Pennsylvania Tax Forms and Templates

Documents:

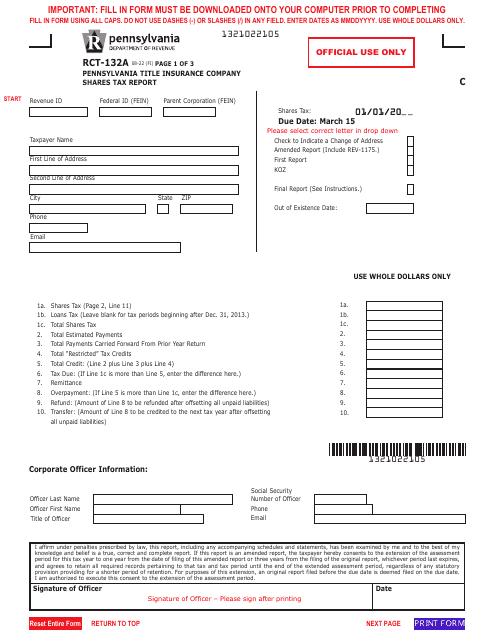

270

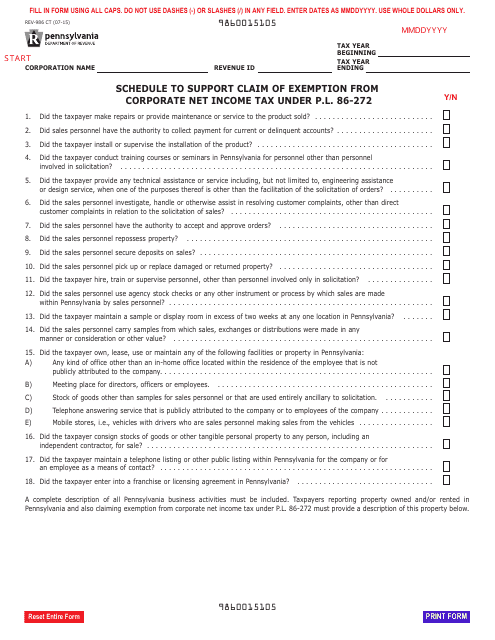

This Form is used for claiming exemption from corporate net income tax in Pennsylvania under P.l. 86-272.

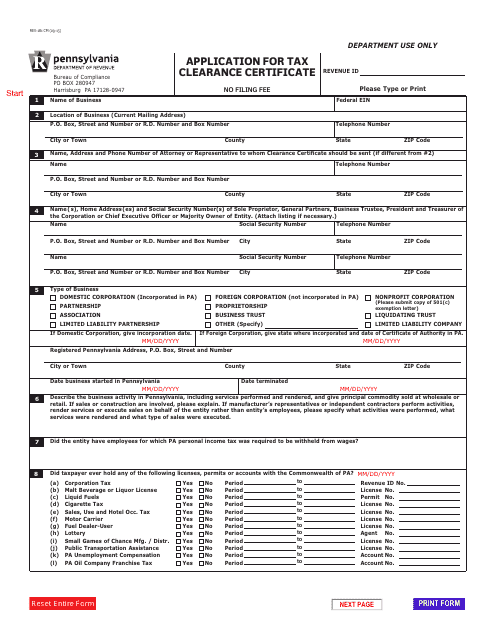

This form is used for applying for a Tax Clearance Certificate in Pennsylvania.

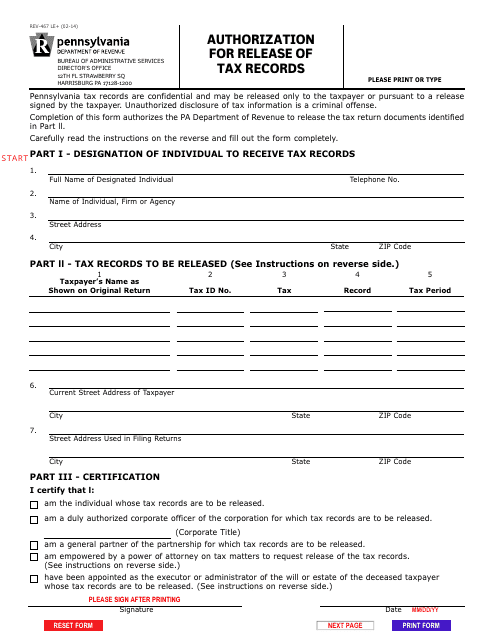

This form is used for authorizing the release of tax records in Pennsylvania.

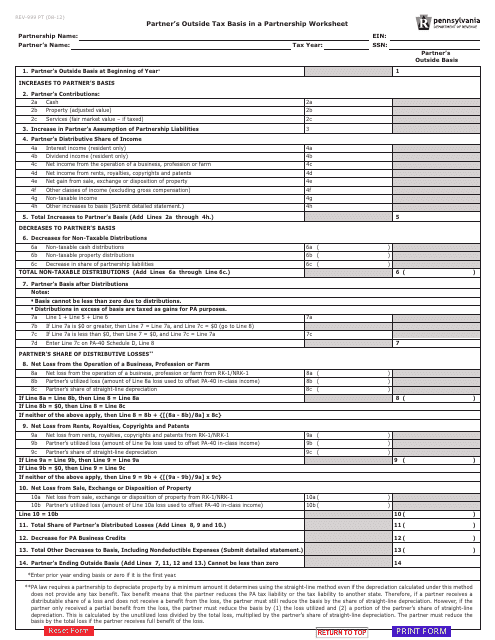

This form is used for calculating the partner's outside tax basis in a partnership in Pennsylvania.

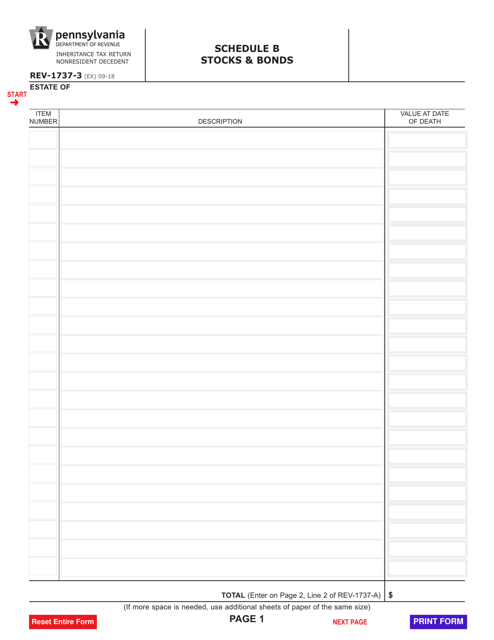

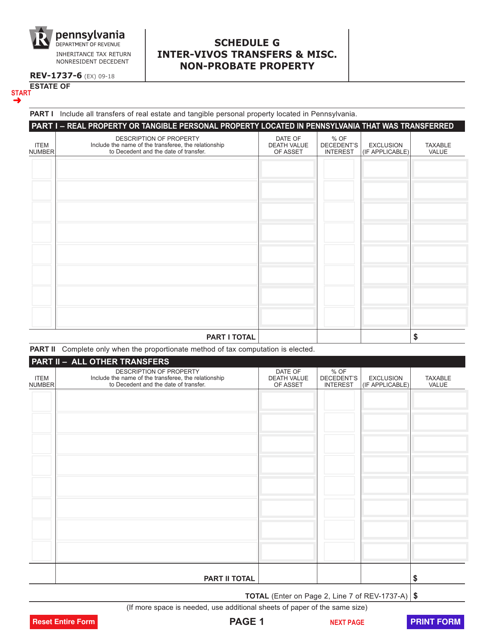

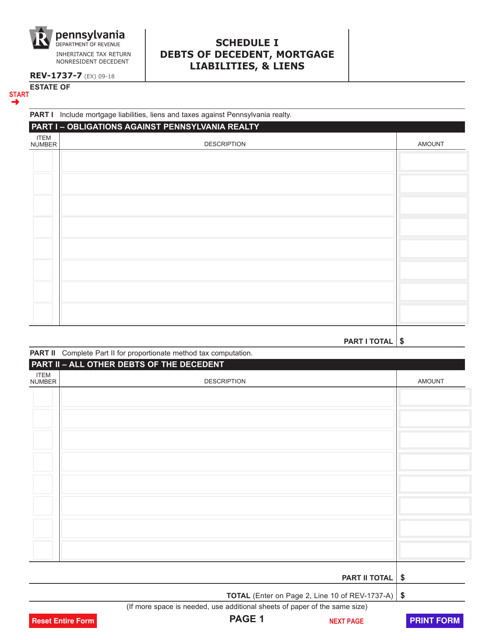

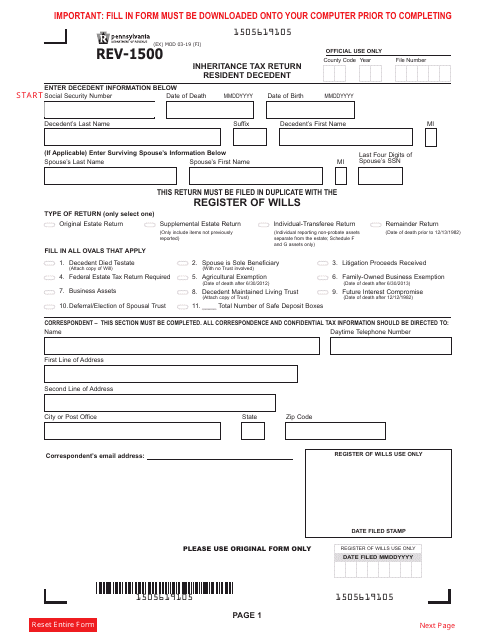

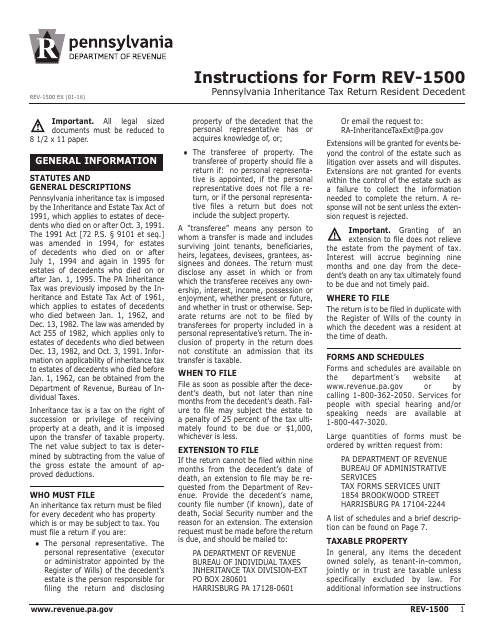

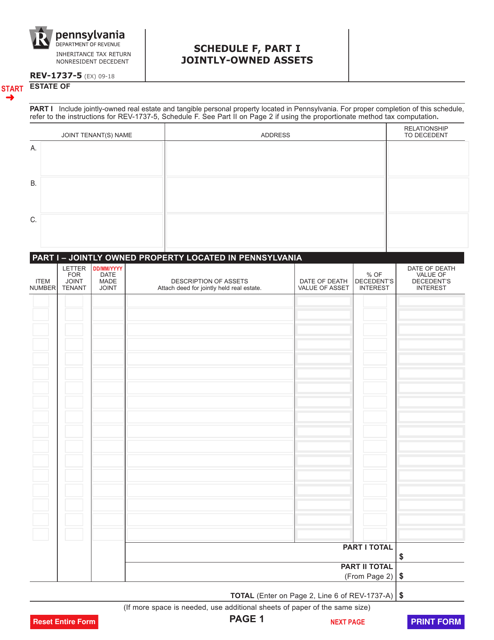

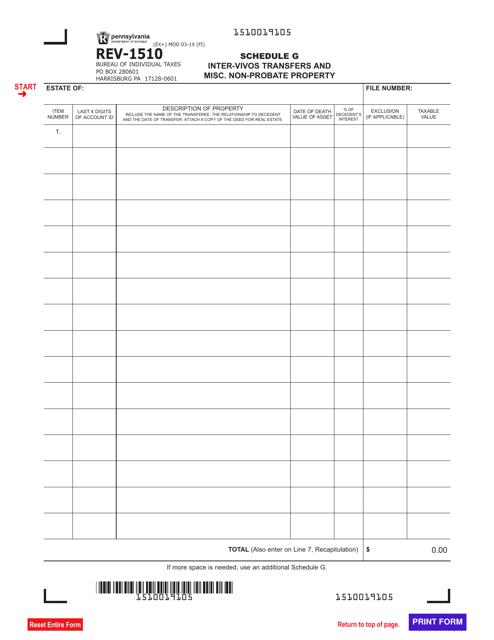

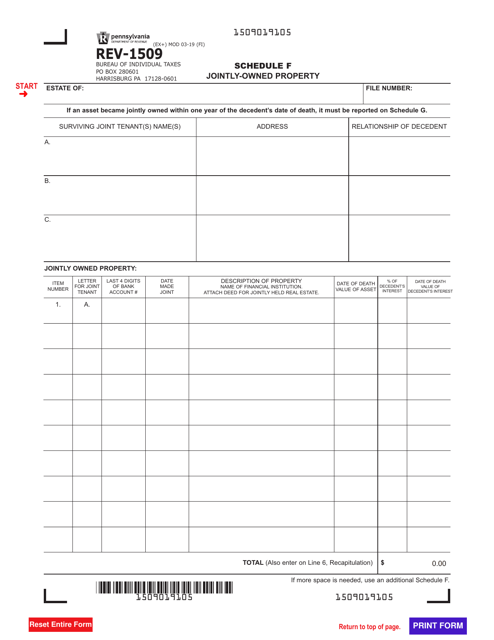

This Form is used for filing the Pennsylvania Inheritance Tax Return for a deceased resident of Pennsylvania. It provides instructions on how to complete the form accurately and report any applicable inheritance tax owed.

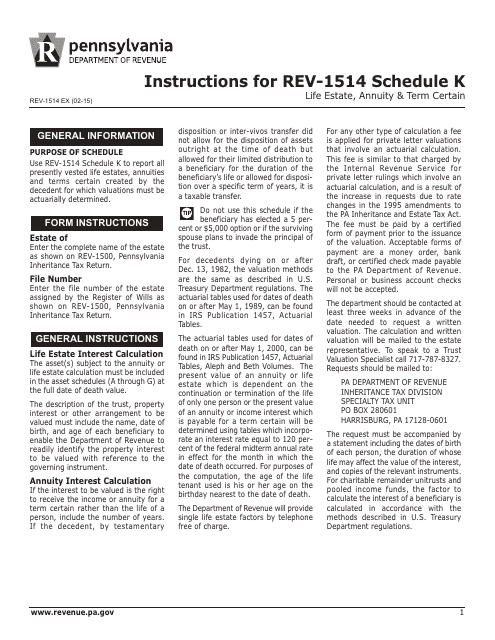

This type of document provides instructions for filling out Form REV-1514 Schedule K, which is used in Pennsylvania to report income from life estates, annuities, and term certain arrangements. It guides taxpayers on how to accurately complete the form and report their income.

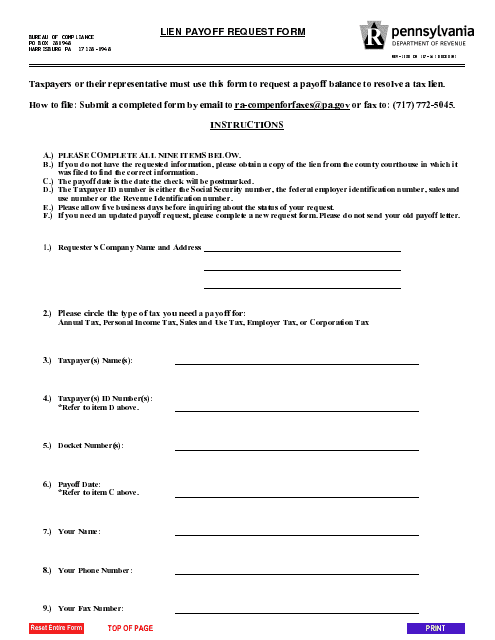

This form is used for requesting a lien payoff in Pennsylvania. It is used to request information about existing liens on a property and to facilitate the payment of those liens.

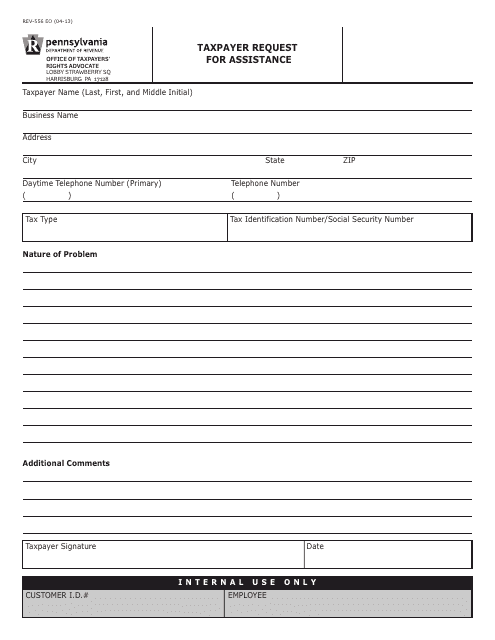

This form is used for Pennsylvania taxpayers to request assistance from the state tax authority.

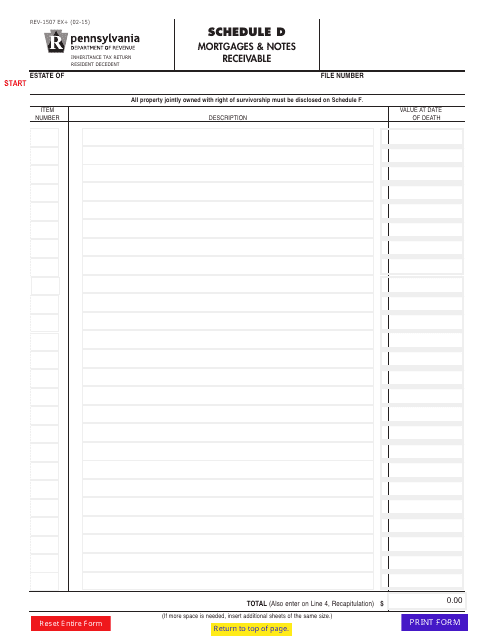

This form is used for reporting mortgages and notes receivable in Pennsylvania for tax purposes.

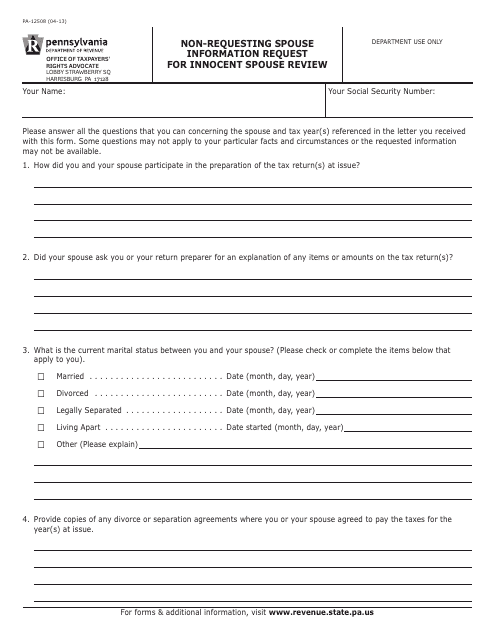

This form is used for requesting information from the non-requesting spouse in order to conduct an innocent spouse review in the state of Pennsylvania.

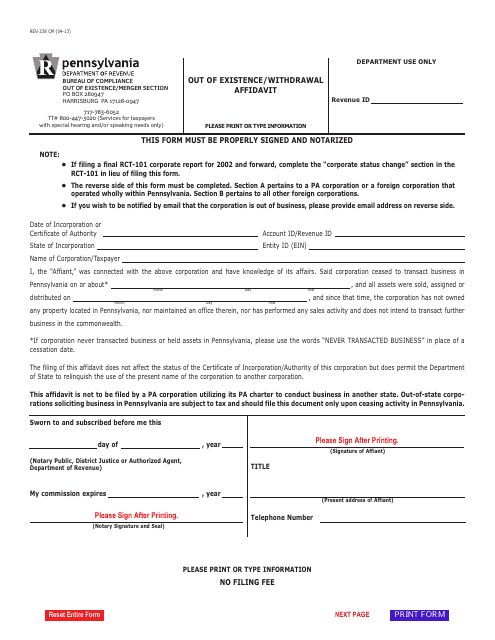

This Form is used for filing an Out of Existence/Withdrawal Affidavit in Pennsylvania. It is used when a business entity wants to dissolve or withdraw from the state.

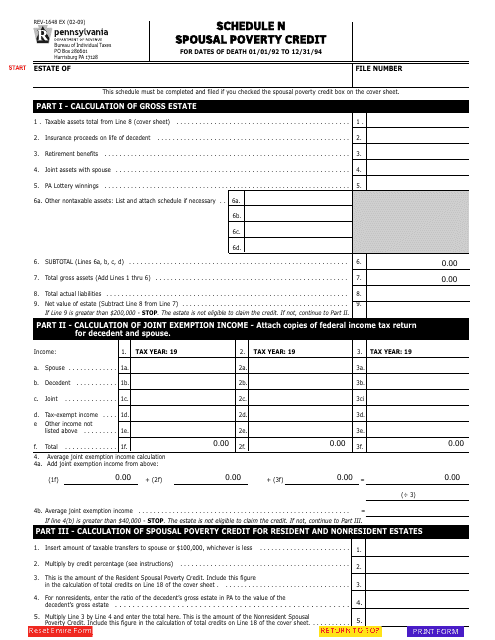

This form is used for claiming the Spousal Poverty Credit in Pennsylvania. It helps married couples who have a spouse with lower income reduce their tax burden.

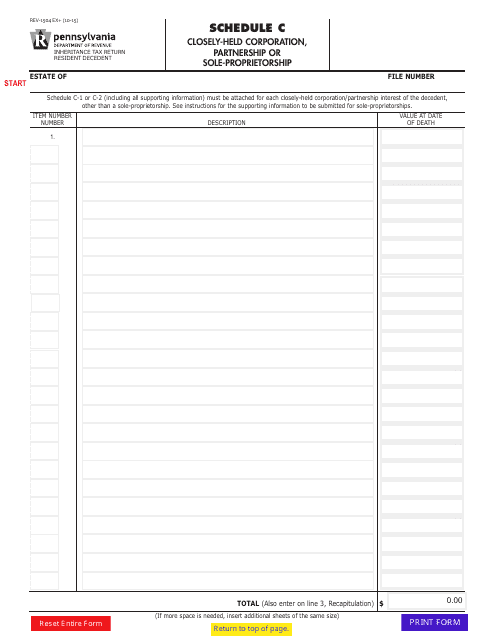

Form REV-1504 Schedule C Closely-Held Corporation, Partnership or Sole-Proprietorship - Pennsylvania

This Form is used for reporting the income, deductions, and credits of a closely-held corporation, partnership, or sole-proprietorship in the state of Pennsylvania.

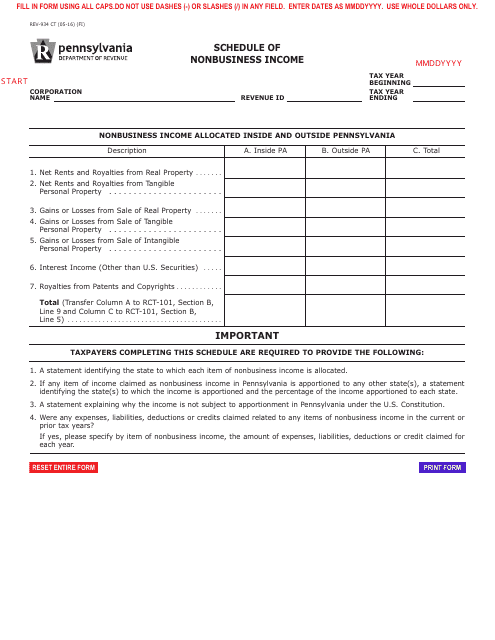

This form is used for reporting nonbusiness income from Pennsylvania for Connecticut residents.

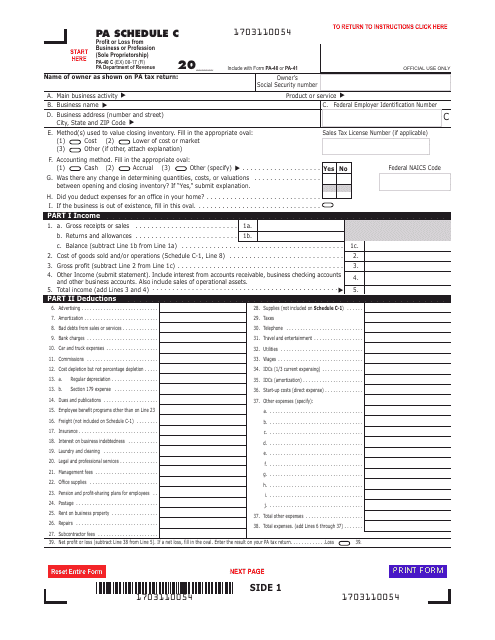

This document is used to report the profit or loss from a sole proprietorship business or profession in Pennsylvania.

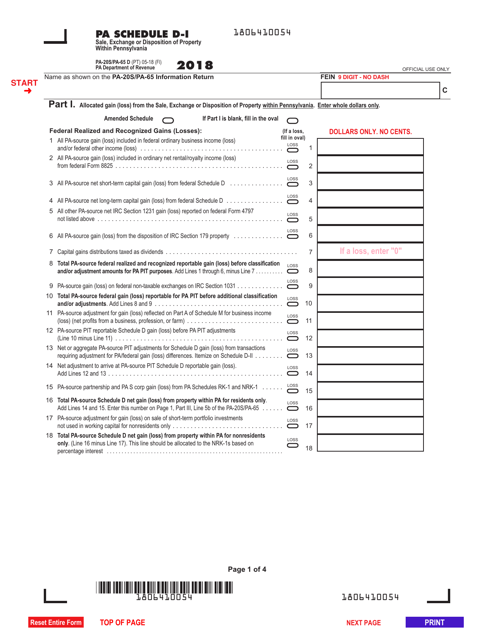

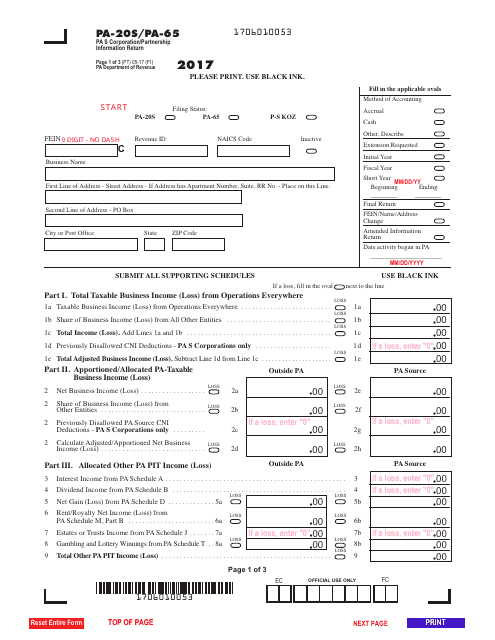

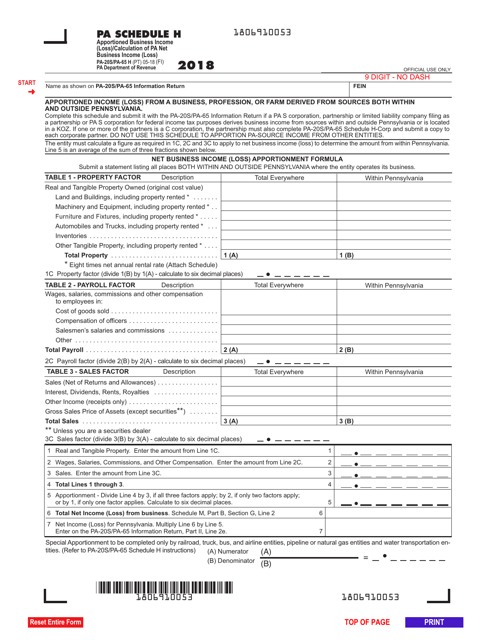

This Form is used for Pennsylvania S corporations and partnerships to file their annual information return.

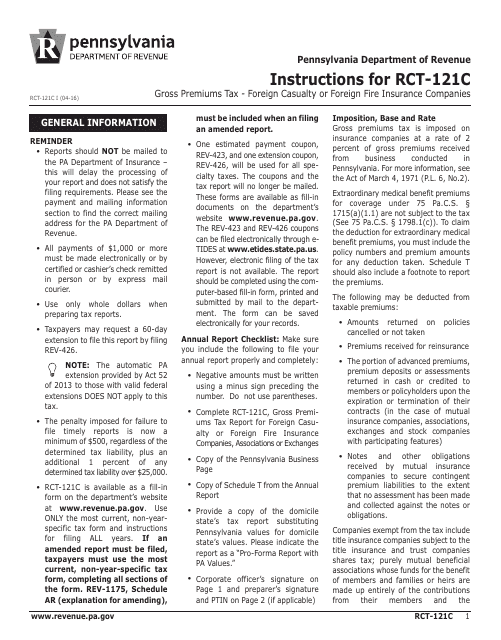

This Form is used for reporting the gross premiums tax for foreign casualty or foreign fire insurance companies operating in Pennsylvania. It provides instructions on how to fill out the RCT-121C Gross Premiums Tax Report accurately and comply with state regulations.

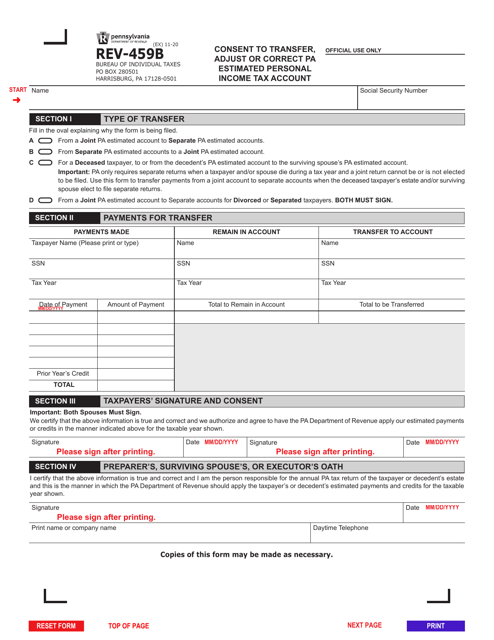

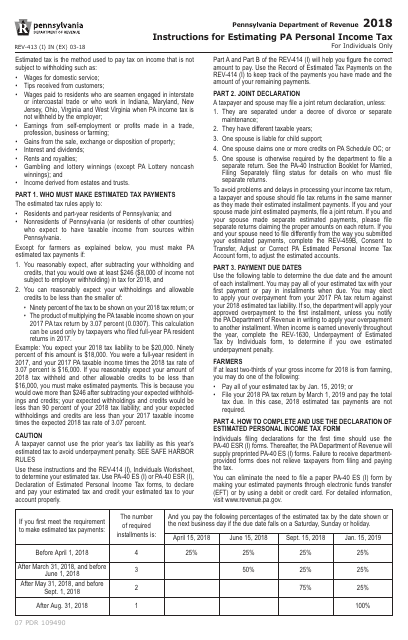

This document provides instructions for estimating Pennsylvania personal income tax. It guides taxpayers on how to accurately calculate and report their estimated tax liability.

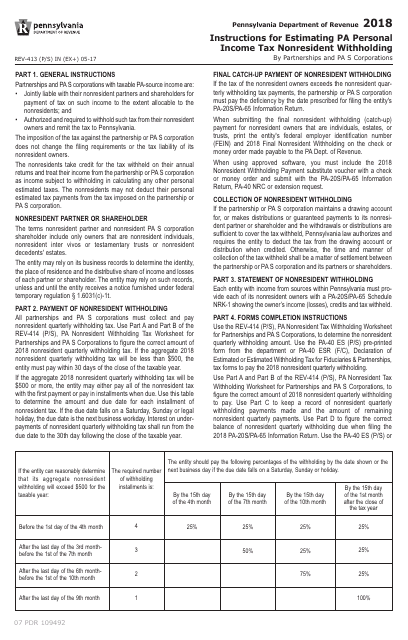

This Form is used for estimating the Pennsylvania personal income tax nonresident withholding for individuals. It provides instructions on how to calculate and pay the appropriate amount of withholding tax for nonresident individuals in Pennsylvania.

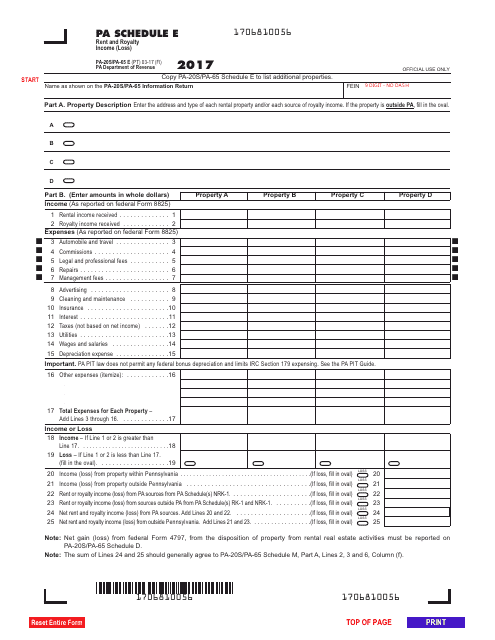

This form is used for reporting rental and royalty income or loss in the state of Pennsylvania for partnerships or S corporations.

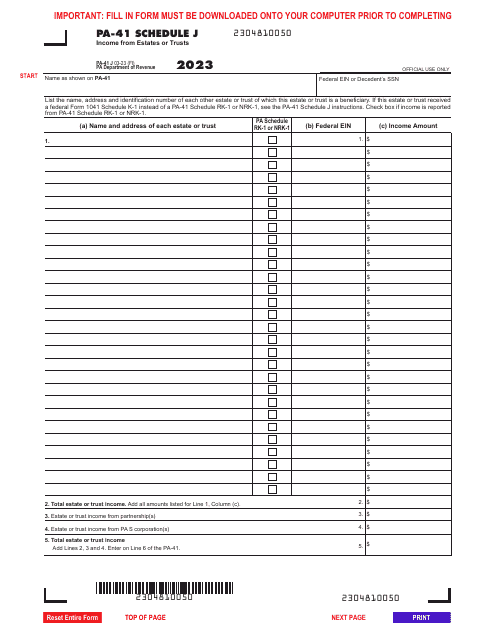

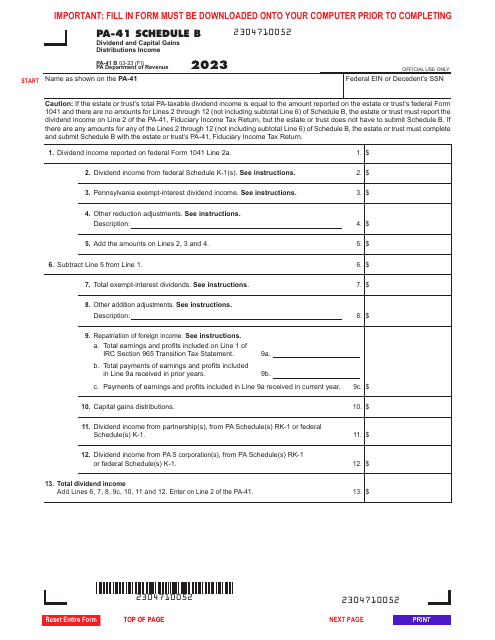

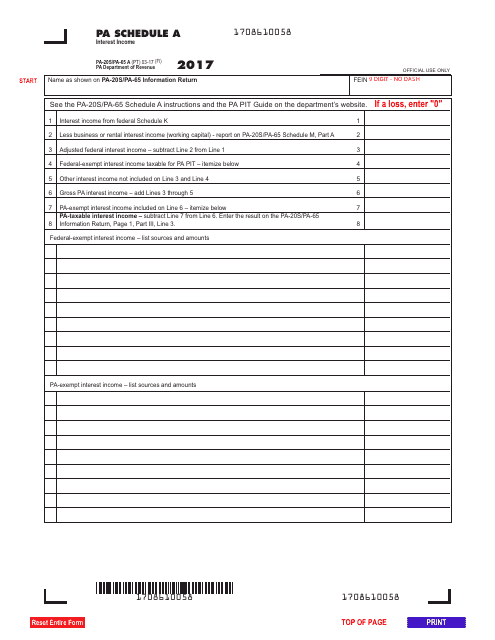

This form is used for reporting interest income in the state of Pennsylvania.