Fill and Sign Illinois Legal Forms

Documents:

6290

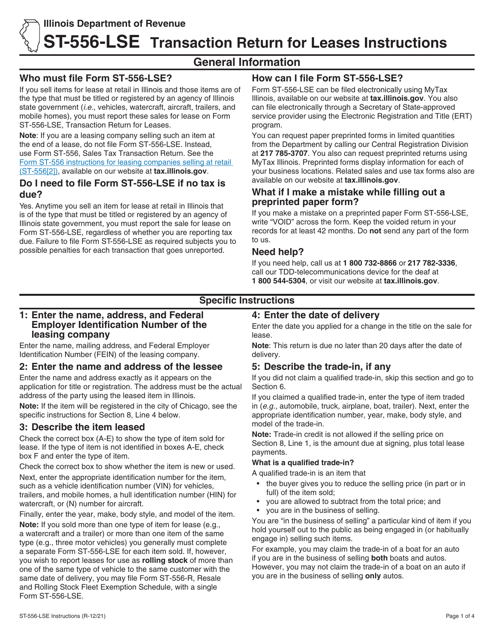

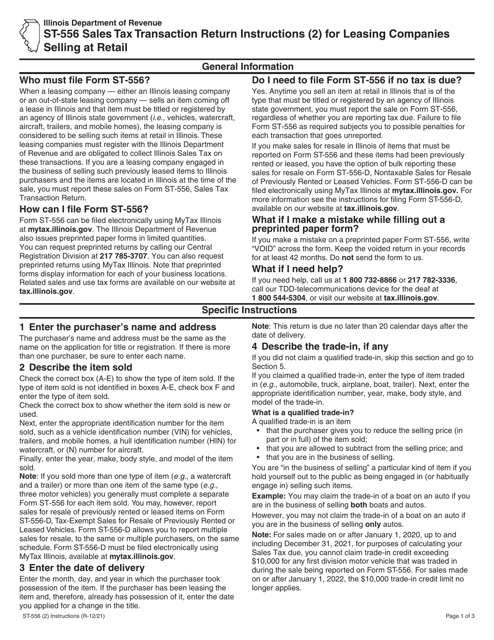

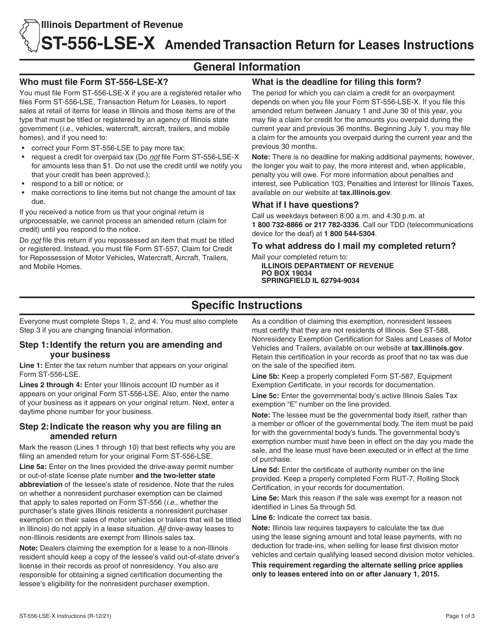

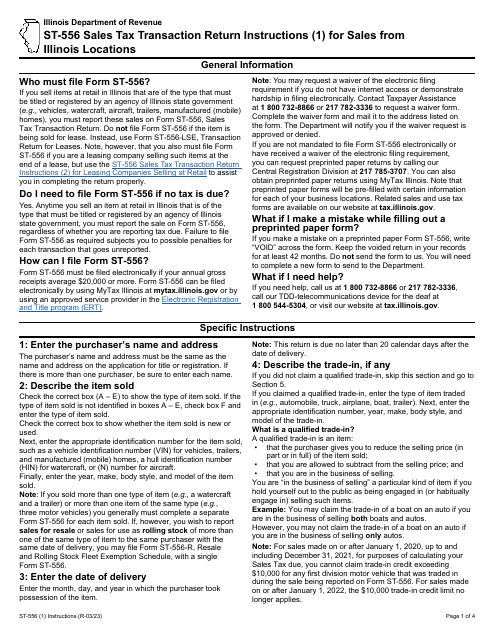

This Form is used for leasing companies in Illinois who sell at retail to report their sales tax transactions.

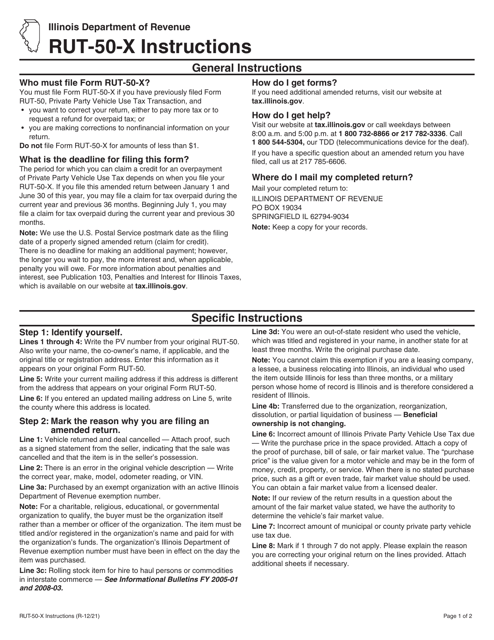

This document provides instructions for filling out Form RUT-50-X, which is used to amend a private party vehicle use tax transaction in Illinois.

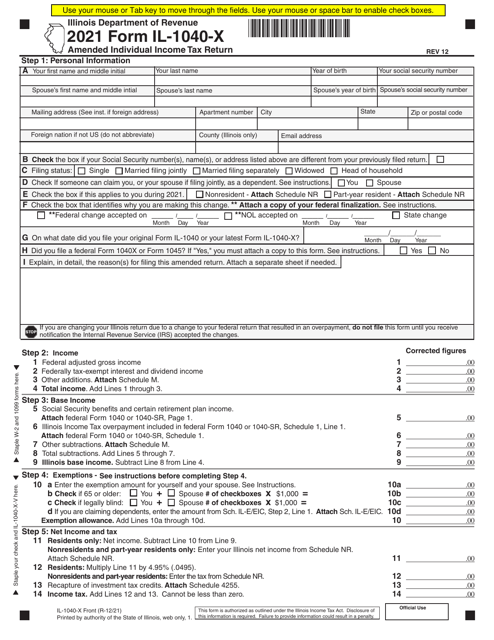

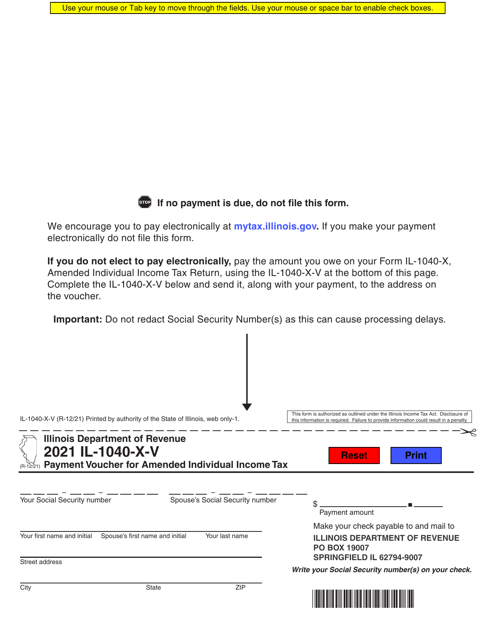

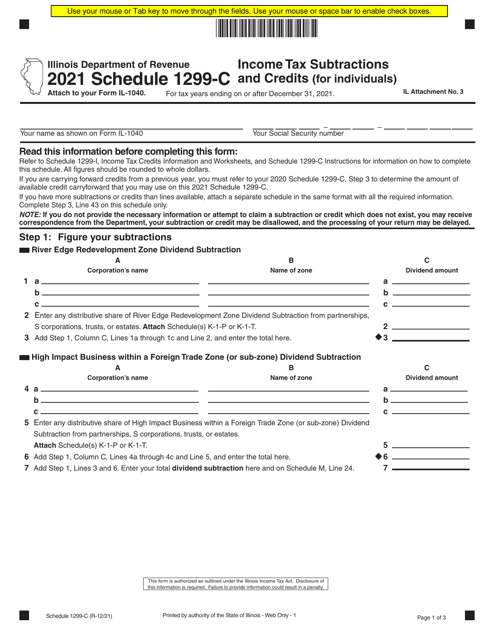

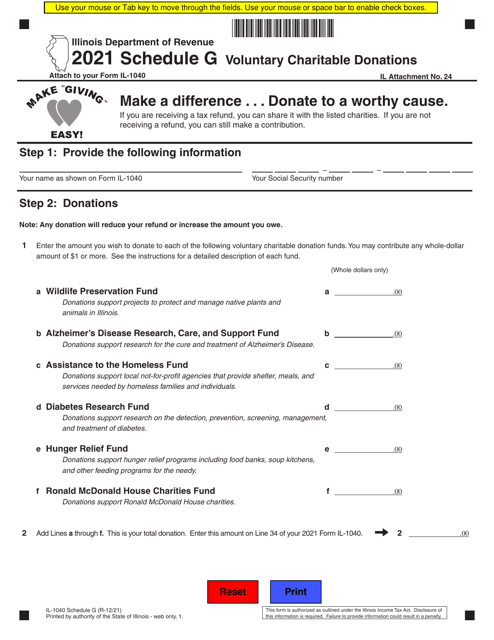

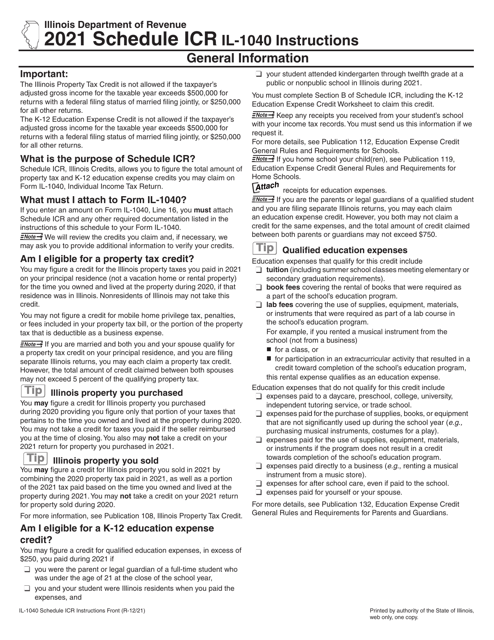

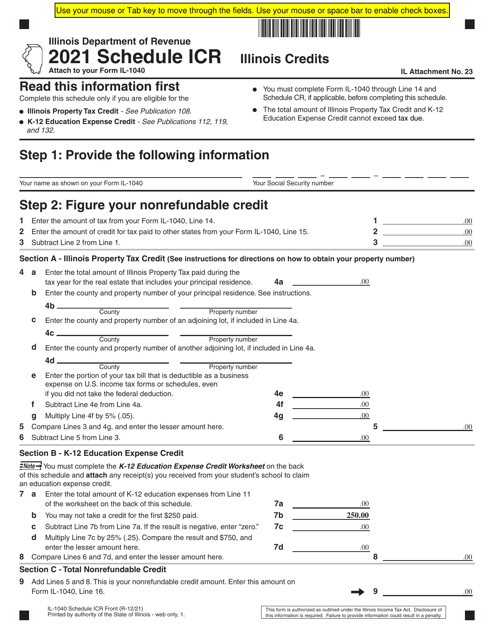

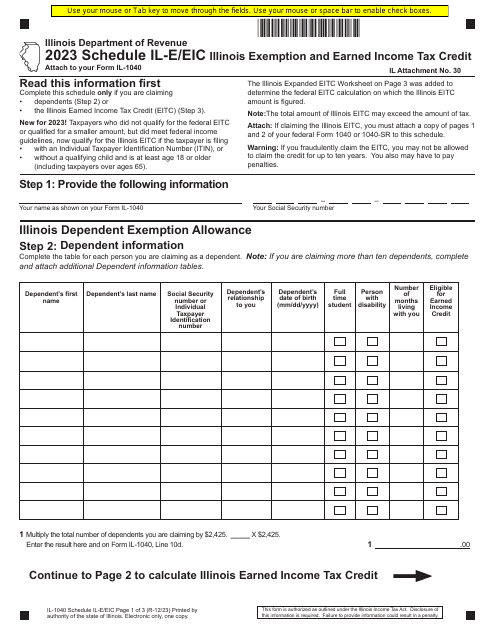

This document is a form used by residents of Illinois to claim various tax credits available in the state.

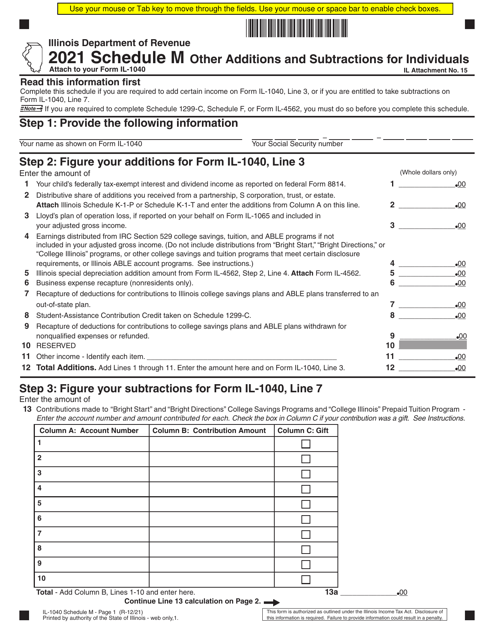

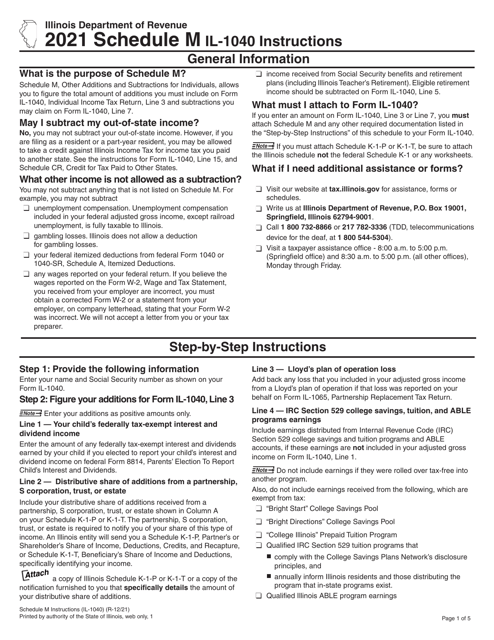

This document provides instructions for Form IL-1040 Schedule M, which is used to report other additions and subtractions for individuals in the state of Illinois. It guides taxpayers on how to calculate and report any additional income or deductions that may affect their state tax liability.

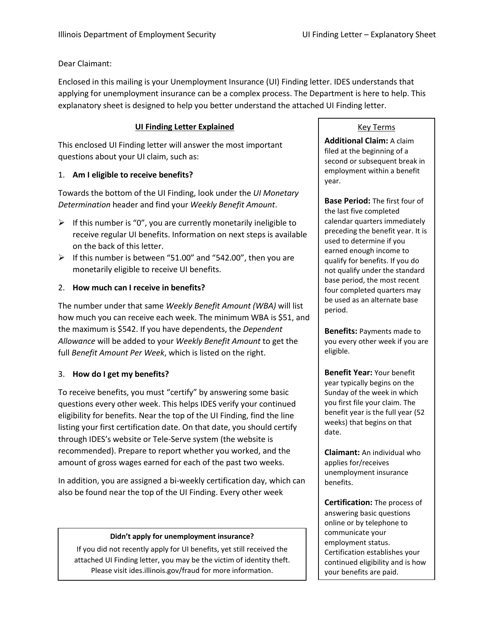

This type of document is an explanatory sheet that accompanies a UI finding letter in the state of Illinois. It provides additional information and clarification regarding the contents of the letter.

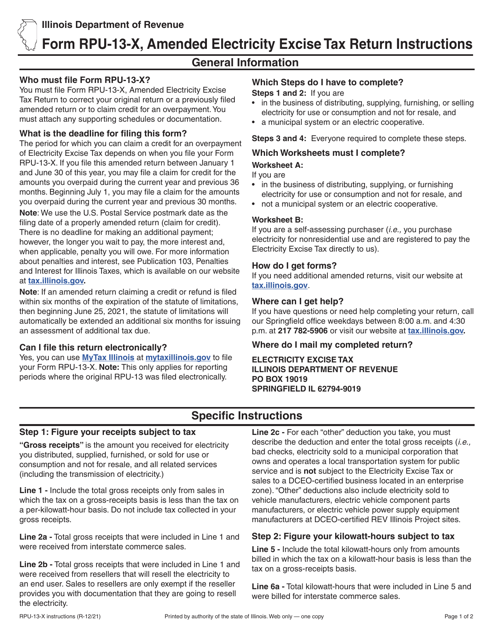

This Form is used for reporting and filing electricity excise tax returns in the state of Illinois. It provides instructions on how to accurately complete and submit Form RPU-13, 411.

This Form is used for reporting liquor sales made to retailers in Illinois. It provides instructions for completing Schedule R of Form RL-26-R, which is required for businesses involved in liquor sales.

This form is used for natural gas distributors in Illinois to report and pay assistance charges. It provides instructions for completing Form RG-6, 554 Assistance Charges Return.

This form is used for natural gas distributors in Illinois to report amended assistance charges returns.