Michigan Tax Forms and Templates

Michigan Tax Forms are used by individuals and businesses in the state of Michigan to fulfill their tax obligations. These forms are used to report income, calculate tax liability, claim deductions and credits, and request refunds. Michigan tax forms include individual income tax forms, corporate income tax forms, sales and use tax forms, withholding tax forms, and various other forms related to specific tax situations.

Documents:

252

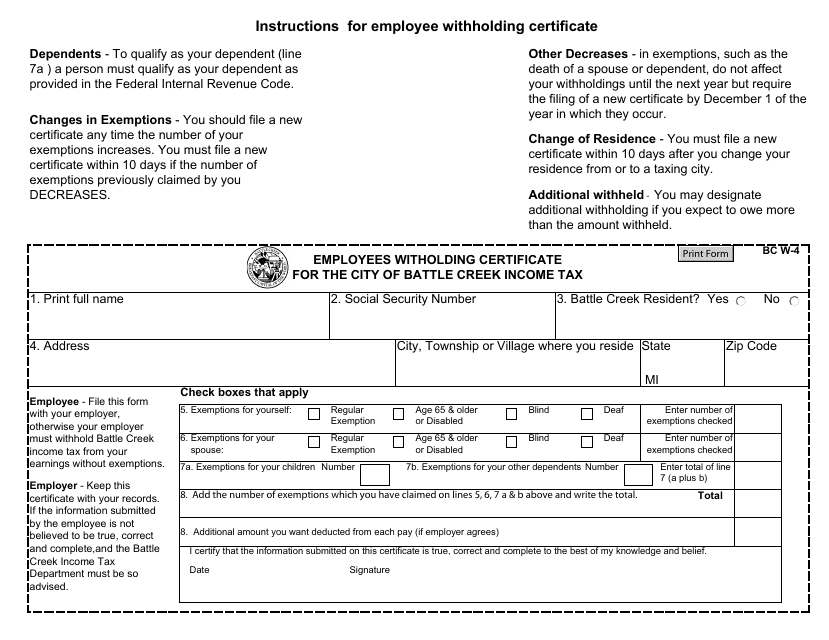

This form is used for employees in Battle Creek, Michigan to declare their withholding for the City of Battle Creek Income Tax.

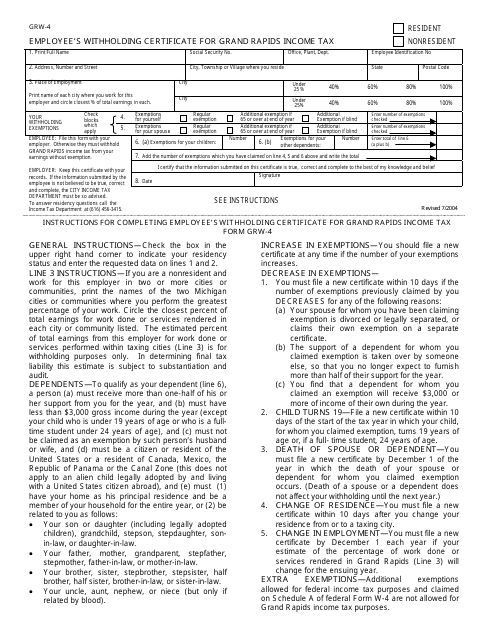

This form is used for employees in Grand Rapids, Michigan to declare their withholding certificate for Grand Rapids income tax.

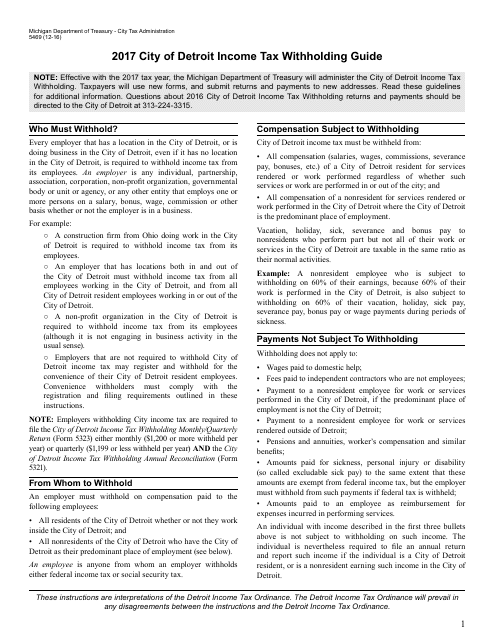

This Form is used for withholding income tax in the City of Detroit, Michigan. It provides instructions on how to correctly complete Form 5489 and comply with the city's tax regulations.

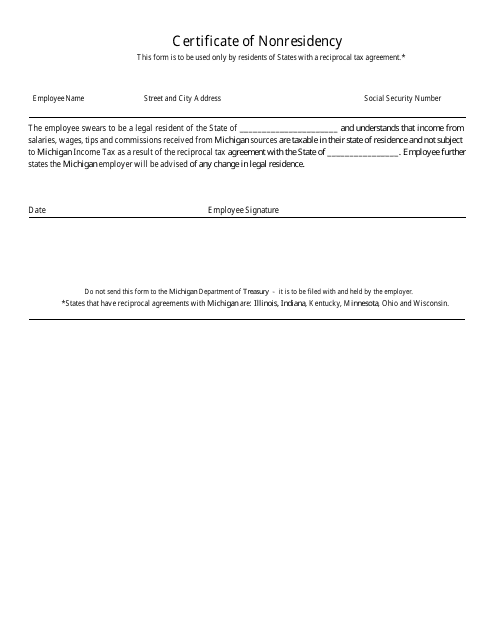

This document certifies that an individual does not reside in Michigan. It may be required for tax purposes or to show their nonresident status for certain benefits or privileges.

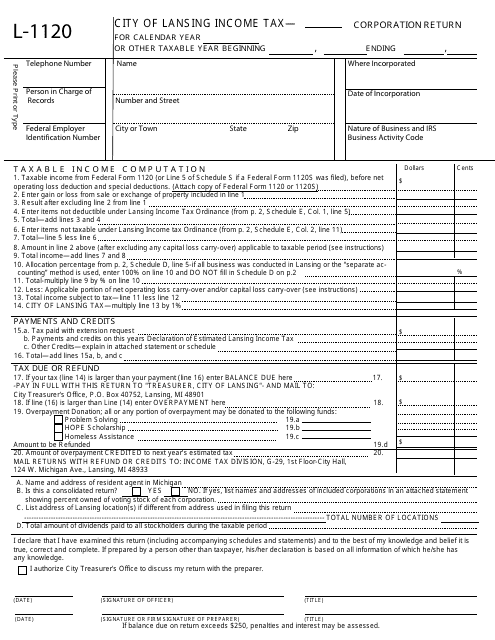

This form is used for filing the income tax corporation return specifically for businesses located in the City of Lansing, Michigan.

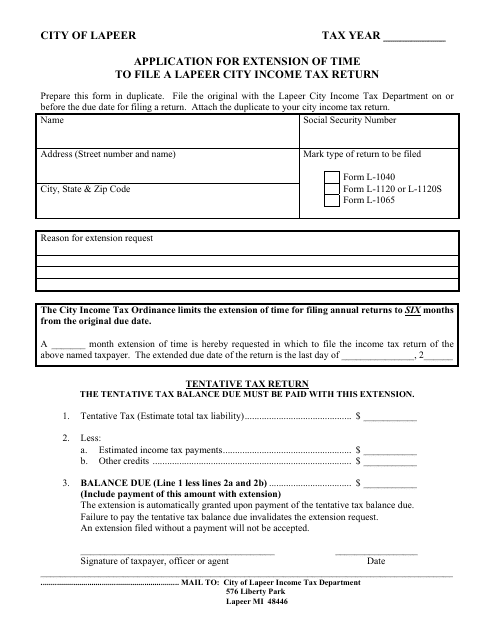

Application for Extension of Time to File a Lapeer City Income Tax Return - City of Lapeer, Michigan

This document is used for requesting an extension of time to file an income tax return for residents of Lapeer City, Michigan.

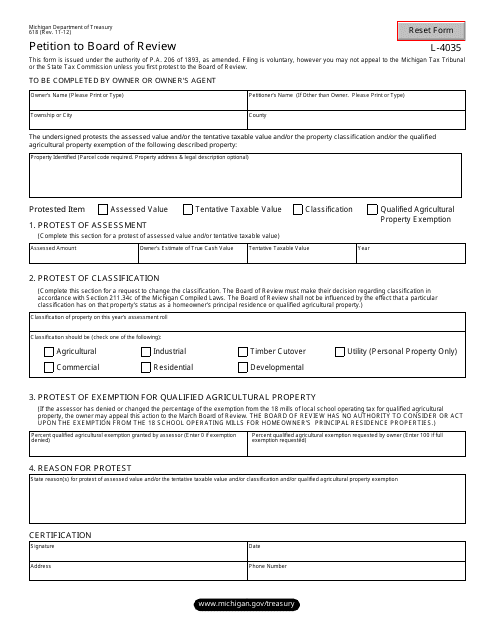

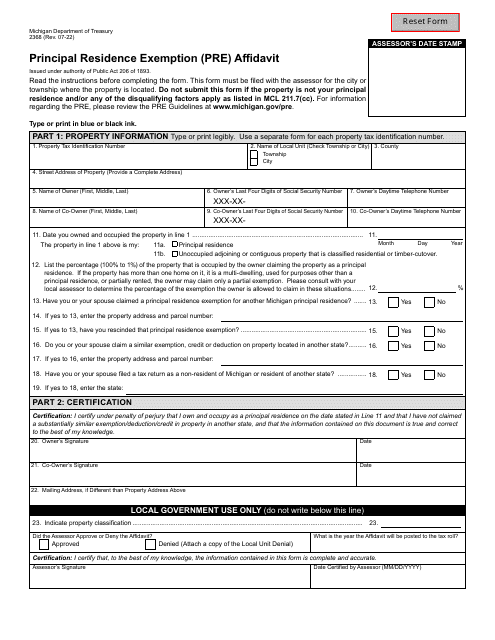

This form is used for filing a petition to the Board of Review in the state of Michigan.

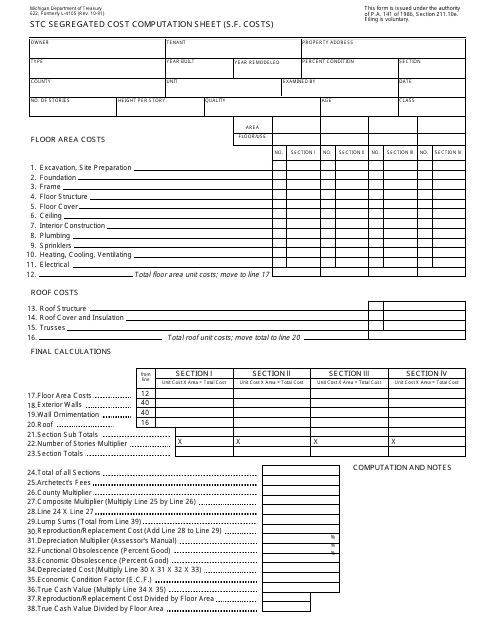

This document is used for calculating the segregated cost computation sheet for S.F. costs in the state of Michigan.

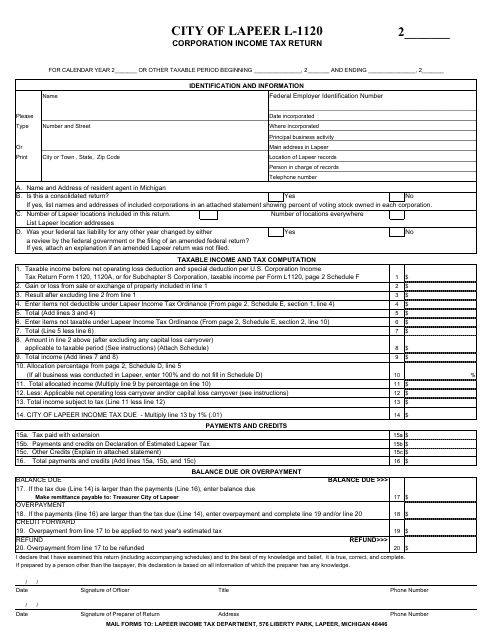

This form is used for filing corporation income tax return specifically for businesses located in the City of Lapeer, Michigan.

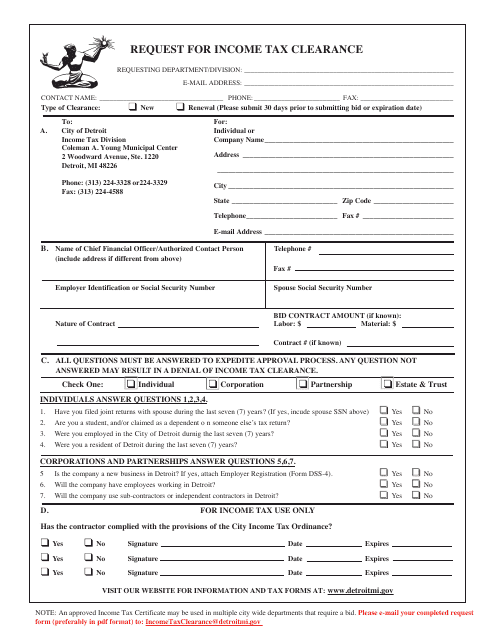

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

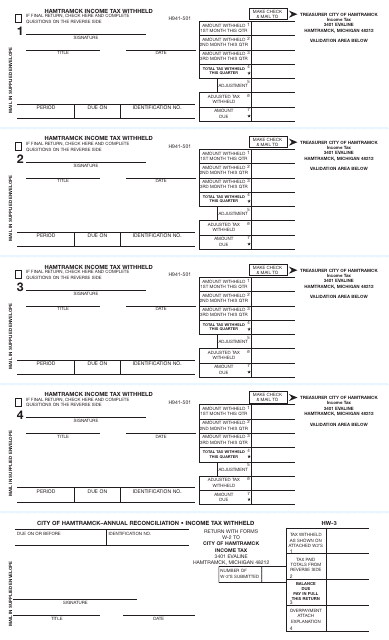

This Form is used for reporting income tax that has been withheld from wages in Hamtramck, Michigan.

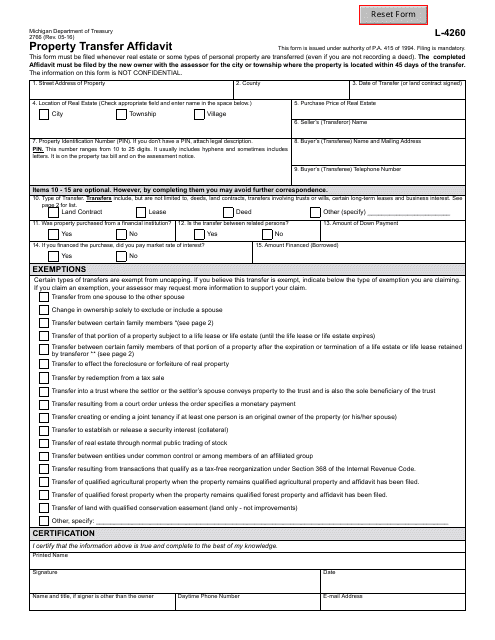

This form is used for reporting the transfer of property in the state of Michigan.

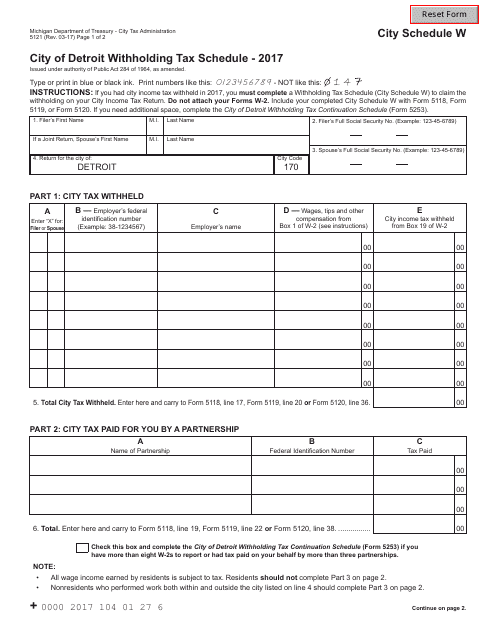

This form is used for reporting and calculating the withholding tax for City of Detroit residents in Michigan.

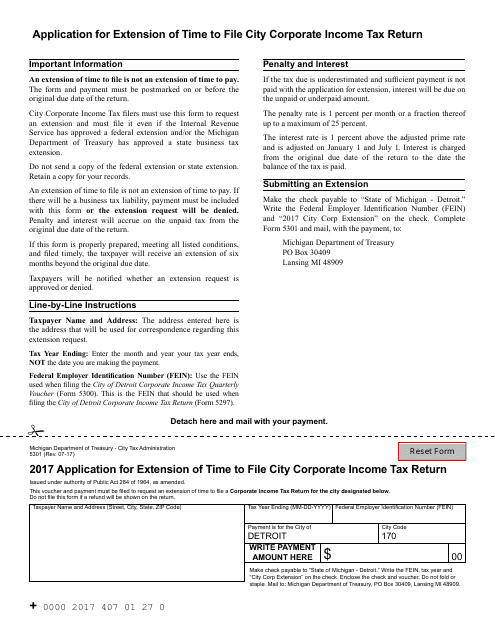

This document is for businesses in the City of Detroit, Michigan who need more time to file their city corporate income tax return.

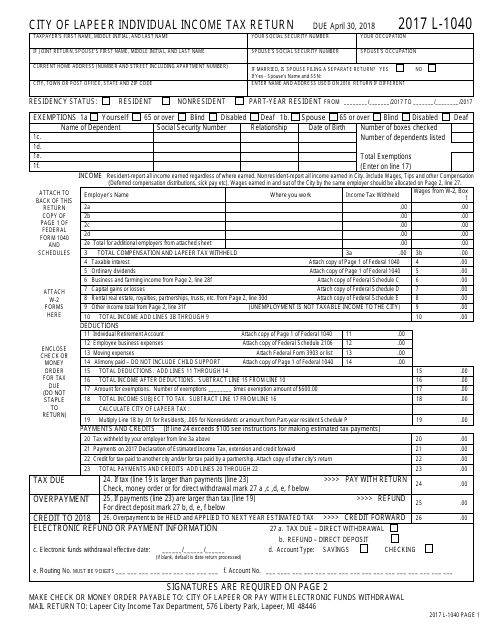

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

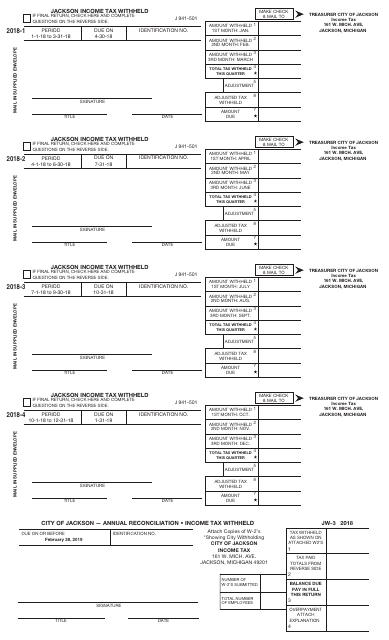

This form is used for reporting income tax withheld by employers in the City of Jackson, Michigan.

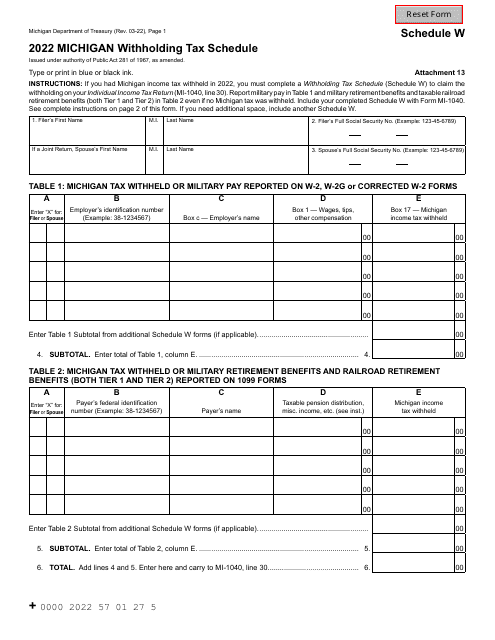

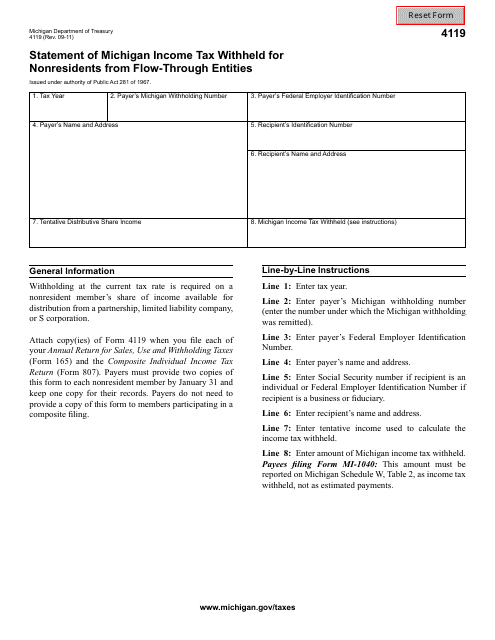

This Form is used for reporting income tax withheld from nonresidents in Michigan by flow-through entities.

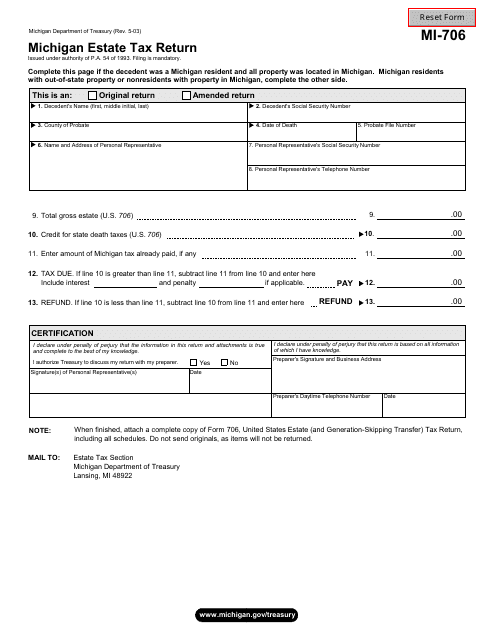

This form is used for filing the Michigan Estate Tax Return in the state of Michigan.

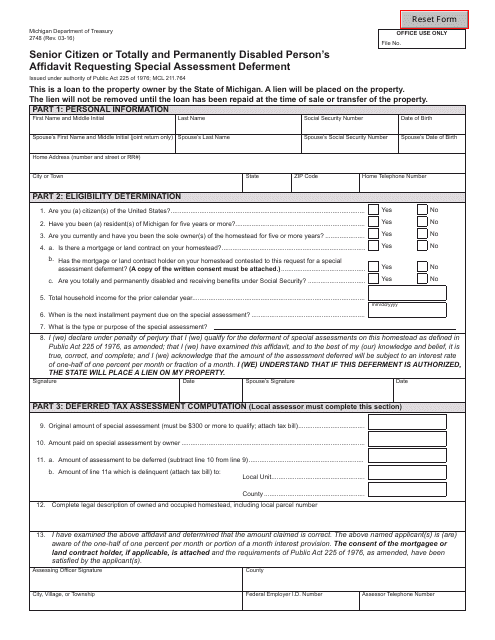

This form is used for senior citizens or individuals who are totally and permanently disabled to request special assessment deferment in the state of Michigan.

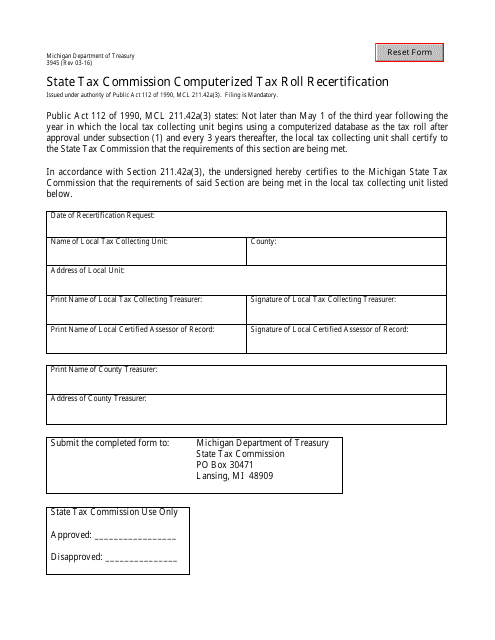

This document is used for recertifying the computerized tax roll with the State Tax Commission in Michigan.

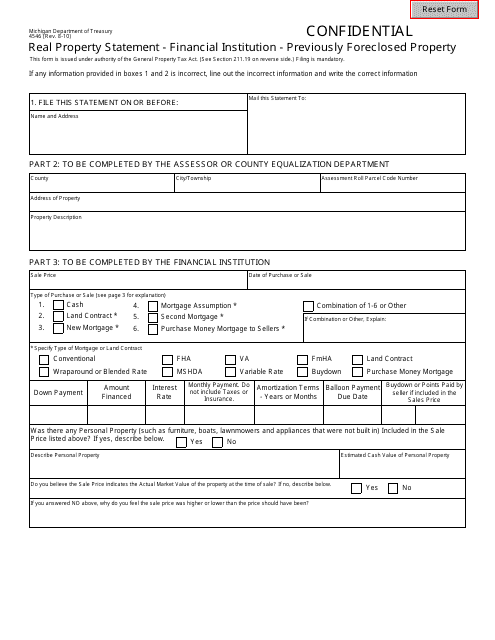

This document is used for reporting real property information to a financial institution in Michigan, specifically for properties that have been previously foreclosed.

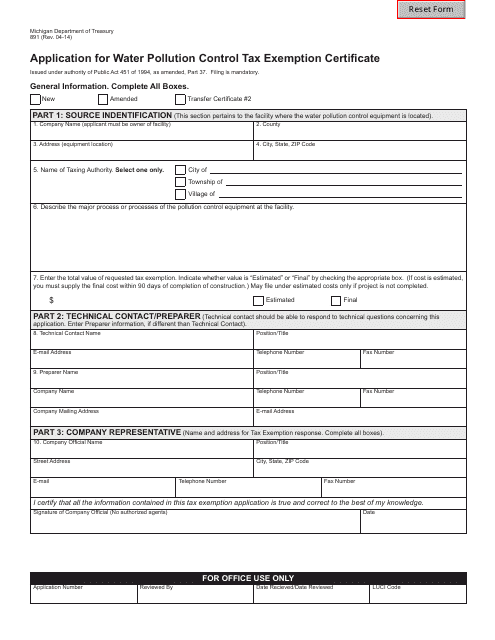

This form is used for applying for a tax exemption certificate for water pollution control in the state of Michigan.

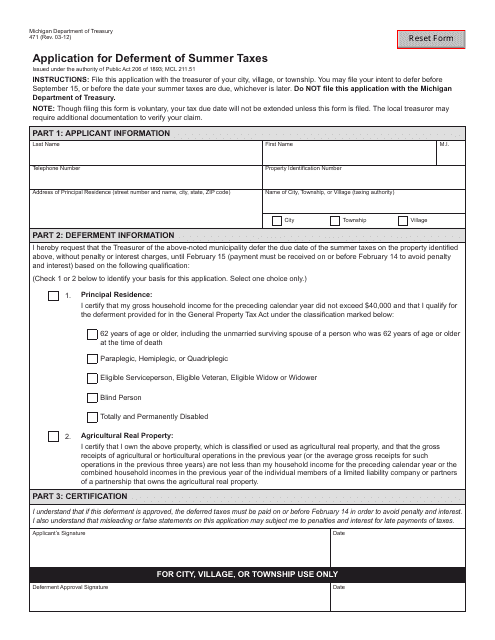

This form is used for applying to defer payment of summer taxes in the state of Michigan.

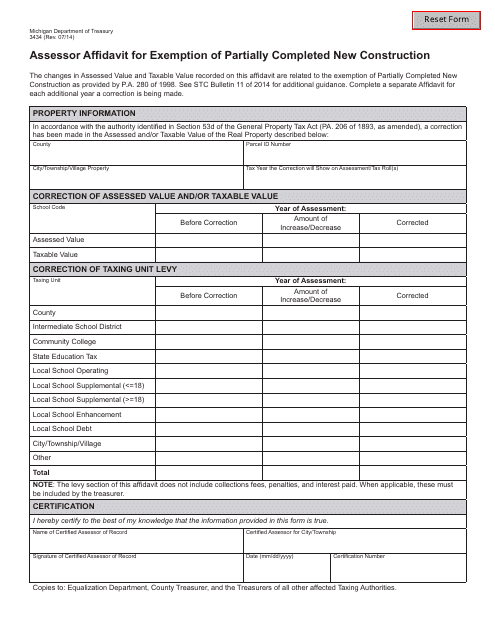

This form is used for filing an Assessor Affidavit for Exemption of Partially Completed New Construction in the state of Michigan. It allows individuals to claim an exemption for property taxes on new construction that is still in progress.

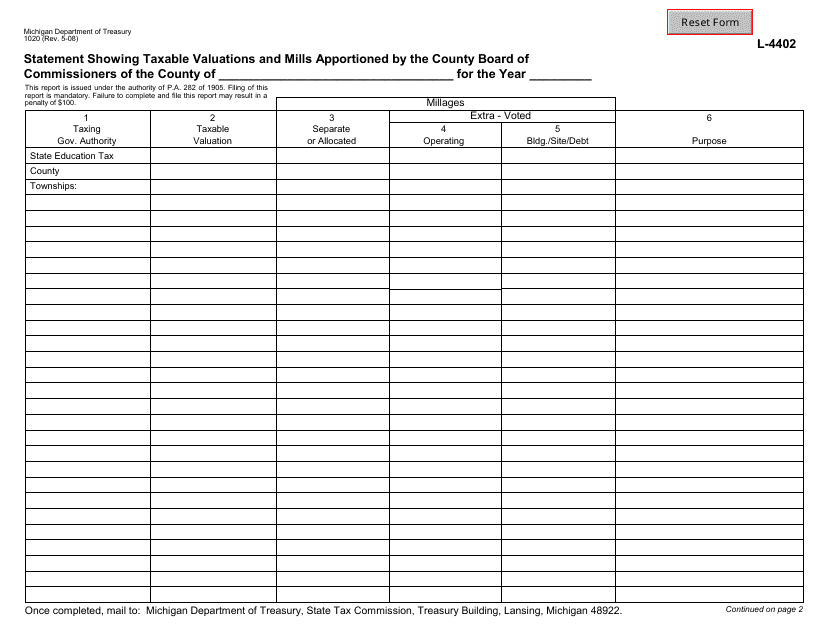

This form is used for showing the taxable valuations and mills apportioned by the County Board of Commissioners in Michigan.

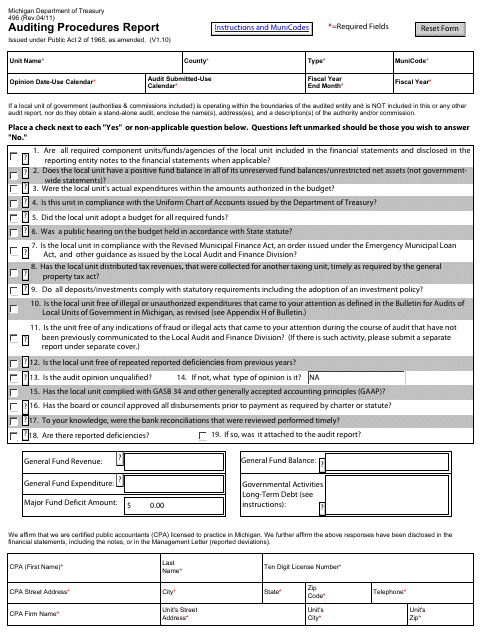

This form is used for submitting an Auditing Procedures Report in the state of Michigan.

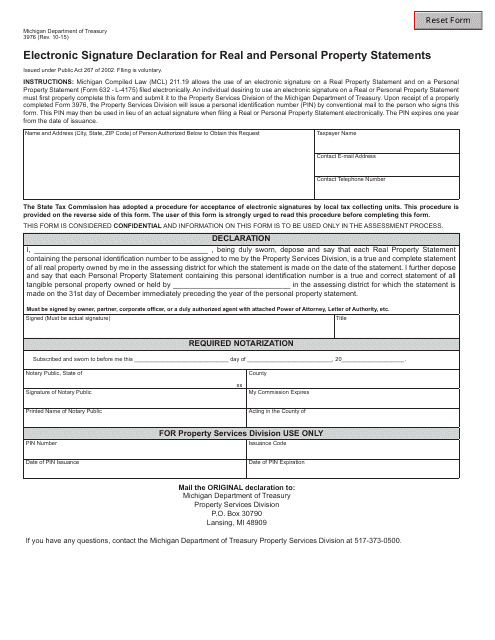

This form is used for declaring electronic signatures on real and personal property statements in the state of Michigan.

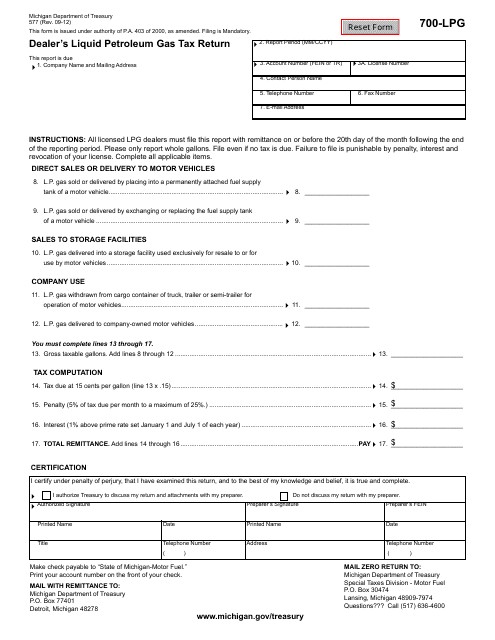

This form is used for dealers in Michigan to report and pay taxes on the sale of liquid petroleum gas.

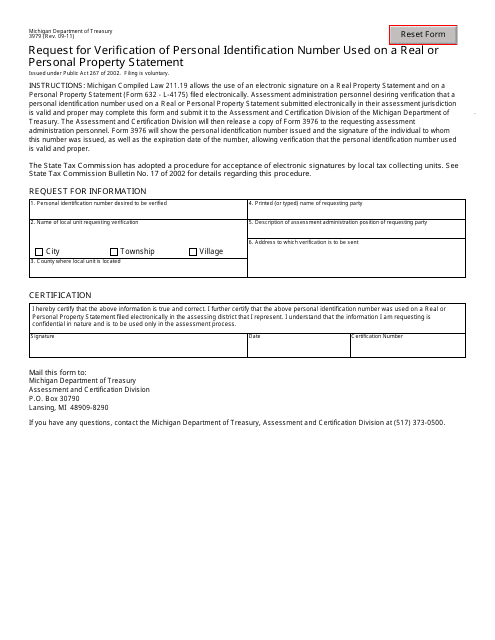

This Form is used for requesting verification of a Personal Identification Number used on a Real or Personal Property Statement in Michigan.

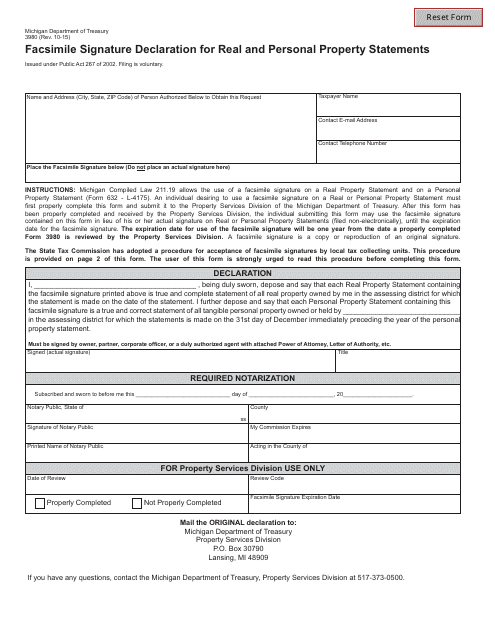

This form is used for declaring facsimile signatures on real and personal property statements in Michigan.

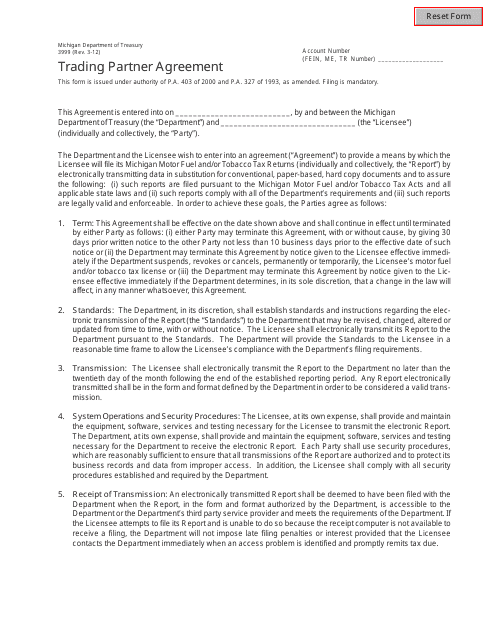

This document is for establishing a trading partner agreement in the state of Michigan.

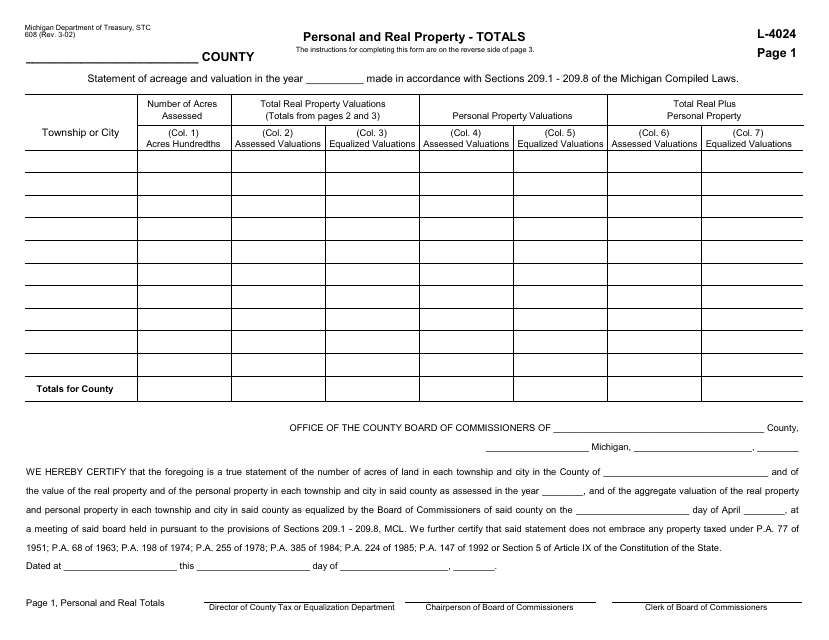

This form is used for reporting equalization in the state of Michigan. It is used to ensure fairness in property tax assessments.

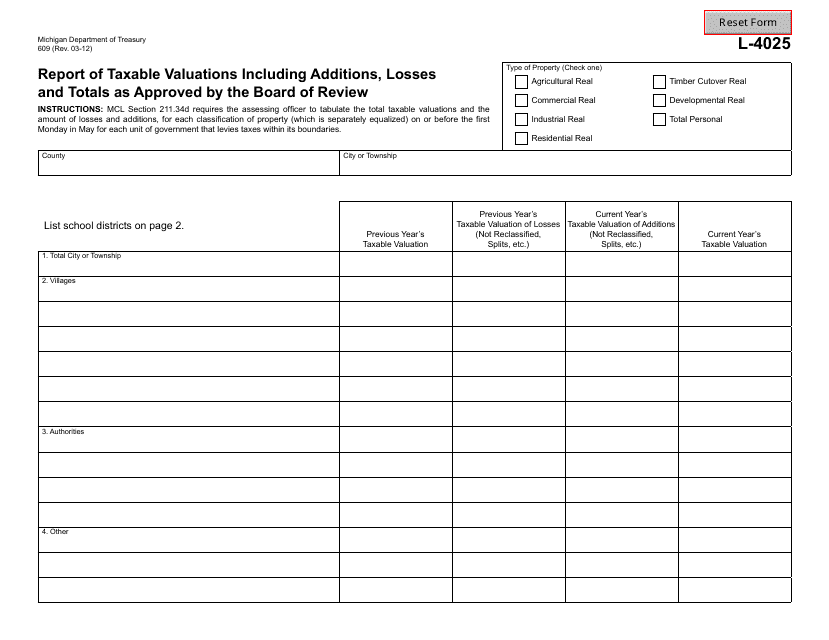

This form is used for reporting taxable valuations including additions, losses, and totals as approved by the Board of Review in Michigan. It helps to calculate the accurate tax amount based on the property values.