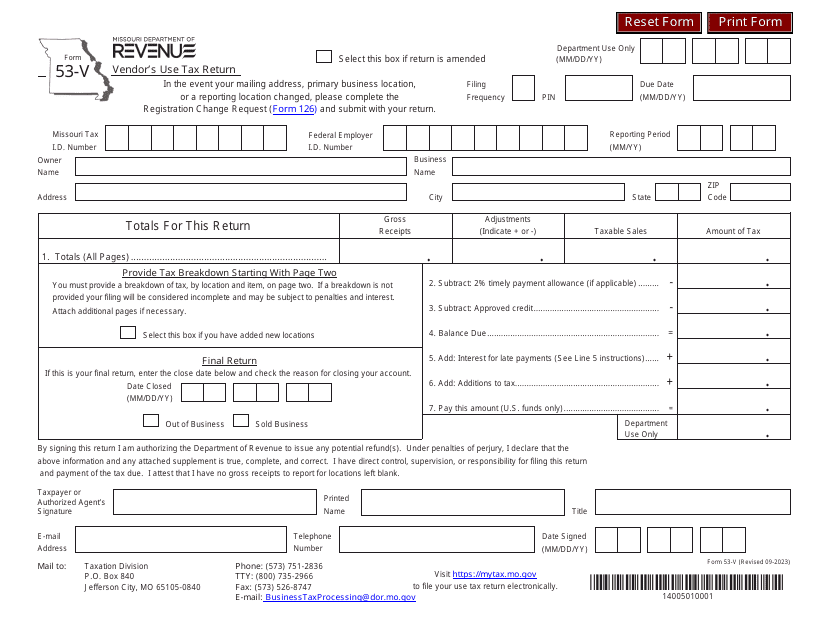

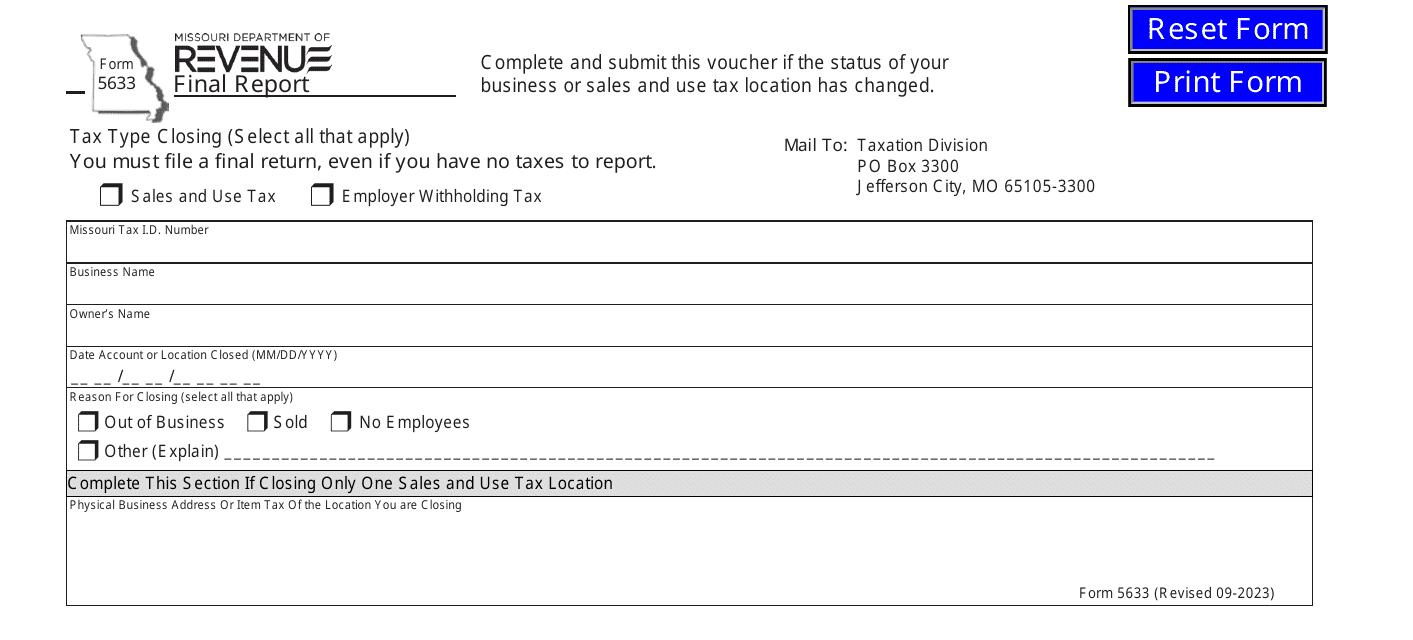

Missouri Sales Tax Form Templates

Missouri Sales Tax Forms are used for reporting and remitting sales taxes to the state of Missouri. Businesses in Missouri are required to collect and remit sales taxes on taxable sales made within the state. These forms help businesses calculate the amount of sales tax owed and provide a means for reporting and paying the tax to the Missouri Department of Revenue.

Documents:

4

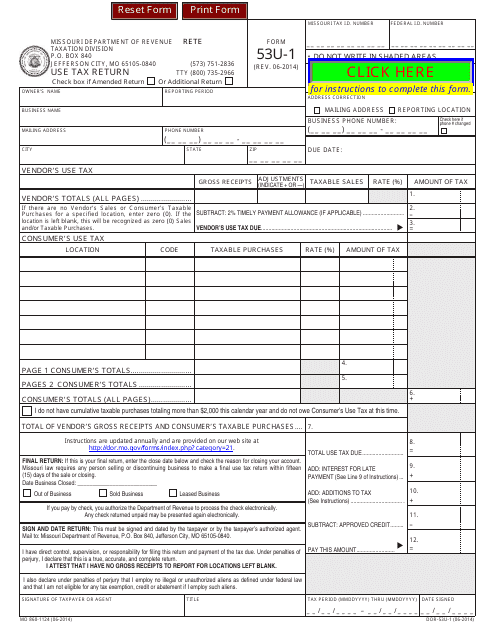

This Form is used for reporting and paying use tax in the state of Missouri. Use tax is owed on taxable items that were purchased tax-free and used in Missouri. The Form 53U-1 is used to calculate the use tax owed and submit it to the Missouri Department of Revenue.

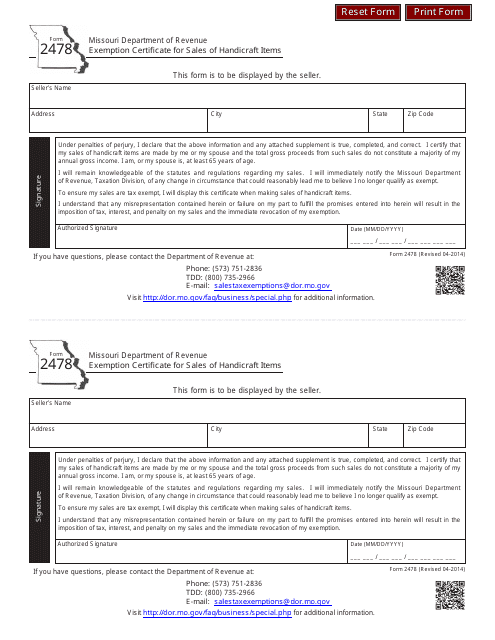

This document is used for obtaining an exemption certificate in Missouri for sales of handicraft items.