Fill and Sign Illinois Legal Forms

Documents:

6290

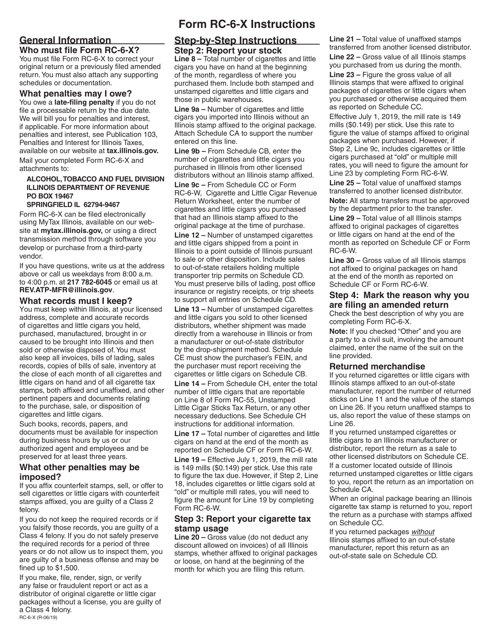

This document provides instructions for filling out Form RC-6-X, which is used to report amended cigarette and little cigar revenue returns in the state of Illinois.

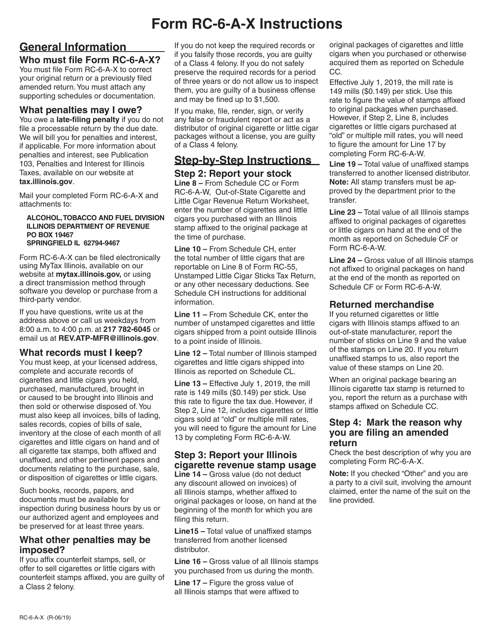

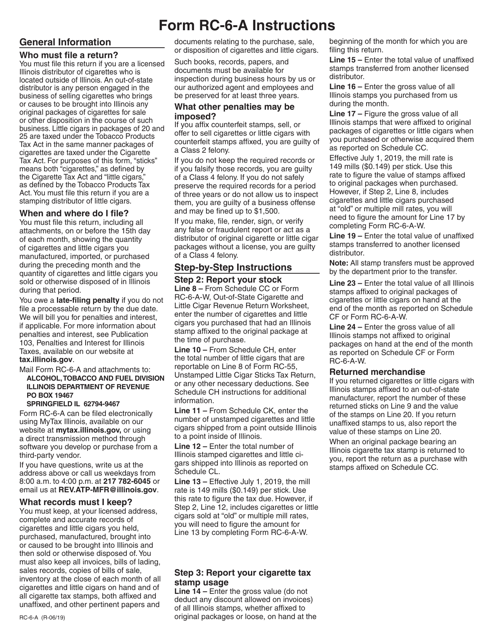

This Form is used for filing an amended out-of-state cigarette and little cigar revenue return for the state of Illinois. It provides instructions on how to report any changes or corrections to the original return.

This Form is used for reporting cigarette and little cigar revenue generated out-of-state. It is specific to the state of Illinois.

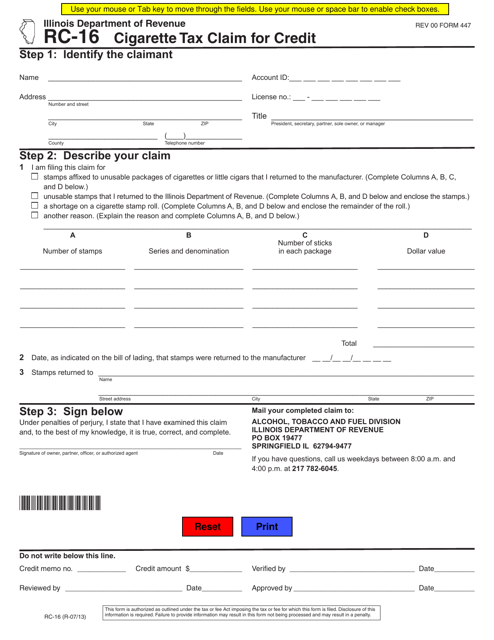

This form is used for claiming a credit on cigarette taxes paid in the state of Illinois.

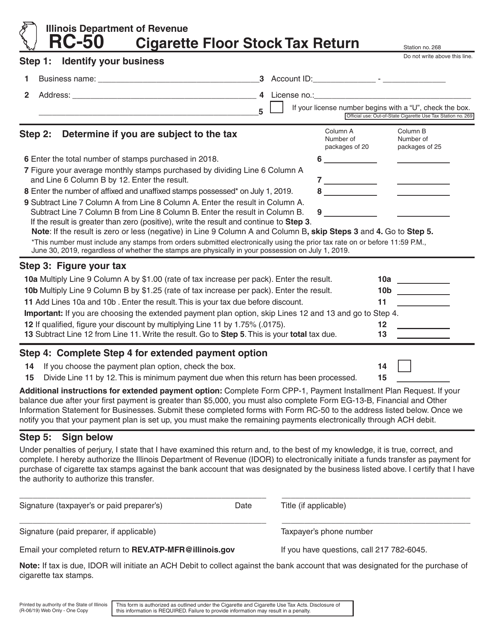

This Form is used for reporting and paying the cigarette floor stock tax in the state of Illinois. It is required for businesses that hold cigarettes for sale or distribution in the state.

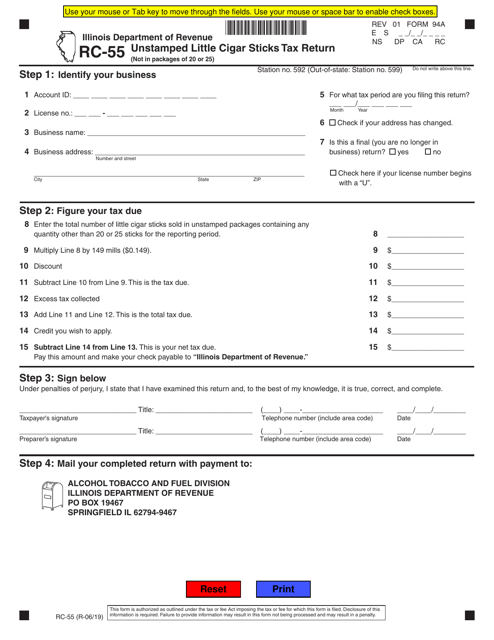

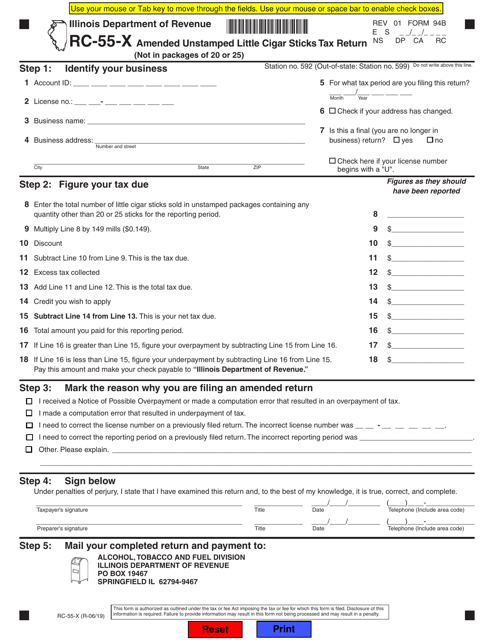

This form is used for filing an amended tax return for unstamped little cigar stick purchases in the state of Illinois.

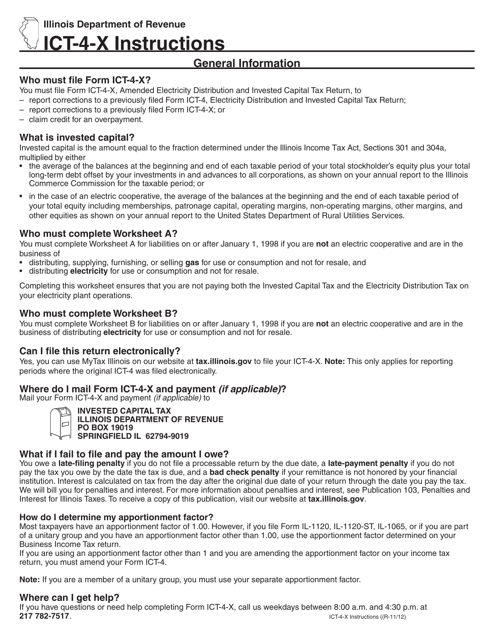

This Form is used for filing an amended electricity distribution and invested capital tax return in the state of Illinois. It provides instructions on how to make corrections or changes to the original tax return submission.

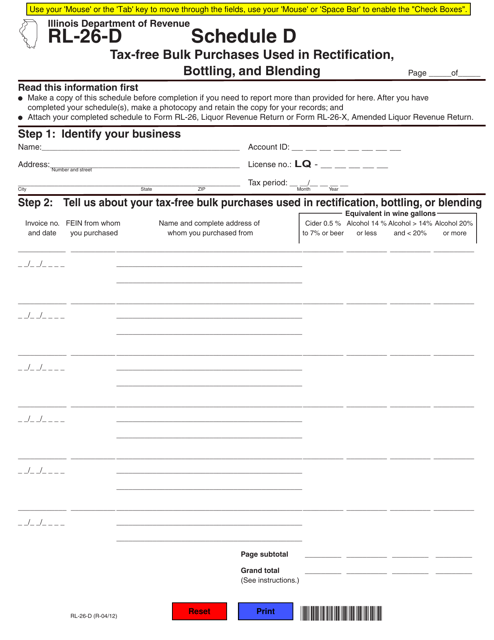

This form is used for reporting tax-free bulk purchases that are used in rectification, bottling, and blending in the state of Illinois.

This Form is used for reporting tax-free bulk purchases used in rectification, blending, and bottling in Illinois.

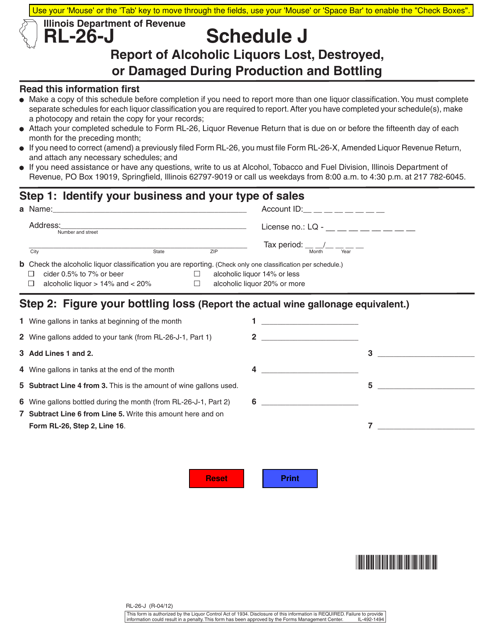

This form is used for reporting alcoholic liquors that have been lost, destroyed, or damaged during production and bottling in the state of Illinois.

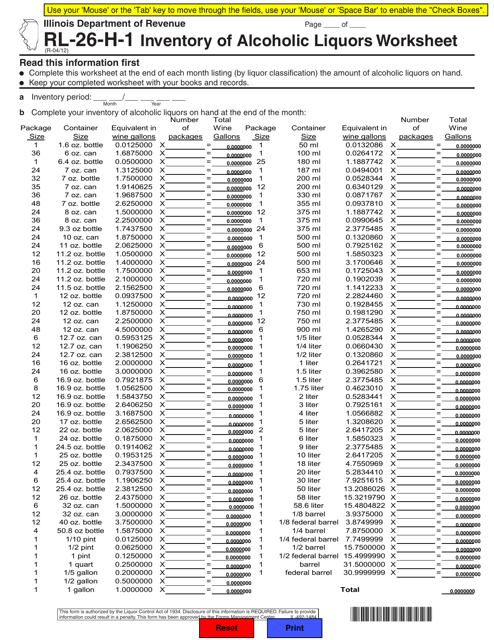

This form is used for completing an inventory of alcoholic liquors in Illinois. It is a worksheet that helps businesses keep track of their alcoholic beverage inventory.

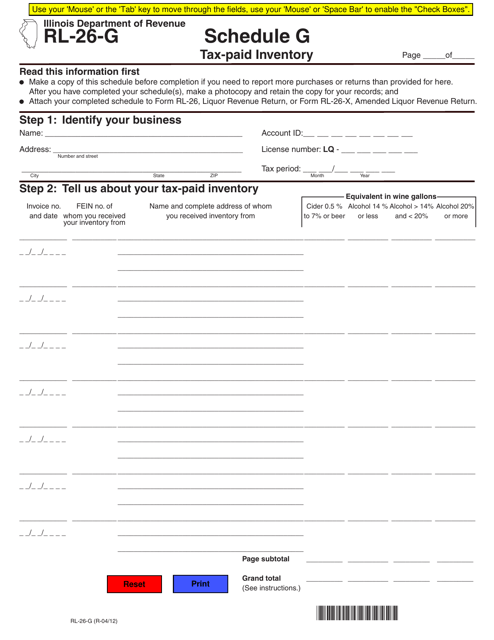

This form is used for reporting tax-paid inventory in Illinois.

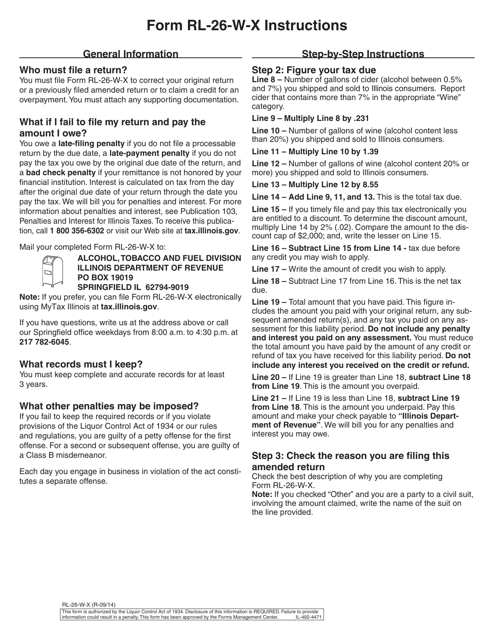

This type of document is used for providing instructions on how to fill out and file the Amended Liquor Direct Wine Shipper Return form RL-26-W-X in Illinois.

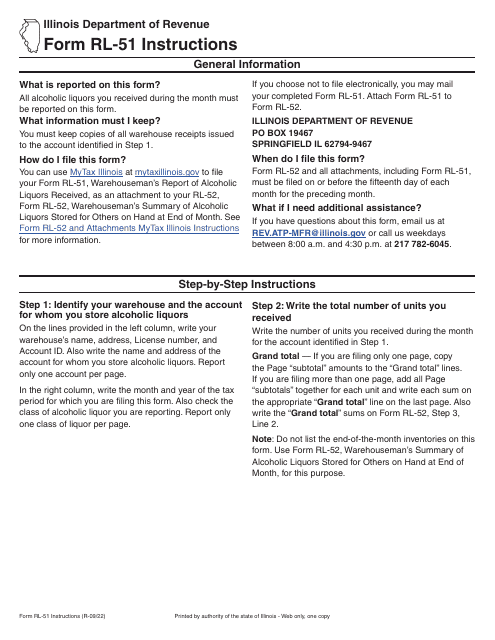

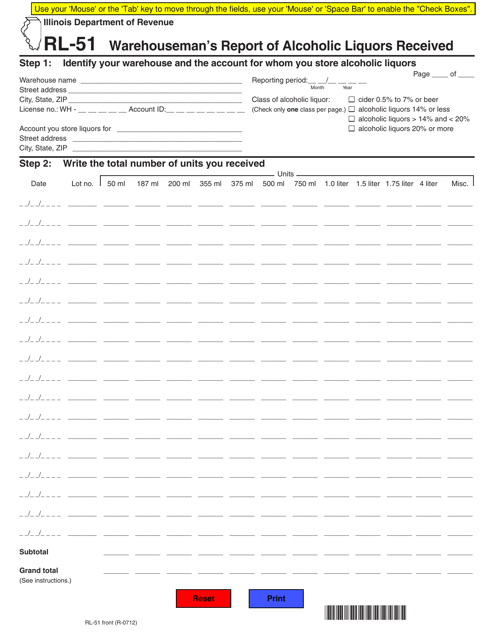

This form is used for warehouse owners in Illinois to report the receipt of alcoholic liquors.

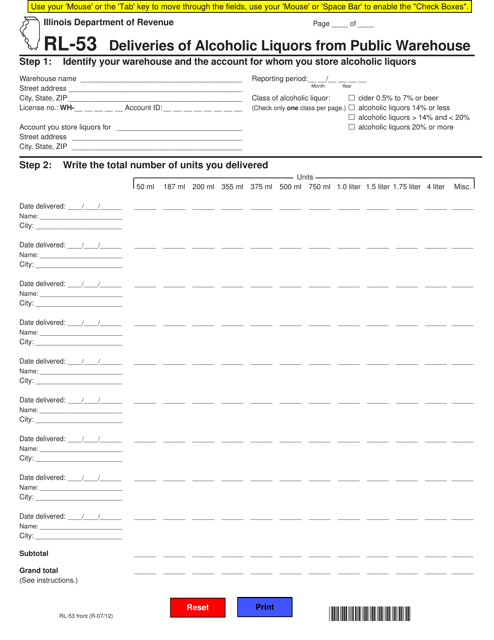

This form is used for reporting deliveries of alcoholic liquors from public warehouses in Illinois. It is necessary for tracking the movement and distribution of alcoholic beverages within the state.

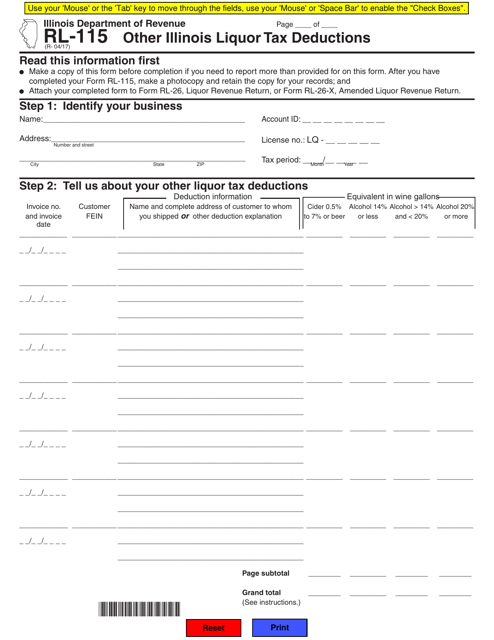

This form is used for reporting and claiming deductions on liquor taxes in the state of Illinois, other than the ones covered by Form RL-115.

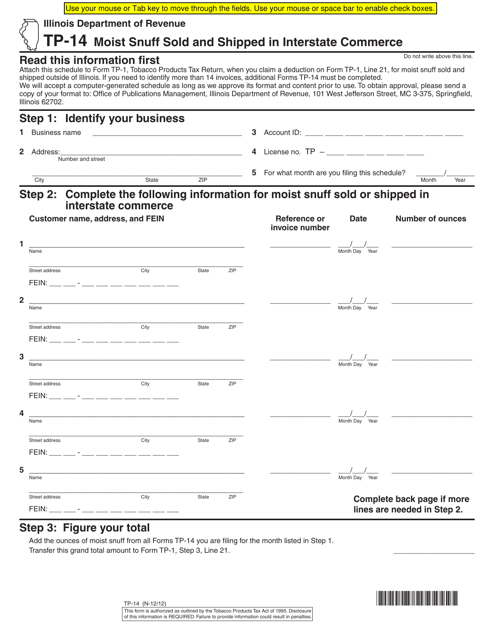

This form is used for reporting the sale and shipment of moist snuff in Illinois that crosses state lines. It ensures compliance with interstate commerce regulations.

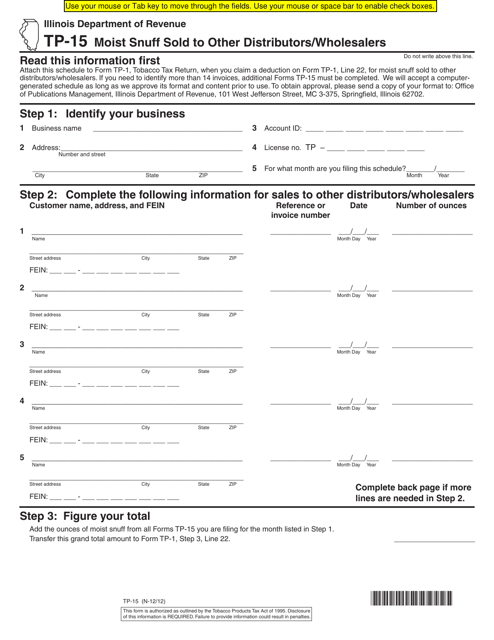

This form is used for reporting the sale of moist snuff products by distributors/wholesalers to other distributors/wholesalers in the state of Illinois.

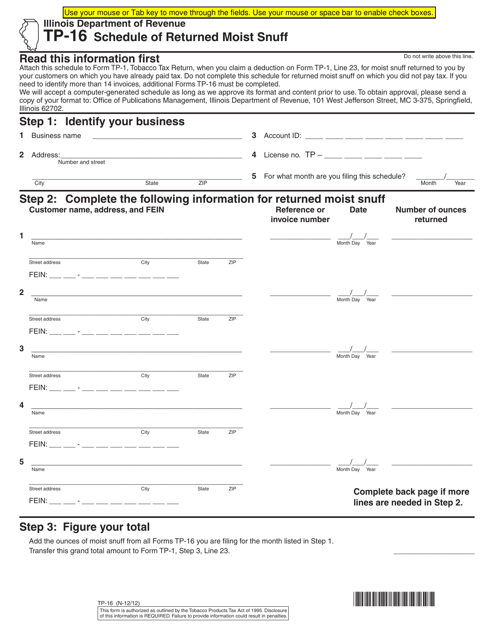

This document is used to report the schedule of returned moist snuff in Illinois.

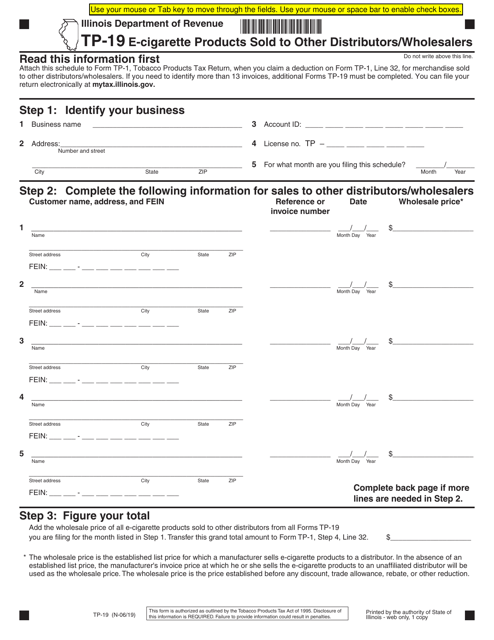

This Form is used for reporting the sales of e-cigarette products to other distributors or wholesalers in the state of Illinois.

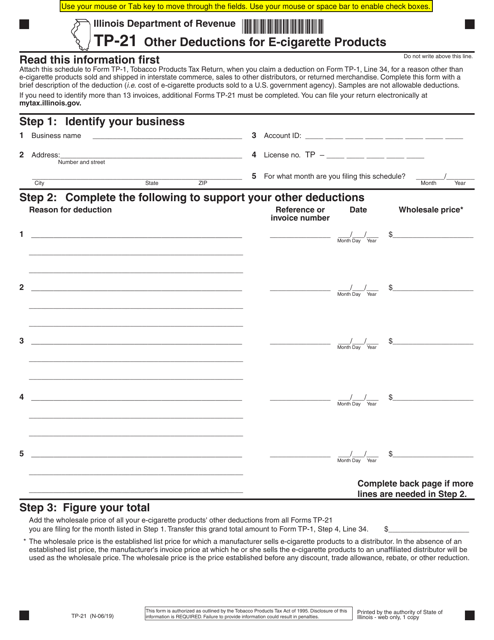

This Form is used for reporting other deductions related to E-Cigarette products in the state of Illinois.

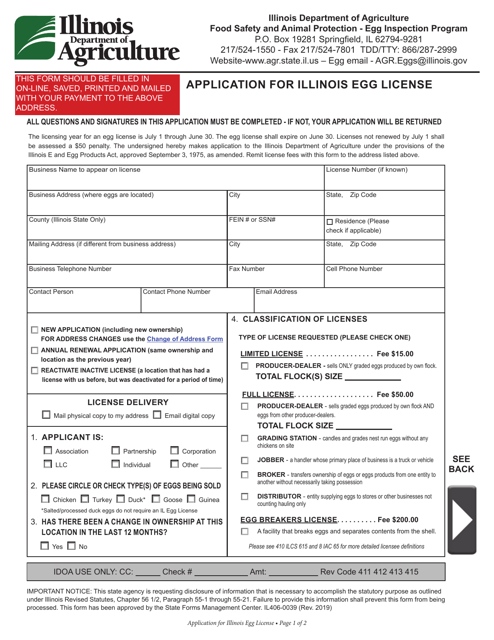

This form is used for applying for an egg license in the state of Illinois. It is necessary for individuals or businesses who plan to operate an egg business in Illinois.

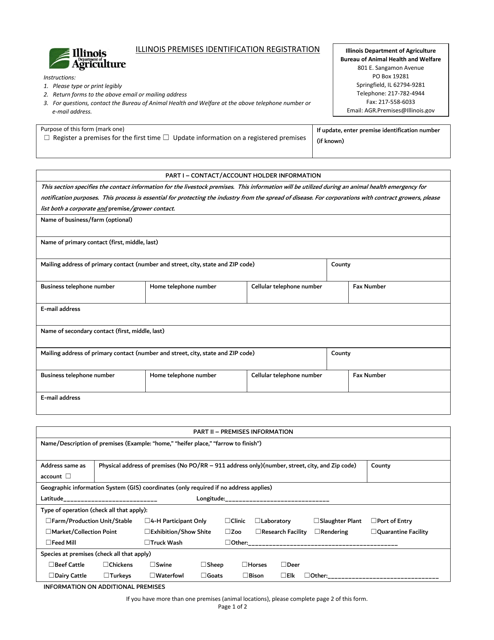

This document is for registering premises in Illinois for identification purposes.

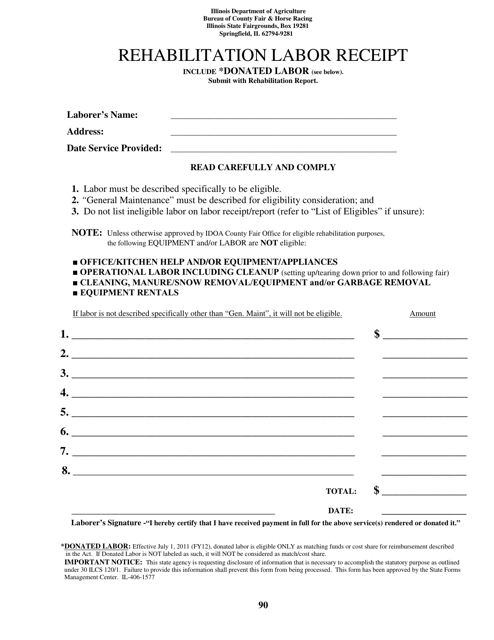

This form is used for recording rehabilitation labor receipts in the state of Illinois.

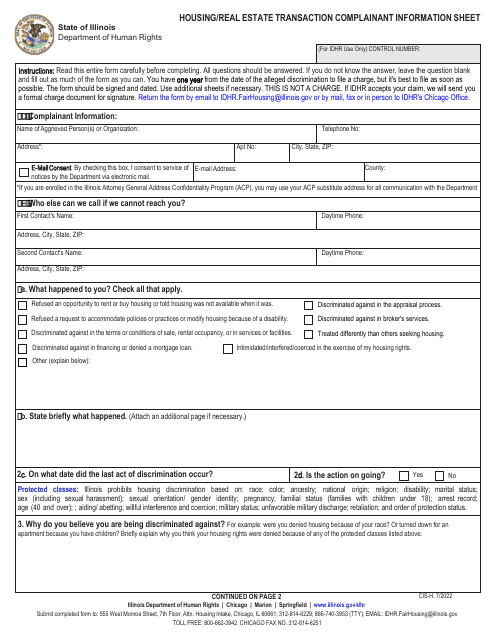

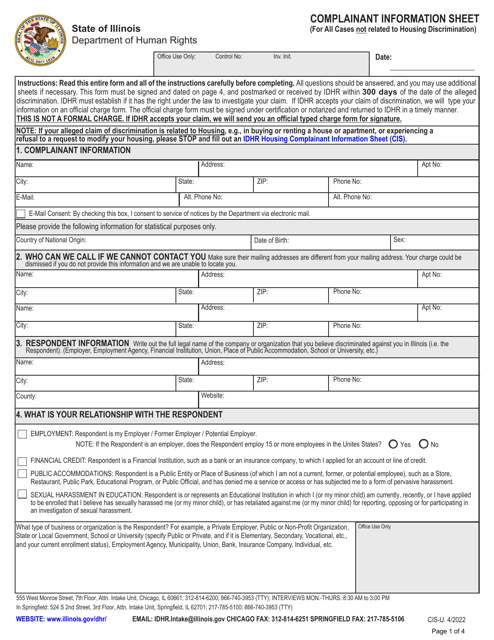

This document is an example of a Discrimination Complaint Form (DHR-21) used in Illinois. It is used to file a complaint regarding discrimination.