Fill and Sign Alabama Legal Forms

Documents:

2822

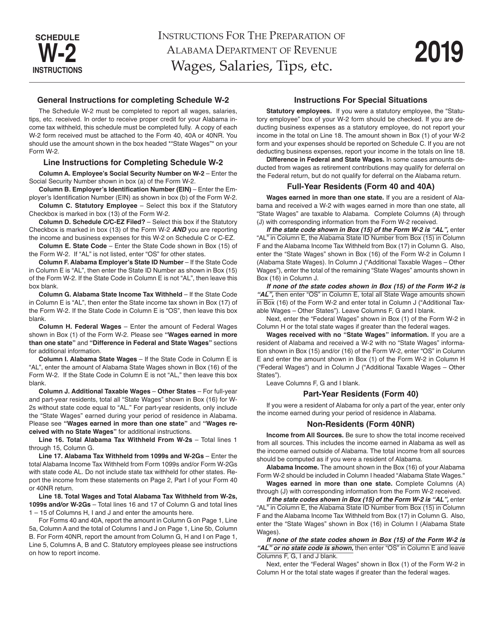

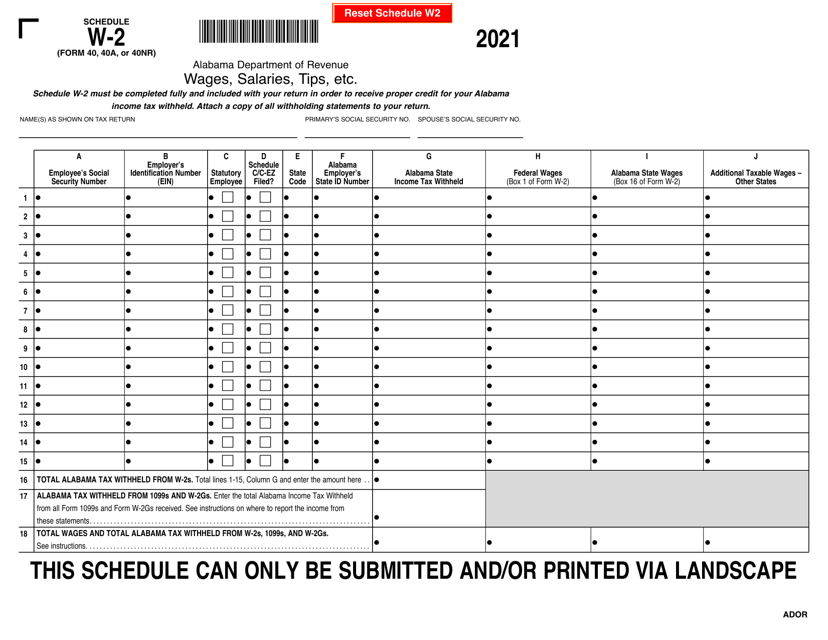

This document provides instructions for reporting wages, salaries, tips, and other income on Schedule W-2 for residents of Alabama.

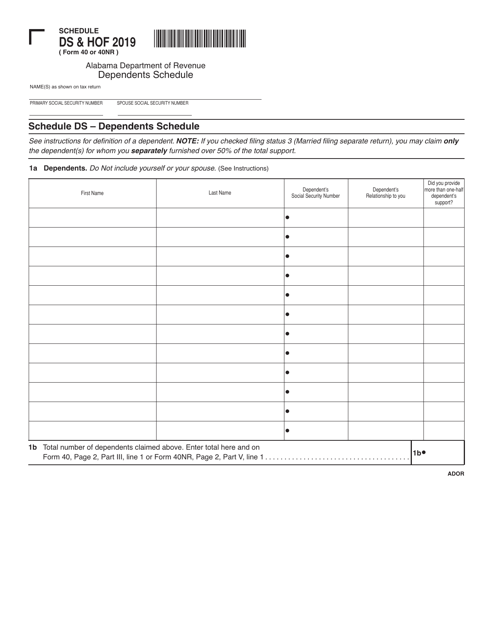

This document is used for reporting dependents and the head of the family for tax purposes in Alabama.

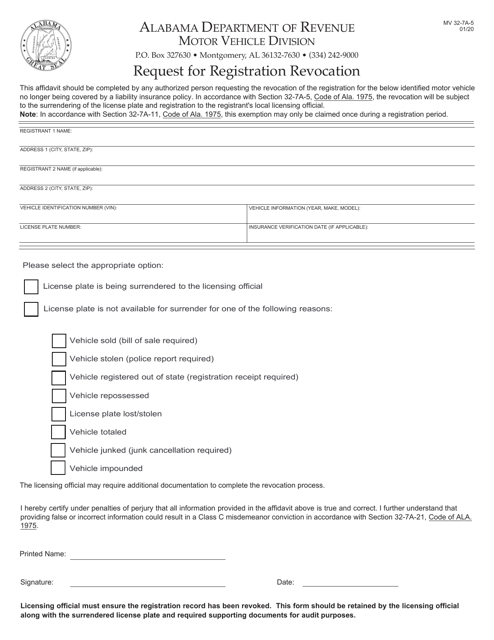

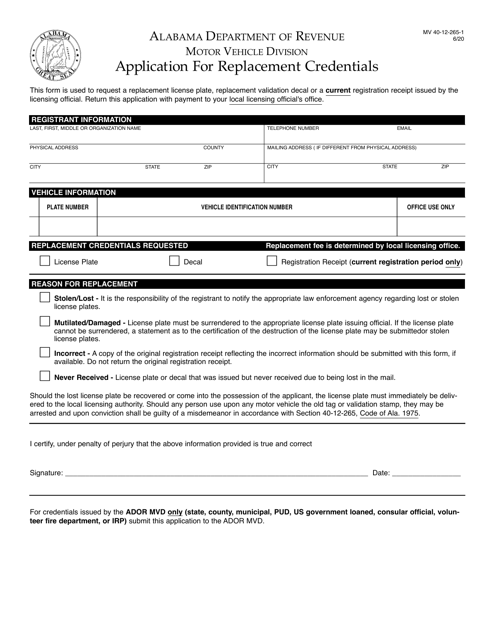

This form is used for requesting the revocation of vehicle registration in the state of Alabama.

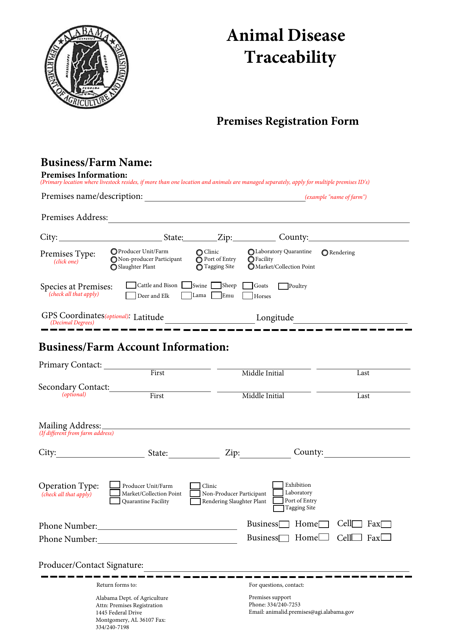

This Form is used for registering premises related to animal disease traceability in Alabama.

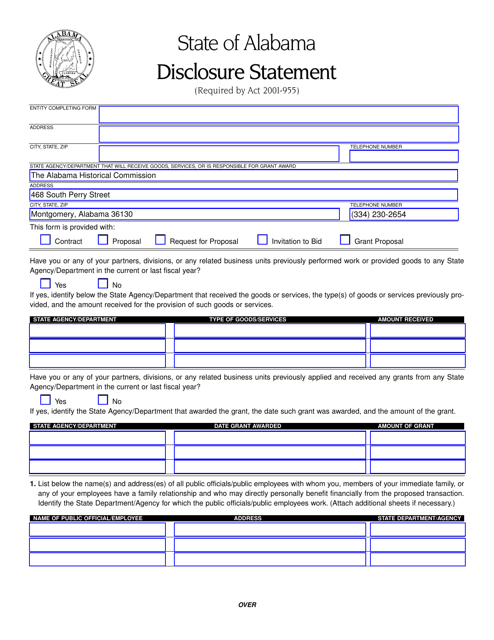

This document is used for disclosing vendors in the state of Alabama. It provides information about vendors and their business relationships in the state.

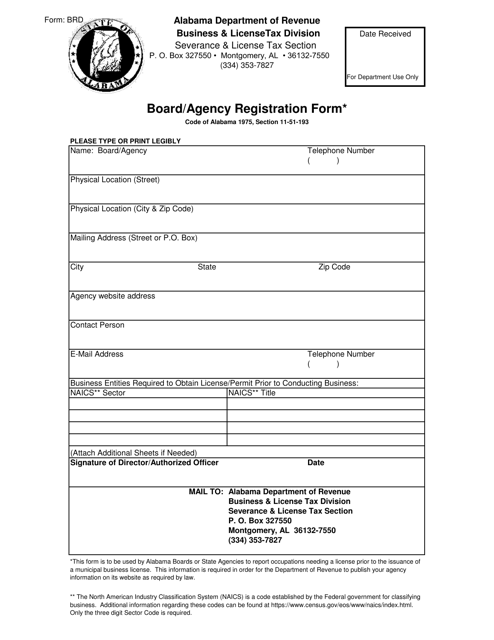

This form is used for registering boards or agencies in the state of Alabama. It is necessary to provide information about the board or agency to complete the registration process.

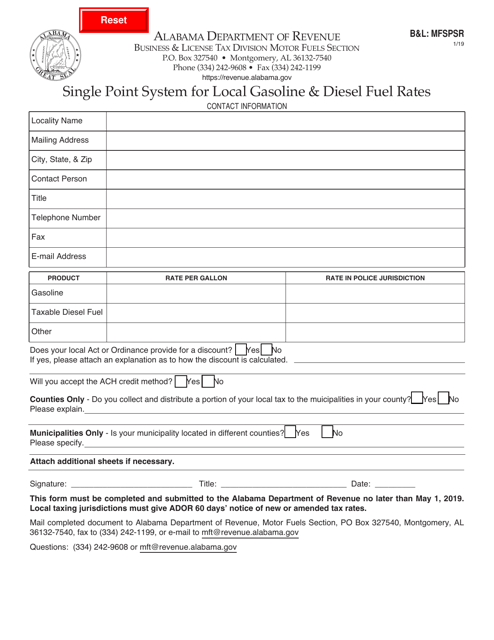

This Form is used for the MFSPSR Single Point System for Local Gasoline & Diesel Fuel Rates in Alabama.

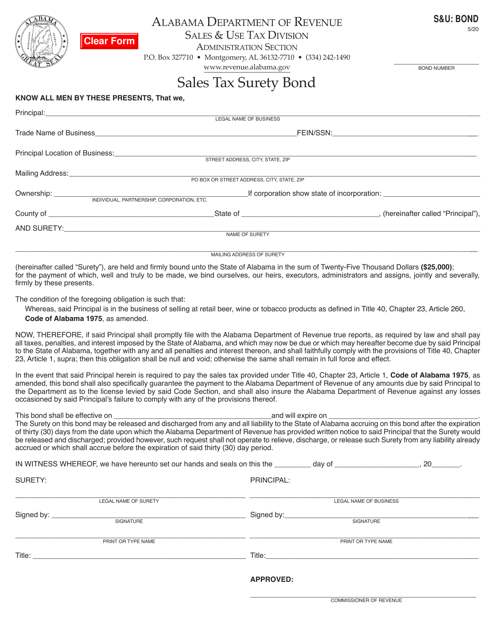

This form is used for obtaining a sales tax surety bond in Alabama.

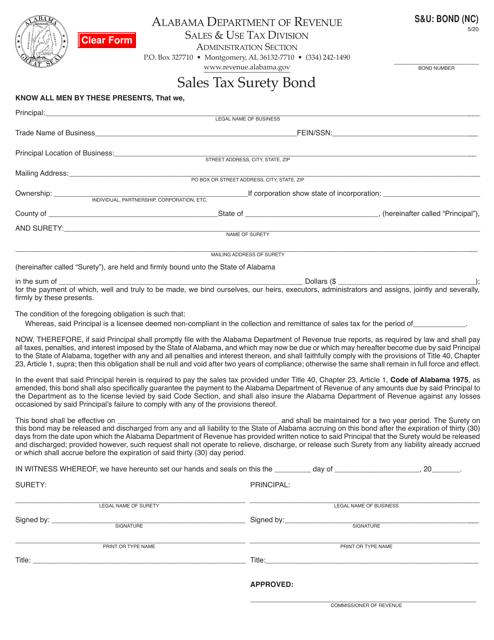

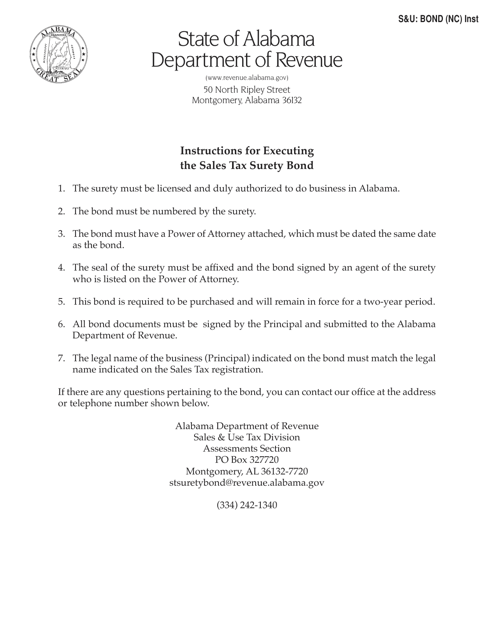

This form is used for obtaining a Sales Tax Surety Bond for non-compliant taxpayers in Alabama.

This Form is used for obtaining a Sales Tax Surety Bond for non-compliant taxpayers in Alabama. The bond is required to ensure payment of sales tax liabilities by businesses.

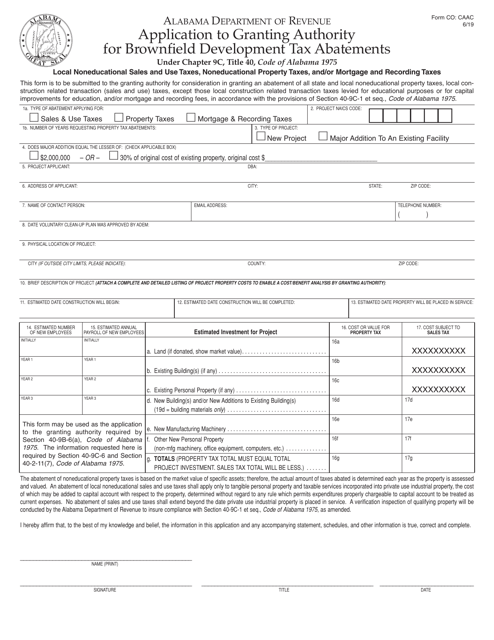

This Form is used for applying for authority to grant Brownfield Development Tax Abatements in Alabama.

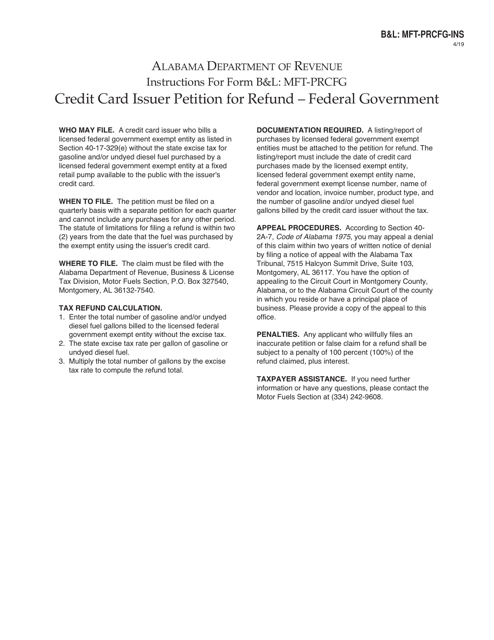

This Form is used for Credit Card Issuers in Alabama to petition the Federal Government for a refund.

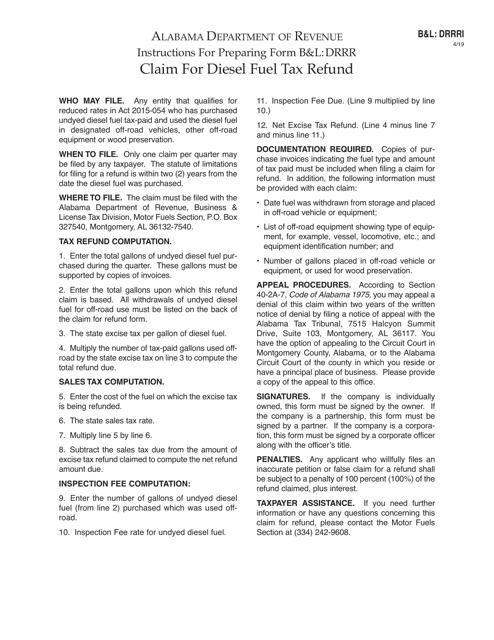

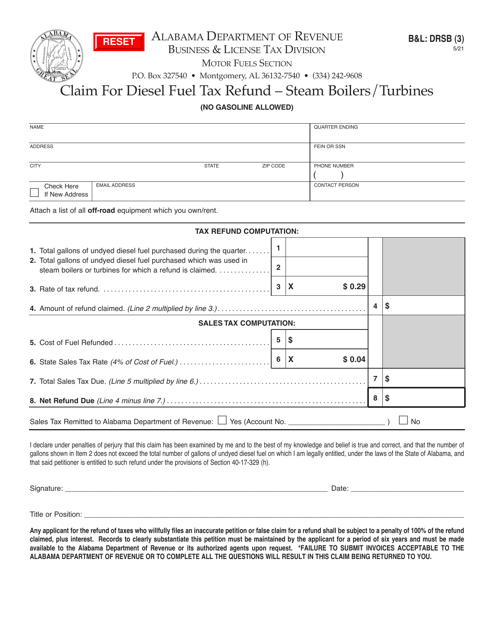

This Form is used for claiming a refund of diesel fuel tax in the state of Alabama. Follow the instructions to file your claim accurately.

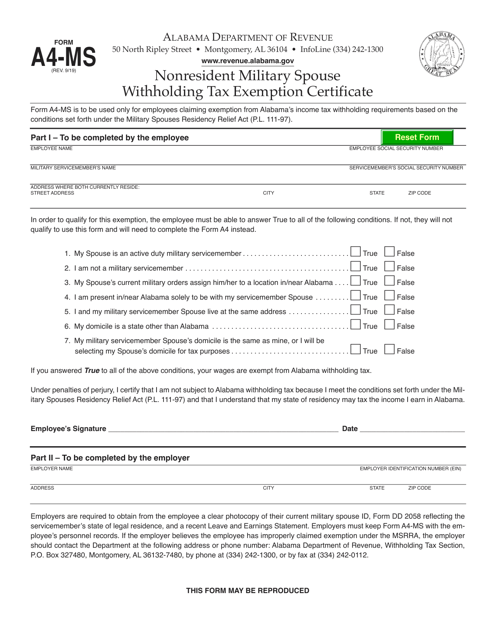

This form is used for nonresident military spouses in Alabama to claim a withholding tax exemption.

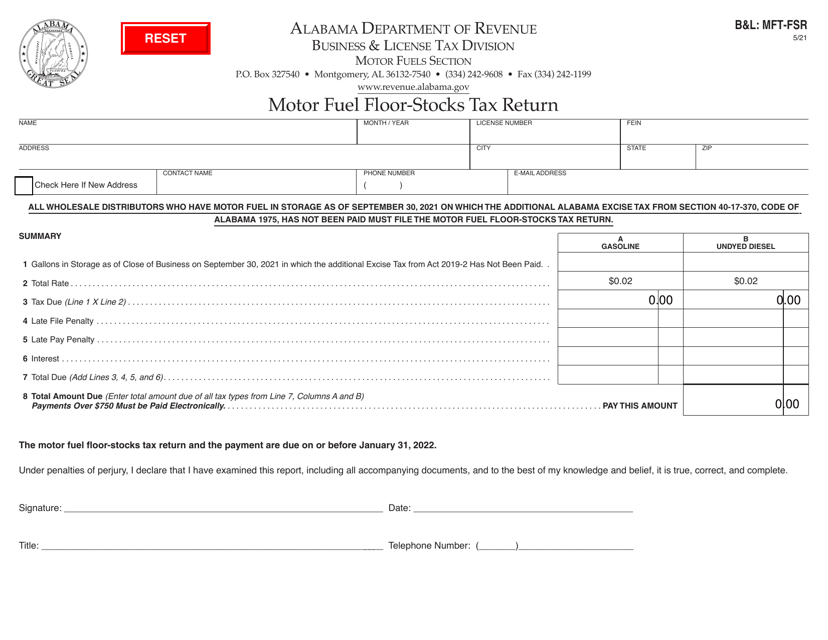

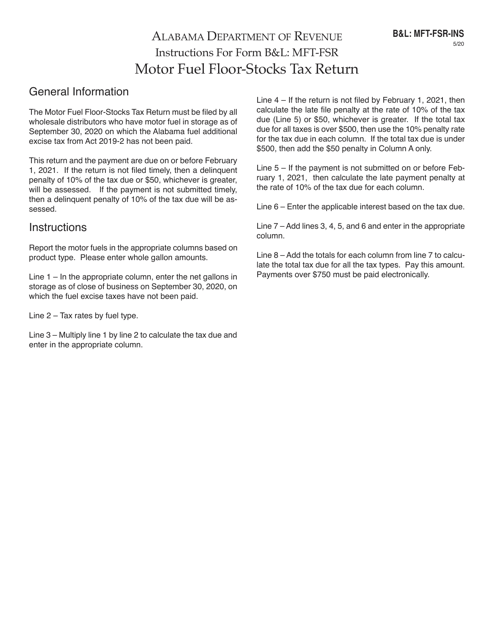

This Form is used for filing the Motor Fuel Floor-Stocks Tax Return in Alabama. It provides instructions on how to complete and submit the form.

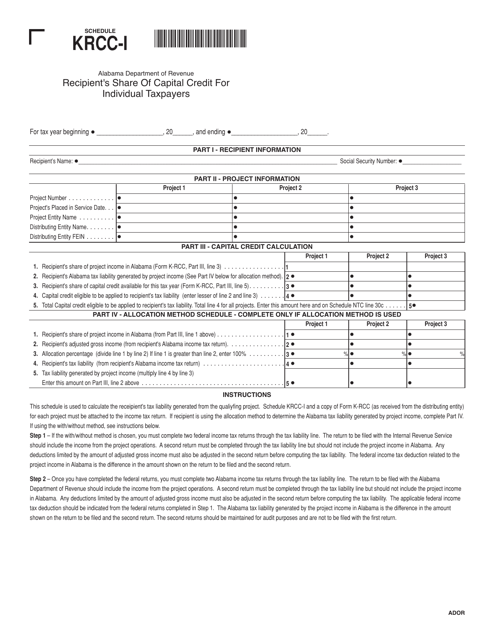

This form is used for individual taxpayers in Alabama to schedule their KRCC-I recipient's share of capital credit.

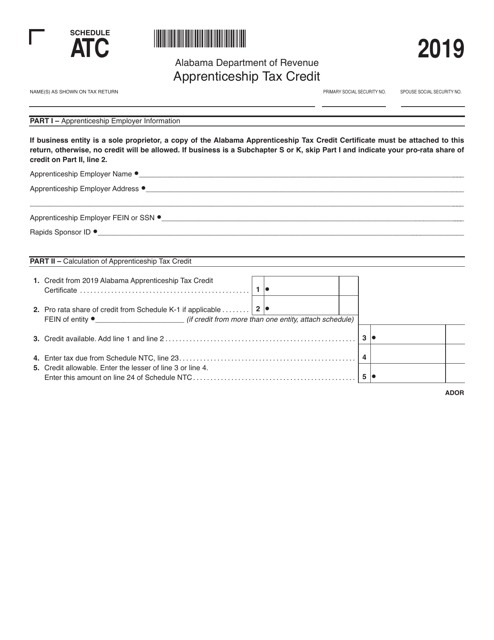

This document is a schedule for claiming the ATC Apprenticeship Tax Credit specific to the state of Alabama. It provides information on how to calculate and claim tax credits related to apprenticeship programs.

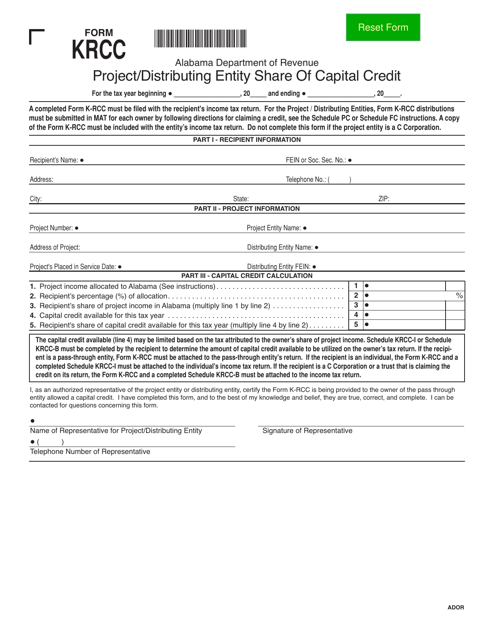

This Form is used for reporting the distributing entity's share of capital credit for the KRCC (Kemper River Coal Cooperative) project in Alabama.

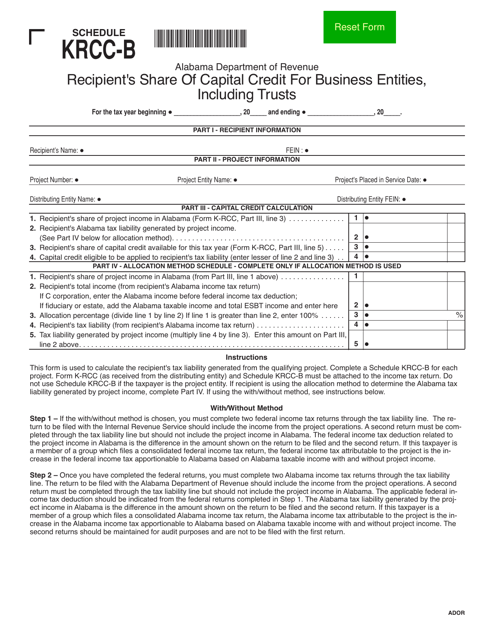

This form is used for reporting and distributing the recipient's share of capital credits for business entities, including trusts, in Alabama.