Missouri Tax Forms and Templates

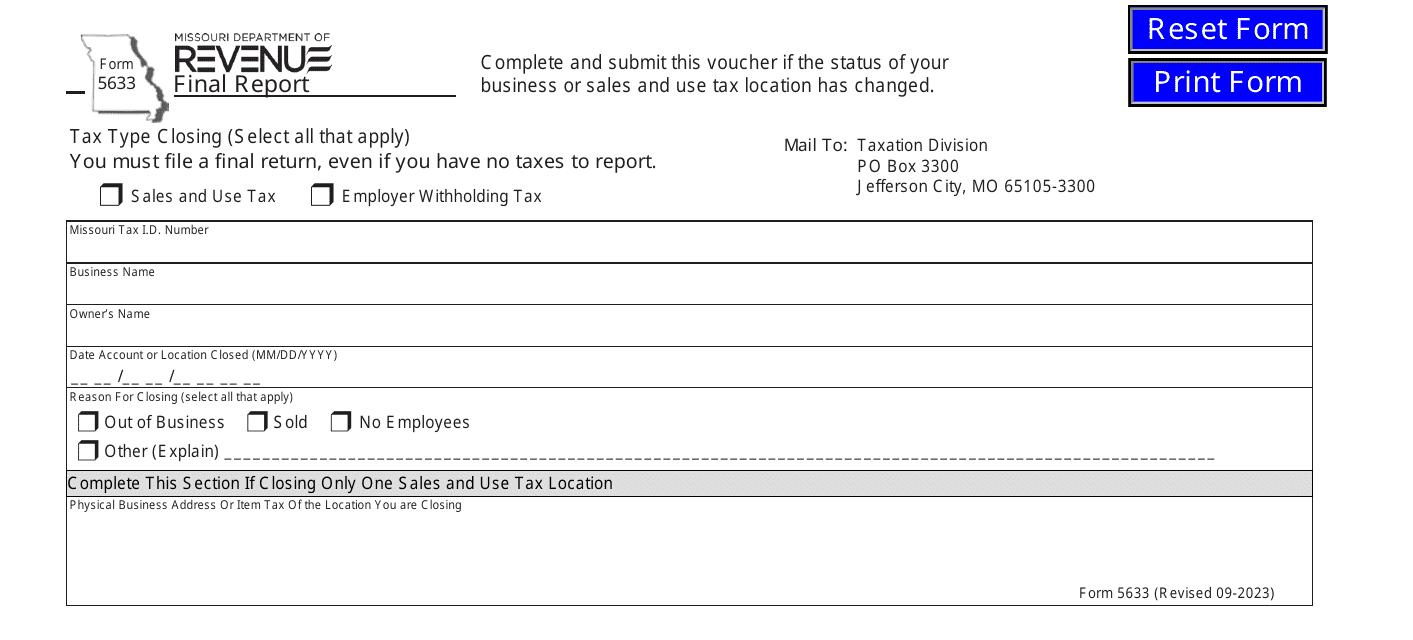

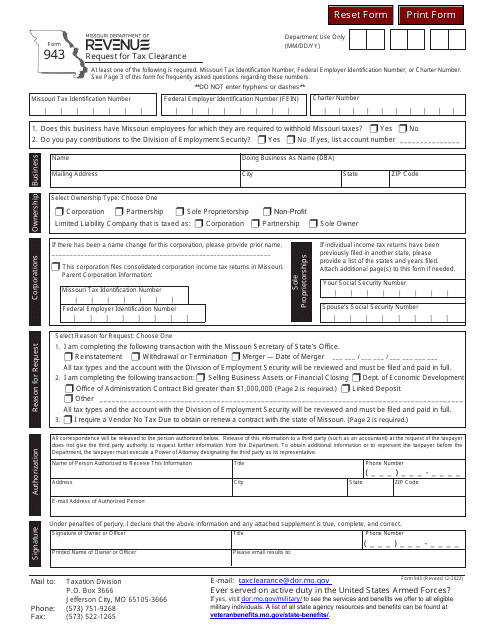

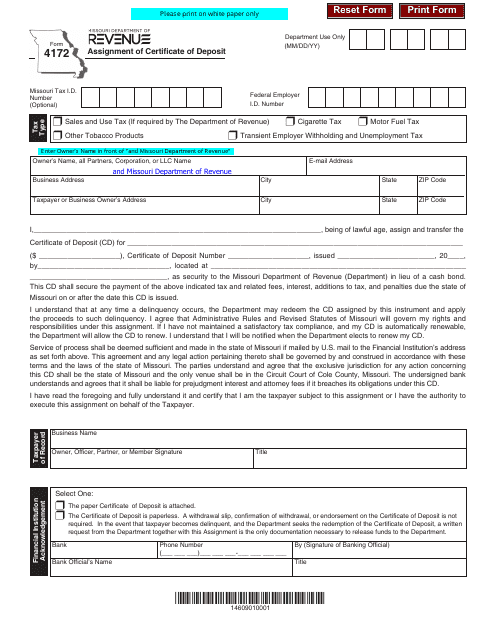

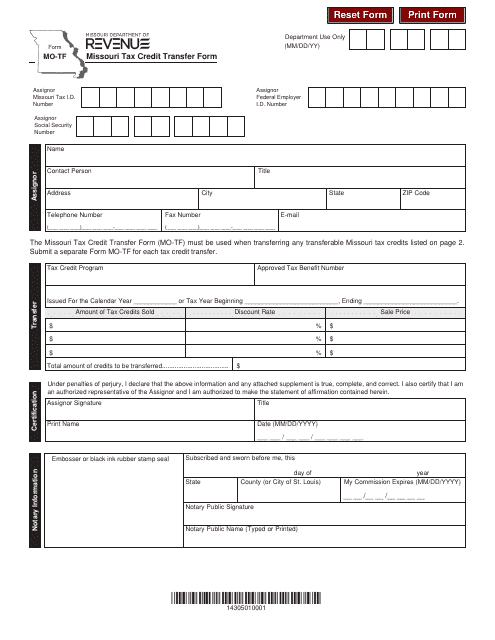

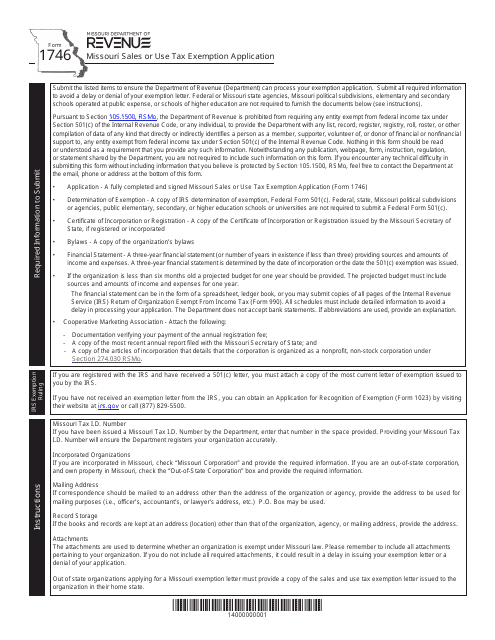

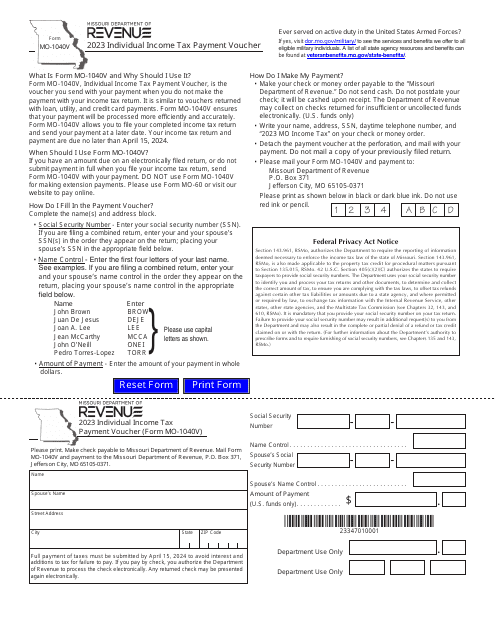

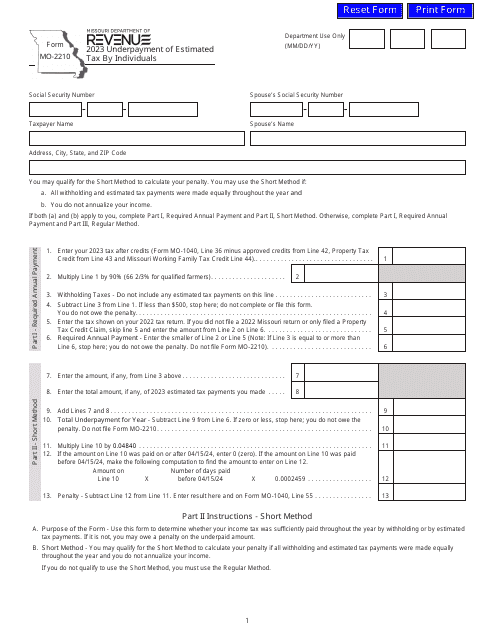

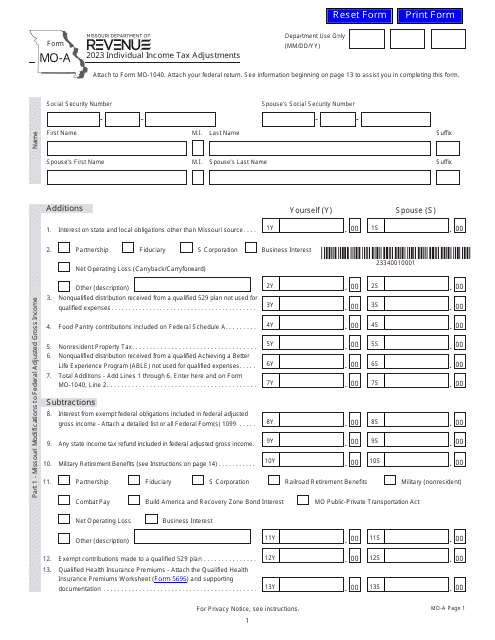

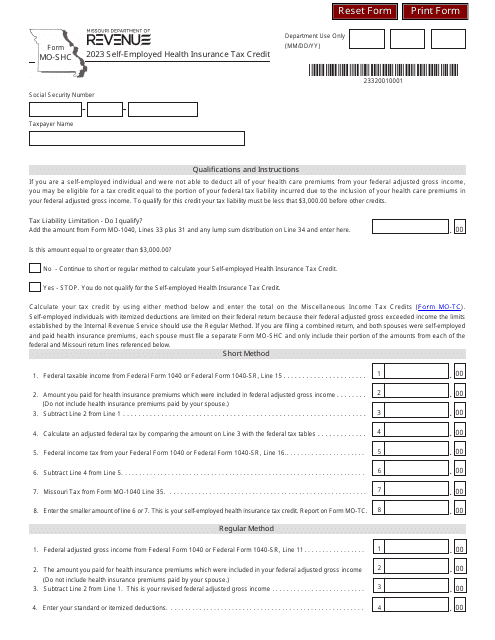

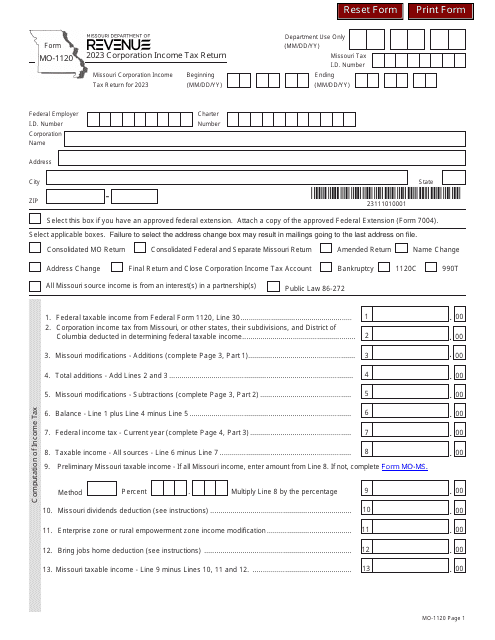

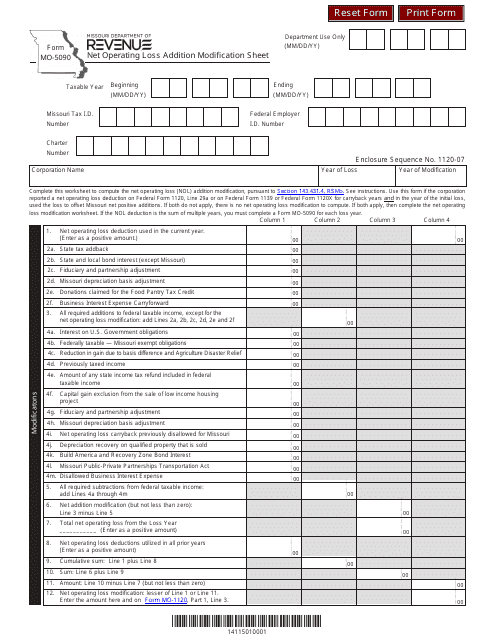

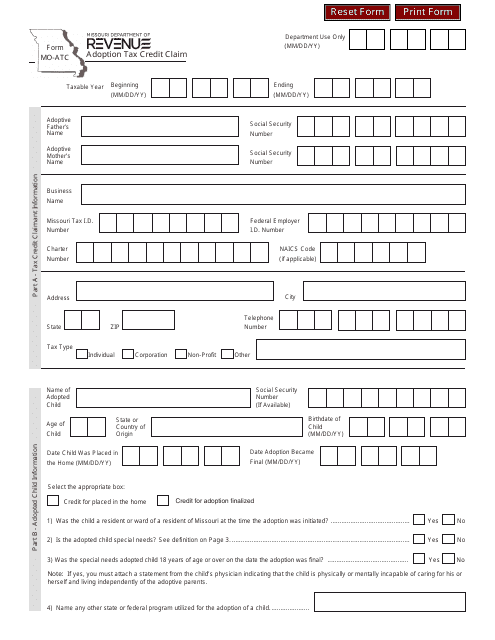

Missouri Tax Forms are used for reporting and filing state income taxes in the state of Missouri. These forms are used by individuals and businesses to report their income, calculate their tax liability, and claim any deductions or credits they may be eligible for. The forms ensure that taxpayers comply with the state's tax laws and enable the efficient collection of tax revenue.

Documents:

33

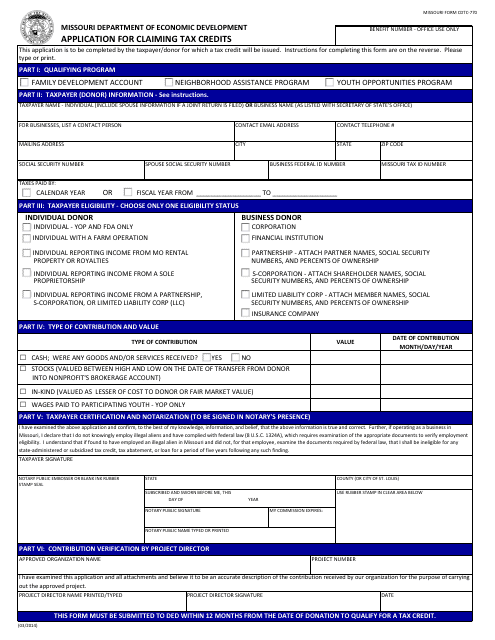

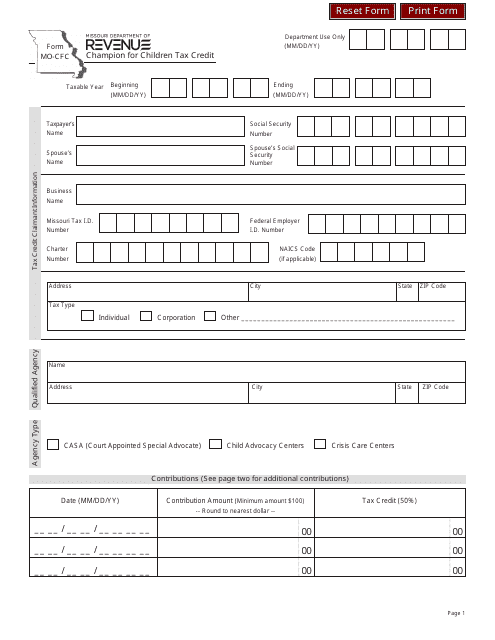

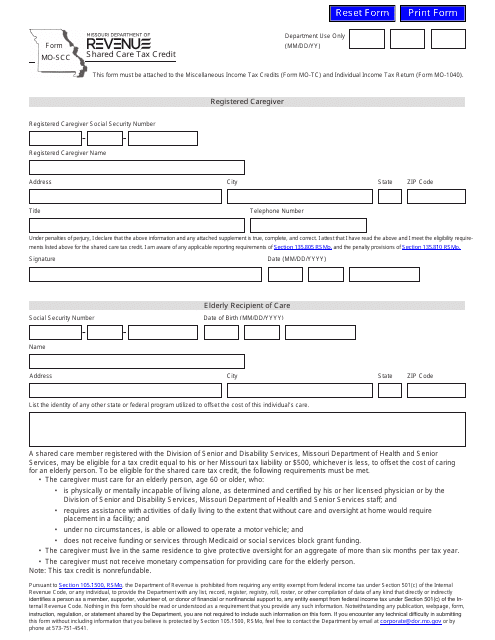

This Form is used for applying for tax credits in the state of Missouri.

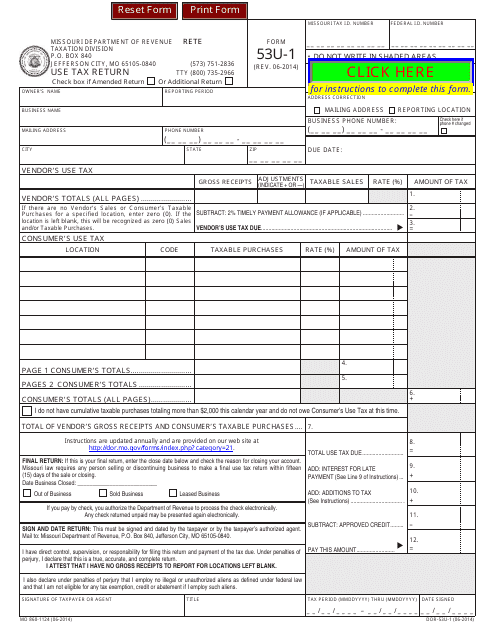

This Form is used for reporting and paying use tax in the state of Missouri. Use tax is owed on taxable items that were purchased tax-free and used in Missouri. The Form 53U-1 is used to calculate the use tax owed and submit it to the Missouri Department of Revenue.

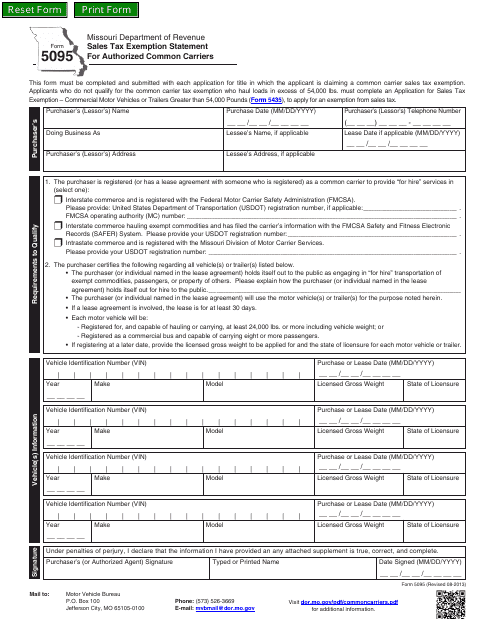

This form is used for authorized common carriers in Missouri to claim exemption from sales tax.

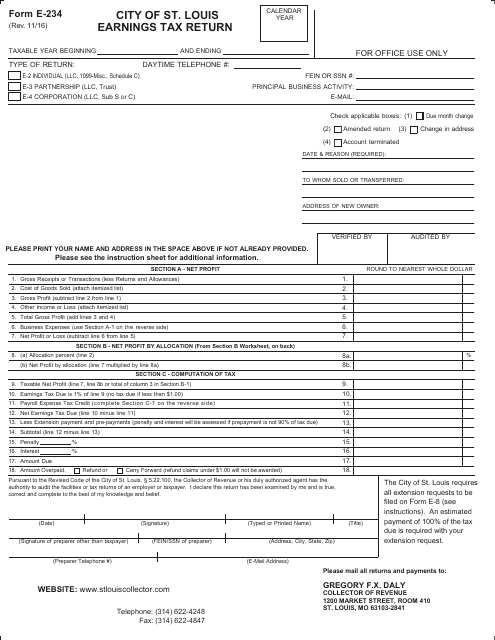

This form is used for filing the City of St. Louis earnings tax return in Missouri.

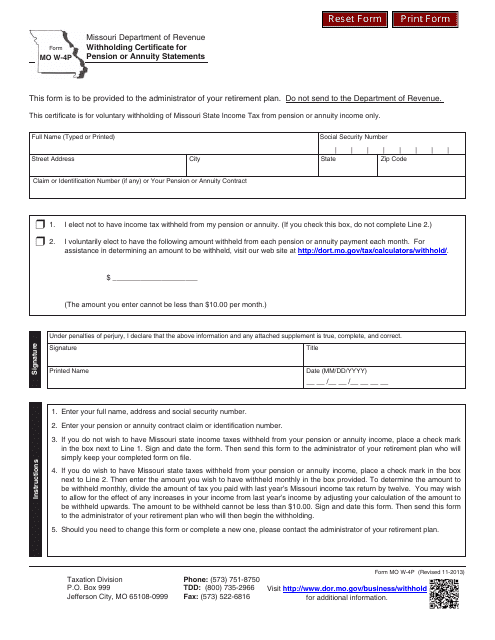

This form is used for pension or annuity statements in Missouri to determine the amount of withholding tax to be deducted from payments.

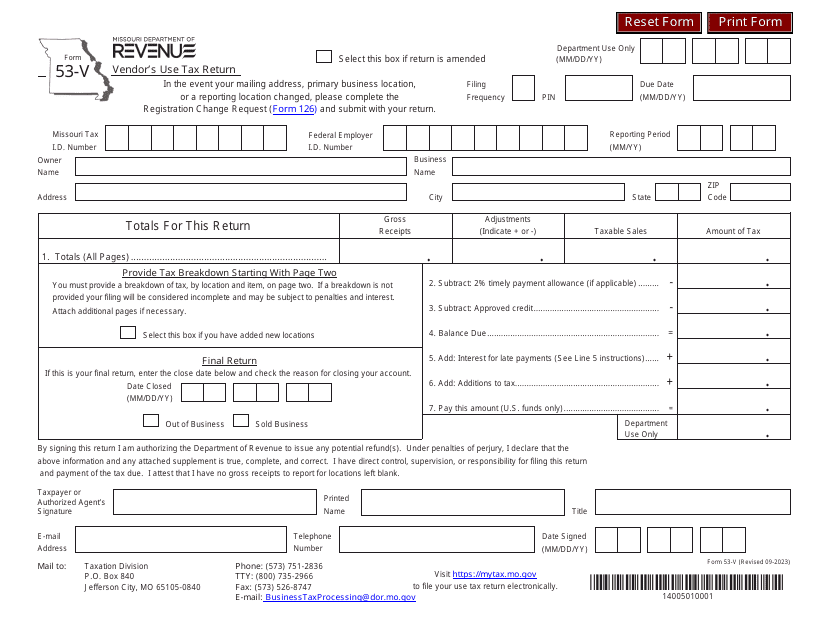

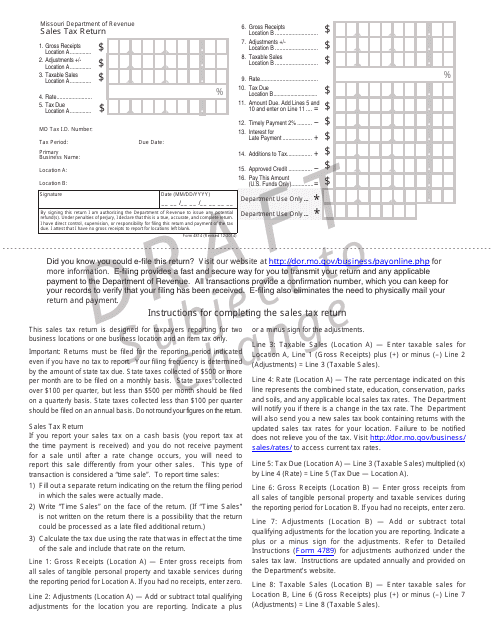

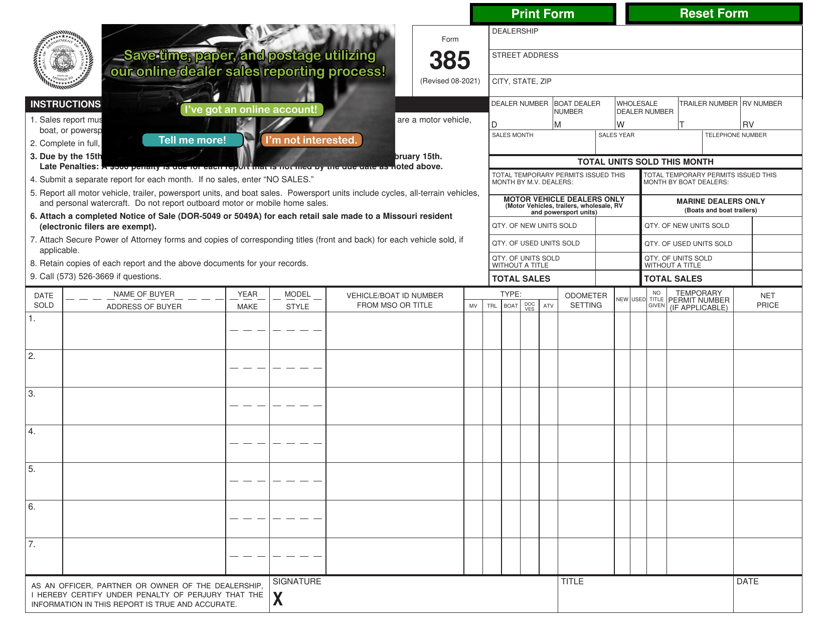

This Form is used for filing sales tax return in the state of Missouri.

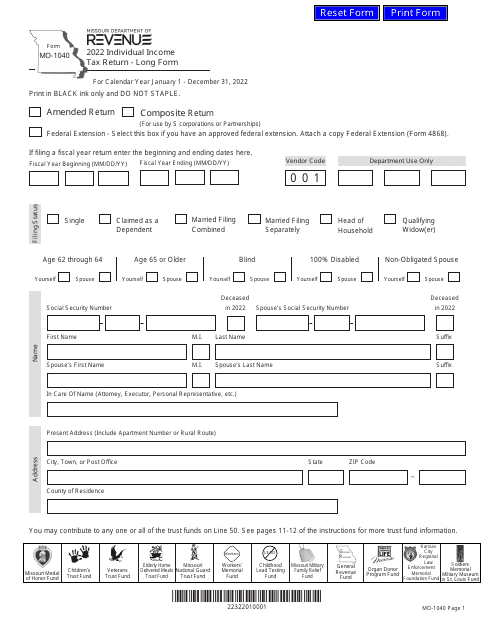

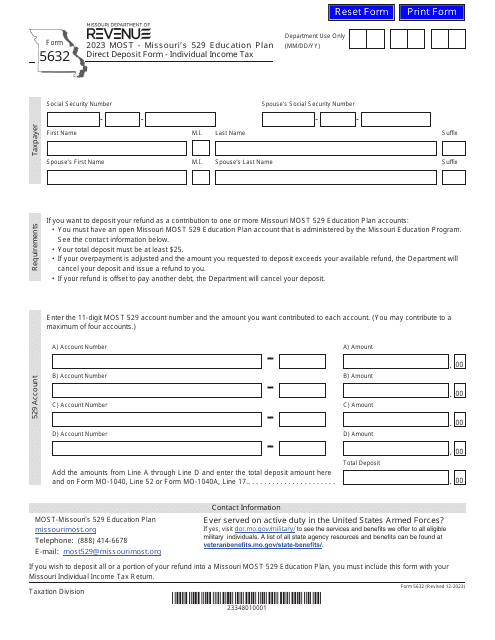

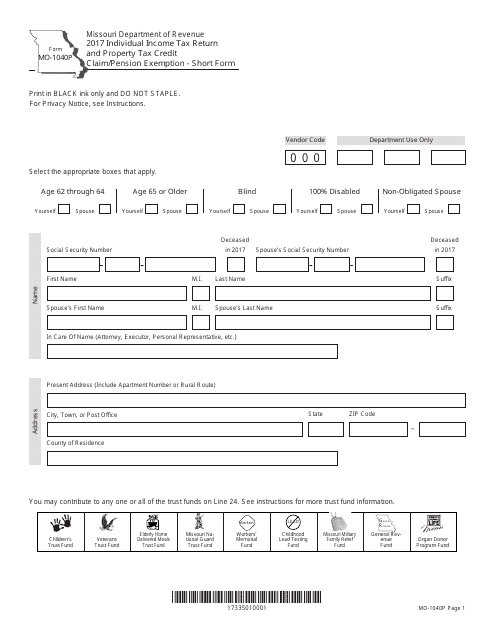

This form is used for filing individual income tax returns, claiming property tax credit, and pension exemption in the state of Missouri.

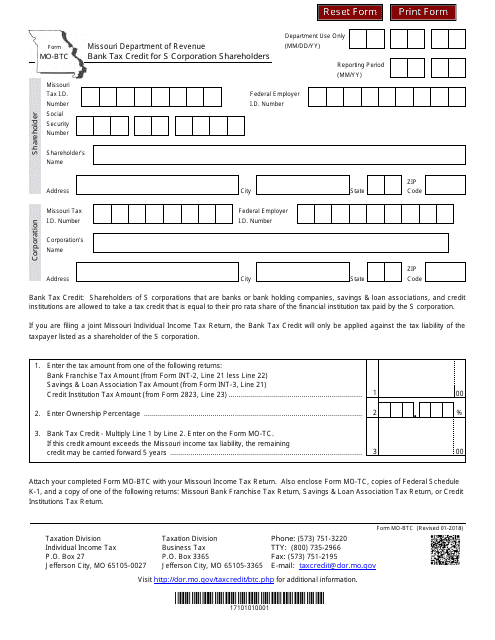

This form is used for claiming bank tax credit for S corporation shareholders in Missouri.