Idaho Tax Forms and Templates

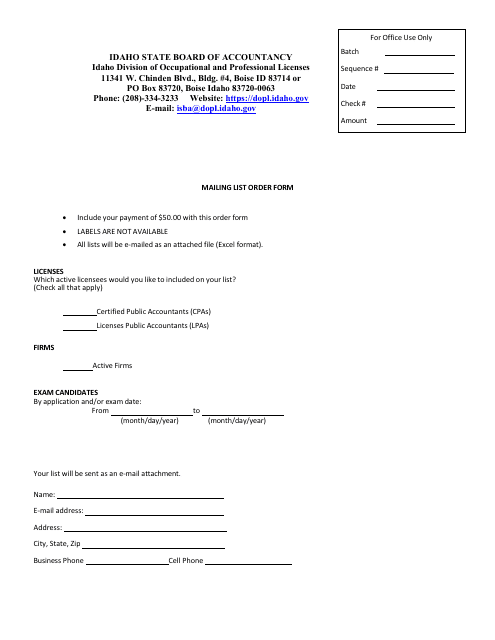

Idaho Tax Forms are used for various purposes related to taxation in the state of Idaho. These forms are used to report and pay taxes, claim exemptions, and provide necessary information to the Idaho State Tax Commission. Some common types of Idaho Tax Forms include income tax forms, sales and use tax forms, property tax forms, and withholding tax forms. These forms allow individuals, businesses, and organizations to fulfill their tax obligations and comply with the tax laws in Idaho.

Documents:

19

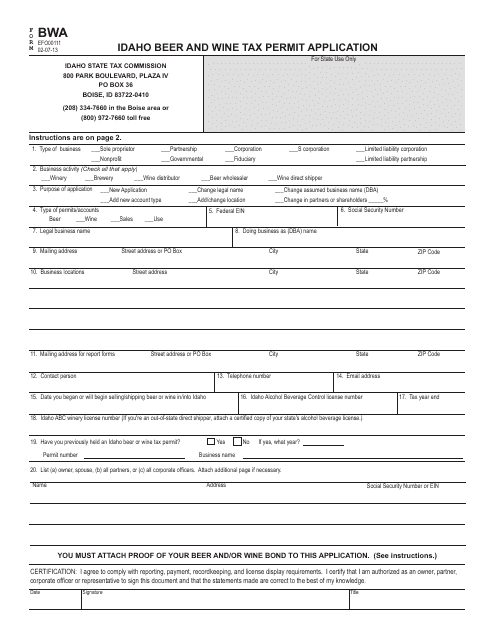

This Form is used for obtaining a beer and wine tax permit in the state of Idaho. It allows individuals or businesses to legally sell beer and wine and comply with the tax regulations in Idaho.

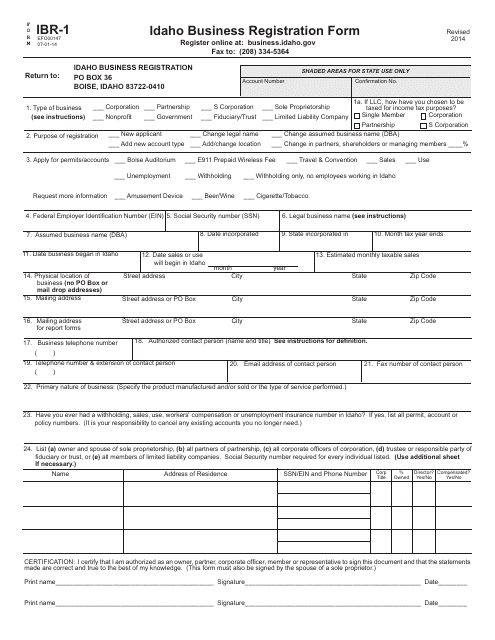

This type of document is used for registering a business in the state of Idaho.

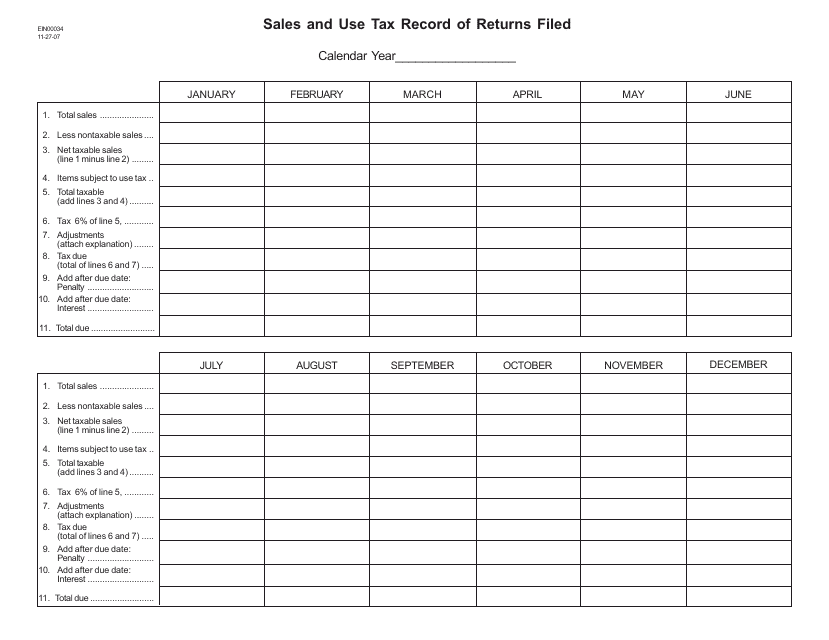

This form is used for recording sales and use tax returns filed in the state of Idaho.

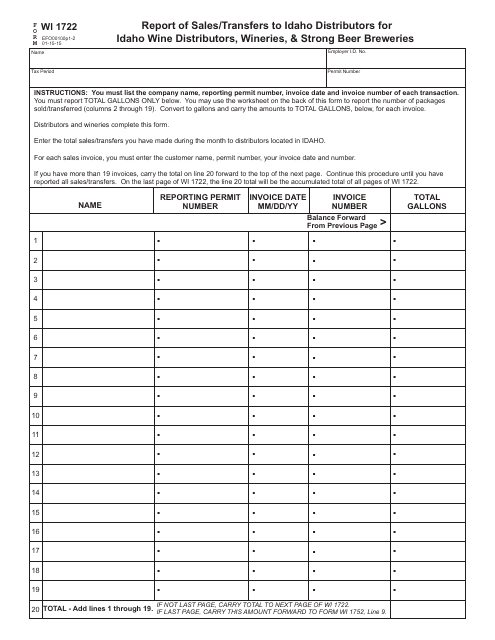

This form is used for reporting sales and transfers of wine and strong beer to Idaho distributors by Idaho wine distributors, wineries, and strong beer breweries.

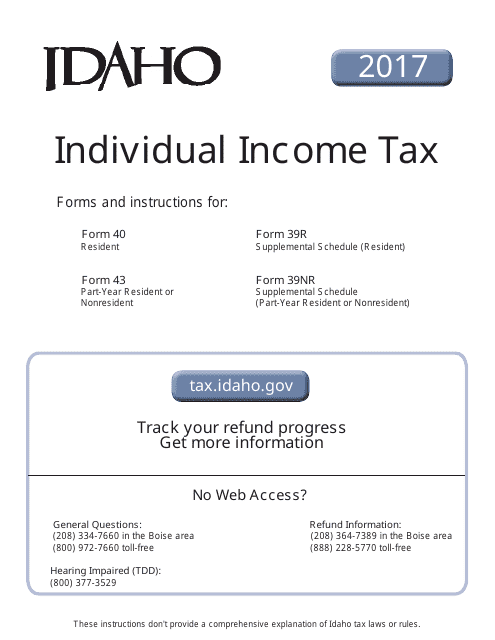

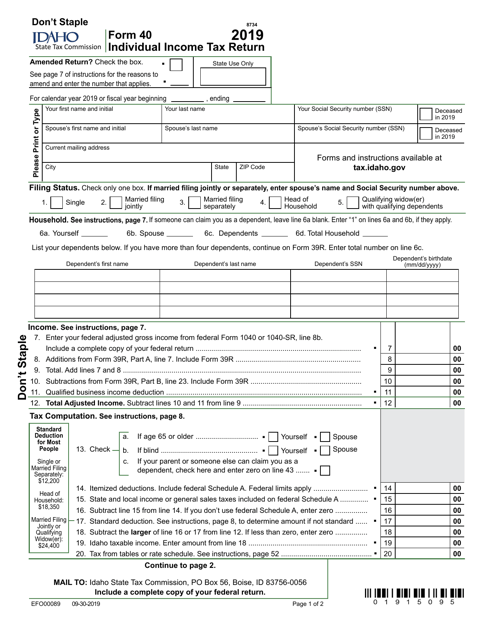

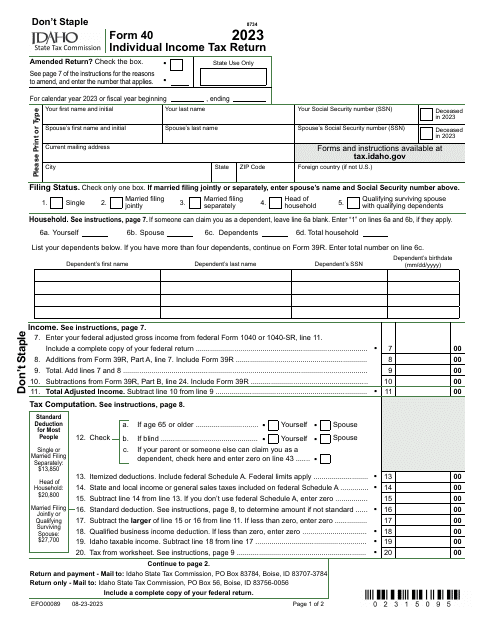

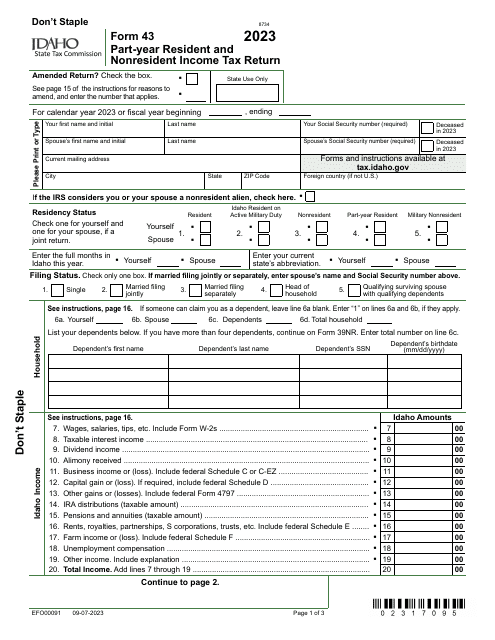

This Form is used for filing individual income tax returns in the state of Idaho. It includes instructions on how to fill out Form 40 for residents, Form 43 for part-year residents, and Form 39NR for nonresidents. The instructions provide guidance on what information to include, how to calculate taxable income, and how to claim deductions and credits.

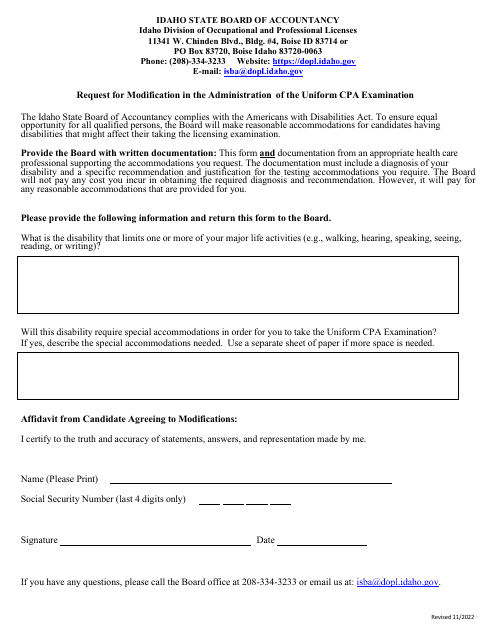

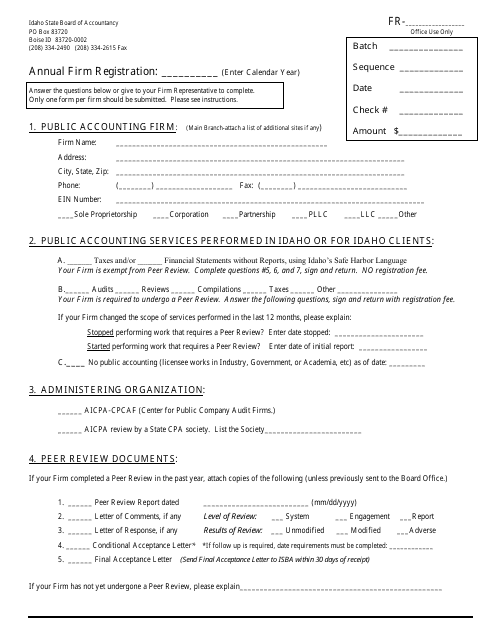

This Form is used for registering a firm on an annual basis in the state of Idaho.

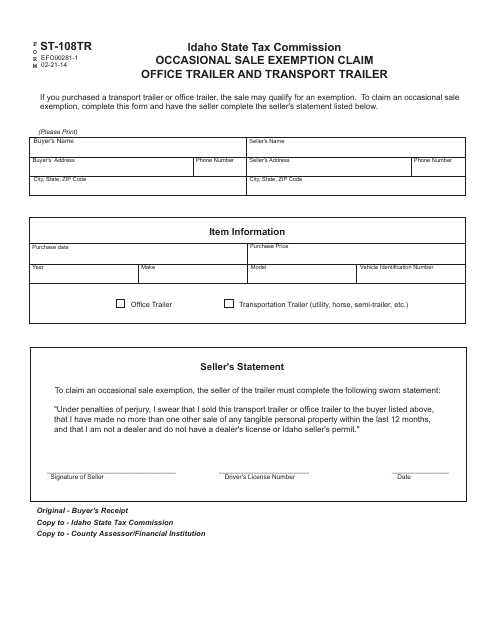

This form is used for claiming an exemption for occasional sales of office trailers and transport trailers in Idaho.

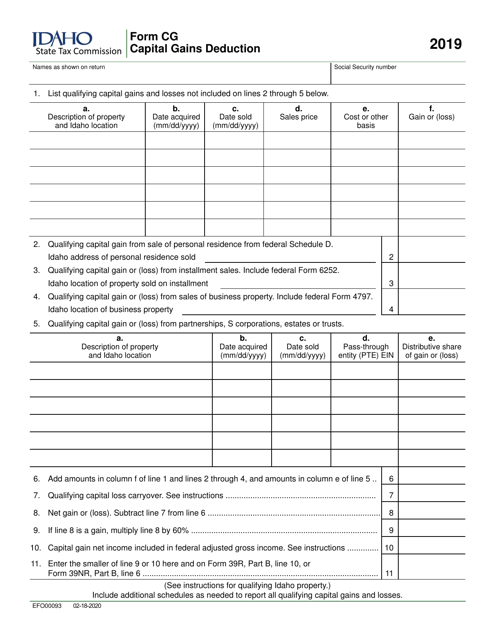

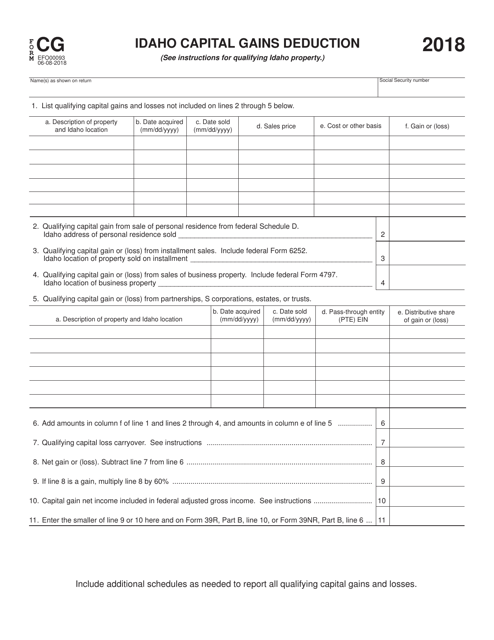

This document is used for claiming the Idaho Capital Gains Deduction in Idaho.

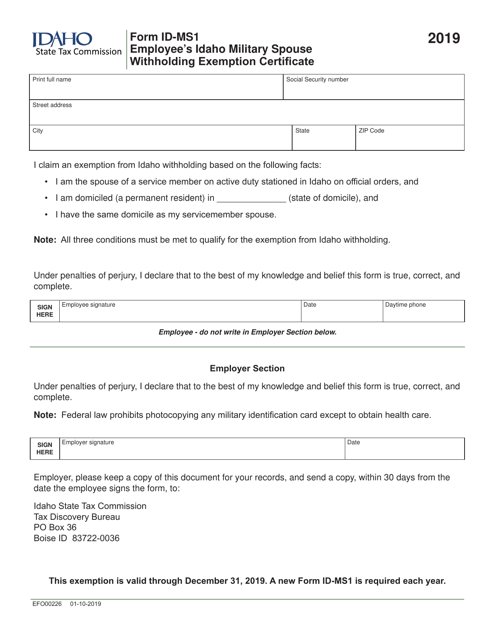

This form is used for employees who are military spouses in Idaho to claim withholding exemption from state income tax.