IRS W-9 Forms and Instructions for 2023

What Are W-9 Forms?

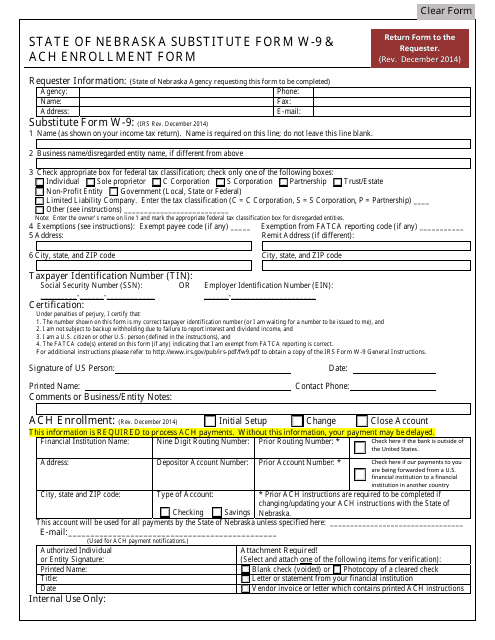

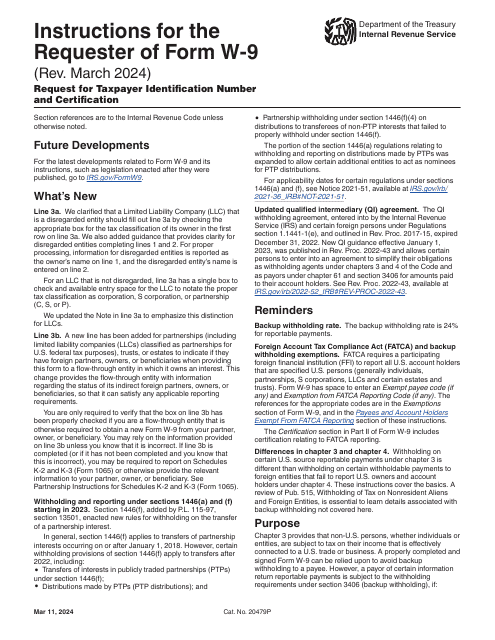

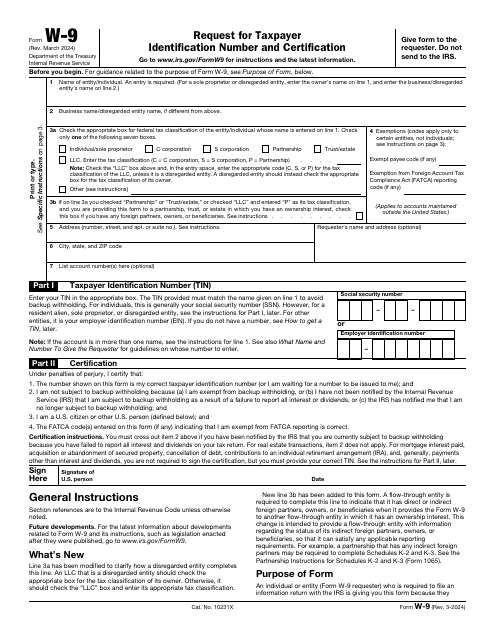

IRS Form W-9, Request for Taxpayer Identification Number and Certification, is a document that is requested by an individual or entity to get a Taxpayer Identification Number (TIN) in order to file an information return with the Internal Revenue Service (IRS). These forms request the name, address, and TIN which can be presented by a Social Security Number (SSN) and Employer Identification Number (EIN), and in certain situations with an Adoption Taxpayer Identification Number (ATIN) or Individual Taxpayer Identification Number (ITIN).

Form W-9 has two specialized versions:

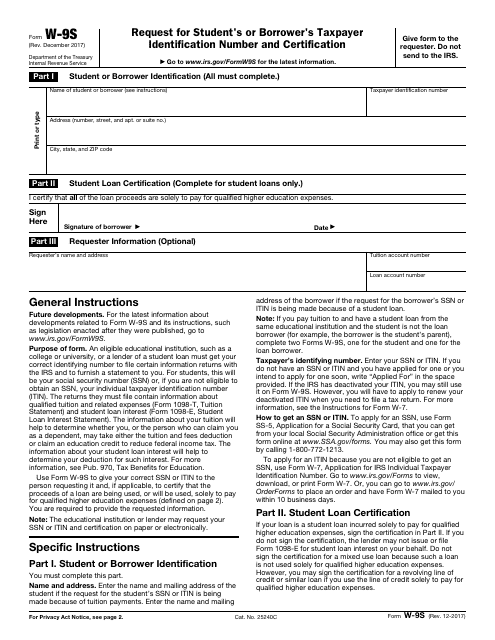

- IRS Form W-9S, Request for Student's or Borrower's Taxpayer Identification Number and Certification, is requested by an educational institution or student loan lender to file certain information returns with the IRS and to verify that a loan’s proceeds will only be used to pay for qualified higher education expenses;

- IRS Form W-9(SP), Solicitud y Certificación del Númer de Identificación del Contribuyente, is a version of Form W-9 constituted especially for spanish-speaking citizens.

What Are W-9 Forms Used For?

W-9 Forms include areas for personal information, instructions for the sender and the recipient, certification information, and a place for signatures. According to the instructions of the IRS, W-9 tax forms are to be completed by receivers of certain types of payments. Some of such are listed below:

- Income Paid to a Person Under Contract Statement. Companies use W-9 forms to demand information from the entrepreneurs they hire. Under certain conditions, companies are required to file Form 1099-MISC. To fill out Form 1099-MISC, companies need to request information, for which W-9 tax forms are used.

- Proceeds From Real Estate Transactions. The process of real estate transactions requires a long list of paperwork to be filled out. It is important for the IRS to understand the unique tax identifiers of all of the involved parties.

- Home Mortgage Interest. Since you can claim a deduction for mortgage interest on your federal income tax return, a W-9 must be provided to third parties.

Other types of payments also include canceled debt, acquisition or abandonment of secured property, stock or mutual fund sales, and certain other transactions by brokers, dividends, merchant card transactions, etc.

How to Get W-9 Forms?

If you’re a requester of the form, in order to receive a filled out application from another party you need to mail them the form with the request of filling it in and sending it back to you. It is acceptable to send the form by email (or fax). Fillable versions of the various IRS W-9 Forms are available for download below.

Where to Mail W-9 Forms?

IRS W-9 Forms are supposed to be mailed to the requester - a person or a company, who is required to file an information return with the IRS to report. It is possible to email the application to the requester if the taxpayer who filled in the W-9 has a certified electronic signature. In any case, the application is supposed to be given to the requester, not sent to the IRS.

Documents:

4

This is an IRS application requested from students to provide their taxpayer information to an educational institution (a college or university) or a lender of a student loan.

This is a formal instrument completed by a taxpayer to list their full name, contact details, and taxpayer identification number when requested by a party they worked with.