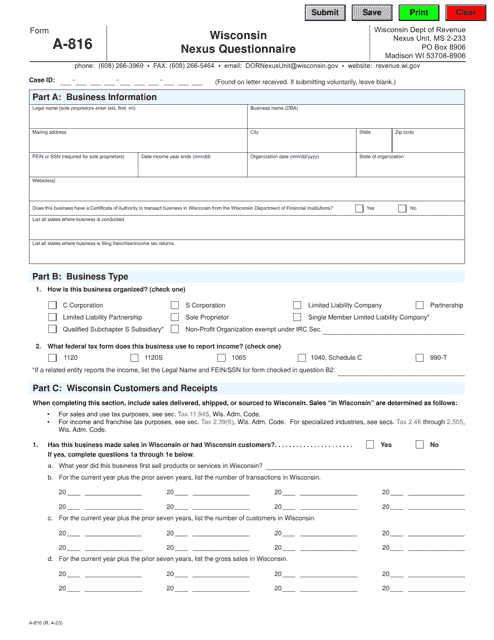

Wisconsin Tax Forms and Templates

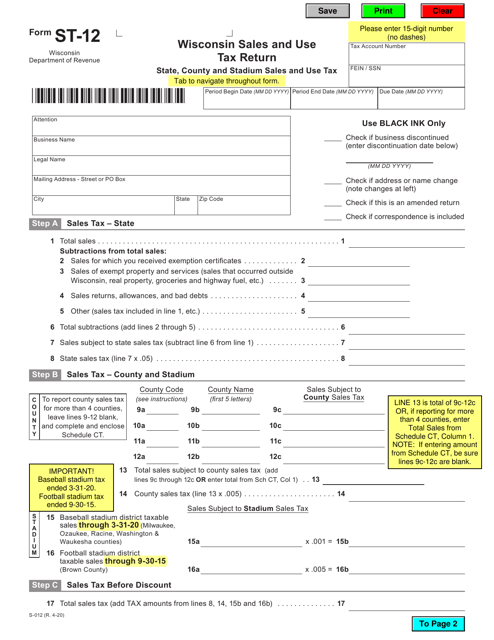

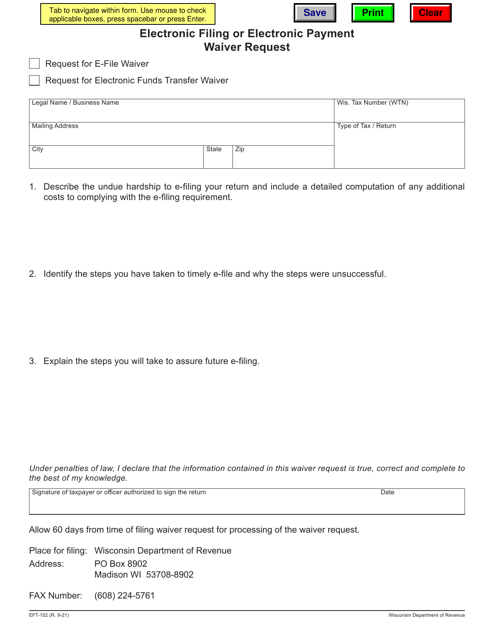

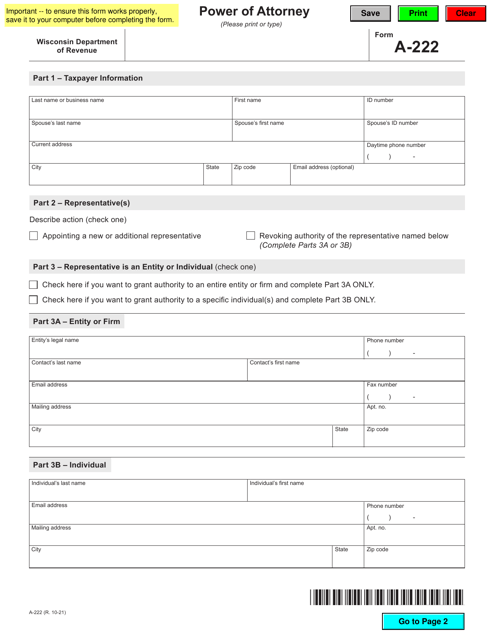

Wisconsin tax forms are used for filing taxes in the state of Wisconsin. These forms are used to report income, calculate tax liability, claim deductions and credits, and determine any tax refunds or amounts owed to the state of Wisconsin. Tax forms are necessary for individuals, businesses, and organizations to fulfill their tax obligations in Wisconsin.

Documents:

14

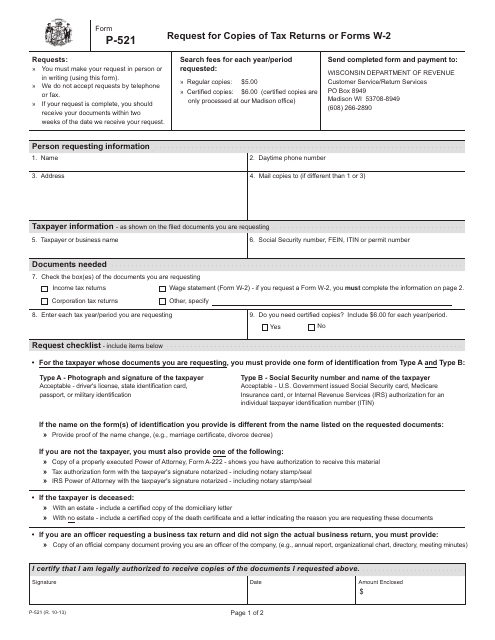

This Form is used for requesting copies of tax returns or Forms W-2 in the state of Wisconsin.

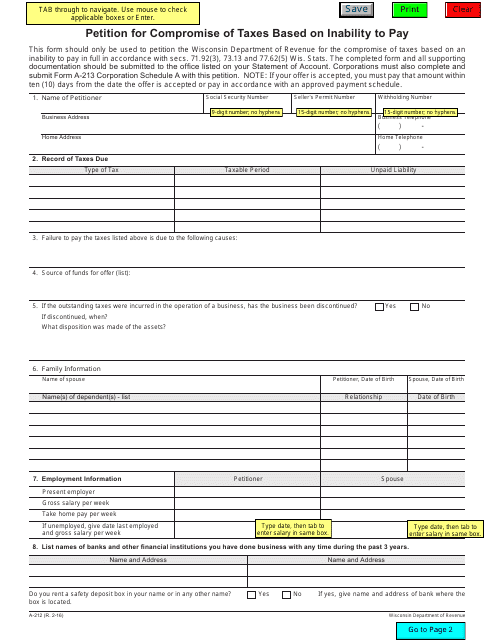

This Form is used for individuals in Wisconsin who are unable to pay their taxes and are seeking a compromise with the state.

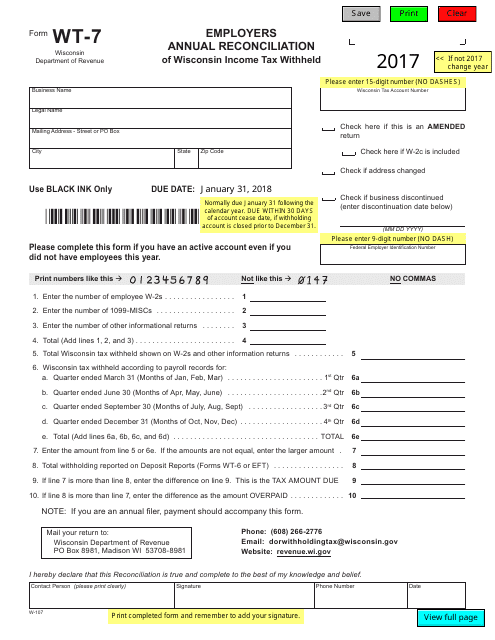

This Form is used for employers in Wisconsin to reconcile their annual income tax withholdings.

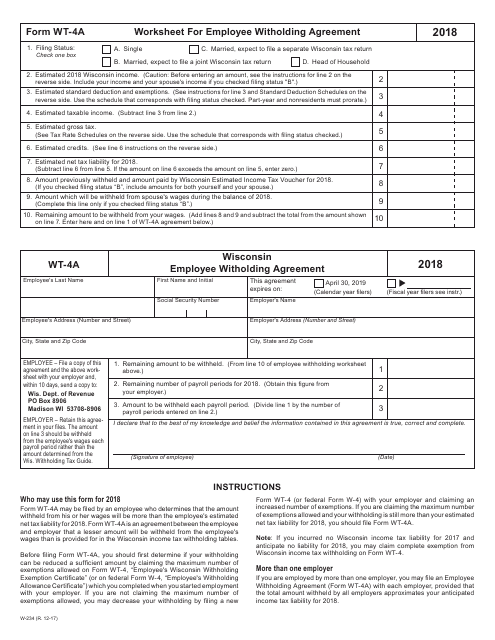

This Form is used for calculating employee withholding agreement in Wisconsin.

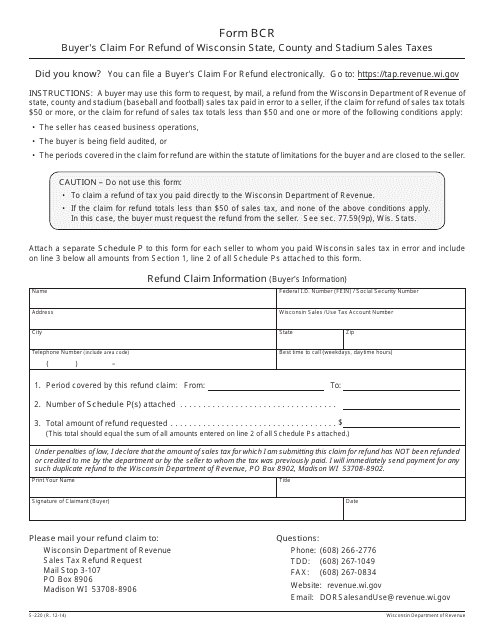

This form is used for buyers to claim a refund of Wisconsin state, county, and stadium sales taxes in Wisconsin.

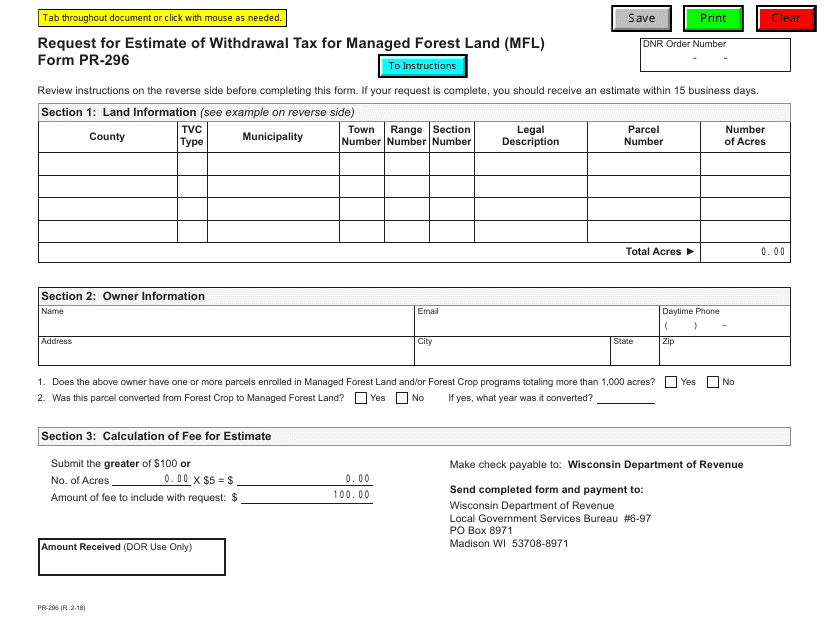

This form is used for requesting an estimate of the withdrawal tax for Managed Forest Land (MFL) in Wisconsin. It helps landowners determine the potential tax liability when withdrawing land from the managed forest program.

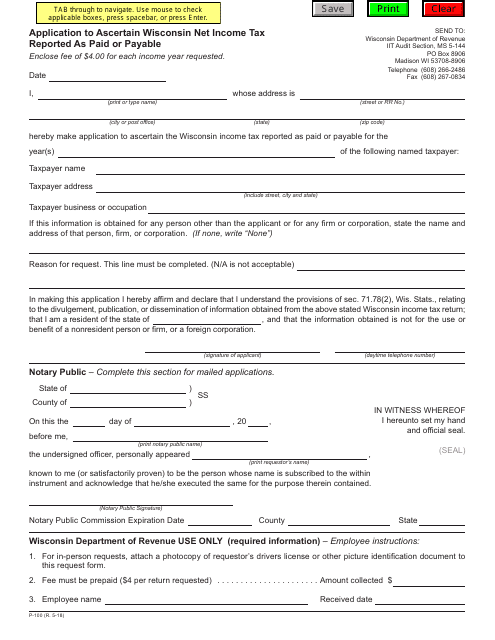

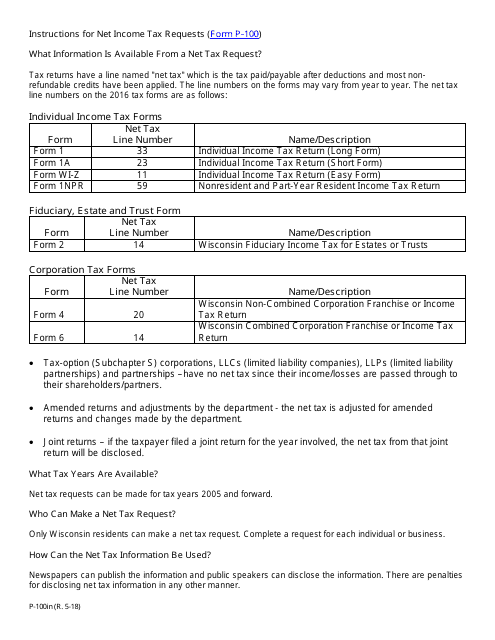

Form P-100 Application to Ascertain Wisconsin Net Income Tax Reported as Paid or Payable - Wisconsin

This Form is used for calculating the net income tax reported as paid or payable in the state of Wisconsin.

This Form is used for applying to determine the amount of Wisconsin net income tax reported as paid or payable.