Pennsylvania Tax Forms and Templates

Documents:

270

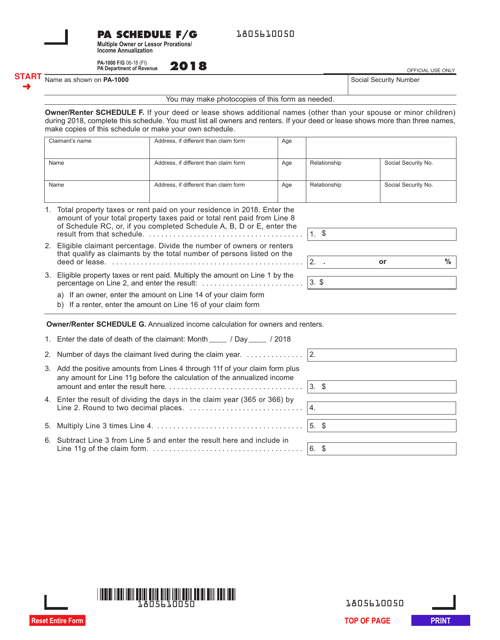

This form is used for calculating multiple owner or lessor prorations and income annualization in Pennsylvania.

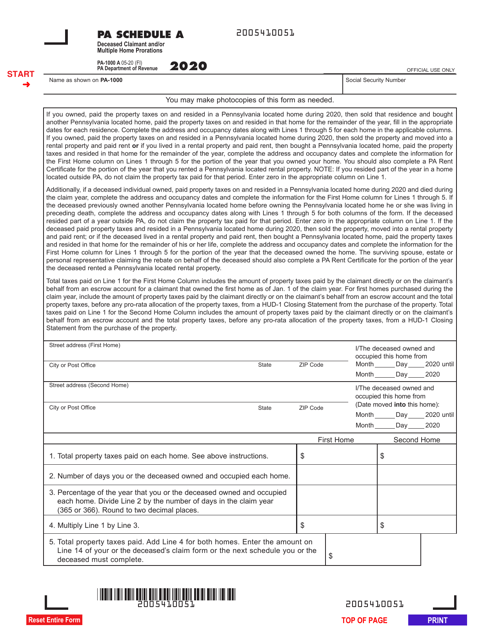

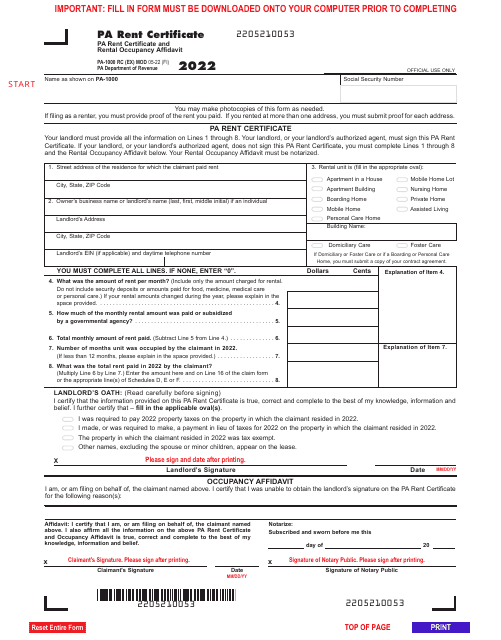

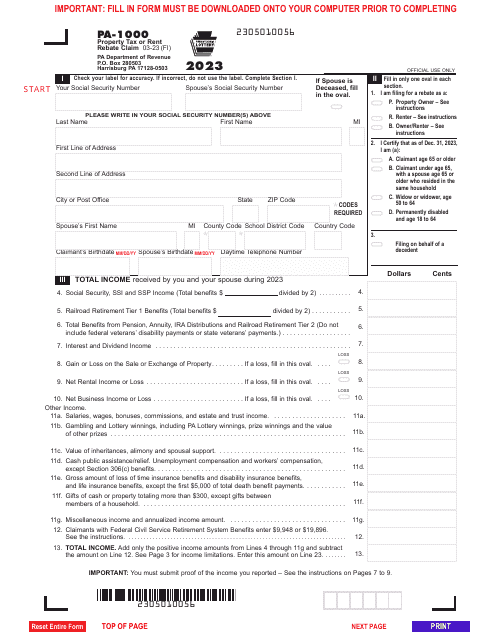

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

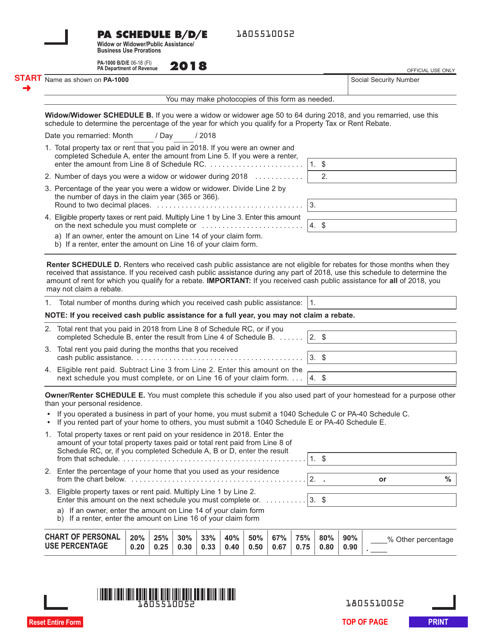

This Form is used for widow or widower/public assistance/business use prorations in Pennsylvania.

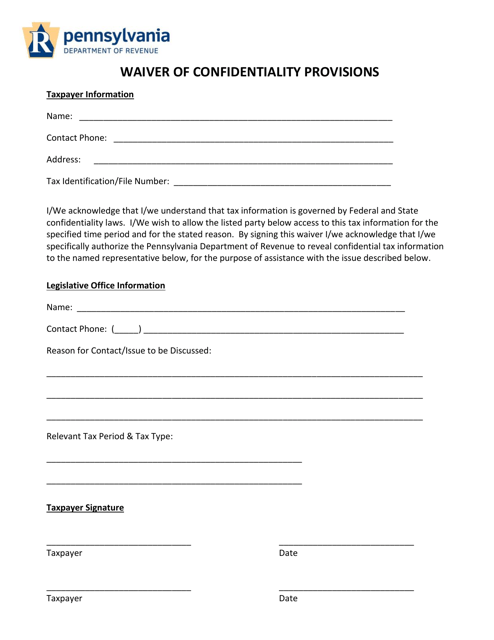

This document allows individuals in Pennsylvania to waive certain confidentiality provisions in legal agreements or contracts.

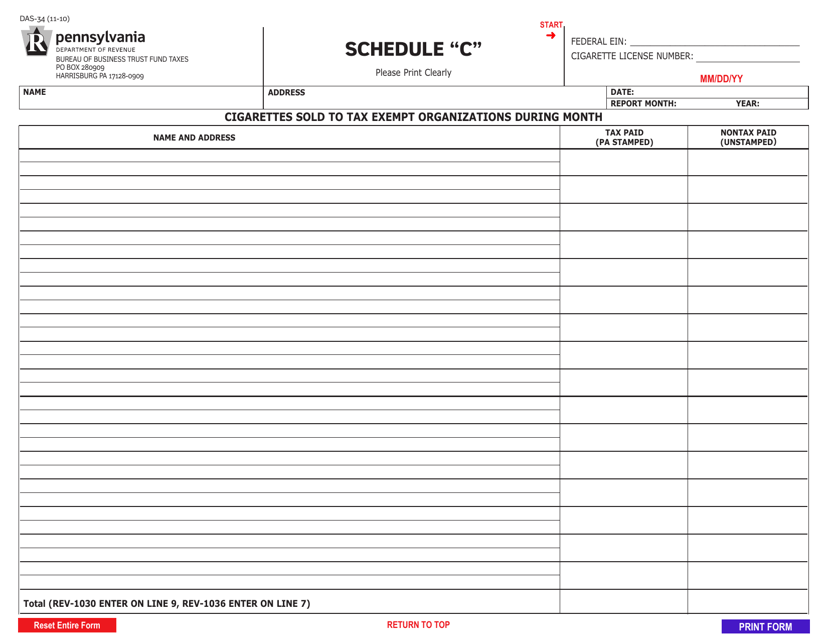

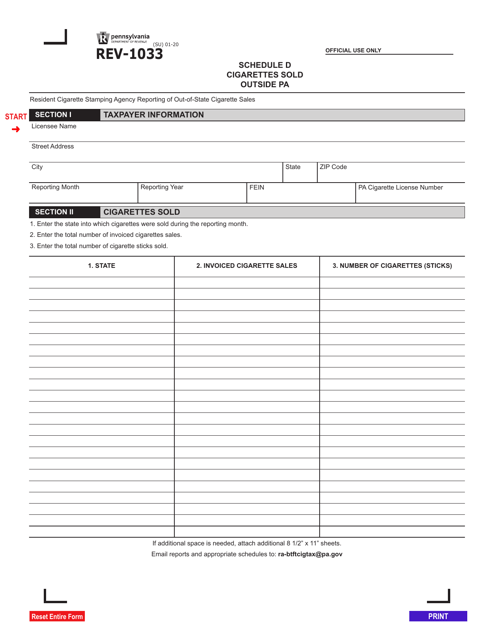

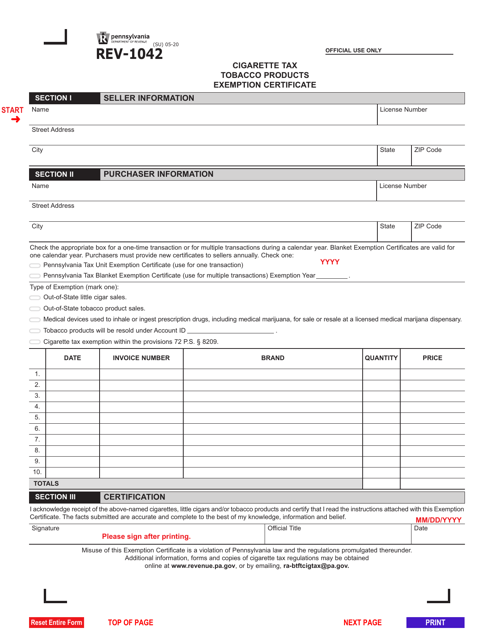

This form is used for reporting the sale of cigarettes to tax-exempt organizations in Pennsylvania during a specific month.

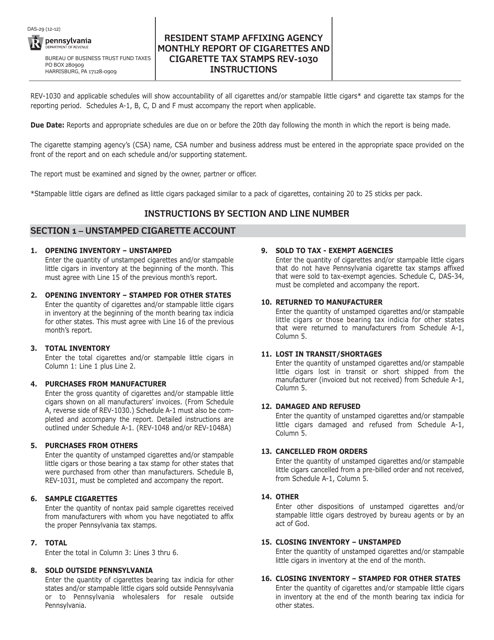

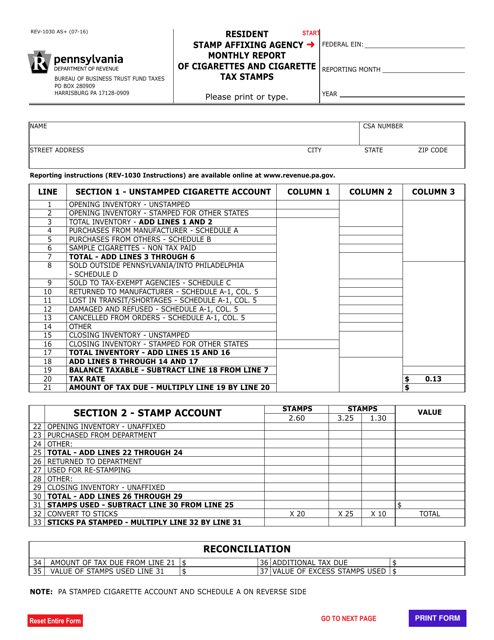

This form is used for the monthly reporting of cigarettes and cigarette tax stamps by resident stamp affixing agencies in Pennsylvania. Residents and agencies can submit this form to report their activities related to the sale and distribution of cigarettes and tax stamps.

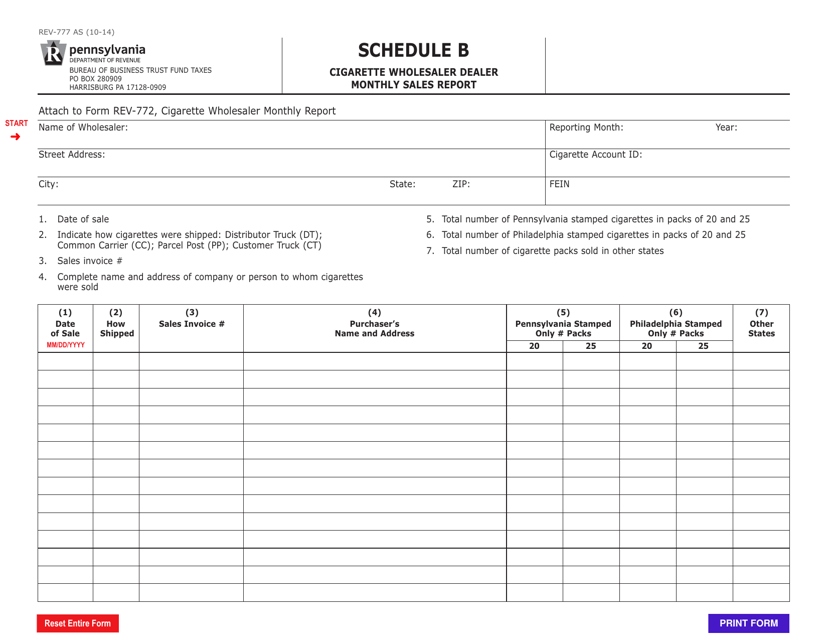

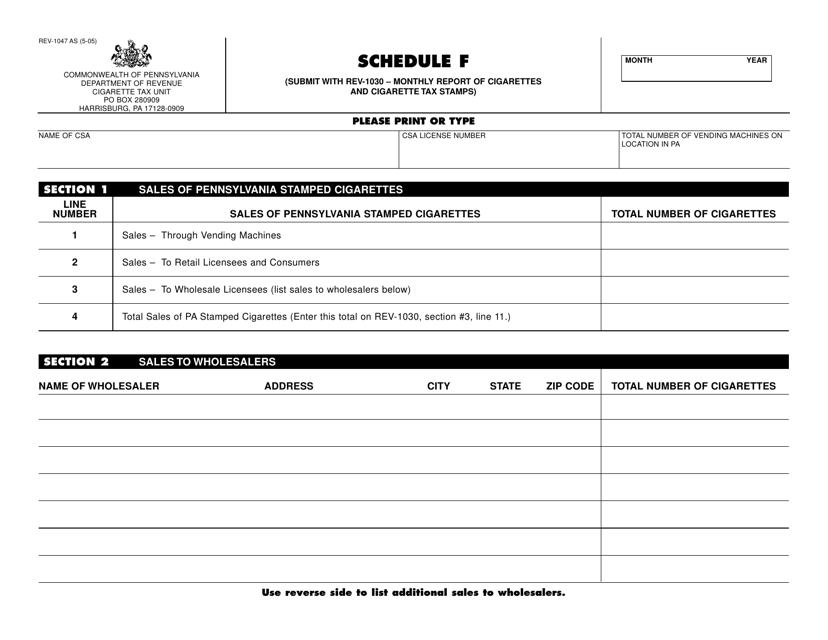

This form is used for reporting monthly sales of cigarettes by wholesalers and dealers in Pennsylvania.

This form is used for the monthly reporting of cigarettes and cigarette tax stamps by resident stamp affixing agencies in Pennsylvania.

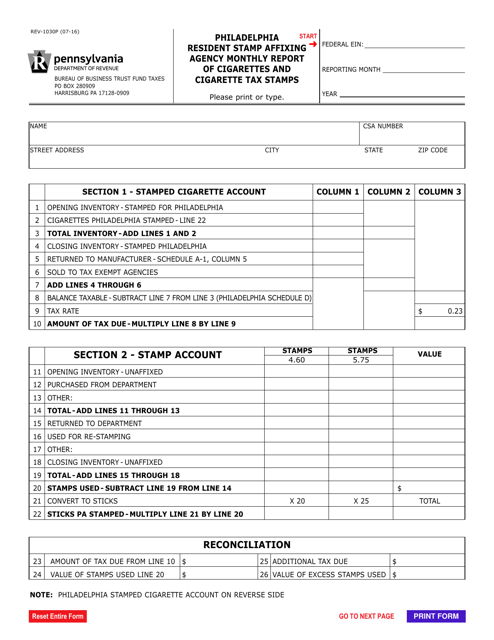

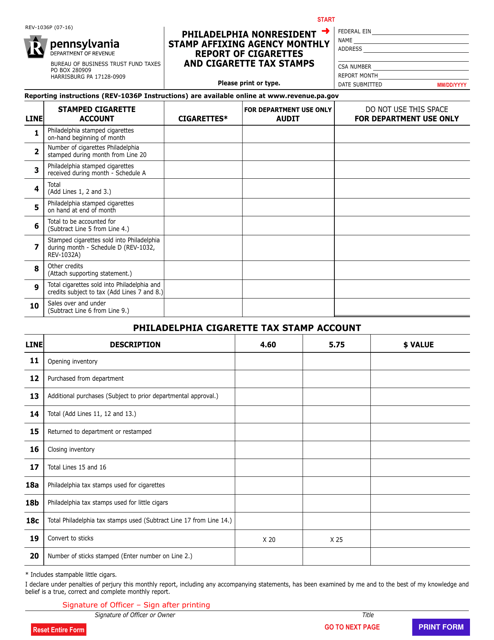

This form is used for Philadelphia residents who are responsible for affixing cigarette tax stamps. It is a monthly report that must be submitted to the Pennsylvania government.

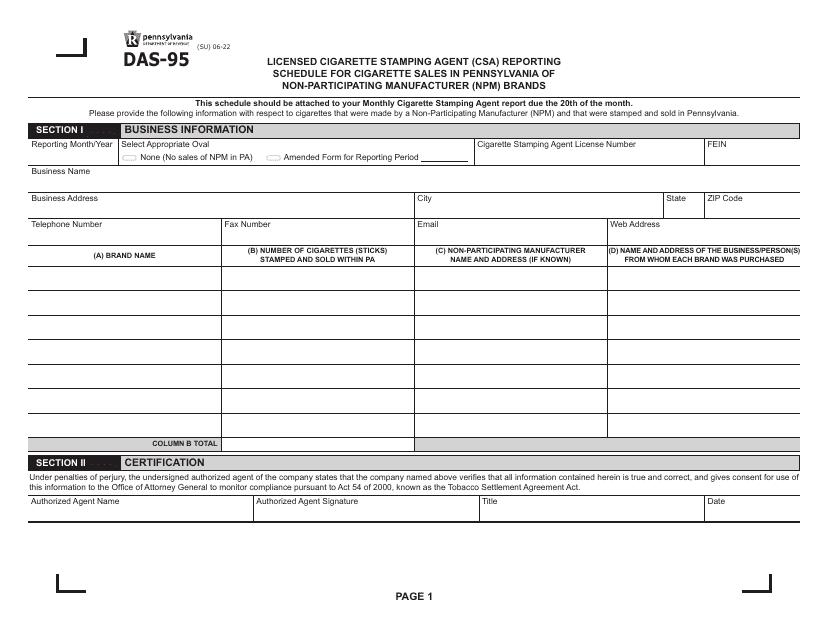

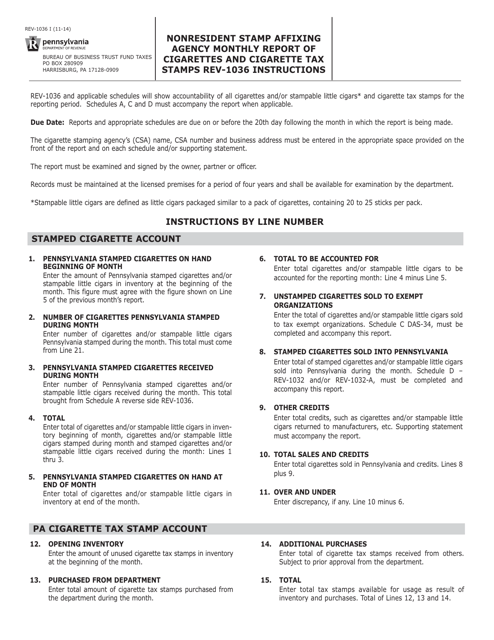

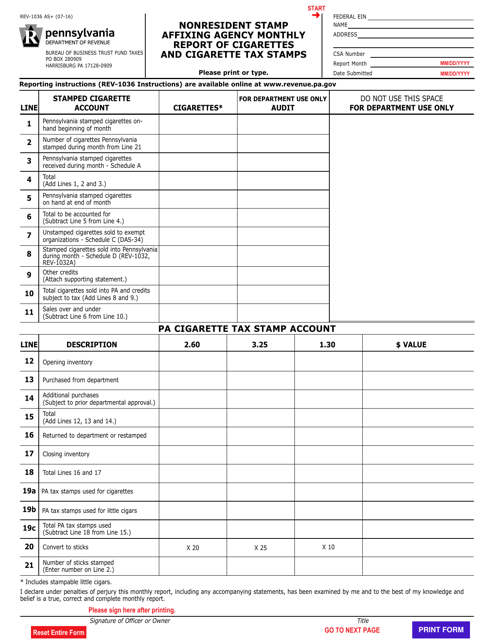

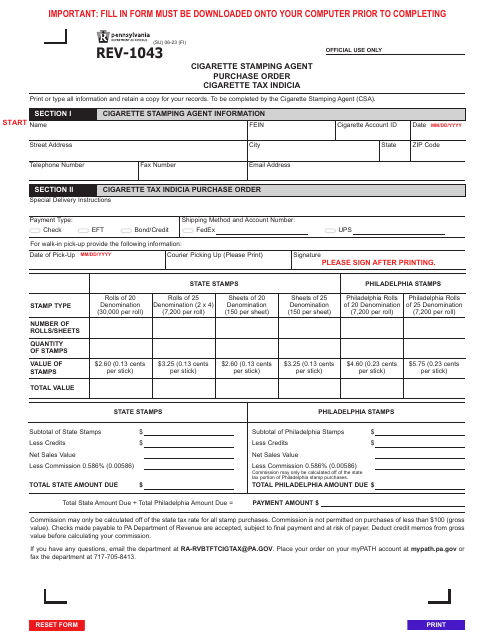

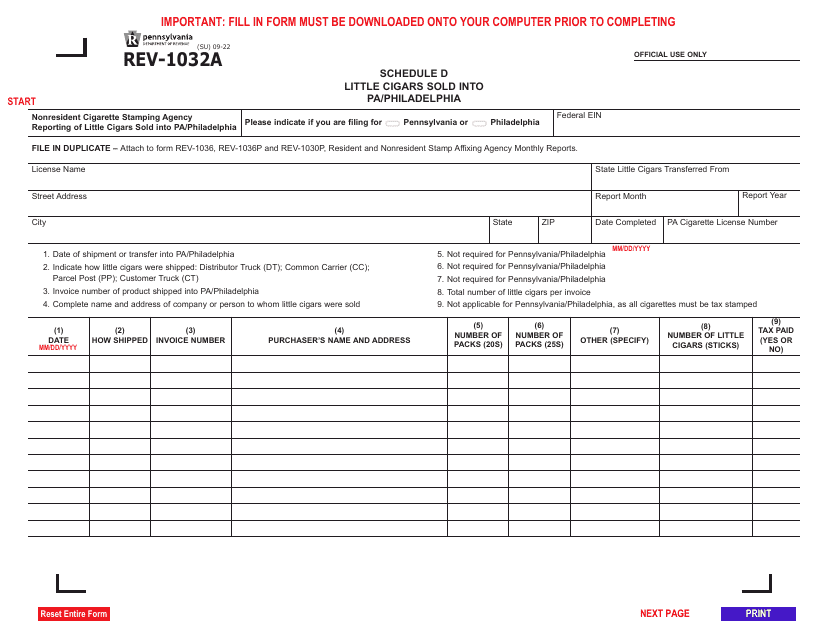

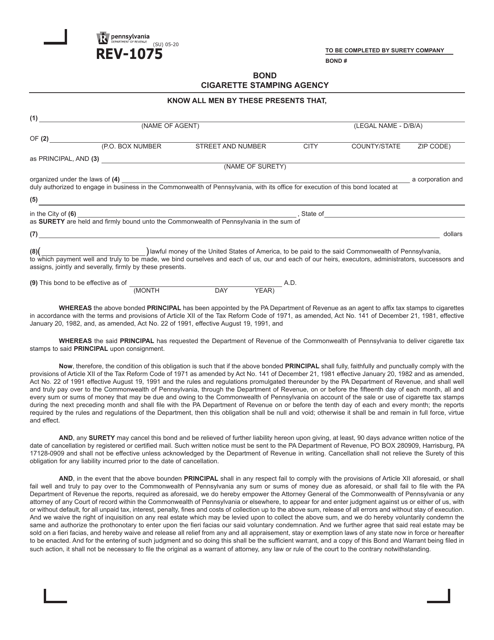

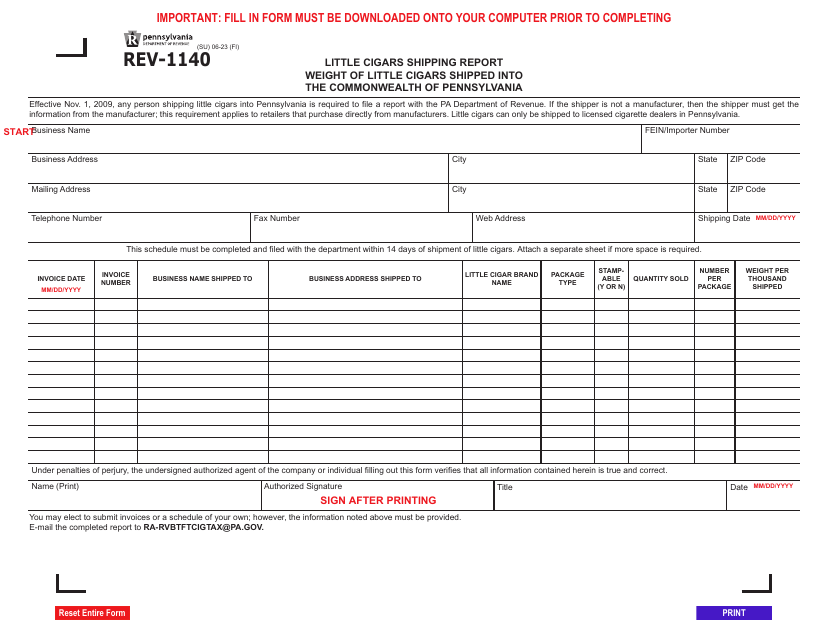

This Form is used for reporting the monthly sales and tax information for nonresident cigarette stamp affixing agencies in Pennsylvania.

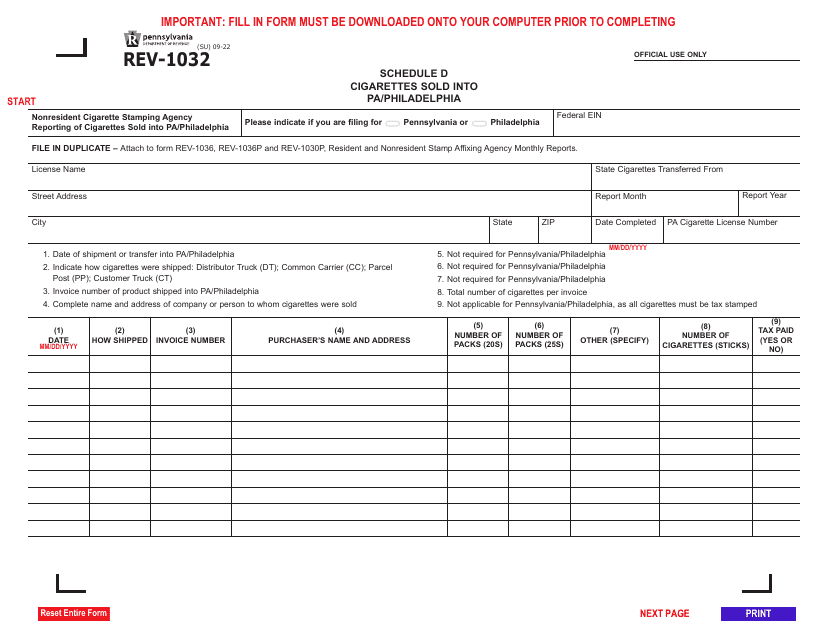

This form is used for reporting the monthly sales of cigarettes and cigarette tax stamps by nonresident stamp affixing agencies in Pennsylvania.

This form is used for reporting the monthly sales and distribution of cigarettes and cigarette tax stamps by a nonresident stamp affixing agency in Philadelphia, Pennsylvania.

This Form is used for filing monthly reports of cigarettes and cigarette tax stamps in Pennsylvania.

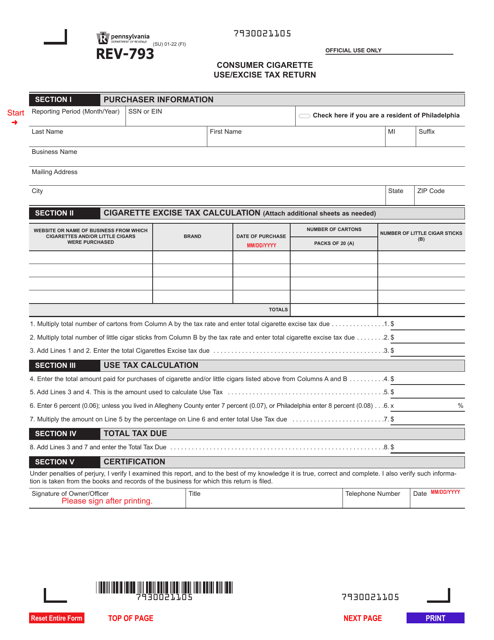

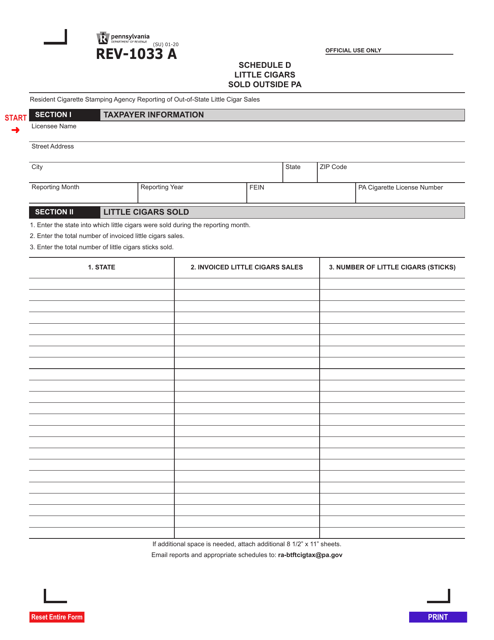

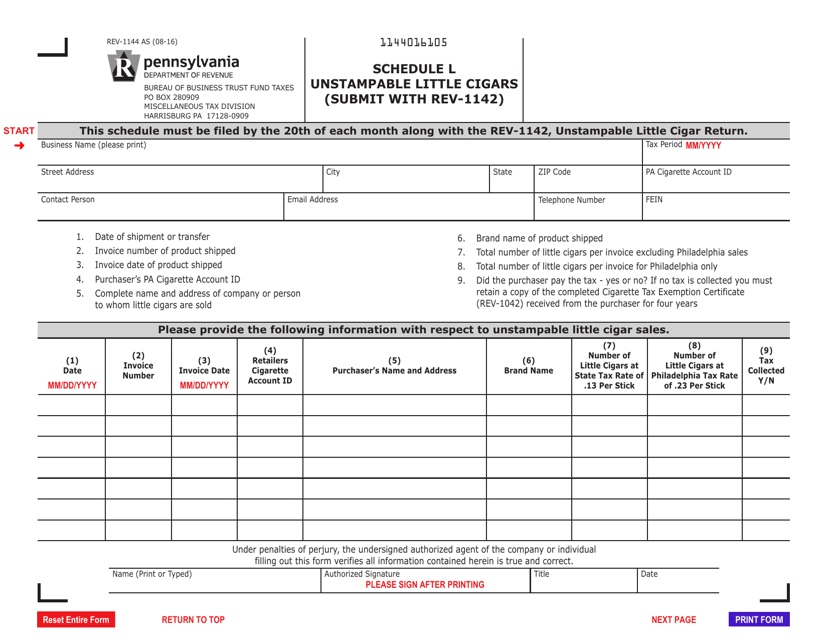

This form is used for reporting and paying the tax on unstampable little cigars in Pennsylvania.