Indiana Department of Revenue Forms and Templates

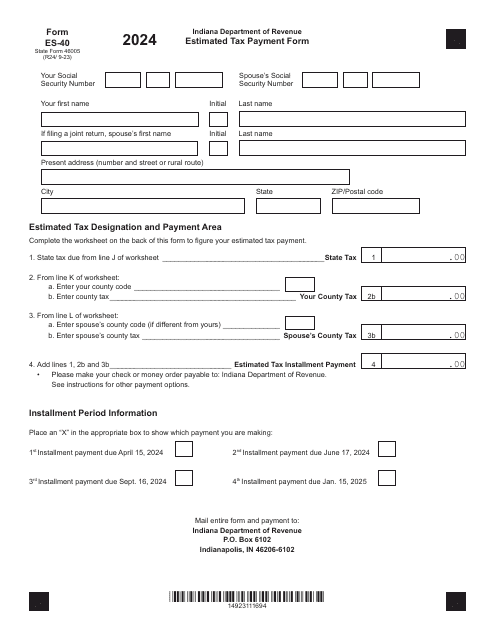

The Indiana Department of Revenue Forms are used for various purposes related to the taxation and revenue collection in the state of Indiana. These forms are used by individuals, businesses, and organizations to report their income, sales tax, property tax, and other taxes, and to request exemptions or credits.

Documents:

16

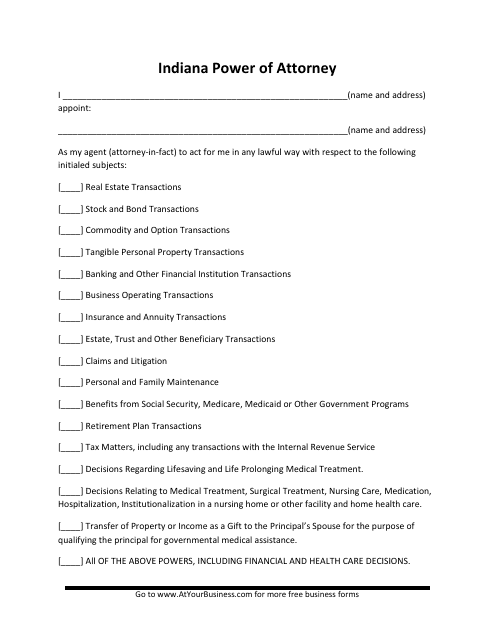

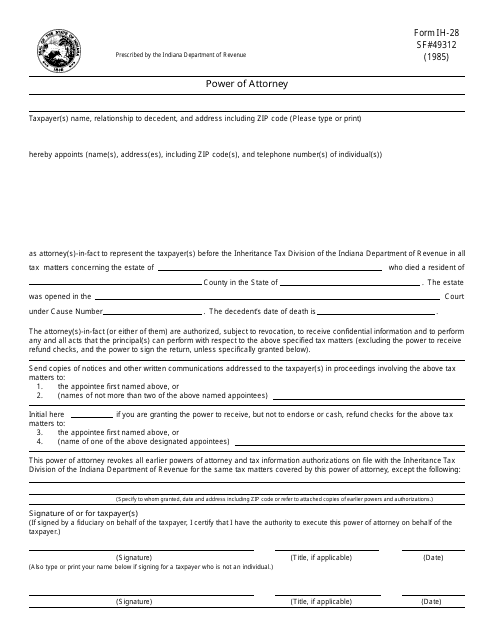

This Form is used for granting someone else the legal authority to make decisions on your behalf in the state of Indiana.

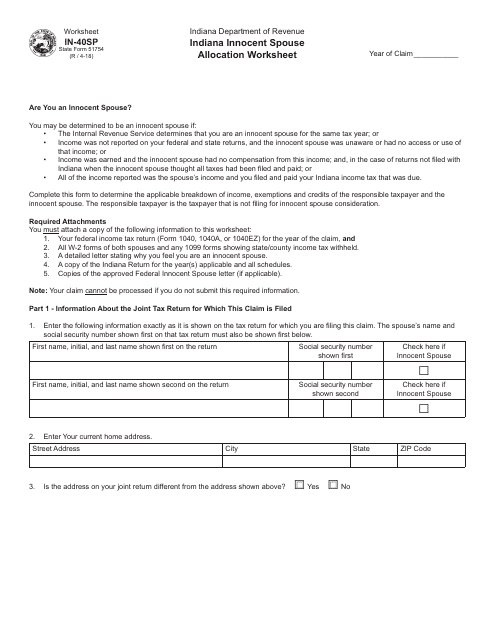

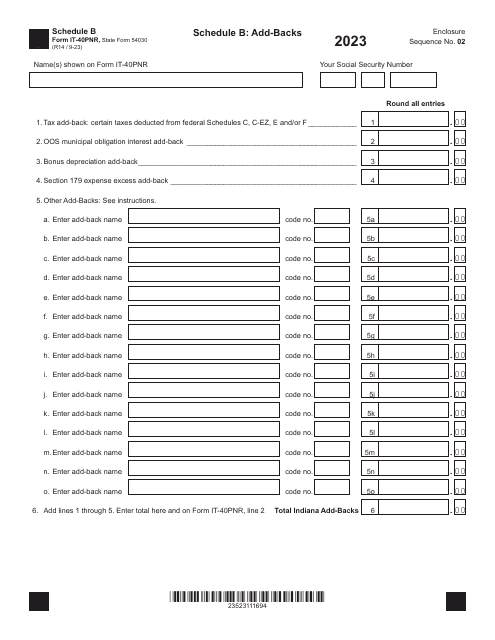

This Form is used for allocating income and tax liabilities between spouses in cases of innocent spouse relief in the state of Indiana.

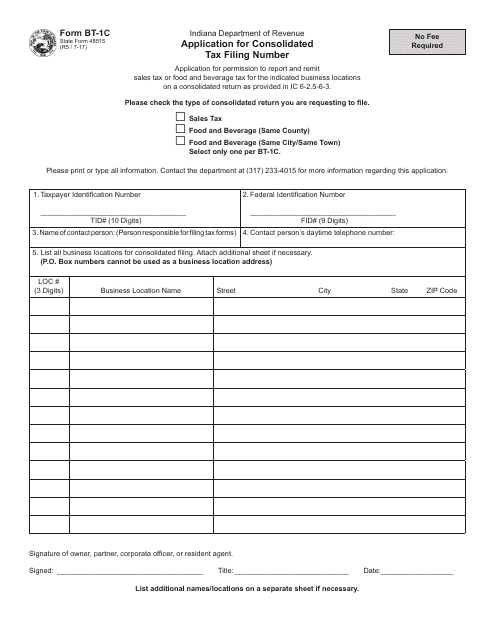

This form is used for applying for a consolidated tax filing number in the state of Indiana.

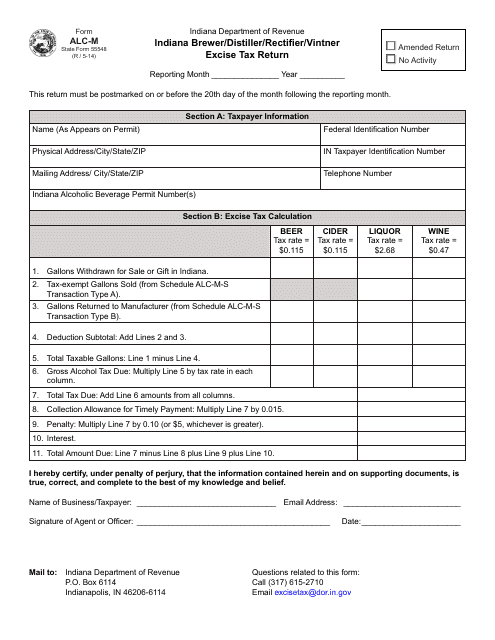

This form is used for Indiana brewers, distillers, rectifiers, and vintners to file their excise tax return.

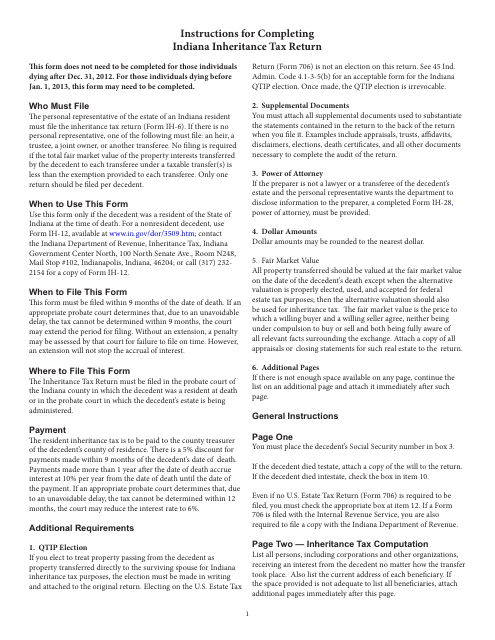

This Form is used for filing an Indiana Inheritance Tax Return in the state of Indiana. It is used to report any inheritance taxes owed on an estate.

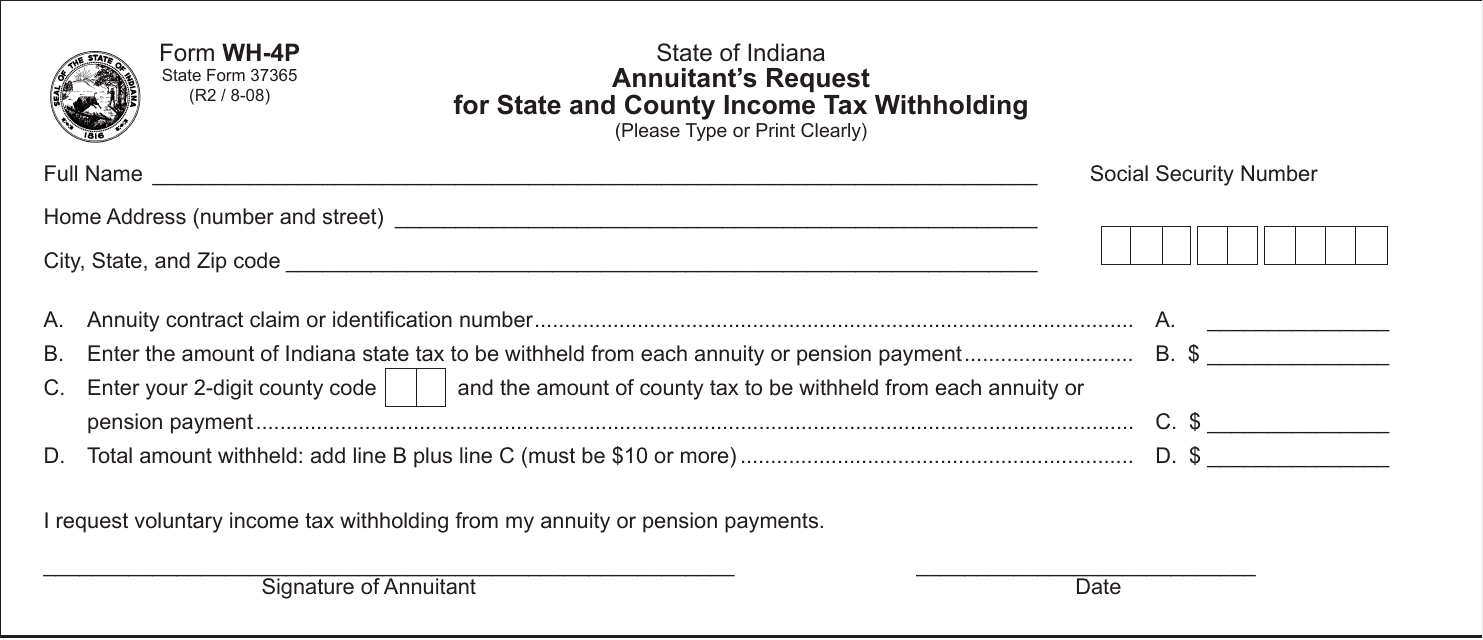

This form is used for annuitants in Indiana to request state and county income tax withholding.

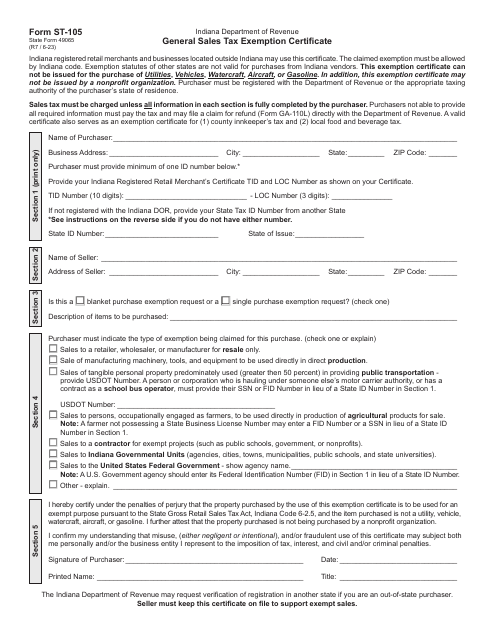

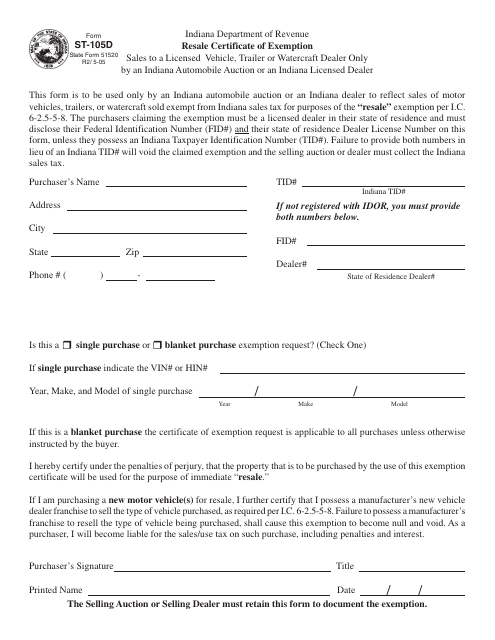

This form is used for claiming a resale exemption in the state of Indiana. It allows businesses to purchase items for resale without paying sales tax.

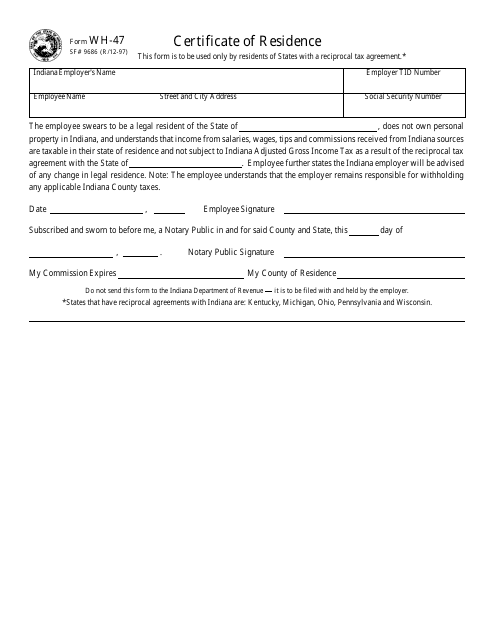

This form is used for obtaining a Certificate of Residence in the state of Indiana. It verifies that an individual is a resident of Indiana for purposes such as tax filings or tuition eligibility.

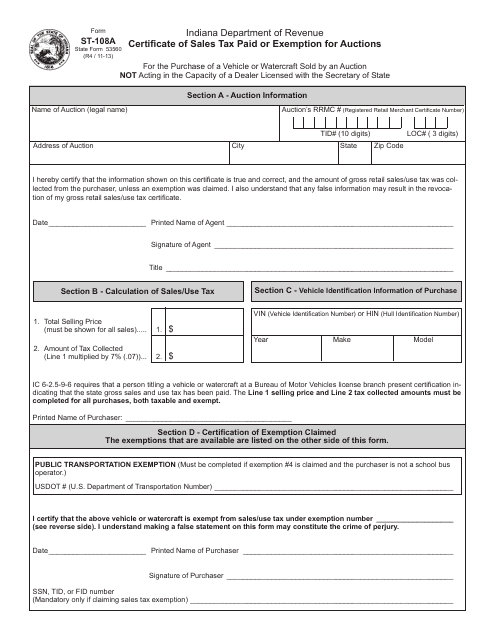

This form is used for reporting sales tax paid or claiming exemption for auctions conducted in the state of Indiana.

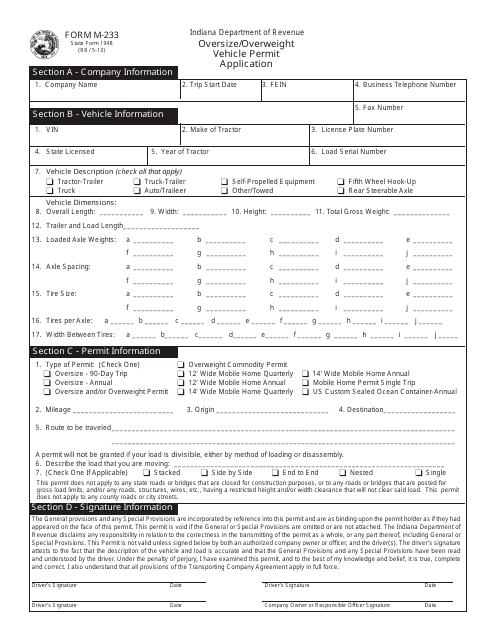

This form is used for applying for an oversize/overweight vehicle permit in Indiana.

This document allows an individual to grant someone else the authority to make decisions on their behalf in the state of Indiana.

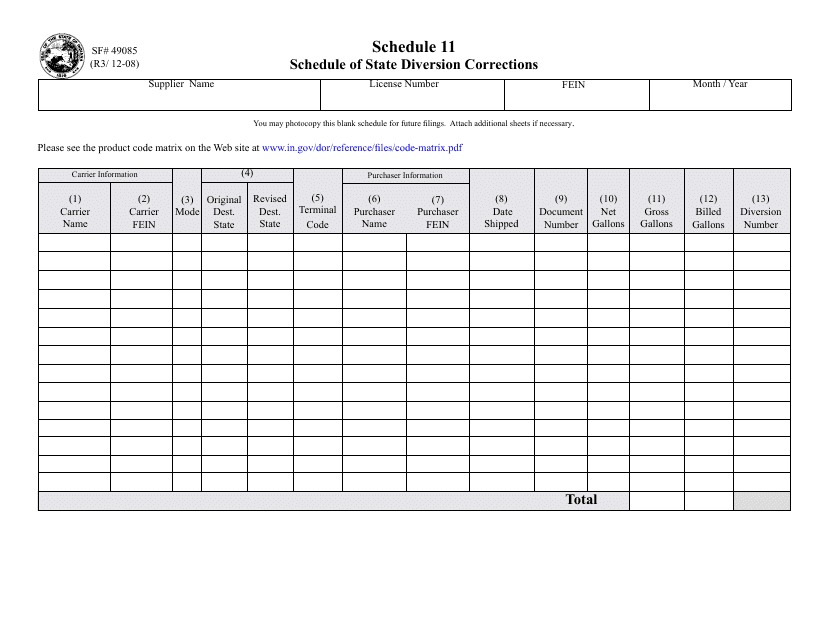

This Form is used for reporting the Schedule of State Diversion Corrections for Indiana. It helps to track and document the diversion programs and corrections activities in the state.

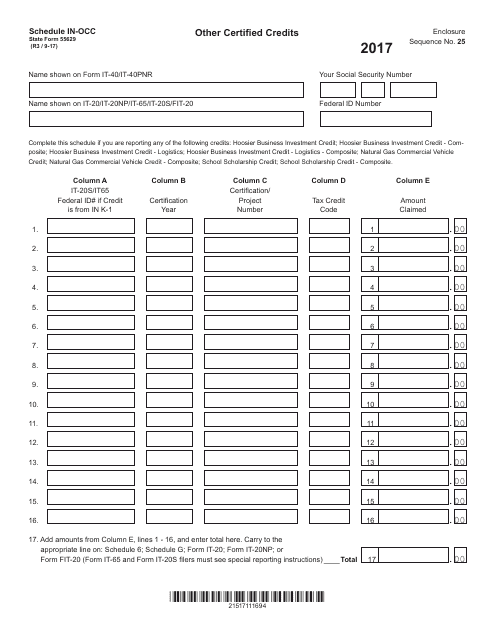

This form is used for reporting and claiming other certified credits in the state of Indiana.