Fill and Sign Alabama Legal Forms

Documents:

2822

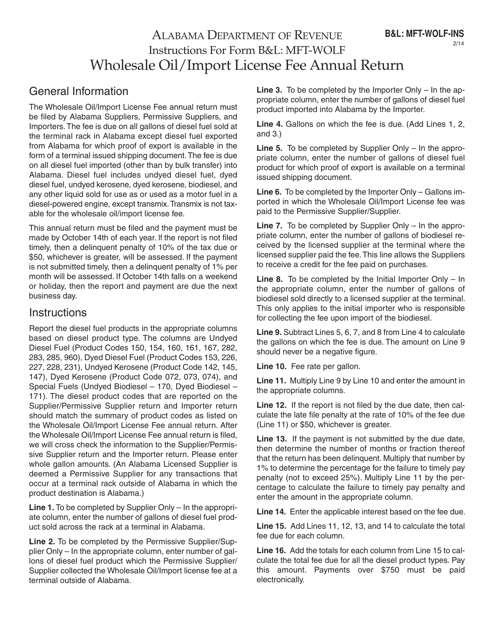

This Form is used for submitting an annual return for the Wholesale Oil/Import License Fee in Alabama. It provides instructions on how to complete the form and fulfill the licensing requirements.

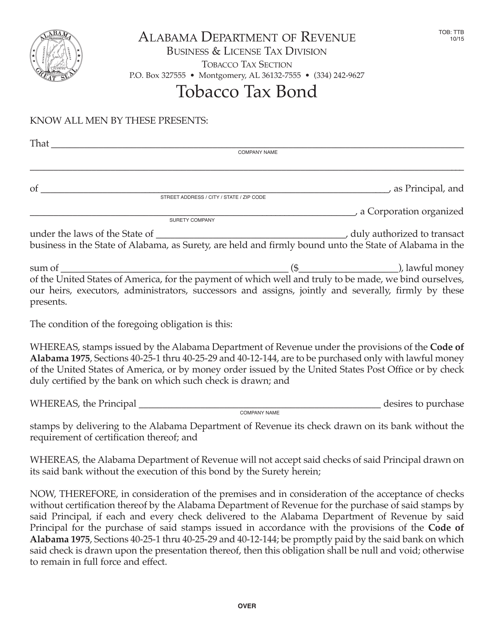

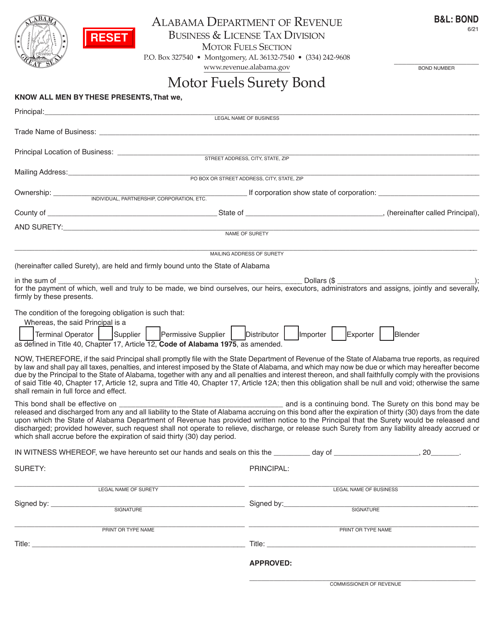

This form is used for obtaining a tobacco tax bond in Alabama.

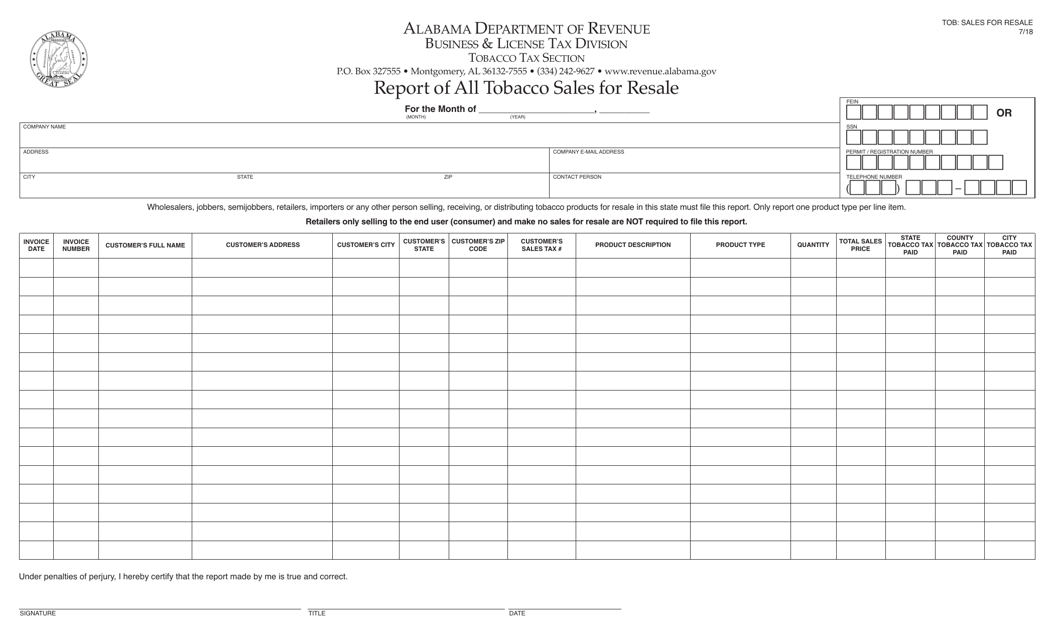

This document is used for reporting all tobacco sales specifically for resale purposes in the state of Alabama.

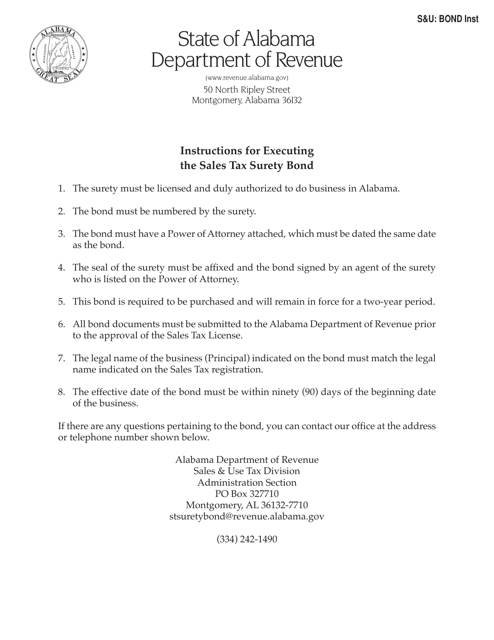

This Form is used for reporting and paying sales tax through a surety bond in the state of Alabama.

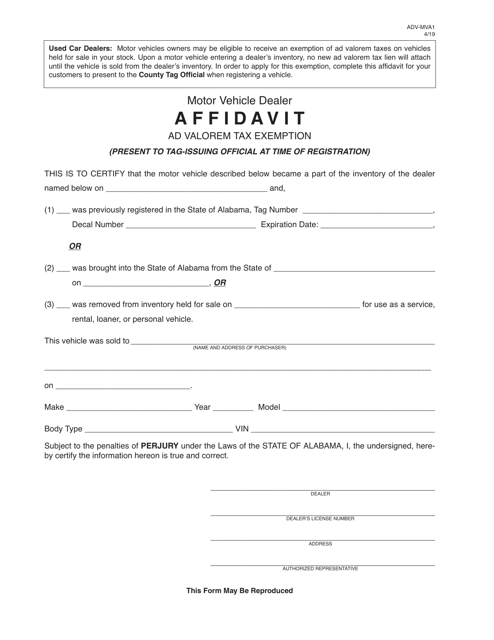

This form is used for motor vehicle dealers in Alabama to apply for an ad valorem tax exemption.

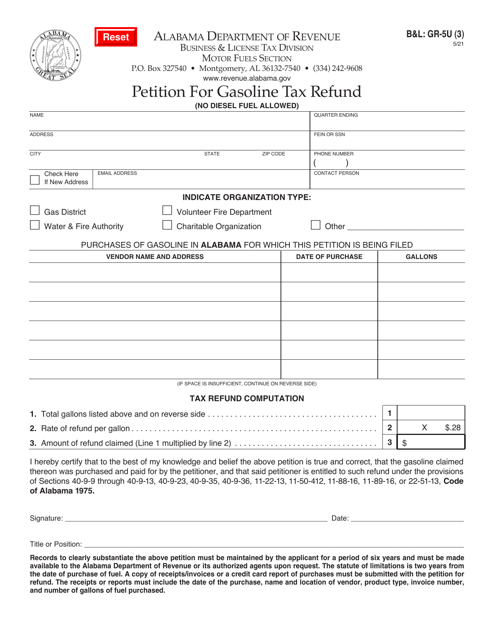

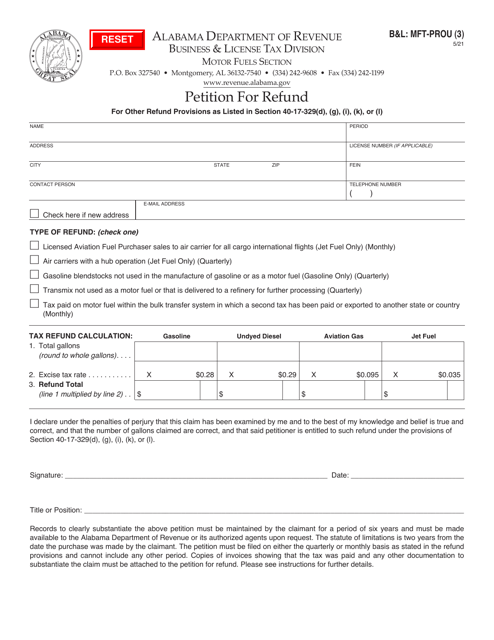

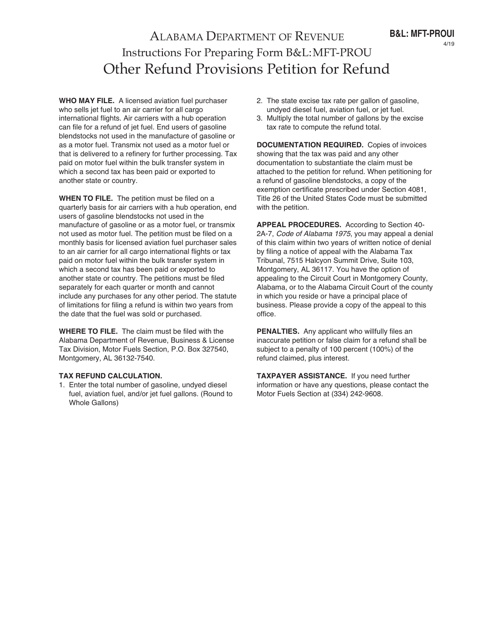

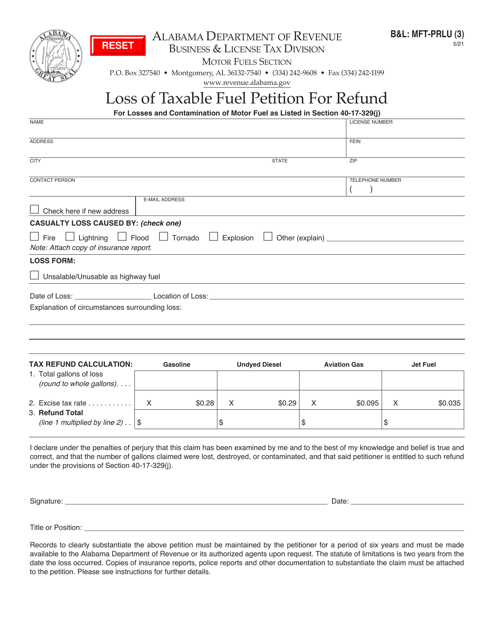

This Form is used for filing a petition for a refund in Alabama for the MFT-PROU tax. It provides instructions on how to complete the form and submit the petition.

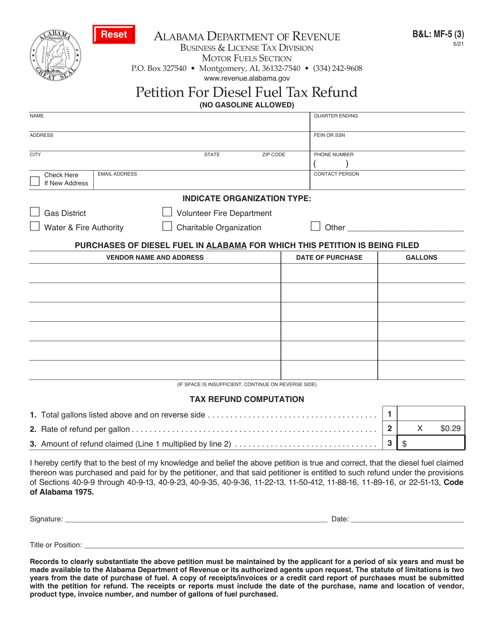

This Form is used for licensed distributors in Alabama to petition for a refund. It provides instructions for filling out Form B&L: MFT-PRDEE.

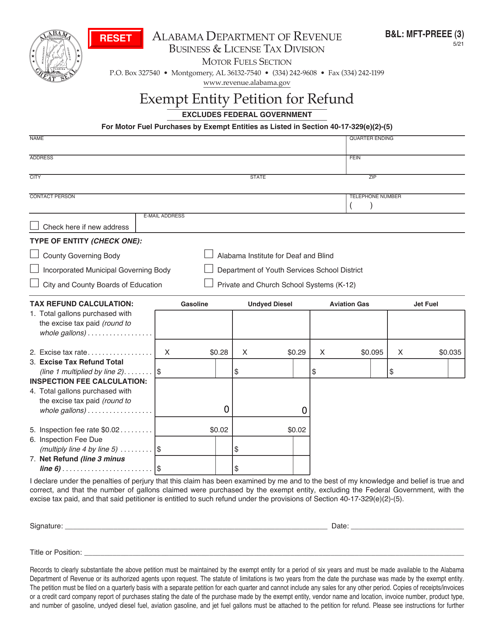

This Form is used for petitioning a refund for an exempt entity in Alabama under the MFT-PREEE program.

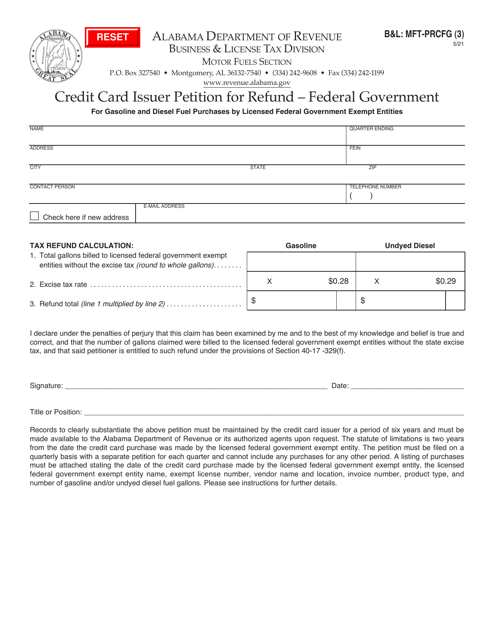

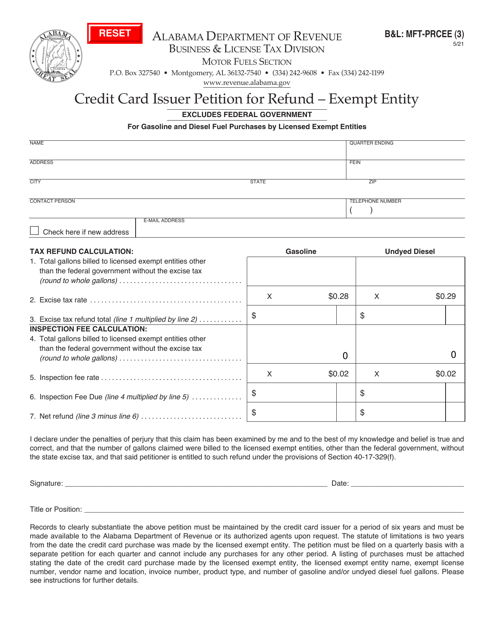

This Form is used for credit card issuers in Alabama to petition for a refund as an exempt entity. It provides instructions on how to complete and submit the form.

This Form is used for claiming a refund of diesel fuel tax for steam boilers/turbines in Alabama. It provides instructions on how to complete the form and submit the claim.

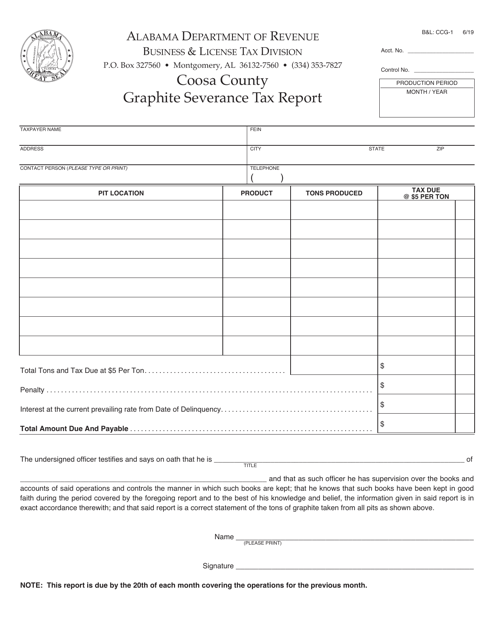

This document is used for reporting graphite severance tax in Coosa County, Alabama.

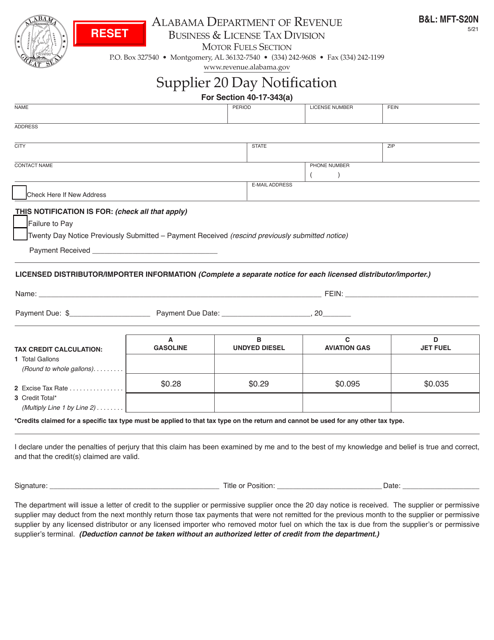

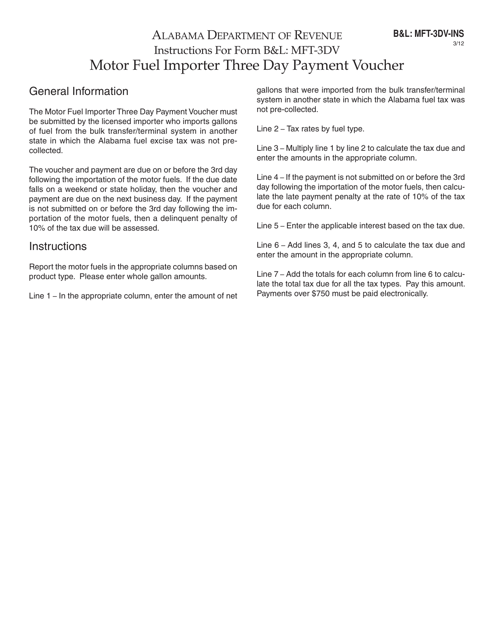

This Form is used for making payment as a motor fuel importer in Alabama.

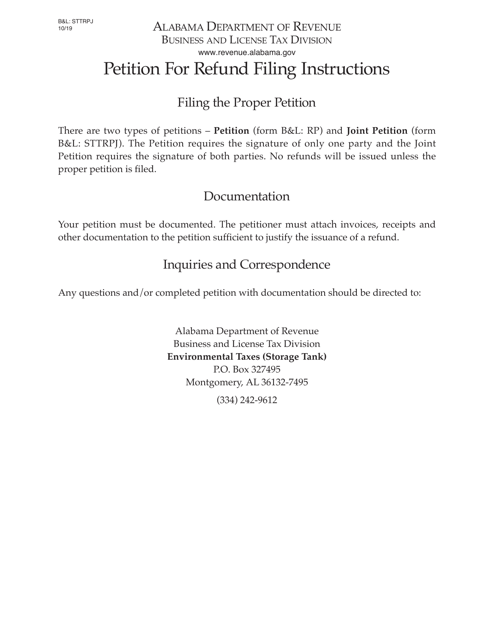

This Form is used for submitting a joint petition for a refund from the STTRPJ Storage Tank Trust Fund in Alabama. It provides instructions on how to complete the form and apply for a refund.

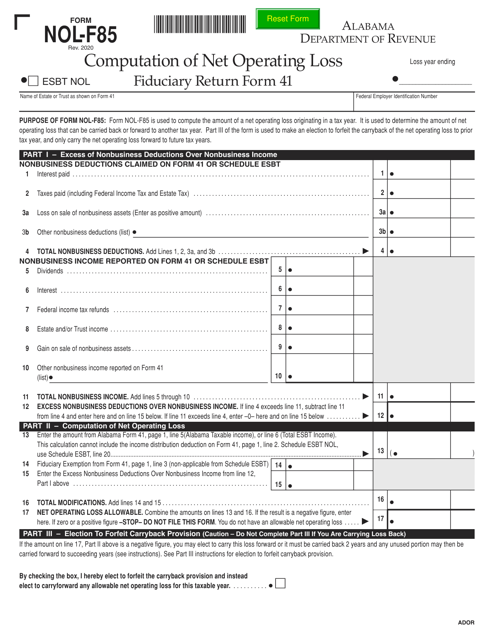

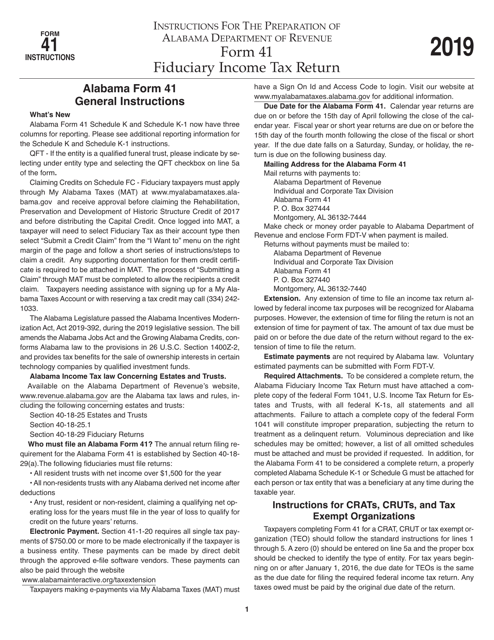

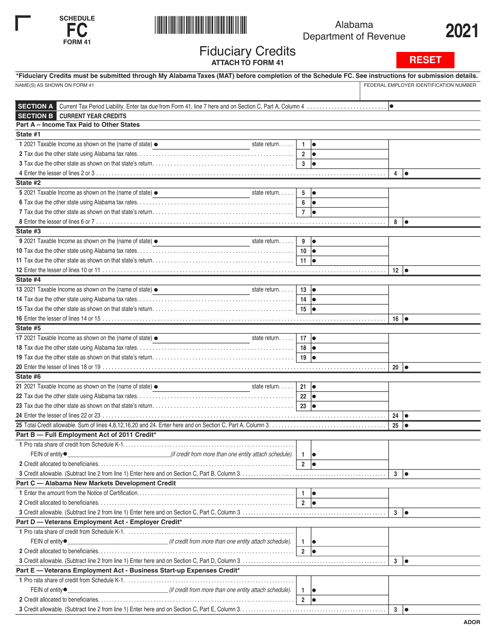

This document provides instructions for completing the Form 41 Fiduciary Income Tax Return in Alabama. It helps taxpayers understand how to report their income and deductions for estates and trusts.

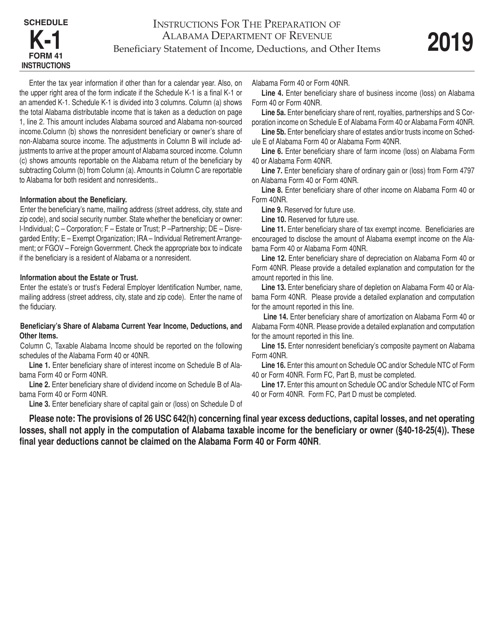

This form is used for providing beneficiary information for the Fiduciary Income Tax in Alabama.

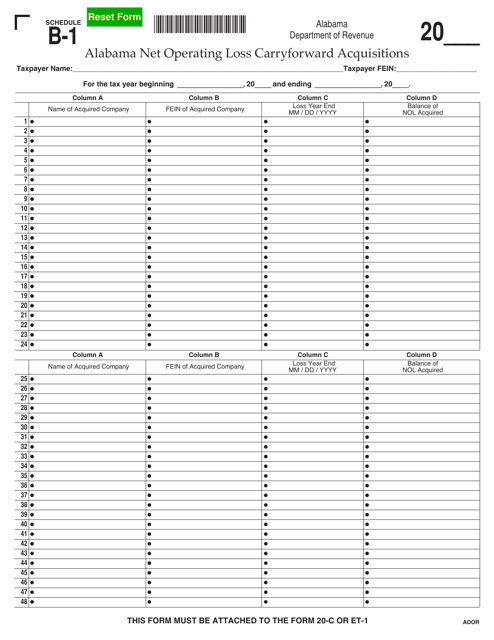

This document provides information about the Schedule B-1 form specific to Alabama, which is used to report net operating loss carryforwards resulting from acquisitions in the state.