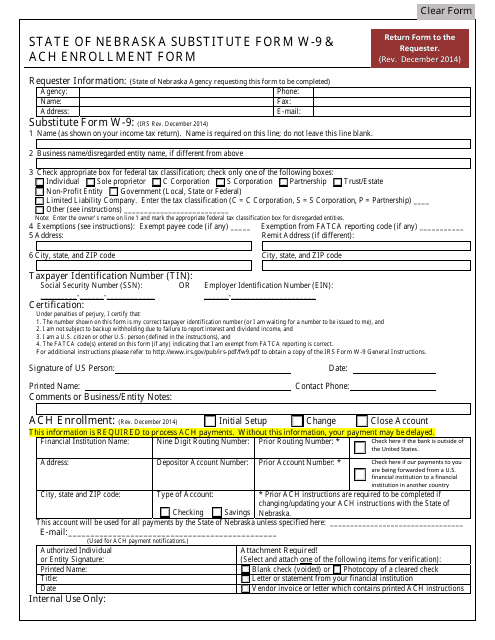

Substitute Form W-9 Templates

Substitute Form W-9 is a document used to collect the taxpayer identification number (TIN) and other information from individuals or entities who are required to provide it to a requester. It is typically used by businesses to gather necessary information from vendors, independent contractors, or other payees for tax reporting purposes. The information provided on the form helps the requester generate Form 1099, which reports income earned by the payee to the IRS.