Louisiana Tax Forms and Templates

Documents:

226

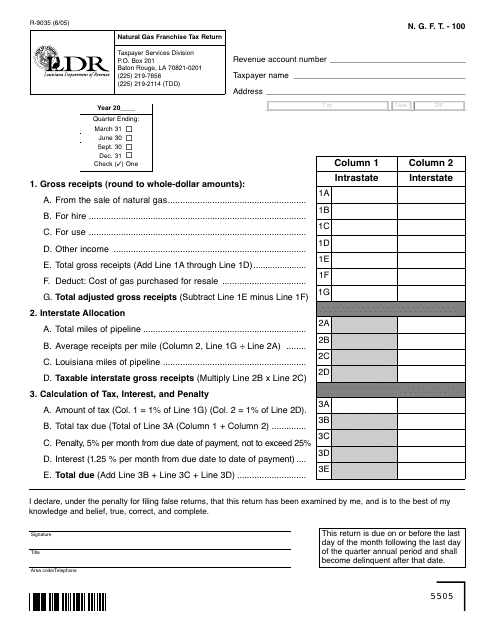

This form is used for filing the Natural Gas Franchise Tax Return in Louisiana.

This Form is used for filing the N.G.F.T.-100 Natural Gas Franchise Tax Return in Louisiana. It provides instructions for completing the form and filing the required tax return.

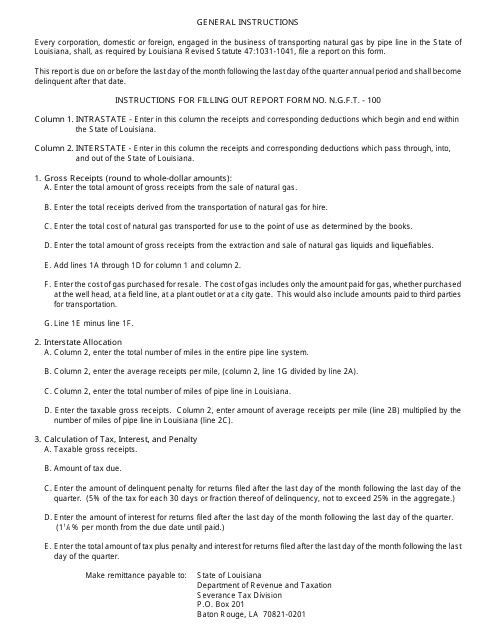

This document certifies that a construction contractor has been designated as an agent of a governmental entity for sales tax exemption in Louisiana.

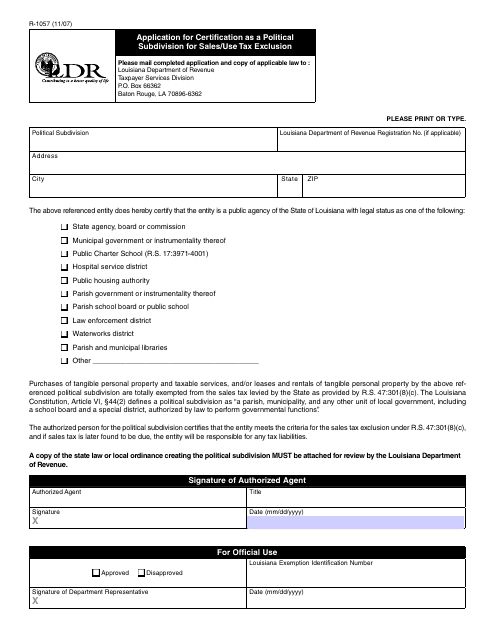

This form is used for applying to certify a political subdivision for sales/use tax exclusion in Louisiana.

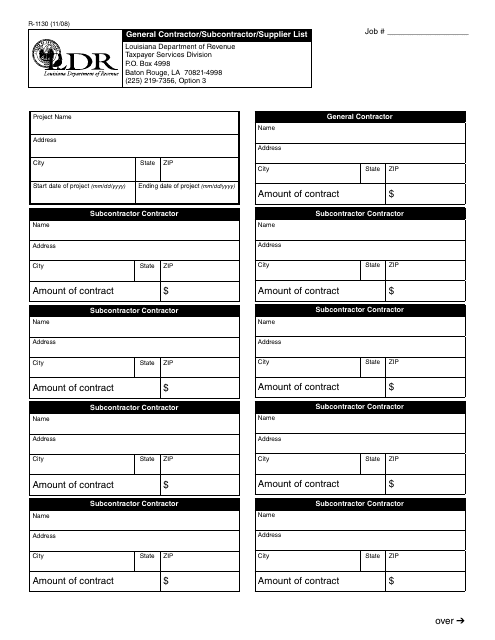

This form is used for providing a list of general contractors, subcontractors, and suppliers in Louisiana.

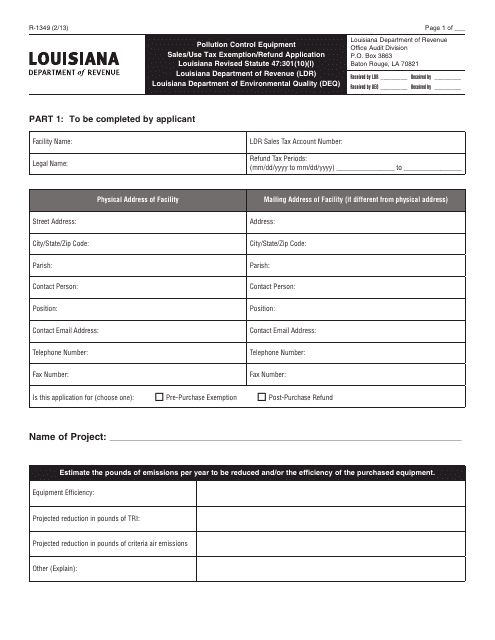

This type of document is an application form used in Louisiana to request an exemption or refund for sales or use tax related to pollution control equipment.

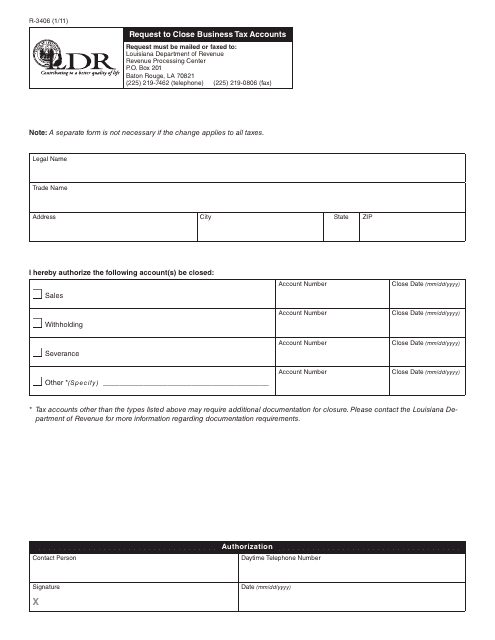

This form is used for requesting the closure of business tax accounts in the state of Louisiana.

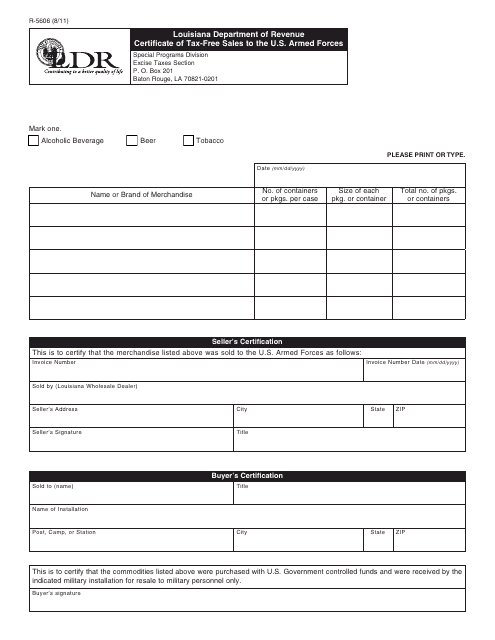

This form is used for certifying tax-free sales made to the U.S. Armed Forces in Louisiana.

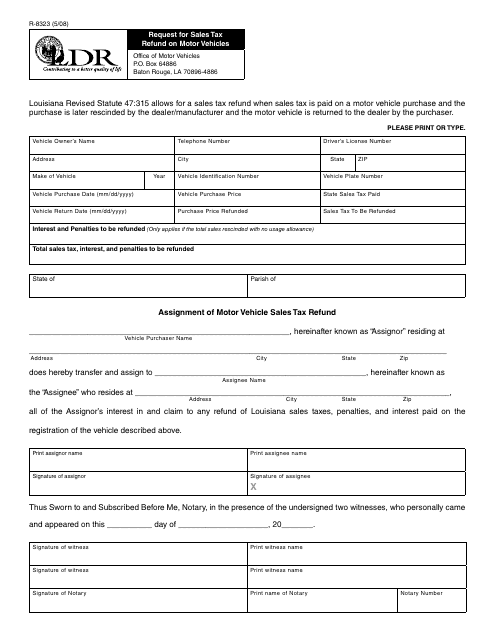

This form is used for requesting a sales tax refund on motor vehicles in the state of Louisiana.

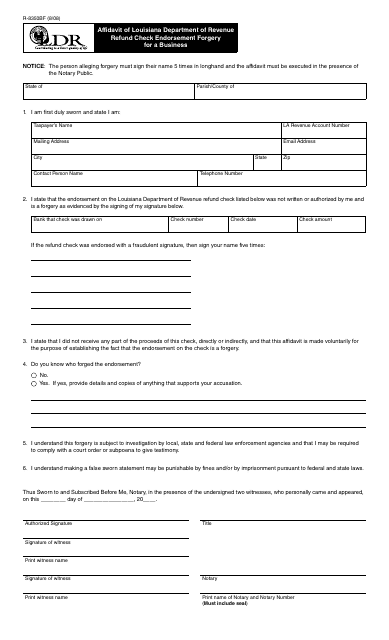

This form is used for reporting and addressing incidents of check forgery involving business refund checks issued by the Louisiana Department of Revenue.

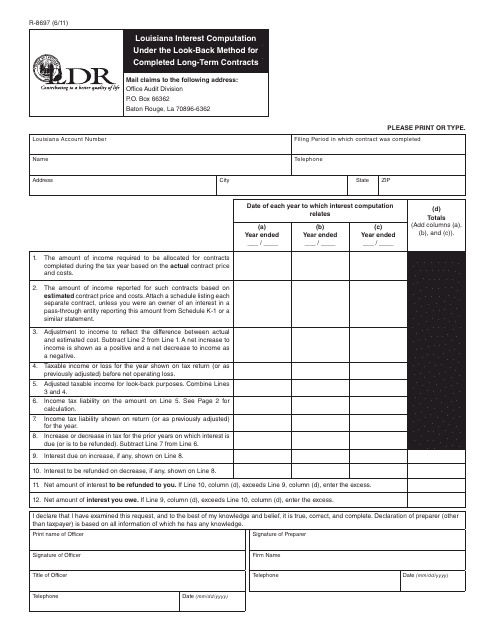

This form is used for calculating interest under the look-back method for completed long-term contracts in the state of Louisiana.

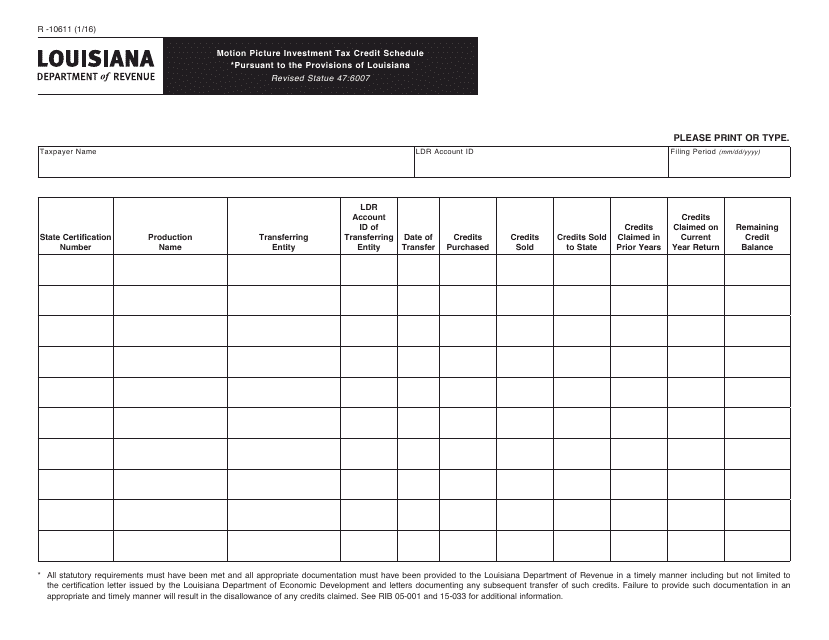

This form is used for reporting and claiming the Motion Picture Investment Tax Credit in Louisiana.

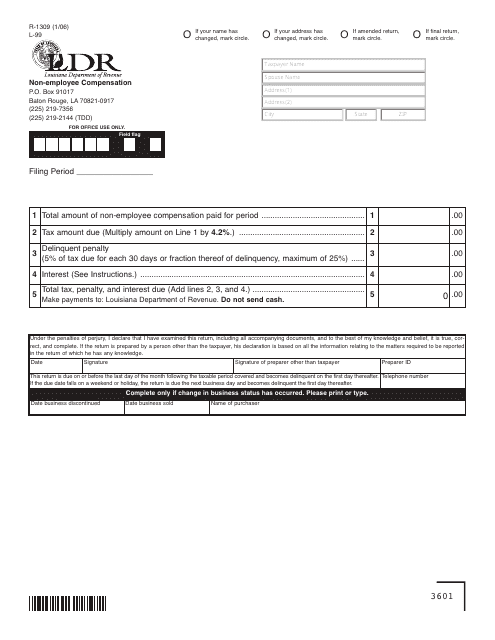

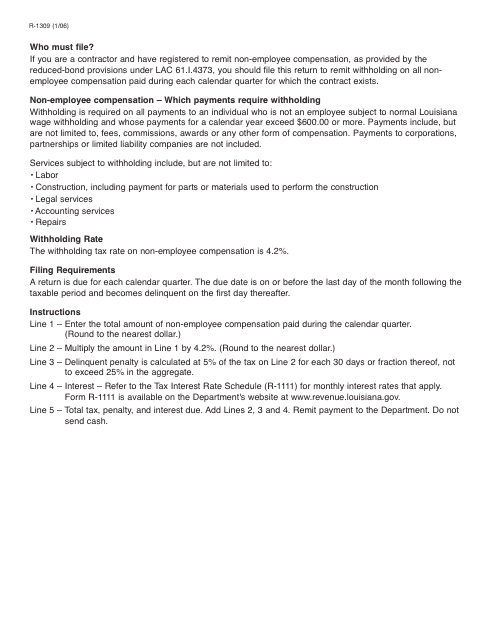

This form is used for reporting non-employee compensation in the state of Louisiana.

This document is used for reporting non-employee compensation in the state of Louisiana.

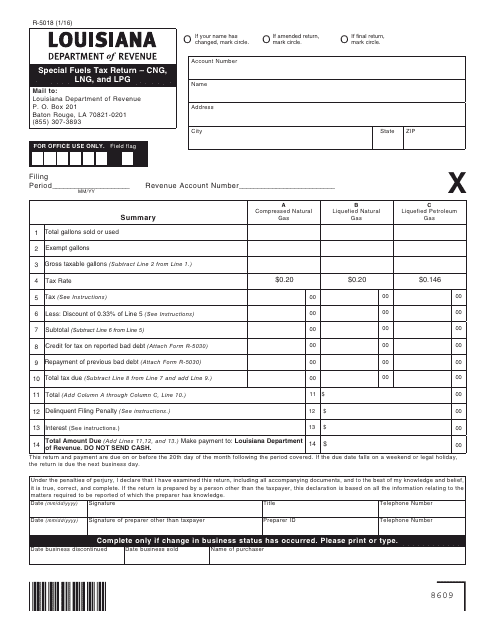

This Form is used for filing the Special Fuels Tax Return for compressed natural gas (CNG), liquefied natural gas (LNG), and liquefied petroleum gas (LPG) in Louisiana.

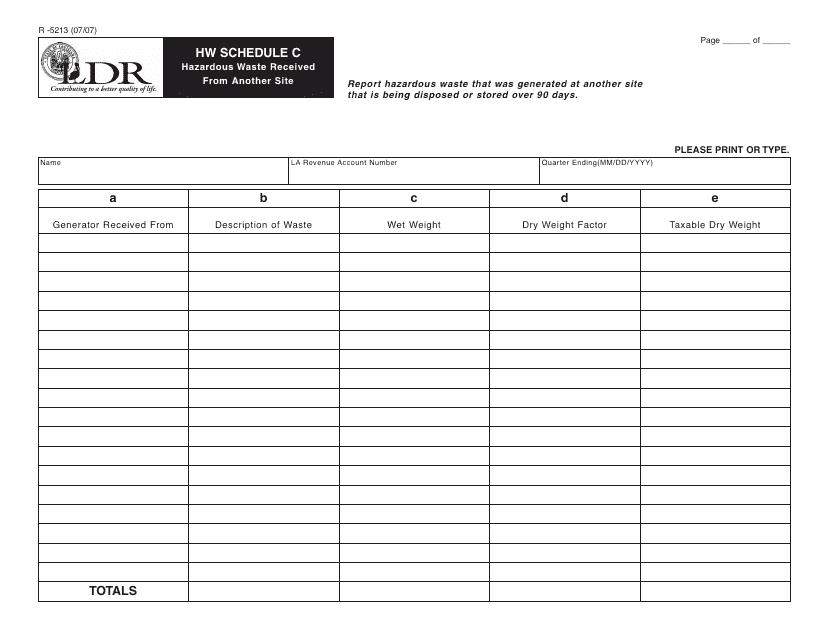

This form is used for reporting hazardous waste received from another site in Louisiana.

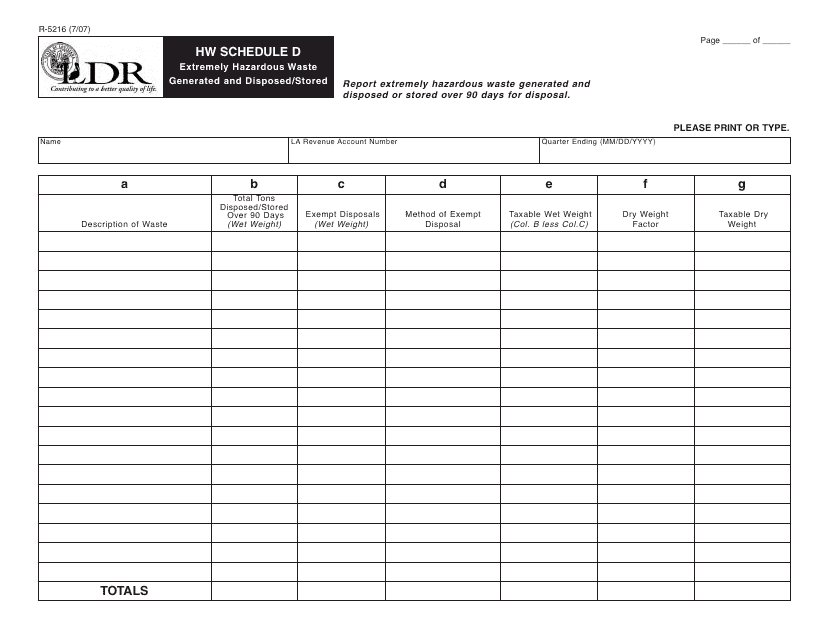

This form is used for reporting the generation and disposal/storage of extremely hazardous waste in Louisiana. It is required by the state environmental agency to track and monitor the handling of these dangerous materials.

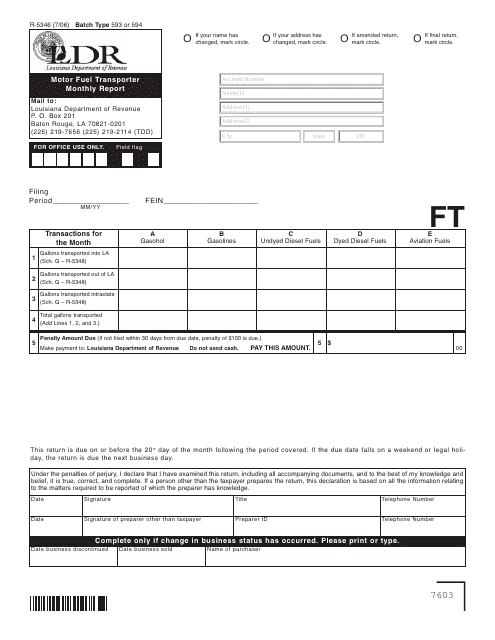

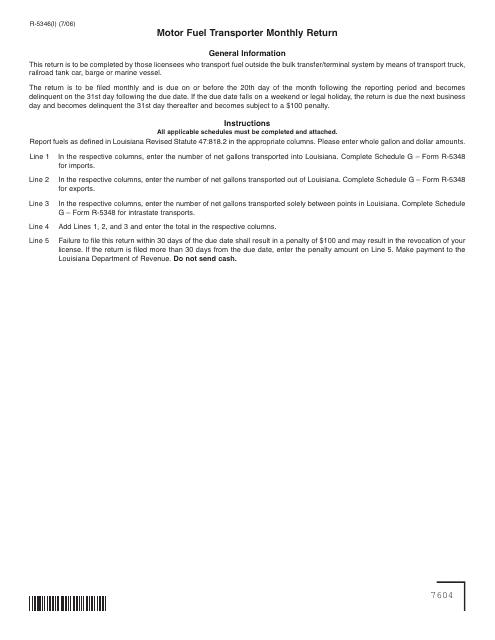

This form is used for submitting monthly reports by motor fuel transporters in Louisiana. It is required for reporting transportation activities related to motor fuel.

This form is used for reporting and remitting motor fuel taxes by motor fuel transporters in the state of Louisiana on a monthly basis.

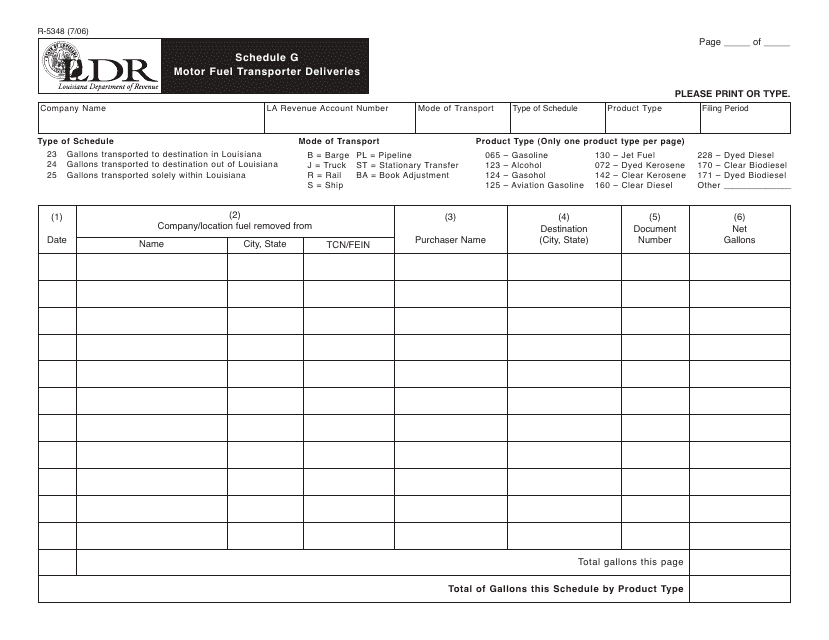

This form is used for reporting motor fuel deliveries by transporters in Louisiana. It is required for compliance with state regulations.

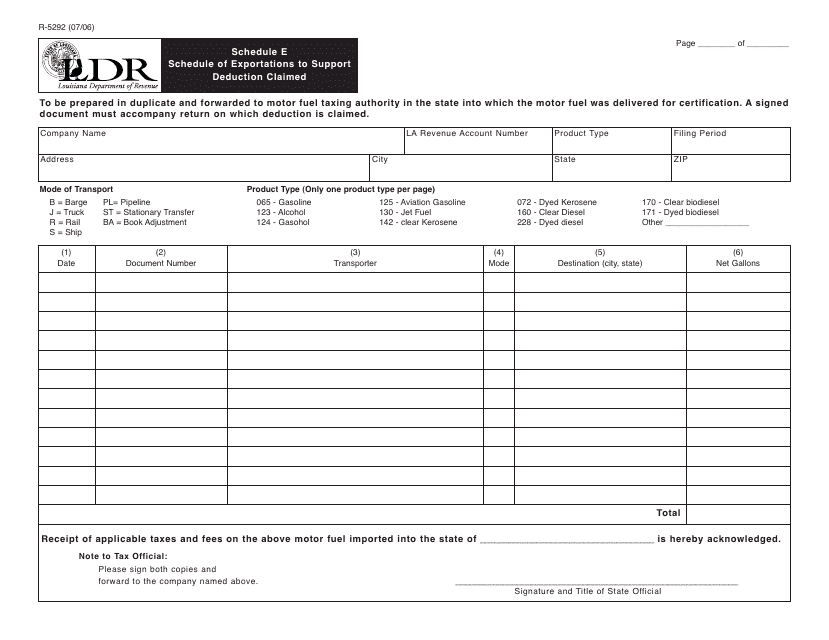

This form is used for reporting exportations to support deduction claimed in the state of Louisiana. It helps individuals and businesses to track and document their export activities for tax purposes.

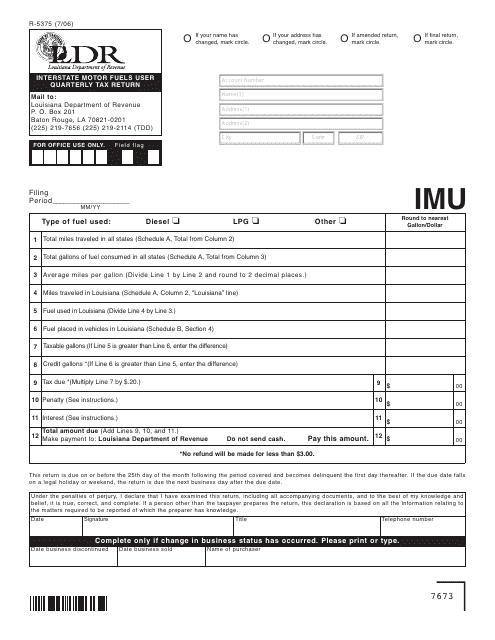

This document is used for filing the quarterly tax return for users of interstate motor fuels in Louisiana.

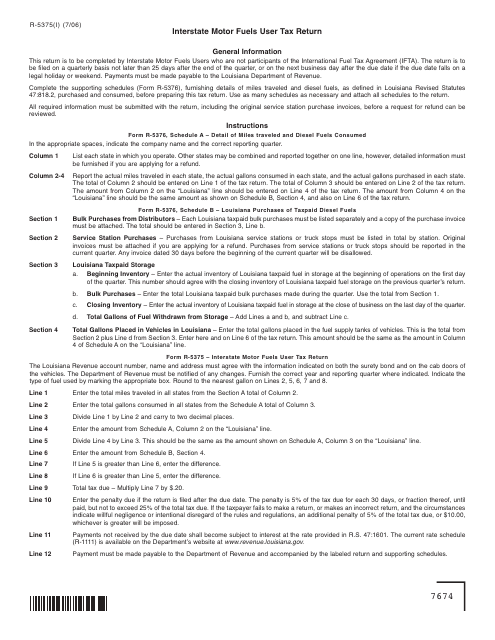

This form is used for filing the quarterly tax return for interstate motor fuels users in Louisiana. The instructions provide information on how to properly fill out and submit the form.

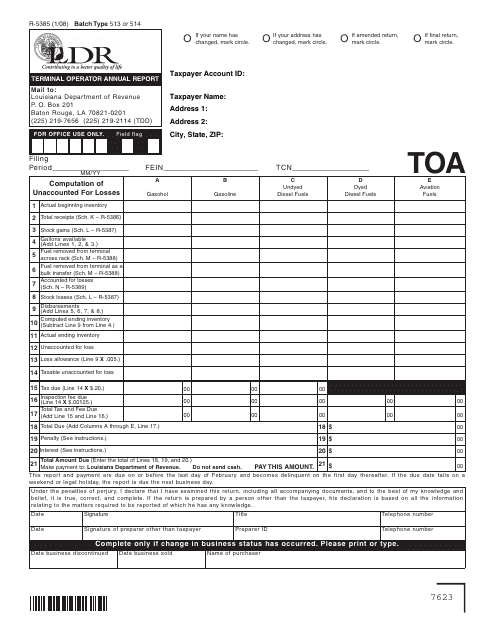

This document is used for submitting the annual report of terminal operators in Louisiana.

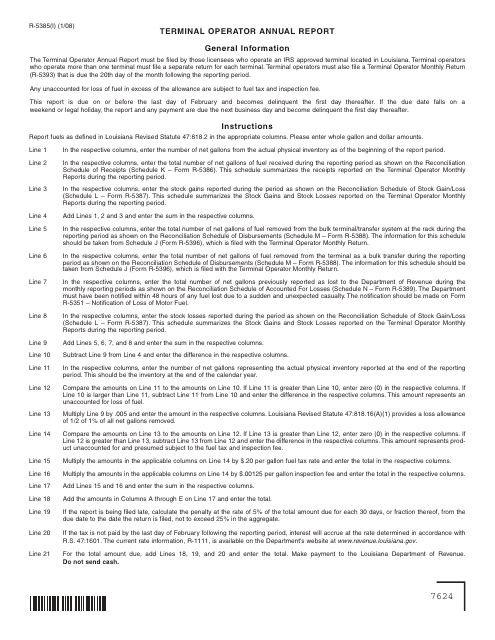

This document provides instructions for completing the Terminal Operator Annual Report (Form R-5385) in the state of Louisiana. It explains how to accurately fill out the form and provides any necessary guidance for submitting the report.

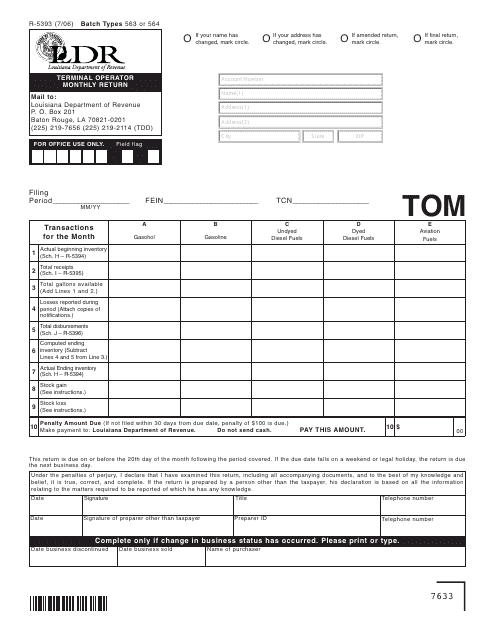

This form is used for terminal operators in Louisiana to submit their monthly returns.

This Form is used for terminal operators in Louisiana to report their monthly activities and submit taxes owed. It provides instructions on how to fill out and submit Form R-5393.

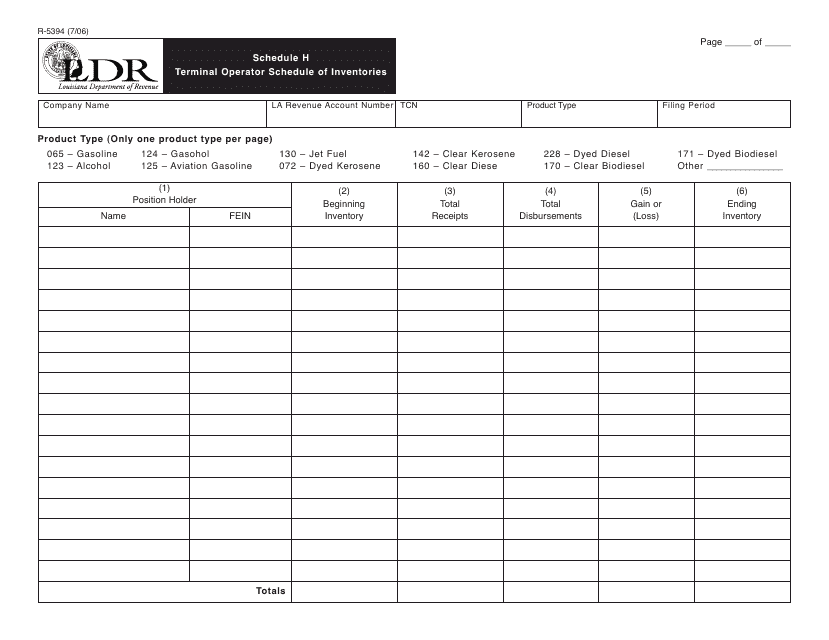

This Form is used for reporting inventories by terminal operators in Louisiana.

This form is used for reporting gifts made by a donor for tax purposes in the state of Louisiana.

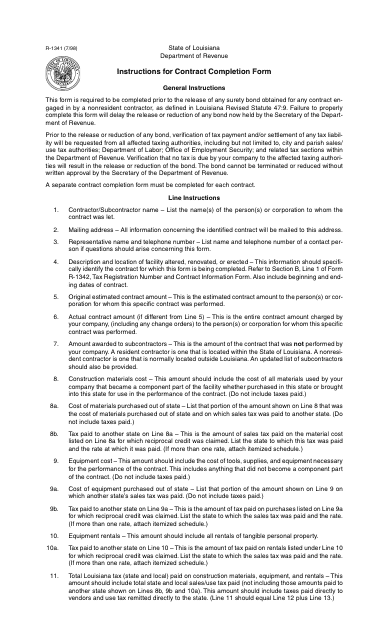

This Form is used for submitting the Contract Completion Form in the state of Louisiana. It provides instructions on how to fill out and submit the form.