Utah State Tax Forms and Templates

Utah State Tax Forms are used for various purposes related to the collection and administration of taxes in the state of Utah. These forms are used to report income, calculate and pay taxes, claim deductions, exemptions, or credits, and fulfill other tax-related obligations imposed by the state. They provide a standardized way for individuals, businesses, and organizations to comply with Utah's tax laws and regulations.

Documents:

11

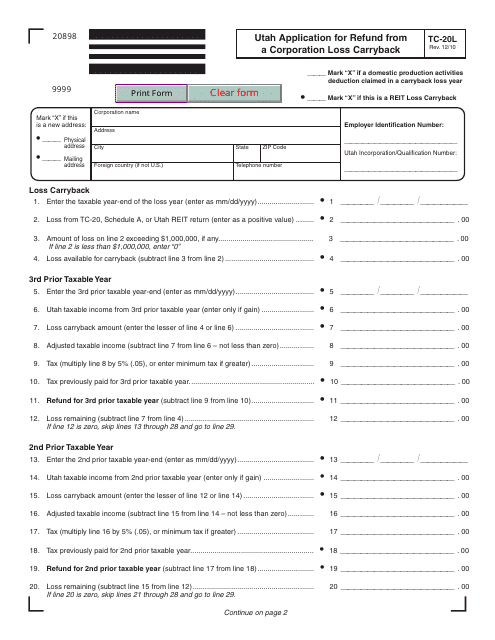

This form is used for corporations in Utah to apply for a refund of taxes from a loss carryback.

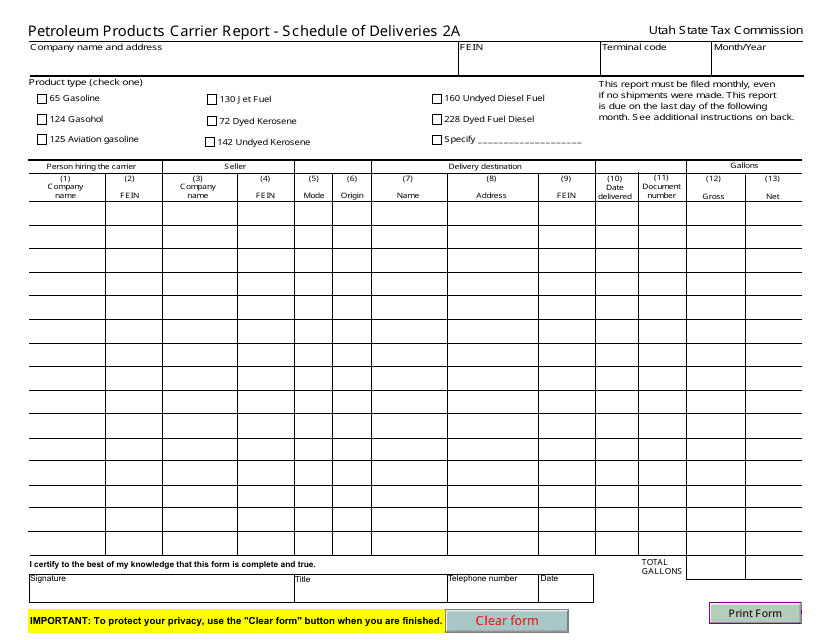

This document is a report that provides a schedule of petroleum product deliveries in Utah.

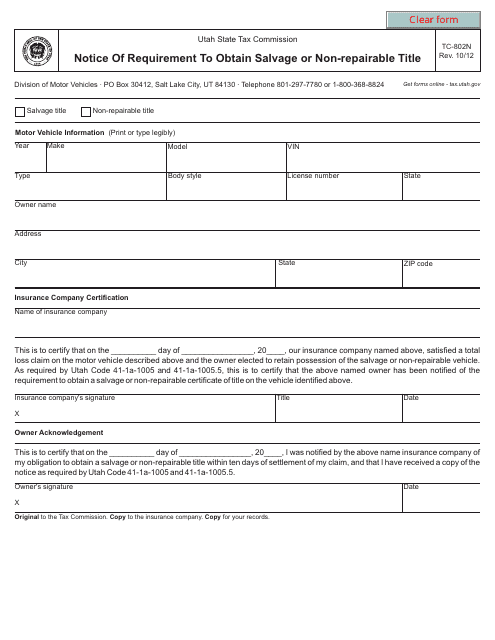

This Form is used for notifying vehicle owners in Utah about the requirement to obtain a salvage or non-repairable title for their vehicle.

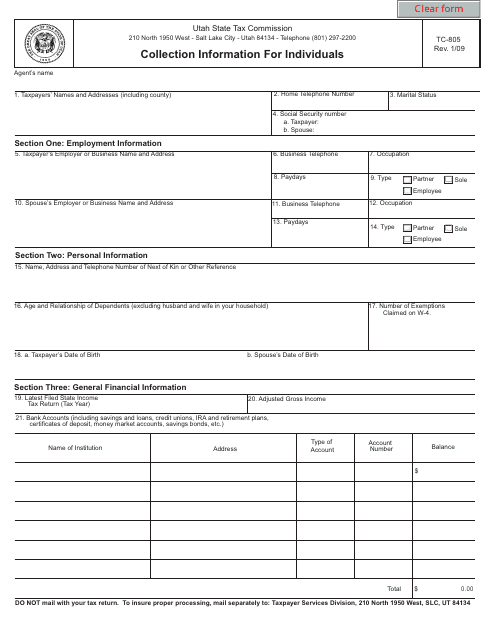

This form is used for collecting information from individuals in Utah for tax purposes. It helps the government determine an individual's ability to pay their taxes.

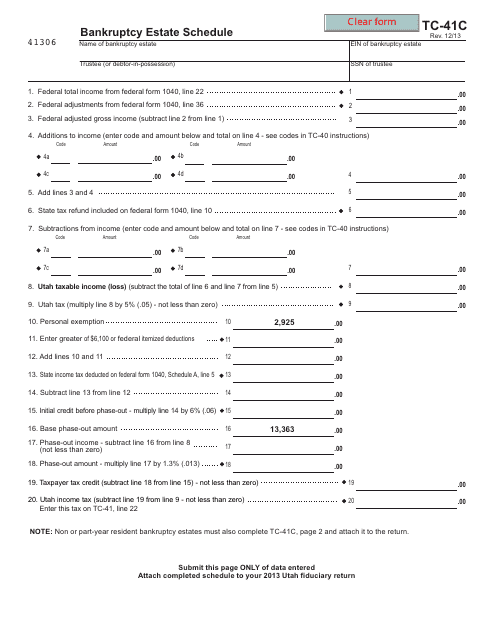

This form is used for filing bankruptcy estate schedule specifically for the state of Utah.

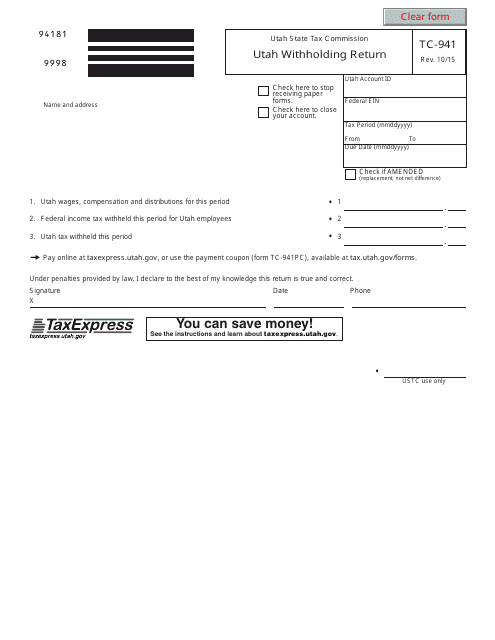

This Form TC-941 is used for reporting and remitting Utah income tax withholdings. Employers in Utah use this form to calculate the amount of state income tax that should be withheld from employees' wages and to report and remit those withholdings to the Utah State Tax Commission.

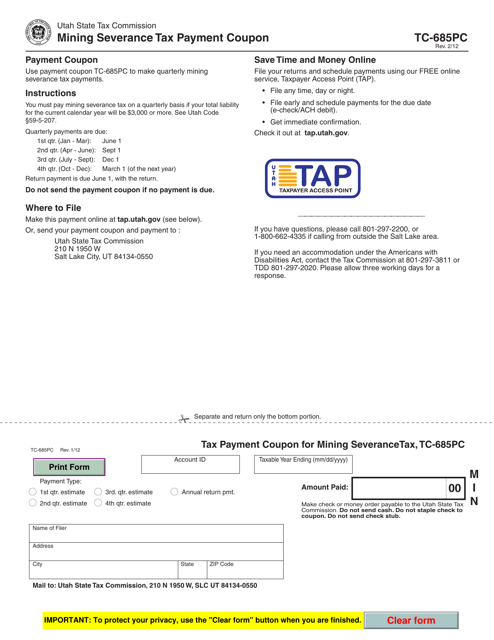

This form is used for making mining severance tax payments in the state of Utah.