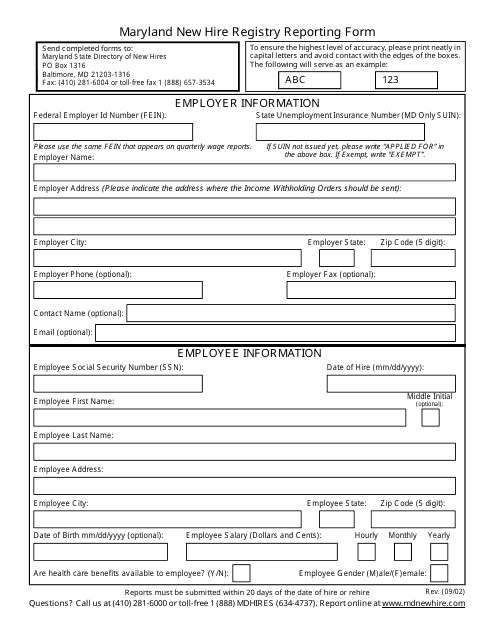

This form is used for reporting new hires in the state of Maryland. Employers are required to submit this form to the appropriate agency to help track and enforce child support orders.

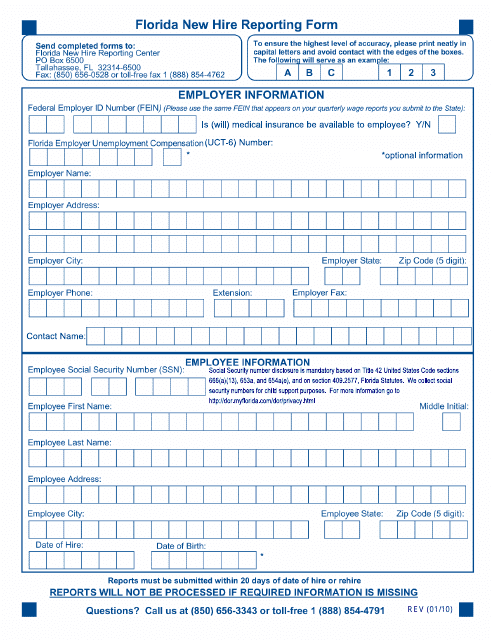

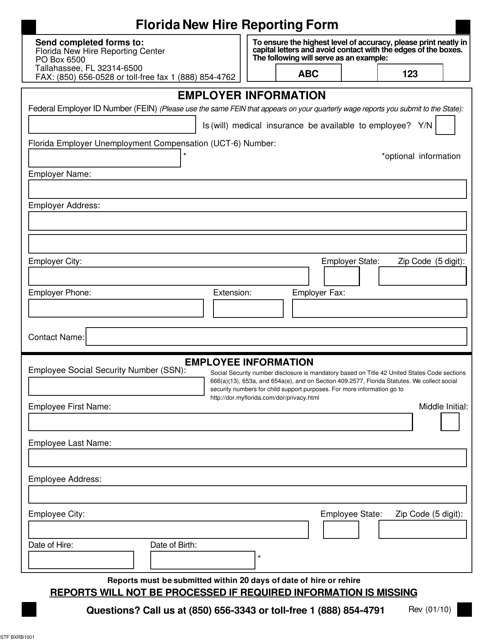

This form is used for reporting new hires in the state of Florida. It ensures that employers fulfill their legal obligations by providing information about newly hired employees to the Florida Department of Revenue.

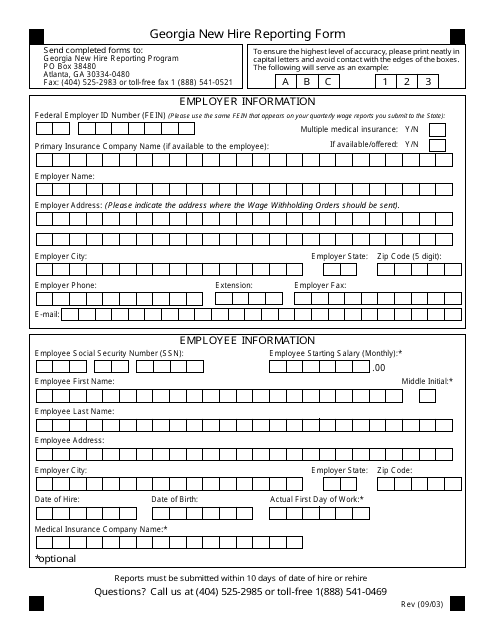

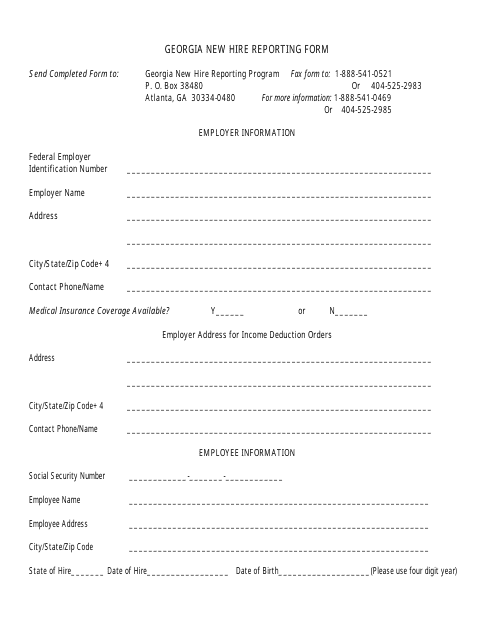

This document is used for reporting new hires in Georgia as part of the Georgia New Hire Reporting Program.

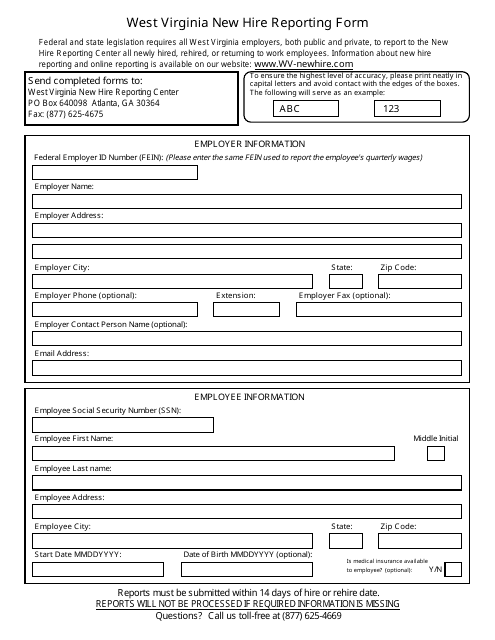

This form is used for reporting new hires to the West Virginia New Hire Reporting Center in West Virginia.

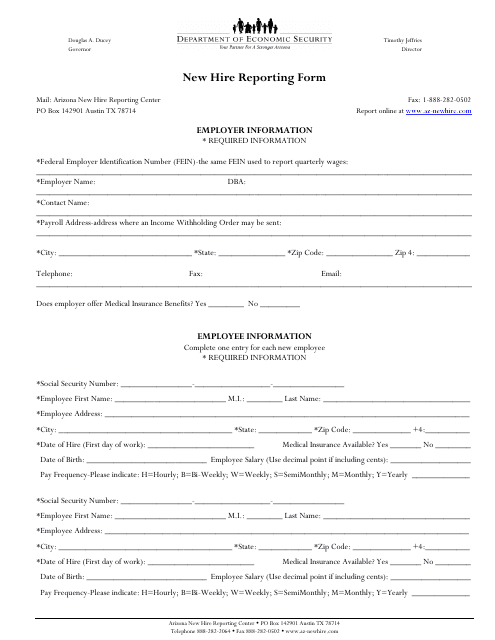

This document is used for reporting the hiring of new employees to the state of Arizona. It helps the state track and monitor employment and ensure compliance with state regulations.

This Form is used for reporting new hires in the state of Georgia, United States. It helps the government track employment and ensure compliance with child support laws.

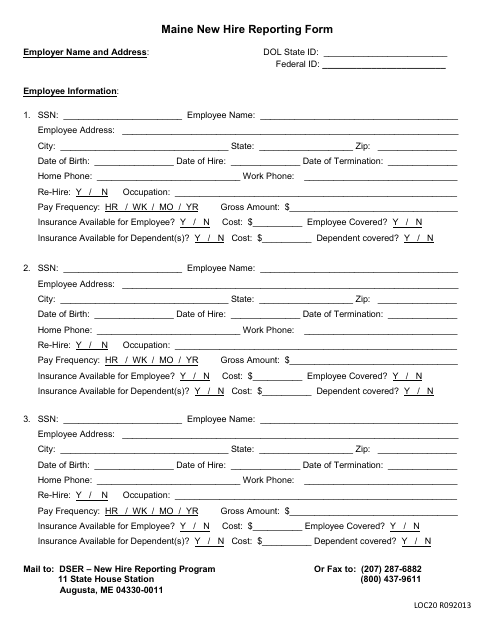

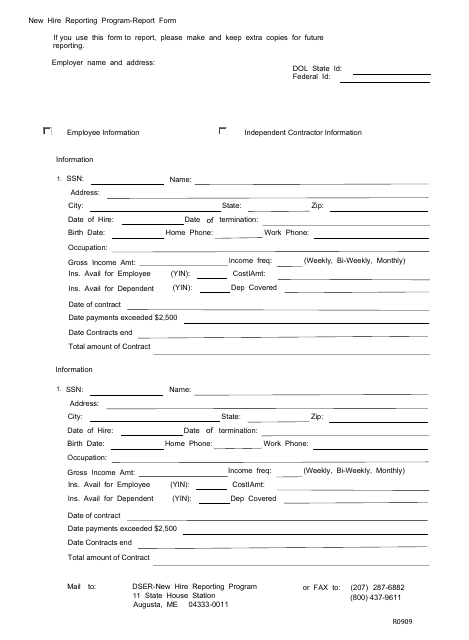

This Form is used for reporting new hires in the state of Maine. Employers are required to submit this form to the Maine Department of Labor to comply with state reporting requirements.

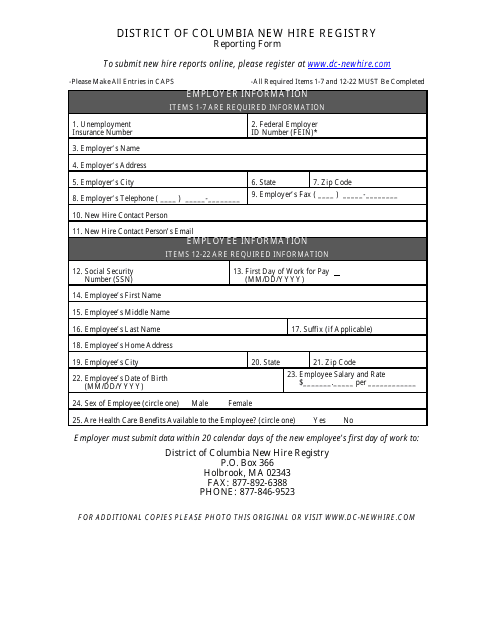

This form is used for reporting new hires to the District of Columbia New Hire Registry in Washington, D.C.

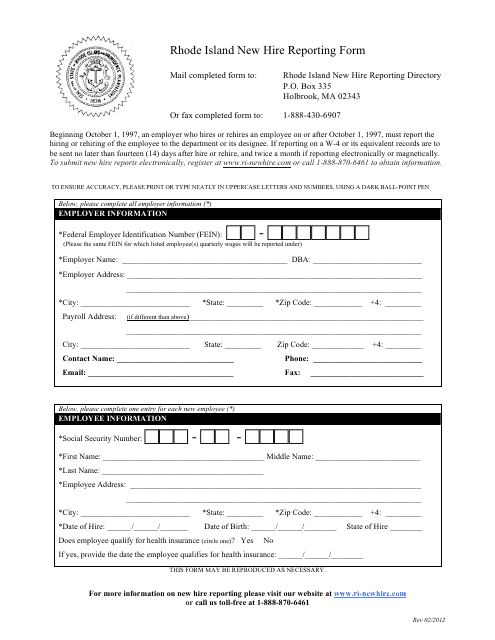

This Form is used for reporting new hires in Rhode Island.

This form is used for reporting new hires in the state of Maine. Employers are required to use this form to provide information about newly hired employees to the state's employment agency.

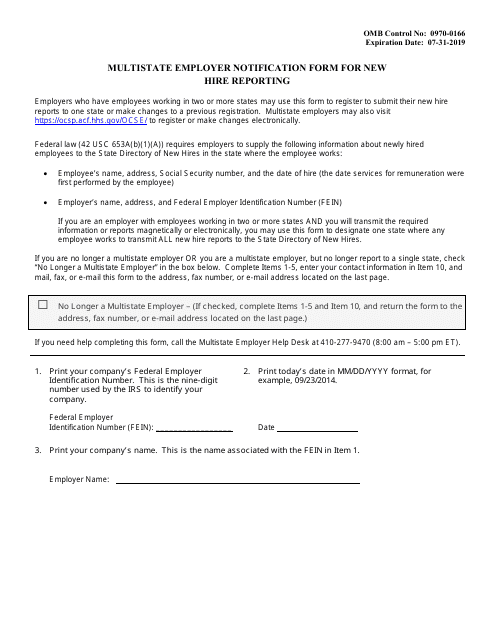

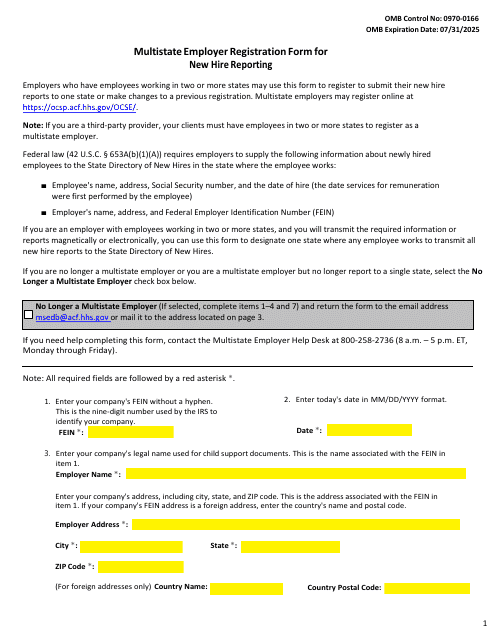

This form is used for notifying employers with operations in multiple states about new hires.

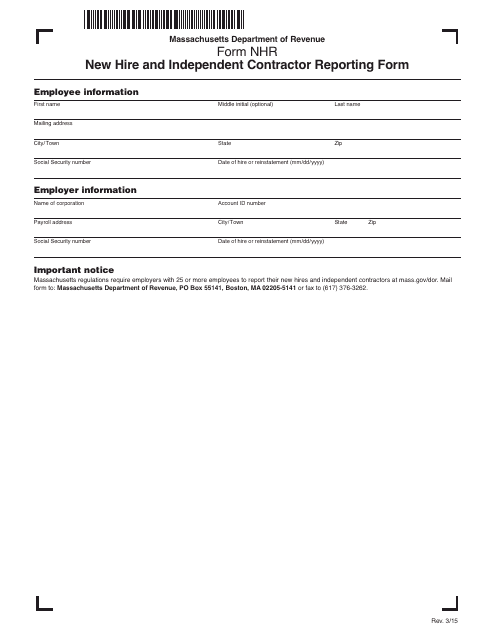

This Form is used for reporting new hires and independent contractors in Massachusetts.

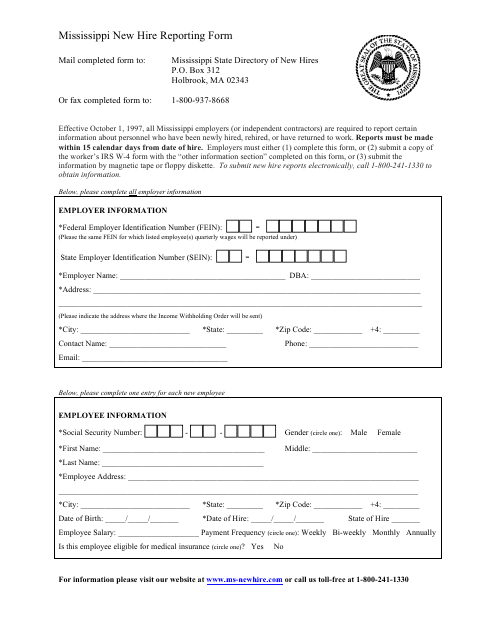

This document is used to report new hires in the state of Mississippi to the Mississippi State Directory of New Hires.

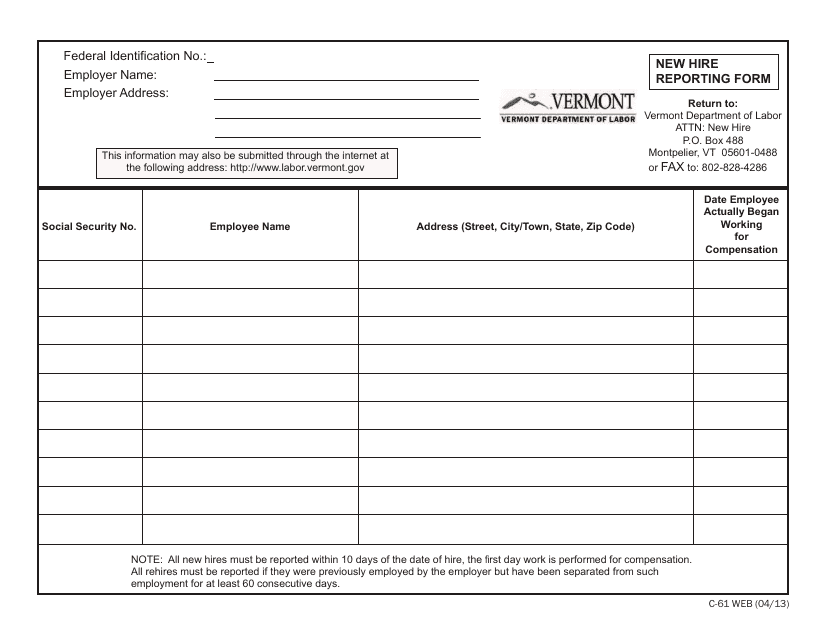

This Form is used for reporting new hires in the state of Vermont to the Department of Labor.

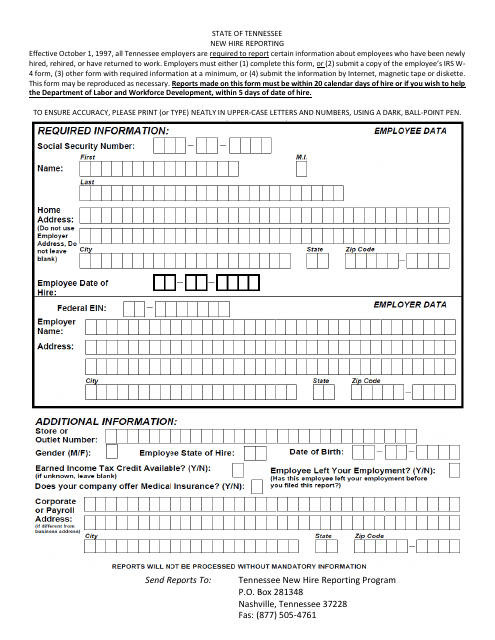

This form is used for reporting newly hired employees in the state of Tennessee. It helps employers comply with state regulations and ensures that appropriate information is provided to the government.

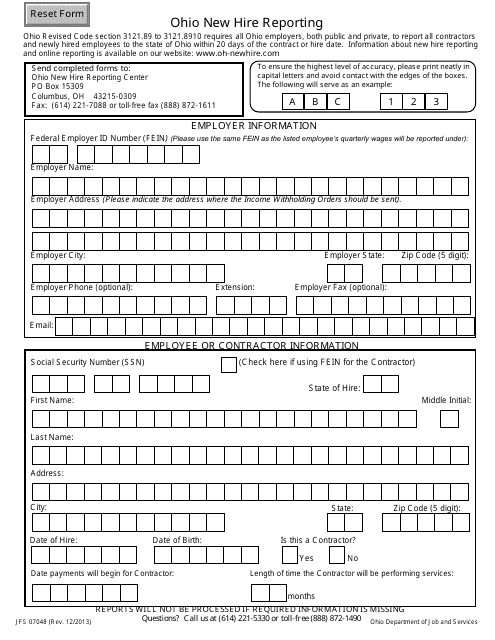

Ohio private and public employers may use this official form to inform the government about an individual recently hired by their business.

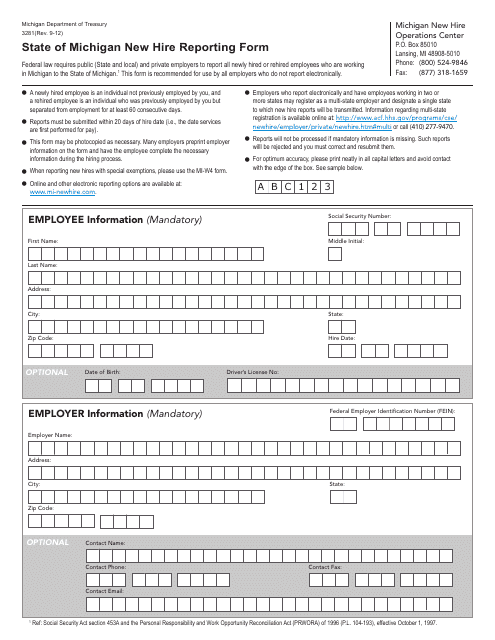

This is a legal document used by an employer to report information on newly hired employees to the Department of Treasury shortly after the date of hire in the state of Michigan.

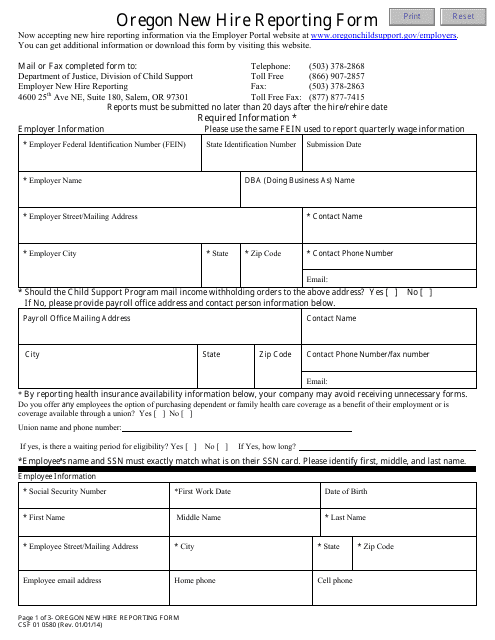

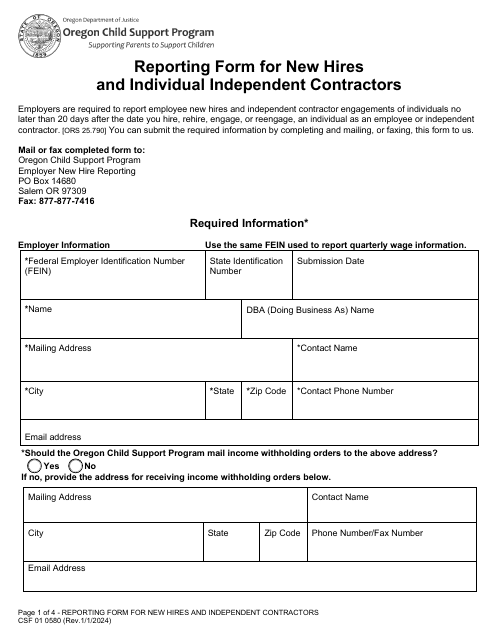

This Form is used for reporting new hires in the state of Oregon.

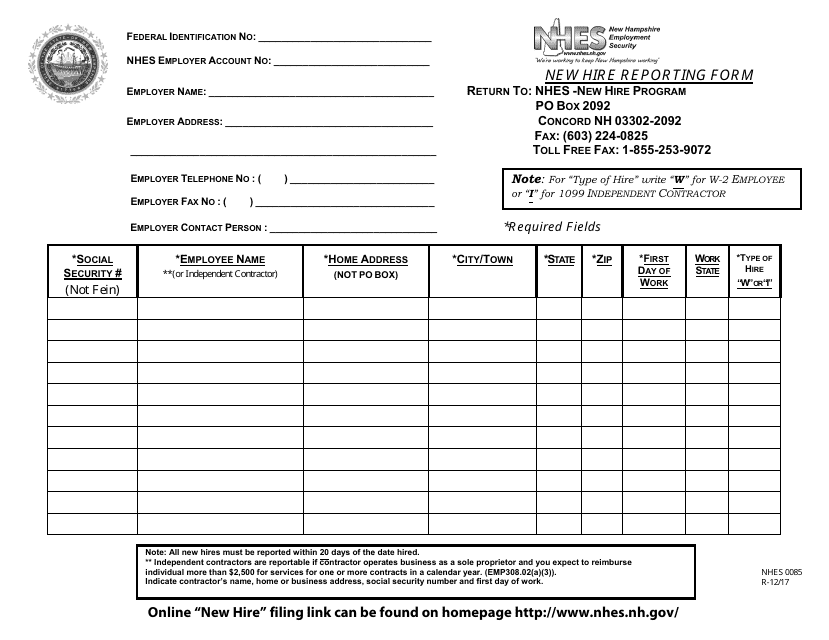

This form is used for reporting new hires in the state of New Hampshire. It is required by law for employers to report new hire information to the state's employment agency.

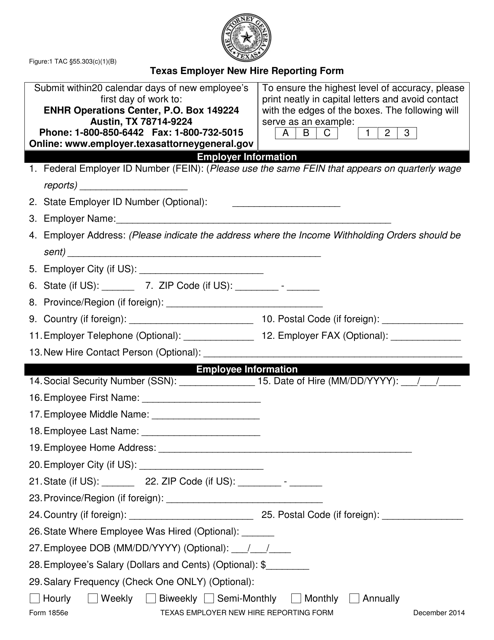

This form is used for Texas employers to report new hires to the state.

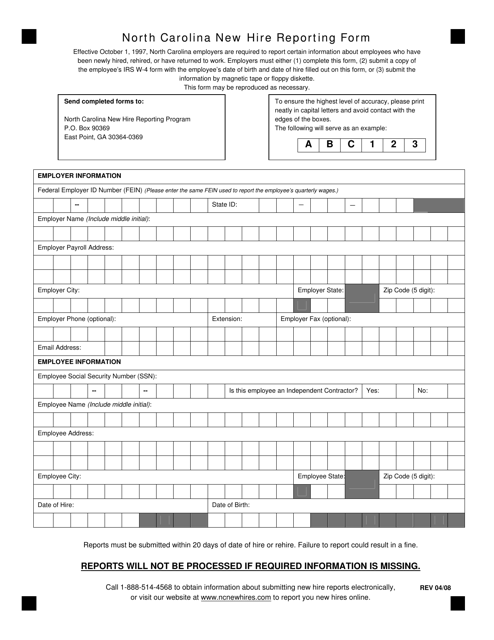

This is a document that is used by employers in the state of North Carolina to report information about their employees who have been newly hired, rehired, or have returned to work.

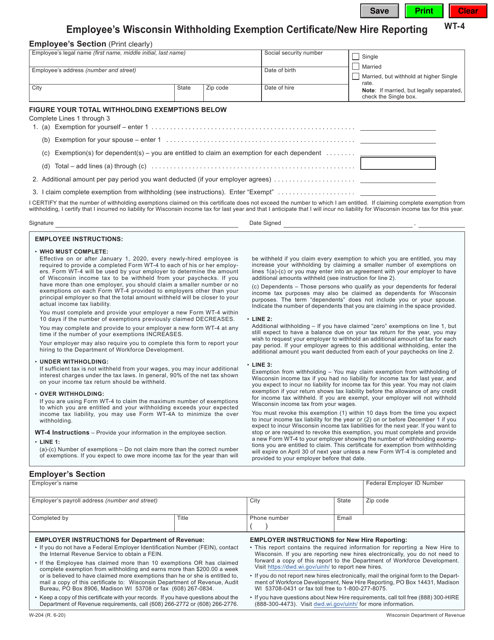

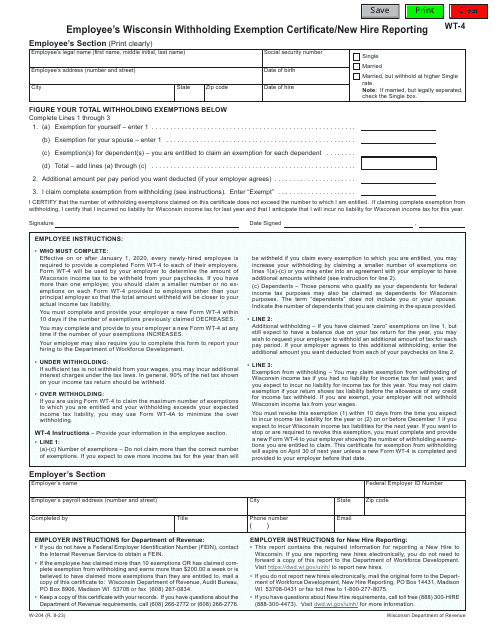

This form is used for reporting new employees in Wisconsin and determining their withholding exemptions for tax purposes.

This Form is used for reporting new hires in the state of Florida. It helps employers comply with state and federal laws by reporting information about newly hired employees to the Florida Department of Revenue.

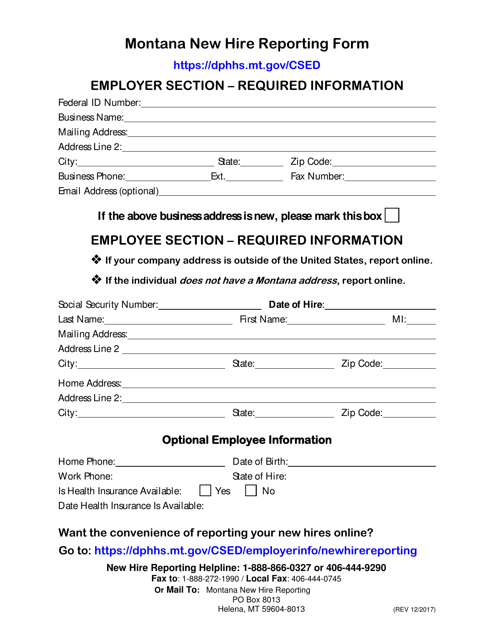

Montana-based employers may use this official form to notify the state government about all of the individuals they employ.

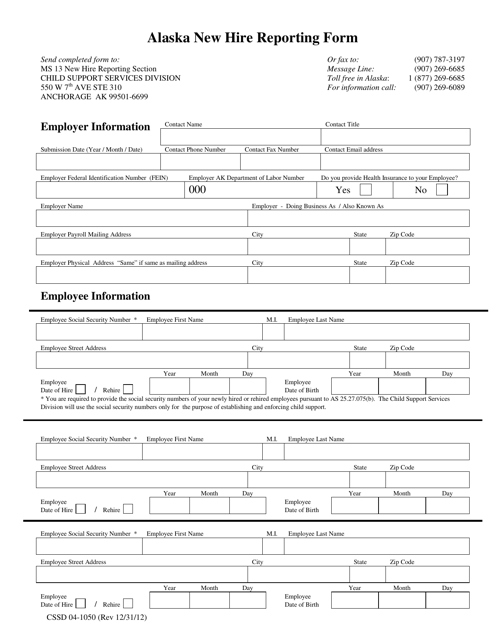

This form is used for reporting new hires in the state of Alaska. It is mandatory for employers to submit this form to the Alaska Department of Labor and Workforce Development within 20 days of hire.

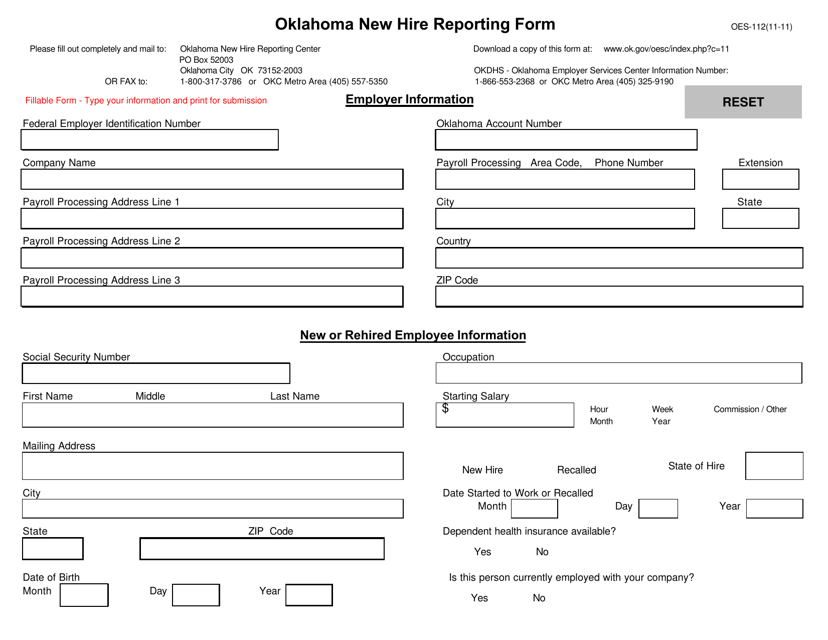

This form is used for reporting new hires in the state of Oklahoma. Employers are required to submit this form to the Oklahoma Employment Security Commission to ensure compliance with state laws regarding new employee reporting.

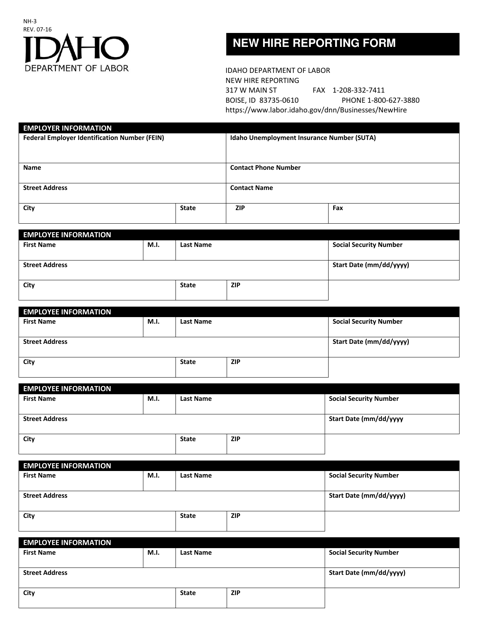

This form is used for reporting new hires in the state of Idaho.

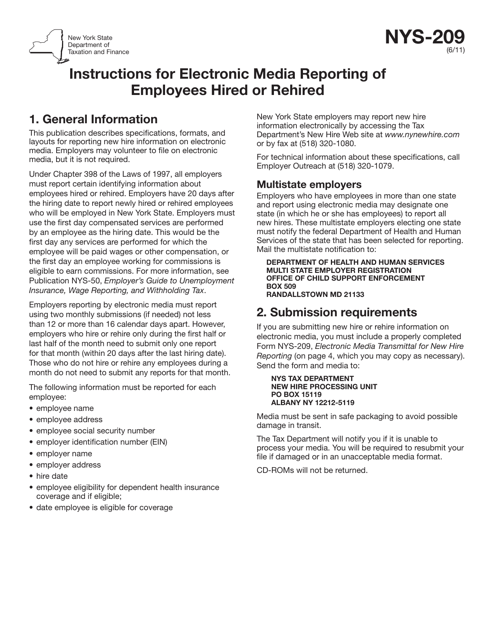

This form is used for electronically transmitting new hire information to the New York State Department of Taxation and Finance. It is required by employers to report the hiring of new employees.

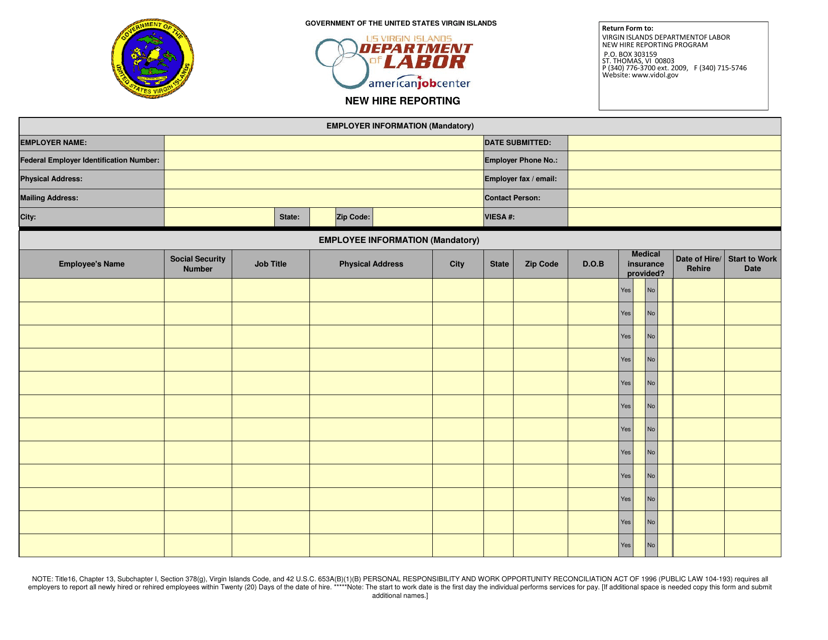

This form is used for reporting newly hired employees in the Virgin Islands.

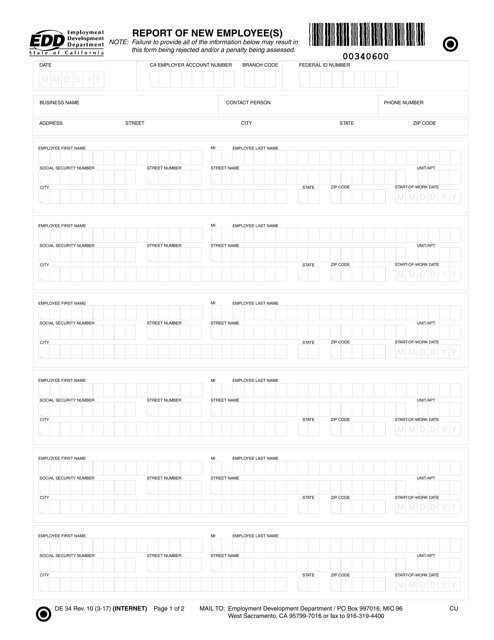

This form is used for reporting new employees to the state of California. It is required by the California Employment Development Department (EDD) to provide information on newly hired employees for tax and unemployment purposes.

This form is used for registering a multistate employer for new hire reporting. It ensures compliance with state requirements for reporting new employee hires.