Hardship Letter Templates and Samples

What Is a Hardship Letter?

A Hardship Letter is a document that individuals can use when they are not able to fulfill their financial obligations due to specific complicated circumstances. The purpose of the letter is to notify the creditor about the hardships that the debtor is going through, and ask them to change the conditions of the deal to help the debtor.

Check out our library below to browse printable Hardship Letter templates and samples.

A simple Hardship Letter can help the debtor to modify the terms of their financial obligation and make it easier for them to pay their debt. With this letter, the debtor can ask their creditor to suspend past due payments, lower minimum payments, modify their loan, and other options that can help to improve their situation.

Hardship Letter Types

A Letter of Hardship can be applied to different types of loans and to various situations. The most popular types are described below.

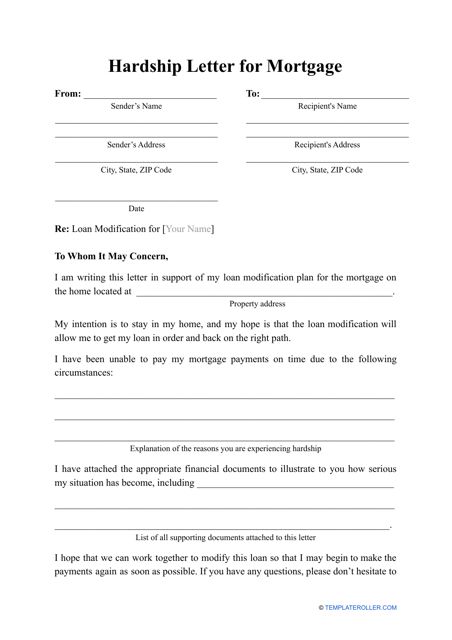

- Hardship Letter for Mortgage. Debtors can use this document to convince their lenders to modify their mortgage due to hardships that have occurred. Generally, the lender has a set of requirements that the debtor must meet if they want their mortgage to be modified.

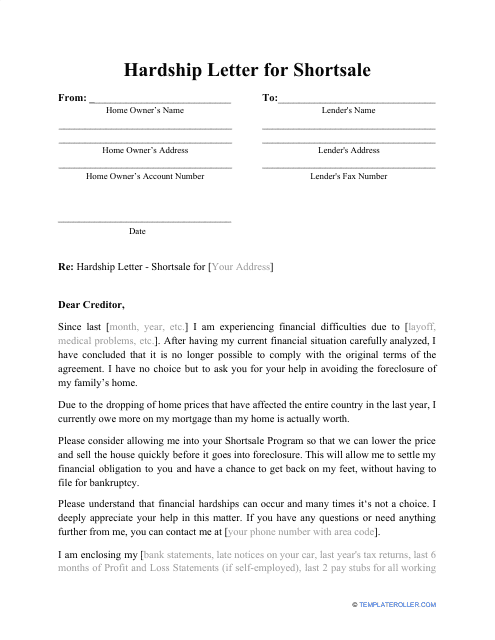

- Hardship Letter for Shortsale. The letter is supposed to be used when individuals can no longer make their mortgage payments due to financial difficulties. With this letter, they can apply to sell their house for a price less than the amount of the balance owed on their mortgage.

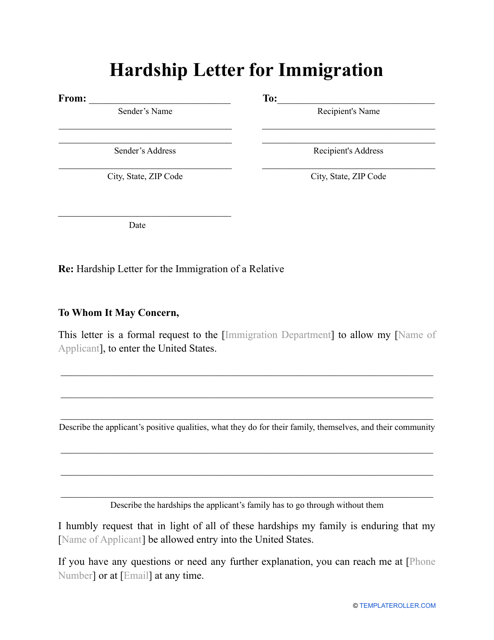

- Hardship Letter for Immigration. This document is applicable to situations when individuals want to explain the complications of their situation to the immigration officials that are managing their case.

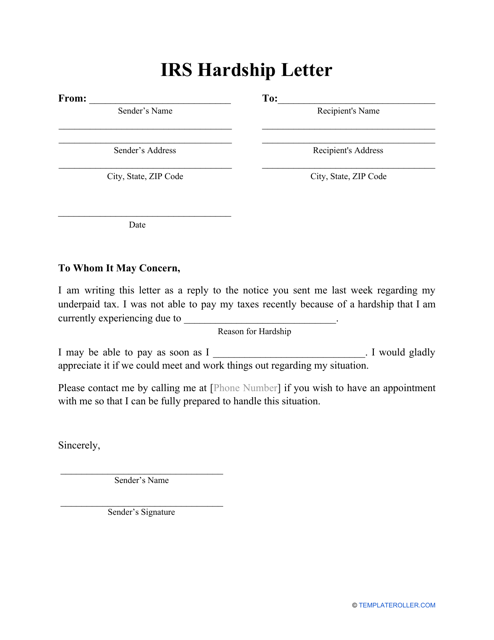

- IRS Hardship Letter. The document can be used when an individual is not able to pay the taxes they owe. The purpose of the letter is to inform the Internal Revenue Service about the individual’s circumstances and apply for the IRS hardship status.

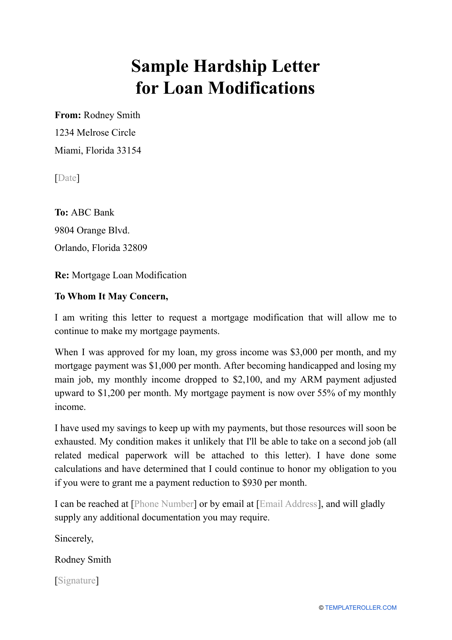

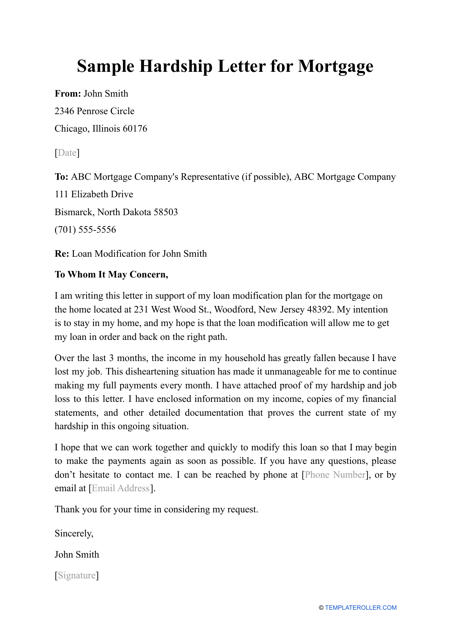

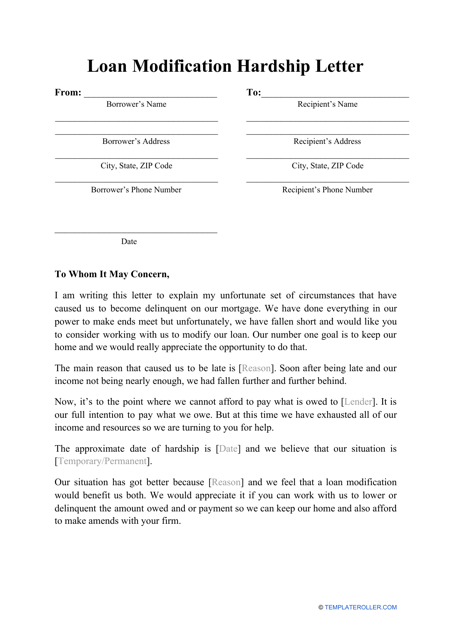

- Loan Modification Hardship Letter. Debtors can use this type of letter when they want to modify their loan conditions because of the hardships that have occurred. The debtor should describe the exact reason that affects their ability to pay the mortgage. Check out our ready-made Sample Hardship Letter for Loan Modifications to use as a reference when composing your letter.

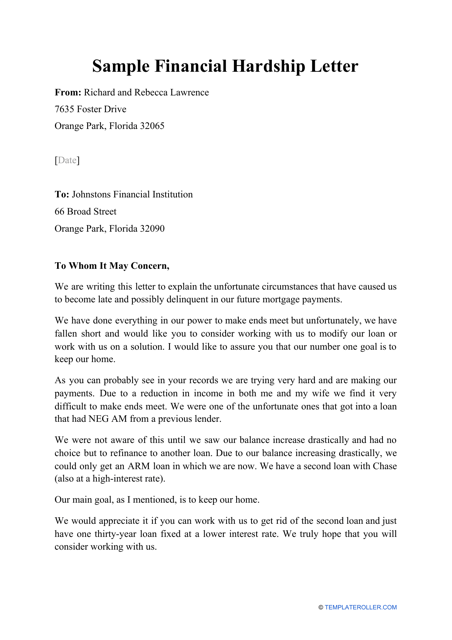

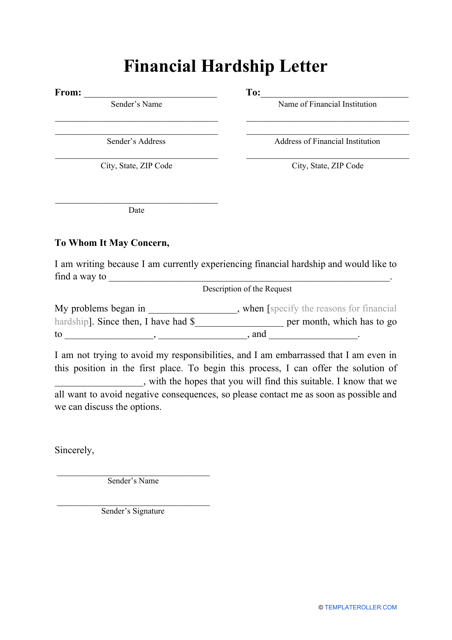

- Financial Hardship Letter. This type of Hardship Letter is supposed to be used when an individual wants to ask for leniency or special consideration due to their difficult financial situation.

How to Write a Hardship Letter?

While writing the letter the individual should remember that it is necessary to be honest. Regardless of the reasons why the individual came to the decision to submit this document, everything stated here should be proven with evidence and attached to the letter. A Hardship Letter template should include the following information:

- Introduction. The individual should start by introducing themselves and stating their full name. They can also include their current address in this part of the letter.

- Information About the Loan. Individuals can use this part to designate information about the loan, mortgage, or any other financial obligation they are not able to fulfill anymore. It should contain information about the loan agreement, the loan amount, how much has been paid, how much has left, etc. If the Hardship Letter is dedicated to non-financial reasons (for example, immigration case) then it should be indicated in this part of the letter.

- Description of the Situation. Here the individual can depict the hardship that has occurred and prevent them from fulfilling their obligations. The most common circumstances that usually affect the financial stability of an individual are job loss, injury, divorce, military deployment, and others.

- Request. In this part of the letter, the individual can ask the addressee (in the majority of financial letters it is a lender, in other cases, it can be a government representative) to change the conditions for them and show leniency due to their complicated situation.

- Conclusion. The individual can end the document by signing and dating. They can also express their hope to hear from the addressee soon.

Not what you need? Browse these related topics:

Documents:

11

This is a typed or handwritten statement prepared by a borrower and sent to the lender to explain the circumstances that led to a payment delay and convince the lender of the necessity to sell the property at a lower price.

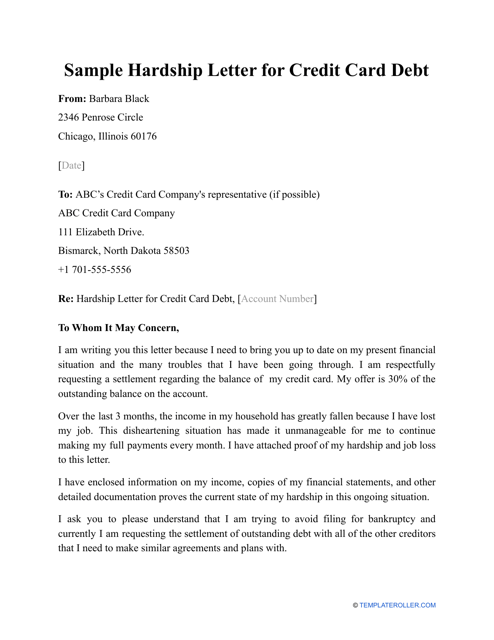

Owners of credit cards can reduce their debt by submitting a Hardship Letter explaining their situation to their credit card company.

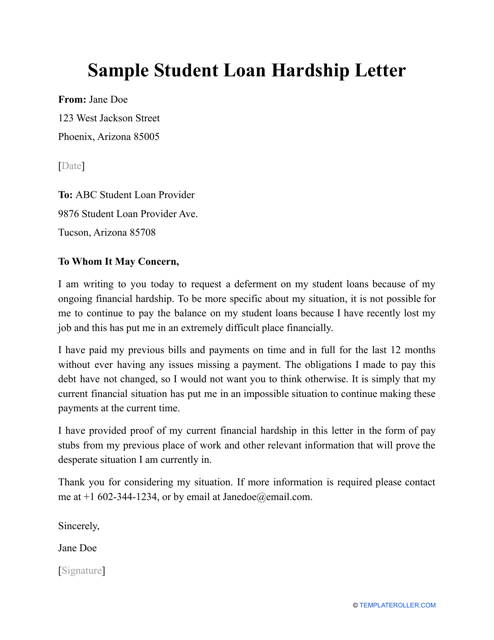

This form is used when an applicant needs to defer payments on their student loan (or decrease, modify, etc.) due to a financial hardship situation.

Individuals use this letter to explain the reasons why they are applying for a loan modification and offer possible loan modifications in order to make it easier for them to pay it back.

Complete this ready-made template to explain to the bank why you're defaulting on your mortgage.

Use this sample as a reference when drafting your own Hardship Letter for Mortgage.

Writing an efficient Loan Modification Hardship Letter is crucial to the success of modifying a home loan .

Use this sample letter to provide your lender with the reason you have not been able to fulfill your financial obligations.

This letter can be sent to the lender with the intention to postpone payments, change the existing loan or mortgage, or cancel the accumulated interest.

Have you been sent out of the country and are struggling to return? Are you about to be sent out of the country? You are allowed to plead your case via a Hardship Letter explaining why you should not be deported or kept out of the U.S.

Complete this template and send it to the Internal Revenue Service (IRS) in order to describe a difficult financial situation you're experiencing, ask the IRS for leniency, or request a new payment deadline.