Military Tax Exempt Form Templates

Military Tax Exempt Forms are used to provide tax exemptions or withholdings relief for military personnel and their spouses who may be stationed in a state where they are not considered residents for tax purposes. These forms allow military members and their spouses to be exempt from certain state taxes or reduce the amount of tax they owe, taking into account their unique circumstances and the challenges of military life.

Documents:

4

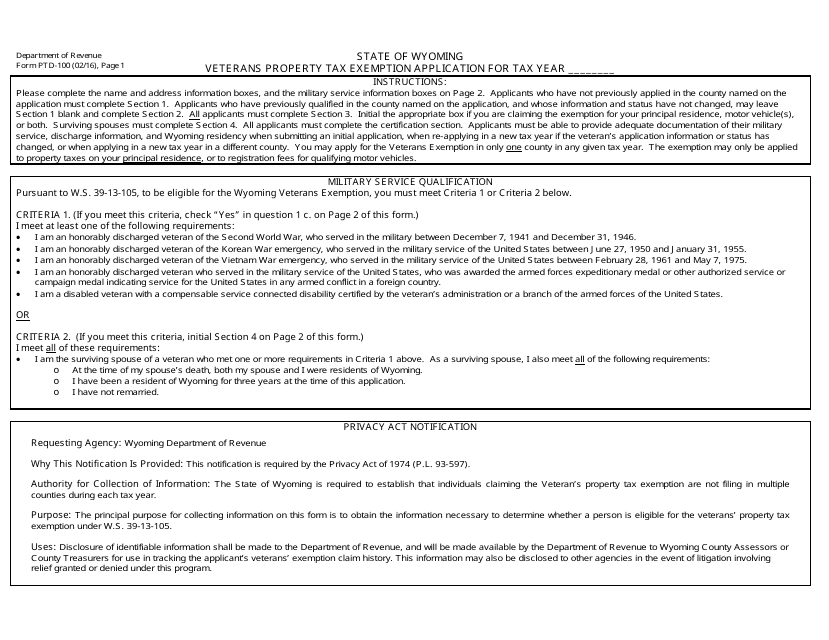

This Form is used for applying for the Veterans Property Tax Exemption in Wyoming.

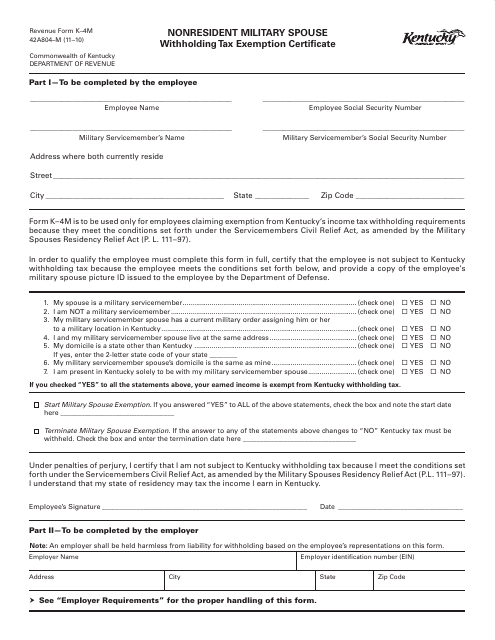

This form is used for nonresident military spouses to claim a withholding tax exemption in Kentucky.