Fill and Sign Alabama Legal Forms

Documents:

2822

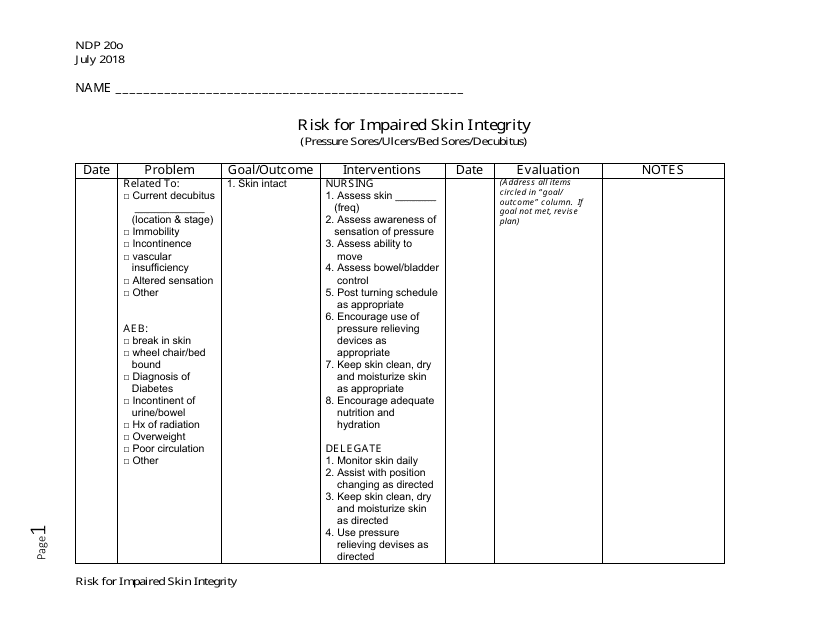

This document is used to assess the risk for impaired skin integrity in the state of Alabama. It helps healthcare professionals identify individuals who may be at risk for developing skin problems and implement appropriate preventive measures.

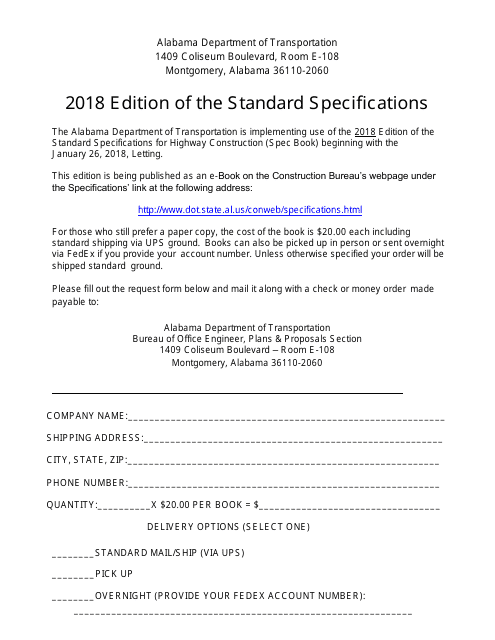

This document is the edition of the Standard Specifications used in the state of Alabama. It provides guidelines and requirements for various construction projects in the state.

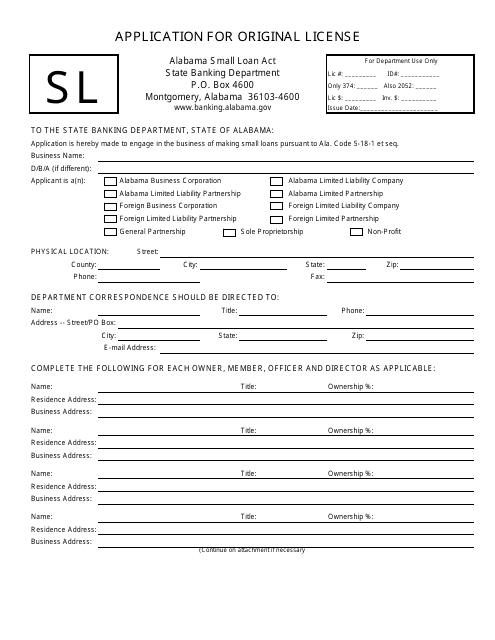

This form is used to apply for an original license in the state of Alabama.

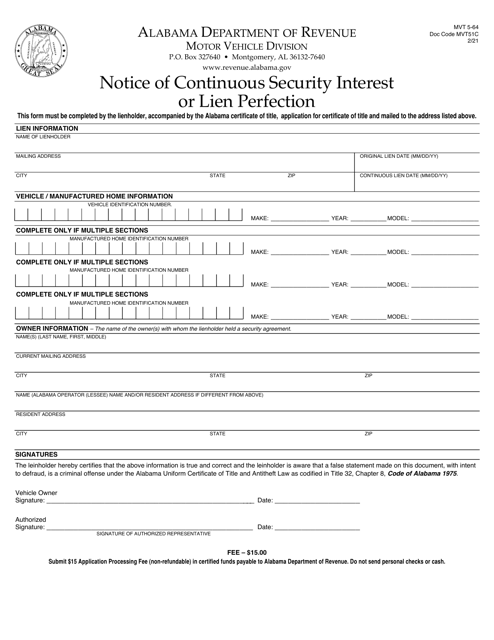

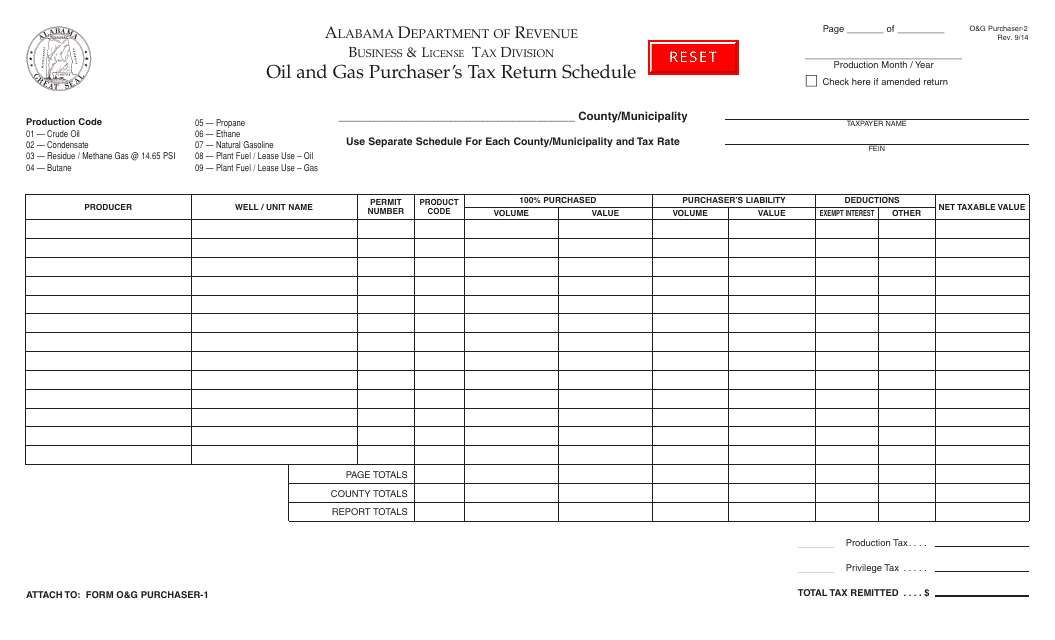

This Form is used for reporting and paying taxes related to oil and gas purchases in the state of Alabama. It must be completed by oil and gas purchasers and submitted to the relevant tax authority.

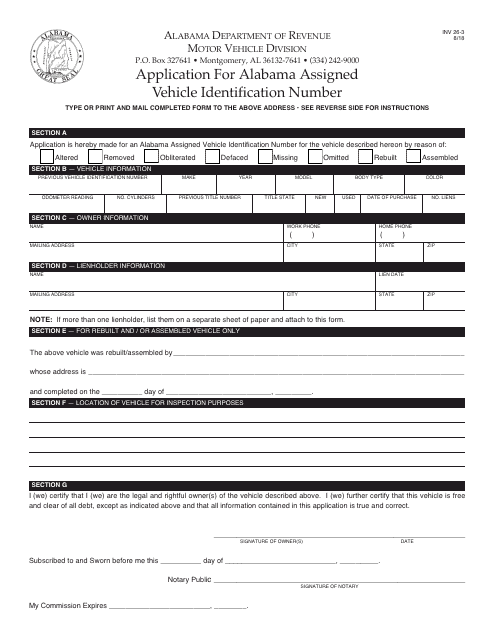

This form is used for applying for an assigned vehicle identification number (VIN) or plate for an assembled vehicle in Alabama.

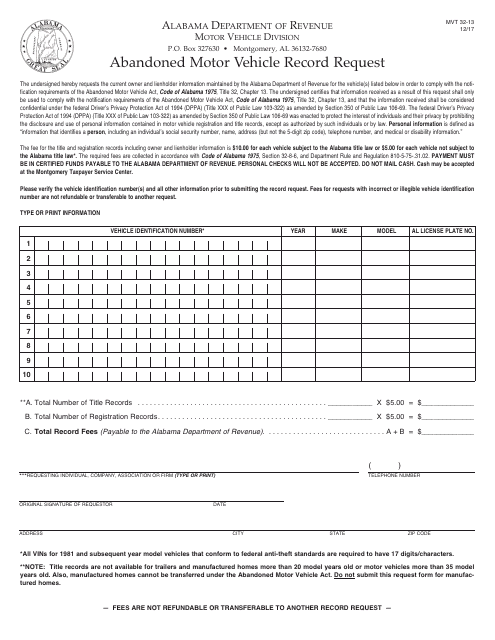

This form is used for requesting the abandoned motor vehicle records in Alabama. It is used to obtain information about a vehicle that has been left unattended or abandoned.

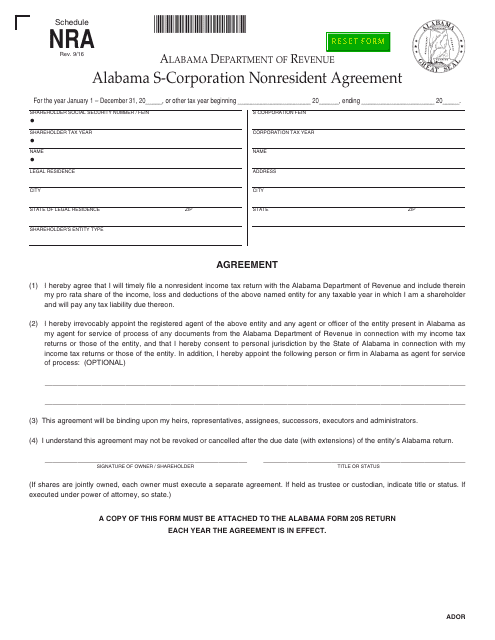

This document is for scheduling an NRA (Nonresident Alien) Alabama S-Corporation Nonresident Agreement in Alabama.

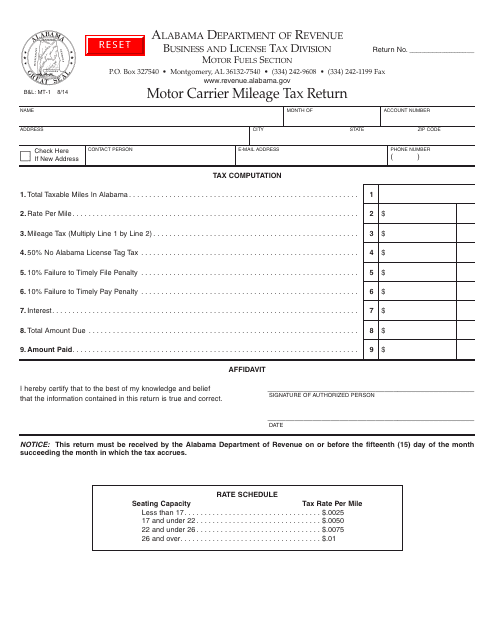

This form is used for reporting and paying the Motor Carrier Mileage Tax in the state of Alabama. It is required for motor carriers to report their mileage and pay the corresponding tax amount.

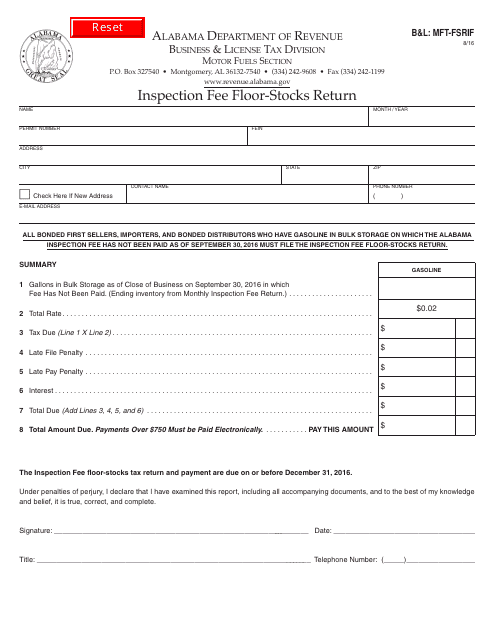

This form is used for reporting and paying inspection fees for floor-stocks returns in the state of Alabama.

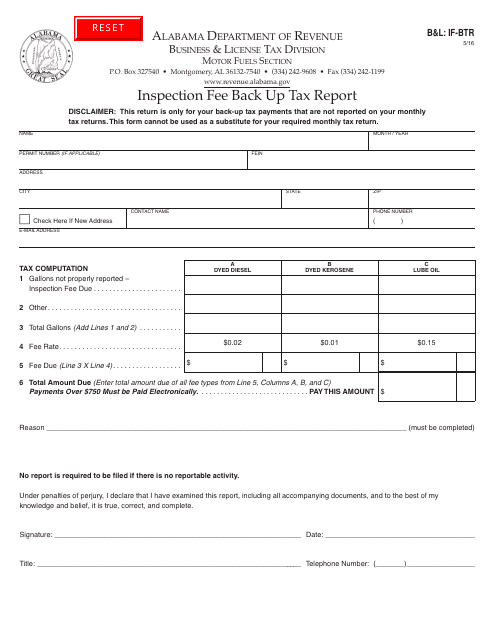

This Form is used for providing a back up tax report for the B&T Inspection Fee in Alabama.

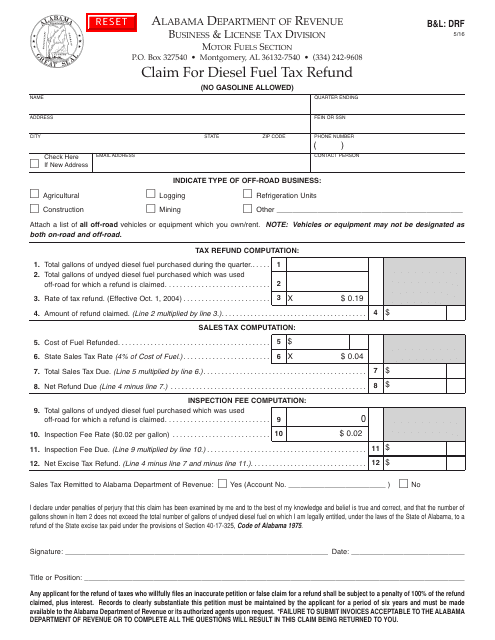

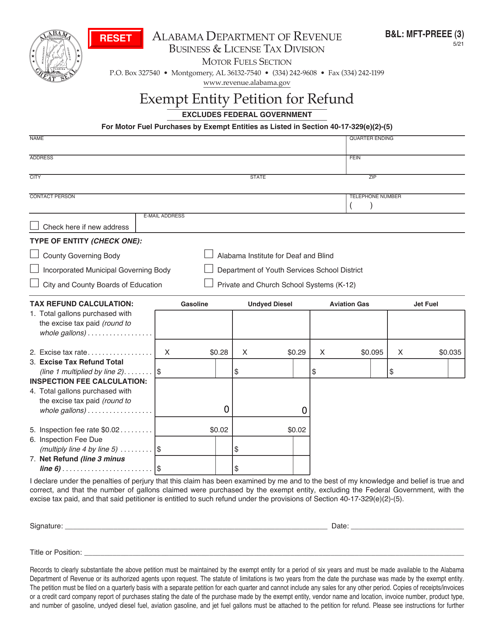

This Form is used for claiming a refund on diesel fuel tax paid in Alabama.

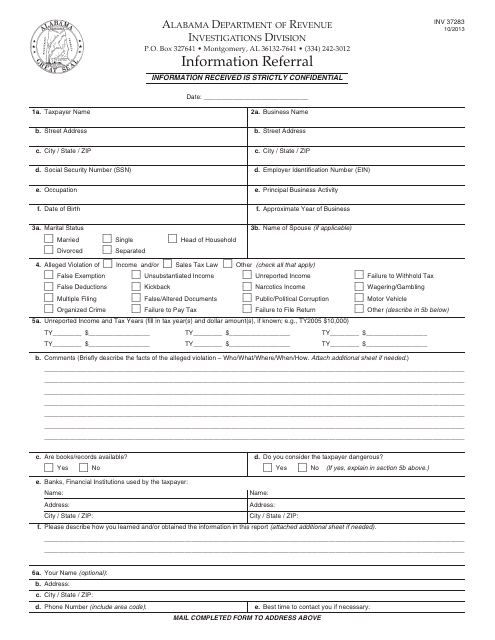

This form is used for submitting information referrals in the state of Alabama.

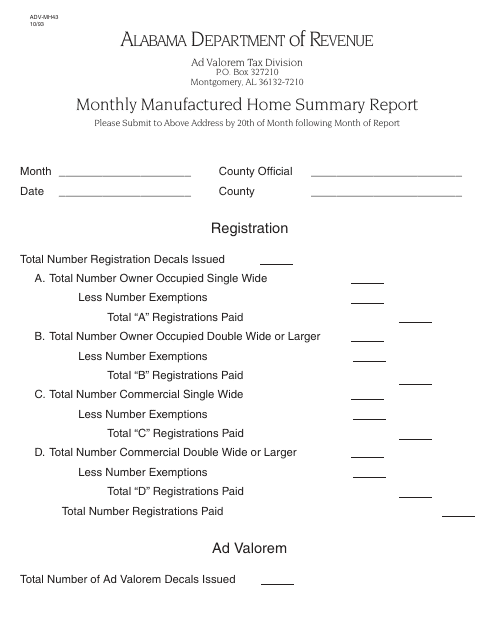

This form is used for submitting a monthly summary report on manufactured homes in Alabama. It provides information on the number of homes sold, transferred, and abandoned during the month.

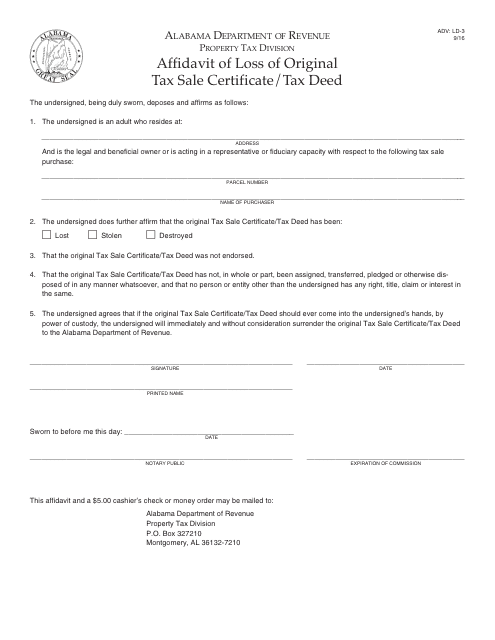

This form is used for declaring the loss of an original tax sale certificate or tax deed in Alabama.

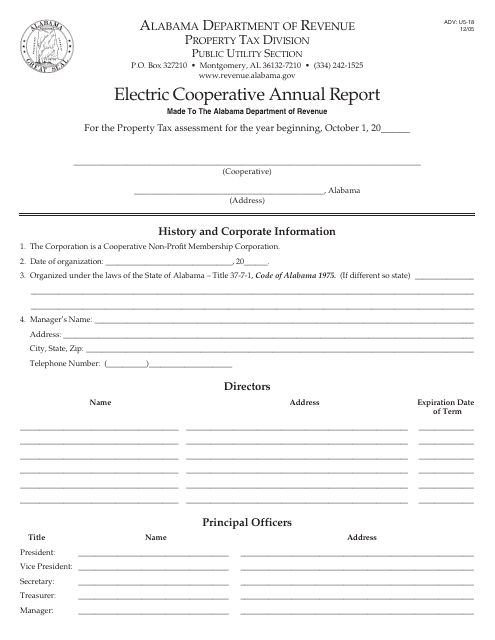

This document is the Form ADV: U5-18 Electric Cooperative Annual Report for Alabama.

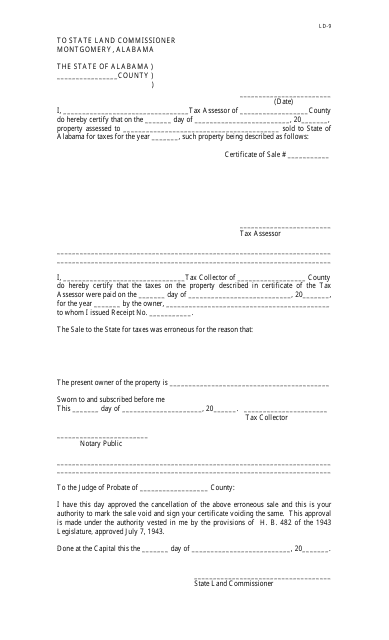

This form is used for requesting the cancellation of certain county-specific documents in Alabama.

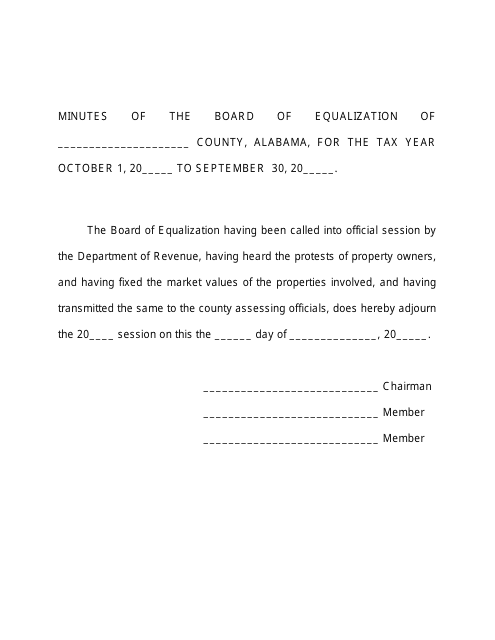

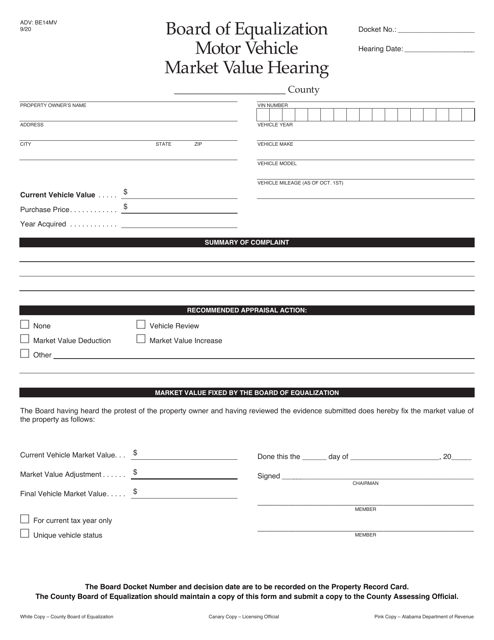

This document provides the minutes of the meetings conducted by the Board of Equalization in Alabama. It contains a summary of discussions and decisions related to property assessments and tax appeals.

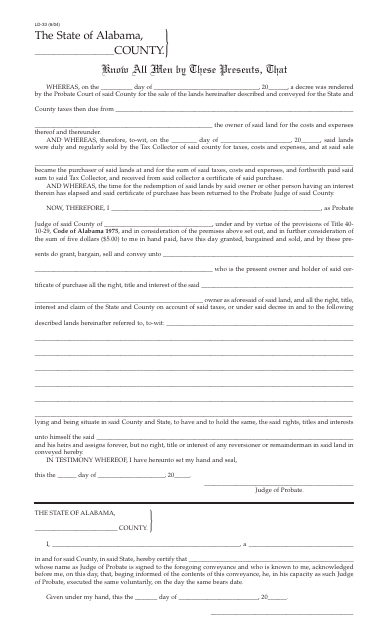

This document is for the issuance of a tax deed by the county in Alabama. It is used by the county for internal purposes only.

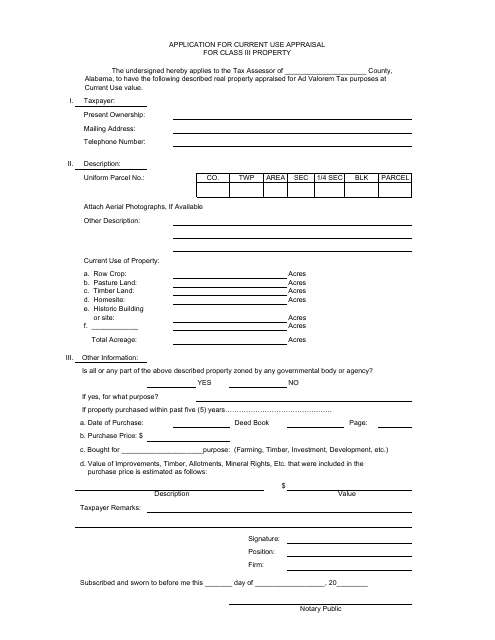

This form is used to apply for a current use appraisal for Class III property in Alabama. It helps property owners get a lower tax assessment based on the property's current use.

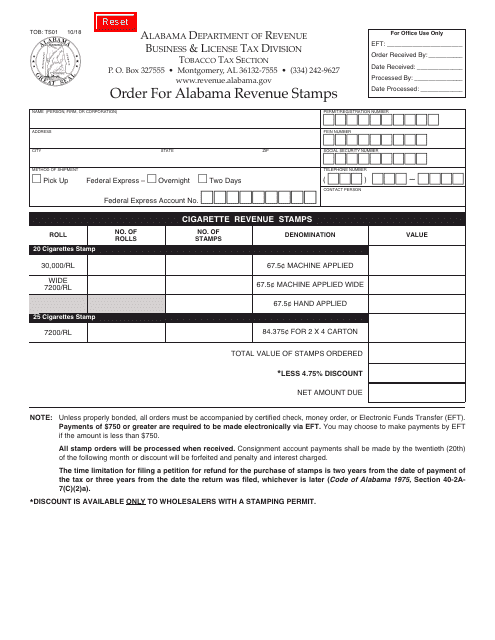

This form is used for submitting an order for Alabama revenue stamps in the state of Alabama.

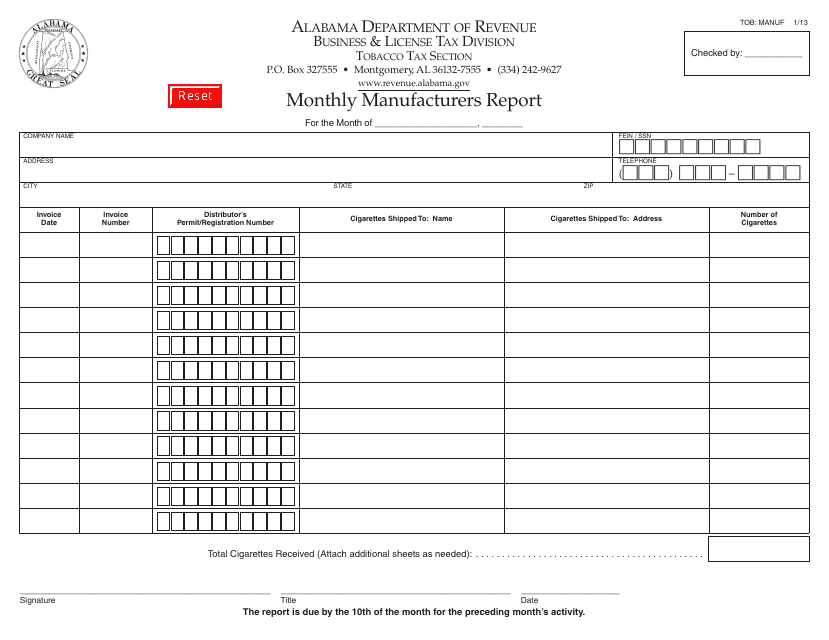

This form is used for the monthly reporting of manufacturing activities in Alabama. It is required for all manufacturers operating in the state.

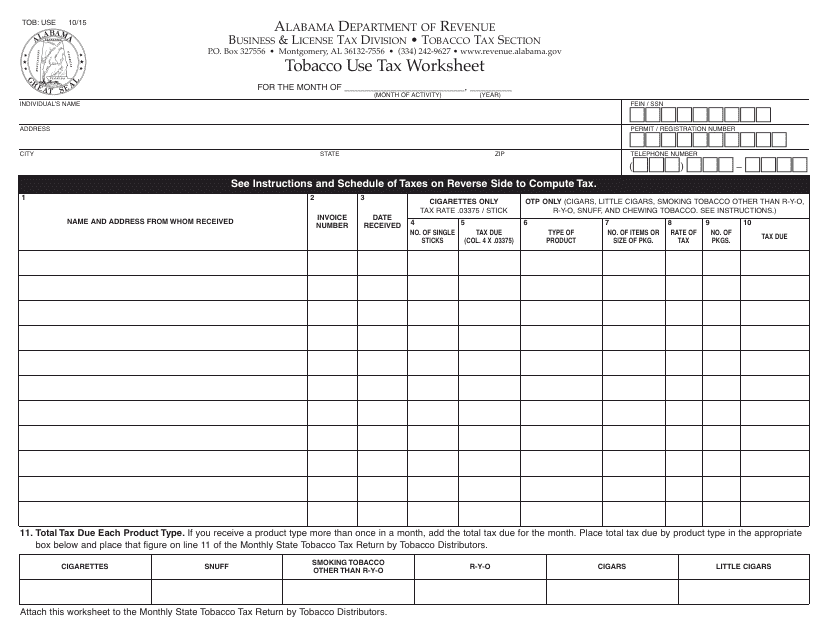

This form is used for calculating and reporting tobacco use tax in the state of Alabama.

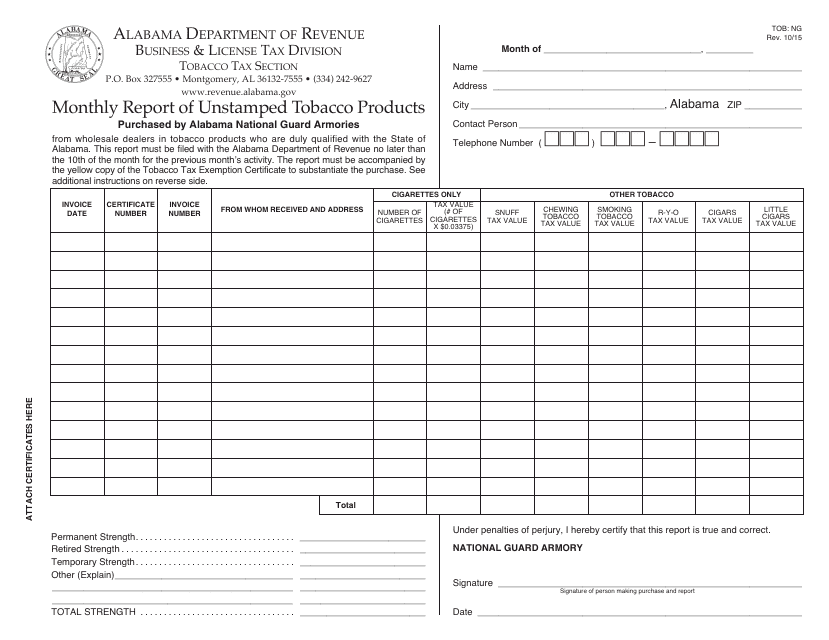

This document is used for reporting unstamped tobacco products on a monthly basis in Alabama.

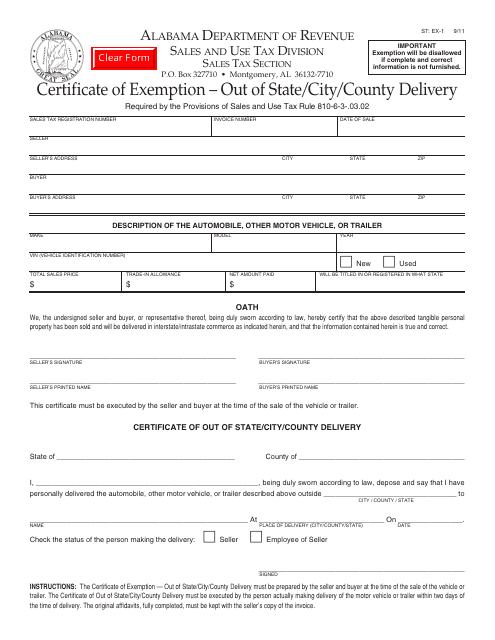

This form is used for obtaining a certificate of exemption for out-of-state or out-of-city/county delivery in Alabama.

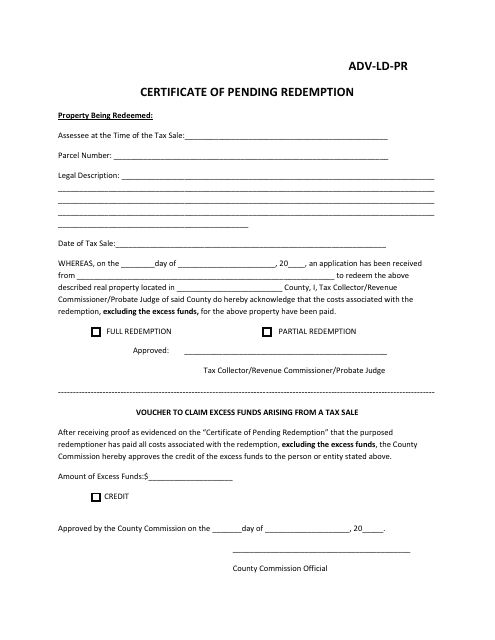

This type of document, the Form ADV-LD-PR Certificate of Pending Redemption, is used for redeeming securities in the state of Alabama. It certifies that a redemption of securities is pending and provides necessary information for the redemption process.

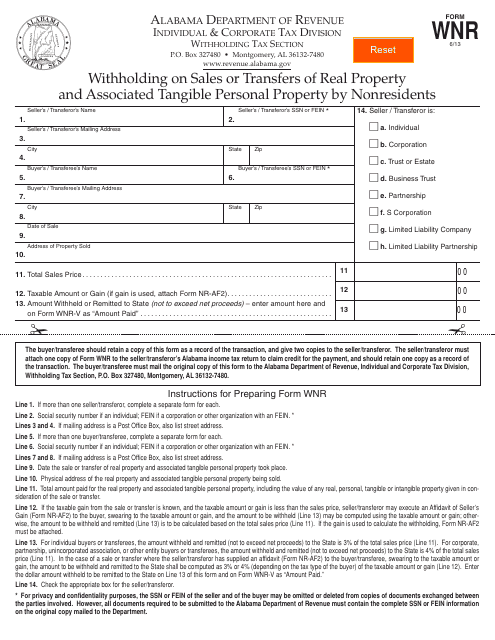

This form is used for reporting and withholding taxes on sales or transfers of real property and associated tangible personal property by nonresidents in the state of Alabama.

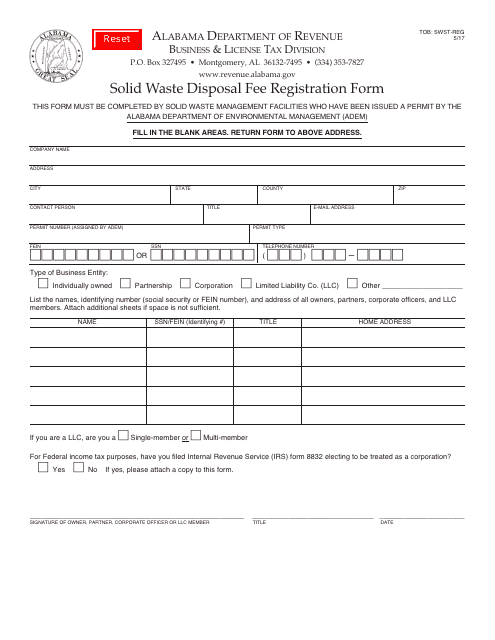

This form is used for registering for the Solid Waste Disposal Fee in Alabama.

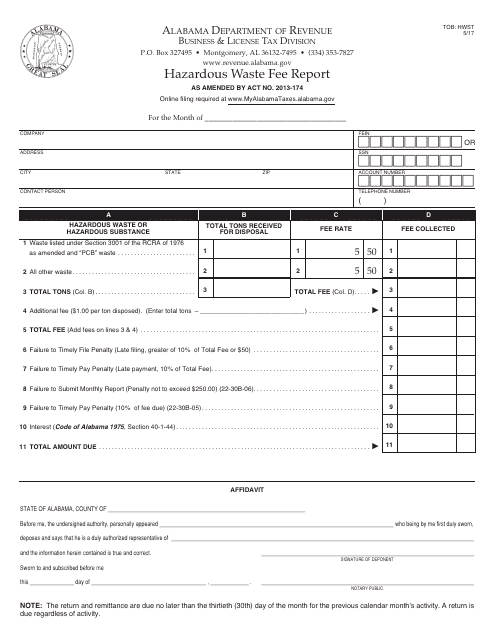

This Form is used for reporting the Hazardous Waste Fee in Alabama.

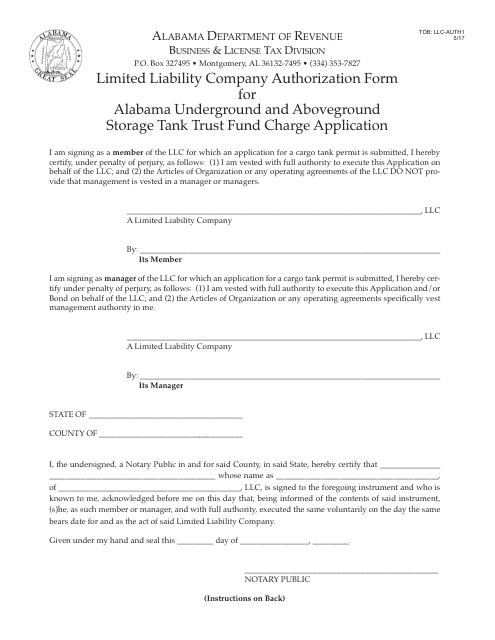

This form is used for LLCs to authorize the Alabama Underground and Aboveground Storage Tank Trust Fund charge application.

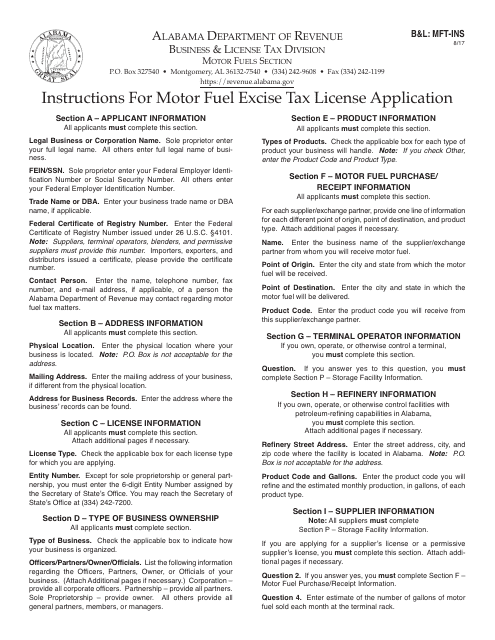

This Form is used for applying for a Motor Fuel Excise Tax License in Alabama. It is also referred to as Form B&L: MFT-INS or B&L:MFT-APP. Follow the instructions provided to complete the application accurately.

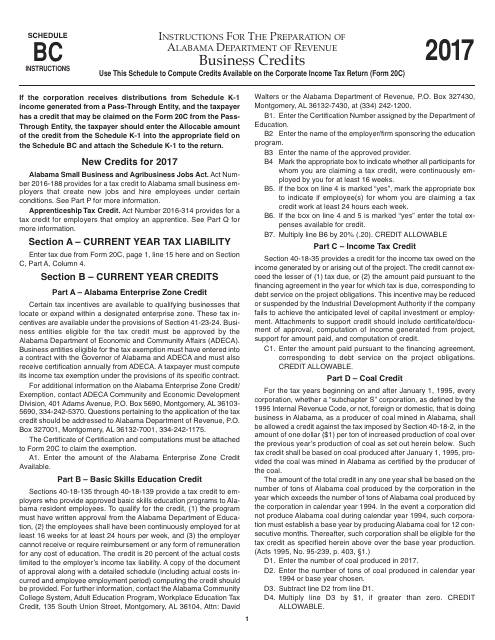

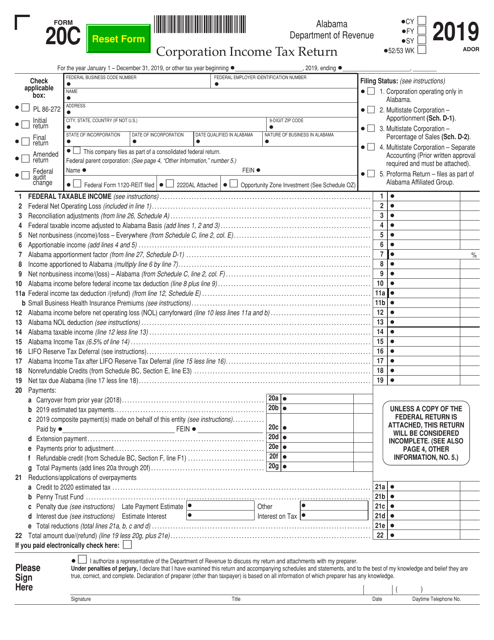

This Form is used for reporting business credits in Alabama. It provides instructions on how to fill out Schedule BC for Form 20C.