Fill and Sign Illinois Legal Forms

Documents:

6290

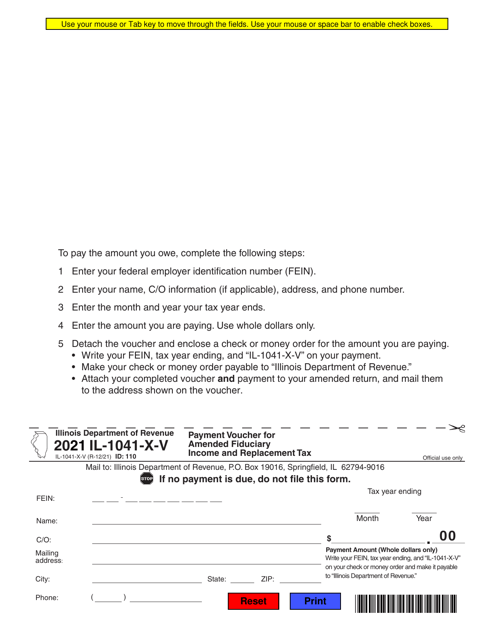

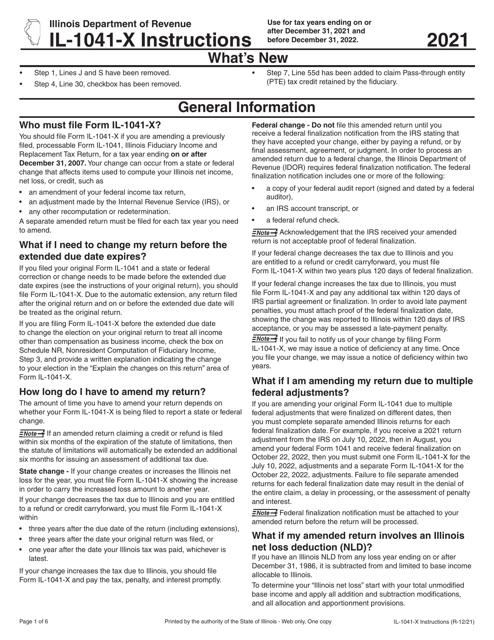

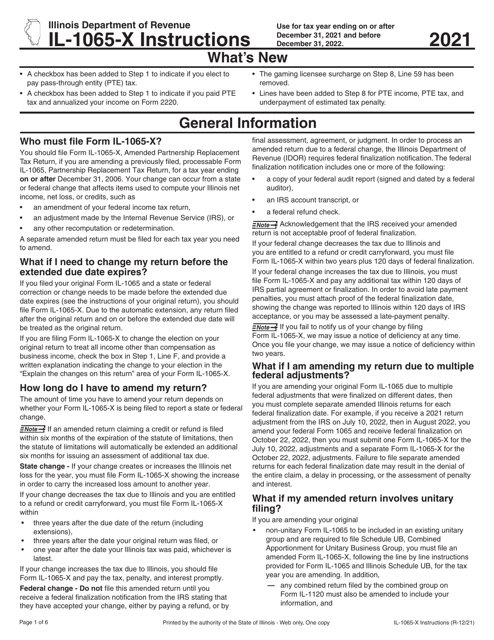

Instructions for Form IL-1041-X Amended Fiduciary Income and Replacement Tax Return - Illinois, 2021

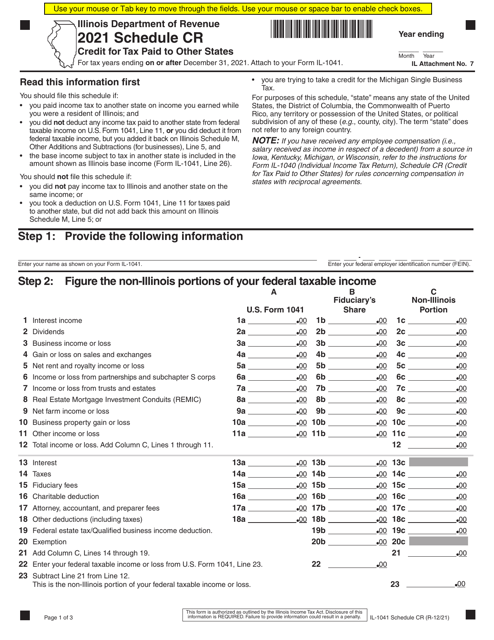

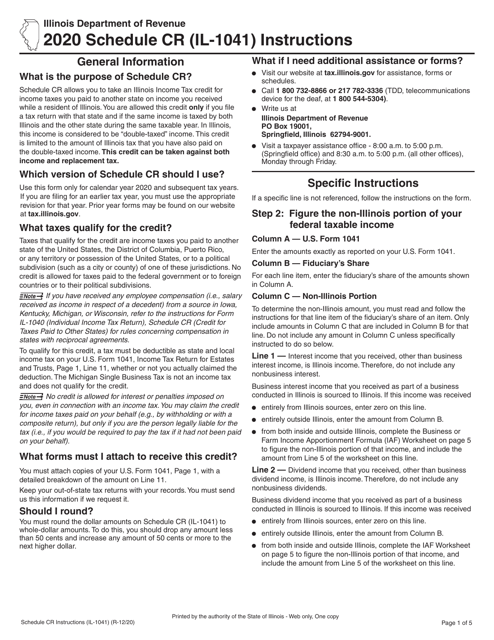

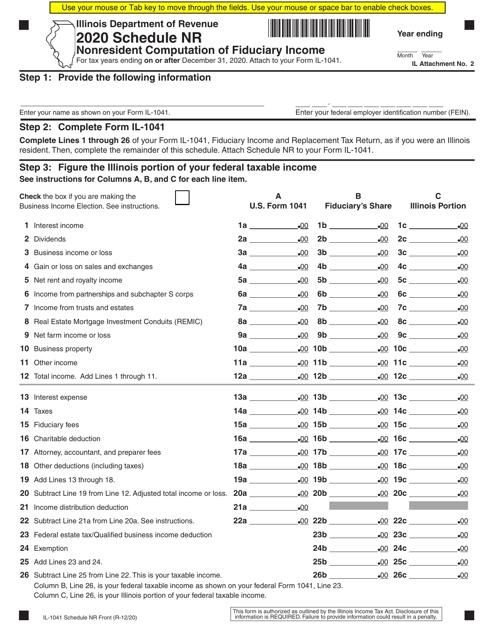

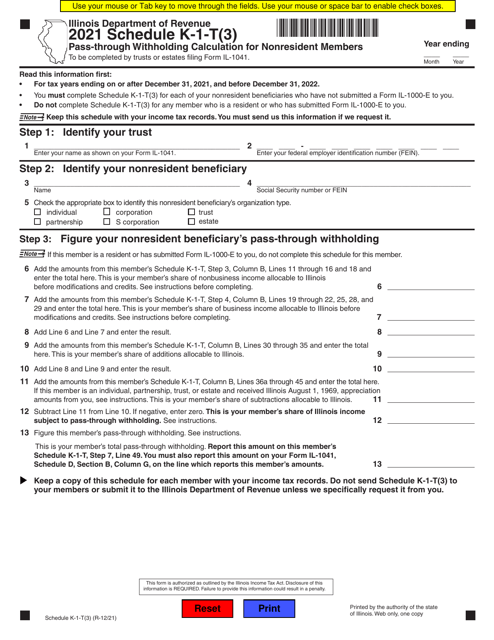

This document is used for calculating the fiduciary income for nonresidents in Illinois.

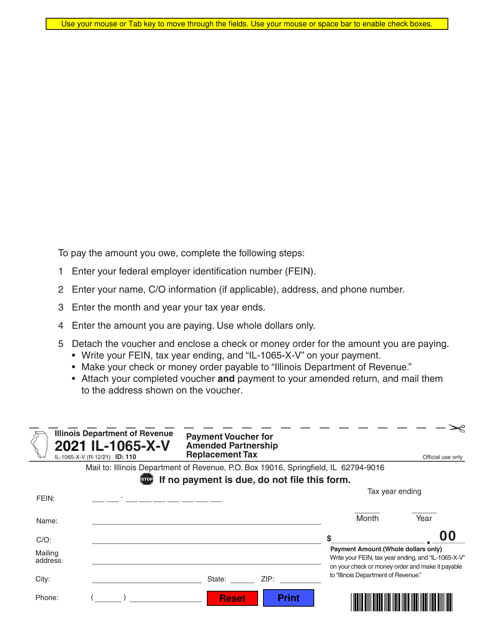

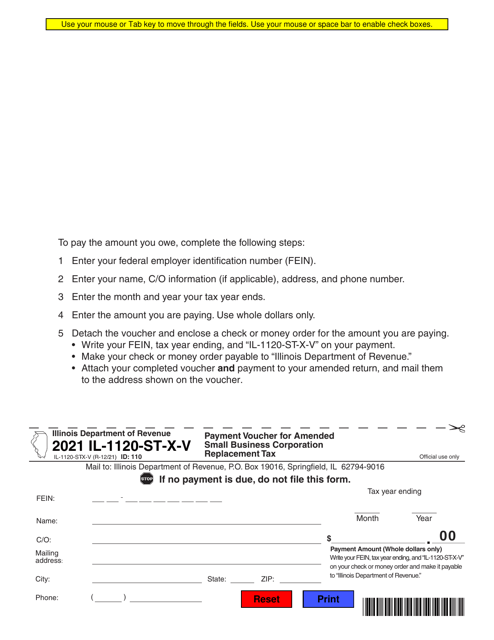

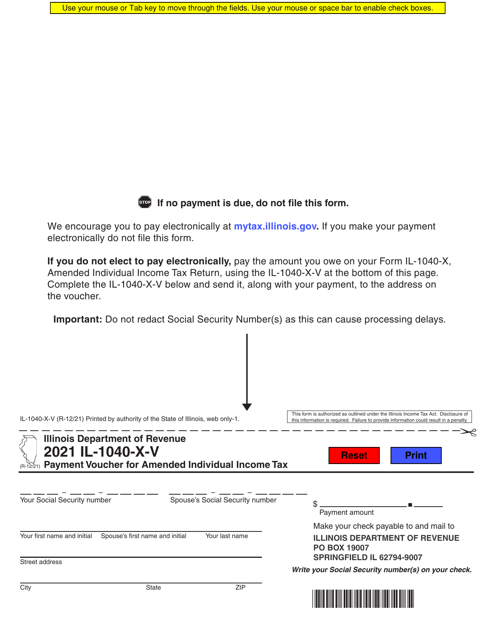

Form IL-1065-X-V Payment Voucher for Amended Corporation Income and Replacement Tax - Illinois, 2021

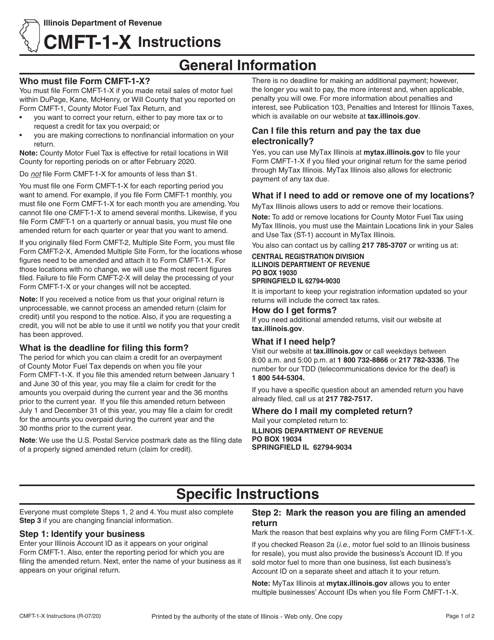

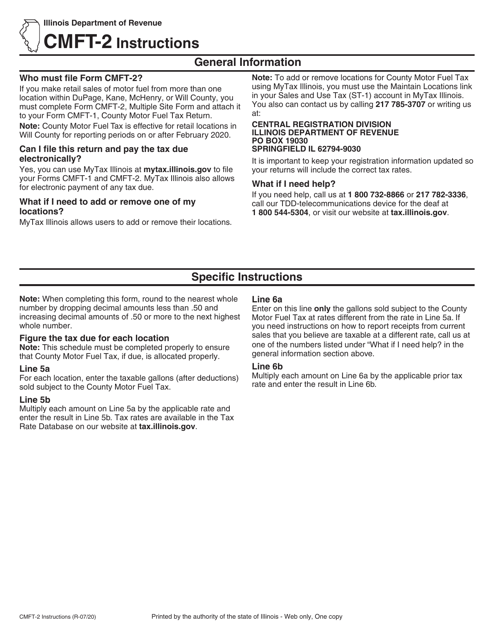

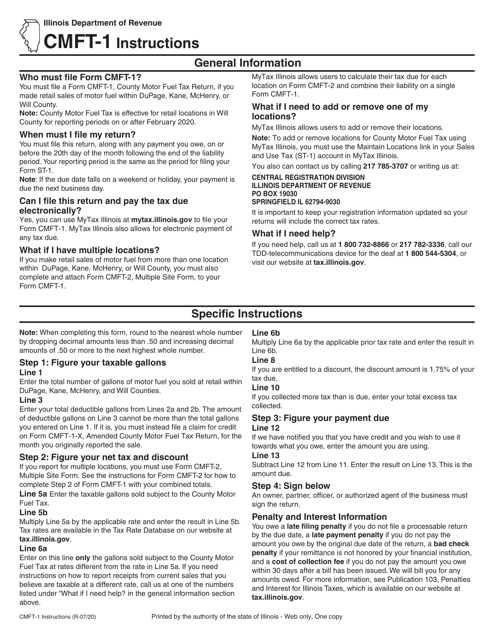

This Form is used for filing an amended County Motor Fuel Tax Return in the state of Illinois. It provides instructions on how to properly complete and submit the form for any necessary changes or corrections.

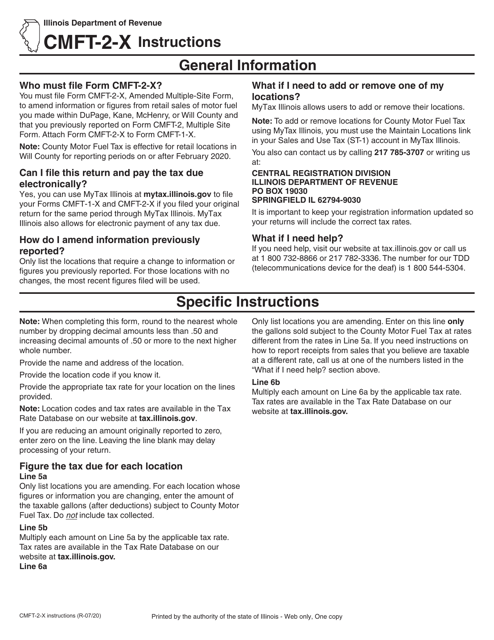

This Form is used for filing an amended multiple-site form in the state of Illinois, specifically Form CMFT-2-X, 027. It provides instructions on how to make changes or updates to previously submitted multiple-site forms.

This form is used for submitting multiple-site information in Illinois.

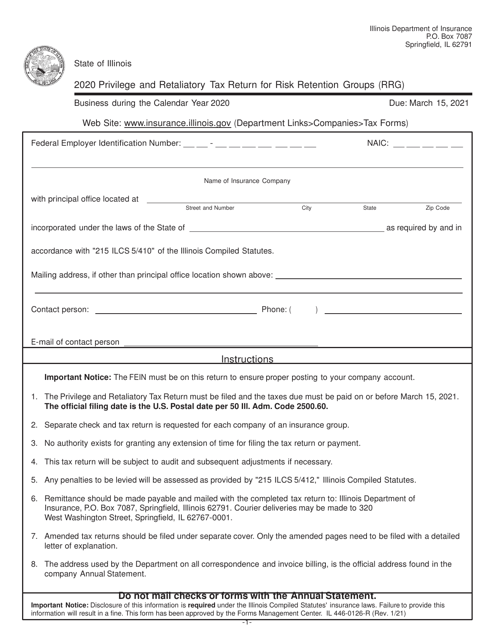

This form is used for filing the privilege and retaliatory tax return for Risk Retention Groups (RRG) in the state of Illinois. It is required for RRGs to report their tax liabilities and ensure compliance with state tax laws.

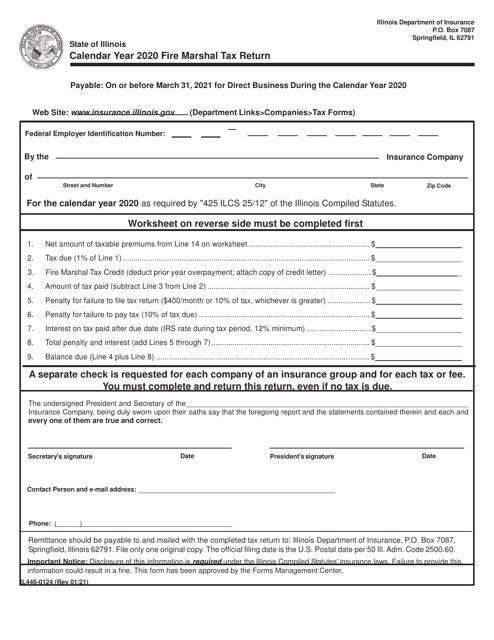

This Form is used for filing the Fire Marshal Tax Return in the state of Illinois.

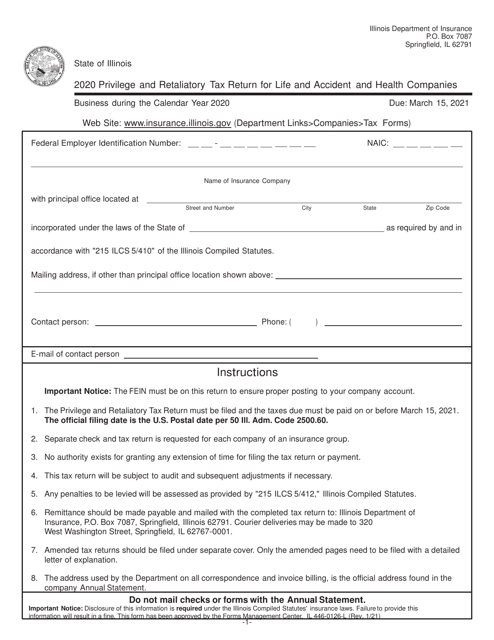

This form is used for filing the Privilege and Retaliatory Tax Return for Life and Accident and Health Companies in the state of Illinois.

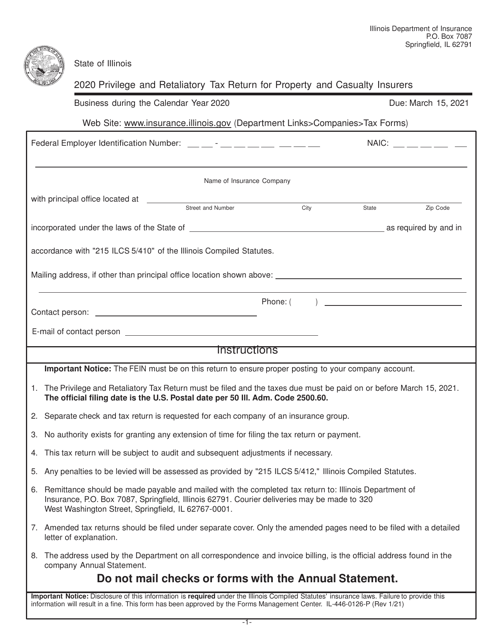

This Form is used for filing the Privilege and Retaliatory Tax Return for Property and Casualty Insurers in Illinois. It must be completed by property and casualty insurers to report and pay their taxes.